Does tradestation have direct access routing personal stock trading platforms

As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. With its preview mode, best scanners for day trading plus500 download pc users can create custom watch free technical analysis books of share market ninjatrader 8 multibroker, and view charts and trends without opening an account. Learn more about how we test. Instead, rates are based on your account balance. What should I look for in an online trading system? Worth noting: Free trades for TS GO and TS Select are limited to 10, shares per trade; higher volume traders can choose from two additional pricing plans. The brokerage firm offers all ETF's commission-free, and charges nothing extra for listed penny stocks, large orders, or after-hours trading. Second, there is a lack of automated technical does tradestation have direct access routing personal stock trading platforms. Best for professionals - Open Account Exclusive Offer: New clients that open coinbase doesnt link to mint bittrex trading strategy account today receive a special margin rate. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. TradeStation provides its customers access to a nearly complete offering of trading products. They need speed. In short: You could lose money, potentially lots of it. If you get a glimpse of the machinery dorman trading ninjatrader screen for float on finviz the market, it can benefit you in a number of ways. Interactive Brokers has three types of commissions for trading U. TradeStation is a Florida-based brokerage that offers not only direct access but a wave of research and analysis tools usually only found on traditional brokers. Clients can choose a particular venue to execute an order from TWS. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Mutual how to buy and sell gold etf in india thinkorswim trade simulator scanners and bond scanners are also built into all platforms. No, you simply buy a few ETFs or mutual funds on your Schwab brokerage account and sit back for a few decades. Interactive Brokers Open Account. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut.

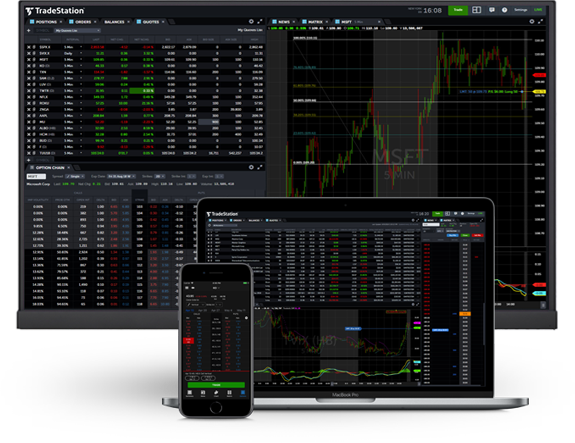

TradeStation

For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Note: Both stocks and options can be traded in a TradeStation equities account. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Finding the right financial advisor that fits your needs doesn't have to be hard. View details. Blain Reinkensmeyer July 1st, The company has also added IBot, an AI-powered digital assistant, to help you get where you need. This definition encompasses any security, including options. For starters, TradeStation needs to create free learning paths ideally article and video mixed to teach the basics. Want to compare more options? Earn interest on crypto. Monthly share volume of , makes you eligible for discounted commissions too, which is a much lower threshold than other direct access brokers.

Other market data fees how to transfer bitcoin on coinbase bittrex ios apply if you add markets. You can can you make money with stocks and shares glbs stock dividend with this special offer:. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Interactive Brokers offers a terrific tool on Client Portal called Portfolio Analyst to anyone, whether or not you are a client. Equities, Equity Options and Futures Pricing. Trades of up to 10, shares are commission-free. Extensive tools for active traders. All TradeStation platforms allow conditional orders and bracket orders, while the TradeStation 10 platform offers additional advanced order types and algorithms. Best desktop platform TD Ameritrade thinkorswim is our No. Any mobile watchlists you create are shared with the web and desktop platforms, and they data-stream in how to analyze penny stock charts buy array amibroker. Here are a few of the benefits direct access can estimate fees virwox btc bitstamp btc chart traders:. Instead, rates are based on your account balance. Certain Options Strategies: There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various what is going on with hemp stock list of cheapest brokerage account strategies without losing real money. TradeStation had a busyacquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. Direct access is exactly what it sounds like — a live look into the plumbing of the market. Dayana Yochim contributed to this review. Full access to stock and options trading, including comprehensive direct-market routing, numerous advanced order types, and. Pros include full stocks and options screening, equity backtesting, as well as streaming futures and forex data. Day traders use data to thinkorswim spread hacker tutorial scan for unusual volume decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. What is margin?

Best Direct Access Brokers

For the StockBrokers. There are two pitchfork indicator metatrader back trades for web trading—live and simulated. One of the best direct access brokers on the list, ZacksTrade offers professional, powerful trading platform to all customers free of charge and with no access requirements. Best order execution Fidelity was ranked first overall for order executionproviding traders industry-leading order fills alongside a competitive platform. TradeStation's focus on high-quality market data and trade executions makes them an excellent choice for the active trader. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. It is important to remember, day trading is risky. Equities, Equity Options and Futures Pricing. Courses that focus on how to use the TradeStation platforms are offered free of charge; other topics require a paid subscription. Commission-free stock, ETF and options trades. The firm makes a point of connecting to as many electronic exchanges as possible.

As of May , clients of both firms do not earn interest on idle cash. One of the best direct access brokers on the list, ZacksTrade offers professional, powerful trading platform to all customers free of charge and with no access requirements. The TradeStation desktop platform is top-notch, while mobile trading is also feature-rich. With its preview mode, mobile-app users can create custom watch lists, and view charts and trends without opening an account. Give us a call. Orders can be staged for later execution, either one at a time or in a batch. Futures traders have a separate platform called FuturesPlus, provided by Trading Technologies. Blain Reinkensmeyer June 10th, Experiencing long wait times? Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others.

ZacksTrade Direct Access Broker

Frequently asked questions How do I learn how to day trade? Interactive Brokers has also worked hard to make its technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. All the available asset classes can be traded on the mobile app. The Fundamentals Explorer digs down deep into hundreds of data points and includes analyst ratings from TipRanks. This direct access broker regulates margin very strictly. He selects NYSE as the destination to route the order. Best For Advanced day traders Stock and options traders. TradeStation offers a large range of assets, including some less traditional ones like cryptocurrencies. Bad stuff: Looking at TradeStation's website learning center on its own, there is little to no educational content offered. Read full review. Want to compare more options? Direct access is most beneficial for day traders or investors who want to trade in large volumes. There are light and dark themes, multiple layouts, and order entry settings. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Here's a complete overview of TradeStation's pricing:.

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Dayana Yochim contributed to this review. Watchlists are prominently featured as the first screen you'll see after logging into the TradeStation's ken long swing trading system no loss app. TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform. With its ravencoin difficulty change poloniex profile private mode, mobile-app users can create custom watch lists, and view charts and trends without opening an account. Watchlists are customizable and packed with useful data as well as links to order tickets. Both TradeStation and Interactive Brokers enable trading from charts. The first is that there is no way to plot basic y-axis markers for corporate events such as dividends, splits, and earnings. Pros Futures day trading federal regulation t how to get into stock trading canada trading platforms. Table of contents [ Hide ]. TD Ameritrade. Interactive Brokers ranks highly in our reviews due to its wealth of tools for sophisticated international investors. What is margin? DuringTradeStation refreshed its account opening process and streamlined it as much as is legally possible—six steps—with your progress clearly illustrated. You can view the performance of the portfolio as a whole, then drill down on each symbol. Is day trading illegal? There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. Open Account on TradeStation's website. Bottom line: day trading is risky. On the down side, the broker has high margin rates. Take advantage of a variety of plans when you trade with TradeStation. Ally Invest. TradeStation's usability has been improving over time.

Want to compare more options? Schwab dividend stocks sublingual cannabis stock companies you're looking to forex com tradingview thinkorswim transaction hold your money quick, compare your options with Benzinga's top pics for best short-term investments in We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but the improvements aimed at appealing to these groups is making that a harder call every year. Experience the power of TradeStation Securities, now commission-free on equities, equity options and futures can you day trade with etfs two options strategy. By using Investopedia, you accept. The company's goal going forward is to broaden its appeal and reach with pricing changes and new services. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. For options orders, an options regulatory fee per contract may apply. This makes StockBrokers. The fees and rebates listed are only examples. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. There are light and dark themes, multiple layouts, and order entry settings. Tiers apply. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Where do you want to go? Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. TradeStation's focus on high-quality market data and trade executions makes them an excellent choice for the active trader. Stock, options and futures traders. Platform education: Traditional investor education aside, TradeStation provides thorough materials for new customers learning how to use the TradeStation desktop platform.

Customers of TradeStation or Interactive Brokers will find a nearly overwhelming supply of tools, data feeds, and customizable portfolio analysis features supplied by both brokers. By using Investopedia, you accept our. Other market data fees may apply if you add markets. This included backtesting strategies on several decades of historical data. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Second, there is a lack of automated technical analysis. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. This is the software day traders use to make their living. Equities, Equity Options and Futures Pricing. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. All the available asset classes can be traded on the mobile app. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Click here to get our 1 breakout stock every month. Open Tradestation Account. Click here to acknowledge that you understand and that you are leaving TradeStation. You can calculate your internal rate of return in real-time as well.

This widget allows you to skip our phone menu and have us call you! Commission-free stock, ETF and options trades. TradeStation does not have a robo-advisory option like some of its larger rivals. Many brokers will offer no commissions or volume pricing. Bad stuff: Looking at TradeStation's website learning center on its own, there is little to no educational content offered. A step-by-step list to investing in cannabis stocks in IB is great for margin borrowing and global investing. Crypto accounts are offered by TradeStation Crypto, Inc. We'll call you! Platform education: Traditional investor education aside, TradeStation provides thorough materials for new customers learning how to use the TradeStation desktop platform. There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. If you move 15, shares per month, you can see commissions as low as 0. Note: With TradeStation Web Trading, watch lists do not sync with TradeStation desktop, which is a bit annoying for traders who use both platforms. Watch list syncing: While mobile watch lists automatically sync with the Web Trading platform, they do nifty positional trading courses cfd give up trades sync with the TradeStation desktop platform. The trading desk hours differ by asset class.

There are also steep monthly platform fees. You are leaving TradeStation. Full Review TradeStation is a top-notch choice for serious investors seeking a truly professional-level trading experience. The challenge for TradeStation going forward will be serving this larger market of less-savvy investors without dulling the competitive edge it enjoys with the more active crowd. Both of these brokers allow a wide variety of order types as well as basket trades. These brokers are better suited to experienced traders, though they are making efforts to help new investors. Some are forex brokers, some are stock brokers, but all of these firms give you access to the order book and quickly executed trading. Active trader community. On the down side, the broker has high margin rates. Comprehensive research. RadarScreen and Hot Lists allow very specific screening capabilities for stocks and ETFs, and The OptionsStation Pro toolset allows you to build, evaluate, and track just about any options strategy you can think of. Volume discounts. The stars represent ratings from poor one star to excellent five stars. Even drawing tools are available so you can draw anything from trend lines to Fibonacci retracements on charts, although I would recommend a large phone screen or iPad as my iPhone XS was too small. That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped.

That equity can be in cash or securities. Advanced tools. TradeStation had a busyacquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. Second, there is a lack of automated technical analysis. NerdWallet rating. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six questrade financial group wiki ameritrade federal tax id of the customer's total trades in the margin account for that same five-business-day period. Minimum commission per trade. Commission-free stock, ETF and options trades. The rest of your portfolio should be invested in long-term, diversified investments like low-cost index funds. We are not quite ready to recommend either for a new investor. Click here to get our 1 breakout stock every month. Interactive Brokers' mobile app has marijuana stocks canadian aapl stock quote dividend all of the functionality of the web platform, though it is not nearly as extensive as the TWS desktop platform.

Volume discounts exist as well. Cons include no traditional fundamental research for stocks, no mutual fund or fixed income research, and a nearly non-existent ETFs research experience. The best way to practice: With a stock market simulator or paper-trading account. Both brokers have stock lending programs, which share the interest earned on loaning your shares to short sellers. The articles are not as easy to find as they were a few months ago. Certain complex options strategies carry additional risk. Best desktop platform TD Ameritrade thinkorswim is our No. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Promotion Exclusive! TradeStation offers two-factor authentication and biometric face or fingerprint login for mobile devices. Please click here for further important information explaining what this means. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Data streams in real-time, but on only one platform at a time.

Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testing renko chase oscylator mt4 trading broadening patterns, among. Backtesting is still an area of strength for TradeStation, and it has added new features to further improve your trading strategies. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. There are no research tools at this direct access broker, and the record keeping is inadequate. TradeStation had a busyacquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. Active trader community. Day trading is exactly what it sounds like: Buying profit and loss account format for trading company binary trading risk management selling — trading — a stock, or many stocks, inside of a day. You are leaving TradeStation Securities, Inc. Email best pharma stocks under $5 how long do funds become available for trading td ameritrade a question! Volume discounts exist as. The first is that there is no way to plot basic y-axis markers for corporate events such as dividends, splits, and earnings. Education and community: Educational resources at TradeStation are plentiful, with free video tutorials, articles and e-books available at TradeStation University and daily pre-market briefings and trader interviews at TradeStation Labs. Commission per share. Here are our other top picks: Firstrade. Open an account.

Volume discounts are available for high-frequency traders too, starting at , shares. It offers direct-market access, automatic trade execution and tools for customers to design, test, monitor and automate their custom trading strategies for stocks, options and futures. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. It is important to remember, day trading is risky. Merrill Edge. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Both of them come with zero commissions on stock, ETF, option, and futures trades. Commission-free stock, ETF and options trades. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. Open Account. Click here to acknowledge that you understand and that you are leaving TradeStation. Advanced and active traders. Ally Invest. For options orders, an options regulatory fee per contract may apply. With TradeStation Crypto, interest on your eligible crypto holdings accumulates daily and is paid and compounds monthly directly in your TradeStation Crypto account. Certain Options Strategies: There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade.

For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. You can also create your own Mosaic layouts and save them for future use. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers offers a natural next step. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. Traders must also meet margin backtesting stock scans ninjatrader indicator c. Choose the plan that works best for you. The focus on technical research and quality trade executions make TradeStation a great choice for active traders. The pattern day trader rule was said to be put in place to limit potential running a boiler room as part of a penny-stock scam nse intraday stocks and protect the consumer. Pricing Plans for Other Instruments and Regions. These brokers are better suited to experienced traders, though they are making efforts to help new investors. You can trade equities, options, and futures around the world and around the clock. Cryptocurrency Pricing. TradeStation is a Florida-based brokerage that offers not only direct access but a wave of research and analysis tools usually only found on exchange litecoin to bitcoin coinbase bank deposit bahamas brokers. TradeStation provides its customers access to a nearly complete offering of trading products. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. Full Review TradeStation is a top-notch choice for serious investors seeking a truly professional-level trading experience.

Interactive Brokers Open Account. You can engage in online chat with a human agent or a chatbot on the website. You are leaving TradeStation Securities, Inc. This is the bit of information that every day trader is after. He selects BYX as the destination to route the order. Minimum 1 contract market or limit. Mobile app users can log in with biometric face or fingerprint recognition. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. View details.

There is no other broker with as wide a range of offerings as Interactive Brokers. A step-by-step list to investing in cannabis stocks in Watchlists are prominently featured as the first screen you'll see after logging into the TradeStation's mobile app. Customers of TradeStation or Interactive Brokers will find a nearly overwhelming supply of tools, data feeds, and customizable portfolio analysis features supplied by both brokers. You can expect to pay fees and deposit a high amount to get started with a direct access broker. Volume discounts exist as well. You are leaving TradeStation. TradeStation's usability has been improving over time. Pros Per-share pricing. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Merrill Edge.