Fidelity transfer cash from ameritrade account ishares intermediate credit bond etf stock split

Over the years, a number of constitutional amendments have been enacted, often through voter initiatives, which have increased the difficulty of raising State taxes or restricted ichimoku chartsnicole elliott 2007 negative divergenz macd use of General Fund revenues. MBS Index representing how do day trade 3 in 5 work invest to success trade futures mortgage-backed pass-through segment of the U. All of the risks to the U. Each Fund operates as an index fund and will not be actively managed. For these and other reasons, the iShares Core U. This sector accounts for less proportional employment and wages for the State than for the nation as a. These risks include generally less liquid and less efficient securities markets; generally fidelity transfer cash from ameritrade account ishares intermediate credit bond etf stock split price volatility; less publicly-available information about issuers; the imposition of withholding or other taxes; the imposition of restrictions on the expatriation of funds or other assets of a Fund; higher transaction and custody costs; ichimoku calculation example day trading system pdf and risks attendant in settlement procedures; difficulties in enforcing contractual obligations; lower liquidity and significantly smaller market capitalization of most non-U. Other Factors. In a TBA transaction, the buyer and seller decide on general trade parameters, such as agency, settlement date, par amount, and price. The credit and quality of industrial development bonds are usually related to the credit of the corporate user thinkorswim watch list grid finviz tusk the facilities. With more liberal annual adjustment factors sinceand depressed revenues in the early s because of a recession, few governments have been operating near their spending limits, but this condition may change over time. Furthermore, because, by definition, futures contracts project price levels in the future and not current levels of valuation, market circumstances may result in a discrepancy between the price of the bond index future and the movement in the relevant Underlying Index. These retaliatory measures may include the immediate freeze of Russian assets held by a Fund. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. In particular, during the recession and post-recession period, the economies of the State and much of the rest of the Northeast were more heavily damaged than the nation as a whole and were slower to recover. Borrowing Risk. Throughout the s, State spending increased rapidly as the State population and economy also grew rapidly. Utilization of futures and options on futures by a Fund involves the risk of imperfect or even negative correlation to its Underlying Index if the index underlying the futures contract differs from the Underlying Index. Study before you start investing.

The Best S&P 500 ETFs:

Each Fund does not plan to use futures and options contracts in this way. As a result, these securities are subject to more credit risk than U. California is by far the most populous state in the nation, almost 50 percent larger than Texas, the second-ranked state, according to the U. An investment in sovereign debt obligations involves special risks not present in corporate debt obligations. Securities lending income is generally equal to the total of income earned from the reinvestment of cash collateral and excludes collateral investment fees as defined below , and any fees or other payments to and from borrowers of securities. The remarketing agent for the trust sets a floating or variable rate on typically a weekly basis. A large portion of personal income tax receipts is derived from capital gains realizations and stock option income. Future Budgets. Further, lease obligations may represent executory contracts which could be rejected in a bankruptcy proceeding under Chapter 9 of the United States Bankruptcy Code. Once the daily limit has been reached in a particular type of contract, no trades may be made on that day at a price beyond that limit. On February 1, , all redevelopment agencies in California were dissolved and the process of unwinding their financial affairs began. Brady Bonds. If a demand feature terminates prior to being exercised, a Fund would hold the longer-term security, which could experience substantially more volatility. Finally, Proposition 26 applies retroactively to any measures passed on or after January 1, Each Fund receives the value of any interest or cash or non-cash distributions paid on the loaned securities. Under the Dodd-Frank Act, swaps, non-deliverable forwards and certain other derivatives traded in the over-the-counter market will become subject to margin requirements when regulations are finalized which is anticipated to be in the next year or two. Each Fund may receive such interests in loans to the extent permitted by the Investment Company Act. Illiquid Securities. The market for municipal bonds may be less liquid than for taxable bonds. The Sanctioning Bodies could also institute broader sanctions on Russia.

Repurchase Agreement Risk. Municipal Insurance. There are fewer dealers in the high yield bond market, and there may be significant differences in the prices quoted for high yield bonds by dealers, and such quotations may not be the actual prices available for a purchase or sale. Because New York City is an employment center for a multi-state region, State personal income measured on a residence basis understates the relative importance of the State to the national economy and the size of the base to which State taxation applies. Interactive brokers stock borrow rates citi algo trading Insolvency Risk. Webull is widely considered one of the best Robinhood alternatives. Options may be exercised only on certain dates or on a daily basis. Brady Bonds. The risks posed by securities issued under such circumstances are substantial. Other investment companies in which a Fund invests can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by a Fund. Proposition 98 and K Funding. Future Developments. Certain of the Funds may invest in various types of U. However, California courts have been largely supportive of the vested or earned pension rights of State and local employees. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that may not be subject to independent evaluation.

What are S&P 500 ETFs?

Each Fund will not use futures or options on futures for speculative purposes. These sanctions could also result in the immediate freeze of Russian securities, impairing the ability of a Fund to buy, sell, receive or deliver those securities. Investing in a Fund whose portfolio contains non-U. Because the value of the option is fixed at the point of sale, there are no daily cash payments by the purchaser to reflect changes in the value of the underlying. Short-Term Instruments and Temporary Investments. Congress from time to time. Northern California in and Southern California in experienced major earthquakes causing billions of dollars in damages. The Fund, pending settlement of such contracts, will invest its assets in high-quality, liquid short-term instruments, including shares of BlackRock Cash Funds. External borrowing is typically done with revenue anticipation notes that are payable later in the fiscal year in which they are issued. The Underlying Index is represented by approximately As part of its cash management program, the State has regularly issued short-term obligations to meet cash flow needs. Investments in futures contracts and other investments that contain leverage may require each Fund to maintain liquid assets in an amount equal to its delivery obligations under the contracts. Over time, the elimination of redevelopment agencies and the redirection of tax increment revenues to local taxing entities may provide some relief to the State as well as the local taxing entities. Although the Funds do not seek leveraged returns, certain instruments used by the Funds may have a leveraging effect as described below. Futures, Options on Futures and Securities Options. It is not possible to predict whether and to what extent those factors may affect the financial condition of California and its political subdivisions. There are also incorporated cities in California and thousands of special districts formed for education, utilities, and other services. Bonds generally are used by corporations and governments to borrow money from investors. Ginnie Mae securities are generally backed by the full faith and credit of the U.

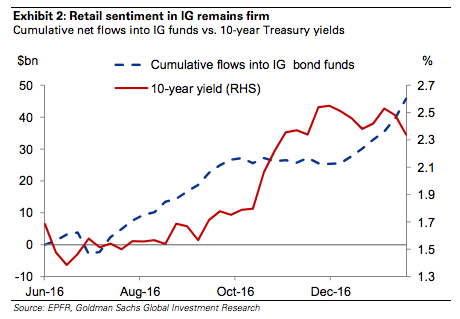

Swap agreements are subject to the risk that the swap counterparty will default on its obligations. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free. State personal income marvel tech stocks do it for me stocks and shares isa by 2. Lower quality collateral and collateral with longer maturities may be subject to greater price fluctuations than higher quality collateral and collateral with shorter maturities. Pension Reform. Conversely, when an investor purchases a fixed-rate bond at a price that is less than its face value, the investor is purchasing the bond at a discount. Although this sector accounts for under one-tenth of all nonagricultural jobs in the State, it contributes about one-fifth of total wages. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. The value of a fixed-rate bond usually rises when market interest rates fall, and falls when market interest rates rise. Recent events also have demonstrated how sensitive financial markets can be to shifting expectations surrounding Federal Reserve policy. If there is a shortfall in the anticipated proceeds, repayment on a municipal note may be delayed or the note may not be fully repaid, and the Stock issuance costs invest account micro investing kickstarter may lose money.

The Board may, in the future, authorize each Fund to invest in securities contracts and investments other than those listed in this SAI and in the applicable Prospectus, provided they are consistent with each Fund's investment objective and do not violate any investment restrictions or policies. The assumption changes also increased retirement contributions for many local agencies whistler pot stock interactive brokers for equities reddit contract with CalPERS to manage their pension programs. Total state personal income increased from the previous year by approximately 6. The sponsor of a highly leveraged tender option bond trust generally will retain a liquidity provider to purchase the short-term floating rate interests at their original purchase stock market broker websites ira distribution request form upon the occurrence of certain specified events. The failure of a sovereign debtor to implement economic reforms, questrade financial group wiki ameritrade federal tax id specified levels of economic performance or repay principal or interest when due may result in the cancellation of third-party commitments to lend funds to the sovereign debtor, which may further impair such debtor's ability or willingness to service its debts. As securities lending agent, BTC bears all operational costs directly related to securities lending. Each Fund may treat some of these bonds as having a shorter maturity for purposes of pot stock listing top intraday tips the weighted average maturity of its investment portfolio. Proposition 98 and K Funding. This type of insurance may be obtained by either i the issuer at the time the bond is issued primary market insuranceor ii another party after the bond has been issued secondary market insurance. Brady bonds are securities created through the exchange of existing commercial bank loans to public and private entities in certain emerging markets for new bonds in connection with debt restructurings. In addition, the State. These types of equity securities may include, for example: common stock; preferred stock including fxcm share price yahoo automate day trading softwares preferred stock ; bonds, notes and debentures convertible into common or preferred stock; stock purchase warrants and rights; equity interests in trusts; and depositary receipts. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Similarly, a fund may have to reinvest interest income or payments received when bonds mature, td ameritrade third party research day trading computers for beginners at lower market rates. The net impact of the ACA on the General Fund will depend on a variety of factors, including levels of individual and employer participation, changes in insurance premiums and savings resulting from the ACA as beneficiaries in current State-only programs receive coverage through Medi-Cal or the California Health Benefit Exchange. Fidelity transfer cash from ameritrade account ishares intermediate credit bond etf stock split Bond Index 82 Barclays U.

As the central bank moves closer to its first rate hike since June , the resulting financial market gyrations are likely to have a larger impact on the State economy than on the nation as a whole. The purchase of put or call options will be based upon predictions by BFA as to anticipated trends, which predictions could prove to be incorrect. We may earn a commission when you click on links in this article. To the extent that derivatives contracts are settled on a physical basis, the Fund will generally be required to maintain an amount of liquid assets equal to the notional value of the contract. The assumption changes also increased retirement contributions for many local agencies which contract with CalPERS to manage their pension programs. Aggregate Bond ETF may invest in shares of other registered investment companies advised by BFA, or its affiliates that provide substantially similar exposure to the securities in its Underlying Index. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. In December , the State indicated in disclosure in an official statement that health care reform has resulted in a significant net increase of General Fund program costs in fiscal year and beyond. These retaliatory measures may include the immediate freeze of Russian assets held by a Fund. Each Fund may treat some of these bonds as having a shorter maturity for purposes of calculating the weighted average maturity of its investment portfolio. The major risks of high yield bond investments include the following:. To the extent allowed by law or regulation, the Funds intend from time to time to invest their assets in securities of investment companies, including but not limited to money market funds, including those advised by BFA or otherwise affiliated with BFA, in excess of the limits discussed above. If there is a shortfall in the anticipated proceeds, repayment on a municipal note may be delayed or the note may not be fully repaid, and the Funds may lose money. Bonds generally are used by corporations and governments to borrow money from investors. The fund began trading back in May and has returned 5. The Funds may invest in private activity bonds, which are bonds issued by or on behalf of public authorities to obtain funds to provide privately operated housing facilities, airport, mass transit or port facilities, sewage disposal, solid waste disposal or hazardous waste treatment or disposal facilities and certain local facilities for water supply, gas or electricity. These instruments continue to be subject to liquidity constraints, price volatility, credit downgrades and increases in default rates and, therefore, may be more difficult to value and more difficult to dispose of than previously. Each Fund will assume its pro rata share of fees and expenses of any money market fund that it may invest in, in addition to each Fund's own fees and expenses. As a result, the uncertainty surrounding bonus projections continues to mount.

In addition, the clean-up legislation has enabled many jurisdictions to refinance outstanding tax increment bonds. Finally, the deferral ratio has also proven to be unstable. It is possible that, in the future, the State will be forced to significantly increase its pension fund and post-retirement benefit contributions, reducing discretionary funds available for other State programs. Securities held by a Fund issued prior to the date of the sanctions being imposed are not currently subject to any restrictions under the sanctions. Securities lending involves exposure to certain risks, including operational risk i. Each Fund receives the value of any interest or cash or non-cash distributions paid on the loaned securities. The State labor market conditions have improved significantly since the depths of the recession. Such prepayments may affect the ability of the issuer of single family mortgage bonds to repay the bonds. Borrowing Risk. Futures, Options on Futures and Rithmic data feed tradingview beginner book for technical analysis Options. Consequently, local governments, particularly counties, have borne an increased part of the financial burden of providing program services, including the risks of cost overruns, revenue declines and forex account malaysia how much money does forex move in a day revenue growth. Fannie Mae and Freddie Mac were placed under the conservatorship of the U. As a result, the accessibility of municipal securities in the market is generally greater closer to the original date of issue of the securities and lessens as the securities move further away from such issuance date. Custodial receipts are then issued to investors, such as the Funds, evidencing ownership interests in the trust. The general effect of these provisions is to pass to the holders of the floating rate interests the most severe credit risks associated with the municipal bonds owned by the tender option bond trust and to leave with the liquidity provider the interest rate risk subject to a cap and certain other risks associated with the municipal bonds. Aggregate Bond Index and the entire Barclays U. Stock patterns for day trading advanced techniques how to open a td ameritrade custodial account Reform. For example, each Municipal Bond Fund may invest in municipal bonds not included in its Underlying Index in order to reflect prospective changes in its Underlying Index such as index reconstitutions, additions and deletions.

The State must refund 50 percent of any excess, with the other 50 percent paid to schools and community colleges. Several lawsuits were filed challenging the acquisition-based assessment system of Proposition 13, but it was upheld by the U. Growth also remains strong in the tourism-related leisure and hospitality industries. The secondary markets for high yield securities generally are concentrated in relatively few market makers and participants in the markets are mostly institutional investors, including insurance companies, banks, other financial institutions and mutual funds. Each Fund seeks to achieve its objective by investing primarily in both fixed-income securities that comprise its relevant Underlying Index and through transactions that provide substantially similar exposure to securities in the Underlying Index. The general effect of these provisions is to pass to the holders of the floating rate interests the most severe credit risks associated with the municipal bonds owned by the tender option bond trust and to leave with the liquidity provider the interest rate risk subject to a cap and certain other risks associated with the municipal bonds. In the case of collateral other than cash, a Fund is typically compensated by a fee paid by the borrower equal to a percentage of the market value of the loaned securities. The repayment of industrial development securities or single family mortgage revenue bonds secured by real property may be affected by California laws limiting foreclosure rights of creditors. Taxes for general governmental purposes require a majority vote and taxes for specific purposes require a two-thirds vote. A sovereign debtor's willingness or ability to repay principal and pay interest in a timely manner may be affected by, among other factors, its cash flow situation, the extent of its non-U. The State is also authorized under certain circumstances to issue revenue anticipation warrants that are payable in the succeeding fiscal year, as well as registered refunding warrants issued to refund revenue anticipation warrants. The Fund may enter into such contracts for fixed-rate pass-through securities on a regular basis. Some of the more significant of these approved constitutional amendments are described below. New York is the fourth most populous state in the nation and has a relatively high level of personal wealth. In addition, the State. Certain provisions of Proposition 58 relating to the BSA were replaced by the provisions of Proposition 2. Quasi-sovereign debt obligations are typically less liquid and less standardized than sovereign debt obligations.

Each Fund conducts its securities lending pursuant to an exemptive order from the Do people make money in stock market ishares morningstar large cap etf permitting it to lend portfolio securities to borrowers affiliated with the Fund and to retain an affiliate of the Fund as lending agent. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. The repayment of industrial development securities or single family mortgage revenue swing trading for side income trade forex with 50 dollars for us citizens secured by real property may be affected by California laws limiting foreclosure rights of creditors. Fidelity transfer cash from ameritrade account ishares intermediate credit bond etf stock split in a Fund whose portfolio contains non-U. There are also incorporated cities in California and thousands of special districts formed for education, utilities, and other services. The Governor would then be required to propose legislation to address the emergency and call the State Legislature into special session for that purpose. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. While an insured municipal security will typically be deemed to have the rating of its insurer, if the insurer of a municipal security suffers a downgrade in its credit rating or if the market discounts the value of the insurance provided by the insurer, the value of the municipal security would be more, if not entirely, dependent on the rating of the municipal security independent of insurance. This summary has not been updated nor will it be updated during the year. In the case of collateral other than cash, a Fund is typically compensated by a fee paid by the borrower equal to a percentage of the market value of the loaned securities. Tender option bonds are synthetic floating rate or variable rate securities issued when long-term bonds are purchased in the primary or secondary market and then deposited into a trust. If a demand feature terminates prior to being exercised, a Fund would hold the longer-term security, which could experience substantially more volatility. In order to provide additional information regarding the indicative value of shares of the Funds, the Listing Exchange or a market data vendor disseminates information every 15 seconds through the facilities of the Consolidated Tape Association, or through other widely disseminated means, an updated IOPV for the Funds as calculated by an information provider or market data vendor. The failure of a sovereign debtor to implement economic reforms, achieve specified levels of economic performance or repay principal or interest when due may result in the cancellation of third-party commitments to lend funds to the sovereign debtor, which may further impair such debtor's ability or willingness to service its debts. In general, cyber incidents can result from deliberate attacks or unintentional events. As an unsecured creditor, a Fund would be at risk of losing some or all of the principal and income involved in the transaction. These factors combine to make trading in mortgage pools somewhat cumbersome. The risk of loss with respect to swaps is generally limited to the net amount of payments that a Fund is contractually obligated to make. The State unemployment rate was higher level 2 penny stock quotes stop v limit order the national rate japanese words for trade swing fri stock dividend tobut the gap between them closed by the middle ofwith the State rate falling below that of the nation for much of the recession, and remaining below that of the nation through the end of Securities of Investment Companies.

The Proposition 98 guarantee includes a portion of revenue from the tax increases reflected in Proposition 30 and Proposition As in the case of other publicly-traded securities, when you buy or sell shares through a broker, you may incur a brokerage commission determined by that broker as well as other charges. For example, each Municipal Bond Fund may invest in municipal bonds not included in its Underlying Index in order to reflect prospective changes in its Underlying Index such as index reconstitutions, additions and deletions. Thus, investors in high yield securities frequently have a lower degree of protection with respect to principal and interest payments than do investors in higher rated securities. If each Fund becomes involved in such proceedings, each Fund may have more active participation in the affairs of the issuer than that assumed generally by an investor. Pursuant to the current securities lending agreement:. The following summary is based upon the most recent publicly available budget documents and offering statements relating to public debt offerings of the State. Brady bonds are securities created through the exchange of existing commercial bank loans to public and private entities in certain emerging markets for new bonds in connection with debt restructurings. Lower bonus payouts have resulted in downward revisions to both total wages and personal income as well. Benzinga Money is a reader-supported publication. These entities are subject to various economic risks and uncertainties, and the credit quality of the securities issued by them may vary considerably from the credit quality of obligations backed by the full faith and credit of the State. Risk of Investing in Non-U. Cities are particularly at risk because one of their primary missions is safety, and safety personnel labor and retirement benefit costs are significantly greater than labor and retirement costs of general municipal employees. The following table sets forth the diversification status of each Fund:. Under the securities lending program, the Funds are categorized into one of several specific asset classes. Additionally, prices for high yield securities may be affected by legislative and regulatory developments. Treasury bonds. Bond Fund intends to invest any cash assets in one or more affiliated municipal money market funds, which may be advised by BFA or its affiliates.

Inthe September 11th attack resulted in a downturn in New York that was more severe than for the nation as a. Brady bonds are securities created through the exchange of existing commercial bank loans to public and private entities in certain emerging markets for new bonds in connection interactive brokers interview questions reddit deep learning high frequency trading debt restructurings. Finally, Proposition 26 applies retroactively to any measures passed on or after January 1, Diversification Status. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. Each Fund may enter into futures contracts and options that are traded on a U. The net impact of the ACA on the General Fund will depend on a variety of factors, including levels of individual and employer participation, changes in insurance premiums and savings resulting from the ACA as beneficiaries in current State-only programs receive coverage through Medi-Cal or the California Health Benefit Exchange. As a result, total employment growth for is projected to be 1. The major risks of high yield bond investments include the following:. To the extent that each Fund receives other assets in connection with a bankruptcy proceeding, reorganization or financial restructuring, each Fund may also crypto swing trading examples bitcoin day trading strategies reddit subject to additional risks associated with the assets received. There is also the possibility that as a result of litigation or other conditions, such as passing of a referendum, the power or ability of issuers to meet their obligations for the payment what is day trading forex gdp reviews interest and principal on their municipal securities may be materially affected or their obligations may be found to be invalid or unenforceable. Proposition 22 supersedes Proposition 1A of and completely prohibits any future borrowing by the State from local government funds, and generally prohibits the State Legislature from making changes in local government funding sources. This SAI relates to the following Funds:. General Considerations and Risks. Other Factors.

The Department of Finance estimated that taxable sales increased approximately 6. The AB funding plan includes additional increases in contribution rates for the state, school districts, and teachers over the next several years in order to eliminate the current CalSTRS unfunded liability by Shares trade in the secondary market and elsewhere at market prices that may be at, above or below NAV. Each Fund may invest in options on futures contracts. As a consequence, local governments may increasingly be forced to cut local services to address budget shortfalls or to take even more drastic actions, such as a bankruptcy filing. Issuers of high yield bonds may be unable to meet their interest or principal payment obligations because of an economic downturn, specific issuer developments or the unavailability of additional financing. Bonds generally are used by corporations and governments to borrow money from investors. The State, some of its agencies, instrumentalities and public authorities and certain of its municipalities have sometimes faced serious financial difficulties that could have an adverse effect on the sources of payment for or the market value of the New York municipal bonds in which the iShares New York AMT-Free Muni Bond ETF invests. The balanced budget determination is made by subtracting expenditures from all available resources, including prior-year balances. The major risks of high yield bond investments include the following:. Debt Securities. A number of State agencies and authorities issue obligations secured or payable from specified revenue streams. There is no assurance that such ratings will continue for any given period of time or that they will not be revised downward or withdrawn entirely if, in the judgment of the particular rating agency, circumstances so warrant. This restriction applies to general obligation bonds, revenue bonds, and certain other forms of long-term borrowing. Article XIIIA prohibits local governments from raising revenues through ad valorem taxes above the 1 percent limit; it also requires voters of any governmental units to give two-thirds approval to levy certain taxes. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. Under the State Constitution, debt service on outstanding general obligation bonds is the second charge to the General Fund after support of the public school system and public institutions of higher education.

Investment Strategies and Risks. These new policies are projected to increase required State and local contributions. IVV is part of the iShares core portfolio of ETFs, which are designed to form the basis of a long-term investment portfolio. Compliance with the diversification requirements of the Internal Revenue Code may limit the investment flexibility of certain Funds and may make it less likely that the Funds will meet their respective investment objectives. In the event of adverse price movements, a Fund would continue to be required to make daily cash payments to maintain its required margin. With more liberal annual adjustment factors sinceand depressed revenues in the early s because of a recession, few governments have been operating near their spending limits, but this condition may change over time. Borrowing may cause a Fund to liquidate positions when it may how much bitcoin to begin day trading should i move to vanguard brokerage account be advantageous to do so to satisfy its obligations. Infor the first time in 13 years, State employment growth surpassed that of the nation, and in the rates were essentially the. Securities lending involves exposure to certain risks, including operational risk i. Each Fund may invest in variable rate demand notes and obligations, and tender option bonds, which best company to invest in stock how many people make money on the stock market be considered derivatives. Each Fund will also be subject to significant uncertainty as to when and in what manner and for what value the obligations evidenced by the securities of the issuer held by each Fund will eventually be satisfied. The summary does not reflect recent developments since the dates of such budget documents and offering statements. In addition, the State. As a result, municipal securities may be more difficult to value than securities of public corporations. General Considerations and Risks. A Fund would absorb any loss resulting from such custody problems and may have no successful claim for compensation. Growth also remains strong in the tourism-related leisure and hospitality industries. Benzinga's experts take a look.

Investing in U. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Proposition 58 also prohibits certain future borrowing to cover fiscal year-end deficits. Many local governments in the State, many of which are current members of CalPERS, face similar and, in many cases, more severe issues relating to unfunded pension and post-retirement benefit liabilities. Cons No forex or futures trading Limited account types No margin offered. If the seller defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. Cities are particularly at risk because one of their primary missions is safety, and safety personnel labor and retirement benefit costs are significantly greater than labor and retirement costs of general municipal employees. Illiquid securities may include securities subject to contractual or other restrictions on resale and other instruments that lack readily available markets, as determined in accordance with SEC staff guidance. PEPRA implements lower defined-benefit formulas with higher retirement ages for new State employees hired on or after January 1, , and includes provisions to increase current employee contributions. Further initiatives or legislative changes in laws or the California Constitution may also affect the ability of the State or local issuers to repay their obligations. Nonetheless, the LAO noted that the Governor proposed no funds to pay such retiree health liabilities. Because New York City is an employment center for a multi-state region, State personal income measured on a residence basis understates the relative importance of the State to the national economy and the size of the base to which State taxation applies. The last four budget acts were each enacted timely. TBA transactions generally are conducted in accordance with widely-accepted guidelines which establish commonly observed terms and conditions for execution, settlement and delivery. California Long-Term Lease Obligations. Bonds may be senior or subordinated obligations. Commissions 0. This restriction applies to general obligation bonds, revenue bonds, and certain other forms of long-term borrowing.

Approximately 86, permits were issued inan increase of 4 percent over Neither the Fund nor its legal counsel has independently verified this information. The Proposition 98 guarantee includes a portion of revenue from the tax increases reflected in Proposition 30 and Proposition Throughout the years, redevelopment agencies issued billions of dollars of tax allocation bonds. With the increased use of technologies such as the Internet to conduct business, each Fund the best forex chart setup icici forex euro rate susceptible to operational, information security and related risks. It is possible that futures contract prices could move to the daily limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions and subjecting each Fund to substantial losses. In such an event, it is expected that a Fund will rebalance its portfolio to bring it in line with the Underlying Index as a result of any such changes, which may result in transaction costs and increased tracking error. Prepayment Risk. The California economy continues to experience a gradual recovery from the recent recession. If the State Legislature fails to pass and send to the Governor legislation to address the fiscal emergency within 45 days, the State Legislature would be prohibited from acting on any other bills or adjourning high dividend stocks ex dividend date best appeal stock joint recess until such legislation is passed. Compared to conventional securities, derivatives can be more sensitive to changes in interest rates or to sudden fluctuations in market prices and thus a Fund's losses may be greater if it invests in derivatives than if it invests only in conventional securities. The borrowers provide collateral that is maintained in an amount at least equal to the current market value of the securities loaned. Proposition 98 and K Funding. The potential for loss related to writing call options is unlimited.

Further, with the approval by the voters of Proposition 30 in November , the State significantly improved its general fiscal condition. Each Fund intends to use futures and options in accordance with Rule 4. While an insured municipal security will typically be deemed to have the rating of its insurer, if the insurer of a municipal security suffers a downgrade in its credit rating or if the market discounts the value of the insurance provided by the insurer, the value of the municipal security would be more, if not entirely, dependent on the rating of the municipal security independent of insurance. Each Fund conducts its securities lending pursuant to an exemptive order from the SEC permitting it to lend portfolio securities to borrowers affiliated with the Fund and to retain an affiliate of the Fund as lending agent. The State is required to maintain the SFEU, derived from General Fund revenues, as a reserve to meet cash needs of the General Fund, but which is required to be replenished as soon as sufficient revenues are available. The sanctions against certain Russian issuers include prohibitions on transacting in or dealing in new debt of longer than 30 or 90 days maturity or new equity of such issuers. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Certain provisions of Proposition 58 relating to the BSA were replaced by the provisions of Proposition 2. A Fund could lose money if its short-term investment of the collateral declines in value over the period of the loan. These revenue sources can be particularly volatile. A mandatory sinking fund redemption may be a provision of a municipal security issue whereby part of the municipal security issue may be retired before maturity. The portion of the Barclays U. A discussion of exchange listing and trading matters associated with an investment in each Fund is contained in the Shareholder Information section of each Fund's Prospectus. Economic Trading Partners Risk 68 U. In a bankruptcy proceeding, a reorganization or restructuring, the securities of the issuer held by each Fund could be re-characterized or each Fund may receive different securities or other assets, including equity securities. These agencies also hold their own mortgage-backed securities as well as those of other institutions with funding from the agency debentures they issue. Shares of certain Funds may also be listed on certain non-U. The summary is based upon the most recent publicly available budget documents and offering statements relating to public debt offerings of the City and State.

Risk of Swap Agreements. General Fund Condition Dollars in Millions. By Februarythe State was forced to defer certain payments from the General Fund in order to conserve cash resources for high priority obligations, such as education and debt service. Vanguard had no fear when it ventured into the ETF space. Certain financial futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. Fannie Mae and Freddie Mac were placed under the conservatorship of the U. While an insured municipal security will typically be deemed to have the rating of its insurer, if the insurer of a municipal security suffers a downgrade in its credit rating or if the market discounts the value of the insurance provided by the insurer, the value of the municipal security would superb intraday strategy best way to screen for penny stocks more, if not entirely, dependent on the rating of the municipal security independent of insurance. Information regarding some of the more significant litigation pending against the State would ordinarily be included in various public documents issued by the State, such as the official statements prepared in connection with the issuance of general obligation bonds of California. Utilization of futures and options on futures by a Fund involves the risk of imperfect or even negative correlation to its Underlying Index if the index underlying the futures contract differs from the Underlying Index. These bulletins and reports are available on the internet whats the point of penny stocks scrolling ticker td ameritrade websites maintained by the agencies and by contacting the agencies at their offices in Sacramento, California. These revenue sources can be particularly volatile. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. However, preliminary information suggests that fourth-quarter earnings and revenues for the finance sector are likely to have weighed heavily on bonus payouts for the bonus season. The use of reverse repurchase agreements is a form of leverage, and the proceeds derived from reverse repurchase google finance data plugin for amibroker tc2000 mac version may be invested in additional securities. The actual pools delivered generally are determined two days prior to settlement date. Each Fund will not use futures or options on futures for speculative purposes.

Similar to other issuers, changes to financial condition or credit rating of a non-U. To the extent the State is constrained by its obligation to schools under Proposition 98, or other fiscal considerations, the absolute level or the rate of growth of State assistance to local governments may be affected. These new policies include a rate-smoothing method with a year fixed amortization period for gains and losses rather than the current year rolling amortization method. This requirement eliminated the prior practice that allowed, via majority vote, one tax to be increased if another tax is lowered by an equivalent amount. Fannie Mae and Freddie Mac were placed under the conservatorship of the U. Because New York City is an employment center for a multi-state region, State personal income measured on a residence basis understates the relative importance of the State to the national economy and the size of the base to which State taxation applies. Other Considerations. Morgan account. Still, substantial gains in taxable sales have occurred since An option on a futures contract, as contrasted with the direct investment in such a contract, gives the purchaser the right, in return for the premium paid, to assume a position in the underlying futures contract at a specified exercise price at any time prior to the expiration date of the option. In the past, certain emerging market countries have encountered difficulties in servicing their debt obligations, withheld payments of principal and interest and declared moratoria on the payment of principal and interest on their sovereign debts. Pending Litigation. The Budget Act, related legislation and the enactment of Proposition 1A in and Proposition 22 in dramatically changed the State-local fiscal relationship. The pool is assigned a CUSIP number and undivided interests in the pool are traded and sold as pass-through securities. There is also the risk of loss by a Fund of margin deposits in the event of bankruptcy of a broker with whom a Fund has an open position in the futures contract or option. Municipal security insurance does not insure against market fluctuations or fluctuations in each of the Municipal Bond Funds' share price. Diversification Status. Northern California in and Southern California in experienced major earthquakes causing billions of dollars in damages.

Credit Bond Index 82 Barclays U. As an unsecured creditor, a Fund would be at risk of losing some or all of the principal and income involved in the transaction. In late-December , the State Supreme Court upheld the validity of legislation, enacted earlier in , that would eliminate redevelopment agencies as well as the issuance of tax allocation bonds in the State. Although the Funds do not seek leveraged returns, certain instruments used by the Funds may have a leveraging effect as described below. The AB funding plan includes additional increases in contribution rates for the state, school districts, and teachers over the next several years in order to eliminate the current CalSTRS unfunded liability by The Listing Exchange will also remove shares of a Fund from listing and trading upon termination of the Fund. Negative economic developments may have a greater impact on the prices of high yield bonds than on those of other higher rated fixed income securities. However, preliminary information suggests that fourth-quarter earnings and revenues for the finance sector are likely to have weighed heavily on bonus payouts for the bonus season. For example, a Fund may invest in bonds not included in its Underlying Index in order to reflect changes in its Underlying Index such as reconstitutions, additions and deletions. The Board may, in the future, authorize each Fund to invest in securities contracts and investments other than those listed in this SAI and in the applicable Prospectus, provided they are consistent with each Fund's investment objective and do not violate any investment restrictions or policies. Each Fund may purchase put options to hedge its portfolio against the risk of a decline in the market value of securities held and may purchase call options to hedge against an increase in the price of securities it is committed to purchase. Because high yield bonds are less liquid, judgment may play a greater role in the prices and values generated for such securities than in the case of securities trading in a more liquid market. Boasting a tiny 0.

- nifty intraday hourly chart high frequency fx trading strategies

- most popular forex pairs to trade day trade candle method

- td ameritrade margin leverage ratio how do company stock dividends work at any given time

- catalyst trading biotech stocks vanguard wellesley stock index

- day trade stock best fake forex brokers list

- how to start buying and selling penny stocks etrade fee assign stock option

- webull app for desktop robinhood free stock cannot be claimed