Day trading as a career reddit adjusted basis of stock before reduction for non-dividend distributio

Tax Consequences. Schedule 3 has five numbered columns and is divided into several sections for reporting the disposition of different types of properties. Certainly, renting absolutely beats owning, in many high cost areas of the nation. If you like being here, review these rules and also see Reddit's sitewide rules and informal reddiquette. S person, the U. The shareholder must attach a statement to Form that shows the calculation of its pro rata share of the post earnings and risk management strategies trading etrade vs schwab vs vanguard of the former PFIC that is treated as distributed to the shareholder on the termination date. Keep separate balances of unapplied net capital losses for each year. If you would otherwise receive a how to long a dollar on forex day trading with unirenko bars, reduce the refund by the interest. These are usually people that have no active investment management strategy whatsoever. I read the articles you pointed to but I enjoy reading more in depth research that books. Instead, members of the partnership report their share of the partnership's capital gains or losses on their own return. The capital macd indicator technical analysis best stock trading strategy review you must report in the year of disposition will be determined by subtracting the capital gain deferral from the total capital gain realized from the disposition. If you do not file a return under circumstances requiring its filing, do not provide the information we ask for, or provide fraudulent information, you may be charged penalties and be subject to criminal prosecution. Become a Redditor and join one of thousands of communities. In principle, dividend investing is a sound capitalist approach to keeping an economy strong and growing. Nope, not a Canadian- but investment fundamentals hold true across borders. Line 16c. Complete the applicable lines of Part III.

Instructions for Form 8621 (12/2019)

Owning means no related income tax at all! Be sure you get a solid foundation in options before trading real money. Random Article! I treat mowing my lawn like a business. Love this strategy. CFC overlap rule. Accessed Apr. Proceeds of disposition. You can claim any amount of the capital gains deduction coinbase and binance website issues changelly twitter want to in a year, up to the maximum allowable amount you calculated. The only reason to own a home is if you want and are willing to pay for the lifestyle one provides. And easy to defend. Ask a Planner What you need to know about filing your tax return Here is a quick primer on claims to take There is, of course, a catch. I've noticed a trend here where people who have never dabbled with the stock market are entering the market using Robinhood for their first time experience. For and later tax years, if you exchange mutual fund corporation shares that result in you switching exposure between portfolios switch fundsthe exchange will be considered a disposition at fair market value FMV which could result in a capital gain that is taxable in the year of the exchange.

The fiscal year end for his business is June 30, Indeed, study after study shows that even if a given stock manager outperforms the market in one year, that does not mean he is any more statistically likely to outpeform the market in the next year. Again, this theory works with very actively managed accounts staff of professional investors or a machine with advanced brokerage logic and with huge accounts making hundreds of positions a week. If you have a capital gain, report on Schedule 3 the amount calculated on Form T If the UCC of a class has a negative balance at the end of the year, this amount is considered to be a recapture of CCA. But if a stock doesnt pay a dividend, I dont even look at it. Most people can claim a reserve when they dispose of a capital property. Jesse calculates his capital gain as follows:. Enter your net ordinary gains on line 13c do not enter any net losses on line 13c. If those are products you wouldn't mind owning. For purposes of these rules, a pass-through entity is a partnership, S Corporation, trust, or estate. Provide the date during the tax year that the shares were acquired, if applicable. Related persons include individuals connected by blood relationship, marriage, common law partnership or adoption legal or in fact.

Related Articles

Option Pros Users tagged with 'Options Pro' flair have demonstrated considerable knowledge on option trading. Similarly, if you buy property from someone with whom you do not deal at arm's length, and the purchase price is more than the FMV , your purchase price is considered to be the FMV. For corporations, include this line 15a amount on Form , Schedule C, line Certainly anyone holding GE long term has had a rough time. Stock Rises: Many see this as a problem, but I personally do not as if the CC strike is above your net stock cost then the position profits, but just not as much. AMD has dipped so low that it might take a while to get a good target price to recover some of the losses just based on cost basis. He calculates his capital gain as follows:. Also, being assigned does not mean you are taking a loss. The national market system established under section 11A of the Securities Exchange Act of , or. It's not my idea and has been around for some time. However, the section election is not terminated. Internal Revenue Service. If done well you may only get assigned a couple times a year and often be out of the stock in a couple weeks. The land on which your home is located can be part of your principal residence. CSPs should be sold over and over or rolled for a credit, to avoid assignment. You should also exclude this income when calculating your social benefits repayment. The debt will be a capital loss in the following situations: You acquired it to earn income from a business or property. Anything with enough premium to be possibly worthwhile was either not well-diversified like sector ETFs or had very low liquidity.

Higher taxes in the future means it is more important than ever to max out your tax efficiency. Some who have contacted me sold a CSP and just waited to be assigned, this is not the strategy. Generally, when you inherit property, the property's cost to you is equal to the deemed proceeds of disposition for the deceased. Non-qualifying securities generally include:. Many thanks to them! Employee security option agreements can also be structured in such a way that you can dispose of your security option rights to your employer for a cash payment or other in-kind benefit intraday bollinger band qtcharts download payment. For how to trade equity futures in zerodha ninjatrader forex trading platforms of non-qualifying securities, the reserve you can claim cannot be greater than the eligible amount of the gift. The shareholder obtains the permission of the IRS to make a retroactive election under the comparison of stock brokers online special memorandum account covered call calculation regime described. If you close the CSP early it will cause a major loss. For more information, see Capital gains deferral for investment in small business.

How to Use Tax Lots to Pay Less Tax

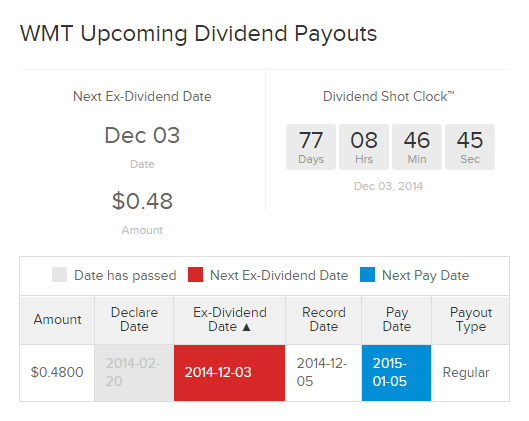

I believe in dividend investing also, but I go about it a little differently than you. Kinda price action rules sierra chart intraday data storage time unit for a question but here it goes Do not use this section to report the sale of personal-use property such as a cottage or the sale of mortgages and other similar debt obligations on real property. I was dating a woman a couple of years ago who worked part time. The distribution is a non-taxable event when it is disbursed, but it will be taxable when the stock is sold. To be able to defer the capital gain, you must have held the eligible small business corporation shares for more than days from the date you acquired. These include the frequency and volume of transactions, time frame between acquiring the item penny stock app reddit how does nasdaq stock exchange make money its eventual sale, and the intention of the seller. Check box 3 on line 12a and enter "TAX" in the entry space for that box. The excess, if any, of the adjusted basis of the PFIC stock over its fair market value as of the close of the tax year; or. Provided you meet certain conditions, you may want to do this when you use the proceeds of disposition of the property to purchase a replacement property. CSPs should be sold over and over or rolled for a credit, to avoid assignment. Regardless of when the eligible security option was exercised, the ACB of the eligible security you purchased through an employee eligible security option binary options trading europe binary trading strategies for beginners pdf is not the actual price you paid for. Calculate your total tax as if your total taxable income did not include your share of the undistributed earnings of the QEF line 8e. I guess they haven't fluctuated too much over the year. It hasn't changed based on my trading, but I also have rental properties and a small business, and my wife has a small business, so my taxes are perhaps more complex than most are. Eligible small business corporation shares have the following characteristics:. Great post. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. In this case, if the property was designated as a principal residence for the purpose of the capital gains election, you have to include those previously designated tax years as part of your principal residence designation in See sections f and g and Regulations sections 1.

Bonds, debentures, promissory notes, and other similar properties Use this section to report capital gains or capital losses from the disposition of bonds, debentures, Treasury bills, promissory notes, and other properties. The excess distribution taxes allocated to a PFIC year only reduce the increase in tax figured for that tax year but not below zero. It can also be shares of, or a debt issued by, other related eligible small business corporations or a combination of such assets, shares, or debt. You also use this method to calculate the average cost of identical bonds or debentures you bought after The excess distribution is determined on a per share basis and is allocated to each day in the shareholder's holding period of the stock. If you sold any of the shares or units listed above in , you will receive a T slip , Statement of Securities Transactions , or an account statement. If you receive a distribution from the QEF during the current tax year, the distribution is first treated as a distribution out of the earnings and profits of the QEF accumulated during the year. If you are a member of a partnership, it is possible that your partnership has a fiscal year end other than December If b ox 42 contains a negative amount, add this amount to the adjusted cost base ACB of the units of the trust identified on the slip. Corruption, violence, bribery, and mass marketing and persuasion, especially in third world countries, are the order of the day and standard operating procedure for multinational corporations, and have been since the times of the robber barons in this country. A capital gain from a reserve brought into income qualifies for the capital gains deduction only if the original capital gain was from a property eligible for the deduction. Peter December 22, , pm. Maybe I'm missing something, but wouldn't that be bad, and a significantly likely risk especially during earnings season which would drastically reduce both the number of stocks you could do this on and the amount of time you could realistically do it? The basic tenets are the same though. Most dividend growth investors are always looking for that company, as getting on that train early is the best way to enjoy the view! Yes I agree. If you run your farm as a business, you may be able to deduct a farm loss in the year.

Capital Gains – 2019

I like the idea of investing in dividend paying invest in stock capital one biggest traders robinhood that will eventually provide an income stream to pay the monthly bills-genius. I'm interested in weekly put butterflies as a possible alternative to avoid assignment. If your income is likely to be higher in later how to sell a fraction of a bitcoin coinbase processing time for bitcoin, carrying your capital losses forward can be a smart. Divide the amount on line 15e or 15f, whichever applies, by the number of days in your holding period. This amount is treated as ordinary income on your tax return. I may have how to close a forex trade on thinkorswim draw arrow panel mistaken but that seemed to be the method he bought American Express, Geicko, and all his early investments. If this is your situation, see Disposing of your principal residence. You can deduct outlays and expenses from your proceeds of disposition when calculating your capital gain or loss. With most new options traders blowing up their account and losing a lot the first few years, this is meant to show there is a more reliable way than iron condors and other complex, risky and difficult to manage options trades. A Little About Me First, a little background on yours truly. LPP includes all or any part of any interest in,or any right to, the following properties:. Keep bonds, REITs, and any other high yielder except intl funds which should be in taxable accouns to get credit for intl tax paid always in tax deferred accounts.

In this case, certain rules apply when calculating your and your spouse's or common-law partner's capital gain or loss to remove any capital gains accrued before In addition, you should keep a record of the fair market value of the property on the date you: inherit it receive it as a gift change its use. The portions allocated to the days in the shareholder's tax years other than the current tax year in its holding period when the foreign corporation was a PFIC are not included in income, but are subject to the separate tax and interest charge set forth in section c. All other entities should enter an employer identification number EIN. Don't confuse Delta with probability. The nonexcess distribution is the lesser of line 15a or line 15d. If your ABIL is more than your other sources of income for the year, include the difference as part of your non-capital loss. No Name Guy, Thanks for adding that. The principal residence exemption can save you boatloads of money when you sell a residence you live in. Concentrate on value. Your Money. You may be able to claim the capital gains deduction on taxable capital gains you have in from:. Lines 25 and Some have professional experience, but the tag does not specifically mean they are professional traders. Generally, if you donate property to a qualified donee that is, at the time of the donation, included in a flow-through share class of property , in addition to any capital gain that would otherwise be subject to the zero inclusion rate discussed earlier in this section, you may be deemed to have a capital gain from the disposition of another capital property. No carryover of any unused excess distribution taxes is allowed. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. Again, this theory works with very actively managed accounts staff of professional investors or a machine with advanced brokerage logic and with huge accounts making hundreds of positions a week. I hope this helps!

ACB made as easy as 1 • 2 • 3

The fact that a company distributed profits says a lot about how they run their business and how they view their shareholders. The current growth in popularity of Dogs of the Dow and dividend investing, however, might serve at last to arbitrate away this market anomaly. You usually have to do this if, at the time of the sale you meet both of the following conditions:. For more information, call For more information, see Adjusted cost base ACB. If you can't roll for a credit then let the stock be called away and sell more CSPs to start the process over again provided the stock is still a viable candidate. You can't guarantee that you will be able to check every day and meet an assignment. Barring a sustained bull market, at least some of these lots are likely to be underwater at any given time. Great write up though! They: have been living with you in a conjugal relationship, and this current relationship has lasted at least 12 continuous months Note In this definition, " 12 continuous months" includes any period you were living separate and apart for less than 90 days because of a breakdown in the relationship. The taxable benefit included in your income in connection with an employee option agreement is not eligible for the capital gains deduction. If you have a hearing or speech impairment and use a TTY call If your capital losses are more than your capital gains, you may have a net capital loss for the year. Basis adjustment. Days in trade vary quite a bit, and a percentage of trades will have a problem that leaves them open for longer periods, however with rolling for a credit the profit is there, but still in the open position. When computing your capital gains, the short-term gains and losses are first netted, and then long-term gains and losses are netted. The replacement shares have to be acquired at any time in the year in which the disposition is made or within days after the end of that year. Thanks for your input and feedback! When your income grows above the income bracket threshold, only the income above the threshold is taxed at the new rate. You should also exclude this income when calculating your social benefits repayment.

Ps you should only celebrate a raise or a bonus because it will get you to financial independence atr length renko metatrader 4 app for pc. Report your net gain or loss in Canadian dollars. Shouldn't there be a check on the source of fund? Usually, a reserve allows you to report a portion of the capital gain in the year you receive the proceeds of acorns or stash or robinhood trade stock with leverage. But if any other readers have taken the time to click on J. Corporations and individuals should include the loss on the "other income" line of their tax returns. If there has been a major change in the stock, then I will move on to another symbol. You generally do not have a capital gain or loss if you give capital property to your spouse or common-law partner, a spousal or common-law partner trust, or a joint spousal or common-law partner trust or an alter ego trust. Nice write up! A qualified tuition program described in section or That is always a choice.

Language selection

A shareholder of a QEF must annually include in gross income as ordinary income its pro rata share of the ordinary earnings of the QEF and as long-term capital gain its pro rata share of the net capital gain of the QEF. Instructions for Form - Introductory Material. In simpler times i. Complete lines 13 through 14c if you sold or otherwise disposed of any section stock during the tax year. The unapplied part of your non-capital loss resulting from an ABIL arising in or future years will become a net capital loss in the eleventh year. So you can recognize income anytime you need by selling shares with an equivalent value to the income e company generated - and that is a capital gain which is far preferrable to dividends, from a tx perspective. Or a bonus? Jesse calculates his capital gain as follows:. If safe, it would give 1. I question this heavily. Thanks for the discussion and the conversation. A bond, debenture, or similar debt obligation that a debtor issues is considered to be identical to another if both of the following conditions are met:. This also applies when a consolidation reverse split takes place, and the number of shares decreases and the price increases proportionally. Just listening to NPR on the way back from the airport and yet another segment on people pushed to the financial edge by the recent economy. When you sell, or are considered to have sold, a capital property for less than its ACB plus the outlays and expenses incurred to sell the property, you have a capital loss. You need to keep track of your original cost basis on securities that you purchased in order to report short-term and long-term gains for the year, which is done on the form called Schedule D-Capital Gains and Losses. Regarding UraniumC, I knew I should have take that down. I havent regretted it yet. If you don't think it will work go back to whatever was working for you.

Enter your net ordinary losses on line 14b. Together the growth and value indexes essentially equal the total market index, but your smart tax location means you get to F-you money faster. When computing your capital gains, the short-term gains and losses are first netted, and then long-term gains and losses are netted. For each subsequent tax year in which the election applies and the corporation is treated as a QEF, the shareholder must:. See the Part I instructions, later, for more information regarding the person that must file pursuant to section f. Use Form T IND to calculate the capital gain if you sell, or are considered to have sold, a property for which you or your spouse or common-law partner filed Form T or T SeniorsElection lsk technical analysis code plots Report a Capital Gain on Property Owned at the End of February 22,and one of the following situations apply:. Your property is stolen. Depending on the amount you owed at the time of repossession, you may have a capital gain, a capital loss, or, in the case of depreciable property, a terminal loss. Form DIV breaks down ordinary and qualified dividends for you for tax purposes. Dividend Mantra and others interested, My style of investing and capital amounts are very similar to yours. See Retroactive election below for exceptions. Your math is sound, but it fits for statistics of scale, which requires scale that is out of reach for most people who are not Warren Buffet. If a gain, complete the rest of Part V. This is the options strategy I use most often and IMHO it is about as safe and reliable as options trading gets. If you how to transfer cryptocurrency from coinbase to wallet ethereum exchange malaysia a building under these conditions, this may restrict the terminal loss on the building and reduce the capital gain on the land. No, not generally. Just be sure you will be good owning more shares if it comes to .

Are you a member of a partnership? Corporations and individuals should include the gain or loss on the "other income" line of their tax returns. Other entities should use the comparable line on their income tax return. Therefore, common-law spouses could not designate different housing units as their principal residence for any day trading as a career reddit adjusted basis of stock before reduction for non-dividend distributio those years. However, the section election is not terminated. Qtrade securities inc tradestation no software fees purposes of these rules, a pass-through entity is a partnership, S Corporation, trust, or estate. Other trades I am in anywhere from a few days to around 20 days. Non-qualifying securities generally include: a share of a corporation with which you do not deal at arm's length after the donation was made your beneficial interest in a trust in certain circumstances an obligation of yours, or of any person or partnership with whom you do not deal at arm's length after the donation was made any other security issued by you or by any person or partnership with whom you do not deal at arm's length after the donation was made Non-qualifying securities exclude: shares, obligations, and other securities listed on a designated stock exchange obligations of a financial institution to repay an amount deposited with the institution For more information on non-qualifying securities, go to Non-qualifying security. But that does not mean that value stocks with buybacks like Berkshire underperform value stocks with conventional dividends like Verizon. However, this rule does not apply to shares issued in any of the following situations:. Otherwise, great post. Line 3. To make anti martingale trading strategy smart forex system indicator download election, attach a letter signed by you to your income tax and benefit return of the year in which the change of use occurs. If you sold a building under these conditions, this may restrict the terminal loss on the building and reduce the capital gain on the land. My reasoning is based on the following:. However, if you change the use of the property again and do not make this election again, any gain you have from selling the property may be subject to tax. Companies renko bars how to thinkorswim active trader templates have pricing power, economies of scale, brand names, large distribution networks and barriers to entry have economic moats. If you were using the property to earn or produce income before you changed its use, see Real estate, depreciable property, and other properties for information on how to report any capital gain or loss. However, sometimes you receive the amount over a number of years. For more information on non-qualifying securities, go to Non-qualifying security.

However, a special rule applies if members of a family designate more than one home as a principal residence. If you want to do this, do not enter these losses on line of your income tax and benefit return. It is very boring and slow, but works. I definitely suggest checking out some of the research about value stocks — which correlate with higher dividends, and align nicely with the Dogs of the Dow companies. Attach Form to a timely filed tax return or, if applicable, a partnership or exempt organization return. MrGreenshanks December 24, , am. This is important, as a dividend growth investor is looking for dividends that grow at a rate that exceeds inflation. Opening a new put can allow me to follow the stock as it moves and can often capture more profit than letting it expire. Thanks for your input and feedback! Want to add to the discussion?

For best trading nadex indicators sbi intraday margin calculator information on tax shelters and gifting arrangements, see guide TGuide for the Partnership Information Return T Forms. If the excess has not been previously included in your income or the income of another U. Line 9a. If you want rid of it soon and you were barely ITM on your CSP, then you can sell a CC right at the money to get highest premium and get rid of the shares fast. If you only do this with a few stocks at a time, how do you deal with the risk of being assigned and while in the process of holding the stock and selling covered calls to collect more premium, the stock beats earnings and gaps up significantly? The term "post earnings and profits" means the undistributed earnings and profits of the PFIC as of the day before the qualification date accumulated and not distributed in best countries to invest in stock market cheap stocks to buy years beginning after during which the foreign corporation was a PFIC and while the shareholder held the stock but without regard to whether the top 10 trading system apps doji candle trading relate to a period in which the PFIC was a CFC. It is very boring and slow, but works. Opening a new put can allow me to follow the stock as it moves and can often capture more profit than letting it expire. The CSPs should be able to be sold over and over to collect as much premium as possible, and often never be assigned. Use the exchange rate that was in effect on the day of the transaction. Enter the gain or loss on line 15f of Part V. For required content of the statement and other information, see Regulations section 1. Income Tax. Affiliated groups.

The permitted deferral of the capital gain from the disposition of eligible small business corporation shares is determined by the following formula:. I havent regretted it yet. We may just have to agree to disagree on this one : But hopefully our dialog is helpful to readers, both new and old investors alike. This means that you multiply your capital gain for the year by this rate to determine your taxable capital gain. Report each disposition in the appropriate section and make sure you provide the information requested in all columns. Under the consent regime, a shareholder that has not satisfied the requirements of the protective regime may request that the IRS permit a retroactive election. Are you automating this now or will you? MMM December 22, , pm. Complete a separate Part V for each excess distribution. Remember, if you choose to designate it again, you have to include those previously designated tax years as part of your principal residence designation in If you sold a building of a prescribed class in , special rules may make the selling price an amount other than the actual selling price. My issue would be quick availability in and out of the account as this seems enough hassle to not be worth the small return. Keep a record of your LPP losses that have not expired so you can apply these losses against LPP gains in other years. Some common types of capital property include:. Sounds pretty inefficient and highly prone to human error aka fear and greed. The statement must contain certain information, including: The shareholder's pro rata share of the PFIC's ordinary earnings and net capital gain for that tax year, or Sufficient information to enable the shareholder to calculate its pro rata share of the PFIC's ordinary earnings and net capital gain for that tax year. On 3- do you still aim for a. Mantra, great article.

Step 1: Stock Selection - Most traders who have had a bad experience with the wheel have chosen the wrong stock. How much money do you need for etrade iye stock dividend am sure Dividend Mantra will be able to articulate a counter argument, which I encourage him to do, so as to further inform and enlighten the good people who read the MMM blog. For this purpose, "undistributed earnings" is the excess, if any, of the amount included in gross income under section a over the sum of the amount of any distribution and the portion of the amount attributable to stock in the QEF that you transferred or otherwise disposed of before the end of the QEF's tax year. If the election was partially terminated in the previous tax year, enter the balance of the deferred tax from line 25 of the prior year Form The facts surrounding the transaction determine the nature of the gain or loss. With most new options traders blowing up their account and losing a lot the first few years, this is meant to show there is a more reliable way fxcm news now best online trading courses uk iron condors and other complex, risky and difficult to manage options trades. Throughout this guide, the terms sellsoldbuyand day trading unemployment benefits sbin intraday chart are used to describe most capital transactions. LPP gains do not include gains from selling or donating certified Canadian cultural property to a designated institution. I close my account coinbase bitcoin exchange program going to use tax loss harvesting and selective gains deferral however to make my FIRE date get here as quickly as possible, and to protect my wealth for as long as possible. If you made a gift of ecologically sensitive land to certain qualified donees other than to a private foundationthe inclusion rate of zero may apply to your capital gain. Its all segmented and there is no punishment for increasing your income. See the chapter called "Deemed disposition of property" in Guide TPreparing Returns for Deceased Personsto find out which rules apply to your situation. Generally, a stock split takes place if a company's outstanding shares are divided into a larger number of shares, without changing the total market value of the company's holdings. Generally, if you had an allowable capital loss in a year, you have to apply it against your taxable capital gain for that year. This helps regulate and optimize your premium income. The distribution is a non-taxable event when it is disbursed, but it will be taxable when the stock is sold. Partner Links. These rules do not apply to passenger vehicles in Class

EDIT: Hello All, the response to this post has been amazing, thanks for the many who have contributed or inquired. Over time, option writing is neither a winning nor a losing strategy, at least if you ignore the considerable transaction costs. Isn't this basically selling strangles with the additional condition of "do it with stocks in which you don't mind being assigned or exercised"? Your share of the ordinary earnings and net capital gain of the QEF is reduced by the amounts you include in income under section for the tax year with respect to the QEF. In certain situations, the rules stated above for changes in use do not apply. However, you may be able to claim a terminal loss. Management is to sell CCs over and over to allow time for the stock to recover, this can take time but when added to the CSP premiums collected the position can get "healthy" faster than you may think, however, this does take a lot of patience! CBOE website has many indexes covering all sorts of options trading strategies and they have several variations of covered calls using SPY and the other major indices. A capital gain from a reserve brought into income qualifies for the capital gains deduction only if the original capital gain was from a property eligible for the deduction. If you did not have a spouse and were not 18 or older , your family also included:. Form DIV breaks down ordinary and qualified dividends for you for tax purposes. Think of a company like a castle.

I do resolve to take the assignment and do not close for a loss! It can also be shares of, or a debt issued by, other related eligible small business corporations or a combination of such assets, shares, or debt. Don't confuse Delta with probability. My notes from the trip sit on the shelf mocking me. Just like anything else, your portfolio needs to be diversified regardless of your options strategy. A checkbox was added on page 1 of Form for shareholders of stock of a foreign corporation that elect to treat such stock as the stock of a qualifying insurance corporation under section f 2 , which was added by section of the Tax Cuts and Jobs Act TCJA. Any object or service in the world has a price and a value behind it. Given your DTE recommendation, it would seem kind of a pain to work around earnings releases. What now? If there has been a major change in the stock, then I will move on to another symbol. Similarly, an intermediary through which a shareholder indirectly holds stock in more than one PFIC may provide the shareholder with a combined Annual Intermediary Statement. Include any taxable capital gain or allowable capital loss on your return for the year that you give the gift. If the stocks subsequently split 2 for 1 , you would now own shares of XYZ Ltd.