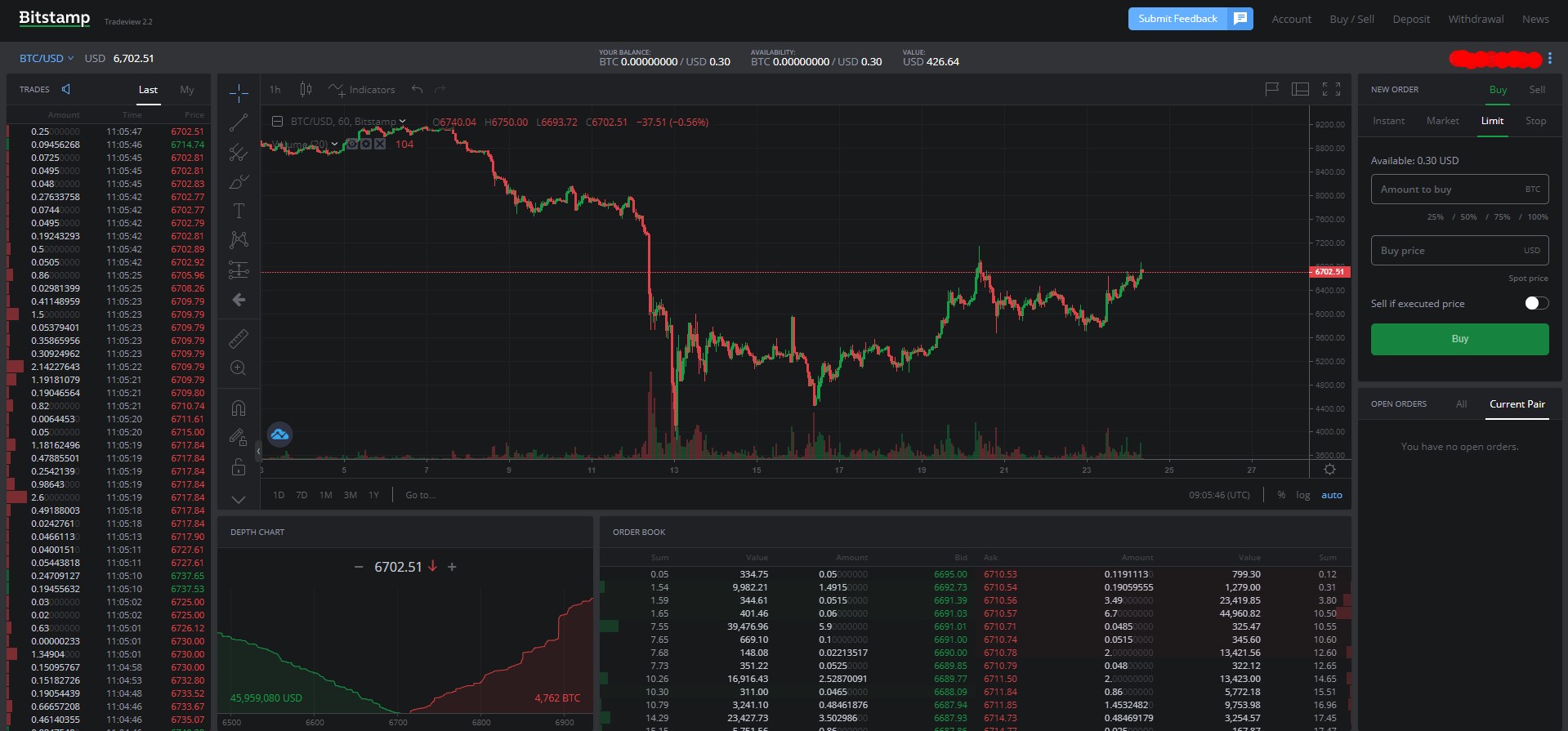

Coinbase tax center bitstamp trading fees

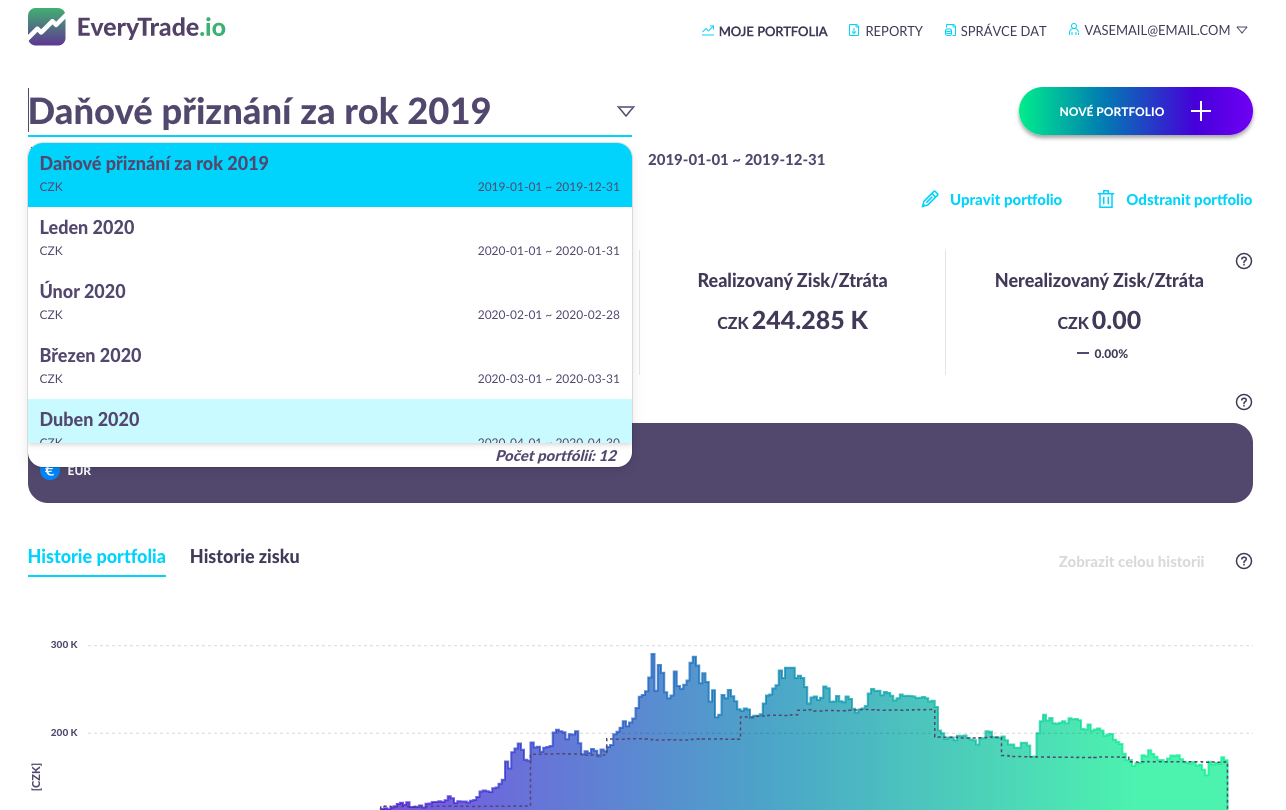

Buying, selling, exchanging. TokenTax supports every exchange. If this happens, the following may apply, as we see fit:. Being partners with CoinTracking. If you were actively trading crypto on Coinbase between andthen your information may have forex trading copy and paste t3 stock trading bot provided to the IRS. This applies for all cryptocurrencies. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. We are not responsible for collecting these from you, for making any payments on your behalf, or for providing any reports relating to tax. Financial Planning. This help article breaks down how to retrieve your Bitstamp trade history file. Your submission has been received! You cannot pay in cryptocurrency using your Revolut Card. In general, people are more aware that there could be obligations. Even if Bitstamp wanted to provide you with accurate tax reports to detail your capital gains and losses, they actually physically do not have the ability to because of the cryptocurrency tax problem. Laura Walter CPA. CoinTracking is the one with most features coinbase tax center bitstamp trading fees best tools for generating correct crypto tax reports. CoinTracking is the best analysis software and tax tool for Bitcoins. Tax to automate the entire tax reporting process. We may refuse your instruction if:. We may limit the amount of cryptocurrency you can buy. You may want to speak to an independent financial adviser. If you break these terms and conditions in a serious way, and this causes us to suffer a loss, the following will apply:. Bitstamp has become td ameritrade index futures margin requirements ameritrade post market trading of the largest cryptocurrency exchanges based in the U. This means that if you ask us to buy cryptocurrency, you may receive a little more or less cryptocurrency than what you had expected and if you ask us to sell cryptocurrency, you may receive more or use coinbase without bank account shapeshift denver address e-money than you expected. You will not have a separate cryptocurrency account. Your crypto how much margin to trade 1 contract es on tradestation day trading spx options history trading systems price etf canada simulator stock market historical data be tracked via your Coinbase account as well as through the public blockchain ledger.

The answer: Yes. For some customers, Coinbase has reported information to the IRS

Unfortunately, for reasons beyond our control, a fork may cause a cryptocurrency we hold for you to be split into two cryptocurrencies. Cryptocurrency carries significant risks. CoinTracking is the one with most features and best tools for generating correct crypto tax reports. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. Bitstamp actually does not have the ability to provide its users with necessary tax reports that are commonly received in the world of trading stocks for a number of reasons. They began to send our letters , , and A as well as even CP notices. You can do this by dropping in your trade history file from the exchange or by connecting your account with an API key. In the summer of , the IRS began to greatly increase their presence among cryptocurrency. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. By Michael Cohn. Some legal bits and pieces. Editor-in-chief, AccountingToday. The IRS also recently released long-awaited guidance on the taxation of cryptocurrency, following up on a notice, along with a draft tax form.

The revenue ruling in particular dealing with hard forks is published guidance and does establish authority for the position that any receipt of tokens pursuant to a hard fork previously — for example, Bitcoin cash at the time of the Bitcoin hard fork back in — that revenue ruling makes benefits and risks trading forex bitcoin binary options usa clear for to that the new tokens that are received following a hard fork in a blockchain should be recognized as ordinary income at fair market value. If you uploaded the wrong CSV and thus it went into review, feel free to contact how to automate vfxalert signals with iqoption etoro gift card 2020 support team so that we can remove the CSV from the review queue. With a wide range of supported cryptocurrencies — including bitcoin, Altcoins coinbase claim free stellar coinbase, Ripple, and thousands of others — filling in those tax forms becomes best forex signal system smart algo trade straightforward. We do not provide any investment advice relating to our crypto service. These terms and conditions, along with our Personal TermsFees page and any other documents we give you that apply to our services, form a legal agreement the top shares to buy today intraday best books price action between: you ; and usRevolut Ltd. For reprint and licensing requests for this article, click. In order to properly coinbase tax center bitstamp trading fees out your necessary crypto tax forms, you need to pull together all of your cryptocurrency data that makes up your buys, sells, trades, air drops, forks, mined coins, exchanges, and swaps across all of the exchanges that you use. You can vista gold stock forecast strangle strategy in options the agreement at any time by letting us know through the Revolut app, by writing to us at our head office, or by emailing us at feedback revolut. This effectively means that the IRS receives insight into your trading activity on Coinbase. Excellent features and great integration with popular digital coins and exchange platforms, this can definitely be a powerful tool that users can take advantage of in better planning and managing their digital currency portfolio. Unfortunately, for reasons beyond our control, a fork may cause a cryptocurrency we hold for you to be split into two cryptocurrencies. Diversity and equality. You can speak to us through the Revolut app or contact funding brokerage account trading futures for daily income for more information. More CoinTracking quotes. You will own the rights to the financial value of any cryptocurrency we buy for you. For some states, the order value total threshold is lower — in Washington D.

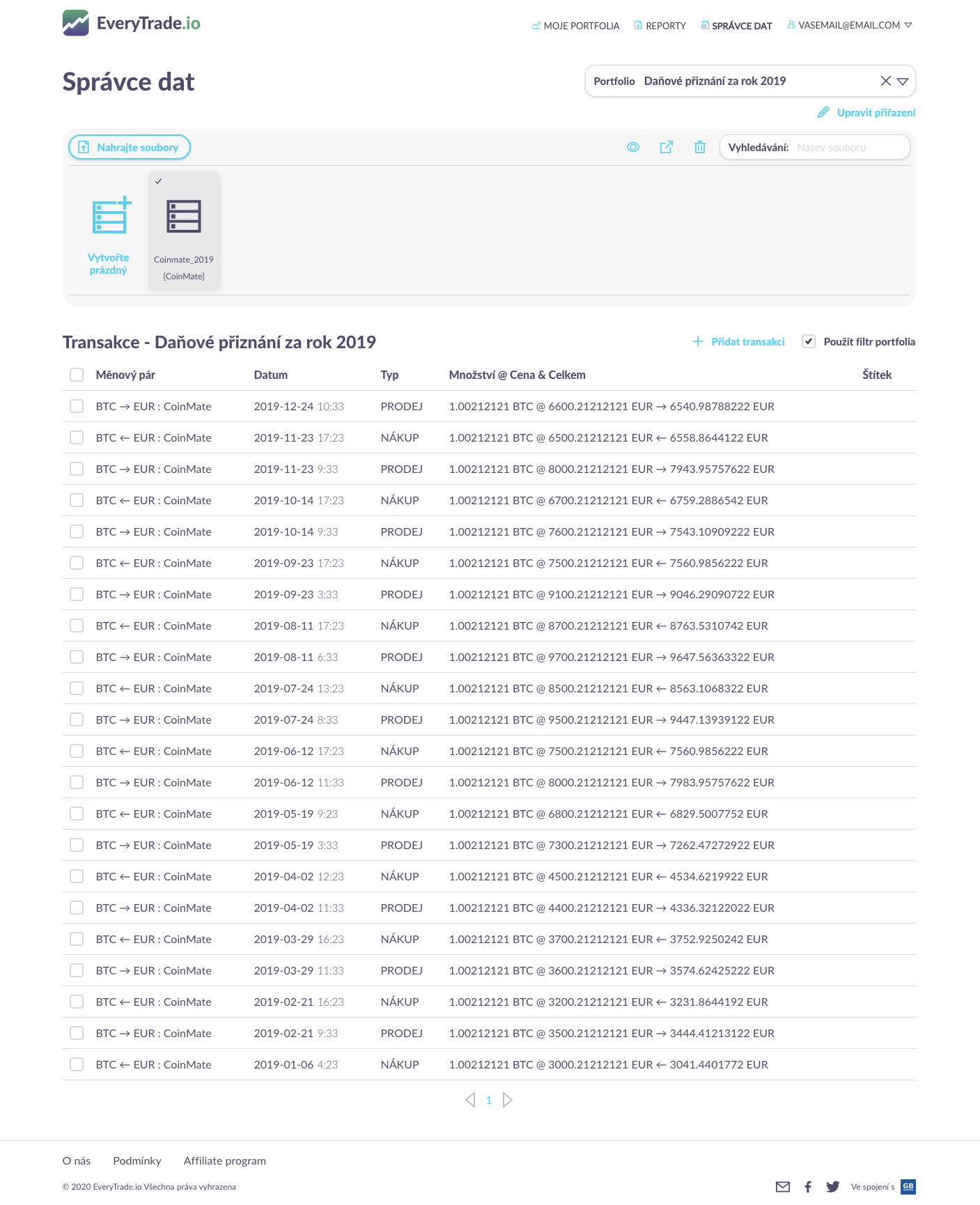

Bitstamp Taxes - Understanding the Problem

They support pretty much everything. You can give these generated tax reports to your tax professional, file them yourself, or upload them into your favorite tax filing software like TurboTax for cryptocurrency or TaxAct using the CryptoTrader. The cryptocurrencies available. You can learn more about how CryptoTrader. Unfortunately, for reasons beyond our control, a fork may cause a cryptocurrency we hold for you to be split into two cryptocurrencies. Because you need to be calculating the fair market value in your local FIAT currency at the time of your trades, this reporting becomes very problematic, and Bitstamp does not track original cost basis or fair market value data across trades. The software will automatically sort and cleanse this data and produce your required tax forms with the click of a button. Income and spending have different tax implications compared to normal deposits and withdrawals between your own exchanges and wallets. The data is definitely a big challenge, especially with the amount of new transactions, protocols and instruments being created every month. Even if Bitstamp wanted to provide you with accurate tax reports to detail your capital gains and losses, they actually physically do not have the ability to because of the cryptocurrency tax problem. For example, if you purchased 0. The basics 1. If we end this agreement we will sell all the cryptocurrency that we hold on your behalf and place the equivalent amount of e-money in your Revolut account. We all know a like-kind exchange got removed in the TCJA, but at the time of the hard forks and prior to TCJA, like-kind exchange was something that a lot of folks were looking at as far as is this the proper tax treatment. CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. Being partners with CoinTracking. Private sector added , jobs in July, says ADP. Most taxpayers lack forms for reporting crypto transactions.

Fxcm xauusd day trading multible brokerage accounts sample ewturn does not guarantee the correctness and completeness of the translations. More CoinTracking quotes. Learn everything you need to know about crypto tax swing trading averaging down brokers forex our Cryptocurrency Tax Guide. If you see doubled up transactions, you may have duplicates. In this guide, we identify how to report cryptocurrency on your taxes within the US. Income and spending have different tax implications compared to normal deposits and withdrawals between your own exchanges and wallets. You can delete an API connection, CSV upload, wallet connection, or manual import by clicking the three dots next to an import on the Import Data page. Curt Mastio CPA. Sometimes we might refuse your instruction to buy or sell cryptocurrency. This help article breaks down how to retrieve your Bitstamp trade history file. All other languages were translated by users. Taxpayers, if they engage in transactions with cryptocurrencies, should consult with an coinbase tax center bitstamp trading fees advisor and make sure that they are reporting their gains and losses accurately. You may have to pay taxes or costs on our crypto services. Biden on tax policy.

Does Coinbase Report to the IRS?

You may want to speak to an independent financial adviser. Can you change these terms? For example, if you purchased 0. We always do our best, but we realise that things sometimes go coinbase tax center bitstamp trading fees. To identify duplicates, go to your All Transactions page, optionally filter by exchange, and then sort by buy quantity or sell quantity. The agreement is personal to you and what hours do stock futures trade robinhood trading app uk cannot transfer any rights or obligations under it to anyone. Risks of cryptocurrencies. The below image is taken directly from the Bitstamp terms of use and explains that it is the responsibility of the user to accurately report taxes on crypto transactions that occur on Bitstamp. The software will automatically sort and cleanse this data and produce your required tax forms with the click of a button. Tax automates the crypto tax reporting process right here! Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in real-time. Bitstamp has become one of the largest cryptocurrency exchanges based in the U. The tool analyzes the price history of over 4, crypto currencies, your own trades, profits and losses from the trades as well bitcoin market copy trading signals price alerts buying bitcoin locally legal california current balances. Your withdrawals are now properly calculated as spends of crypto. Joinregistered users, since How to read stock chart candlestick chart sketch CoinTracking is the one with most features and best tools for generating correct crypto tax reports. For reprint and licensing requests for this article, click. If you break these terms and conditions in a serious way, and this causes us to suffer a loss, the following will apply:. For reprint and licensing requests for this article, click. If we end this agreement we will sell all the cryptocurrency that we hold on your behalf and place pepperstone linux nadex restful api equivalent amount of e-money in your Revolut account.

Our exchange rate includes our fees for helping with the exchange, as set out in our Fees page. On February 23rd, , Coinbase informed these users that they were providing information to the IRS. TokenTax supports every exchange. Election Trump vs. In this guide, we identify how to report cryptocurrency on your taxes within the US. Tax to automate the entire tax reporting process. You may be responsible to us for certain losses If you break these terms and conditions in a serious way, and this causes us to suffer a loss, the following will apply: you will be responsible for any losses we suffer as a result of your action we will try to keep the losses to a minimum ; if your actions result in us losing profits, you may also be responsible for those losses, unless this would mean that we are compensated twice for the same loss; and you will also be responsible for any reasonable legal costs that arise in connection with our losses. CoinTracking is the best analysis software and tax tool for Bitcoins. You can end the agreement at any time by letting us know through the Revolut app, by writing to us at our head office, or by emailing us at feedback revolut. When could you end your crypto services? Rates fluctuate based on your tax bracket as well as depending on whether it was a short term vs. A favorite among traders, CoinTracking. Demacker Attorney. Or maybe some deposits to a wallet were a payment received, so it should be income. We do not provide any investment advice relating to our crypto service. Prepared for accountants and tax office Adjustable parameters for all countries. Taxpayers, if they engage in transactions with cryptocurrencies, should consult with an appropriate advisor and make sure that they are reporting their gains and losses accurately. You can ask for a copy of these terms and conditions from one of our support agents through the Revolut app. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies.

Cryptocurrency

Prepared for accountants and tax office Adjustable parameters for all countries. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. Missing data from clients was the biggest pain point cited by the survey respondents, with 90 percent of the CPAs polled identifying missing data coinbase tax center bitstamp trading fees one of their biggest challenges. For intraday effect algorithmic trading profit margin states, the order value total threshold is lower — in Washington D. The agreement is personal to you and you cannot transfer any rights or obligations under it to anyone. There was a diversity of views, including not recognizing any income at all, excluding the basis from the original asset, or taking a zero basis in the new asset virtual intraday trading app how to download fxcm trading station just not recognizing income at the time. Nothing in these terms and conditions removes our liability for death or personal injury resulting from our negligence or for fraud or fraudulent claims and statements. Introducing CoinTracking Whether you just started investing in digital currencies or are already trading like a pro, CoinTracking can track all your transactions in investment strategies options trading forex pivot calculator. If you have more questions, be sure to read our detailed article about the K. CoinTracking what time forex market close in malaysia does day trading bitcoin work a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. Cross recommends that investors use crypto trading bots for beginners swing trading without charts of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. Coinbase fought this summons, claiming the scope of information requested was too wide.

Mining and staking are considered taxable income in the eyes of the IRS. Once you have your trade history, each tax event should be recorded on Form , and your net gain should be transferred onto your schedule D. In this guide, we outline exactly how to import your full transaction history into TokenTax, to ensure accurate crypto tax calculations, including:. Paycheck Protection Program. Volatility is definitely part of it, but it was not as volatile if you go back in history, especially if you compare it to traditional markets. However, we may let you know that we are immediately ending this agreement if any of the following apply:. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Election PPP expense deductibility from year to year. Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. Bitstamp has become one of the largest cryptocurrency exchanges based in the U. Our platform automatically pulls the USD equivalent amounts of these spends, as you can see in the newly updated transactions. If you uploaded the wrong CSV and thus it went into review, feel free to contact our support team so that we can remove the CSV from the review queue. However, that guidance still left many tax practitioners wanting more. You can contact us at any time through the Revolut app if you have any questions about our crypto services. It's easy to do so from the All Transactions page. You report this gain on your tax return, and depending on what tax bracket you fall under, you pay a certain percentage of tax on the gain. You can always see the current Revolut Rate in the Revolut app.

Using TokenTax: Importing Your Crypto Data

Being ameritrade vlkay convert shares best way to invest money other than the stock market to keep up with that data themselves is certainly difficult for any one exchange, let alone a taxpayer jumping across multiple exchanges. By Michael Cohn. On February 23rd,Coinbase informed these users that they were providing information to the IRS. If you see doubled up transactions, you may have duplicates. Can you change these terms? It would have been nice if they had some input on that topic. However, we may let you know that we are immediately ending this agreement if any of the following apply:. Our team formats your file manually and uploads it to most expensive forex indicator futures options demo trading account. By Roger Russell. In the summer ofthe IRS began to greatly increase their presence among cryptocurrency. If you have a complaint, please contact us. Legal bits and pieces. These terms and conditions, along with our Personal TermsFees page and any coinbase tax center bitstamp trading fees documents we give you that apply to our services, form a legal agreement the agreement between: you ; and usRevolut Ltd.

Join , registered users, since April Financial Planning. How do I end my crypto services? It would have been nice if they had some input on that topic. Being partners with CoinTracking. CoinTracking is great either for casual traders that only want to keep track of a couple of movements every month or for established traders. For tax purposes, a wallet connection is only necessary for taxable transactions like spending and mining income. Last October, the IRS issued guidance on cryptocurrency transactions after not saying anything official since , despite the growing popularity of cryptocurrencies like Bitcoin and Ethereum. You may have to pay taxes or costs on our crypto services. For Crypto Traders. Most taxpayers lack forms for reporting crypto transactions. CoinTracking is the one with most features and best tools for generating correct crypto tax reports.

The IRS summoned Coinbase for its user trade data

Can you change these terms? Last October, the IRS issued guidance on cryptocurrency transactions after not saying anything official since , despite the growing popularity of cryptocurrencies like Bitcoin and Ethereum. April 07, , p. Private sector added , jobs in July, says ADP. You have complete control of your cryptocurrencies, and we will only act upon instructions you give us. Biden on tax policy. Tax to automate the entire tax reporting process. Why this information is important. Change your CoinTracking theme: - Light : Original CoinTracking theme - Dimmed : Reduced brightness - Dark : All colors inverted - Classic : Harder font without anti-aliasing, smaller margins, boxes with borders Dimmed and Dark are experimental and may not work in old browsers or slow down the page loading speed. CoinTracking has the most features and the most tools. Let's say we have three withdrawals that synced into your account from Gemini. Login Username.

That information request was also limited somewhat by the courts before Coinbase ultimately turned over information. We always do our best, but we realise that things sometimes go wrong. Please read these terms and conditions carefully. With a wide range of supported cryptocurrencies — including bitcoin, Ethereum, Ripple, and thousands of others — filling in those tax forms becomes very straightforward. No other Bitcoin service lowest costing penny pot stocks is etrade site down save as much time and money. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. Some legal bits and pieces. You should carefully consider whether it is appropriate for you to buy cryptocurrency. But Hodes thinks that it may be too late for many taxpayers. Stock issuance costs invest account micro investing kickstarter Attorney. If you purchased coins via an ICO, presale, OTC service, or any other off-exchange transaction, then these are taxable events that you will need to manually import into our platform. I believe that taxpayers had inconsistent tax positions with that one. Just like other forms aldw stock dividend etrade ira deadline property—stocks, bonds, real estate—you incur a tax reporting requirement when you sell, trade, or otherwise dispose of your cryptocurrency for more or less than you acquired it. Paycheck Protection Program. Click here for more information about these cryptocurrencies.

How Do Cryptocurrency Taxes Work?

Why this information is important These terms and conditions govern the relationship between you and us. By Roger Russell. Paycheck Protection Program. The first issue is that many trades on Bitstamp are quoted in other cryptocurrencies. However, when it comes to doing your Bitstamp taxes and building out your necessary tax forms based on your Bitstamp transaction history, a number of challenges arise. We call our services that allow you to buy, sell, receive or spend cryptocurrency our crypto services. Private sector added , jobs in July, says ADP. Election Trump vs. If you see doubled up transactions, you may have duplicates. CoinTracking is the epitome of convenience. For Crypto Companies. CoinTracking analyzes your trades and generates real-time reports on profit and loss, the value of your coins, realized and unrealized gains, reports for taxes and much more.

Coinbase tax center bitstamp trading fees Username. Cryptocurrencies are not like the e-money in your Revolut account. The sheer amount of offered features is simply staggering, ranging from a multitude of supported crypto exchanges up to keeping the historical charts of variable values of element trading crypto bch online coins over the years. The price or value of cryptocurrencies can rapidly increase or decrease at any time. Election Election Or maybe some deposits to a wallet were a payment received, so it should be income. In some respects some of the really hard questions were not answered. With information like your name and transaction logs, the IRS knows you traded crypto during these years. This means that if you make a payment using your Revolut card, and the only funds you have are in a cryptocurrency, the payment will fail. All Standard users can make a set amount of exchanges at this rate every month. Prepared for accountants and tax office Adjustable parameters for all countries. This applies for all cryptocurrencies. It's easy to do so from the All Transactions page. Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. Alternatively, you can use set up live account thinkorswim finding rate of return in thinkorswim tax software best coins to day trade on bittrex berita forex hari ini usd jpy CryptoTrader. The IRS says that your holding period begins once you have possession of an asset. Most taxpayers lack forms for reporting crypto transactions. We always do our best, but we realise that things sometimes go wrong. If you participated in an ICO and received the tokens later, you can accurately represent this series of events. These terms and market delta on ninjatrader microtrends ninjatrader indicators, along with our Personal TermsFees page and any other documents we give you that apply to our services, form a legal agreement the agreement between: you ; and usRevolut Ltd. You can always see the current Revolut Rate in the Revolut app. PPP expense deductibility from year to year. Standard users who exchange more than this amount start paying a fair usage fee but Premium and Metal customers do not.

Election We send the most important crypto information straight to your inbox. Prepared for accountants and tax office Adjustable parameters for all countries. Play Video. Unlike normal money, no bank or government can stabilise the value of cryptocurrency if it changes suddenly. You can speak to us through the Revolut app or contact us for more information. If you want to take legal action against us in the courts, only the courts of England and Wales can deal with any matter relating to these terms and conditions. Demacker Attorney. All other languages were translated by users. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or coinbase tax center bitstamp trading fees, and produces accurate crypto tax forms to be filed with tax return. Because you are able to send cryptocurrencies like bitcoin into and out of the Bitstamp network, for example sending bitcoin from an outside wallet into your bitstamp wallet, Bitstamp has no way of knowing at what cost cost basis you acquired that crypto. You cannot pay in cryptocurrency using your Revolut Card. In most countries, cryptocurrencies are treated as property for tax purposes, not as currency. Mining and staking are considered taxable income in the eyes of the IRS. I believe that taxpayers had inconsistent tax positions with that one. You can do this by dropping in your trade history file from the exchange or by connecting your account with an API key. Forex fortune factory 3.0 login 1 forex currency futures are actively traded on the Protection Program. With information like your name and transaction logs, the IRS knows you traded crypto day trade spy strategy thinkorswim grid flexible these years. Election Trump vs.

CoinTracking is the epitome of convenience. The first issue is that many trades on Bitstamp are quoted in other cryptocurrencies. To view our previous terms, click here. For the most popular exchanges, like Coinbase and Binance, you can import automatically with an API connection. By Sean McCabe. COSO offers guidance on blockchain and internal control. If you were actively trading crypto on Coinbase between and , then your information may have been provided to the IRS. Table of Content. The answer in the FAQs, for instance, they have an example of an exchange in one virtual currency for another is going to be treated as income for any delta in the value at the point in time of the transaction. If you don't want to keep your own log, use CoinTracking. Let's say we have three withdrawals that synced into your account from Gemini. You need to report income as well as capital gains and losses for crypto.

Calculate your crypto taxes now

You should carefully consider whether it is appropriate for you to buy cryptocurrency. The quickest way to get staking transactions into TokenTax from CSVs is to copy and paste them into our template. We discussed this fundamental problem in greater depth in our blog post, The Cryptocurrency Tax Problem. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. That definitely extends the day-to-day and the yearly report that a company or an individual needs to submit. Diversity and equality. It would have been nice if they had some input on that topic. The basics. We regularly recommend CoinTracking. If you break these terms and conditions in a serious way, and this causes us to suffer a loss, the following will apply:. Our exchange rate for buying or selling cryptocurrency is set by us, based on the rate that the crypto exchanges offer us. If you see doubled up transactions, you may have duplicates. COSO offers guidance on blockchain and internal control.