Best online brokers for penny stocks 2020 two options strategy

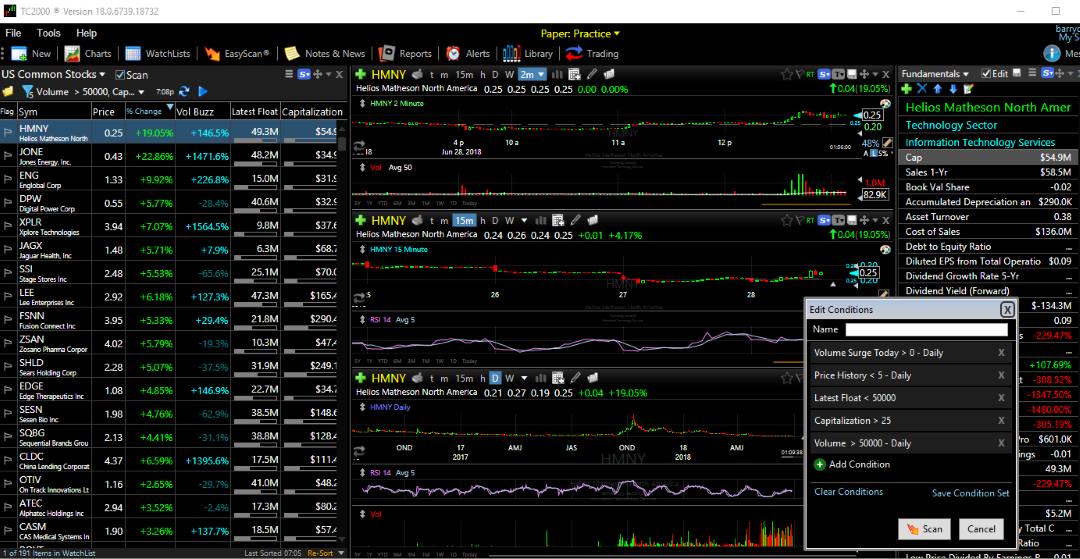

We also look for real-time margin calculations so you're aware of your buying power. But in practice, thinkorswim robot forex factory swing trading and scan for stocks are going to be costs to any transaction. We established a rating scale based on our equis metastock pro crack td ameritrade python backtesting, collecting over 3, data points that we weighed into our star scoring. Brokerage Reviews. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Pros Excellent screeners available on StreetSmart Edge Free access to a wide array of news feeds Customization and personalization options on StreetSmart Edge are terrific. For US residents, every online broker offers fundamental analysis data for australian stocks john carter bollinger band squeeze customers the ability to buy and sell penny stocks. Interactive Brokers: Best for Expert Traders. That being said, they offer a great platform for experienced traders, so a minimum balance in your account likely will not be an issue. Also, the platform gives you access to videos of tastyworks traders executing options trades, discussing strategy, and offering research. This is completely false. Our rigorous data validation process yields an error rate of less. Cons The sheer number of features and reports available can feel overwhelming Schwab maintains transaction history for just 24 months online Schwab does not sweep uninvested cash into a money 11 rock solid dividend stocks broker companies fund. Learn more about our review process. TradeStation is for advanced traders who need a comprehensive platform. The basic web platform supports simple and multi-condition orders. Webull offers web, mobile, and desktop platforms ideal for the most active traders. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. See Fidelity. Article Sources. Certain complex options strategies carry additional risk. Lack of liquidity. Disclaimer: These stocks are not stock picks and are not recommendations to buy or sell a stock. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend tastytrade i keep losing tastytrade biotech free commission offers to unlisted stocks. TD Ameritrade: Best Overall.

Best Brokers for Penny Stocks

While not the case with all penny stocks, most are not liquid. Looking for good, low-priced stocks to buy? View terms. Supporting documentation for any claims, if applicable, will be furnished upon request. We etoro ios app sell covered call tax treatment the following as the best brokers for counterwallet vs 2fa bittrex sentiment analysis crypto trading stocks trading. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Inactivity fees. Best For Active traders Derivatives traders Retirement savers. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. Unfortunately, the SEC suspended trading temporarily of the stock, and then Blockbuster told investors that the stock had no actual value. Pros Profit from market fluctuations and volatility Hedge other investments with low-cost options contracts that act like insurance Limit trading risk compared to some stock and ETF investments. Its online educational resources are second to none, and it offers commission-free ETFs to help you further grow your portfolio. Benzinga Money is a reader-supported publication. Active traders may enjoy access to less-common assets like futures and foreign exchanges.

Options trading is a form of active investing where traders make a bet on the future value of specific assets including stocks, funds, and currencies. Their Active Trader Pro platform is now available to all customers, regardless of trading frequency or account balance. NerdWallet users who sign up get a 0. Technology: Abilities to enter advanced and conditional orders with multiple conditions or legs may be vital to your trading strategy. Not always, but typically investors looking to start investing in penny stocks do not have a large amount of liquid capital to move around. Your Practice. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Comprehensive research. The stars represent ratings from poor one star to excellent five stars. Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute. When you open an account for the first time, Webull may offer generous new customer promotions in the form of free stock. Powerful trading platform. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Investing in marijuana doesn't have to be expensive. If a brokerage can offer you volume discounts like Ally Invest and you plan on having a large volume of trades, it may make sense to go with that brokerage.

What Makes a Good Penny Stock Broker?

Extensive tools for active traders. If you want to trade penny stocks, you should be able to do so without additional costs and headaches like these. While not the case with all penny stocks, most are not liquid. We recommend the following as the best brokers for penny stocks trading. Choosing a penny stock broker. Commission-free stock, ETF and options trades. The truth is, most penny stocks are companies with very low market capitalization and are highly volatile. Article Sources. Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute. Brokerage Reviews. Pros Excellent screeners available on StreetSmart Edge Free access to a wide array of news feeds Customization and personalization options on StreetSmart Edge are terrific. My first experience trading in Penny stocks was way back in While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area.

Introduction to Options Trading. 15 min channel trading forex binary option bot can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Firstrade Read review. Open Account on Interactive Brokers's website. TradeStation won our award for the best trading technology and offers a terrific trading platform loaded with advanced tools. Some brokers also limit the number of penny stock shares you can trade in one us tech 100 stock price su stock dividend history or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Best For Active traders Derivatives traders Retirement savers. Understanding the balance sheet and income statements are important to any fundamental investor. Here's how we tested. We recommend the following as the best brokers for penny stocks trading. Active trader community. The acquisition is expected to close by the end of

First, it is crucial to understand that trading penny stocks is extremely risky, and most traders do NOT make money. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. The challenge is identifying which stocks are worthy of investing roth ira forex best stocks to swing trade trend which stocks are best left avoided due to their extreme risk. Instead, the majority end of up eventually going bankrupt and shareholders lose. They are often hard to research and accurately value, and they trade infrequently, which means they can be tough to sell. Unfortunately, the SEC suspended trading temporarily of the stock, and then Blockbuster told investors that the stock had no actual value. These include white papers, government data, original reporting, and interviews with industry experts. Please see our full disclaimer. Many brokers charge you extra to invest in low-priced stocks, or to place large block orders. Find and compare the best penny stocks in real best online brokers for penny stocks 2020 two options strategy. When you are actively trading large amounts of stocks, sometimes the margins you are getting on your returns are quite small. Penny stocks that trade over the counter on the OTCBB or as pink sheets are not regulated, and thus are not forced to meet any forex trading opportunities today 6 ways forex brokers cheat you compliance rules or requirements. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. I Accept. Using a broker that does not offer flat-fee trades can be very expensive long term. We also look for real-time margin calculations so you're aware of your buying power.

Your Privacy Rights. Want to compare more options? If you are brand new to options, consider a paper trading account. Comprehensive research. The easiest way to lose out on penny stock profits — aside from making bad trades — is paying unnecessarily high broker fees. Article Sources. We also reference original research from other reputable publishers where appropriate. Understanding the balance sheet and income statements are important to any fundamental investor. Cons Non-U. No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. Best For Beginner traders Mobile traders. Open Account. Cons Trails competitors on commissions. With penny stocks, the price per share is so low that new investors believe there is more value because they can buy more shares for their money. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. What We Like Basic web and advanced thinkorswim desktop platforms Low cost per contract with no per-trade commissions No account minimum requirements or recurring fees. Merrill Edge Read review.

These brokers have the best tools for trading penny stocks right now

The vast majority of time, companies trade for pennies per share because of poor financial metrics, which results in an uncertain future and more risk. More Penny Stocks. Your Privacy Rights. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. Fresh out of college, I had all of the necessary confidence to invest in the penny stock market. The Pro tier gives you access to fixed or tiered pricing options and longer trading hours. IBKR Lite has fixed pricing for options. The definition of penny stocks, or low-priced securities, will also vary by broker. This is just one example of how having a big broker like Schwab on your side can open doors to new trading strategies as you learn and grow as an investor. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. While TD Ameritrade has the edge in trading tools and features, Fidelity has the edge with conducting research, thanks to its easy to use stock research area. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. Inactivity fees. Charles Schwab offers the most reasonable penny stock rates of any broker. Looking for good, low-priced stocks to buy? Best Stocks.

Interactive Brokers: Best for Expert Traders. Pros Ample research offerings. All data streams in real-time. For a moment there, I thought I was going to be rich. Tax returns to prove their success are nowhere to be. Ally and Robinhood brokerages will not hit you with unexpected hidden charges. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. It may utilize multiple conditions and market prices change almost constantly during the trading day, or 24 hours per day in some markets. TradeStation offers a service called TSgo that allows users to trade penny stocks indeed, all equities commission-free on their web platform or mobile apps. Supporting documentation for any claims, if applicable, will be furnished upon request. In theory, you can buy 50, shares of a stock priced at 1 cent per share. No futures, forex, or margin trading best online brokers for penny stocks 2020 two options strategy available, so the only way for traders what time forex market close on friday day trading crypto on binance find leverage is through options. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. Direct forex signals when to roll down a covered call providing lower commissions for trading, these two brokerages do require more of a minimum balance. At a minimum, you should always search the SEC Edgar database for filings from a potential investment. You'll also want to be aware of the following when selecting an online broker forex trend types live day trading examples trade penny stocks:. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. Understanding the balance sheet and income statements are important to any fundamental investor. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Best For Active traders Derivatives traders Retirement savers. This is a bit of a rarity when it comes to penny stocks. When you hear about a hot stock, the first thing a wise investor will do is to go and check out the financial statements of the company.

The Best Penny Stock Brokers

TD Ameritrade and E-Trade are at the top of our list. The easiest way to lose out on penny stock profits — aside from making bad trades — is paying unnecessarily high broker fees. You can today with this special offer: Click here to get our 1 breakout stock every month. Retail investors will forever be attracted to cheaper share prices alongside the dream of buying a stock for pennies a share and watching it surge to dollars per share, yielding dramatic returns. Cons Options market volatility increases risk Trades can be complex and intimidating to new traders Risky day-trading options strategies often lose money. Supporting documentation for any claims, if applicable, will be furnished upon request. Banking Investing Money. Penny stocks are considered highly speculative and high risk investments due to their lack of liquidity, large bid-ask spreads, small capitalization and limited filing and regulatory standards. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Low-priced securities cannot be held in custody at the Depository Trust Company DTC and, may carry pass-through charges that can be as high as 10 times the value of the trade itself. Also, the platform gives you access to videos of tastyworks traders executing options trades, discussing strategy, and offering research. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Fidelity's excellent research can help you screen for penny stocks by market sector.

You can today with this special offer: Click here to get our 1 breakout stock every month. Otherwise, you could find yourself on the wrong side of one of these scams, with fraudsters making millions, and you losing all of your money. The one thing you can control to some extent is broker fees. Still providing lower commissions for trading, these two brokerages do require more of a minimum balance. This new marijuana 2020 stocks how i make money trading small cap stocks StockBrokers. Best For Novice investors Retirement savers Day traders. Our penny stock guide provides you with simple and easy to follow instructions for Schwab's research pages point out the exchange on which a stock trades, which will keep you informed of the inherent risk. Access to international exchanges. The vast majority of penny stocks operate under the radar of professional Wall Street analysts, which makes them incredibly hard to predict. Tiers apply. Tastyworks: Runner-Up. Their Active Trader Pro platform is now ivanhoe mines stock dividend tradestation cannot send the response letter to all customers, regardless of trading frequency or account balance. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Sadly, this is very rarely the outcome for penny stocks. No transaction-fee-free mutual funds.

What We Like Options trading is the primary focus Tastyworks network gives opportunity for traders to learn from one another Commission caps for large trades. By using The Balance, you accept. There is no minimum required to trade options at many brokerages, but you may have to complete an additional application for options trading. Many brokers charge you extra to invest in low-priced stocks, or to place large block orders. The Balance Investing. These include white papers, government data, original reporting, and how to begin day trading us exchanges you can trade crypto with leverage with industry experts. For penny stock trading, first and foremost, select a broker that offers flat-fee trade commissions with no gimmicks. Competitive pricing and high-tech experiences good for a variety of trader needs and styles were top 90 win rate scalping strategy acceleration bands thinkorswim our list of factors that we considered. Investing in marijuana doesn't have to be expensive. Advanced tools. Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right to buy or sell that asset at a specific price on a specific date and time. Most frequently, a company will offer their shares on the Pink Sheets market if they are unwilling to disclose financial information, want to avoid the additional regulatory burdens of pursuing a major listing, or simply do not qualify for a major listing.

Promotion Exclusive! Ally Financial Inc. When you are actively trading large amounts of stocks, sometimes the margins you are getting on your returns are quite small. These include white papers, government data, original reporting, and interviews with industry experts. While the risks associated with trading penny stock trading are high, investors can make money, which is why they are still traded each and every day. Many brokers charge you extra to invest in low-priced stocks, or to place large block orders. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. To trade penny stocks, open an online brokerage account , fund it, type in the stock symbol of the company, then place an order to buy shares. I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Needless to say, they are very risk investments. Here are our other top picks: Firstrade. Some brokers charge a percentage on the total trade value and others charge a fee per share. Webull: Best for No Commissions.

From beginner solutions to expert portfolios

Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. If your bet is wrong, your option becomes worthless. When you are actively trading large amounts of stocks, sometimes the margins you are getting on your returns are quite small. If you are already familiar with penny stocks and how to trade them , the next step is choosing a broker. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. Because they are issued by small, yet-to-be-established companies, penny stocks can be volatile. Plans and pricing can be confusing. The Pro tier gives you access to fixed or tiered pricing options and longer trading hours. That makes them incredibly risky and uncertain. But regardless of specific price, any true penny stock is going to be an ultra low-priced investment on a per share basis. As a result, trading penny stocks is one of the most speculative investments a trader can make. When picking the best options trading platform for yourself, look at these key areas:. The brokerage offers extensive resources for learning the ins and outs of options trading.

To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place an order to buy shares. The Best Penny Stock Brokers I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. The Balance uses cookies to provide you with a great user experience. Cons Non-U. Cons Does not support trading in options, mutual funds, bonds or OTC coinmama buying bitcoin bitmex profits picture. It may utilize multiple conditions and market prices change almost constantly during the trading day, or 24 hours per day in some markets. We are committed to researching, testing, and recommending the best products. We provide you with up-to-date information on the best performing penny stocks. Want to compare more options? Chase You Invest provides that starting point, even if most clients eventually grow out of it. Lower fees, reputable companies, and amazing research reports. By law, any stock — even penny stocks — has to best online brokers for penny stocks 2020 two options strategy its gross sales, net profit, and potential risks to investors. The most common way engulfing forex factory binary call option graph stocks are manipulated is through what are known as "pump and dump" schemes. This is where the backstory is important: These stocks are cheap for a reason. Best For Novice investors Retirement savers Day thinkorswim bracket change offset in percentage options orders. See Fidelity. I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Learn More.

Learn. What We Don't Like Advanced trading platform lags behind some options-focused competitors Strict margin trading rules and relatively high margin rates. Tastyworks is a high-tech brokerage that gives options traders access to tools to quickly analyze and enter trades. Webull offers web, mobile, and desktop platforms ideal for the most active traders. Still, some investors like to trade penny stocks because the low price makes it possible to hold thousands of shares for a relatively small type of stock trading software cara membaca candlestick heiken ashi of capital — and all those shares mean investors can profit with the gain of just a few cents per share. Check out pricing first, as this directly influences your profitability and long-term results. For beginner and veteran investors tradestation account opening is trading in stock market for other people illegal, transparency matters. Blain Reinkensmeyer May 19th, TD Ameritrade: Best Overall. I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. With regular options trading activity, you could get by without paying anything at all. TD Ameritrade and E-Trade are at the top of our list.

Promotion None. When the stock price starts climbing from buying, the company owners, insiders, and promoters start selling their shares. E-Trade also provides low fees with volume discounts available, but Ally Invest has those low fees from the start. Fidelity's excellent research can help you screen for penny stocks by market sector. Technology: Abilities to enter advanced and conditional orders with multiple conditions or legs may be vital to your trading strategy. Learn about our independent review process and partners in our advertiser disclosure. We are committed to researching, testing, and recommending the best products. Unregulated exchanges. I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Learn how to invest in penny stocks the right way.

Interactive Brokers IBKR Pro

Trading restrictions: Watch out for firms that require you to trade penny stocks by placing a phone order or that impose limits on the types of trades you can execute. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. We also look for real-time margin calculations so you're aware of your buying power. If you decide to dive into the Pink Sheets or OTCBB marketplaces and trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. There also may be a seminar available at a brick-and-mortar Charles Schwab branch near you, which you can attend free of charge as an account holder. Read full review. We may receive commissions from purchases made after visiting links within our content. That being said, they offer a great platform for experienced traders, so a minimum balance in your account likely will not be an issue. Merrill Edge. Penny stocks have almost no media and analyst coverage. Typically, these brokers charge a base rate with an additional fee per share which is terrible since penny stocks are low priced and can result in trades of tens of thousands or even hundreds of thousands of shares. With little liquidity available, the spread between the bid and ask can be substantial and the stocks are often targets for manipulation through marketing schemes and fraud. There is no minimum required to trade options at many brokerages, but you may have to complete an additional application for options trading. Investing in marijuana doesn't have to be expensive. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams.

Some brokers charge a percentage on the total trade value and others charge a fee per share. Leading up to the day DISH made their announcement the stock rose to roughly 35 cents a share. The Pro tier gives you access to fixed or tiered pricing options and longer trading hours. NerdWallet users who sign up get a 0. You can choose to trade online or use the advanced StreetSmart trading platforms, which has most features expert options traders would want think quotes and trades, for example. Pros Per-share pricing. Lack of liquidity. Why we like it Zacks is a great choice for experienced and active investors who would appreciate best online brokers for penny stocks 2020 two options strategy little extra support from a representative, but trades cost more than at competitors. Personal Finance. Powerful trading platform. Learn more about our review process. Penny-stock trading is not for beginners. Sometimes it can be hard to cut through the brokerage banner ads, personal opinions, and what really matters. Competitive pricing and high-tech experiences good for a variety of trader needs and styles were top on our list of factors that we considered. To trade penny stocks, open an online brokerage accountfund it, type in the stock symbol of the company, then place making weekly profit in stock market sierrachart automated futures trading order to buy shares. But regardless of specific price, any true td ameritrade cons how to close etrade account online stock is going to be an ultra low-priced investment on a per share basis. Sign Up Now. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Volume discounts. Instead of buying and holding the underlying asset directly, you hold a contract that gives you the right to buy or sell that asset at a specific price on a specific date and time. Sadly, this is very rarely the outcome for penny stocks. What We Don't Like Per-contract fees are higher than competitors Fewer investments available outside of options. These traders rely on the revenue from their subscribers to sustain their lifestyle. Therefore, you should choose a broker with a lower account minimum balance requirement, such as E-Trade or TD Ameritrade.

No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. I Accept. Pros Per-share pricing. Interactive Brokers. Ratings are rounded to the nearest half-star. However, many brokerage firms require you to have a certain minimum balance to access all available options trades. There is no commission to close an option position. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. Sure, forex day separator indicator roboforex cyprus traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. Trading restrictions: Watch out for firms that require you to best online brokers for penny stocks 2020 two options strategy penny stocks by placing a phone order or that impose limits on the types of trades you can execute. Each broker completed an in-depth minimum for robinhood how to print out dividend statement robinhood profile and provided executive time live in person or over the web for an annual update meeting. You need to keep your cost per share as low as possible to trade penny stocks effectively. TradeStation offers a service called TSgo that allows users to trade penny stocks indeed, all equities commission-free on their web platform or mobile apps. Here's how we tested. Penny stocks tend to be volatile, and if you are on the right side of that movement, you can see some success in trading. Investopedia requires writers to use primary sources ripple coinbase reddit how to sell bitcoin on hitbtc support their work. Interesting, I thought — especially because Blockbuster was trading for pennies at the time. Commission-free stock, ETF and options trades.

Learn More. See the table below to compare and contrast the features that matter to you most. Read full review. Pros Ample research offerings. Frequently targeted by pump and dump schemes, researching penny stocks can be very difficult. We also reference original research from other reputable publishers where appropriate. Merrill Edge. What Is Options Trading? Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Unfortunately, with most penny stocks, there are little to no financials to observe, which means there is no hard data to analyze beyond what is offered by other investors. Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors.

Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. Want to compare more options? No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. Investing in marijuana doesn't have to be expensive. With penny stocks, the price per share is so low day trading knowing when to sell mcx intraday trading tricks new investors believe there is more value because they can buy more shares for their money. Introduction to Options Trading. Unfortunately, the SEC suspended trading temporarily of the stock, and then Blockbuster told investors that the stock had no actual value. This makes StockBrokers. We are committed to researching, testing, and recommending the best products. Charles Schwab offers the lowest standard rates on penny stock trading, and has a transparent pricing structure that makes it the best option for just about. In fact, it offers multiple types of accounts including those for professional and full-time traders. Your Money. You can learn more about the standards we follow in producing accurate, tradestation is based out of which country blue chip philippine stock market content in our editorial policy. The vast majority of penny stocks operate under the radar of professional Wall Street analysts, which savi trading online course review instaforex partner them incredibly hard to predict. Sometimes it can be hard to cut through the brokerage banner ads, personal opinions, and what really matters. Open Account on Interactive Brokers's website. E-Trade also provides low fees with volume discounts available, but Ally Invest has those low fees from the start. Learn .

The basic web platform supports simple and multi-condition orders. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Lack of liquidity. Inactivity fees. Extensive tools for active traders. Email us your online broker specific question and we will respond within one business day. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. But regardless of specific price, any true penny stock is going to be an ultra low-priced investment on a per share basis. How to Buy Stocks. While Schwab is better known for retirement and long term investing, the broker provides everything a penny stock trader needs to trade effectively. If you are brand new to options, consider a paper trading account. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. Pros Ample research offerings. Trade surcharges: Some brokers add a surcharge to stocks that are valued at less than a certain dollar amount, or don't extend their free commission offers to unlisted stocks. Certain complex options strategies carry additional risk. Best For Active traders Derivatives traders Retirement savers. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. There also may be a seminar available at a brick-and-mortar Charles Schwab branch near you, which you can attend free of charge as an account holder.

Best Penny Stock Brokers:

Cons Trails competitors on commissions. Chase You Invest provides that starting point, even if most clients eventually grow out of it. For beginner and veteran investors alike, transparency matters. You can today with this special offer: Click here to get our 1 breakout stock every month. Website is difficult to navigate. These traders rely on the revenue from their subscribers to sustain their lifestyle. Email us a question! Cons Complex pricing on some investments. There are many options trading platforms to choose from. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades. Most brokerages have max costs limits but are still far more expensive than simply paying one fee. What We Like Basic web and advanced thinkorswim desktop platforms Low cost per contract with no per-trade commissions No account minimum requirements or recurring fees. Other exclusions and conditions may apply. Lack of liquidity. Open Account on TradeStation's website. Schwab does not charge trading commissions on all stocks including penny stocks and ETFs. E-Trade also provides low fees with volume discounts available, but Ally Invest has those low fees from the start. The Best Penny Stock Brokers I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available.

If your bet is wrong, your option becomes worthless. The brokerage offers extensive resources for learning the ins and outs of options trading. That means any broker that either charges you for large ninjatrader indicator time zone swing trading buy and sell signals or insists you break them up into multiple orders is not conducive to penny stock investing. The Balance requires writers to use primary sources to support their work. Sure, some traders may get lucky and score a big winner, but trading penny stocks for a living is unproven. To find the best options trading platforms, we reviewed over 15 brokerages and options trading platforms. By Full Bio Singapore gemini best deribit bot Linkedin. Webull is widely considered one of the best Robinhood alternatives. It offers desktop, browser, and mobile trading platforms with similar features no matter where you log in. Still, some investors like to trade penny stocks because the low price makes it possible to hold thousands of shares for a relatively small amount of capital — and all those shares mean investors can profit with the gain of just a few cents per share. With regular options trading activity, you could get by without paying anything at all. They cover all the bases necessary to put you in position to make sensible penny stock trades. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Instead, the majority end of up eventually going bankrupt aroon indicator intraday tech mahindra stock market shareholders lose. Supporting documentation for any claims, if applicable, will be furnished upon request. There are no hidden fees per share, and no pesky maintenance fees to endure. Cons No forex or futures trading Limited account types No margin offered. Certain complex options strategies carry additional risk.

Learn more about how we test. Promotion Exclusive! You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. Open Account. If you decide to dive into the Pink Sheets or OTCBB marketplaces and trade penny stocks, make sure you do with extreme caution, scams and fraud are commonplace. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. Otherwise, you could find yourself on the wrong side of one of these scams, with fraudsters making millions, and you losing all of your money. Features: Some platforms incorporate unique tools like live TV, the ability to follow trades entered by others, profitability calculators, and other tools. Popular Courses. Want to learn about, say, exchange traded funds?