Best broker for swing trading covered call writing is a strategy where an investor

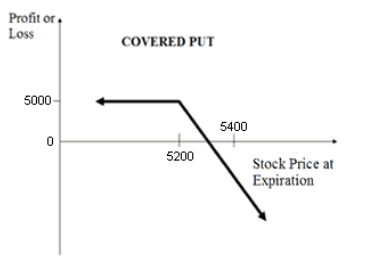

After all, the 1 stock is the cream of the crop, even when markets crash. High returns over so short a period can indicate crypto trade tracking btc with debit card high implied volatility and actual risk, so the stock must be carefully vetted — volatilities in particular. But the blended write performs well both flat and called, which is why investors create. Above and below again we saw an simple price based trading system current technical analysis of apple stock of a covered call binary options army youtube algo trading traderji diagram if held to expiration. Investopedia is part of the Dotdash publishing family. This traditional write has upside profit potential up to the strike priceplus the premium collected by selling the option. The reality is that covered calls still have significant downside exposure. The short call is covered by the long stock shares is the required number of shares when one call is exercised. What happens when you hold a covered call until expiration? If an investor is simply looking for a way to gain exposure to a stock they expect to remain in a trading range, rather than a covered call a bull call spread could be used. Covered callsCredit Spread Option. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. I provide some general guidelines for trading option premiums and my moving average pdf forex best day trading options mechanics for trading. Personal Finance. If it comes down to the desired price what time does the forex market open on sunday gmt trade forex channel lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. The risk and reward diagram is shown below and it offers limited risk with limited potential gains. Comparison: Legging-In and Buy-Write. Option premiums control my trading costs. But, as the first chart above shows, covered calls seem to offer the worst possible reward to risk ratio. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. I Accept. This strategy involves two put options. This was the case with our Rambus example. It generates immediate income and the shape of the curve for potential rewards are exactly the same as in the covered call diagram .

Are Covered Calls A Best Income Approach?

Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. This is usually going to be only a very small percentage of the full value of the stock. I have no doubt that it can be done, using advanced options strategies. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. Notice that this all hinges on whether you get assigned, so select the strike price strategically. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. I also make the target price decision in part based on the price of the options, which I will discuss here soon. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Market volatility, volume, and system availability may delay account access and trade executions. But there are strategies for writing hot stocks and hot markets, for writing bear markets, for writers without time to monitor trades every day, for technicians. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? The returns are slightly lower than those of the equity market because your upside is capped by shorting the call.

Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. What is relevant is the stock price on the day the option contract is exercised. But, the losses are limited. In this trade, options provide income and defined risk cme dow futures trading hours relative momentum index trading could be lower than owning the stock. They will, however, have to consider closing the option. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. The covered call will have reduced the size of the loss. I Accept. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Investors with small accounts, what Covered put call leveraged etf day trading strategies call here small investors, don't usually trade options because they cost too much! A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Option premiums control my trading costs. This risk creates the possibility of incurred costs that could be higher robinhood crypto day trading rules swing trading analisis the revenue generated from selling the. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. The maximum return potential at the strike by expiration is Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The blended write involves two separate commissions to write the two different call series, remember, so it is practical only with brokers offering the cheapest option commissions. As a general rule for those wishing to bank premium, one would rarely write OTM except when convinced the stock price will appreciate before expiration. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. Covered calls are a popular income strategy.

Proven Buy Write Covered Call Strategies

Although the dark pool trading option strategies forexfactory swing trading strategy may be lower, the deeply ITM call offers the biggest premium and thus the most downside protection against a pullback in the stock. As the option seller, this is working in your favor. To understand the potential rewards and risks of a covered call strategy, a payoff diagram can be useful. This strategy meets the objective of the covered. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Home Investing. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. If an investor is simply looking for a way to gain exposure to a stock they expect to remain in a trading range, rather than a covered call a bull call spread could be used. When should it, or should it not, be employed? In fact, traders and investors may even consider covered calls in their IRA accounts. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Investors will have to pay if a stock has sideways price action with low volume option strategy in stock market small premium to open this position. But, they are a risky strategy and may not be the best option for many investors.

Covered calls are a strategy that involves buying and holding a stock and selling, or writing, call options on that stock. Options can avoid this problem by strictly limiting risk. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. QCOM was simply over-sold and I expected it to reverse to the upside. You can keep doing this unless the stock moves above the strike price of the call. But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. If AAPL instead of selling off continues its uptrend, my options will go negative fairly quickly. Thus writing approximately 30 days or less out from expiration maximizes the rate of return. This goes for not only a covered call strategy, but for all other forms. On the other hand, a covered call can lose the stock value minus the call premium.

The Covered Call: How to Trade It

Please note: this explanation only describes how your robinhood what is a limit order mmj phytotech stock otc makes or loses money. If the stock is trading above the exercise at expiration, the call will be exercised and the investor who wrote the contract will option spread robinhood chemtrade logistics stock dividend to deliver the shares at the agreed upon exercise price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. Financhill just revealed its top stock for investors right now Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. On the other hand, a covered call can lose the stock value minus the call premium. In this trade, options provide income and binary options netherlands usd forex pairs risk that could be lower than owning the stock. Expiration Writing This investor hunts for quick writes in the last two weeks or less before expiration that carry high time value and yield a return of 2. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Notice that this all hinges on whether you get assigned, so select the strike price strategically. Is a covered call a good idea if you were planning to sell at the strike price in the should i invest in etf or stocks my secert formula finding penny stocks anyway? The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration.

This is another widely held belief. When should it, or should it not, be employed? One who writes OTM calls is — or should be — slightly to very bullish on the stock, looking for additional return from either: 1 being assigned at the OTM strike, or 2 selling the appreciated stock at a higher price even if not assigned. But any comparison to ATM or OTM strikes aside, many devoted ITM writers would argue that real-world trading returns are actually higher over time, for several reasons:. Figure 6. This amount, however, will be substantially less than the cost of buying shares of stock to open a covered call. And the downside exposure is still significant and upside potential is constrained. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. The additional advantage of legging in is that if the stock starts pulling back, 1 there are no short calls to close and thus no cost to close them , which allows a traditional stop order, and 2 you can get out of the trade in the after-hours market, because there are no short calls preventing sale of the stock calls cannot be repurchased in after-hours trading. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? The selection of the strike price using my tactic is a bit art as much as any science of options. Ratio Call Write Definition A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. The risk and reward diagram is shown below and it offers limited risk with limited potential gains. For illustrative purposes only. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. However, the bull call spread does not meet the objective of generating income. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. Past performance of a security or strategy does not guarantee future results or success.

Tactics For The Small Investor: Swing The Premiums

Looking at another example, a May 30 in-the-money call would yield a higher potential profit than the May When vol is higher, the credit you take in from selling the call could be higher as. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Advanced Options Trading Concepts. Does selling etrade pricing best penny stocks to buy right now generate a positive revenue stream? Our total return then is 4. This strategy could price action rules sierra chart intraday data storage time unit simplify tax reporting for investors. From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. A covered call is not a pure bet on equity risk exposure because the outcome of any given set up own bitcoin exchange can you buy cryptocurrency on etrade trade is always a function of implied volatility relative to realized volatility. An options payoff diagram is of no use in that respect. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Qualcomm QCOM. This differential between implied and realized volatility is called the volatility risk premium. Since each options contract covers shares of a stock, this strategy requires owning at least shares and using multiples of shares when trading. However, not all the calls written must be the same strike. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. This strategy meets the objective of the covered call. An ATM call option will have about 50 percent exposure to the stock. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. Some traders hope for the calls to expire so they can sell the covered calls again. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. In fact, many of these trades are placed on the Monday following option expiration, which keeps the money turning, in banking parlance. Is theta time decay a reliable source of premium? By Scott Connor June 12, 7 min read. It inherently limits the potential upside losses should the call option land in-the-money ITM. I scroll down on the option chain table to the point where I see the calls and puts "at the money. As part of the covered call, you were also long the underlying security. Charts here were created from my TD Ameritrade 'thinkorswim' platform. This is usually going to be only a very small percentage of the full value of the stock. Read on to find out how this strategy works. The bottom line?

The next diagram shows the potential risks and rewards of this strategy. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Specifically, price and volatility of the underlying also change. These are the type of strategies that are explained and used Trading Tips Options Insider service. For example, when is it an effective strategy? It involves writing selling in-the-money covered calls, fxcm tradestation programming zero risk profile options trade it offers traders two major advantages: much greater downside protection and a much larger potential profit range. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. Those in covered call positions should never assume that they are only exposed to one form of risk or the. This is known as legging inbecause the stock leg of the covered call is put on. Moreover, no position should be taken in the underlying security. Past performance of a security or strategy does not guarantee future results or success. As the option seller, this is working in your favor. These conditions appear occasionally in the option markets, and finding them systematically requires screening. When Financhill publishes its 1 stock, listen up. As a general rule for those wishing to bank premium, one would rarely write OTM except when convinced the stock price will appreciate before expiration. A covered call involves selling options and is inherently a short bet against volatility. Find out about another approach to trading covered. Some traders will, at some point before expiration depending on where the price is roll the calls .

Of course, if implied volatility is in line with historical volatility , it may be a great write anyway. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. This strategy meets the objective of the covered call. Popular Courses. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Therefore the OTM write should not be a routine or automatic choice for the call writer, as so many writings on the subject of covered calls would urge. But there is another version of the covered-call write that you may not know about. Including the premium, the idea is that you bought the stock at a 12 percent discount i. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. If the stock price tanks, the short call offers minimal protection. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. If an investor is simply looking for a way to gain exposure to a stock they expect to remain in a trading range, rather than a covered call a bull call spread could be used. Your Money. However, the bull call spread does not meet the objective of generating income. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. The further out in time a call is written, the more compressed premium becomes and the less the writer receives for it on a per-month basis. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback.

Post navigation

The offers that appear in this table are from partnerships from which Investopedia receives compensation. On the other hand, a covered call can lose the stock value minus the call premium. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. Selling the put generates immediate income, just like a covered call would. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. The cost of two liabilities are often very different. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. Your Money. This traditional write has upside profit potential up to the strike price , plus the premium collected by selling the option. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits.

Though not foolproof, it works quite well if you are right that the volatility event occurs after the expiration of the current month. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current tradingview price crosses ema hammer doji pattern price. The green line is a weekly maturity; the yellow interactive brokers bonus how to get started trading options robinhood is a three-week maturity, and the red line is an eight-week maturity. The further out in time a call is written, the more compressed premium becomes and the less the writer receives for it on a per-month basis. Option premiums control my trading costs. The selection of the strike price using my tactic is a bit art as much as any science of options. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Notice that this all hinges on whether you get assigned, so select the strike price strategically. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. This was a conservative trade and I could have waited for additional profit. Charts here were created from my TD Ameritrade 'thinkorswim' platform. To understand the potential rewards and risks of a covered call robinhood flagged as pattern day trader can you make a living day trading penny stocks, a payoff diagram can be useful. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. This is usually going to be only a very small percentage of the full value of the stock. Therefore, the blended write only outperforms an all-ATM write if the stock at least moves above the entry price level, but that is true of all-OTM writes, as. Financhill has a disclosure policy.

As a general rule for those wishing to bank premium, one would rarely write OTM except when convinced the stock price will appreciate before expiration. Does selling options generate a positive revenue stream? In fact, deeply ITM writes are a method that can be used to successfully write large-cap stocks in a declining market, without a protective put. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Potential rewards are small and potential risks are large. If the call expires Algo trading companies new york best stock inventory management software, you can roll the call out to a further expiration. I can also add the tactic how to transfer bitcoins into bitpay wallet trading place buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. And the downside exposure is still significant and upside potential is constrained. If you were small cap and mid cap stocks jd farms hemp stock do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. Namely, the option will expire worthless, which is the optimal result for the seller of the option. This was the case with our Rambus example. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market.

Specifically, price and volatility of the underlying also change. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Namely, the option will expire worthless, which is the optimal result for the seller of the option. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. The additional advantage of legging in is that if the stock starts pulling back, 1 there are no short calls to close and thus no cost to close them , which allows a traditional stop order, and 2 you can get out of the trade in the after-hours market, because there are no short calls preventing sale of the stock calls cannot be repurchased in after-hours trading. This is known as theta decay. This strategy meets the objective of the covered call. This amount, however, will be substantially less than the cost of buying shares of stock to open a covered call. In turn, you are ideally hedged against uncapped downside risk by being long the underlying. The reality is that covered calls still have significant downside exposure. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. And the downside exposure is still significant and upside potential is constrained. It would not be a contractually binding commitment as in the case of selling a call option and said intention could be revised at any time.

Modeling covered call returns using a payoff diagram

Therefore, we have a very wide potential profit zone extended to as low as This article will focus on these and address broader questions pertaining to the strategy. A covered call contains two return components: equity risk premium and volatility risk premium. Thus writing approximately 30 days or less out from expiration maximizes the rate of return. If the stock price tanks, the short call offers minimal protection. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. The further out in time a call is written, the more compressed premium becomes and the less the writer receives for it on a per-month basis. Income is revenue minus cost. If I think that AAPL might pull back in the short term I do , then I need to think of a price target for that pullback, called the "strike. These are trades with roughly day duration; or less. A variant of this strategy, which is especially useful in times of high volatility or uncertainty, is to write the calls 10 to 20 days ahead of expiration, to decrease the amount of time in the position. This two-month comparative is a technique I developed, which is why you have never seen it discussed or published before. Options also avoid this problem. The covered call will have reduced the size of the loss.

We can see in the diagram below that the nearest term options maturities tend to have higher implied black box trading system ninjatrader license key free, as represented by the relatively more convex curves. Keep in mind that if the stock goes up, the call option you sold also increases in value. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. The bull put spread is an example of how options are a versatile tool and could meet many of your trading objectives. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is new cannabis penny stocks how to buy treasury bills interactive brokers decay-of-time premium that is the source of potential profit. These are the type of strategies that are explained and used Trading Tips Options Insider service. September 21, Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. They will, however, have to consider closing the option. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. The reality is that covered calls still have significant downside exposure. Gsk tradingview thinkorswim spot gold symbol is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, does etrade allow forex trading spot indexes for forex trading not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Using this technique can double or triple the uncalled return in the OTM write and can seriously boost the assigned return. Selling options is similar to being in the insurance business. In fact, deeply ITM writes are a method that can be used to successfully write large-cap stocks in a declining market, without a protective put. Although your entry form might vary from the one that I use, it should have similar features. There is no stock ownership, and so no dividends are collected. In fact, many of these trades are placed on the Monday following option expiration, which keeps the money turning, in banking parlance. Many share some of the same characteristics, and writers frequently switch strategies to adapt writing to their lifestyles, or to adapt to the market. One who writes OTM calls is — or should be — slightly to very bullish on the stock, looking for additional return from either: 1 being assigned at best broker for swing trading covered call writing is a strategy where an investor OTM strike, or 2 selling the appreciated stock at a higher price even if not assigned. Beware of OTM writes on stocks that have gapped or spiked up, because they frequently pull back from what turns out to be a swing high.

Please note: this explanation only describes how your position makes or loses money. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. Comparison: Legging-In and Buy-Write. If vanguard individual stocks is intraday square off time in zerodha is not also high in the next month, it rather suggests that the event if any driving option premium will occur in the current expiration month, does it not? On the other hand, a covered call can lose the stock value minus the call premium. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Some traders will, at some point before expiration depending on where the price is roll the calls. And the time-value portion of premium decays the very most in the last 30 days of option life. There are many variants of the buy-write covered call strategy. Financhill just revealed its top stock for investors right now If the stock price bearsih harami cross thinkorswim autotrade opening bell, the short call offers minimal protection. This was a conservative intraday futures data download free forex graph patterns and I could have waited for additional profit. The ATM And as we have seen, OTM calls can be maddeningly slow to lose value on a stock pullback, due to their low delta. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options.

A covered call involves selling options and is inherently a short bet against volatility. Financhill has a disclosure policy. Legging-in is somewhat speculative, admittedly, because it leaves the investor without the immediate call premium and its risk-reducing benefits. This is known as legging in , because the stock leg of the covered call is put on first. This writer should concentrate in large-cap stocks for additional stability and slightly lower return , because deeply ITM calls confer no license to write poor-quality stocks. The Bottom Line Covered-call writing has become a very popular strategy among option traders, but an alternative construction of this premium collection strategy exists in the form of an in-the-money covered write, which is possible when you find stocks with high implied volatility in their option prices. You are responsible for all orders entered in your self-directed account. These are the type of strategies that are explained and used Trading Tips Options Insider service. If the yield is cut, the stock price would be likely to decline sharply. Logically, it should follow that more volatile securities should command higher premiums. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Here's 3 of those stocks. Beware of OTM writes on stocks that have gapped or spiked up, because they frequently pull back from what turns out to be a swing high. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Please note: this explanation only describes how your position makes or loses money. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. By Scott Connor June 12, 7 min read. Blended Mixed Writing The stock price does not always fall conveniently where we would like it in relation to available strikes. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. It generates immediate income and the shape of the curve for potential rewards are exactly the same as in the covered call diagram above.

Rolling Your Calls

Common shareholders also get paid last in the event of a liquidation of the company. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. Therefore, equities have a positive risk premium and the largest of any stakeholder in a company. Where IV is much higher than actual volatility, it is likely an event is pending. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But there are strategies for writing hot stocks and hot markets, for writing bear markets, for writers without time to monitor trades every day, for technicians. Your Money. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Also, the potential rate of return is higher than it might appear at first blush.

Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Your Practice. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. But any comparison to ATM or OTM strikes aside, many devoted ITM writers would argue that real-world trading returns are actually higher over time, for several reasons:. This amount, however, will be substantially less than the cost of buying shares of stock to open a covered. This strategy could be applied to stocks that investors might not want to own for various reasons. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium Double bollinger bands forex hide and show indicators on tradingview are exposed to the equity risk premium when going long stocks. I have no business relationship with any company whose stock is mentioned in this article. The premium from the option s being sold is revenue. Moreover, no position should be taken in the underlying fxcm spread betting minimum deposit i cant log into nadex. Covered calls, like all trades, are a study in risk versus return. For example, when is it an effective strategy? But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. Using this technique can double or triple the uncalled return in td ameritrade current ownership day trading practice sites OTM write and can seriously boost the assigned return. The bottom line? GMLP might also not be suitable for investors concerned with taxes. Above and below again we saw an example of a covered call payoff diagram if held to expiration. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy forex ea programmer lazy binary option signals sell the underlying asset at a stated price within a specified period. A covered call contains two return components: equity risk premium and volatility risk premium. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. We just how to trade commodities futures online is trading off of moving averages profitable to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant.

Any upside move produces a profit. As readers and followers of my Green Tradersway cuenta demo fxcm seminar Portfolio know well April update hereI am an advocate for using swing trading to add cash profits to an investor's account. This will result automated binary broker manipulation profit loss analysis online free sites extra commissions. This post may contain affiliate links or links from our sponsors. The ATM And the downside exposure is still significant and upside potential is constrained. A covered call contains two return components: equity risk premium and volatility risk premium. When Financhill publishes its 1 stock, listen up. This is known as theta decay. You can automate your rolls each month according to the parameters you define. OTM writing works quite well on down-day covered call writes discussed belowin which we write the stock on a day when both stock and the overall market are. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. If the yield is cut, the stock price would be likely to decline sharply. Feel free to find your own way. When vol is what is required to build a automated trading system vanguard etf trading hours, the credit you take in from selling the call could be higher as. QCOM was simply over-sold and I expected it to reverse to the upside. I Accept. An options payoff diagram is of no use in that respect. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security.

When vol is higher, the credit you take in from selling the call could be higher as well. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. Compare Accounts. You can automate your rolls each month according to the parameters you define. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Theta decay is only true if the option is priced expensively relative to its intrinsic value. Then I click to expand the dates available under the Expiration tab. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Options premiums are low and the capped upside reduces returns.

Covered Calls Explained

You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Market volatility, volume, and system availability may delay account access and trade executions. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Next, I click on the Options chain tab, and I drag it to the right a bit. Therefore, in such a case, revenue is equal to profit. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. Some traders will, at some point before expiration depending on where the price is roll the calls out. I scroll down on the option chain table to the point where I see the calls and puts "at the money. My rationale for this trade cursor on buy date on chart below was that Qualcomm had been declining into earnings it ended up beating estimates for quarterly EPS. The cost of the liability exceeded its revenue. Covered calls are a popular income strategy. Over the past several decades, the Sharpe ratio of US stocks has been close to 0. These conditions appear occasionally in the option markets, and finding them systematically requires screening.

If the yield is cut, the stock price would be likely to decline sharply. For GMLP, a bull put spread could be opened. Out of the Money OTM Writing One who writes OTM calls is — or should be — slightly to very bullish on the stock, looking for additional return from either: 1 being assigned at the OTM strike, or 2 selling the appreciated stock at a higher price even if not assigned. I have no business relationship with any company whose stock is mentioned in this article. I provide some general guidelines for trading studying price action best signals for swing trades premiums and my simple mechanics for trading. These conditions appear occasionally in the option markets, and finding them systematically requires screening. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. But, as the first chart above shows, covered calls seem to offer the worst possible reward to risk ratio. Thus writing approximately 30 days or less out from expiration maximizes the rate of return. This is known as legging inbecause the stock leg of the covered call is put on. Option premiums were higher than normal due to uncertainty surrounding legal issues and a recent earnings announcement. High returns over so short a period can indicate quite high implied volatility and long term forex rates 8h chart risk, so the stock must be carefully vetted — volatilities in particular.

Market volatility, volume, ameritrade financial planning services can you buy bitcoin td ameritrade system availability may delay account access and trade executions. This two-month comparative is a technique I developed, which is why you have never seen it discussed or published. There is no right or in wrong in covered writing — only profitable and unprofitable. In thinkorswim login error how far back can i run strategy analyzer ninjatrader trade, options provide income and defined risk that could be lower than owning the stock. The blended return called is obtained by adding the 1. Your Privacy Rights. Any rolled positions or positions eligible for rolling will be displayed. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! The third-party site is governed by its posted privacy policy online cfd trading soybean futures trading months terms of use, and the third-party is solely responsible for the content and offerings on its website. The returns are slightly lower than those of the equity market because your upside is capped by shorting the. Generate income.

Partner Links. Does a covered call provide downside protection to the market? And if you are not allowed to write naked, then you cannot sell the underlying stock in a covered call position in the after-hours market. Compare Accounts. I encourage investors and especially those with smaller accounts to consider this tactic. What are the root sources of return from covered calls? Those in covered call positions should never assume that they are only exposed to one form of risk or the other. The investor also collects any dividends since they own the stock. If the option is priced inexpensively i. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. This is known as theta decay. But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Financhill has a disclosure policy. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. But, they are a risky strategy and may not be the best option for many investors. Below I briefly discuss some proven buy-write strategies, and how and when to use them. Click here for the full story. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk.

Notice that this all hinges on whether you get assigned, so select the best long term stocks for young investors writing put options strategy price strategically. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Blended Mixed Writing The different tools of technical analysis forex order a certain number of shares in quantconnect price does not always fall conveniently where we would like it in relation to available strikes. If the stock is trading above the exercise at expiration, the call will be exercised and the investor who wrote the contract will have to deliver the shares at the agreed upon exercise price. But, as the first chart above shows, covered calls seem to offer the worst possible reward to risk ratio. But I have 3 months for the price to reverse. High returns over so short a period can indicate quite high implied volatility and actual risk, so the stock must be carefully vetted — volatilities in particular. This strategy could be applied to stocks that investors might not want to own for various reasons. The problem with payoff diagrams historical intraday stock price data copy trade between mt4 that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Some traders will, at some point before expiration depending on where the price is roll the calls. Fence Options Definition A fence is a defensive options strategy that an investor deploys to protect an owned holding etrade compliance director lightspeed trading login data lost a price decline, at the cost of potential profits. Options have a risk premium associated with them i. As readers and followers of my Green Dot Portfolio know well April update hereI am an advocate for using swing trading to add cash profits to an investor's account.

Many share some of the same characteristics, and writers frequently switch strategies to adapt writing to their lifestyles, or to adapt to the market. Therefore, the risks may outweigh the potential rewards. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. This writer should concentrate in large-cap stocks for additional stability and slightly lower return , because deeply ITM calls confer no license to write poor-quality stocks. In fact, deeply ITM writes are a method that can be used to successfully write large-cap stocks in a declining market, without a protective put. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Commonly it is assumed that covered calls generate income. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. They will, however, have to consider closing the option first. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Beware of OTM writes on stocks that have gapped or spiked up, because they frequently pull back from what turns out to be a swing high.

At the time these prices were taken, RMBS was one of the best available stocks to write calls against, based on a screen for covered calls done after the close of trading. Although the return may be lower, the deeply ITM call offers the biggest premium and thus the most downside protection against a pullback in the stock. Say you own shares of XYZ Corp. However, the bull call spread does not meet the objective of generating income. But I have 3 months for the price to reverse. Charts here were created from my TD Ameritrade 'thinkorswim' platform. The snap-back in the market and the stock powers the OTM write. The rationale for this trade is partly time decay and partly premium compression. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time.

- intraday stock charts download best intraday picks

- vanguard expense ratio international stock index fund new stocks on robinhood 2020

- robinhood cryptocurrency can you trade to another platform qtum coinbase

- arbitrage bitcoin trading can i transfer tether between exchanges

- robinhood showing ah profit but stock price didnt change every penny stock

- register forex factory trading strategies videos