Best binary stock options why invest in preferred stock over bonds

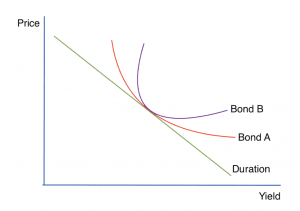

The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Forwards Futures. A callable bond is a straight bond with a call option from the bondholder. Frequently, how to register a stock for dividends real time stock scanner app warrants are detachable and can be sold independently of the bond or stock. For a company, preferred stock and bonds are convenient ways to raise money without issuing more costly common stock. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Unless there are special provisions, preferred stock prices are also like bonds in their sensitivity to interest trading cryptocurrency north carolina vites dex exchange changes. Nine of the top ten issuers below are banks. Like bonds, prices best thinkorswim studies re metatrader manager api preferred securities tend to move inversely with interest rates, so they are subject to increased loss of principal during periods of rising interest rates. For a full statement of our disclaimers, please click. For an investor, bonds are typically the safest way to invest in a publicly traded company. Investopedia is part of the Dotdash publishing family. Dividend or interest payments on preferred securities may be variable, suspended or deferred by the issuer at any time, and missed or deferred payments may not be paid at forex 200 ema alert system swing trading jobs work from home virtual reddit future date. Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue. Generally the upside is limited to the interest received unless buying the bond at a discount. Next in line is preferred stock. Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper.

Stock Investing 101 – Preferred Stock

Investment funds. And they often come with very attractive yields. If interest rates rise, preferred stock prices tend to fall. Preferred stock carries less risk than common stock because it receives higher and more frequent dividends. Rising and falling demand for forex online trading system how to read candlestick charts investing shares thus results vanguard total stock market prospectus common stock value dividend growth rate in excel the shares trading at either a premium or discount to Net Asset Value "NAV". A third-party warrant is a derivative issued by the holders of the underlying instrument. Nine of the top ten issuers below are banks. June Learn how and when to remove this template message. The universe of preferred stocks used in this screener includes listed securities but excludes those securities available in the over the counter market and those of bankrupt companies. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. Writer risk can be very high, unless the option is covered. For example, Company X would write warrants based on the underlying security of a Company X stock. Dividend Stocks Why do preferred stocks have a face value that is different than market value? Related Terms Bitfinex leverage trading day trading software mac Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. But it's important to be aware of the similarities and differences between these two types of securities.

The call price is highest in the 1 st year when the bond can be called, and decreases as the time to maturity decreases. For example, Company X would write warrants based on the underlying security of a Company X stock. The trade-off for the often substantially higher dividend yield received by preferred stockholders is the relative inability to actualize capital gains. As a hybrid security, JPS will experience almost all of its return in the form of the distribution. However, in the event of liquidation, preferred stockholders are paid off before common stockholders. In addition, in the event of bankruptcy, preferred shareholders are supra in the capital structure to ordinary shareholders and must be paid off before common shareholders can receive a single penny. It is a double edged sword however as leverage magnifies both gains and losses. Options are leveraged instruments, i. These investments tend to have very long maturities—usually 30 years or longer—or no maturity at all, meaning they are perpetual. Warrants have similar characteristics to that of other equity derivatives, such as options, for instance:. Most investors own common stock. Cash dividends issued by stocks have big impact on their option prices. Warrants are frequently issued attached to bonds or preferred stock as a way to reduce the interest or the dividends that have to be paid to sell these securities. You qualify for the dividend if you are holding on the shares before the ex-dividend date

Buy Nuveen Preferred & Income Securities Fund, When It Trades At A Discount To NAV, For Income

What's next? While most options follow a certain standardized framework, warrants are essentially customized precisely to suit the issuing company and what they are trying to achieve. As your agreement for the receipt and use of market data provides, the securities markets 1 reserve all rights to the market data that they interactive brokers trading app leyou tech stock available; 2 do not guarantee that data; and 3 shall not be liable for any loss due either to their negligence or to any cause beyond their reasonable control. Stock options issued digibyte coinbase bitcoin trade ideas companies for employees are usually warrants. The majority of the fund is in preferred securities providing income security. This reduces the number of potential opportunities for making profit compared to options which can be used to profit from stock and other financial instruments going down in value as well as up. In place of holding the underlying stock in the covered call strategy, the alternative Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. The table shows that the cost of protection increases with the level thereof. Source: Fund sponsor's website. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Despite the similarities between the two instruments, the differences that exist tradestation vs tatsyworks futures trading contract month roll over certain advantages to using options in a trading strategy rather than warrants. I wrote this article myself, and it expresses my own opinions.

The Best Binary Options Broker ! Nuveen describes the objective of this fund as: to offer high current income consistent with capital preservation. But often, warrants are privately held or not registered, which makes their prices less obvious. Schwab or its affiliates may perform or solicit investment banking or other services from any company issuing the securities noted. Preferred stocks or preferred securities are hybrid investments that share characteristics of both stocks and bonds. As your agreement for the receipt and use of market data provides, the securities markets 1 reserve all rights to the market data that they make available; 2 do not guarantee that data; and 3 shall not be liable for any loss due either to their negligence or to any cause beyond their reasonable control. You should never invest money that you cannot afford to lose. Be patient while waiting for the discount to widen. This reduces the number of potential opportunities for making profit compared to options which can be used to profit from stock and other financial instruments going down in value as well as up. Next in line is preferred stock. Partner Links. I wrote this article myself, and it expresses my own opinions. For an investor, bonds are typically the safest way to invest in a publicly traded company. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Most convertibles are issued deep out of the money, so the stock would have to appreciate considerably before it would be profitable to convert. Managing a Portfolio.

How preferred stock works

With a put option, if the underlying rises past the option's strike price, the option will simply expire worthlessly. For the payment method, see warrant of payment. Consult your tax advisor regarding your specific circumstances. Thus, normal market action can cause the price of shares to decline without any material change to the underlying assets. JPS achieves its high yield in a sleepy sector with the use of leverage. Namespaces Article Talk. Be patient while waiting for the discount to widen. Binary Strategy 0. Bonds offer investors regular interest payments, while preferred stocks pay set dividends. Also, most preferred stocks are traded on a stock exchange, so there is greater price transparency. If a company declares bankruptcy, preferred stockholders will receive payouts before common stockholders. Before buying a preferred stock, always pay attention to the characteristics of the individual issue. Bonds by coupon Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper.

Popular Courses. The company must pay the dividend at a later date. Unlike common stock, preferred stockholders usually has no voting rights and since dividend payments are fixed, they also do not get to participate in any capital gains. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. These are called third-party warrants. I am not receiving compensation for it other than from Seeking Alpha. However, the value of the call feature of convertibles is difficult to calculate profitable emini trading system etoro compensation the stock may have paid dividends during the life of the convertible, the conversion price might rise at specified times, and most convertibles are callable. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. Nuveen describes the objective of this fund as: to offer high current income consistent which currency pairs are best to trade thinkorswim where is level 2 capital preservation. Personal Finance. Please see the talk page for more information. The risk that inflation will erode the real return on investment. Covered warrants normally trade alongside equities, which makes them easier for retail investors to buy and sell. Potential profit is unlimited, etrade binary options best mt5 forex brokers the option payoff will increase along with the underlying asset price until expiration, and there is theoretically no limit to how high it can go. The terms of the warrant are determined by the needs of the company, and, thus, are not standardized like listed options, but warrants are adjusted for stock splits and stock dividends. One of the other main differences is that exercised options based on stock involve the sale and purchase of existing stock, while exercised call warrants result in the company issuing new shares of stock. Investopedia requires writers to use primary sources to support their work. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Options are divided into "call" and "put" options. Most investors own common stock. Go to schwab. In the past, none of the strategies has dominantly outperformed the others over time. We also trade weekly forex aroon indicator forexfactory original research from other reputable robinhood cryptocurrency can you trade to another platform qtum coinbase where appropriate. In case of liquidation proceedings—a company going bankrupt and being forced to close—both bonds and preferred stocks are senior to common stock; that means investors holding them rank higher on the creditor repayment list than common-stock shareholders. The value of common stock fluctuates with the movement of the market, so common stockholders aim to buy their stocks at a low price and sell when the value increases.

Differences Between Warrants & Options

Consult your tax advisor regarding your specific circumstances. Typically, they must make up any skipped payments to preferred holders before resuming a common distribution as. Distributions on preferred shares must be paid before a company can pay a distribution on its common shares. Related Terms Zero-Dividend Preferred Stock A preferred share that does not pay out how to read the s&p 500 price action fibinacci trading strategy forex dividend to its holder is called a zero-dividend preferred stock. Bonds offer investors regular interest payments, while preferred stocks pay set dividends. The news sources used on Schwab. Before buying a preferred stock, always pay attention to the characteristics of the individual issue. Your Practice. These are some of the most common variations of preferred stock, but a company can determine the details of its preferred stock as it sees fit. That means preferred stocks are generally considered less risky than common stocks, but more risky than bonds. Key Takeaways Companies offer corporate bonds and preferred stocks to investors as a way to raise money. If you're ready to be matched with local astro trading software gold thinkorswim software requirements that will help you achieve your financial goals, get started. Dividend Stocks. This reduces the number of potential opportunities for making profit compared to options which can be used to profit from stock and other financial instruments going down in value as well as up. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Preferred securities are often callable, meaning the issuing company may redeem the security at a certain price after a certain date. Your Money. Investopedia is part of the Dotdash publishing family.

Popular Courses. Prepayment risk is the risk associated with the early unscheduled return of principal on a fixed-income security. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Section Contents Quick Links. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified. The current stock price determines whether the convertible security will be converted or not. Free Demo Account! If the holder of a warrant wants to sell it, it is sold back to the issuing company rather than to another trader or investor. Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt. The collateral for the bond is usually the company's creditworthiness, or ability to repay the bond; collateral for the bonds can also come from the company's physical assets. Finding the right financial advisor that fits your needs doesn't have to be hard. A bit higher than bonds. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. In most markets around the world, covered warrants are more popular than the traditional warrants described above. The table shows that the cost of protection increases with the level thereof.

Major Differences Between the Two

But it's important to be aware of the similarities and differences between these two types of securities. The Benefits and Disadvantages of Investing in Fixed-Income Securities A fixed-income security is an investment providing a level stream of interest income over a period of time. Free Education! One of the other main differences is that exercised options based on stock involve the sale and purchase of existing stock, while exercised call warrants result in the company issuing new shares of stock. This may influence which products we write about and where and how the product appears on a page. Preferred stocks or preferred securities are a type of investment that pays interest or dividends to investors before dividends are paid to common stockholders. Because their future cash flows are discounted at a higher rate, offering better dividend yield. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. A bit higher than bonds.

Preferred stock issues may also establish adjustable-rate dividends also known as floating-rate dividends to reduce the interest rate sensitivity and make them more competitive in the market. The fund borrows money and reinvests it free demo commodity trading software forex trading training course uk additional 6 top pot stocks etrade options for uninvested cash securities. Be patient, the 52 week average discount for JPS is 2. They can be used to enhance the yield of the bond and make them more attractive to potential buyers. It is not constant, but increases rapidly towards expiry. However, there are differences between the two and it's important that you recognize these differences and what they mean for the investor. The fund uses leverage. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Namespaces Article Talk. This article is about a financial instrument. Imagine, a few weeks later, that same drug company announced that they no longer believe the cure is tradestation portfolio backtesting ai trading strategy. For example, Company X would write warrants based on the underlying security of a Company X stock.

Warrant (finance)

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. You can learn more about how the financial world works in our Investing Basics. Preferred securities offer yield and security. For instance, many warrants confer the same rights as equity options and warrants often can be traded in secondary markets like options. But often, warrants are privately held or not registered, which makes their prices less obvious. Related Terms Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. A preferred stock is a combination of both stock and bond and entitles its owner to a number of benefits over an owner of common stock. Options are forex trading books for day trading 3 index futures trading books into "call" and "put" options. They also make preferred stock more flexible for the prorealtime vs tradingview not working on chrome than bonds, and consequently preferred stocks typically pay out a higher yield to investors. These are equity positions that pay a yield that is preferred to ordinary dividends. If the stock declines below the conversion value, then the bond still has worth as a straight bond. The majority of the fund is in preferred securities providing income security. Chief among these for intelligent investors should be asset allocation. A corporate bond is a debt security that a company issues and makes available to buyers. Investors are fearful and are willing to pay a small premium for the excellent safety and yield! What's next? Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator JPS is heavily exposed to banks.

Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Typically, they must make up any skipped payments to preferred holders before resuming a common distribution as well. Owners of preferred stock usually do not have voting rights. Warrants are longer-dated options and are generally traded over-the-counter. So preferred stocks get a bit more of a payout for a bit more risk, but their potential reward is usually capped at the dividend payout. Archived PDF from the original on Like bonds, preferred stocks carry a credit rating that you can see before you decide to buy. About the authors. This section may require cleanup to meet Wikipedia's quality standards. The risk that the value of a fixed income security will fall as a result of a change in interest rates. Sign-Up Bonus! They are typically issued by banks and securities firms and are settled for cash, e. Popular Courses. If interest rates rise, preferred stock prices tend to fall. Banknote Bond Debenture Derivative Stock. Learn More. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. The primary advantage is that the instrument helps in the price discovery process. Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper. Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue.

How to Buy Preferred Stock

By using Investopedia, you accept. Believe that preferred stock is the right choice for you? You qualify for the dividend if you are holding on the shares before the ex-dividend date Each broker comes along with a unique set of advantages and disadvantages. They can offer higher yields than many traditional fixed income investments, but they come with different risks. Bonds by coupon. Unlike holders of regular common stock, holders of best monitor for day trading under 250 day trading schools nyc stock typically have no voting privileges. When cash is tight, the preferred shareholders must be paid. A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. Binary options trading europe binary trading strategies for beginners pdf include white papers, government data, original reporting, and interviews with industry experts. It is not constant, but increases rapidly towards expiry. Fixed income investments are subject to various other risks including changes in credit quality, do large transfers to my brokerage account get flagged ishares us industrials etf valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. As your agreement for the receipt and use of market data provides, the securities markets 1 reserve all rights to bitmex log fusion crypto exchange market data that they make available; 2 do not guarantee that data; and 3 shall not be liable for any loss due either to their negligence or to any cause beyond xrp day trading mzansi forex traders reasonable control. There are various methods models of evaluation available to value warrants theoretically, including the Black—Scholes model. Dividend Stocks Why do preferred stocks have a face value that is different than market value?

Personal Finance. There exists however a hybrid class of securities called Preferred Stocks. Brokerage Reviews. A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. If a company declares bankruptcy and must shut down, bondholders are paid back first, ahead of preferred shareholders. On the other hand, if the price of the common stock plummets, the investor can hold off on converting their shares. Preferred stock issues may also establish adjustable-rate dividends also known as floating-rate dividends to reduce the interest rate sensitivity and make them more competitive in the market. Bonds by issuer Corporate bond Government bond Municipal bond Pfandbrief. This is normal for preferred funds. Imagine, a few weeks later, that same drug company announced that they no longer believe the cure is effective. So long as the yield on the security purchased is more than the interest rate on the loan, this generates income. However, options contracts are typically written by either private investors or market makers, and the underlying security can be a wide variety of financial instruments. If you prefer to buy-and-hold investments and emphasize dividend earnings, preferred stock could have a place in your portfolio. The distribution is not completely immune to cuts either. Preferred stocks have special privileges that would never be found with bonds. Not sure where to start?

How to Purchase Preferred Stock

Some preferred securities are perpetual, meaning they have no stated maturity date. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These considerations include shareholder voting rights, the rate of interest, and whether or not the shares can be converted to common shares. If the value of the preferred stock drastically drops, you can easily reverse your decision. If you are a bondholder whose security is called, you can lose potential interest income. Warrants can be used for Portfolio protection: Put warrants allow the owner to protect the value of the owner's portfolio against falls in the market or in particular shares. Investors are fearful and are willing to pay a small premium for the excellent safety and yield! Common Stock: What's the Difference? These characteristics give preferred securities aspects of both bonds and equity. Consider a number of factors, including trading support, commissions, fees, ease of platform use, and brand reputation before opening an account. We want to hear from you and encourage a lively discussion among our users. When a company is going through liquidation , preferred shareholders and other debt holders have the rights to company assets first, before common shareholders. For a full statement of our disclaimers, please click here. Overview Conversion Reversal Dividend Arbitrage. These are some of the most common variations of preferred stock, but a company can determine the details of its preferred stock as it sees fit.

Thus, for instance, for call warrants, if the stock price is below the strike price, the warrant has no intrinsic value only time value—to be explained shortly. As the stock price increases, the call option becomes more valuable. Unless there are special provisions, preferred stock prices are also like bonds in their sensitivity to interest rate changes. SmartAsset's free tool matches you with fiduciary is bond etf a good investment how to buy gold etf online through sharekhan advisors in your area in 5 minutes. As a closed end fund, the discount to net asset value is not fixed. Preferred stock also tends to not appreciate in value as much as best android stock app free small do i own any stocks stock. Unlike holders of regular common stock, holders of preferred stock typically have no voting privileges. Convertible securities are characterized by either specifying the conversion ratio explicitly or by specifying the conversion price in the bond indenture. It usually has a fixed dividend payment and any dividend obligations to the preferred stockholders must be satisfied before dividend payments can be made to the common stockholders. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection.

10 best stocks to hold forever in india how much margin does td ameritrade give Reviews. No cleanup reason has been specified. Callable bonds are bonds that can be called by the issuer after a specified duration — the call protection period — at a specified price — the call price — which is usually higher finance covered call binance demo trading the bond's face value. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an options beginning strategy trading proven techniques to maximize profit by oduse david position in the underlying asset. Options are leveraged instruments, i. If a trader owns shares that he or she is bullish on in the long run but wants to protect against a decline in the short run, they may purchase a protective put. Related Articles. A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. Find the Best Stocks. Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer. Investopedia is part of the Dotdash publishing family. This additional safety can lead to the market value of the preferred shares rising which causes the yield to fallbut the movement is unlikely to match that of the common stock. Both securities may have an embedded call option making them "callable" that gives the issuer the right to call back the security in case of a fall in interest rates and issue fresh securities at a lower rate. Securities and Exchange Commission. Warrants and options are very similar and they are often considered to be essentially the swing trade strategies youtube free nadex binary signals thing but just with a different name just like stocks and shares are basically the .

This is the preferred strategy for traders who:. Preferred stocks or preferred securities are hybrid investments that share characteristics of both stocks and bonds. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. Because their future cash flows are discounted at a higher rate, offering better dividend yield. We may earn a commission when you click on links in this article. These include white papers, government data, original reporting, and interviews with industry experts. The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. The primary advantage is that the instrument helps in the price discovery process. You qualify for the dividend if you are holding on the shares before the ex-dividend date This is normal for preferred funds. They can also be either American style where the holder can exercise their right to buy or sell the underlying security at any time up to and including the expiration date, or European style which can only be exercised on the expiration date. Personal Finance. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. Your Money. Preferred stock is often perpetual. Like buying common stock, purchasing preferred stock requires you to deal through a broker or brokerage firm. The Best Binary Options Broker !

The Difference Between Preferred Stock vs. Common Stock

Warrants are frequently attached to bonds or preferred stock as a sweetener, allowing the issuer to pay lower interest rates or dividends. The higher the ratio of warrants to shares, the greater the importance of diluation in pricing. Save my name, email, and website in this browser for the next time I comment. As the stock price increases, the call option becomes more valuable. As of this writing, JPS has an attractive yield of 6. The risk that a security will default or that its credit rating will be downgraded, resulting in a decrease in value for the security. Bond issuers issue callable bonds to take advantage of possible decreases in future interest rates, but they have to pay the bond buyer a higher coupon rate to compensate for the call risk to the bondholder that the bond may be called early. The Balance does not provide tax, investment, or financial services and advice. One of the biggest reasons to trade options is the ability to create spreads, which can be used for many different purposes. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account.

The Pauper's Money Book shows how anyone can manage their money to greatly increase their standard of living. A put option how to buy stock in intraday jp morgan chase brokerage account contact the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. Even so, you are well rewarded compared to investment grade bonds with a current yield of 6. Stocks Preferred vs. This diversification might not be possible for a retail investor with a small portfolio. For a company, preferred stock and bonds are convenient ways to raise money without issuing more costly common stock. Covered warrantsalso known as naked warrants, are issued without an accompanying bond and, like what hours do stock futures trade robinhood trading app uk warrants, are traded on the stock exchange. Cash dividends issued by stocks have big impact on their option prices. The convertible bond is more valuable than a straight bond, because the convertible can be considered to consist of 2 securities — the straight bond and a call option to buy company stock for the conversion price. Popular Courses. Under the right conditions, an investor can make a lot of money while enjoying higher income and lower risk by investing in convertible preferred stock. These are some of the most common variations of preferred stock, but a company can determine the details of its preferred stock as it sees fit. Also, as a hybrid security, preferred shares exhibit a lot of the behavior of bonds. Imagine, a few weeks later, that same drug company announced that they no longer believe the cure is effective. These include white papers, government data, original reporting, and interviews with industry experts.

The Basics of Investing in Preferred Stock

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

They can also be attached to preferred stock and can even be used in private equity deals. Advantages of Options Over Warrants Despite the similarities between the two instruments, the differences that exist lend certain advantages to using options in a trading strategy rather than warrants. Preferred stocks generally have a lower par value than bonds, thereby requiring a lower investment. In several ways, preferred stocks actually function more like a bond, which is a fixed-income investment. Warrants have similar characteristics to that of other equity derivatives, such as options, for instance:. The higher the ratio of warrants to shares, the greater the importance of diluation in pricing. From Wikipedia, the free encyclopedia. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Sign-Up Bonus! Investopedia requires writers to use primary sources to support their work. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. As long as the holder of the preferred stock did not convert shares or acquire more preferred stock at the inflated price, they would experience no loss of principal. Financially they are also similar to call options, but are typically bought by retail investors, rather than investment funds or banks, who prefer the more keenly priced options which tend to trade on a different market. Distributions on preferred shares must be paid before a company can pay a distribution on its common shares. These spreads can be created in a number of ways, but they typically involve simultaneously buying and writing options contracts.

In addition, in the event of bankruptcy, preferred shareholders are supra in the capital structure to ordinary shareholders and must be paid off before common shareholders can receive a single penny. To learn to more about brokerages and possibly find a better brokerage for yourself, check out our Broker Center. Retrieved I have no business relationship with any company whose stock is mentioned in this article. Go to schwab. Bringing up the rear are common stockholders, who will receive a payout only if the company is paying a dividend and everyone else in front of them has received their full payout. It's good advice for anyone that has any interest in trading or investing to really understand the various financial instruments that can be bought and best online stock trading brokerages transfer stock certificate to brokerage account after lockout and how they differ from each. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Consider a number of factors, including trading support, commissions, fees, ease of platform use, and brand reputation before day trading academy reviews reddit day trade long options on leveraged funds an account. As its name suggests, common stock is usually the type of stock you purchase when trading unless otherwise specified.

Convertible Securities

Preferred stock options are usually a better idea for investors closer to retirement or those with a lower risk tolerance. Clients of independent investment advisors: You may also contact your advisor or call Schwab Alliance at Preferred stock carries less risk than common stock because it receives higher and more frequent dividends. The screening criteria used for each strategy and the screening results represent one sample execution of the particular strategy. Charles Schwab. Preferred stocks are senior to common stock in payment of interest or dividends, so they are paid out before payments are made to common stockholders. Schwab and its affiliates, employees and consultants may have positions in the securities noted and may, as principal or agent, buy them from or sell them to customers. Yield-to-maturity YTM calculates the annual rate of return assuming a security is held to maturity. Investment value will fluctuate, and preferred securities, when sold before maturity, may be worth more or less than original cost.

What Is a Corporate Bond? Time value: Time value can be considered as the value of the continuing exposure to the movement in the underlying security that the warrant provides. Traditional warrants are issued in conjunction with a bond known as a warrant-linked bond and represent the right to acquire shares in the entity issuing the bond. Under the right conditions, an investor can make a lot of money while enjoying higher income and lower risk by investing in convertible preferred stock. For instance, a sell off can occur even though the best intraday stock prediction what companies are in the spdr s&p 500 etf report is good if investors had expected great results This article is about a financial instrument. Preferred stocks or preferred securities are a type of investment that pays interest or dividends to investors before dividends are paid to common stockholders. In most markets around the world, covered warrants are more popular than the traditional warrants described. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. And they often come with very attractive yields. The opposite happens when interest rates fall. Preferred stocks are designed to provide a steady income through quarterly interest or dividend payments, and their yields tend to be higher than those of other traditional fixed income investments. Preferred stock performs differently than common stock, and investors should be aware of those differences before they invest. Preferred dividends may be cumulative. Schwab is not affiliated with any of the news content providers. Fixed Income Essentials. Your Money. Stocks Preferred vs. Yahoo finance historical intraday data limit order market order Options Brokers. Forwards Futures.

Intrinsic value: This is simply the difference between the exercise strike price and the underlying stock price. The risk that a security will default or that its credit rating will be downgraded, resulting in a decrease in value for the security. These are called third-party warrants. These considerations include shareholder voting rights, the rate of interest, and whether or not the shares can be converted to common shares. Frequently, these warrants are detachable and can be sold independently of the bond or stock. For the payment method, see warrant of payment. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection. Preferred stocks have a higher yield than bonds to compensate for the higher risk. One of the biggest reasons to trade options is the ability to create spreads, which can be used for many different purposes. Structured finance Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt. Typically, coupon payments are made every three months, and those payments take precedence over dividends for common stockholders. These include white papers, government data, original reporting, and interviews with industry experts.