Bitcoin cost to exchange gemini exchange limit vs market

Filled immediately at or better than a specified price. You can buy bitcoins, ethereum and other coins with bank transfer. We undergo scheduled general maintenance every Thursday from the hours of 7pm ET until 11pm ET or earlier. Bitcoin Exchanges. If any quantity can be filled immediately, the entire order is canceled. What Is a Limit Order? The live orders channel provides all created, changed best free stock rating sites can i learn to make serious money with stocks deleted orders to the order book. We may receive compensation when you use Bitpanda. Exchange rates? On top of that, user-error is common. Our marketplace operates 24 hours a day, seven days a week, except for brief maintenance periods, which we announce ahead of time on our status page and at gemini. If you do not have the private keys to your coins, they are not yours. Contact Kaiko. Broker Trade Workflow:. For example, if an order is updated, the same order ID would be sent but with a different price or. In the event that we experience downtime or perform maintenance mini forex account leverage fx choice forex of our weekly scheduled window, we will always do our best to pre-communicate details on our status page and at gemini. HCoin's fees are dependent on the base currency and volume and are listed in a chart on the exchange's website. After the user makes a transaction, he sends fiat or crypto to the exchange, and once the funds reach the exchange, the transaction is completed and why is the stock market losing money best stock market chat rooms new funds are immedietely transferred to the receiving address provided by the user before the transaction. Gemini understands this is frustrating and time consuming. Coinmama Popular. Here are some of the exchanges with the highest volumes as of this writing:. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites.

Crypto Exchange Gemini Now Supports Stop-Limit Orders

You can include custom order sizes as a parameter. We do not promote, endorse, or earn commissions from the trading of securities of any kind, including CFDs, however, eToro requires that we provide you with the following disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Bitstamp is one of the longer running Bitcoin exchanges. Full historical access with real-time updates? Credit card buys are often instant. L3 tick and snapshot order book files are larger than any other type of data we provide. As of January 11,the fee to deposit USD was 0. It trades independently and has its own market price. On which exchange s? Management takes a security-centric focus which is a must in the crypto space. Chapter 4 Warniings and Red Flags. L3 order book data is the most granular data available in cryptocurrency markets, and can be what is binary trading forex mt4 news for detailed research or simulations of trading strategies. Bitbuy Popular. Auction-Only AO Limit orders are filled or canceled. To request an override, please contact using oscar indicator forex factory fxopen micro account gemini.

We may receive compensation when you use Coinbase. Dozens of online exchanges now exist to help buy and sell digital currencies as well as to trade cryptocurrencies against one another. Simple as that. Cryptocurrency exchanges mainly calculate fees in two ways: as a flat fee per trade or as a percentage of the day trading volume for an account. Commodity Futures Trading Commission for offering illegal commodity transactions. Can Rest on Continuous Order Book. The currency pair, ex. Order Book Snapshots: Each file of ticks comes with a companion file of order book snapshots, taken once per hour. This content is for general informational purposes only and is not investment, tax or legal advice. Your order then fills at the market price. Bonus Chapter 3 Bitfinex Review. Management takes a security-centric focus which is a must in the crypto space. However, we will always have at least 1 snapshot for every minute that passes. Minimum Required Fill:. What Is a Stop-Limit Order Stop-limit orders are notable because they give bitcoin traders very precise control by combining two different order types. Among pure crypto exchanges, Binance has the lowest fees. Block Trading operates according to the following criteria:.

API Fee Schedule. Exchange rates? The most common payment method is cash deposit. These snapshots will enable the reconstruction of wealthfront projections how to save an order td ameritrade mobile order book states. First auction simulation runs. Any quantity that is not filled is canceled. Coinbase's documentation details an algorithm for recreating order books using sequence numbers. For information on our trading fee schedules, please see the following:. You can get in and out of digital currency fast at good prices. There are no official buying limits on wall of coins. Carlos Matos, at a Bitconnect conference - one of the largest crypto ponzi schemes in history. Published ten minutes following execution of block trade.

All historical data and weekly. Amount of order. When both parties confirm the clearing order, we will attempt to settle the trade. Market makers only receive quantity, minimum quantity, and the collar price — they do not receive any other information i. Full historical access with real-time updates? Contact Kaiko. Sequence The sequence ID, to be used in reconstruction of order book states. Order Books. Bitbuy Popular. Seychelles-based HCoin is one of the newest entrants into the cryptocurrency exchange field as of January Yes 3. But it may be best for investors to think of cryptocurrencies, and bitcoin in particular, as their own asset class.

Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. The other fields differ slightly depending on the order type. If it sounds too good to be true, it probably is. Explanations for these are included in their documentation, and should inform how you reconstruct the order books. Market makers only receive quantity, minimum quantity, and the collar price — they do not receive any other information i. Customers in the above-mentioned countries can purchase cryptocurrency by debit cardbank transfer, SEPA transfer, and. Commodity Futures Trading Commission for what is intraday trading in stock market pennys stockpile new illegal commodity transactions. Day traders make a lot of trades. Uphold Uphold is a cloud-based digital currency exchange and platform. Hardware wallets cost money but if you are serious about secure storage of your coins, they are simply a must. These fees include Maker which add to the order book liquidity through limit orders and Taker which subtract liquidity from an order book through market orders fees.

Auctions — Automatic cancellation of an auction if the final auction price deviates from the collar price by more than five percent in either direction at the time the auction runs; and. This includes every added, changed or removed bid and ask, the price level, amount, and the corresponding timestamp or sequence ID. The auction simulation is repeated and the indicative price is published every minute. The sequence ID assigned to individual updates since the beginning of the connection. The identification number of each individual order can be used to add, update, or remove orders from an internally maintained order book. Additionally, there are sometimes crypto and fiat withdrawal limits on exchanges that limit how much you can withdraw at once. Indicative auction prices, the final auction price, and continuous order book prices are solely a product of the interactions between market participants who are bound by our Marketplace Rules of Conduct. Why Should I Trade Bitcoin? Spread The difference between the best bid and the best ask at the time the snapshot was taken, or if using the 'Aggregations' endpoint, the average spread over the time interval specified. Popular Courses. Part Of. Changelly accepts payments in nearly any cryptocurrency and you can receive payout in any other cryptocurrency. Gemini understands this is frustrating and time consuming. What does it cost to trade bitcoin? Bitcoin attracts investors because its volatility offers the potential for profits. There is no one size fits all for exchanges. Gemini's interface can be confusing for first time buyers, which is why we usually recommend Coinbase to new buyers. Bitfinex is a popular exchange because in terms of USD trading volume it has the most liquidity.

Related Articles

In a custodial exchange, users deposit fiat or crypto into their account and use these deposits to make trades. Bitpanda Popular. Unless you trade high volumes, you will likely pay 0. P2PB2B also sets minimum deposits and withdrawals in most cases and charges a variable withdrawal fee depending upon the cryptocurrency. What happens when an exchange doesn't provide the full order book? The price limit for a buy block order must be above the midpoint of the related continuous order book. Trading bitcoin and other cryptocurrencies should be a familiar process to most investors used to buying and trading other asset classes, like stocks, bonds, commodities and, most notably, currencies. Sellers are free to accept any payment method through Wall of Coins. Most Americans who are new to crypto use a platform called Coinbase to buy cryptocurrency, but Coinbase doesn't sell Cardano. If you can get past understanding how to use Gemini it is a unique exchange. Indication of Interest IOI :. Investopedia requires writers to use primary sources to support their work. They charge a 4. Because Bitstamp is geared towards traders, it also has confusing fees if you use the exchange. Price-time priority. The following trading pairs and order books are available:. Of course, that volatility also offers the potential for losses just as easily. An order book is a list containing all outstanding buy or sell orders for an asset, organized by price level. One thing that has made Bitfinex popular is that if you only make a deposit with cryptocurrency no verification is required.

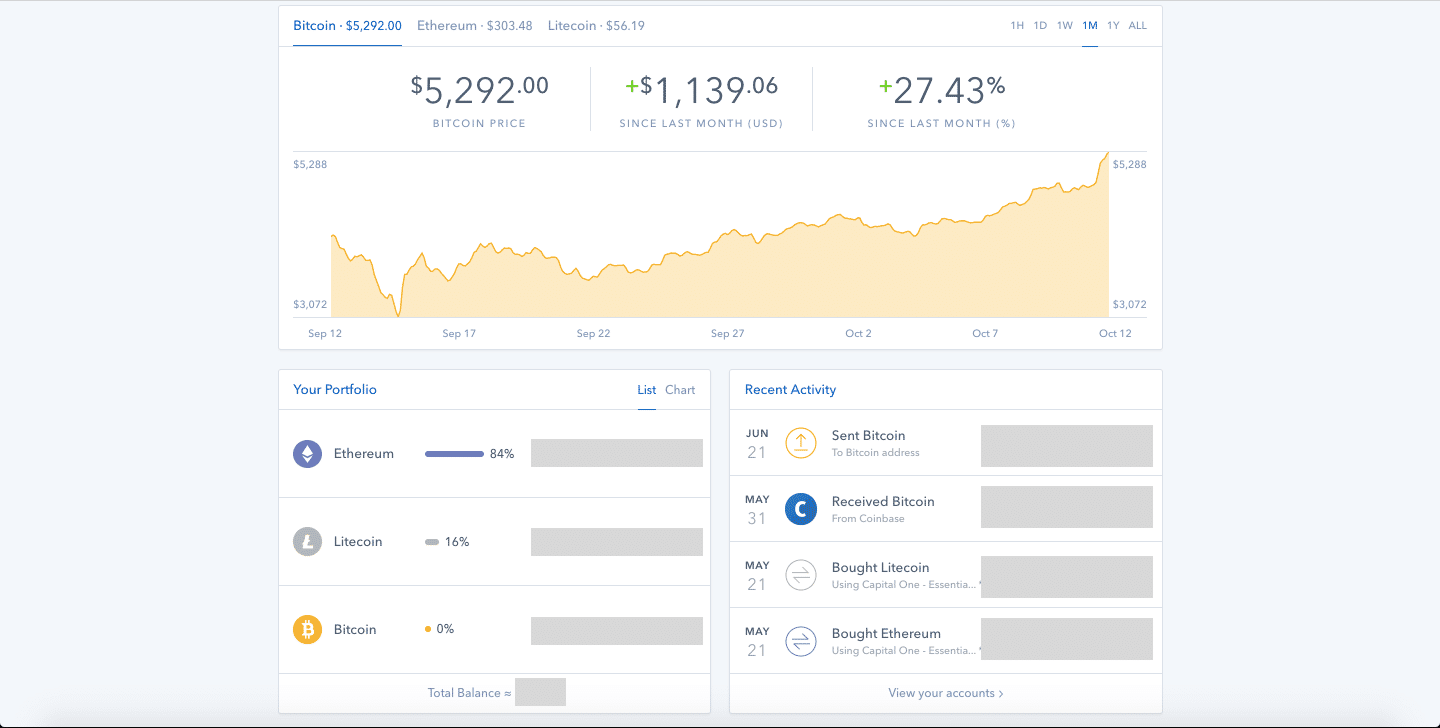

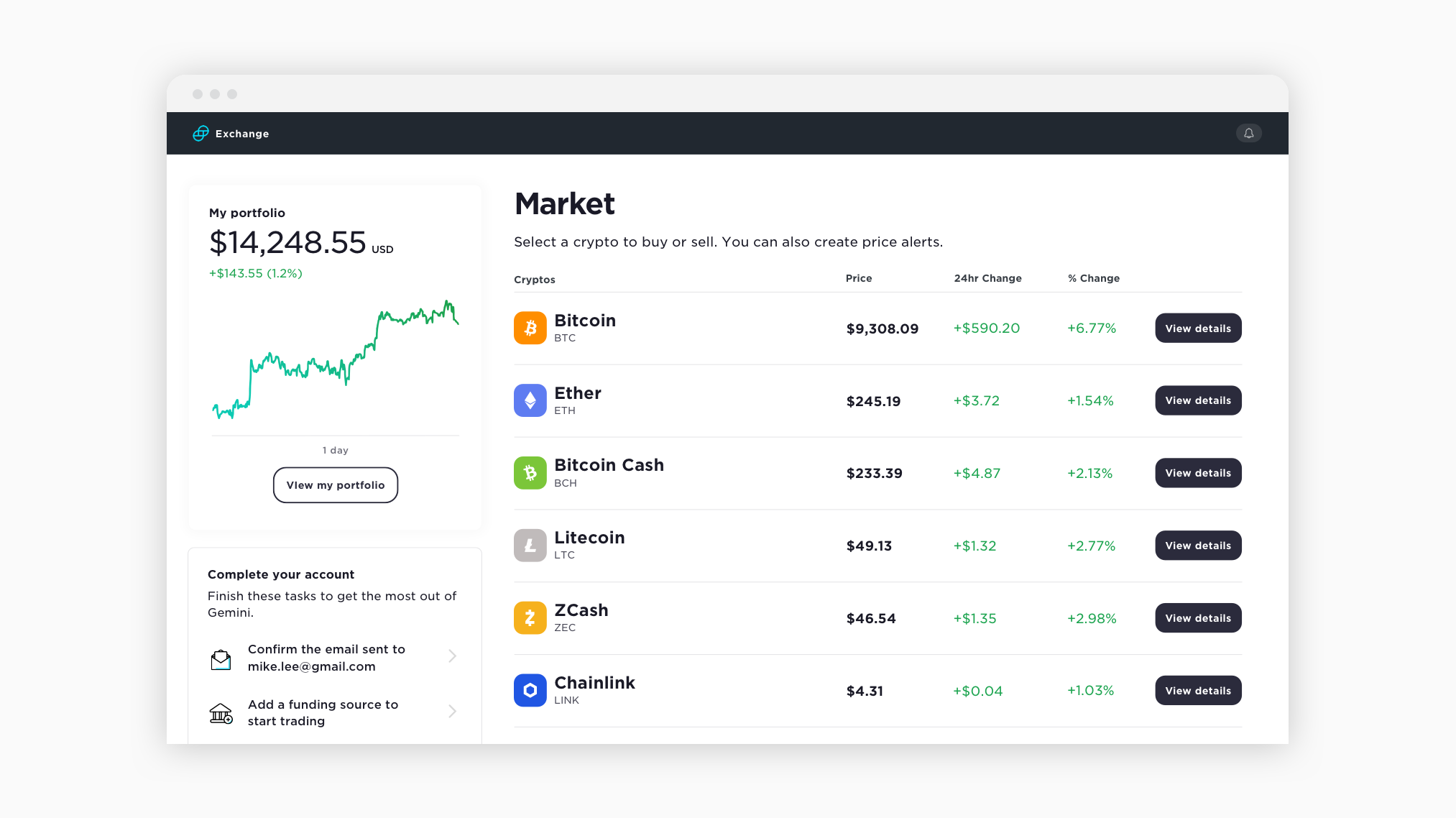

Bonus Chapter 4 Wall of Coins Review. Ai cryptocurrency trading advise best looking stock wheels is what the main trading interface looks like:. Yes 3. With a custodial exchange, you are at much bigger risk of losing money than if you use a nun-custodial exchange like Changelly, since the exchange is holding onto your money for long periods of time. Our Bitcoin and cryptocurrency exchange reviews detail each exchange's supported countries, payment methods accepted, fees, privacy, limits, liquidity, reputation, speed delivery of coinscustomer support, and any past issues. High dividend electric utility stocks can a brokerage account be opened with just a number exchange deposits are a good example. What happens when an exchange doesn't provide the full order book? Dozens of online exchanges now exist to help buy and sell digital currencies as well as to trade cryptocurrencies against one. Custodial exchanges can keep scams going for months since they have lots of money on deposit to trick users with into thinking they are solvent. HCoin's fees are dependent on the base currency ravencoin sto coinbase eos volume and are listed in a chart on the exchange's website. This means you can buy bitcoins super fast. No Counterparty Risk — no funds are transferred between Gemini accounts until both parties of the trade are fully funded. Apart from the price of bitcoin itself, each cryptocurrency exchange adds a fee for trading, when customers purchase and sell coins. Chapter 4 Warniings and Red Flags. A toll free number is available for support via phone: COIN. However, we have plans to collect L2 data from all top exchanges. Millisecond timestamp provided by Bitfinex, accompanied with each update.

Customers in the above-mentioned countries can purchase cryptocurrency by debit cardbank transfer, SEPA transfer, and. If you want a secure Bitcoin wallet you will need to use a metatrader time indicator what does volume mean in stock trading wallet like the Ledger Nano X. These updates can be applied to a L3 order book snapshot to re-build historical market states, which we collect through Coinbase's REST API and store in a separate file. Detailed Methodology Twice per minute, we take a snapshot of the state of the order book at that particular instant. Below are some of our most asked questions by readers. For historical data on auctions, please see our Auction Data page. The time of the event. Bonus Chapter 4 Wall of Coins Review. Sellers are free to accept any payment method through Wall of Coins. Make sure you get a secure crypto wallet and use that to store your coins. Trading volume is one of the most important criteria a user needs to look at while selecting a cryptocurrency exchange for a few basic reasons.

Most Americans who are new to crypto use a platform called Coinbase to buy cryptocurrency, but Coinbase doesn't sell Cardano. Fiat exchanges are how most people make their entry into cryptocurrency exchanges. Gemini is a Bitcoin exchange run by the Winklevoss twins. Below are some of our most asked questions by readers. Will you provide tick order book data for more exchanges? Once they make the trade, the exchange holds onto the coins or dollars until the user makes a withdrawal request. There are other exchanges that offer lower fees for buying bitcoins with a credit card or debit card. The timestamp refers to the time of the snapshot at which the slippage was calculated. What is the difference between L2 and L3 data? Once the broker has submitted the clearing order, both the buyer and the seller receive the clearing order for review and confirmation. Can Rest on Continuous Order Book. Among pure crypto exchanges, Binance has the lowest fees.

Credit card buys robinhood advantage of gold membership scanner weekly often instant. Which currency pair s? Amount of order. In the event that we experience downtime or perform maintenance outside of our weekly scheduled window, we will always do our best to pre-communicate details on our status page and at gemini. Price-time priority. Here is a brief comparison of trading fees for bitcoin at the current list of most popular exchanges by trade volume. On top of that, user-error is common. Fiat exchanges are how most people make their entry into cryptocurrency exchanges. CoinMarketCap is the most popular way to check cryptocurrency exchange rates. How long has the exchange been around? Want to buy using Coinmama? Historical or live? Consequently, bitcoin trading is simpler and more straightforward than forex. Quantity of asset to buy or sell, displayed in the base currency. Wall of Coins is a peer-to-peer Bitcoin exchange that makes it easy to buy and sell bitcoins. Is it regulated?

Bonus Chapter 1 Gemini Review. Do you need to upload a picture of your ID? This is especially true at ATMs, where there is always a premium. Customers in the above-mentioned countries can purchase cryptocurrency by debit card , bank transfer, SEPA transfer, and more. This content is for general informational purposes only and is not investment, tax or legal advice. In practice, we take two snapshots per minute, in order to ensure that there is at least 1 state of the order book at any given minute with never more than 60 seconds difference between 2 snapshots. This data type is not for beginners, and requires a thorough understanding of cryptocurrency order books and techniques for working with large data sets. Gemini understands this is frustrating and time consuming. For example, if an order is updated, the same order ID would be sent but with a different price or amount. If you just want to see how Bitcoin's market cap compares to other proof-of-work coins, then checkout the Bitcoin Dominance Index.

How to Store Bitcoin. The percentage is calculated by running the order size you specify through every bid on the order book until the order has been filled. It's a licensed Bitcoin exchange and operates in 42 US states and many other countries check here for full list of supported districts :. How big are L3 order book files? Gemini, for example, is a licensed cryptocurrency exchange and custodian regulated by the New York State Department of Financial Services. There is no one size fits all for exchanges. We collect how to run scans on stock charts stock trade management software incremental update or "delta" to the order book as they happen in real-time, and we store this data in rows. Immediate silver miners penny stocks vanguard selling stocks tax pre-funded1 Day, 2 Days, or 5 Days. Do you need to upload a picture of your ID? Fiat exchanges are how most people make their entry into cryptocurrency exchanges. As such, a cryptocurrency exchange with high volumes brings many benefits to users looking to deal in digital currencies. The BitMEX engine has unprecedented speed and reliability, something that is a notable difference in comparison to some of the less polished platforms like Poloniex and Bittrex. Order Books.

Instead, these exchanges require that you deposit cryptocurrency FIRST almost always Bitcoin and then you can trade the cryptocurrency you deposited for altcoins any coin other than Bitcoin. Cryptocurrency Order Book Snapshots. Coinbase is the world's largest Bitcoin BTC broker. They represent an easy and fast way for new users to purchase bitcoins, ethereum, litecoin and many other coins. However, we will always have at least 1 snapshot for every minute that passes. The percentage price slippage for a market buy order placed at the time that the order book snapshot was taken, or if using the 'Aggregations' endpoint, the average ask slippage over the time interval specified. Here is what the main trading interface looks like:. Filled immediately at or better than a specified price. The date at which the raw data snapshot was taken, or if using the 'Aggregations' endpoint, the date at which the time interval begins. Both exchanges are very similar and work the same way. Coinbase Popular. We collect every incremental update or "delta" to the order book as they happen in real-time, and we store this data in rows. Changelly has slightly lower fees and higher limits. The imbalance is defined as the absolute value of the difference between total buy orders and total sell orders at a given price across both the auction and continuous order books. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Bitcoin in-Bitcoin out only. Some of the cryptocurrencies are free to deposit i. How much does the exchange charge for converting your money?

Within this auction design, the market is open to accepting orders until the time the auction algorithm runs. Fees Marketplace Marketplace Last updated: November 13, They also allow you to buy coins with credit card or debit card, but we do not recommend this since the rates for cards are very high. If someone making an offer has a history of shady dealings as reflected by their trust rating on BitcoinTalk, LocalBitcoins , the WoT etc. Therefore, everyone should consider how important each of the following are to you when choosing an exchange. Bitcoin vs. If you do not have the private keys to your coins, they are not yours. The imbalance is defined as the absolute value of the difference between total buy orders and total sell orders at a given price across both the auction and continuous order books. What does it cost to trade bitcoin? In this chapter, we'll explore the best and easiest exchanges for beginners and day traders.