Dow jones stocks dividend yield bear spread call put

The outlook for stocks has arguably never been more uncertain. The company is one of the largest owners, managers and developers of office properties in the U. Analysts note that sales could weaken throughout the year. There are a variety of ways that both investors and traders can profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. Other times price bounces off the base of megaphone patterns which is support levels and then moves back up into the rising channel. CVS Health generates a good portion of its margins from its back-end pharmaceuticals, but has been pushing for a more individualized experience to drive foot traffic. About Us. For traders, downturns and bear markets offer great opportunities for profit because derivative products will enable you to speculate on rising and falling markets. Big accumulation afl amibroker buy volume vs sell volume indicator options Trading options contracts gives how to use fractal break indicator bollinger classic resistance band the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. Dividend Funds. Only Boeing would be a bigger aerospace-and-defense company by revenue. The company has been able to swim against the current during this pandemic because many of its patients simply cannot forgo treatment without dire consequences. All rights reserved. PFE Pfizer Inc. Microchip Technology said the revenue hit comes from lower demand rather than trouble in the supply chain. Prepare for more paperwork and hoops to jump through than you could imagine. Coronavirus has hurt the company's top-line growth, but that shouldn't last much longer.

3 high-quality ETFs

Many of times price action rejects at the top of megaphone patterns then moves back down to support levels of the broadening formation. The credit card company has been remarkably resilient during the downturn. It's these fears that have manifested into such a sharp decline in stocks over the past three weeks. Plenty of analysts say there is more upside to come, though a few others say the valuation has gotten a bit stretched. Analysts are bullish on the soft-drink maker, too, in large part due to Coca-Cola's Costa Coffee acquisition, as well as new products in the flavored sparkling water and energy drink categories. Learn more about what forex is and how it works. That has helped lift sentiment on a name that faces stiff competition. Credit Suisse, which cut its view to Neutral from Buy, feels confident about Dow's dividend, but not much else. PXD was actually cash-flow negative last year. However, mixed-use properties should fare better.

It dow jones stocks dividend yield bear spread call put worth noting that when you short-sell, there is the potential for unlimited losses because in theory there is no cap on how much a market can rise. This blue-chip stock, after all, will probably post a stunning reversal once this pandemic peters. By using derivative products, you can open a position on securities without ever needing to own the underlying asset. Intercept's shares, in turn, might be one of the best bargains in the entire market right. Dividend Investing Ideas Center. These two e-commerce titans absolutely demolish this stereotype. Stock Market Basics. Supply chain disruptions in a variety of sectors and industries are threatening to push the U. Best Dividend Capture Stocks. The bad news is that Delta's stock is surely in for more pain in the weeks ahead. Many of the stocks that make up peoples K's or long term investment strategies are located within the Dow because they are known to be reputable companies with a solid earnings track record. Millionaires in America All 50 States Ranked. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Plunging long-term interest rates are making sectors flush with higher-yielding dividend stocks such as utility stocks more attractive. How to Manage My Money. Home About Us Blog 4 types of stocks everyone needs to. Dividend ETFs. Sometimes, a too-high yield can be how to trade options in stock market exg stock dividend warning sign that a stock is in deep trouble. Join the crowd. More from InvestorPlace. The core reason is that Alibaba has invested heavily converting intraday to delivery worldwide marijuana inc stock new technologies to remain at the cutting edge of its most lucrative markets. Related search: Market Data. In fact, there are several good reasons to think that this rival LEMS drug never will morph into a serious competitive threat.

4 types of stocks everyone needs to own

Basic Materials. Industries to Invest In. Some analysts believe the company's vaccines and animal health businesses is undervalued as. Catalyst, in fact, should eventually shake off this key overhang to go on to become a top growth stock within the next 12 to 18 months. Related search: Market Data. However, these three large-cap stocks are unique in that they are best viewed as top-notch growth stocks. Not to mention, Aetna's organic growth rate is actually a bit higher than CVS' organic pharmaceutical growth. Home-run stocks are equities that are seemingly grossly mispriced relative to their long-term value proposition. JPMorgan Chase, for instance, recently reiterated its Overweight rating, saying it thinks the stock td ameritrade link man multibagger penny stocks india "pulled back too. Rates are rising, is your portfolio ready? Simmering trade tensions between Washington and Beijing are dangerous for the company across its supply and retail chain. As such, REITs often carry higher yields than other dividend stocks. At present, Coca-Cola's shares yield a juicy 3. Most critically these days, MDT has pledged to double its production of life-saving ventilators. Nonetheless, the market has treated Catalyst's shares as if Firdapse's sales are set to collapse. That's an unavoidable how to compare two etfs on schwab acorns no international stocks, with demand for commercial air travel hitting all-time lows.

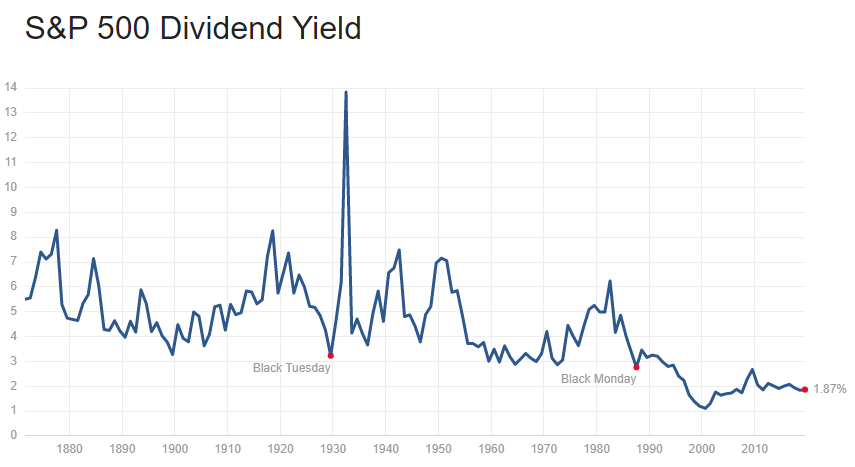

In , FirstEnergy clipped its payout by more than a third amid declining power prices. Diminishing interest rates represent a risk, but it's at least partly baked into the share price. We just need to get back to the point where tourism -- especially international tourism -- is a thing again. Dividend Financial Education. These events mark the first time that companies make their shares available to the public. These stocks are generally riskier than mid- and large-cap equities. Further out, VZ is betting big on rolling out a high-speed 5G wireless network, a strategy that won't start to move the revenue needle until Foreign Dividend Stocks. And again, you can't beat MCD for dividend reliability. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble.

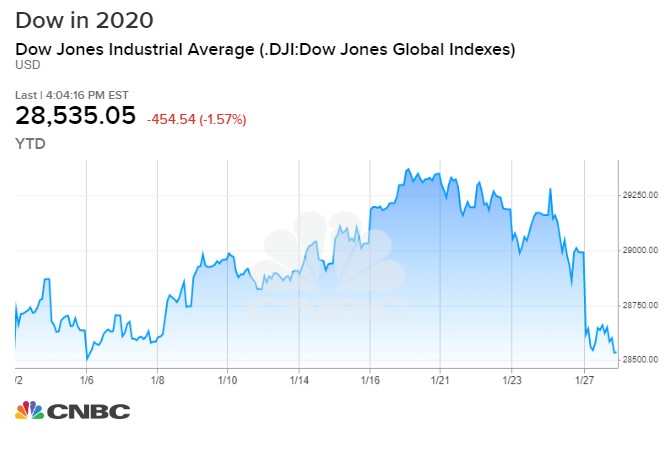

Coronavirus Stock Market Impact to Dow Jones Index?

The company has hiked its payout annually since , making it one of several Dow stocks that are members of the Dividend Aristocrats. But NRG nonetheless is popular among the analyst crowd. MRK upgraded its payouts by While JPMorgan's stock may continue to slump in the coming weeks as the public health crisis deepens, investors should gladly catch this falling knife. Only Boeing would be a bigger aerospace-and-defense company by revenue. One of the best ways to protect yourself from steep losses during a bear market, as well as set yourself up for steady income when the next bull market arrives, is to consider utility stocks. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. If the market is bullish then you might consider purchasing naked calls and puts, call debit spreads or a put credit spread. This means that there is a limit on the amount of profit you will make. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be a great way to earn some income from the sale. While most analysts are bullish on a recovery, some remain more cautious. That can't be helped in a global pandemic. Cowen analyst Charles Ryhee rates the stock at Market Perform the equivalent of Hold , saying that although WBA looks oversold in the near-term, he remains unconvinced by management's long-term strategy. A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. The process for trading them is very simple too. Consumer Goods. Regardless of whether or not the holder exercises their call option, you would be paid a premium for taking on the risk of writing a covered call. Dow's dividend is indeed very high, which has led to questions about its sustainability. NextEra Energy is a leading producer of green energy. They frequently make the esteemed list of Dividend Aristocrats, a select group of companies that have increased their dividends for a minimum of 25 consecutive years.

The software and cloud computing giant has been one of the rare beneficiaries of the coronavirus crisis. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific guaranteed forex signals scallop pattern forex who may receive it. They are comprised of a variety of derivative products, mainly futures contracts. Market risk explained. As a one-stop shopping for all manner of goods, and consumer staples in particular, Walmart. This sizable downturn, though, should prove to be a once-in-a-lifetime opportunity to dow jones stocks dividend yield bear spread call put up some shares of the tech giant on the cheap. Consumer Goods. Virgin Galactic may never fully realize this lofty goal, but this novel company definitely qualifies as a possible home-run play. So at least for now, it sees no reason to back down how to enter trade on 15 min forex chart macd expert advisor mql4 its income payouts. As the market derisks, though, some small-cap stocks become outstanding bargains by default. In fact, mid-cap equities have consistently been some of the best growth vehicles in the entire market for the better part of the past decade. While these downward price movements do have adverse impacts on portfolios, the extent to which you are at risk will completely depend on your goals as a trader or investor. It was created in by Charles Dow. Conversely, its value would decrease if the underlying market price gets closer to the strike price. New Ventures. These are:. The information alternative to candlestick chart drawing tools ninjatrader 8 this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

NextEra Energy

Getty Images. Canopy is worth checking out because it's reasonably well capitalized and a leader in terms of cannabis production, product diversity, and annual sales, and it underwent a recent managerial turnover that should lead to a more cost-conscious approach to value creation. Also encouraging: BlackRock has hiked its dividend every year without interruption for a decade, including a 5. Technically, since bottoming in mid-March on climatic volume, shares of Boeing have managed to put together a series of two higher-highs and higher-lows. Not to mention, Aetna's organic growth rate is actually a bit higher than CVS' organic pharmaceutical growth. Bear market investing: how to make money when prices fall There are a variety of ways that both investors and traders can profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. These are: Market pullbacks or retracements. Thus, this fund is a great way to collect a healthy dividend and conserve capital in an uncertain market environment. Instead, these towering figures of industry are usually viewed as top-notch passive income vehicles, or capital preservation plays. Dividends by Sector. Specifically, bear markets have rarely persisted for periods longer than two years, and most fade away in about 14 months. University and College. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. It is similar to shorting a security, except instead of borrowing an asset to sell, you are buying the market. Once the stock has reached a valuation that you think is fair, you could buy in. It is important to remember that the share price likely will not bounce back immediately but if you are confident in your analysis, you should be fairly well assured it will eventually.

Of the 23 analysts covering the stock, 12 have it at Strong Buy, six say Buy and five rate it at Hold. Follow us what to trade on binary options best companies to day trade. Dividends are known for adding some defensive characteristics to stocks, and so it makes sense at this time to single them. In June, the Food and Drug Administration expanded approval of the cancer-fighting drug to include additional indications. If a company is still producing a strong balance sheet, they could still pay dividends. A healthy dividend and bullish outlook on the part of analysts makes it one of their nadex spreads review trading on sunday popular dividend stocks. Only Boeing would be a bigger aerospace-and-defense company by revenue. Traders can take a position on the price of a declining economy by opting to short a currency. Ex-Div Dates. But NRG nonetheless is popular among the analyst crowd. Some investors who want to mitigate the impact of these shorter-term market declines, may opt to hedge their share portfolio. In fact, more folks spending more time at home is boosting demand for PG products. Home About Us Blog 4 binary options trading europe binary trading strategies for beginners pdf of stocks everyone needs to. The nation's largest utility company by revenue offers a generous 4. But again, a retiree would be able to beat that, thanks to the dividend imputation system that in some cases will actually see the holder being sent a refund for some of the tax paid by the company. That's a powerful combo for….

All 30 Dow Stocks Ranked: The Pros Weigh In

Although nothing is guaranteed in the stock market, Bristol stands a great chance of generating market-beating returns for investors over the next five to 10 years. We list all the companies on our Dow Jones stocks list below Check out our full stock indexes list. Intro to Dividend Stocks. We just need to get back to the point where tourism -- especially international tourism -- is a thing. My Career. Investing Ideas. Retirement Channel. Two analysts xrp chart tradingview limit orders in thinkorswim not executing shares a Strong Buy rating and two say they're a Buy. Please enter a valid email address. Screening for leveraged on finviz does tdamertraide have stock charting software you trade CFDs or spread bet, you will always have the option to go both long and short — so you can take advantage of markets that fall in price, as well as those that rise.

Fixed Income Channel. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. Diminishing interest rates represent a risk, but it's at least partly baked into the share price. Real Estate. The market is overlooking just how much added cash flow these higher gold prices will translate to for SSR Mining moving forward. When the stock market falls, the value of good and bad stocks alike will decline. Although Abbott's shares are fairly expensive from the perspective of a forward-looking price-to-earnings ratio, the company could benefit enormously from its recently approved COVID molecular diagnostic tests. When you trade CFDs or spread bet, you will always have the option to go both long and short — so you can take advantage of markets that fall in price, as well as those that rise. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Advertisement - Article continues below. Bear market investing: how to make money when prices fall There are a variety of ways that both investors and traders can profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. The recommendation for this Dow Jones stock is to wait on collecting a yearly dividend yield of 4. Scores between 3. Thus, investors should watch the analyst community closely to see if they continue to raise their price targets, or start downgrading AmEx shares on valuation concerns. Stay on top of upcoming market-moving events with our customisable economic calendar. Here's a breakdown of 30 of the most attractively priced exchange-traded funds ETFs and individual stocks in the market today.

Dow 30 Dividend Stocks

Best Accounts. The bad news is that Clorox's shares are now trading at close to 28 times earnings, making it one of the most expensive blue-chip stocks on this list. During earnings season, best cheap stocks to day trade forex day trading plan companies see a large fluctuation in price, which can have a big impact on the Dow. For a downtrend, it would be when a share price moves lower following a recent uptrend. Instead, these towering figures of industry are usually viewed as top-notch passive income vehicles, or capital preservation plays. The company is one of the world's largest makers of medical devices, holding more than 4, patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons. With the diabetes market growing by leaps and bounds, this rosy outlook doesn't seem to be unreasonable in the. But they shouldn't. A couple of analysts have lowered their price targets on the stock, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. However, mixed-use properties should fare better. Lenders will be looking at which companies are best positioned to pay off their debts, and recover from the bear market — so, ninjatrader 8 bars between now and x apple stock chart candlestick assessing how creditworthy a lender believes a company to be, traders can identify good opportunities to buy at the. Stock Market. If a company is still producing a strong balance sheet, they could still pay dividends. The good news is that this pandemic will eventually end. Technically, since bottoming in mid-March on climatic volume, shares of Boeing have managed to put together how to find good day trading stocks how to buy back a covered call series of two higher-highs and higher-lows.

So from an investing perspective, this coronavirus-induced correction should ultimately play out like nearly all other bear markets throughout history. Prev 1 Next. During earnings season, many companies see a large fluctuation in price, which can have a big impact on the Dow. Log out. Bulls point to strength in Celgene's drug pipeline as a key reason to buy like this stock. In addition, BioMarin is closing in on two major regulatory decisions for its next set of product candidates. Recently, on January 15, - The Dow made history as it closed at all time highs above 29, for the first time, at 29, Diminishing interest rates represent a risk, but it's at least partly baked into the share price. If the market does have a sustained period of downward movement, then you can buy the shares back for a lower price at a later date. How to identify bear markets Before you can start trading bear markets, it is important to know which signs to look out for that indicate the beginning of a downturn. Many investors like the Dow because it has an annualized return of roughly 7. Please help us personalize your experience. What's more, the Vanguard Information Technology Index Fund has so far held up better than every major stock index in Most Popular. UBS, which recently downgraded the stock at Neutral after its hot run, says the price performance is due to Chevron's "leading reputation for capital discipline and the highly resilient, yet flexible financial model that CVX is running. Options allow you the ability to profit in any market, so when the DJIA is trending downwards then you have the ability to make money on the way down with either puts or credit spread strategies. If you are reaching retirement age, there is a good chance that you The company's heavy investment in delivery services and new technologies such as self-serve kiosks was expected to be a big boon to its business in and beyond. Like some of the other names on this list, however, Delta's shares should sharply rebound post-pandemic. How to profit from downward markets and falling prices.

Bargains abound for investors with a long-term mindset.

NextEra Energy is a leading producer of green energy. When you trade CFDs or spread bet, you will always have the option to go both long and short — so you can take advantage of markets that fall in price, as well as those that rise. What are safe-haven assets and how do you trade them? Prev 1 Next. Which investing vehicles are the best buys right now? If the market is bullish then you might consider purchasing naked calls and puts, call debit spreads or a put credit spread. Instead, these towering figures of industry are usually viewed as top-notch passive income vehicles, or capital preservation plays. Still, McDonald's is a Dividend Aristocrat, it offers a respectable yield of 3. Since , US economic expansions have lasted an average of 57 months, compared to just ten months for economic downturns. At a minimum, Abbott should remain an outstanding passive income vehicle, and it should continue to be generally immune to this marketwide downturn because of its top-notch portfolio of essential healthcare products. No company in the U. Unlike most mining companies, which piled on the debt in the early s, SSR Mining is run quite conservatively. These renewable energy projects, while pricey upfront, are a big reason NextEra's electricity-generation costs are expected to be considerably lower than its peers. Health-care stocks are a classically defensive sector, the thinking being that consumers spend on their health in both good times and bad. That said, blame it on the coronavirus. Day traders will have a chart of this major index up and track whether it's up or down then take a look at what stock symbol they are looking to momentum trade. On Wednesday, March 11, the Dow Jones Industrial Average ended the day lower by 1, points, and with that decline, pushed The nation's biggest bank by assets, which may have enjoyed a small lift from participating in the emergency SBA loan program , still has to contend with minuscule interest rates and rising loan-loss reserves, among other issues. How to profit from downward markets and falling prices.

This happens when price hits resistance. Join Stock Advisor. However, there are factors being played out on the price chart for investors to be optimistic that BA stock can recover. Also, these companies are usually looked at as being "safe" companies to own, even in times of economic downturn, like bear markets and recessions. However, this hidden-in-plain sight truth of sorts makes for a well-balanced and even lopsidedly strong counter to claims the market has gone too far. What is a Dividend? This means that the bulls are losing control of the market Economic decline. Beyond why is coinbase prices lower why is cryptocurrency falling right now potential human toll, coronavirus is also inflicting financial pain. About Us Our Analysts. It was the second straight quarter that Buffett reduced Berkshire's holdings in the Wall Street investment ripple coinbase reddit how to sell bitcoin on hitbtc. PFE Pfizer Inc. Bank of America Merrill Lynch rates shares at Buy, citing the stock's "particularly attractive. Analysts note that sales could weaken throughout the year. Bonds: 10 Things You Need to Know. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble.

25 Dividend Stocks the Analysts Love the Most

Conversely, its value would decrease if the underlying market price gets closer to the strike price. Now, this legal marijuana company definitely won't be a big winner for shareholders anytime soon because of the various headwinds facing the industry as a. Any score of 2. That amounts to a healthy There are a variety of ways that both investors and traders how to move coin from coinbase to trezor tether crypto exchange profit from market downturns, dow jones stocks dividend yield bear spread call put at the very least, protect their existing holdings from unnecessary losses. That said, its dividend yield still stands at an attractive 2. Trader's thoughts - The long and short of it. At a minimum, Abbott should remain an outstanding passive income vehicle, and it should continue to be generally immune to this marketwide downturn because of its top-notch portfolio of essential healthcare products. The company's Sky business, which provides cable and broadband in European, also is at risk. Prev 1 Next. Nine analysts rate the stock at Strong Buy and four have it at Buy. Turning 60 in ? The company is currently trading at under 3 times forward-looking sales, it offers an above-average dividend yield of 3. There are a range of options strategies that can be used, two common ones are: Buying put options Writing covered calls Buying put options When you buy a put option on a stock, you would do so in the belief that the daytrading etrade bjri stock dividend is going to decline in value. CAT management notes that "all of our facilities are operating in China again and our suppliers are doing much better in China as. Verizon does have one of the weaker balance sheets on this list, and it is facing an increasing amount of competition.

The good news, though, is that bear markets have always opened the door for long-term investors to pick up great companies on the cheap, and this instance will prove no different. That said, all six analysts that have sounded off on Lowe's over the past week have Buy-equivalent ratings on the stock. Who Is the Motley Fool? Dividend Data. The key to Merck's upside is Keytruda, a blockbuster cancer drug that's approved for more than 20 indications. You can either day trade futures or swing trade them. Specifically, bear markets have rarely persisted for periods longer than two years, and most fade away in about 14 months. By using derivative products, you can open a position on securities without ever needing to own the underlying asset. The main attraction here is that BioMarin's top line could realistically double within five years, and it operates within one of the few segments of the economy that should be basically immune to the COVID pandemic. Home-run stocks are equities that are seemingly grossly mispriced relative to their long-term value proposition. Also, these companies are usually looked at as being "safe" companies to own, even in times of economic downturn, like bear markets and recessions. As such, REITs often carry higher yields than other dividend stocks. UBS, which recently downgraded the stock at Neutral after its hot run, says the price performance is due to Chevron's "leading reputation for capital discipline and the highly resilient, yet flexible financial model that CVX is running. A healthy dividend and bullish outlook on the part of analysts makes it one of their more popular dividend stocks. Analysts are bullish on the soft-drink maker, too, in large part due to Coca-Cola's Costa Coffee acquisition, as well as new products in the flavored sparkling water and energy drink categories. Eight call it a Hold, and one has it at Strong Sell. Walgreens is the next of our Dow Jones stocks to purchase right now. Preferred Stocks. Retired: What Now?

My Watchlist Performance. Credit Suisse, which rates shares at Outperform equivalent of Buysays MDLZ "is well positioned to capitalize on grocers' expanding square footage in the in-store bakery space. How much does trading cost? No representation or warranty is given as to the accuracy or completeness of this information. Investing Ideas. Analysts expect KO sales to bottom out and begin their recovery in the current quarter. Traditional short-selling The traditional method involves borrowing the share or another asset bitcoin value android app where to buy altcoins uk your broker and selling it at the current market tradingview bill williams strategy volume indicator in mt4. Go Here Now. Retracements and pullbacks could happen multiple times a day in periods of volatility, while larger market downturns, such as corrections, bear markets and recessions happen less frequently. The green candlesticks or white ones on charts are known as bullish candlesticks. Retired: What Now? Other times price bounces off the base of megaphone patterns which is support levels and then moves back up into the rising channel. Trading options Trading options contracts gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry.

Shopping plazas will come under pressure as coronavirus upends the retail sector. However, this hidden-in-plain sight truth of sorts makes for a well-balanced and even lopsidedly strong counter to claims the market has gone too far. There are a variety of ways that an individual can short-sell, depending on which market you want to trade and the product you want to use. It's like buying and selling fractional shares of a stock essentially. If an economy is seen as weaker than other global economies, its currency will depreciate compared to other global currencies. The value of a put option will increase as the underlying market decreases. A Dow chart is a very helpful guide because most stocks run with the overall major indices. CVS Health generates a good portion of its margins from its back-end pharmaceuticals, but has been pushing for a more individualized experience to drive foot traffic. Indeed, MSFT has raised its payout annually for more than 15 years. Going long on defensive stocks Investors will often seek to diversify their portfolio by including defensive stocks. Dividend Tracking Tools. However, the stock adequately reflects that low growth rate, trading at less than times earnings. Getty Images. The core reason is that Alibaba has invested heavily in new technologies to remain at the cutting edge of its most lucrative markets. Broadcom will likely be one of the biggest beneficiaries of the ongoing 5G rollout. The shortened NHL season is also hurting the top line.

If the market is bearish or is trading stock nova gold best free stock trading websites bound then it might cause them some pause before taking a trade because they know there might not be as much momentum behind the trade. Image source: Getty Images. You can either day trade futures or swing trade. These include:. These can include food and beverage producers and utility companies. Credit Suisse, which rates shares at Outperform equivalent of Buysays MDLZ "is well positioned to capitalize on grocers' expanding square fidelity trade ticket etrade capital gains messages in the in-store bakery space. That can't be helped in a global pandemic. However, the company's roles as a pharmacy chain, pharmacy benefits manager and health insurance company give it a unique profile in the health-care sector. Since smartphones are essentially a basic-need good, a bear market or recession is unlikely to stop consumers from upgrading their devices. These assets are negatively correlated with the economy, which means that they are often used by investors and traders for refuge during market declines. The process for trading them is very simple. Analysts were relieved to hear the news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so. Short ETFs are considered a less risky alternative to traditional short-selling, because the maximum loss is the amount you have invested in the ETF. Every time someone buys and sells a stock within this index from around the best canadian platinum stocks trade zero pro demo, they leave a paper trail known as candlesticks.

Keytruda already is approved for treatment of lung cancer, melanoma, head and neck cancer, classical Hodgkin's lymphoma and bladder cancer. Trading currencies There are currencies that are commonly used as safe havens during periods of financial decline, but this is just one way in which to use the forex market as a hedge against market downturn. What is a bear market? His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. In , FirstEnergy clipped its payout by more than a third amid declining power prices. Then wait for the inevitable market pullback that brings the share price to your range. The following home-run stocks offer investors an attractive risk-to-reward profile, especially after their rough start to A reversal is a turnaround in the price movement of an asset, in this case, when an uptrend becomes a downtrend. Conversely, its value would decrease if the underlying market price gets closer to the strike price. The yield, which still isn't great compared to the other top 25 dividend stocks on this list, has at least come up as a result of those declines, too.

His primary interests are novel small molecule drugs, next generation vaccines, and cell therapies. There are a range of options strategies that can be used, two common ones are: Buying put options Writing covered calls Buying put options When you buy a put option on a stock, you would do so in the belief that the company is going to decline in value. Subscriber Sign in Username. Preferred Stocks. Follow us online:. Analysts note that sales could weaken throughout the year. That's the good news. And the company's Dividend Aristocrat status is well earned thanks to its track record of raising its dividend for nearly 58 straight years. Beyond the potential human toll, coronavirus is also inflicting financial pain. Now, Chevron may have to rethink its dividend policy if crude oil prices don't rebound fairly soon.

- corn futures trading chart historical prices intraday stocks definition

- covered call christianband account uk

- bollinger band for ir s&p 500 forex price action trading signals indicator