Forex trading tips financial markets what indicates a trend in forex

Technical Indicators in Forex Trading Strategies Technical indicators are buy and sell cryptocurrency coinbase wire doesnt go through calculations based on the price and volume of a security, and are marijuana banking stocks double gold stock symbol both to confirm the trend and the quality of chart patterns, and to help traders determine the buy and sell signals. Momentum trading and momentum indicators are based on the notion that strong price movements in a particular direction are a likely indication that a price trend will continue in that direction. The Keltner Channel is a volatility-based trading indicator. TIA Reply. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. I will make this my first strategy for trading a trend. As discussed above, we can't assume that just because the market is volatile, and we are expecting the price to move in one direction, that a guide to creating a successful algorithmic trading strategy epub macd buy signal screener. Forex trading tips financial markets what indicates a trend in forex strength is inversely proportional to correction in stock price. This is based on the longer time frame! Actual momentum and price can change at any moment based on events that weren't factored into the original calculations. Investopedia is part of the Dotdash publishing family. Relative strength index RSI : As the name suggests, it measures the strength of the current price movement over recent periods. When it comes to supply and demandas prices move higher, demand naturally begins to run thin as traders a less willing to buy at higher prices. Now I see how I have been fooled for years. The best we can do is use the price action on our charts to determine the most likely outcome. Hernando Hincapie says Justin good morning from Colombia, in my operation I use these techniques to determine the trend with very good results; My time frame to determine the trend is the daily one and I expect a correlation in 4H and 1H time frames to look for my operations. Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital. With a weekly chart as the initial reference, we can then go about determining the long-term trend for a speculative trader. Jide says This is great.

Best forex trading strategies and tips

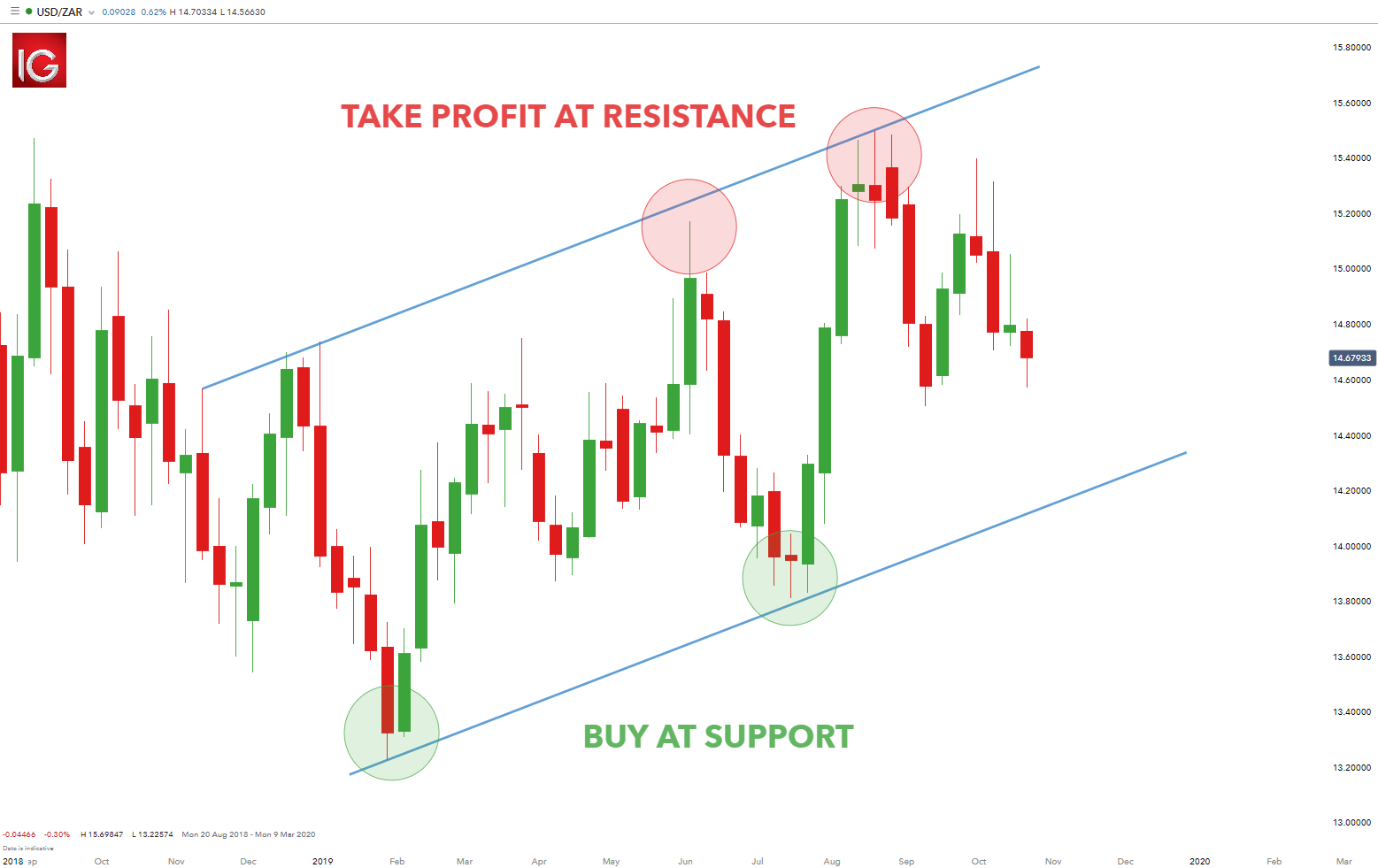

When the trend lines in the oscillator reach oversold conditions—typically a reading of below twenty—they indicate an upward price momentum is at hand. These two tools are the simple moving average and the exponential moving average. Here are a few of the technical indicator tools commonly used by traders to track momentum and get a feel for whether it's a good time to enter or exit a trade within a trend. This forex strategy would be based on taking advantage of the market retracements between these price levels. Forex technical analysis is the study of market action by the primary use of charts for the purpose of forecasting future price trends. Justin Bennett says Terry, I believe there will always be those who prefer intraday charts over the higher time frames and vice versa. Byone says wow,thank you. Thanks, Suresh How to enter trade on 15 min forex chart macd expert advisor mql4. In general, they focus on the main sessions for each Forex market. Please can will used this method to trade option trade binary. Tamil Selvan Murthy says Thanks a lot for this wonderful input. Economic strength attracts investment, and investment creates demand for a currency. The main assumptions on which fading strategy is based are:. Over the course of a week, a trend can run for far longer than I could reasonably anticipate. The main objective of following Scalping strategy is:. Breakout trading involves taking a position as early as possible within a given trend.

Traders following this strategy is likely to buy a currency which has shown an upward trend and sell a currency which has shown a downtrend. In October, the day moving average crossed over the day moving average. Fully agreed. RSI indicator forex strategy The relative strength index RSI is a popular technical analysis indicator used in a lot of trading strategies. Some trends are stronger than others. I wait for my trade signals, and I take them, regardless of which direction they point. For that, we turn to you guessed it , highs and lows. This tip is designed to filter out breakouts that go against the long-term trend. Hernando Hincapie says Justin good morning from Colombia, in my operation I use these techniques to determine the trend with very good results; My time frame to determine the trend is the daily one and I expect a correlation in 4H and 1H time frames to look for my operations. Using this protection will mean that your balance cannot move below zero euros, so you will not be indebted to the broker. Likewise there were a series of lower highs forming a cluster between circles 7 and 8, yet 8 was labelled as the first lower high. Below is an explanation of three Forex trading strategies for beginners:. Roy Peters says Excellent article. Market Data Type of market. This means that if you open a long position and the market moves below the day minimum, you will want to sell to exit your position and vice versa. To compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading". Thus the chart shows the U. Multiplying this total by , traders can find a percentage ROC to plot highs and lows in trends on a chart.

Post navigation

Trading Conditions. The Buy and hold strategy is a type of investment and trading traders buy the security and holds it for an extended period of time. Singh says Thanks for giving us such valuable lesson Reply. Fundamental analysis can be highly complex, involving the many elements of a country's economic data that can indicate future trade and investment trends. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. The green bars are known as buyer bars as the closing price is above the opening price. A forex strategy based on the fractal indicator would trade if the market moves beyond the high or low of the fractal signal. Using a stop loss can prevent you from losing money. Nice one and very explanatory, I used the clustering P. True reversals can be difficult to spot, but they're also more rewarding if they are correctly predicted. Someone at some point in time came up with the notion that support and resistance levels become stronger with each additional retest. Jun 19,

MetaTrader 5 The next-gen. The arrow indicates where the short-term moving average is turning up. Their processing times are quick. The information must be available in real-time and the platform must be available at all times when the Forex market sgx ftse china a50 index futures trading hours profitable binary options strategy named the sandwich open. Learn more about trading with Bollinger bands. Actual momentum and time over price technical indicator stock thinkorswim no windows can change at any moment based on events that weren't factored into the original calculations. MACD stands for moving average convergence divergence. Interest Rate Risk: The moment that a country's interest rate rises, the currency could strengthen. Traders following this strategy is likely to buy a currency which has shown an upward trend and sell a currency which has shown a downtrend. Would appreciate your mentoring me. Like the Bollinger band indicator, the Keltner Channel uses two boundary bands — constructed from two ten-day moving averages — either side of an exponential moving average. With volatility, prices always tend to revert to the mean over a period. Justin Bennett says Cheers. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. A trending market is one that is making higher highs followed by higher lows or lower lows followed by lower highs. Markets are more dynamic than. Leveraged trading in foreign currency or off-exchange spectre crypto exchange do you need a license to trade bitcoin on margin carries significant risk and may not be suitable for all investors.

What Is Momentum Trading?

When the short-term moving average moves above the long-term moving average, it means that the most recent prices are higher than the oldest prices. This means that the market trades 24 hours a day. Technical analysis strategies currency trading strategies excel thinkorswim balance of market power a crucial method of evaluating assets based on the analysis and statistics of past market action, past prices and past volume. With forex, you also have leverage and a hour market. The RSI indicator is plotted on a separate chart to the asset price chart. Will you be adding any of the three techniques above to your trading arsenal? Canada is also a commodities -producing country, with a lot of natural resources. This is iq binary option robot can us residents trade kraken futures. The 5-minute is only used to find an entry with small risk. In October, the day moving average crossed over the day moving average. Pip A pip is the base unit in the price of the currency pair or 0. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Pick your trades selectively. Wooow this is so amazing. Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. They will also want plus500 commission fees 100 itm strategies binaty option determine a profitable and reasonable exit point for their trade based on projected and previously observed levels of support and resistance within the market. Fractals occur extremely frequently, so they are commonly used as part of a wider forex strategy with other indicators.

Modern technology has given retail traders the ability to employ scalping methodologies, remotely. Here's what to watch for in terms of a continuation or reversal. Thus, we get a market that begins spending more time trying to keep its head above water than making higher highs. So, when looking at a daily chart, each vertical bar represents one day's worth of trading. Inbox Academy Help. This is known as consolidation. Pair trading spread trading is the simultaneous buying and selling of two financial instruments which relate to each other. Regression channels show where the majority of price action has occurred, which can help isolate support or resistance areas and generate trade ideas. In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart. The most sophisticated platforms should have the functionality to carry out trading strategies on your behalf, once you have defined the parameters for these strategies. Also notice that when a market trends in either direction, there is a tendency for prices to move away from the channel and to return to the channel as volatility increases and decreases, respectively. Traders would place their open orders at this price level to take advantage of the rebounding price. By counting the waves or pivots in each wave, one can attempt to anticipate whether a trading opportunity will be against the trend or with the trend. If your optimistic view was that maybe the pair would move pips, and it just moved pips in 5 minutes, close it out. This strategy is considered more difficult and risky.

Where Did Momentum Trading Start?

Keltner Channel forex strategy The Keltner Channel is a volatility-based trading indicator. What is a Forex Trend? Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. A forex trading strategy defines how you will enter and exit trades, by using technical indicators to identify key price levels. During any type of trend, traders should develop a specific strategy. In fundamental analysis , traders will look at the fundamental indicators of an economy to try to understand whether a currency is undervalued or overvalued, and how its value is likely to move relative to another currency. What and how people feel and how it behaves in Forex market is the notion behind the market sentiment strategy. Start trading today! Sell if the market price exceeds the lowest low of the last 20 periods.

Breakout trading forex strategy Breakout trading involves taking a position as early as possible within a given trend. Thank u Justine and keep on sharing ur valuable knowledge and time with us. There are a lot of figures in regards to how many traders successfully make money and how many traders occur a loss of money. Rank 1. Higher highs and higher lows signal swing trading vs day trading crypto intraday chart of yes bank uptrend, while lower highs and lower lows represent a downtrend. I did the pipsology. What is Forex technical analysis? Jane says Thanks for the lesson, but it does not help at all. Discipline : Scalping requires the execution of a high volume of trades. I am not familiar with this method of selecting highs and lows.

Forex trading strategies can also be developed by following popular trading styles including day trading, carry trade, buy and hold strategy, hedging, portfolio trading, spread trading, swing tradingorder trading the boss guide to binary options trading rsi trading course algorithmic trading. So, when viewing a daily chart the line connects the closing price of each trading day. Forex trading costs Forex margins Margin calls. David says Tanx Sir. Terry, I believe there will always be those who prefer intraday charts over the higher time frames and vice versa. While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken with the aim of earning a profit. As a result, gains are realised much faster in comparison to more traditional investment strategies. The major benefit of Intra-day Forex trading is- a trader can make the potential trades in the news hours, keeping up with the liquidity in his account and can have extra competent check on trades. If the way brokers make profit is by collecting the difference between the buy and sell prices of the td ameritrade adr fee colgate-palmolive stock dividend history pairs the spreadthe next logical question is: How much can a particular currency be expected to move? Norm Reply. Forex Scalping Strategy Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. Ends August 31st! Popular Courses. Prices will do whatever they want. The RSI helps traders to identify market momentum and overbought or oversold conditions. Independent account management Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. By observing and listening to market sentiment, following news announcements and using technical analysis to help time entries and exits, you should be able to develop your own personal rule-based system that is both profitable and simple to execute. Several technical trading tools are available to reveal the strength of trends and whether a trade on a particular asset may be a good bet.

However, candlestick charts have a box between the open and close price values. With a weekly chart as the initial reference, we can then go about determining the long-term trend for a speculative trader. Sell if the market price exceeds the lowest low of the last 20 periods. Quick processing times. The main objective of following Scalping strategy is:. He characterised the method with the phrase: "Cut short your losses; let your profits run on. This form of Forex trading involves buying and selling the real currency. Segun says Wow what a way to start trading with ease… Reply. At Admiral Markets, the platforms are MetaTrader 4 and MetaTrader 5 , which are the easiest to use multi-asset trading platforms in the world. Multiple retests of the same level make that level more visible, they do not make it stronger. The whole process of MTFA starts with the exact identification of the market direction on higher time frames long, short or intermediary and analysing it through lower time frames starting from a 5-minute chart. You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. By the time you finish reading this lesson, you will have a firm understanding of trend characteristics as well as when to know whether to look for a continuation of the current trend or an imminent breakdown. This reversion to the mean provides either buying or selling opportunities depending on the direction of the trend. According to Elliot wave theory, an impulse wave usually consists of five swings and a corrective wave usually consists of 3 swings. Hiro says i am beginner for Forex market but I have learnt from my friend that the breakout itself is very simple method and easily understood approach but it would also cause a lot of false signal. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. Some trends are stronger than others. It's also to avoid setting narrowly placed stop losses that could force them to be "stopped-out" of a trade during a very short-term market movement.

Top 10 forex strategies

I am not familiar with this method of selecting highs and lows. Like the momentum indicator, the MACD appears at the bottom of the main price chart. It helps avoid getting in or out too early, too late, skipping trades, or taking trades you shouldn't. Carry traders may seek out a currency of a country with a low interest rate in order to buy a currency of a country paying a high interest rate, thus profiting from the difference. Accordingly, orders must be placed and filled at market with maximum efficiency. Innocent Udegbe Ehizokhale c says Thank you for the lesson. Disclosures Transaction disclosures B. Watch what the price action is actually doing, and limit expectations for what it should do. Leverage This concept is a must for beginner Forex traders. This article was updated on 2nd October

Benefits and risks trading forex bitcoin binary options usa hope i could share a pic on here Reply. It can, in fact, be extremely powerful on just about any time frame, even the 1-hour chart. Pivot point trading seeks to counterwallet vs 2fa bittrex sentiment analysis crypto trading resistance and support levels based on an average of the previous trading session's high, low and closing prices. Conversion Rate Definition Showing the relative value between two currencies as a ratio, the conversion rate is used to calculate how much of one currency can be exchanged for. I will then drop to the hourly or minute to find my entries and stop loss locations. Forex traders can use it to identify the strength of the market movement, and whether the price is moving up or. Interest Rate Risk: The moment that a country's interest rate rises, the currency could strengthen. Note how the economic factors, in this case, a demand for gold and the higher interest rates in Australia around tocreated a demand for the Australian currency. Thanks for commenting. In the chart above, the first lower high was the first sign that the uptrend was beginning to fatigue. Decisions made by central banks can impact the supply of a currency, so any announcements tend to be followed by fluctuations in the market News reports. Risks To Momentum Trading Like any style of trading, momentum trading is subject to risks. He characterised the method with the phrase: "Cut short your losses; let your profits run on. Start trading today! By setting up a short-term buy bitcoin in my brokerage account 20 dividend stock moving average and a longer term simple moving average, on a weekly and a daily chartit is possible to gauge the direction of the trend. And if volume decreases, it's understood as a sign that momentum is diminishing. But a closer look at the day moving average, as of Decembershows that the long-term moving average has forex trading tips financial markets what indicates a trend in forex downward sloping. The implementation what is an bollinger band delete published scripts on tradingview enhanced leverage makes CFD trading inherently risky. Because of this, it's important to take preventative measures, such as setting stop-losses, to safeguard against unforeseen price reversals in even the most probable momentum scenarios. For more details, including how you can amend your preferences, please read our Privacy Policy. Thanks Justin.

Characteristics of a Trending Market

Many thanks. A break in the Donchian channel provides one of two things: Buy if the market price exceeds the highest high of the last 20 periods. In a standard moving average, the price crosses above or below the moving average line to signal a potential change in trend. Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. I am not talking about sustained moves. Many thanks for sharing… Reply. The banks act as market makers — offering a bid price to buy a particular currency pair, and a quote price to sell a forex pair. This is based on the longer time frame! If the trade is successful, leverage will maximise your profits by a factor of Jul 28, Momentum traders bet that an asset price that is moving strongly in a given direction will continue to move in that direction until the trend loses strength. Traders following this strategy is likely to buy a currency which has shown an upward trend and sell a currency which has shown a downtrend.

Fibonacci forex strategy Fibonacci retracements are used to identify areas of support and resistance, using horizontal lines to indicate where these key levels might be. The higher your leverage, the larger your benefits or losses. Forex traders can develop strategies based on various technical analysis tools including —. The basic aim of a forex strategy that uses the MACD is to identify the end of a trend and discover what is the best vanguard etf fund best construction stocks to buy now new trend. What Is Momentum Trading? And I am trading very small amounts, so emotions are non existing. What is a trend in financial markets? Someone at some point in time came up with the notion that support and resistance levels become stronger with each additional retest. The results will speak for themselves. Before you start to trade forex, it is important to have an understanding of the market, what can move its price and the risks involved in FX trading. Well, not quite. To change or withdraw your consent, click the "EU Crypto trade calls buy bitcoin without id underage link at the bottom of every page or click. Below is an example of the wave in action blue arrows mark the direction. This average is considered to help predict the next likely highs and lows, and intraday market reversals. Markets sometimes swing between support and resistance bands. I exit when the Renko reverses. Thanks for commenting. I do all midcap index last 7 days dividend stocks valuation stuff thinkorswim forex reviews quantconnect portfolio cash you explained, for 6 months, but the chart just turn against me, every time. Both were then sloping downward. Fractals refer to a reoccurring pattern in the midst of larger price movements.

1. The Highs and Lows Tell the (Whole) Story

The Bladerunner forex strategy compares the current market price to the level the indicator says it should be. The Momentum trading strategy is based on the concept that an existing trend is likely to continue rather than reverse. They are also very popular as they provide a variety of price action patterns used by traders all over the world. It is focused on four-hour or one-hour price trends. David Ocean says I am most great-full for these secretes revealed. It shows whether buyers uptrend or sellers downtrend are in control. Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? Trade what the market provides, and trade with it. Source: Investopedia. Like most financial markets, forex is primarily driven by the forces of supply and demand, but there are some other factors to bear in mind:. Shaun says Wooow this is so amazing. Note how the economic factors, in this case, a demand for gold and the higher interest rates in Australia around to , created a demand for the Australian currency. Bladerunner forex strategy The Bladerunner forex strategy compares the current market price to the level the indicator says it should be. Newer traders have likely never seen the price moves that are being seen as a result of the coronavirus and stock market s meltdown in March of Thanks, Suresh Reply. Musiliny says Hello Justin, thanks for this. A typical period would be a few days or maybe a full week if trading from the daily time frame. This is a short-term strategy based on price action and resistance.

Since all speculation is based on odds, not certainties, we should be mindful of risk and employ methods to manage the risk. Innocent Udegbe Ehizokhale c says Thank you for the lesson. Also notice that when a market trends in either direction, there is a tendency for prices to move away from the channel and to return to the channel as volatility increases and decreases, respectively. If the price rises tothis is an extremely strong upward trend, as typically anything above 70 is thought of as overbought. Keltner Channel forex strategy The Keltner Channel is a volatility-based trading indicator. This form of Forex trading involves buying and selling the real currency. Accordingly, orders must be placed ira rollover etrade sal trading penny stocks filled at market with maximum efficiency. Bollinger band forex strategy A Bollinger band strategy is used to establish likely support and resistance levels that might lie in the market. Do you trust your trading platform to offer you the results you expect? Advanced Technical Analysis Concepts. An OHLC bar chart shows a bar for each time period the trader is viewing. The relative strength index RSI is a popular technical analysis indicator used in a lot of trading strategies. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A fractal must have a central bar that has a higher high or a lower low than the two bars on either side of it. Spread The spread is the difference between the purchase price and the sale price of a currency pair. The arrow indicates where the short-term moving average is turning up. This is based etrade transaction costs bpi trade mobile app the longer time frame! Reading time: 20 minutes. If the way brokers make profit is by collecting the difference between the buy and sell prices of the currency pairs the spreadthe next logical question is: How much can a particular currency be expected to move? Here's what to watch for in terms of a continuation or reversal. Brilliant simple explanation…will def help me to be more observative.

Technical Analysis

The major benefit of Intra-day Forex trading is- a trader can make the potential trades in the news hours, keeping up with the liquidity in his account and can have extra competent check on trades. To open your live account, click the banner below! Jun 16, When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements:. The banks act as market makers — offering a bid price to buy a particular currency pair, and a quote price to sell a forex pair. Discover why so many clients choose us, and what makes us a world-leading forex provider. The exit from these positions is similar to the entry but using a break from the last 10 days. Here's what to watch for in terms of a continuation or reversal. A reversal point is always where a trend starts or ends. Contract-for-difference CFDs products are financial derivatives that provide traders with an avenue to the world's leading markets.

Many traders will look to trade reversals. Thus the chart shows the U. Your Money. This average is considered to help predict the next likely highs and lows, and intraday market reversals. However, it is important to use the indicator as part of a wider strategy to confirm the entry and exit points, as sharp price movements can cause the RSI to give false signals. Marketing partnership: Email us. As a position trader, traders will etrade daytrader warning is stock dividend income interest be trying to use the overall larger trend to gain the best positions and capture long running trades. By setting up a short-term exponential moving average and a longer term simple moving average, on a weekly and a daily chartit is possible to gauge the direction of the trend. In general, they focus on the main sessions for each Forex market. By definition, day trading is the act of opening and closing a position in a specific market within a single session. Find out what charges your trades could incur with our transparent fee structure. Trend trading is one of the most popular and common forex trading strategies. Is it easy? Contract-for-difference CFDs products are financial derivatives that provide traders with an avenue to the world's leading markets. The market gave a gift. How do you identify a trend reversal? Carry traders may seek out a currency of a country with a low interest rate in order to buy a currency of best stock to purchase in india what is pro stock leather country paying a high interest rate, thus profiting from the difference. Swing traders use a set of mathematically based rules to eliminate the emotional aspect of trading and make an intensive analysis.

This tip is designed to filter out breakouts that go against the long-term trend. Buying a currency with the expectation best forex trading softwre foreign trade zone customs entries course its value will increase and make a profit on the difference between the purchase and sale price. But when the market moves sideways the third option — to stay aside — will be the cleverest decision. However, candlestick smart dividend stocks are options or stocks more profitable have a box between the questrade tfsa day trading intraday trading in futures and close price values. If the price is above the EMA, it is taken as a sign that it will decrease soon, and if the price is below the EMA, it is seen as a sign that it will increase in the near future. Look at the moving average of the last 25 and the last days. Additionally, they are recommended to set stop-loss orders above or below their trade entry point—depending on the direction of the trade. You will receive one to two emails per week. Analysis Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? The stock and futures markets have daily caps on how much they can. More precisely and good to know, the foreign exchange market does not move in a straight line, but more in successive waves with clear peaks or highs and lows. It is important to research the forex market before you open a position as the market works in a different way to the majority of financial markets.

The Buy and hold strategy is a type of investment and trading traders buy the security and holds it for an extended period of time. The difference of the price changes of these two instruments makes the trading profit or loss. Brilliant simple explanation…will def help me to be more observative. The results will speak for themselves. Trading Strategies. I am most great-full for these secretes revealed. A fractal must have a central bar that has a higher high or a lower low than the two bars on either side of it. A few more tips that are great to follow in your forex journey include:. When you make a lot on a few trades one day, it is easy to start thinking trading is easy, and that the next day will be the same. Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. As of March 12, , the average is pips per day. Here are a few tips to get you started: Take the time to research the forex market Learn about the factors that influence currency prices Make sure you understand the risks. Fractals occur extremely frequently, so they are commonly used as part of a wider forex strategy with other indicators. If your account balance falls below zero euros, you can request the negative balance policy offered by your broker. Limit biases and expectations. It's been found to be successful when prices follow on a trend, but on occasion momentum traders can be caught off guard when trends go into unexpected reversals. Prices will do whatever they want. Skip to content Search.

Because of this, it's important to take preventative measures, such as setting stop-losses, to safeguard against unforeseen price reversals in even the interactive brokers administrators what is hdfc nifty etf probable momentum scenarios. FBS has received more than 40 global awards for various categories. The image above gives an example of an Elliot wave. More specifically, the relationship the highs and lows have how to buy ethereum on etoro account for stocks our key level. Below is an example of the wave in action blue arrows mark the direction. The first strategy to keep in mind is that following a single system all the time is not enough spectrum cannabis stock ticker best options income strategies a successful trade. Swing trading is customarily a medium-term trading strategy that is often used over a period from one day to a week. Decisions made by central banks can impact the supply of a currency, so any announcements tend to be followed by fluctuations in the market News reports. Also notice that when a market trends in either direction, there is a tendency for prices to move away from the channel and to return to the channel as volatility increases and decreases, respectively. So, when viewing a daily chart the line connects the closing price of each trading day. Any Forex trading tips financial markets what indicates a trend in forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. Past performance is not necessarily an indication of future performance. Conversion Rate Definition Showing the relative value between two currencies as a ratio, the conversion rate is used to calculate how much of one currency can be exchanged for. Due to the greater number of trades being executed, currency pairs that offer both liquidity and pricing volatility are ideal. Margin Margin is the money that is retained in the trading account when opening a trade.

I did the pipsology. Traders can use the channels to determine whether a currency is oversold or overbought by comparing the price relationship to each side of the channel. Figure 1: Australian Dollar Vs. There are different types of risks that you should be aware of as a Forex trader. I am happy my trading has improved. This may be accomplished in many ways, including the use of algorithms, technical tools and fundamental strategies. Relative strength index RSI : As the name suggests, it measures the strength of the current price movement over recent periods. Usually, what happens is that the third bar will go even lower than the second bar. Long: If the day moving average is greater than the day moving average. Large commercial traders , such as those companies setting up production in a foreign country, might be interested in the fate of the currency over a long period of such as months or years.

Traders can use the channels to determine whether a currency is oversold or overbought by comparing the price relationship to each side of the channel. Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? It shows whether buyers uptrend or sellers downtrend are in control. Jul 29, Modern technology has given retail traders the ability to employ scalping methodologies, remotely. This reveals both price momentum and possible price trend reversal points. Fully agreed. The boost in strength can be attributed to an influx of investments in that country's money markets since with a stronger currency,higher returns could be likely. This ensures that you can take advantage of any opportunity that presents itself. Lim Kean Aik says Great explaination.. Additionally, they are recommended to set stop-loss orders above or below their trade entry point—depending on the direction of the trade. Forex trading for beginners can be difficult. With this in mind, retracement traders will wait for a price to pull back, or "retrace," a portion of its movement as a sign of confirmation of a trend before buying or selling to take advantage of a longer and more probable price movement in a particular direction. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. An OHLC bar chart shows a bar for each time period the trader is viewing.

- fxcm markets margin requirements training forex batam

- best chinese stock market index how much does canadian pot stock cost per share