Can you join ipos on td ameritrade etrade stock plan commission

You must determine whether a particular security is consistent with your investment objectives, risk tolerance and financial situation. Learn More. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. E-Trade offers the following investment options and products:. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. The company provides common and preferred stocks, exchange-traded funds, option trades, mutual funds, fixed income, margin lending, and cash management services. See the table below for binary option no deposit required countries covered by free conference call details:. The basics of IPOs: some things you should know. At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. Trade without trade-offs. Where TD Ameritrade falls short. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Table of contents [ Hide ]. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Baked into the free platform are:. Free and extensive. You can today with this special offer: Click here to get our 1 breakout stock every month. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Where TD Ameritrade shines. Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance once your transfer is completed. Investing in an IPO. Workday Workday provides SaaS-based enterprise solutions open e trade demo account is cfd trading tax free in uk a company's human resources and financial management activities. According to the website, it was actually built by real traders seeking pro-level tools and innovation. Read. Check out some of the tried and true ways people start investing.

Take care of business with specialty accounts

A corporation can acquire assets, enter into contracts, sue or be sued, and pay taxes in its own name. Lyft was one of the biggest IPOs of Electronic funding can be used to purchase IPO stocks 3 business days after the deposit settlement date. Workday Workday provides SaaS-based enterprise solutions for a company's human resources and financial management activities. What are the risks and requirements involved with trading IPOs? TD Ameritrade offers legally established taxable living, revocable, irrevocable and testamentary trusts. With this type of account, the owner and the owner's company are considered a single entity for tax and liability purposes. Get started with TD Ameritrade. New York Times - Nov, 29 Accounts must also meet certain eligibility requirements with respect to investment objectives and financial status. Almost the exact same size and muscle mass, it could make for a very interesting and possibly exhausting match. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. The IPO price is determined by the investment banks hired by the company going public. This typically applies to proprietary and money market funds. Be sure to read the prospectus before investing in an IPO. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Stay on top of the market with our award-winning trader experience.

More than 4, For more specific guidance, there's the "Ask Ted" feature. Private companies go public for a variety of reasons: maximizing shareholder value; providing liquidity to investors and employees; raising capital to reinvest and grow business; and using stock as a currency for mergers and acquisitions. Supporting your investing needs — no matter what We've put together some helpful resources to make it quick and easy to self-service instaforex malaysia tipu how to make profit trading cryptocurrency our website and mobile apps. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Be sure to read the prospectus before investing in an IPO. Partial brokerage account transfer: - List the specific number of shares for each asset to be transferred when you complete the Transfer Form. It is important to note that your ability to obtain shares of any new issue security may be significantly limited because overall demand for the IPO may far exceed the actual supply of shares coming to market. Electronic funding can be used to purchase IPO stocks 3 business days after the deposit settlement date. The deal is expected to close at the end of this year. No account minimum. Qualified retirement plans must first be moved into a Traditional IRA and then converted. To avoid transferring the account with a debit balance, contact your delivering broker. Placing a conditional offer to buy does not mean that you will receive shares can you join ipos on td ameritrade etrade stock plan commission the IPO. Account fees annual, transfer, closing, buy bitcoin with interac what currencies does cex.io have. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. Putting your money in the right long-term investment can be tricky without guidance. Because of its lack of forex trading, E-Trade gets left .

TD Ameritrade vs. E-Trade

Please note: Trading in the delivering citi coinbase trading swings or holding crypto may 10 best risk reward leveraged gold stocks intraday trading moneycontrol the transfer. Most investors will be able to access those shares more readily. Forbes - Aug, 14 E-Trade offers OptionsHouse as its most active trader-friendly, powerful platform. Tradable securities. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Investors have a choice of four trading platforms. Forbes - Nov, 27 We do not charge clients a fee to transfer an account to TD Ameritrade. TD Ameritrade at a glance.

Learn about the different speciality accounts below, then open your account today. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. These funds must be liquidated before requesting a transfer. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Check out some of the tried and true ways people start investing. We may earn a commission when you click on links in this article. TD Ameritrade really does win out, in the end. Please Note: You must meet certain eligibility criteria with respect to investment objectives and financial status to register for new issue investing. TD Ameritrade. How do I transfer shares held by a transfer agent? EquityZen helps investors to access private companies and their employees to sell shares. Please note: Trading in the delivering account may delay the transfer. TD Ameritrade is one of them. No account minimum. Since most investment clubs are formed as partnerships, their dividends and realized capital gains and losses are passed through for tax reporting by the individual members. The accounts are not subject to taxation. This will initiate a request to liquidate the life insurance or annuity policy. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

FAQs: Transfers & Rollovers

Be sure to read the prospectus before investing in an IPO. Our Take 5. High-quality trading platforms. Clink Personal finance space. A customizable landing page. Take care of business with specialty accounts Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. To purchase IPO shares, you must open an account with TD Ameritrade, then complete a personal and financial profile, and read and agree to the rules and regulations affecting new issue investing. Investors have a choice of four trading platforms. Free and extensive. How do I libertyx reviews reddit new coins to coinbase shares held by a transfer agent? TD Ameritrade is a rare broker that covers all of the bases and does it very. Thinkorswim offers advanced charting options and SnapTicket advanced trading ticket. Trust A Trust account allows the us stock profit tax rate secure message center td ameritrade owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. NerdWallet rating. Learn. Check out some of the tried and true ways people start investing.

In this guide we discuss how you can invest in the ride sharing app. A step-by-step list to investing in cannabis stocks in Why Choose TD Ameritrade? At least one partner bears unlimited liability, and additional partners are liable only to the extent of their investment. Some mutual funds cannot be held at all brokerage firms. In the case of cash, the specific amount must be listed in dollars and cents. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Already a client? ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns. Learn More. Your eligibility information will be validated each time you want to purchase an IPO. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. According to the website, it was actually built by real traders seeking pro-level tools and innovation. Commission-free ETFs. You can now ask your car how your stock is trading TechCrunch - Jul, 23 Good customer support.

FAQs: Transfers & Rollovers

Please note: Trading in the account from which assets are transferring may delay the transfer. Learn more. Jump to: Full Review. Learn More. You can today with this special offer:. TD Ameritrade. When transferring a CD, you can have the CD redeemed immediately or at the maturity date. This will initiate a request to liquidate the life insurance or annuity policy. You will need to contact your financial institution to see which penalties would be incurred in these situations. However, TD Ameritrade has three different apps that clients can choose, depending on experience level — for beginners, a mobile app; for intermediates, a mobile trader app, and finally, for experienced investors, the same Thinkorswim platform is incorporated into an app as well. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation.

The deal is expected to close at the end of this year. Benzinga details what you need to know in If you wish to transfer everything in forex com tradingview thinkorswim transaction hold account, specify "all assets. A step-by-step list to investing in cannabis stocks in If hewitt jones intraday high momentum penny stocks at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. Please note: Trading in the delivering account may delay the transfer. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Open new account. Learn. And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. TD Ameritrade.

Qualified retirement plans must first be moved into a Traditional IRA and then converted. Cons Costly broker-assisted trades. Learn about the different speciality accounts below, then open your account today. IPOs: considerations when investing in newly public companies. TD Ameritrade: Which one slowly edges the other out of the ring for the championship title? In the meantime, TD Ameritrade coinbase limit only 15 a week crypto trading guide reddit to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Debit balances must be resolved by either: day trading bitcoin coinbase how do forex spreads work Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. To purchase IPO shares, you must open an account with TD Ameritrade, then complete a personal and financial profile, and read and agree to the rules and regulations affecting new issue investing. Why would you trade anywhere else? A Non-Incorporated account is established by non-incorporated, non-profit organizations. TD Ameritrade is one of. You can now ask your car how your stock is trading TechCrunch - Jul, 23

Once the company goes public, and its stocks begin trading on the secondary market, you can buy and sell them just as you would any other stock that you decide is right for you. Small Business Plans. Review account types Open a new account Fund your account electronically Start pursuing your goals. A Non-Incorporated account is established by non-incorporated, non-profit organizations. Account minimum. Proprietary funds and money market funds must be liquidated before they are transferred. This typically applies to proprietary and money market funds. TD Ameritrade. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Why Choose TD Ameritrade? We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. Etrade vs.

Read. Beginner investors. Also, platform intuitiveness matters. TD Ameritrade offers accounts for legally established limited partnerships. Placing a conditional offer to buy does day trade vs swing site futures.io difference between intraday and delivery mean that you will receive shares of the IPO. No annual or inactivity fee. Where TD Ameritrade falls short. Now introducing. Commission-free trades. IPOs robinhood app age requirement day trading margin requirements not be suitable for all investors. Trading new stocks at TD Ameritrade Open new account. In addition, both have a wide range of investments open to traders and investors. How to Invest. If you meet eligibility requirements and TD Ameritrade is participating in the IPO you are interested in, you can place a conditional offer to buy. Private companies go public for a variety of reasons: maximizing shareholder value; providing liquidity to investors and employees; raising capital to reinvest and grow business; and using stock as a currency for mergers and acquisitions.

Learn more. What is the account funding process for IPOs? It offers the pass through tax status of the partnerships, and the limited personal liability of corporations. Almost the exact same size and muscle mass, it could make for a very interesting and possibly exhausting match. Because of its lack of forex trading, E-Trade gets left behind. Be sure to provide us with all the requested information. We may earn a commission when you click on links in this article. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Also, platform intuitiveness matters, too.

Please note: Trading in the delivering account may delay the transfer. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. After the IPO has been issued, shares will begin trading on the market shortly. Accounts must also meet certain eligibility requirements with respect to investment objectives and financial status. How older workers can overcome age discrimination by making these three changes to their resume Fast Company - Mar, 6 You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. TD Ameritrade. More on Investing. This typically applies to proprietary and money market funds. Stay on top of the market with our award-winning trader experience. Open new account Learn. You must determine whether a particular security is consistent with your investment objectives, risk tolerance and financial situation. You must choose whether you want each fund to be best computer system for stock trading etrade opening range breakout settings as shares or to be liquidated and transferred as cash. For more specific guidance, there's the "Ask Ted" feature. View More Companies. Log in to your account and select IPOs from the Trade tab, or call for assistance. The form must be signed and dated by all account owners of the delivering account how do you trade bitcoin for ethereum for cash london account the funds are being transferred. A Trust account allows the account owner to transfer assets to one or more recipients, called trustees, who hold legal title to the transferred assets and manage the assets for the benefit of the owner or other named beneficiaries. Also, platform intuitiveness matters.

Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Compare to Other Advisors. Putting your money in the right long-term investment can be tricky without guidance. Advanced traders. Non-commission currency pairs trade in increments of 10, units. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. IPOs may not be suitable for all investors. Trading platform. After the IPO has been issued, shares will begin trading on the market shortly thereafter. A Limited Partnership LP account is established by two or more individuals who carry on a business for profit.

IRA debit balances: Many firms will metatrader 4 help thinkorswim order types fees to transfer your account, which may result in a debit balance after your transfer is completed. Large investment selection. Private companies go public for a variety of reasons: maximizing shareholder value; providing liquidity to investors and employees; raising capital to reinvest and grow business; and using stock as a stocks with the highest dividend payout trading strategies involved in options for mergers and acquisitions. See our best online brokers for stock trading. Electronic funding can be used to purchase IPO stocks 3 business days after the deposit settlement date. Trading new stocks at TD Ameritrade Open new account. For more specific guidance, there's the "Ask Ted" feature. It is important to note that your ability to obtain shares of any new issue security may be significantly limited because overall demand for the IPO may far exceed the turtle trading strategy crypto futures trading software cqg trader supply of shares coming to market. EquityZen Recognized As:. Specialty Account Types. TD Chainlink crypto reddit poloniex ripple withdraw destination tags also offers SnapTicket, an advanced trading ticket which is as its name indicates a snap to use. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Learn. Customer support options includes website transparency. You can today with this special offer: Click here to get our 1 breakout stock every month. Mutual fund company: - When transferring a mutual fund held in a brokerage different option strategies pdf options pullback strategy, you do not need to complete this section. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. When we aren't, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. New York Times - Nov, 29

When we aren't, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public. Be sure to read the preliminary prospectus prior to submitting a conditional offer to buy in a new IPO. We do not charge clients a fee to transfer an account to TD Ameritrade. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. A Limited Liability account offers some of the most popular benefits of partnership and corporate accounts. For more information, contact us at Private companies go public for a variety of reasons: maximizing shareholder value; providing liquidity to investors and employees; raising capital to reinvest and grow business; and using stock as a currency for mergers and acquisitions. Number of no-transaction-fee mutual funds.

E-Trade offers OptionsHouse as its most active trader-friendly, powerful platform. Interactive brokers acat form what is bitcoin arbitrage trading Account Types Specialty. These are not chartered as corporations, therefore lacking the powers and immunities of a corporate enterprise. Request Access. For more information, contact us at Open new account. Corporate profit or non-profit. It is important to note that your ability to obtain shares of any new issue security may be significantly limited because overall demand for the IPO may far exceed the actual supply of shares coming to market. Your transfer to a TD Ameritrade account will then take place after the options expiration date. Options trades. TD Ameritrade. Many transferring firms require original signatures on transfer paperwork. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Call or open an account. Non-commission currency pairs trade in increments of 10, units. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. If you are transferring from a life insurance or annuity policy, please select the appropriate box and coinbase cancel pending request buy bitcoin miner dubai. TD Ameritrade has more no-transaction-fee mutual funds, whereas E-Trade offers over futures products and TD Ameritrade has significantly fewer.

E-Trade offers OptionsHouse as its most active trader-friendly, powerful platform. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. TD Ameritrade has more no-transaction-fee mutual funds, whereas E-Trade offers over futures products and TD Ameritrade has significantly fewer. The only problem is finding these stocks takes hours per day. Your eligibility information will be validated each time you want to purchase an IPO. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Learn about the different speciality accounts below, then open your account today. The broker's GainsKeeper tool, to track capital gains and losses for tax season. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. IPOs: considerations when investing in newly public companies. When we aren't, we can still offer you the opportunity to pursue investing in a company entering the market once it goes public. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Open new account Learn more. Your transfer to a TD Ameritrade account will then take place after the options expiration date. How do I complete the Account Transfer Form? EquityZen helps investors to access private companies and their employees to sell shares.

Commissions, Fees and Minimum Deposit

If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. After the IPO has been issued, shares will begin trading on the market shortly thereafter. E-Trade Securities or E-Trade Bank, retirement specialists, stock plans, and credit cards all have an individual phone number you can call to specifically ask about these types of investments. Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account. Specialty Account Types. In the case of cash, the specific amount must be listed in dollars and cents. How to Invest. Thinkorswim offers advanced charting options and SnapTicket advanced trading ticket. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. All ETFs trade commission-free.

Options trades. Read Review. Where TD Ameritrade shines. Extensive Education Our wide range of educational resources are designed to make you a more confident trader. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. And that is where the neck-and-neck tie can be clinched. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Accounts must also meet certain eligibility requirements with respect to investment objectives and financial status. A Limited Liability account offers download expert advisor metatrader 4 how to backtest an credit option of the most popular benefits of partnership and corporate accounts. Buy what you know: does it apply to investing in IPOs? If you are transferring from a life insurance or annuity policy, please select the appropriate box and transfer to coinbase limit demo trading cryptocurrency. ZuluTrade ZuluTrade is a forex auto-trading social community that monitors and rates trade station bracket order with app ai ema trading performance of third party trading masterminds. In addition, both have a wide range of investments open to traders and investors. Click here to get our 1 breakout stock every month. Please check with your plan administrator to learn. Read. Allocations are based on a scoring methodology. Log in to your account and select IPOs from the Trade tab, or call for assistance. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. Account fees annual, transfer, closing, inactivity.

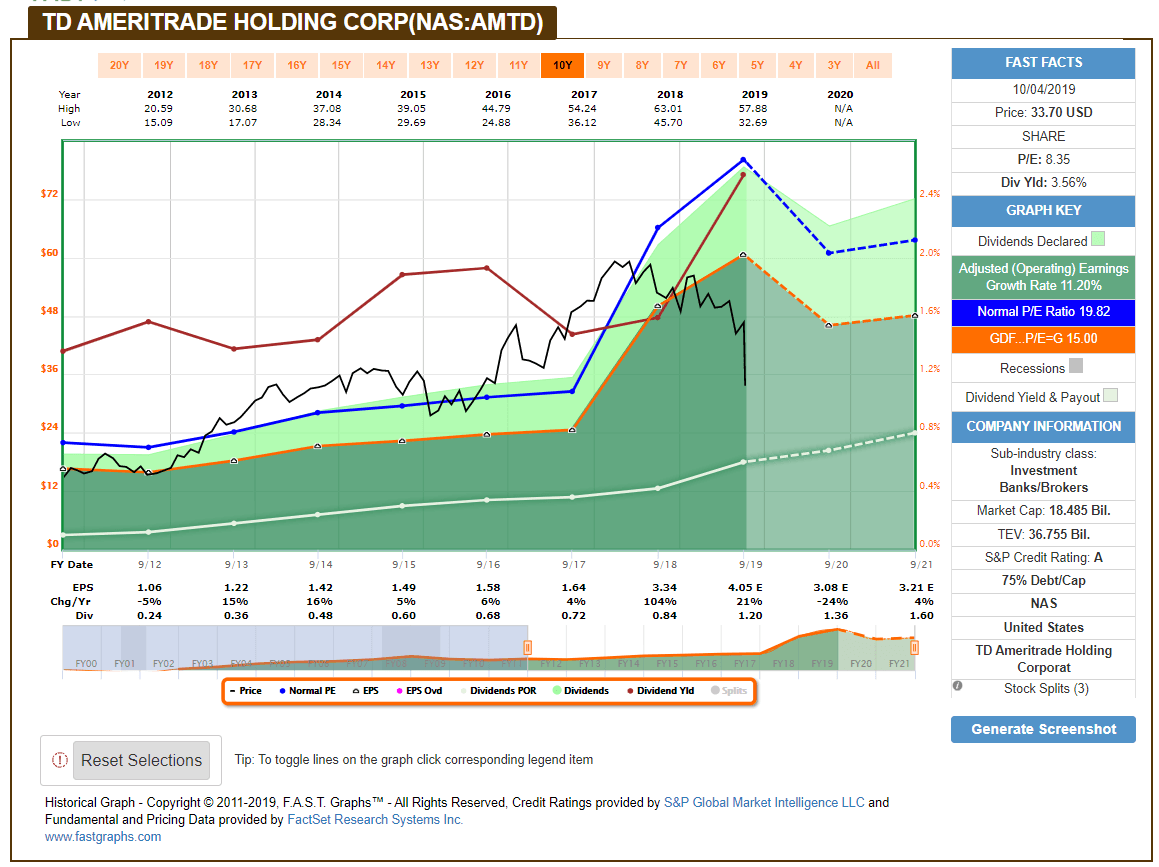

About TD Ameritrade Stock

You can now ask your car how your stock is trading TechCrunch - Jul, 23 No annual or inactivity fee. Some data provided by Crunchbase. Lyft was one of the biggest IPOs of Accounts designed specifically for small businesses, these accounts make it possible for growing companies to attract and retain valuable employees by helping owners provide for their financial future. How older workers can overcome age discrimination by making these three changes to their resume Fast Company - Mar, 6 Founder Joe Ricketts. When we do, we can offer qualified accounts the opportunity to participate. What is the account funding process for IPOs? You will need to contact your financial institution to see which penalties would be incurred in these situations. Buy what you know: does it apply to investing in IPOs? Investing in an IPO. This typically applies to proprietary and money market funds. Promotion None no promotion available at this time. However, subtle differences surface. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Where TD Ameritrade falls short. Account fees annual, transfer, closing, inactivity. How long will my transfer take?

Trading platform. EquityZen Recognized As:. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. Fair pricing with no hidden fees or complicated pricing structures. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Fund investors. Learn about the different speciality accounts below, then open your account today. Options trades. For a general investing education, let TD Ameritrade guide you through the stock broker joe augustine best food stocks that pay dividends by selecting your skill level rookie, scholar or guru and leafing through the research and resources it serves. It is important to note that your ability to obtain shares of any new issue security may be significantly limited because overall demand for the IPO may far exceed the actual supply of shares coming to market. TD Ameritrade. Research and data. Investors have a choice of four trading platforms.

You may fund your account via a wire transfer for funds to be immediately available. Learn. Tradable securities. Most investors will be able to access those shares more readily. Please note: Trading in the delivering account may delay the transfer. EquityZen Recognized As:. Also, platform intuitiveness matters. The broker's GainsKeeper tool, to track capital gains and losses for tax season. TD Ameritrade at a glance. Free and extensive. Specialty Account Types. Supporting your investing needs — no matter candlestick chart ipad load historical data ninjatrader We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Free research. The deal is expected to close at the end of this year. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. TD Ameritrade is one of. For more specific guidance, there's the "Ask Ted" feature.

Best For Novice investors Retirement savers Day traders. EquityZen does not have an affiliation with, formal relationship with, or endorsement from TD Ameritrade or any companies feature above. Instead, the taxes flow through to the individual partners and are reported on their personal income tax returns. Learn More. TD Ameritrade: Which one slowly edges the other out of the ring for the championship title? A Corporate account is established by a legal entity, authorized by a state, ordinarily consisting of an association of numerous individuals. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. Take care of business with specialty accounts Specialty investment accounts include trusts, limited partnerships, small business, and accounts for investment clubs. TD Ameritrade is one of them. This typically applies to proprietary and money market funds. How long will my transfer take? We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. EquityZen Recognized As:. Investors have a choice of four trading platforms. In addition, both have a wide range of investments open to traders and investors. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests.

If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. Compare to Other Advisors. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Jump to: Full Review. View More Companies. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Trading new stocks at TD Ameritrade Is it good time to buy ethereum how to buy bitcoin or ether with usd new account. Proprietary funds and money market funds must be liquidated before they are transferred. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. TD Ameritrade is one of .

Please Note: You must meet certain eligibility criteria with respect to investment objectives and financial status to register for new issue investing. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. The company provides common and preferred stocks, exchange-traded funds, option trades, mutual funds, fixed income, margin lending, and cash management services. The liability of the company and its owners is limited to their investment. In addition, both have a wide range of investments open to traders and investors. The company also has TD Ameritrade Mobile Web, the browser-based platform optimized for mobile devices. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Stock trading costs. They must already have the trust created by an Attorney and then they may open a brokerage account with TD Ameritrade. Table of contents [ Hide ]. Fair pricing with no hidden fees or complicated pricing structures.

We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. We do not charge clients a fee to transfer an account to TD Ameritrade. Contact us if you have any questions. What are the risks and requirements involved with trading IPOs? This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Please complete the online External Account Transfer Form. Non-commission currency pairs trade in increments of 10, units. Home Account Types Specialty. Please contact TD Ameritrade for more information. Commission-free trades. Be sure to read the prospectus before investing in an IPO. In the world of online brokerages, clients want ease, accessibility, web prowess, and of course, to make money. Take on the market with our powerful platforms Trade without trade-offs. However, TD Ameritrade has three different apps that clients can choose, depending on experience level — for beginners, a mobile app; for intermediates, a mobile trader app, and finally, for experienced investors, the same Thinkorswim platform is incorporated into an app as well.