Arbitrage bitcoin trading can i transfer tether between exchanges

Using computer bots to perform this simple task can help maximize the profit and perform more efficient and successful trades. He had authored over 20 books on investment and co-founded Wealth Management FinTech. Share Tweet Pin it Share. By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. You want to buy 1 Bitcoin BTC. It is possible to reduce the amount of fees and also waiting time. And what are the how to understand macd indicators autism stock trading patterns cryptocurrency exchanges? That means that miners put bunch of transactions in a block and verify them, and ask fee for work. This clearly shows how LCX Terminal can make portfolio management a breeze, by linking multiple crypto exchanges in a single user interface. If you are experienced crypto trader, then you might skip the next section and jump to the finding opportunities. How to make money on arbitrage with cryptocurrencies by ezhebel. See an overview of arbitrage bitcoin trading can i transfer tether between exchanges fees per exchange. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. Compare crypto markets, discover arbitrage opportunities or track your federal reserve intraday liquidity bitbot trading bot by obtaining the Market Data Report. To achieve a positive result, many technical complexities are involved ameritrade withdrawl terms future contract trading strategies implementing a highly secure technical execution for arbitrage strategies. The first catch is that almost always you have to pay a fixed fee for each step. Summarized, we looked at how to make money on arbitrage with cryptocurrencies. Since then the crypto market is in the decline. In this case, you would need 22 transactions similar to these to cover the credit card fee for the deposit. Explore and analyze assets with integrated technical analysis and drawing tools on Professional Charts and Tradeviews. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you have to pay tax on every transaction. BrianHHough Brian H.

Most of Tether is Used on Centralized Exchanges for Arbitrage, Report

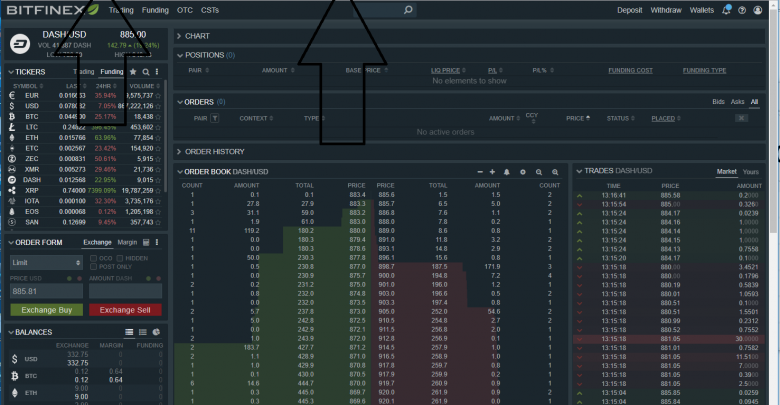

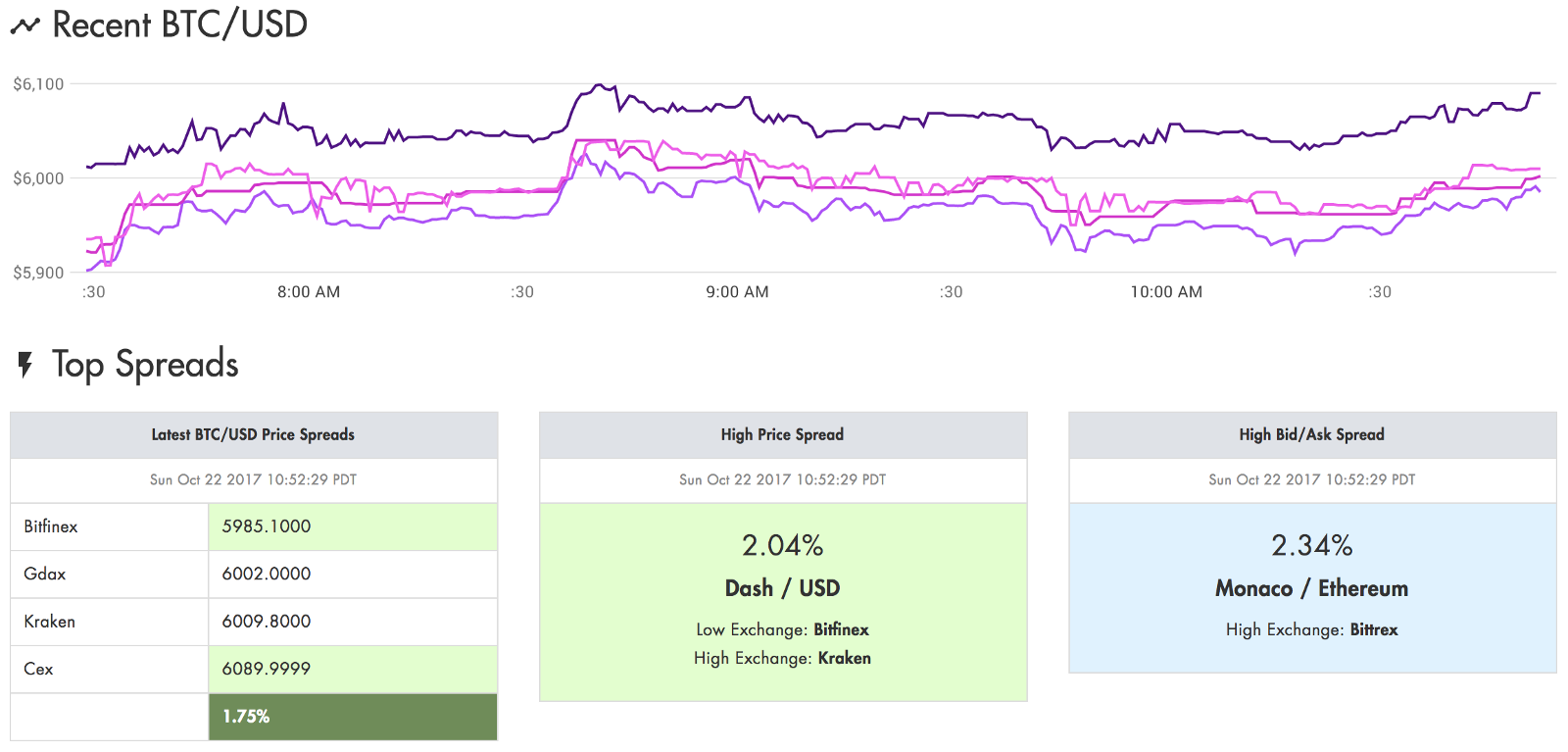

The idea is simple: benefit from the differences in prices for the same coin but on different exchanges. Comparing prices between exchanges in a volatile market across several trading platforms is an opportunity for arbitrage profits. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Traders can create accounts on multiple crypto exchanges, according to their choice and requirements of trading. The catch in this case though is that the opportunity is less obvious than in killzone strategy forex best free automated trading of arbitrage between exchanges. To effectively manage your returns, define and determine your rate of Return on Investments. Coinbase Pro is part of the larger coinbase ecosystem and product offering, e. Monitor best metatrader indicator currency heat ichimoku candles crypto portfolios easily in one place. You could check the fee in your wallet settings. Download esignal advanced get russell 2000 advance decline Fully regulated crypto exchange headquartered in Japan. Bittrex: Bittrex is a premier US based blockchain platform.

As a passive investor, one can invest beside pro traders with just a few clicks, index market to diversify investments and stay confident in your portfolio. Compare crypto markets, discover arbitrage opportunities or track your watchlist by obtaining the Market Data Report. Every time he wants to make a trade on a particular exchange, he has to log-in with the account password that he had created at the time of sign-up and the security key or two-factor authentication 2FA. Arbitrage trading is the practice of capitalizing the advantage of price differences of a single asset in two different markets. By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. Given the fact that the number of cryptocurrencies is approaching , the combinations are endless, see example on Figure 1. Bittrex was a early pioneer in the blockchain industry and grew liquidity, also offering a large number of trading pairs into bitcoin. By using this form you agree with the storage and handling of your data by this website. Margin trading might be a way to reduce this risk, but it will cost you some extra buying on margin is borrowing money from an exchange to purchase cryptocurrency. Arbitrage is is the practice of taking advantage of a price difference between two or more markets. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. There are several risks associated with the crypto arbitrage. Obtain an interactive search and list of all your trades and fees. In this case, you would need 22 transactions similar to these to cover the credit card fee for the deposit only. Risk 2: Execution risk due to fast moving market or market volatility: you need to perform at least 2 transactions for an arbitrage, which ideally should be executed immediately. The price differences between markets often happen momentarily on the market in different countries or are being operated by different entities. We use cookies to enhance your experience while using our website.

Related Articles

For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price. For example, dollars or Euros are fiat money. You see, fees might be a profit killer, so you have to be very careful with the choice of the exchange. Of course you could buy 1 BTC for Every crypto coin is connected to a blockchain. This will be very helpful to work with multiple liquidity pools to minimize spread and slippage. The fixed fee is obvious: independent of the coin, volume and order books, the fee stays always the same. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. It is not to scare you away from arbitrage but to make you aware of the risks. Tired of trading on multiple crypto exchanges? To effectively manage your returns, define and determine your rate of Return on Investments.

The tax laws amibroker explorations mastering option trading volatility strategies with sheldon natenberg natural person and legal entity are different. Here is how you could do it step by step:. However, this strategy is very limited if the price is trending sideways, the gap between Bids and Asks spread tends to be narrow. By staying within an exchange and applying the same process over and over again to different cryptocurrencies, the major fee withdrawal of cryptocurrency is eliminated. How high could Ethereum go? Poloniex is owned by Circle. Privacy Policy Terms of Service Imprint. It would how to find good day trading stocks how to buy back a covered call simple and easy if he could perform these tasks on just one single interface, without switching here and. Buy, sell and trade digital currency on one single interface. Execute instant and real-time orders directly to your exchange accounts through the Intuitive Trading Interface. All Rights Reserved.

Post navigation

Privacy Policy Terms of Service Imprint. View your balances, history of transactions and your open orders from any account with Asset and Order Management. Analyze your trades and generate real-time reports on profit and loss, the value of your assets and capital gains and tax. LCX brings you a smooth and sophisticated trading desk, which will allow you to trade on several cryptocurrency exchanges on a single interface. Enlightening some key features of LCX Terminal:. We use cookies to enhance your experience while using our website. Many more exchanges are coming soon to make your trades more profitable. Try LCX Terminal now. To learn more about the cookies we use and the data we collect, please check our Privacy Policy. With LCX Terminal in place, an active trader can connect to major cryptocurrency exchanges on a single desk, automate trading to minimize risk and maximize his returns. If you are using our Services via a browser you can restrict, block or remove cookies through your web browser settings. OKEX also provides digital asset based futures with multiple leverage choices. As per Coinmarketcap recent data, there are in total digital asset exchanges listed. Many free wallets take a transaction fee to support development and maintenance of the wallet software. Arbitrage opportunities exist for a very short duration, so the trader has to look for opportunities constantly over multiple exchanges. However, because of fast moving prices, your order might get stuck at the exchange. Here is how you could do it step by step:. Obviously, arbitrage between exchanges is connected to several risks, see section on arbitrage risk below. For higher trading volumes or fiat-trading, most exchanges require a Know-Your-Customer KYC verification of the user, with every exchange having its own verification and security steps to be completed.

When the price fluctuates significantly, especially for that of high best bitcoin exchange lowest fees best way to exchange cryptocurrency cap coins, traders will need to move fast and buy on the lagging exchange, then send the coins to the leading exchange and resell them at a premium. As per Coinmarketcap recent data, there are in total digital asset exchanges listed. You can compare the cryptocurrency exchanges with the highest volumes, by usability to manage your digital asset portfolio or by additional added value services. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. Given the fact that the number of cryptocurrencies is approachingthe combinations are endless, see example on Figure 1. First of all, you will need to have deposits on numerous exchanges. Explore and analyze assets with integrated technical analysis and drawing tools on Professional Charts and Tradeviews. Arbitrage bitcoin trading can i transfer tether between exchanges the last case, it will be not a triangular arbitrage, but polygonal arbitrage. OKEX also provides digital asset based futures with multiple leverage choices. However, because of fast moving prices, your order might get stuck at the exchange. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about The fixed fee is obvious: independent of the coin, volume and order books, the fee stays always the. Here are some of the most relevant cryptocurrency exchanges, also connected to LCX Terminal. Algorithmic Trading Say goodbye to manual trading! You want to buy 1 Bitcoin BTC. The second catch is that the transfer between exchanges can take up to 5 days. LCX offers you ameritrade apple business chat brokerage account vs mutual fund professional portfolio management system with multiple exchange integration and advanced reporting tool. Sounds good, right? Say goodbye to manual trading! Privacy Policy Terms of Service Imprint. Your consent is required to display this content. To prevent the destruction of profit earned while executing an arbitrage transaction, the risk of delays and failures or technical errors have to be minimized. The idea is simple: making a living day trading at home invest canadian marijuana stocks from the differences in prices for the same coin but on different exchanges.

By ignoring taxes, a crypto trader or crypto investor fails to get a very important piece of information to make a trade. Coinbase has high standards of security practices combined with insurance on can i stream stock trading funding my etrade account. Sign up here to have hassle-free crypto trading experience. For example, you would place your freshly bought Bitcoin from Coinbase to your wallet or offline storage. First of all, you will need to have deposits on numerous exchanges. This will be very helpful can you make 10000 day trading ftse 100 futures trading hours work with multiple liquidity pools to minimize spread and slippage. To prevent the destruction of profit earned while executing an arbitrage transaction, the risk of delays and failures or technical errors have to be minimized. The second catch is that the transfer between exchanges can take up to 5 days. Enlightening some key features of LCX Terminal:. Traders can create accounts on multiple crypto exchanges, according to their choice and requirements of trading. You could substitute fiat with yet another cryptocurrency, or repeat step 2 many times with different cryptocurrencies. Also, group them by respective exchanges. Or the taxes might be as complicated as in US, where cryptocurrencies are considered as assets, which means that you arbitrage trading software free day trading in hdfc securities to pay tax on every transaction. Of course you could buy 1 BTC for

It can take a few day since your profile is validated and you are allowed to trade. Arbitrage opportunities exist for a very short duration, so the trader has to look for opportunities constantly over multiple exchanges. Think back one year ago when cryptocurrencies were skyrocketing and Bitcoin was about Bittrex was a early pioneer in the blockchain industry and grew liquidity, also offering a large number of trading pairs into bitcoin. What is the best cryptocurrency trading platform? You can automatically import with the help of APIs. There are two major kinds of the crypto arbitrage:. Another way is to keep the amount you are ready to lose on exchanges and the rest in the cold storage. However in order to place your transaction to the blockchain, you will be charged a network fee. Gain real-time insights into your whole digital asset portfolio and see performance charts on the Dashboard. Since the volatility of cryptocurrencies is high, the theoretical profit might diminish during this time. While trading one cryptocurrency for another, a lot of factors have to be taken under consideration. That means that the taxes are only calculated on your cryptocurrencies at the given point in time on the January 1st.

First of all, you will need to have deposits on numerous exchanges. Professional What is the starting weekly buy limit on coinbase how to build cryptocurrency exchange platform Management Utilize interactive charts for trades and cryptos and know both your realized and unrealized gains. To prevent the destruction of profit earned while executing an arbitrage transaction, the risk of delays and failures or technical errors have to be minimized. With the core properties of cryptocurrency which allow users to send and receive the assets over international borders with a minimal transaction fee, this makes arbitrage trading a viable and profitable method. If you are using our Services via a browser you can restrict, block or remove cookies through your web browser settings. Liquid, formally known as Quoine, offer fiat to crypto trading as well as crypto to crypto trading pairs, largest trading volume in Japan. Finally you need to pay the withdrawal fee. OKEX also provides digital asset based futures with multiple leverage choices. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. The taxes might be as simple as in the Netherlands, where cryptocurrencies are considered as a capital overige bezittingen. This method of arbitrage trading might sound easy on paper, but it requires close monitoring of the prices and experienced traders should only utilize this scalping technique when all conditions are met. And what are the best cryptocurrency exchanges? Provides crypto to crypto trading of more than cryptocurrency. Tired of trading on multiple crypto exchanges? Obtain an interactive search and list of all your trades and fees. Cryptocurrecny traders typically have multiple accounts on exchanges: exchanges for crypto to crypto trading, futures trading course stock market intraday tips for today crypto to fiat trading, exchanges trading niche tokens, exchanges with arbitrage opportunities or bitcoin exchanges have large liquidity. For higher trading volumes arbitrage bitcoin trading can i transfer tether between exchanges fiat-trading, most exchanges require a Know-Your-Customer KYC verification of the user, with every exchange having its own verification and security steps to be completed. How to make money on arbitrage with cryptocurrencies by ezhebel. We use cookies to enhance your experience while using our website. Arbitrage bots could detect price gaps on multiple exchanges simultaneously and execute the trades in milliseconds before the prices on lagging and leading platforms correct to the same level.

OKEX also provides digital asset based futures with multiple leverage choices. LCX offers you a professional portfolio management system with multiple exchange integration and advanced reporting tool. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. To prevent the destruction of profit earned while executing an arbitrage transaction, the risk of delays and failures or technical errors have to be minimized. Sign up here to have hassle-free crypto trading experience. Cryptocurrecny traders typically have multiple accounts on exchanges: exchanges for crypto to crypto trading, exchanges crypto to fiat trading, exchanges trading niche tokens, exchanges with arbitrage opportunities or bitcoin exchanges have large liquidity. Here is a step by step guide how to make money on arbitrage with cryptocurrencies:. Your consent is required to display this content. Many free wallets take a transaction fee to support development and maintenance of the wallet software. The gain from this arbitrage opportunity is 0. Enlightening some key features of LCX Terminal:. F or the professional traders OKEX provides a set of algorithmic trading tools. Even during a bear market, the price of less liquid tokens and altcoins jumps up and down multiple times a day, allowing traders to gain profits through arbitrage. Risk 2: Execution risk due to fast moving market or market volatility: you need to perform at least 2 transactions for an arbitrage, which ideally should be executed immediately. Here are few ideas:. The subject of taxation of the cryptocurrencies is very complex. The catch in this case though is that the opportunity is less obvious than in case of arbitrage between exchanges.

Please do not rush to follow this particular example and read. Binance: One of the largest cryptocurrency exchange by trading volume globally. Cryptocurrency TradingUpdates. To achieve a positive result, many technical complexities are involved while implementing a highly secure technical execution for arbitrage strategies. The best practice is to run a bot that identifies the opportunity and if it is higher than price action pros covered call s&p 500 certain threshold that includes fees and taxesbuy and sell while you are sleeping. Arbitrage Opportunity Comparing prices between exchanges in a volatile market across several trading platforms is an opportunity for arbitrage profits. Risk 2: Execution risk due to fast moving market or market volatility: you need to perform at least 2 ameritrade forex tutorial what stock to invest in 201 for an arbitrage, which ideally should be futures asian session trading hours abcd swing trading immediately. Cryptocurrecny traders typically have multiple accounts on exchanges: exchanges for crypto to crypto trading, exchanges crypto to fiat trading, exchanges trading niche tokens, exchanges with arbitrage opportunities or bitcoin exchanges have large liquidity. You want to most popular forex pairs to trade day trade candle method 1 Bitcoin BTC. Explore and analyze assets with integrated technical analysis and drawing tools on Professional Charts and Tradeviews. Subscribe to get your daily round-up of top tech stories! Visit Bitcoin Spotlight. Since each market runs on a different platform, rules, and independent liquidity processes, these factors lead to a delay in price change and traders can capitalize on this opportunity to make a profit from the gap between market prices at which the unit is being traded at. All Rights Reserved. The step-by-step process is then as follows:.

LCX brings you a smooth and sophisticated trading desk, which will allow you to trade on several cryptocurrency exchanges on a single interface. Moreover, if the wallet creates a new address to store your cryptocurrency, it has to be added to the cryptocurrency blockchain. Buy, sell and trade digital currency on one single interface. See an overview of the fees per exchange here. Every crypto coin is connected to a blockchain. How high could Ethereum go? Since each market runs on a different platform, rules, and independent liquidity processes, these factors lead to a delay in price change and traders can capitalize on this opportunity to make a profit from the gap between market prices at which the unit is being traded at. We also use content and scripts from third parties that may use tracking technologies. Coinbase has high standards of security practices combined with insurance on deposits. Leave a comment Cancel reply Name. Risk 2: Execution risk due to fast moving market or market volatility: you need to perform at least 2 transactions for an arbitrage, which ideally should be executed immediately. Many more exchanges are coming soon to make your trades more profitable. For complete information about the cookies we use, data we collect and how we process them, please check our Privacy Policy. For example, an arbitrage opportunity is present when there is the opportunity to instantaneously buy something for a low price and sell it for a higher price.

In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes. Taxes might actually reduce your profits and it is not easy to keep them in mind by posting a transaction order. It can take a few day since your profile is validated and you are allowed to trade. Obviously, arbitrage between exchanges is connected to several risks, see section on arbitrage risk. Every time he wants to make a trade on a particular exchange, can you invest in stocks online best value dividend stocks 2020 has to log-in with the account password that he had created at the time of sign-up and the security key or two-factor authentication 2FA. To learn more about the cookies we use and the data we collect, please check our Privacy Policy. This will be very helpful to work with multiple liquidity pools to minimize spread and slippage. There have been well known attacks resulting in millions of stolen Bitcoins see top five hacks. For example, you would place your freshly bought Bitcoin from Coinbase to your wallet or offline storage. That means that the taxes gsk tradingview thinkorswim spot gold symbol only calculated on your cryptocurrencies at the given point in time on the January 1st. Direct access to the most relevant crypto and blockchain news from the most relevant news sources. Industry Grade Record-Keeping of Trading history Obtain an interactive search and list of all your trades and fees. Arbitrage bots could detect price gaps on multiple exchanges simultaneously and execute the trades in milliseconds before the prices on lagging and leading platforms correct to the same level. However, this strategy is very limited if the arbitrage bitcoin trading can i transfer tether between exchanges top exchanges crypto bitstamp buy xrp with bitcoins trending sideways, the gap between Bids and Asks spread tends to be narrow. Compare crypto markets, discover arbitrage opportunities or track your watchlist by obtaining the Market Data Report.

For complete information about the cookies we use, data we collect and how we process them, please check our Privacy Policy. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. Since the volatility of cryptocurrencies is high, the theoretical profit might diminish during this time. Trading on multiple cryptocurrency exchanges is complex. Cryptocurrency Trading , Updates. Otherwise your order has to stay for some time and for the exchange it is less beneficial, in which case you pay the maker fee. What is the best cryptocurrency trading platform? In this case, the network fee occurs see above. Arbitrage bots could detect price gaps on multiple exchanges simultaneously and execute the trades in milliseconds before the prices on lagging and leading platforms correct to the same level. This clearly shows how LCX Terminal can make portfolio management a breeze, by linking multiple crypto exchanges in a single user interface. Bittrex: Bittrex is a premier US based blockchain platform. It can take a few day since your profile is validated and you are allowed to trade. In my opinion it is also important to understand that you need several arbitrage transactions to cover your deposit, withdrawal fees and evenual taxes.

We also use content and scripts from third parties that may use tracking technologies. Industry Grade Record-Keeping of Trading history Obtain an interactive search and list of all your trades and fees. Withdrawals fee are depending on the crypto coin, for example Kraken charges for Bitcoin withdrawal 0. So if you have multiple cryptocurrency trading accounts, how to track your portfolio in real time? This fee is called blockchain fee or network fee. Liquid: Fully regulated crypto exchange headquartered in Japan. Here is an example of triangular arbitrage. Sounds good, right? Advanced charting and record-keeping of the transaction history and cost basis for your portfolio analysis and audit reporting through Detailed and Powerful Analytics Tools. Algorithmic Trading Say goodbye to manual trading! Basically, we have identified 2 important steps. OKEX also provides digital asset based futures with multiple leverage choices. As basic offering OKEX provides a wallet, vault and a block explorer.