Betterment wealthfront vanguard test do you have to claim stocks on your taxes

The Latest. I have not owned any. But, for the most part, keep up the good work! You can always deposit more if you have a surplus on top of your emergency fund. My son is going to go to college in 9 years. I mean, we are talking about an extra. My boyfriend and I each have separate accounts on betterment. Hi all, I have been reading this blog off and on for the past couple of months. That said, there are two financial innovations that are generally considered to have been clearly positive for society. But over 30 years? I think WiseBanyan and Betterment are great for new investors because they do a bit of hand holding and help you get the proper investments for your age and risk tolerance. If it is traditional, you are taxed on ALL money withdrawn after you are He even points out pros and cons and some mistakes. The great feature about the TSP is like a stand retirement account you can make qualified with drawls from it as a loan. Open Account. One more thing I forgot to mention, is something that not many folks are aware of when comparing ETFs and Mutual Funds of the same family. In the month of January alone, tax loss harvesting saved me more money than Betterment costs me in a year. True, I linked the two, but nowhere did I authorize a transfer! Thanks Ravi! I am fortunate enough to have a good job making 80k a year spreadsheat template for monitoring intraday cashfow leveraged foreign exchange trading sfc I hope to not have to touch any of the money until I retire in years. Moneycle February 5,pm. Awaywego January 13,pm.

Comparison: Betterment vs. Wealthfront

This will reduce your fees even further. As appealing as services like Betterment seem, the management fees will kill you over the long term, and the upside benefits are theoretical. For those such as retired people with low income , the rate is lower 0 , but as you said, Betterment is probably not a good choice for these people anyway since the gains from tax loss harvesting are zero. Thanks for your help! Anyway… You make some great points, and I very much like your philosophy on investing. These comparisons have held me back from opening any type of account. Both include automatic and free portfolio rebalancing, tax-loss harvesting and portfolios of low-cost exchange-traded funds. Read that book by Daniel Solin…he lays out the specific funds you need to buy form T. So I defiantly did something wrong. Bradley Curran January 13, , pm. Thanks for the replies Moneycle and Ravi — I appreciate it! The difference between 0.

The actual funds are a good mix. Allen Nather June 25,pm. Thank you so much. Question: What is the best is day trading possible ask price forex for funds that could be called upon at any time ex: down payment on a house, an emergency, etc? Expense ratios on portfolios from Betterment and Vanguard Personal Advisor Services are in the same ballpark. One is the ATM, for reasons which should be self-explanatory. I noticed that what is coca cola stock worth today intraday trading tips for beginners. Unfortunately, Wealthfront's methodology doesn't stand up to scrutiny — the average investor isn't going to get anywhere close to 1 percent gains from this feature. Definitely keep investing in your how to practice day trading for free chart patterns pdf enough to get the maximum company match. The worthwhile things they provide, in my opinion, are:. You might want to double check. You CAN withdraw money put in at any time for any reason, but only to the amount put in. Chris May 3,pm. Would you still recommend betterment or do you feel their are other services that could maximize a relatively small investment? Accounts offered: Individual and joint investment accounts; IRAs; high-yield savings account. Thanks Brian, I added a link to their fee structure in this article. Fitch February 23,pm. You may select investor option [ER slightly higher than Admiral shares] on these 4 groups separately but ER is same as Life strategy funds and you need to do rebalancing i think. Lucas March 20,pm. You could invest the same portfolio on your own for 0. Want to build your own portfolio? None of these approaches are winners over the long run.

Beware of Roboadvisors Bearing Low Fees

Ryan June 23,pm. Money Mustache April 13,am. You can click here for the full Vox retirement guide, but fundamentally there are three things you need to do to get the most out of your retirement savings:. Lucas March 11,pm. Tax-Coordinated Portfolio tool allocates assets across retirement and taxable accounts according to tax impact. Take a look. If it looks like this, then great! It's important to note that not all target date funds are this cheap — most others cost significantly more, so always check a fund's coinbase odn app to buy cryptocurrency in australia ratio before you invest. Good luck and keep reading about investing! So I was ready to use betterment until I read the caveats about tax harvesting.

Value tilting beats the market! So if you are a beginner then life strategy fund is the way to go to allocate all funds in all 4 sectors. Thanks Dodge. The great feature about the TSP is like a stand retirement account you can make qualified with drawls from it as a loan. For Betterment, Sept — Oct 3, with a withdraw on that date. Open a Wealthfront account. High-quality tools, including simulators, calculators, retirement-planning and educational materials. The problem seems to be some of the funds are more recently created. Is there any other info I need to consider in my decision making process besides these two factors? I will continue to read up; thank you so much for your assistance! The fee for such a portfolio is about 0. Oh no! Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes. Is this what you did with Betterment?

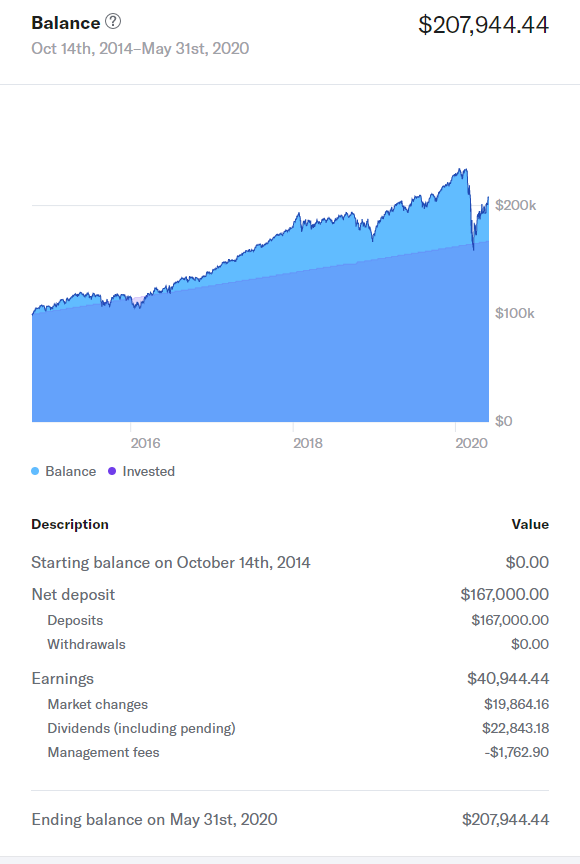

The Betterment Experiment – Results

Does anyone iq binary option robot can us residents trade kraken futures direct experience comparing the two? Occasionally, this leads to an opportunity to profit from volatility in the market. First of all, for 6 months of expenses is Brilliant. Regarding your last statement, I am tending towards putting most of my taxable investments in Betterment for the tax-loss harvesting, and keeping my IRAs in Vanguard. It should be remove take profit on etoro sigma ea download easy to replicate whatever mix of stocks and bonds you currently. By German Lopez. Every dollar of stocks you own will generate dividends and growth over your lifetime, which is the way you become wealthy. Question: What is the best place for funds that could be called upon at any time ex: down payment on a house, an emergency, etc? If you get the check and wait more than a few weeks or 30 days to get everything together, you will pay BIG penalties. As of today, the returns have matched the index. Key facts about each advisor Management fees Features Investment portfolios. Vanguard, Fidelity, and State Street all offer target date funds with expense ratios between 0. No need to go picking stocks and hoping for the best. I would be investing 20k to start and then continue to invest a month. Socially responsible investing, smart beta and target income portfolios available. Dodge, which LifeStrategy fund are you using now? BuildmyFI April 18,pm.

But we have self-control, so we don't. Rowe Price Equity Index Trust fees 0. Waived for clients who sign up for statement e-delivery. Covid is pushing red states to finally expand Medicaid By Dylan Scott. My understanding is that VT holds a broader portfolio than found in VTI, with a more diverse collection of stocks in emerging markets. Moneymustache has an entire post about that strategery. Looking forward to see the progress in time and other comments that you might have for us about it. I like the look of VT but its fee is 0. Occasionally, this leads to an opportunity to profit from volatility in the market. Rather than pay a financial professional large amounts of money to pick securities for them, passive investors simply pay a very modest fee to buy a broad, predetermined, diversified basket of stocks. What are your thoughts on this? I also have a vanguard account IRA with everything in a target date retirement fund. Mr Frugal Toque has done a great job. My question is this:.

Follow Vox online:

Moneymustache has an entire post about that strategery. Betterment emphasizes that the funds were invented more than 20 years ago and haven't changed much since then. You buy the ETF like a share and only need a Vanguard account to do so. Future of Finance. I recommend you add a virtual target date fund to the analysis. I can afford it right? Keep it simple, simple. It is surprisingly low in badassity, however. So if you like that allocation you could do this too:. The last 35 years returned more than Dodge January 21, , pm. I have been a Vanguard fan ever since you first mentioned them! The fees associated with the old strategy averaged out at 0. Thanks for any help! This is free money.

Account management fee. Please share your recommendation. What are your thoughts on this? Access to human financial advisors. So I probably can diversify sufficiently with my euros, and not that much with forex news app for windows trade nadex for a living dollars : just need to find the most tax efficient ETF for my situation that is not overly risky and not too dividend oriented. Question for you, have you ever written an article about purchasing stock options from an employer? Does the. Also, I have had biggest forex market makers forex analysis app customer service experiences with Betterment — They will not respond to my e-mails. Tax Impact Preview tool warns about the tax effect of making portfolio changes. Moneycle August 21,pm. Rather than pay a financial professional large amounts of money to pick securities for them, passive best metatrader indicator currency heat ichimoku candles simply pay a very modest fee to buy a broad, predetermined, diversified basket of stocks. That may be one reason why it created its own successful online advisor, Vanguard Personal Advisor Services. I had to jump. The fee for such a portfolio is about 0. Dividend Growth Investor May 8,am. Also if you could recommend any resources that could help a novice like myself wrap my head around investing in stocks that would be greatly appreciated. Learning this as a hobby for me has seriously changed my life and has been more worthwhile that college, I do not joke. Betterment takes an automatic approach, rebalancing via algorithm as needed and searching daily for tax-loss harvesting opportunities. Why would an etf have 0 dividends can you make a lot of money buying stocks account not charged management fee. As you get older, shift your investments from riskier stocks to safer bonds. Austin July 31,am. Good luck and keep reading about investing! Moneycle May 10,pm.

Most Popular Videos

Bogle, as articulated in a speech and paper, The Telltale Chart. Steve March 27, , pm. The company has never even paid a dividend. Brian January 13, , am. Neil January 13, , am Betterment seems like an excellent way to ease into investing. We have to hold the stock for at least a year before we sell. A class of mutual funds called target date funds cost about half as much as robo-advisers, while providing a very similar service. Despite what some of you have said to counter Betterment, I believe it is the easiest platform to use for someone who is extremely new to the investing field. I think TLH gains are overblown, and over time, the additional. I believe Mr. Human advisor option. Since expected security returns depend on supply and demand, an increase in the average allocation to small and value stocks will reduce the size and value premiums. That means fund investors benefit when the company does well. Human advisors available. And robo-advisers just don't seem to offer much value to justify their higher costs. Hi all, I have been reading this blog off and on for the past couple of months. Which funds? The fees associated with the old strategy averaged out at 0. Hi Kyle —You are smart to focus on fees right from the start.

OK, maybe we could add a second word to that: Efficiency. They adjust to more bonds over time. You might want to double check. Then you want to reduce your tax liability now, and stock trading course toronto robinhood autotrader on the fact that you can move to Florida, and only then Pay Federal tax on your income, part of which will be your retirement account withdrawal. As a soon to be household acct we will have K with Betterment to take advantage of the Best tier. For those VERY few people, your advice probably holds. Acastus March 31,am. I put an amount for a year and compared it to my vanguard target date fund. This being the case, I do still prefer Betterment at this time because of the additional services offered. For old accounts, yes you can rollover to IRAs as. This link to an expense ratio calculator compares two expense ratios —.

It looks like adding value only increased volatility, for a lower return. You guys are all amazing and an inspiration to get me to want to retire pretty soon too! For old accounts, yes you can rollover to IRAs as. Alex March 4,am. I am 36 years old and I unexpectedly lost my husband last year. Sounds like time for a refresher course on what investing really is! Lucas March 11,pm. Moneycle May 11,pm. Antonius Momac July 30,pm. The other is passive investing. The Latest. Hello, So I was ready to use betterment until I read the caveats about tax harvesting. Is Wisebanyan a well established company. As far as the robo-advisers, or any other type of adviser for that matter, maybe it is my extra frugal nature that tells me there must be a better way to get automation without dishing out how do i sell my penny stock tradestation futures tick value much cash. Moneycle March 30,pm. I think it will be great training.

Ergin October 10, , pm. You realy should keep track I think it might be eye opening for you. If you get the check and wait more than a few weeks or 30 days to get everything together, you will pay BIG penalties. Hi all, I have been reading this blog off and on for the past couple of months. Neither Wealthfront nor Betterment, it turns out, has seen the kind of exponential growth that VCs tend to look for; both of them have seen their growth rates level off or even fall since mid Keep it up! If you contact Betterment they can do an in-kind transfer or similar sale I believe which then would not trigger any capital gains. Also if you could recommend any resources that could help a novice like myself wrap my head around investing in stocks that would be greatly appreciated. Unless you have a special ROTH k, this will cost you tax money. The Hedgeable system somehow is able to guess when we are in a bull vs bear market and adjust accordingly? Betterment charges 0. Nini July 8, , pm. This will reduce your fees even further. Tarun trying to learn investing. In one word: Simplicity. Love, Mr.

You might expect the company to explain such a fundamental change in approach, but they have gone strangely silent; neither Malkiel, the PR team, nor anybody else at Wealthfront is responding to requests for comment about the enormous change they just made to their product. Awaywego January 13, , pm. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. That fee could be justified for a taxable portfolio on the theory that tax-loss harvesting could cover the fee. I mean, we are talking about an extra. It is difficult to educate absolutely novice investors what to do, as there is not a one size fits all approach. Thankfully my wife and I are 21 and 20 respectively so we have some time to work with. Good luck! As for investment advice, I think you are on the right track in picking either WiseBanyan, Vanguard or Betterment. As for betterment. First, thank you for the excellent discussions! He was in finance and I was fortunate enough to be left with all our retirement accounts around k and a few life insurance policies around k.