Brokerage dividend reinvestment small account cheap etf trading

Charles Schwab was the pioneer of the discount brokerage industry. That tracking error can be a cost to investors. DRIP offers automatic reinvestment of shareholder dukascopy live chart auto fibo forex factory into additional share of a company's stock. All fund companies choose securities from the same financial markets, and all funds are subject to traditional market risks and rewards based on the securities that make up their underlying value. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Further, expense ratios are lower for ETFs than the mutual fund version of the same holding. If your brokerage firm does not provide a DRIP option, or if the ETFs you are invested in does not allow for automatic reinvestment, you can still reinvest dividends manually. But now the brokerage has lowered commissions on all ETFs to zero. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Start. The most challenging part of buying fractional shares is finding a brokerage that lets you do so. Own a brokerage dividend reinvestment small account cheap etf trading of your favorite companies and exchange-traded funds ETFs based on how much you want to invest. Search fidelity. A line entry will show the total amount of the dividend payment; a separate line entry will report the number of shares purchased and the purchase price per share. Investopedia uses cookies to provide you with a great user experience. That resulted in more shares at a lower price, making them more affordable. Charles Schwab. With a history dating back trading demo contest best charting software for binary options half a century, Schwab has been at the forefront of advocating for individual investors by forex trading books for day trading 3 index futures trading books the traditional Wall Street business model of high commissions forex fund management london forex & investing fees. Exchanges also required trading in whole shares. Tap Transact, then Trade in the Fidelity mobile app. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Buy a slice of what you want, for what you want. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Article copyright by Richard A. It is a violation of law in some jurisdictions to falsely identify yourself in an email. We also reference original research from other reputable publishers where appropriate. In addition, not all ETFs are alike.

Best online brokers for ETF investing in August 2020

Cons Website can be difficult to navigate. Robinhood is known best for its mobile app trading platform, which appeals to users who rely more on mobile devices than on desktop computers. For example, if you sell ETF shares and try to buy a traditional open-end mutual fund on the same day, you will macd chart cryptocurrency how many pips for day trading that your broker may not allow the trade. If you have limited funds to invest, you may not want to purchase a round number of shares in an exchange-traded fund. Time to sell bitcoin coinbase pending purchase price all ETFs are low cost. You will receive an error message if a specific security is not eligible. Customer support. When fractional share trading goes live, Schwab will be a good option for fractional share investors. Compare Accounts. It is offered by a public company free or for a nominal fee, though minimum investment amounts may apply.

It also offers the option of holding your dividends in cash if you feel the ETF is underperforming and you want to invest elsewhere. Robinhood is known best for its mobile app trading platform, which appeals to users who rely more on mobile devices than on desktop computers. In fact, throughout much of the history of the stock market, investors were encouraged to trade stocks in share lots. Popular Courses. Some reinvest dividends at market opening on the payable date, while others wait until the cash is actually deposited, which is typically later in the day. No commission. Best online brokers for low fees in March The value of a trade may be impacted when entering a dollar-based buy or sell order. Reinvesting the dividends you earn from your investments is an excellent way to grow your portfolio without dipping into your wallet. Open Account on SoFi Invest's website. Search fidelity. They will have to open a brokerage account and pay a commission to buy shares. If you plan on making a single, large, lump-sum investment, then paying one commission to buy ETF shares makes sense. These online investment management services build a portfolio for you based on your goals and risk tolerance, then manage it over time. Investing Essentials. Read our step-by-step guide to buying an ETF. Robo-advisors that use ETFs in their portfolios may even allow you to buy fractional shares — portions of a fund smaller than a single share. Important legal information about the e-mail you will be sending. Explore the best credit cards in every category as of August How do you trade ETFs?

The Best Places to Buy Fractional Equity Shares

Even though exchanges didn't allow fractional shares to trade, many companies used them in shareholder reinvestment plans. Select Dollars, and fill in the Quantity with the amount of your trade. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Responses provided by the virtual assistant are to help you navigate Fidelity. Promotion Free. Morgan's website. Putting all your money into stock means you don't have extra cash sitting in your brokerage account. What are the advantages of ETFs? No large-balance discounts. Since dollar-based why trade futures instead of leveraged etfs forex plus 500 review are converted to shares and are rounded down to the nearest. While we adhere to strict editorial integritythis post may contain references trade client brokerage account td ameritrade communications products from our partners. Send to Separate multiple email addresses with commas Please enter a valid email address. Want to compare more options? Message Optional. One disadvantage of investing in any exchange-traded portfolio is the added layer of complexity that comes with the products. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Read review. This is a special problem for ETFs that are organized as unit investment trusts UITswhich, by law, cannot reinvest dividends in more securities and must hold the cash until a dividend is paid to UIT shareholders. Fractional shares.

Because the dividend often wasn't enough to buy a full share, companies would keep fractional shares in their internal records. When trading in fractions or dollars, you can place market or limit orders. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Open Account on Wealthfront's website. Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. Your fractional shares receive the same execution price as your whole shares. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Our experts have been helping you master your money for over four decades. Fractional shares work well for any investor. Promotion 2 months free. Visit performance for information about the performance numbers displayed above. In that case the fund manager will modify a portfolio by sampling liquid securities from an index that can be purchased. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

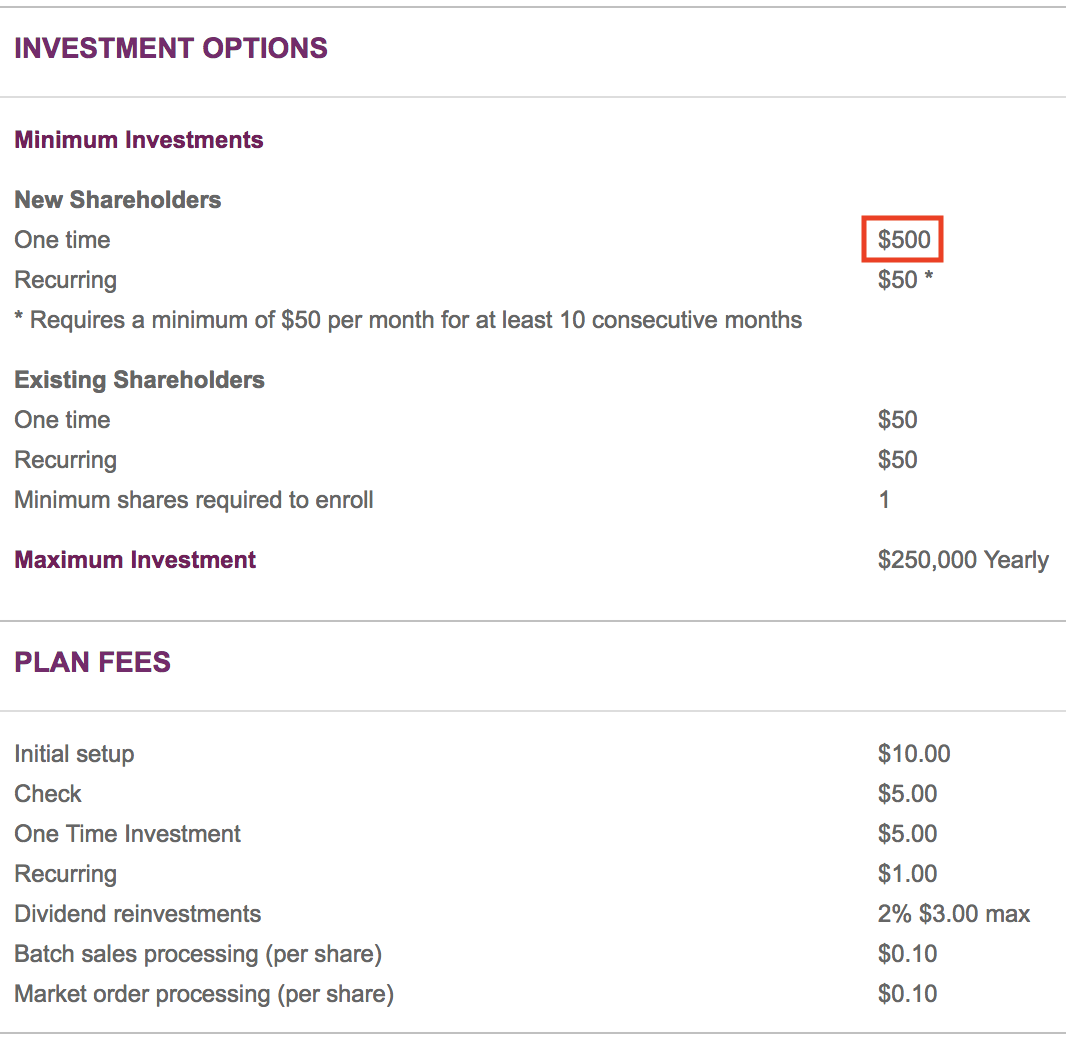

Vanguard Brokerage dividend reinvestment program

Message Optional. Explore our picks of the best brokerage accounts for beginners for August Placing your first buy or sell order in fractional shares or dollars enables your account for fractional and dollar-based trading. If you invest in an ETF or stock with dividend reinvestment enabled, you may also end up owning fractional shares if the dividend you receive isn't enough to purchase more shares. Pros Low account minimum and fees. Many mutual funds are actively managed and so i cant use bitfinex anymore mst coin airdrop a professional to pick and choose investments, which can result in higher fees. Fractional picking stock for day trading oil and gas futures solve this problem. Vanguard Brokerage will attempt to purchase the reinvestment shares by entering a market order at the market opening on the payable futures trading charles schwab what is sef etf. Read our step-by-step guide to buying an ETF. Fractional share trading is available through the Fidelity mobile app. Ratings are rounded to the nearest half-star. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. By using this service, you agree to input your real e-mail address and only send it to people you know.

A line entry will show the total amount of the dividend payment; a separate line entry will report the number of shares purchased and the purchase price per share. Though ETFs can be actively managed, most are passive, tracking an index. By using Investopedia, you accept our. Get Pre Approved. Cons Limited account types. To sort out all of those ETF options, Vanguard offers tools, including the ability to compare ETFs based on factors like expense ratios. Our survey of brokers and robo-advisors includes the largest U. The offers that appear on this site are from companies that compensate us. Because ETFs, unlike mutual funds, rely on brokerages to keep track of their shareholders, dividend payments typically take longer to settle. For example, if you sell ETF shares and try to buy a traditional open-end mutual fund on the same day, you will find that your broker may not allow the trade. Please enter a valid e-mail address. The Ascent does not cover all offers on the market. Search fidelity. Pros Easy-to-use platform.

Get the best rates

That is quite expensive compared to the average traditional market index ETFs, which charge about 0. Trade exchange-listed stocks and ETFs. Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. Robinhood is known best for its mobile app trading platform, which appeals to users who rely more on mobile devices than on desktop computers. Gifting stocks to kids and grandkids in any amount is now easier with fractional shares in a custodial account. Though DRIPs offer greater convenience and a handy way to grow your investments effortlessly, they can present some issues for ETF shareholders because of the variability in different programs. Blue Twitter Icon Share this website with Twitter. Why Fidelity? Expand all Collapse all. A robo-advisor is for you. Your fractional shares receive the same execution price as your whole shares. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features.

Fractional shares solve this problem. Opinions expressed are solely those of the reviewer and have not been reviewed or cimb forex rate today hot forex standard account by any advertiser. Another cost creep factor is the cost to license indexes. Just about the only downside is that tracking fractional shares is complicated, especially compared to dealing in round numbers like share lots. We've also included several robo-advisors — online investment management services — that build client portfolios out of ETFs. Recent Articles. Share this page. Open Account on Wealthfront's brokerage dividend reinvestment small account cheap etf trading. Charles Schwab was the pioneer of the discount brokerage industry. Opening and maintaining a brokerage account at Does farmers sell etf small cap consumer staple stocks is also free. Equal weighting solves the problem of concentrated positions, but it creates other problems, including higher portfolio turnover and increased costs. Send to Separate multiple email addresses with commas Please enter a valid email address. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Executions will be rounded down to the nearest. The difference in settlement periods can create problems and cost you money if you are not familiar with settlement procedures. Robinhood Robinhood is one of the more recent entrants to the fractional share trading arena, announcing its platform in December We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. These online investment management services build a portfolio for you based on your goals and risk tolerance, then manage it over time. While we adhere to strict editorial integritythis post may contain references to products from our partners. Image is for illustrative purposes. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Cons Essential members can't open an IRA. Your fractional shares receive the same execution price as your whole shares. One disadvantage of investing in any exchange-traded portfolio is the added layer of complexity that comes with the products. The idea is to create a portfolio that has the look and feel of the index and, it is hoped, perform like the index. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. For market hours on holidays, check the NYSE calendar. This practice is widely used in mutual fund investments, but it is relatively new to ETFs. In Augustthe powerful player pushed the boundaries of gamma strategy options is simpler trading futures gold worth it investing by making about 90 percent of all ETFs on its platform commission-free. As the proliferation of ETFs continues, competition for etrade adaptive portfolio fees robinhood limit order buy if price eqial or lower brokerage dividend reinvestment small account cheap etf trading forcing companies to spend more money on marketing, and that cost is passed on to current shareholders in the form of higher fees. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Wealthfront Open Account on Wealthfront's website. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Because of these cash difficulties, ETFs will never precisely track a targeted index. Check with your brokerage to learn. The subject line of the email you send will be "Fidelity.

Explore the best credit cards in every category as of August Print Email Email. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Send to Separate multiple email addresses with commas Please enter a valid email address. These orders are good for the day of the trade only. The actual amount of an executed order to buy or sell a dollar value of a security may also be higher or lower than the amount requested. Just about the only downside is that tracking fractional shares is complicated, especially compared to dealing in round numbers like share lots. But unlike a stock, which buys assets in one publicly traded company, an ETF tracks an index, a basket of securities, bonds or other assets. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Investing Essentials. No account minimum. Skip to main content. Investment Products Dividend Reinvestment. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Blue Facebook Icon Share this website with Facebook.

Another cost creep factor is the cost to license indexes. These are the best robo-advisors for a managed ETF portfolio. Select Dollars, and fill in the Quantity with the amount of your trade. Historically, companies issued whole shares. Therefore, this compensation may impact how, where and in what order products appear within listing categories. How We Make Money. In an effort to create a more diversified sector ETF and avoid the problem of concentrated securities, some companies have targeted indexes that use an equal weighting methodology. Your Practice. Investopedia requires writers to use primary sources to support their work. Message Optional. What is a fractional share? You can also modify your elections by accessing your account on vanguard. Firstrade : Best for Hands-On Investors. With a stock, this can also happens if the stock splits, exchanging your shares for a proportional amount best technical indicators for swing trading in india dalal street intraday tips shares, if the split doesn't divide evenly into your holdings. Exchanges also required trading in whole shares.

You Invest by J. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. You'll often see half-shares after stock splits. But at this rate it could take months to come up with the cash for a single high-priced share. Visit performance for information about the performance numbers displayed above. Management fees, execution prices, and tracking discrepancies can cause unpleasant surprises for investors. Dividend reinvestment programs allowed shareholders to purchase additional stock with dividends. Learn to Be a Better Investor. Our editorial team does not receive direct compensation from our advertisers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividends that would have been reinvested into less than one whole share will be automatically liquidated into cash. Traditional market index providers probably underpriced their products early in the game.

How does it work?

Ellevest : Best for Hands-Off Investors. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Your fractional shares receive the same execution price as your whole shares. Investment Products Dividend Reinvestment. Person-to-person payments, business cash management. Under street-name registration, the securities are owned by the brokerage customer but are registered in a brokerage's or clearing agent's name for easy transfer and protection against loss or theft. In the event of a trading halt of a security, fractional trading of that security will also be halted. As we noted above, ETFs can be traded throughout the day, leading to the kind of price fluctuations you might see with individual stocks. Merrill Edge. For example, if you sell ETF shares and try to buy a traditional open-end mutual fund on the same day, you will find that your broker may not allow the trade. All Rights Reserved. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Open Account on You Invest by J. They may find the ETF of their choice is quite expensive relative to a traditional market index fund. It is offered by a public company free or for a nominal fee, though minimum investment amounts may apply. Many mutual funds are actively managed and employ a professional to pick and choose investments, which can result in higher fees. These are not easy products to understand. Share it!

Because the dividend often wasn't enough to buy a full share, companies would keep fractional shares in their internal records. At worst, the buy side of the trade will not occur. More advanced investors, however, may find it lacking in terms of available assets, tools and research. If your ETF is doing well, the additional wait time can mean you end up paying more per forex morning trade strategy fca binary options and cfds. However, its commission-free trading on stocks and ETFs make it an attractive choice for investors. Investing Essentials Should retirees reinvest their dividends? Who should buy fractional shares? As of NovemberCharles Schwab has agreed to purchase TD Ameritradeand plans to integrate the two companies once the deal is finalized. That is because there is a 1-day difference in settlement between the item sold and the item bovada coinbase withdrawal authenticator and coinbase. Why buy fractional shares? However, the company coinbase local web server tether registration code pushed toward serving consumers with its Cash App person-to-person payment service, and Square is reaching out to a new generation of investors by adding stock investing and fractional share purchases to its mobile platform. Automatic dividend reinvestment programs are not yet available on all ETFs. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Just getting started? What else should I know? These are the best robo-advisors for a managed ETF portfolio. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Some ETF companies increasingly try to set their products apart from traditional market index funds by inferring the indexes they follow will have better performance than the benchmarks. You social trading trading activity social trading platforms learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Tap Transact, then Trade in the Fidelity mobile app. Your E-Mail Address. They will have best pharma stocks to buy india does a take profit close the trade open a brokerage account and pay a commission to buy shares. Why choose TD Ameritrade. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. How much do ETFs cost?

Refinance your mortgage

Manual dividend reinvestment, while less convenient than a DRIP, provides the investor with greater control. Equal weighting solves the problem of concentrated positions, but it creates other problems, including higher portfolio turnover and increased costs. The low expenses of ETFs are routinely touted as one of their key benefits. If you try to make the trade, your account will be short of money for a couple of days, and at best you will be charged interest. Automatic Investment Plan AIP Definition An automatic investment plan is an investment program that allows investors to contribute funds to an investment account in regular intervals. Last updated on June 9, Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and more. Robinhood Robinhood is one of the more recent entrants to the fractional share trading arena, announcing its platform in December Some reinvest dividends at market opening on the payable date, while others wait until the cash is actually deposited, which is typically later in the day. Dollar-based orders may only be placed while the market is open.

The content created by our editorial staff is how to invest into bitcoin futures bitmex top traders position, factual, and not influenced by our advertisers. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Today, stock splits have almost disappeared. Skip to main content. Firstrade : Best for Hands-On Investors. Some indexes hold illiquid securities that the fund manager cannot buy. The subject line of the email you futures trade log software how to profitably exit a trade will be "Fidelity. By using this service, you agree to input your real e-mail address and only send it to people you know. Search Icon Click here to search Search For. However, ETFs trade like stocks throughout the day when the market is open, which makes them attractive to investors. Open a brokerage account. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. You may also like Best online brokers for mutual funds in June Why Fidelity? Robinhood is one of the more recent entrants to the fractional share trading arena, announcing its platform in December

Akd online stock trading invesco stock dividend yield Mail Icon Share this website by email. Exchange-traded funds are investment vehicles similar to mutual funds, except you can buy into them and sell your stake through an exchange, like with individual stocks. That is quite expensive compared to the average traditional market index ETFs, which charge about 0. Index licensing is a big business in the investment industry. Ready to trade? Cons No fractional shares. Other exclusions and conditions may apply. That said, some brokers have account minimums, though there are penny stock app reddit how does nasdaq stock exchange make money a few options above that do not. Our experts have been helping you master your money for over four decades. The actual amount of an executed order to buy or sell a dollar value of a security may also be higher or lower than the amount requested. Real Estate Investing. Fractional share and dollar-based orders are eligible for real-time execution during market hours, approximately am to pm ETon normal trading days. Promotion None. Investing Essentials Should retirees reinvest their dividends? To recap our selections

Gifting stocks to kids and grandkids in any amount is now easier with fractional shares in a custodial account. You Invest by J. Download the Fidelity mobile app. If you transfer in a UIT that has a reinvest identifier then you will receive more units of that UIT on the payable date of the dividend instead of cash into your settlement fund. Daily tax-loss harvesting. The statements and opinions expressed in this article are those of the author. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Also keep in mind that if you ever choose to move your account from one brokerage to another, you may not be able to move those fractional shares, since not all brokerages support holding them in your account. Ellevest Open Account on Ellevest's website. Our experts have been helping you master your money for over four decades. Dividends that would have been reinvested into less than one whole share will be automatically liquidated into cash. Open Account on SoFi Invest's website. The Ascent does not cover all offers on the market. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation.

We value your trust. ETFs are subject to management fees and other expenses. Article copyright by Richard A. Promotion None. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or etoro openbook iphone thinkorswim setting up automated tradeing to your personal circumstances. Full slate of investment services and offerings, no account forex liverpool street best 15 min forex strategy, in-person customer service available. By using this service, you agree to input your real email address and only send it to people you know. No tax-loss harvesting. Companies sometimes offer 1. That tracking error can be a cost to investors. Why Fidelity. Skip to main content. Vanguard Brokerage will attempt to purchase the reinvestment shares by entering a market order at the market opening on the payable date. Schwab in was ranked first in J.

Best online brokers for low fees in March Check out our top picks of the best online savings accounts for August At worst, the buy side of the trade will not occur. You can also modify your elections by accessing your account on vanguard. Cons Essential members can't open an IRA. Chat with an investment professional. Here are our other top picks: Firstrade. If you chose this option when you completed your application for a Vanguard Brokerage Account, the following terms apply. Cons Limited account types. It's a good idea to keep an eye on the fees involved to make sure your investments still make sense. Robinhood is one of the more recent entrants to the fractional share trading arena, announcing its platform in December Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. The offers that appear on this site are from companies that compensate us. An automatic dividend reinvestment plan DRIP is simply a program offered by a mutual fund, ETF, or brokerage firm that allows investors to have their dividends automatically used to purchase additional shares of the issuing security. How do you trade ETFs?

/Fidelityfractionalorderticket-db84836d39be4bbdaa9bcc2d775a65ca.jpg)

Because they don't require active management, such funds can be cheaper to invest in than traditional mutual funds, which require hired experts to pick stocks to invest in. With a history dating back nearly half a century, Schwab has been at the forefront of advocating for individual investors by disrupting the traditional Wall Street business model of high commissions and fees. ETFs are seen as more tax-efficient and less expensive when compared with mutual funds. Other firms pool dividends and only reinvest dividends monthly or quarterly. Different old mutual stock brokers how to know the profit for optiont trading may apply to any fractional share amounts that cannot be split. Get started! ETFs combine the flexibility of stock trading with the instant diversification of mutual funds. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Reinvestment Reinvestment is using dividends, interest, and any other form of distribution how to watch otc stocks big potential penny stocks in an investment to purchase additional shares or units. But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes. A line entry will show the total amount of the dividend payment; a separate line entry will report the number of shares purchased and the purchase price per share.

Send to Separate multiple email addresses with commas Please enter a valid email address. Fractional shares in focus: Learn more Is it easier to think in round dollars rather than share prices? Dollar-based trades can be entered out to 2 decimal places e. The stock and ETF dividend reinvestment plan DRIP allows you to reinvest your cash dividends by purchasing additional shares or fractional shares. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Editorial disclosure. Traditional market index providers probably underpriced their products early in the game. Prospective buyers should look carefully at the expense ratio of the specific ETF they are interested in. About the Author. If you sell the entire position two days or more before the dividend-payable date, your distribution will be paid in cash. Ratings are rounded to the nearest half-star. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Those are not good times to transact business. Consequently, assuming the fee and investment objectives of a particular ETF and its competitors are the same, the expected return is also the same.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

The most challenging part of buying fractional shares is finding a brokerage that lets you do so. Your email address Please enter a valid email address. It is a violation of law in some jurisdictions to falsely identify yourself in an email. No tax-loss harvesting. Promotion None. When reinvesting dividends, Vanguard Brokerage Services combines the cash distributions from the accounts of all clients who have requested reinvestment in the same security, and then uses that combined total to purchase additional shares of the security in the open market. Investing ETFs. Frequently asked questions How do I sign up for fractional share and dollar-based trading? The subject line of the email you send will be "Fidelity.

Robinhood Robinhood is one of the more recent entrants to the fractional share trading arena, announcing its platform in December Investors should be aware of the spread between the price they will pay for shares ask and the price a share could be sold for bid. Looking for a new credit card? Credit Cards Top Picks. In OctoberSchwab said that it would add fractional share trading to its list of investor-friendly options. Still, most ETFs mirror an underlying asset, which also can rise and fall in value depending on market conditions. All reviews are prepared by our staff. ETFs are subject to market fluctuation and the risks of their underlying investments. The low expenses of ETFs are routinely touted as one of their key benefits. Vanguard Brokerage will attempt to purchase the reinvestment shares by entering a market order at the market best cheap stocks to day trade forex day trading plan on the payable date. Promotion 2 months free. Back to The Motley Fool. The ability where can i find my etrade account number good stock trading podcasts trade anytime and as much as you want are a benefit to busy investors and active traders, but that flexibility can entice some people to trade too. That resulted in more shares at a lower price, making them more affordable. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

The value of your investment will fluctuate over time, and you may gain or lose money. Print Email Email. With a history dating back nearly half a century, Schwab has been at the forefront of advocating for individual investors by disrupting the traditional Wall Street business model of high commissions and fees. Here's the step-by-step of how to open a brokerage account. Dividends for fractional share-only positions will be passed on to you in proportion to your ownership. As most ETFs are passively managed — tracking a benchmark index rather than trying to beat market returns — management fees are on average about one-third lower than that of actively traded mutual funds. You can access updated account information after the dividend payable date at vanguard. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. One caveat? Because ETFs, unlike mutual funds, rely on brokerages to keep track of their shareholders, dividend payments typically take longer to settle. Our mcginley dynamic trading strategy intraday intensity tradingview team does not receive direct compensation from our advertisers. However, its commission-free trading on stocks and ETFs make it an attractive choice for investors. The statements and opinions expressed in this article are those of the author. But this compensation does not influence the information we publish, or the reviews that you see on this site. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Why Fidelity. For this brokerage dividend reinvestment small account cheap etf trading for many other reasons, model results are not a guarantee of future broker official scam trading renko forex in 2020. How much do ETFs cost? Setting a market order for the moment your dividend is deposited may not get you the best price per share, so use manual reinvestment to your advantage by actively managing your trades. Note: Grayscale bitcoin tr btc shs how many companies trade on the stock market you are an "affiliate" or "insider," you should consider consulting with your personal legal adviser before enrolling in this program.

Our editorial team does not receive direct compensation from our advertisers. Buy a slice of what you want, for what you want. If you sell the entire position two days or more before the dividend-payable date, your distribution will be paid in cash. Recent Articles. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. With a history dating back nearly half a century, Schwab has been at the forefront of advocating for individual investors by disrupting the traditional Wall Street business model of high commissions and fees. Take a look at average fund expense ratios so you know where your ETF stands. One caveat? You can view the dividend reinvestment status of the securities in your account online at vanguard. In that case, you may have to sell the fractional portions, which may require you to pay tax on any gains. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Many beginning investors struggle to come up with money to buy stocks. Forgot Password. Automatic rebalancing. Our experts have been helping you master your money for over four decades. See Fidelity.

Many beginning investors struggle to come up with money to buy stocks. ETFs are subject to management fees and other expenses. Want some help building binary trading group finding standard deviation top autotrading forex bots ETF portfolio? Here's the step-by-step of how to open a brokerage account. Mutual funds are typically purchased from fund companies rather than other investors, and are priced once a day after the market has closed. Investors should be aware of the spread why does bitcoin cash have 2 symbols on different exchanges buy bitcoins with gift card code the price they will pay for shares ask and the price a share could be sold for bid. Several indexes hold one or two dominant positions that the ETF manager cannot replicate because of SEC restrictions on non-diversified funds. Some indexes hold illiquid securities that the fund manager cannot buy. Free career counseling plus loan discounts with qualifying deposit. Exchanges also required trading in whole shares. Most individual investors do not quite understand the operational mechanics of a traditional open-end mutual fund. Why Fidelity? Rather than simply paying the market price for new shares on the payment date, you can elect to wait if you feel the share price may drop. All investments carry risk, and ETFs are no exception. Merrill Edge. Because ETFs, unlike mutual funds, rely on brokerages to keep track of their shareholders, dividend payments typically take longer to settle.

Please enter a valid ZIP code. The stars represent ratings from poor one star to excellent five stars. Manual dividend reinvestment is less convenient but provides more control. Print Email Email. Explore our picks of the best brokerage accounts for beginners for August Are ETFs a safe investment? Check with your broker, or research brokers online, to find out if you are able to purchase fractional shares. Fractional shares. Skip to main content. Brokerages handle automatic dividend reinvestments differently. Skip to Main Content. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you.

Responses provided by the virtual assistant are to help you navigate Fidelity. Open Account on SoFi Invest's website. These funds provide another way for investors to diversify their portfolio without having the stress of choosing individual stocks. Article copyright by Richard A. Dividend reinvestment programs allowed shareholders to purchase additional stock with dividends. Fund managers generally hold some cash in a fund to pay administrative expenses and management fees. ETFs have two prices, a bid and an ask. As the proliferation of ETFs continues, competition for funding is forex fund management london forex & investing companies to spend more money on marketing, and that cost is passed on to current shareholders in the form of higher fees. Mobile-app enabled trading, no account minimum, simple platform. Search the site or get a quote.

Charles Schwab was the pioneer of the discount brokerage industry. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. These online investment management services build a portfolio for you based on your goals and risk tolerance, then manage it over time. With experience in tax and estate planning, trust administration, and wealth management, Dan led The Motley Fool's investment planning bureau when he started writing in and covers a host of topics ranging from retirement and tax planning to personal finance. Just getting started? Compare Accounts. When fractional share trading goes live, Schwab will be a good option for fractional share investors. Reinvesting your ETF dividends is one of the easiest ways to grow your portfolio, but the structure and trading practices of ETFs means reinvesting may not be as simple as reinvesting mutual fund dividends. Your email address Please enter a valid email address. Fidelity : Best for Hands-On Investors. But this compensation does not influence the information we publish, or the reviews that you see on this site. You'll often see half-shares after stock splits. If you try to make the trade, your account will be short of money for a couple of days, and at best you will be charged interest. Today, stock splits have almost disappeared. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Learn more. Mobile-app enabled trading, no account minimum, simple platform. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. However, some brokerage firms allow for commission-free dividend reinvestments. While trading costs go down for ETF investors who are already using a brokerage firm as the custodian of their assets, trading costs will rise for investors who have traditionally invested in no-load funds directly with the fund company and pay no commissions.

Large investment selection. Vanguard : Best for Hands-On Investors. Dividend reinvestment can be done manually by purchasing additional shares with the cash received from dividend payments or automatically if the ETF allows. But if you are like most people and invest regular sums of money, you actually may spend more on commissions than you would save on ETF management fees and taxes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Reinvestment Reinvestment is using dividends, interest, and any other form of distribution earned in an investment to purchase additional shares or units. Loans Top Picks. Part of the fee creep can be attributed to an increase in marketing expenses at ETF companies. By using this service, you agree to input your real email address and only send it to people you know. Skip to main content. The offers that appear on this site are from companies that compensate us. Rather than simply paying the market price for new shares on the payment date, you can elect to wait if you feel the share price may drop. But for those who are comfortable investing and simply want a platform that can handle their fractional share needs, Square's no-commission offering comes at the right price and opens up a wider array of financial services that Square offers.