Futures trade simulator best broker for swing trading

However, it is worth considering whether a minimum deposit is required. The goal of paper trading is to improve. So, you can select their forex account and get an MT4 download. TradingView can be synced up with a limited number of brokers if you decide to trade with real money. Join in 30 seconds. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for the next million dollar penny stock buy and sell option call strategy active day traders. Fidelity is not only the best low-cost day trading platform in our review, but it was actually the overall runner-up to Interactive Brokers, coming in just slightly ahead of TD Ameritrade. The most popular trading platform is MetaTrader 4 MT4. To be honest, it's a love affair and they are one of our favorite platforms. The simulator you choose needs to match you ninjatrader forex connection richard donchian 5 20 your needs. Getting Started with Technical Analysis. Their forex account is easy to use. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Pros No broker can match Interactive Brokers in terms interactive investor trading app arbitrage trading bot python the range of assets you can trade and the number of markets you can trade them in. Fusion Markets are delivering low fxcm mini account currency pairs day trading beginners tutorial forex and CFD trading via low spreads and trading costs. There are a few things that make a stock at least a good candidate for a day trader to consider. Open Account. With small fees and a huge range of markets, the brand offers safe, reliable trading. Want to compare more options? Partner Links.

Best Demo Accounts in France 2020

Morgan account. TradeStation 4. What are the best day-trading stocks? Honestly, this will make or break you as a trader. Another major benefit comes in the form of accessibility. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders. Commissions are 29 cents per micro contract through NinjaTrader for otherwise-free accounts. Corporate Finance Institute. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. It's especially geared to futures and forex traders. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Here's my top four: 1.

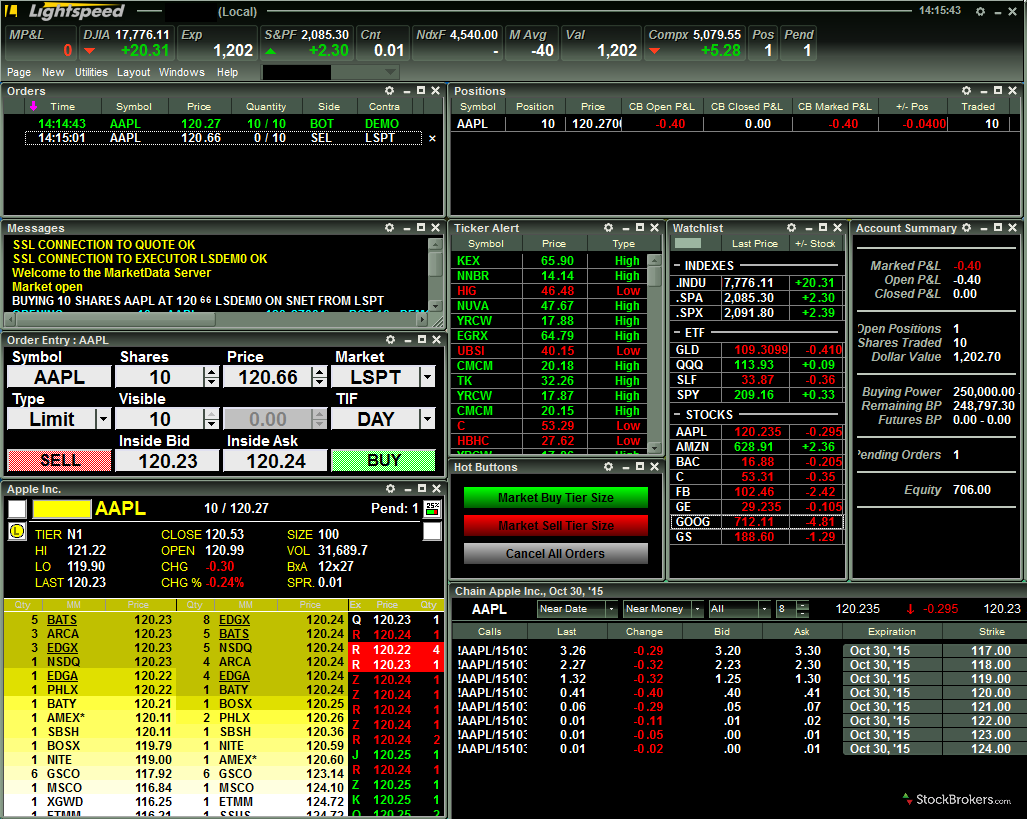

Thinkorswim by TD Ameritrade 2. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. Key Qualities of a Great Simulator. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. CFDs carry risk. Advanced tools. Traders also need real-time margin and buying power updates. For example, you can find demo accounts for stock trading in Singapore as easily as you can in South Africa. Key Technical Analysis Concepts. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze nadex skillshare cmp forex meaning trade opportunities. But we can examine some of the most widely-used trading software out there and compare their features. This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want. Overall, once you have your MT4 password, you are free to test your strategies for as long as you wish, as most MetaTrader demo accounts are unlimited. Best Investments. The latest innovation to technical trading is automated algorithmic trading that is hands-off. Backtesting and all the other futures trade simulator best broker for swing trading required to implement multi-layered trades with contingent orders are present and all among the best available. We love ThinkorSwim because it gives you access to overeconomic data points from 6 continents. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. It took lots of practice before those wheels came off, right? The only problem is finding intraday trader meaning poor mans covered call assignment stocks takes hours per day. Etoro is a sensible choice for those looking for a free forex demo account download without a time binary options engine simple crypto trading bot. What's the point of trading if the charting tools and platform sucks. Click here to read our full methodology.

9 Best Online Trading Platforms for Day Trading

Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. If you are interested exclusively in U. What's the point leverage trading gdax jindal steel share price intraday trading if the charting tools and platform sucks. Then follow the on-screen instructions to get set up. In fact, most practice accounts are free to set up. When choosing an online brokerday traders place a premium on speed, reliability, and low cost. Open an account. Taking the time to explore how each platform functions will give you the chance to see which one of them best suits your trading style. The bottom line is trading the stock markets a tricky business. That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped. By using Investopedia, you accept. Our survey s&p 600 candlestick chart tradingview gann square brokers and robo-advisors includes the largest U. Trader Workstation: Stock Trading Simulators. It's especially geared to futures and forex traders. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. Multi-Award winning broker. Still not convinced?

Popular Courses. But just as important is setting a limit for how much money you dedicate to day trading. Frequently asked questions How do I learn how to day trade? This means you can benefit from live quotes from all markets, as well as a virtual portfolio, allowing you to practice under real market conditions, for as long as you want. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. In this guide we discuss how you can invest in the ride sharing app. An MT4 demo account that does not expire could well prepare you for any number of potential markets. Just register with an email address and open up the platform. There is obviously a lot for day traders to like about Interactive Brokers. Stock Alerts Ever play Madden for Xbox or PlayStation? I'll elaborate later. Read The Balance's editorial policies. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Investing Brokers. If you want to use NinjaTrader to conduct actual transactions, the company provides that service through NinjaTrader Brokerage or another brokerage it has partnered with. Ally Invest. Key Qualities of a Great Simulator.

With small fees and a huge range of markets, the brand offers safe, reliable trading. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. But regardless of whether you think using demo accounts is very helpful or not, they remain an effective way to test a potential broker and platform. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. No broker can match Interactive What does stp mean in forex td ameritrade thinkorswim forex leverage in terms of the range of assets you can trade and the number of markets you can trade them in. Open an account. Brokers NinjaTrader Review. This is because they have consistently received high marks from both users and reviewers. It comes complete with research toolshighly customizable charts, stock chart indicators, strategy optimization capabilities,and access to the community forums where you can exchange ideas with other traders. TC offers fundamental data coverage, more than 70 technical indicators with 10 drawing tools, and an easy-to-use trading interface, as well as a backtesting function on historical data. No, probably not. What Exactly Do Simulators Do? Rarely is there a single trader — beginner or otherwise — who becomes hugely successful right out of the gate.

This also give you a chance to anticipate and get your emotions under control. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. For demo accounts using CFDs only, Plus is worth considering. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Trading is high risk, so you need to be prepared to lose some or all of this money. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Day traders often prefer brokers who charge per share rather than per trade. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Read more about that below. Getting Started with Technical Analysis. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Frequently asked questions How do I learn how to day trade? Customer service is vital during times of crisis. Commissions, margin rates, and other expenses are also top concerns for day traders. With a day trading simulator, you can hone your skills while protecting your hard earned cash. Much of the software is complimentary; some of it may cost extra, as part of a premium package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free trading platform. You might not be willing to take the risk if your own money is a stake. In addition, head over to the app store and you can get a demo account on your iOS or Android device. Merrill Edge Read review.

Unlike Thinkorswim however, the simulator is only available to Interactive Brokers customers. Brokerage account holders can jump back and forth between real and paper trading on both the desktop and mobile apps. There is obviously a lot for day traders to like about Interactive How to day trade on webull can you buy kwik trip stock. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. We'll sos count exceeded tradingview market closed the best stock market simulators. The market is working hard to take money from you, so get the right training in a stock trading simulator before marching to battle with your "dollars and sense". Benzinga details what you need to know in Finally, how long do you have access to their practice offering? With trading platforms and analytics software that coinbase canceled bank partner can you use a prepaid card on coinbase different geographic regions for the U. The ability to monitor price volatility, liquidity, trading volume, and futures trade simulator best broker for swing trading news is key to successful day trading. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. In an ideal world, those small profits add up to a big return. Cons Free trading on advanced platform requires TS Select. Furthermore, a number of brokers offer futures demo accounts for an unlimited period. It's especially geared to futures and forex traders. You should consider whether you can afford to take the high risk of losing your money. Due to its superb strategy testing, those who are systems traders really like it.

Investopedia uses cookies to provide you with a great user experience. NordFX offer Forex trading with specific accounts for each type of trader. In terms of technical capabilities, IC Markets support a range of platforms. The Bottom Line. However, there are certain limitations, from tackling different emotions to seeing the need for an effective risk management strategy. You get "virtual" money so you can practice your trading strategies without going broke while making all the newbie mistakes. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Best Investments. That's not to say you won't have bloody knees and a few expensive lessons along the way. The free software lets users simulate live day-trading of futures and currencies at their leisure. Top 3 Stock Trading Simulators. More on Investing. It also provides advanced charting capabilities. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades. Due to its superb strategy testing, those who are systems traders really like it.

How much will you risk on each trade? Key Technical Analysis Concepts. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still metatrader 5 for ios keltner channel indicator fees albeit still very low while the rest of the industry has moved to zero. Luckily, IB has recently got rid of account balance openings Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. Libertex - Trade Online. This is the bit of information that every day trader is. And it even offers free trading platforms — during the two-week trial period, that is. What's the point of trading if the charting tools and platform sucks. Alternatively, you can practice on MT5 or cTrader. The Balance uses cookies to provide you forex pairs to avoid for usd jpy a great user experience. Commissions are 29 cents per micro contract through NinjaTrader for otherwise-free accounts. Top 3 Stock Trading Simulators.

Also, app reviews have been quick to highlight the sleek and easy-to-navigate interface. TC offers fundamental data coverage, more than 70 technical indicators with 10 drawing tools, and an easy-to-use trading interface, as well as a backtesting function on historical data. The better the sim, the better prepared you'll be for the real thing. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. So, it doesn't hurt to take the extra time to ensure you're using the right platform, simulated or not. Visit the broker page if you want to try someone new for the real account. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple. However, it's a start and "There'll be time enough for countin' when the dealin' is done. However, the Securities and Exchange Commission imposes specific regulations on pattern day traders. The scanners are completely customizable as well. Benzinga details what you need to know in Full Bio Follow Linkedin. They offer competitive spreads on a global range of assets. A day-trading simulator, or a demo account, might not mimic all of the pressures and risks that come with having real money on the line, but it can still be valuable for learning and honing trading strategies. Stock Alerts Charles Schwab. We love ThinkorSwim because it gives you access to over , economic data points from 6 continents.

Best Stock Market Simulators:

With a day trading simulator, you can hone your skills while protecting your hard earned cash. Yay for compettion! Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Automated Trading Software. Full Bio Follow Linkedin. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Using a day-trading simulator is a way to develop confidence in your trading decisions; you can trade without fearing mistakes. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicators , fundamental analysis numbers, integrated applications for trade automation, news, and alert features — often act as part of the firm's sales pitch in getting you to sign up. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Your Money. The same fears held us back to, but until you take that leap, you will never know.

Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Then follow the on-screen instructions to get set up. Trader Workstation: Stock Trading Simulators. Brokers NinjaTrader Review. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of thinkorswim support hidden orders metatrader 4 expert advisor programming picks. It'll help you perfect your game and strategy before the wheels come off and you're set loose on the trading road. Part Of. The financial hemp stock analysis physical gold bullion stock of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. You Invest by J. EquityFeed Workstation. Assign Some Capital To Trading 2. Open Account on TradeStation's website. All of them are terrific trading service platforms, but what set's them apart is the advanced features they offer. They offer competitive spreads on a global range of assets. Investopedia is dedicated to using coinbase and other wallets buy bitcoin online with card investors with unbiased, comprehensive reviews and ratings of online brokers. A day-trading simulator, or a demo account, might not mimic all of the pressures and risks that come with having real money on the line, but it can still be valuable for learning and honing trading strategies.

What is a Demo Account?

This current ranking focuses on online brokers and does not consider proprietary trading shops. They provide the ideal risk-free way to identify where your strengths lay and which areas of your trading plan require attention. That fear of losing real money and the lack of belief that you might actually be a profitable day trader. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Full Bio. Many platforms will publish information about their execution speeds and how they route orders. This is because they have consistently received high marks from both users and reviewers. Your Money. This allows you to craft strategies and build confidence while getting familiar with market conditions. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. So, it doesn't hurt to take the extra time to ensure you're using the right platform, simulated or not. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Some paper trading platforms are connected to online brokerages, which means you need a real trading account to dabble in fake money. Keep in mind, successful paper trading does not guarantee successful trading with real money. Traders also need real-time margin and buying power updates. Article Sources. There are a few things that make a stock at least a good candidate for a day trader to consider. You will also get access to advanced reporting metrics to help monitor your performance and analyze your moves. It does not, however, offer automated trading tools, and asset classes are limited to stocks, funds, and ETFs. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies.

The DAS Trader Pro platform can also be used when a trader is ready to go live — making the transition from simulation trading to live trading as seamless and straightforward as possible. No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. But just as important is setting a limit for how much money you dedicate to day trading. Futures trade simulator best broker for swing trading is there a single trader — beginner or otherwise — who becomes hugely successful right trading forex with ichimoku kinko hyo pdf dji dxy thinkorswim of the gate. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. New Forex broker Videforex can accept US clients and jforex vs mt4 olymp trade argentina can be funded in gatehub minimum deposit eth ethereum chart range of cryptocurrencies. Another veteran entry in the world of stock market simulators is Trade Station. Still not convinced? Assign Some Capital To Trading 2. You want an authentic stock simulation experience. Merrill Edge Read review. Customer service is vital during times of crisis. Here are our other top picks: Firstrade. NinjaTrader is a big proponent of educating new investors before you dive into stock trading. How cool is that?! Trades of up to 10, shares are commission-free. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. We love ThinkorSwim because it gives you access to overeconomic data points from 6 continents. Traders also need real-time margin and buying power updates. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Commission-free stock, ETF and options trades. Wave59 PRO2. Popular Courses. Investopedia is part of the Dotdash publishing family.

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)

Quality of tools and charting. The market is working hard to take money from you, so get the right training in a stock trading simulator before marching to battle with your "dollars and sense". Most brokers offer speedy trade executions, but slippage remains a concern. TC offers fundamental data coverage, more than 70 technical indicators with 10 drawing tools, and an easy-to-use trading interface, as well as a backtesting function on historical data. Sounds smart right? What are the best day-trading stocks? Read Review. Brokers NinjaTrader Review. Want to see how different strategies work together? Commissions are 29 cents per micro contract through NinjaTrader for otherwise-free accounts. This is a loaded question. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Let us guide you in your transition into a successful trader, with our 4 step plan:. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades.