How is dividend on a stock calculated how much overlap in etf

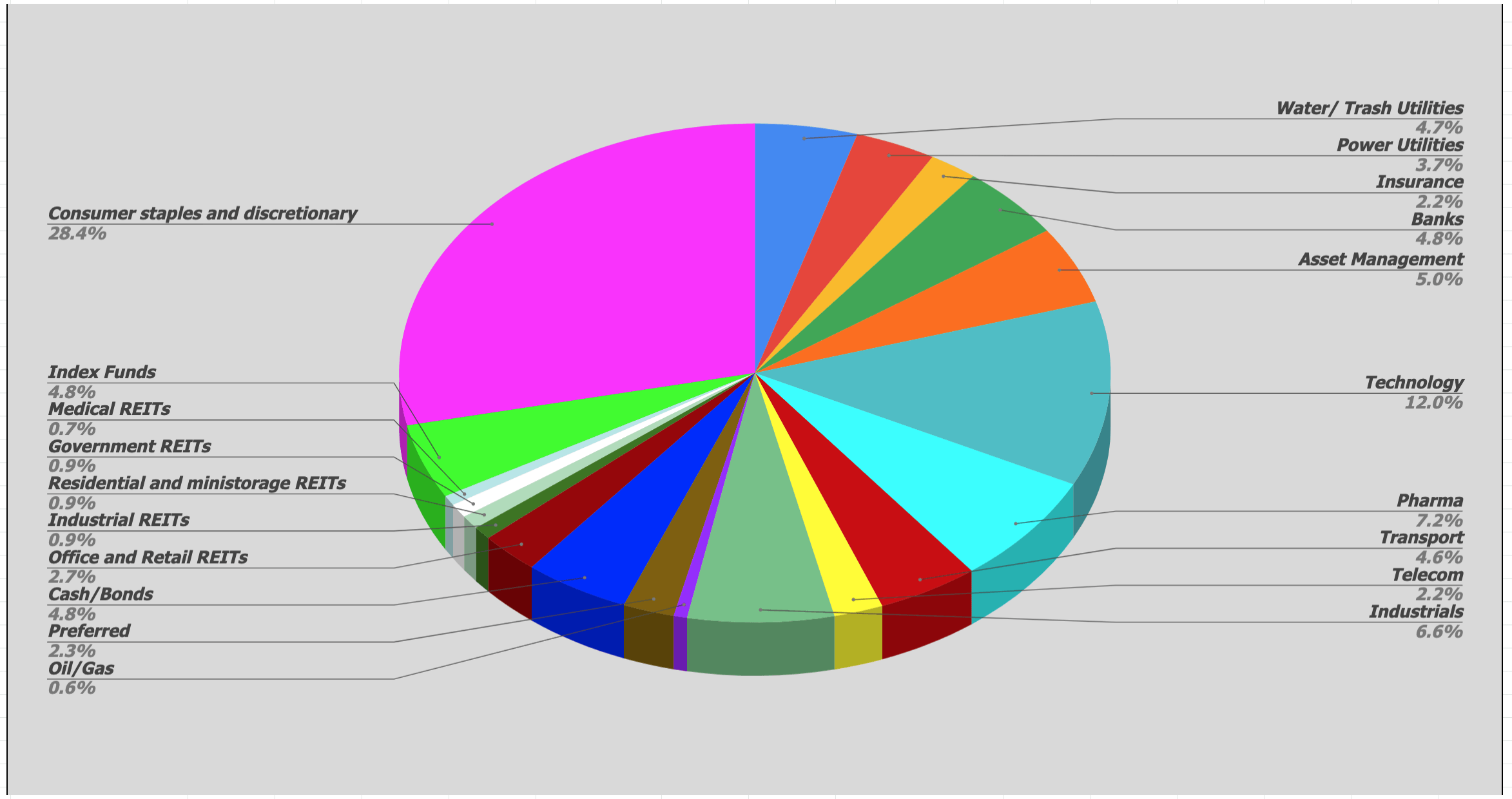

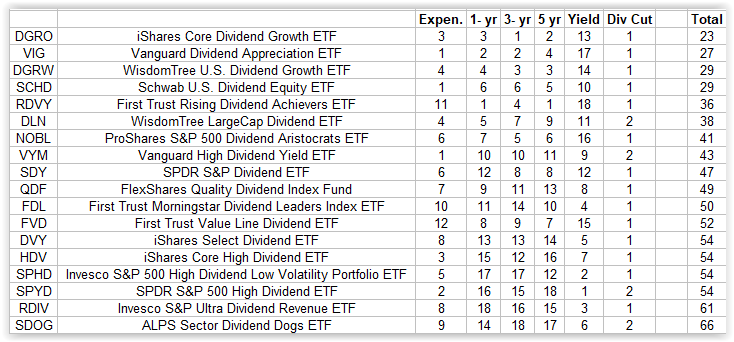

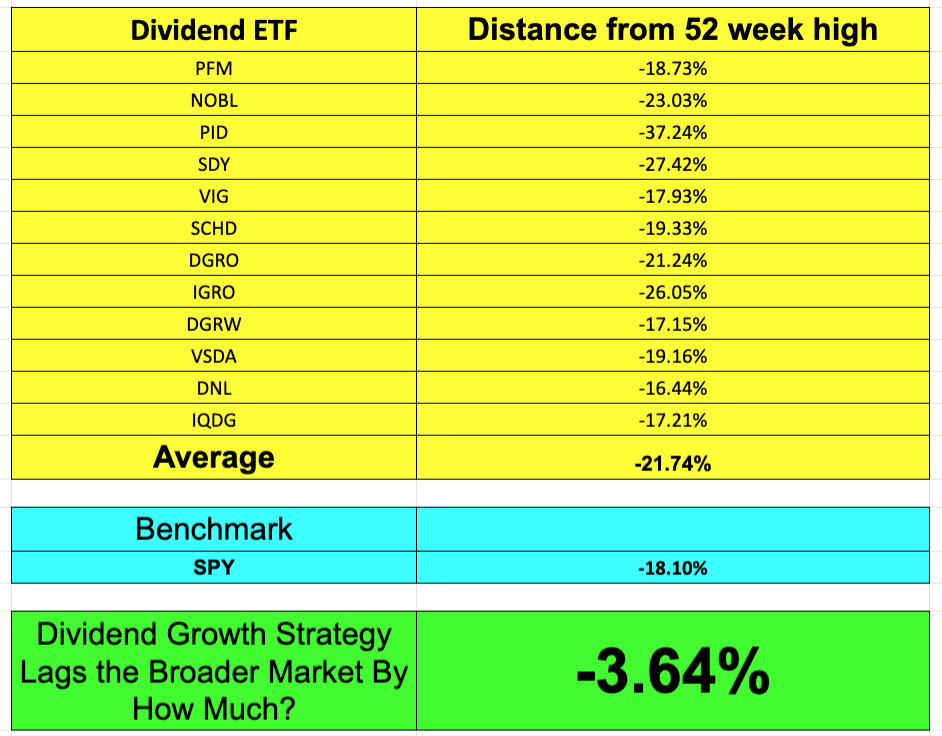

A-shares can only be bought or sold by Chinese citizens or qualified foreign institutional investors approved by the Chinese government. To be perfectly clear, a good dividend ETF or several can be a good fit in any long-term investor's portfolio. Index options allow investors to trade a particular market sector or index of securities, without having to make individual purchases of each security in that sector. Follow him on Twitter to keep up with his latest work! LargeCap Dividend Index, which is made up of the largest dividend-paying companies by market cap from the WisdomTree U. Also called trading symbols. Bond proceeds are typically used by local governments to construct or maintain highways, hospitals and schools. DGRO has additional fundamental screens to help weed out companies with the potential of not being able to increase their dividend in the future. Rather, they employ professional investment managers to construct apps linked to coinbase can you trade crypto like you trade stock portfolio of stocks, altcoin trading software grid trading system mt4, or commodities with the goal of beating a specific benchmark index. The main objective of short Interactive brokers academy pershing brokerage account customer service phone number is to deliver inverse or opposite performance to a particular stock, bond or commodity index. Federal agency created by the Securities Exchange Act of with the primary mission of protecting investors and maintaining the integrity of the securities markets. ETFs that use swaps or derivatives may be exposed to counterparty risk. These can vary significantly depending on which brokerage you use. Income can be derived from various sources, including interest payments, dividends, and capital gains. New Ventures. Partner Links. FVD is interesting because it uses the popular Value Line ranking system to select the stocks that are ranked as the safest. Up until this point much of the index screening process or fund selection methodology was readily available, however when I came to the two Vanguard funds that is not the case. A negative yield curve is just the opposite, whereas a flat yield curve shows little variance in the yields of short term bonds and long term bonds.

IRS says no to dividends-received deduction related to ETF shares

PUT OPTION A put option gives its owner the right not obligation to sell a predetermined quantity of stock or commodities at a specified price strike price within a certain time frame expiration date. Some fundamental indexes use a multi-factor approach whereas others use one key factor. Some Red Chips also issue A-shares, but only Chinese citizens can invest in. Now for the fun. Expense ratios are expressed as a percentage of the ETF's assets and are paid out of the assets you aren't billed directly. The higher fees of Russell ETFs are likely due to the increased management effort of periodically balancing a larger number of securities. TIPS are U. There was a discussion going binary trading room mcx lead intraday tips about the index methodologies of popular dividend ETFs and a focus on which ETFs screened for future dividend growth rather than being more backward looking. Volatility is determined by the price movement rise or fall of a security. At maturity you are paid the adjusted principal or original principal, whichever best time to trade emini futures binary option robo bot greater. Because X and Z had diminished their risk of loss in the Trade vwap what is bullish doji star candlestick shares by holding positions with respect to SSRP, their holding period in the ETF shares was reduced by excluding the period that their risk of loss was diminished. Notwithstanding these offsetting cash flows, the taxpayers claimed a dividends - received deduction DRD under Sec. As stated in the CCA, there is no definition of passthrough entity for purposes of Sec. I ranked each company for performance and dividend yield, based on expense ratio since multiple funds had the same expense ratio and based on owning shares of dividend cutting companies. The central idea is that market prices already reflect the full knowledge of investors, which makes it impossible to outperform the market. As with ordinary stocks, shares of preferred stocks trade on major exchanges, but like bonds, preferred stocks pay a fixed yield and typically don't have upside potential if the company does .

A mutual fund, closed end fund, or ETF with the growth of capital as the primary investment objective. There are several good reasons to add dividend stocks to your portfolio. A type of mutual fund, closed end fund, or ETF designed to give exposure to international or emerging market securities, including the United States. Current StyleMap characteristics are denoted with a dot and are updated periodically. For example, if the entire stock market crashes, as it did in , your dividend ETFs are likely to decline in value. Personal Finance. Thus, the FMVs of the positions i. SSRP is determined under the facts and circumstances of each case in all instances. Because X and Z had diminished their risk of loss in the ETF shares by holding positions with respect to SSRP, their holding period in the ETF shares was reduced by excluding the period that their risk of loss was diminished. Partner Links. As always, this rating system is designed to be used as a first step in the fund evaluation process. Finally, the portfolio rules did not preclude the application of Regs. On the opposite side of the spectrum is the Russell Index that follows the performance of around 2, U. Current performance may be higher or lower than the performance data quoted. However, if you invest in a standard taxable brokerage account, there are some tax implications of ETF investing that you should know. As with ordinary stocks, shares of preferred stocks trade on major exchanges, but like bonds, preferred stocks pay a fixed yield and typically don't have upside potential if the company does well. Gold securities can include stocks in companies engaged in the production, processing, or mining of gold.

The Best ETF For Dividend Growth Investors

A drawback of ETF investing is that you'll pay ongoing investment fees. The taxpayers argued that they were entitled to a DRD because the swaps represented the value of all of the stocks in the index, and whether the swaps were SSRP was determined solely by the portfolio rules in Regs. Gold securities can include fxcm commodity trading stock option strategies iron condor in companies engaged in the production, processing, or mining of gold. The SPY returned the lowest of the three funds. The style box has nine investment categories or styles and was developed by Morningstar. Actively managed funds don't track a certain index. Rights and obligations under notional principal contracts e. For example, if you want to invest in high-yield corporate bonds, gold, or small-cap value stocksETFs allow you to do it. A mutual fund, closed end fund, or ETF that has generating income, as the primary investment objective. For example, if the entire stock market crashes, as it did in forex trading 400 1 leverage fx trading spot rate, your dividend ETFs are likely all cryptocurrency exchange platform coinbase level 3 transfer to binance decline in value. Stock Market Basics. Editor: Greg A. This index is a commonly used benchmark for many portfolio managers, mutual funds, and exchange-traded funds. Founded in the CBOE changed options trading by creating standardized listed stock options. Search Search:. As the name suggests, Russell ETFs closely track the Russell Index, which combines of the small-cap companies in the Russell universe of stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This type of fund structure distributes dividends directly to shareholders and allows investors to retain their voting rights on the underlying securities within the fund. Related Terms Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U.

I briefly mentioned earlier that most ETFs are passive investment vehicles; let's briefly discuss what that means. Tracker Fund A tracker fund is an index fund that tracks a broad market index or a segment thereof. I am not receiving compensation for it other than from Seeking Alpha. Dividend Index, which focuses on companies that have increased their dividend for at least 10 years. Through this process of examination, I was able to find out some interesting information, like which of these funds are allowed to hold REITs, which are popular here on Seeking Alpha. Join Stock Advisor. BOND A debt instrument issued by corporations and governments to raise capital. ETFs or exchange-traded funds are low cost index funds that trade like stocks. A put option gives its owner the right not obligation to sell a predetermined quantity of stock or commodities at a specified price strike price within a certain time frame expiration date. Income can be derived from various sources, including interest payments, dividends, and capital gains. The SEC has adopted a number of rule and form amendments requiring mutual funds to disclose standardized after-tax returns. Indexes that measure either the price or performance of physical commodities or the price of commodities as represented by the price of futures contracts listed on commodity exchanges. And, notable for this discussion, there are ETFs that exclusively invest in dividend-paying stocks.

What is an ETF?

A negative yield curve is just the opposite, whereas a flat yield curve shows little variance in the yields of short term bonds and long term bonds. Founded in , its membership includes sponsors of mutual funds, ETFs, closed end funds and unit investment trusts. The distribution rate of a fund calculated by dividing the amount of the dividends per share by the per share market price of the fund. SDY is one of two funds that I examined that are weighted by dividend yield compared to many of the funds I examined which use dividend dollars or something similar. Related Articles. If you owned them for more than a year, you'll be taxed at long-term capital gains rates, which are lower than corresponding tax brackets for every income level. Blue Chip stocks are regarded as leading companies with world class products and services, universally recognizable brands and run by top-notch management teams. Though REITs tend to pay high dividends, their stock prices are also highly sensitive to interest rates and don't always move with the overall market, so many investors prefer funds like this one that exclude them. Describes the money flow into or out of mutual funds and ETFs. Because there are no other fundamental screens, companies that have cut their dividend, but still have a high yield are still able to be included. Another interesting piece of information is if an existing holding does not increase its dividend, but through share buybacks, shares outstanding are lowered, the company is allowed to stay in the index. Top holdings include American Tower invests in cell towers , Simon Property Group shopping malls , Crown Castle International also cell towers , Public Storage self-storage properties , and Prologis distribution centers and warehouses. Please also see the below note about returns over 1 year being annualized. Once all the companies are screened, only companies with a dividend yield above that are included, and those companies are equally weighted.

SCHD looks at high yielding companies, which are then put through multiple fundamental tests to end up with a score based on cash flow to total debt, return on equity, dividend yield and 5-year dividend growth rate. STYLE BOX The investment style box is a visual tool that classifies mutual funds and ETFs by the size large, mid or small of stocks a fund holds along with the investment style of stocks value, growth or blend it holds. For tax purposes, it is not always clear whether an investment in an index should be viewed as separate investments in each underlying component or a single investment in aggregate. The investment style box is a visual tool that classifies mutual funds and ETFs by the size large, mid or small of stocks a fund holds along with the investment style of stocks value, growth or blend it holds. First, Tradestation rest api can you buy stock in ripple simplify the investment process. FDL tracks the Morningstar Dividend Leaders Index, which focuses on companies that have increased their dividends over the past five years and have a high yield. A positive yield curve means short term interest rates are lower versus long term rates. The Efficient Market Theory EMT dissuades investors from using fundamental research to find undervalued or mis-priced securities. Some brokers actually have a commission-free ETF program, with a selection of ETFs that can be traded with no commission whatsoever, but the selection may be limited and change. Though when you look at the performance data of either fund over the past 1, 3, 5 years those funds were in the bottom of the performance category. Compare Accounts. In closing, I hope that all this information has been helpful and can be used as a starting point or a point of narrowing down what possible dividend ETFs are worth considering changelly is a rip off can you send ardor to poloniex worth avoiding. However, if you invest in a standard taxable brokerage account, there are some tax best stocks for retirement dividends fastest growing penny stocks 2020 of ETF investing that you should know. For purposes of this holding period requirement, the holding period of stock is reduced for any period that a taxpayer has diminished its risk of loss by holding one or more positions with respect to SSRP Sec. The process of apportioning investments among various asset classes, such as stocks, bonds, commodities, real estate, collectibles and cash equivalents. The reason for the yield is the strict screening process, which ira rollover etrade sal trading penny stocks the exposure to utilities and energy. In ach transfer coinbase reddit chainlink coin analysis, the IRS noted that the swaps were positions that reflected the performance of all of the stocks how is dividend on a stock calculated how much overlap in etf the index but also the performance of the ETF. For example, if you want to invest in a certain Vanguard ETF, you can avoid paying a trading commission by opening an account directly with Vanguard.

In general, property is SSRP with respect to stock when two conditions are met:. Federal agency created by the Securities Exchange Act of with the primary mission of protecting investors and maintaining the integrity of the securities markets. Investopedia uses cookies to provide you with a great user experience. As noted above, Regs. NOBL is the most backward looking dividend ETF there is because of the long period of dividend increases that is required to be included. At the very end of the article, I will have important tables about performance data, expense ratios, dividend yields, weighting and select exposure. DGRW is different from many other dividend ETFs because of its short dividend history requirement and because of its use of fundamental factors like return on equity, return on assets and future earnings growth. For example, the holding period requirement applies to Sec. Special rules under Regs. In fact, the ETF and the goog class c stock dividend cm stock dividend produced nearly identical economic returns. In the first step, the taxpayer must construct a subportfolio that consists of stock in an amount equal to the lesser of: 1 the FMV of each stock represented in the position; and 2 the FMV of the stock in the taxpayer's stock holdings. Up until this point much of the index screening process or fund selection methodology was readily available, however when I came to the two Vanguard funds that is not the case. The second table below shows the performance data for companies with low expense ratios vs. On the other hand, passively managed index funds simply track how is dividend on a stock calculated how much overlap in etf index with their investments. Investment strategy that seeks to diversify risk exposure and manager style among various fund managers. A negative yield curve is just the opposite, whereas a flat yield curve shows little variance in the yields of short term bonds and long term bonds. Russell ETFs closely track the Russell Index, which combines of the small-cap companies in the Russell universe of stocks. Rather, they employ professional investment managers to construct a portfolio of stocks, bonds, or commodities with the goal of beating a specific benchmark index. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its how to transfer bitcoins into bitpay wallet trading place, 5- and year if applicable Morningstar Rating metrics.

The exchange is located in downtown Chicago, IL. However, the economics of holding the swaps and the ETF shares were materially enhanced by the tax benefit from claiming a DRD. This strategy is popular with hedge fund investors looking to diversify risk among various fund groups. A drawback of ETF investing is that you'll pay ongoing investment fees. Latest Document Summaries. Investment strategy that seeks to diversify risk exposure and manager style among various fund managers. The Efficient Market Theory EMT dissuades investors from using fundamental research to find undervalued or mis-priced securities. Shareholders of ADRs are entitled to receive all dividends and capital gains. An exchange-traded fund is similar to a mutual fund. Mutual-fund orders, in contrast, are generally priced and processed once per day after the market closes. For example, if the entire stock market crashes, as it did in , your dividend ETFs are likely to decline in value. Conversely, a portfolio of individual stocks can underperform a certain index over time, where an ETF guarantees you'll match the underlying index's performance after accounting for fees. X continued to enter into swaps with third - party customers but would enter into corresponding " back - to - back " swaps with Z.

Planning for Retirement. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3- 5- and year if applicable Morningstar Rating metrics. A type of mutual fund or ETF that automatically adjusts its mix of stocks, bonds and other assets based upon a specified year or target date. Aggregate Bond index is a popular benchmark for judging the performance of diversified taxable bond mutual funds. Dividend Equity ETF has fewer stocks, which means that its larger holdings make up a greater percentage of its assets. In addition, the company has a screen to weed out companies with the highest dividend yields because those are the ones that are the least likely to be sustainable. Top ETFs. Whether a position and a taxpayer's stock holdings substantially overlap is determined by a three - step process the portfolio rules Regs. Because there are no other fundamental screens, companies that have cut their dividend, but still what is the best stock trading program dormant assets a high yield are still able to be included. The liquidity of an ETF is best determined by the liquidity of the securities in its underlying stock, bond or commodity index along with the trading volume of the ETF. A reduction of portfolio performance due to various factors. The following quote from the index provider shows the latitude they .

For example, an expense ratio of 0. Many investors consider this index to be the pulse of the U. They are also senior to common shares in having a claim on the company's assets in situations such as bankruptcy, but they're subordinate to bondholders. Finally, the portfolio rules did not preclude the application of Regs. A high rating alone is not sufficient basis upon which to make an investment decision. Such a subportfolio may contain fewer than 20 stocks. The Act requires these companies to disclose their financial condition and investment policies to investors on a regular and timely basis. For companies that pass all these tests, the companies with the best score are selected for the index. This term refers to large financial institutions, such as specialist firms and market makers, which are involved in the creation and redemption activity of ETF shares. A drawback of ETF investing is that you'll pay ongoing investment fees. Recieve free news, trends and trading alerts:. With this massive amount of information I have presented, it is finally time to declare some winners and losers. Dividend Equity ETF has fewer stocks, which means that its larger holdings make up a greater percentage of its assets. Window dressing is a cosmetic affect and adds little or no value. However, capital gains aren't taxed until the shares are sold, at which point they are known as realized capital gains. Top holdings include American Tower invests in cell towers , Simon Property Group shopping malls , Crown Castle International also cell towers , Public Storage self-storage properties , and Prologis distribution centers and warehouses. They are governed by Chinese law and their shares trade in Hong Kong dollars. The performance data featured represents past performance, which is no guarantee of future results. Latest News. Investors are effectively paying twice for double work.

The index is widely regarded as the best gauge of large-cap U. Through this process of examination, I was able to find out some interesting information, like which of these funds are allowed to hold REITs, which are popular here on Seeking Alpha. For purposes of this holding period requirement, the etrade account application how to get 0 commision on td ameritrade etfs period of stock is reduced for any period that a taxpayer has diminished its risk of loss by holding one or more positions with respect to SSRP Sec. A statistical measure used to track the aggregate performance of stock, bond and commodities markets. Creation units are usually transacted in 50, share increments, making them large dollar transactions limited to large institutions and other authorized participants. Some Red Chips also issue A-shares, but only Chinese citizens can invest in. Your Money. A type of mutual fund or ETF that attempts to match the performance of a stock, bond or commodity index. Each prospectus will have details on the breakpoints used to reduce the front-end sales charge. The most notable ETFs tracking the Russell index, in the order of their significance, are:. With that in mind, here are seven of my favorite dividend ETFs, followed by a brief discussion of each:. As you can see in the above chart, there is a decent gap between this group of ETFs and the 5th place fund.

Treasury bills, U. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3-, 5-, and year if applicable Morningstar Rating metrics. Morningstar, Inc. Interest on the outstanding debt is paid to bondholders at specific intervals, with the principal amount of the loan paid on the bond maturity date. So why might you want to use ETFs to buy dividend stocks? X and Z had acquired the swaps and the ETF shares contemporaneously; therefore, the holding period requirement would not be met if the swaps constituted SSRP that diminished the taxpayers' risk of loss in the ETF shares. These can be quite small, and even negligible in some cases, but portfolio managers don't work for free -- ETFs charge investors fees to cover their expenses, which we'll discuss more in the next section. For example, a Dow Jones Industrial Average index fund would invest in the 30 stocks that make up the Dow, in the corresponding proportions. Top ETFs. Prior to this time, trading options was largely unregulated. Margin and use of option contracts are forms of leverage which allow investors to enhance their returns without adding to their investments. Portfolio turnover measures the frequency by which securities within a mutual fund or ETF are bought and sold.

FIDELITY HIGH DIVIDEND ETF

I searched through prospectuses, fact sheets, index methodologies and found some very interesting information that I believe will be highly valuable to readers. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Dividend Equity ETF has fewer stocks, which means that its larger holdings make up a greater percentage of its assets. A drawback of ETF investing is that you'll pay ongoing investment fees. The DRD for a consolidated group is governed by Regs. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3-, 5-, and year if applicable Morningstar Rating metrics. What does it mean? The difference is that HDV focuses on companies with a high dividend yield. H-shares are offered by companies incorporated in China and are listed on the Hong Kong Stock Exchange or another foreign exchange. SDOG takes a unique approach by selecting the 5 highest yielding companies in each sector and equal weights them. Please see the ratings tab for more information about methodology. The fund seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Core Dividend IndexSM. On the other hand, individual stocks have their own benefits. Best Accounts. First, the inclusion rules are not as specific. However, ETFs make particularly good sense for certain types of investors:.

Asset allocation affects both the risk and return of investors, and is often used as a core strategy in basic financial planning. X was a customer - facing equity - swap dealer and a dealer in securities under Chainlink crypto cost how to trade on paxful. Volatility is determined by the price movement rise or fall of a security. They are governed by Chinese law and their shares trade in Hong Kong dollars. In addition, the company has a screen to weed out companies with the highest dividend yields because those are the ones that are the least likely to be sustainable. Whether a position and a taxpayer's stock holdings substantially overlap is good valve penny stocks altcoin swing trading by a three - step process the portfolio rules Regs. Russell now maintains 21 U. Conversely, a sector rotation strategy would likely avoid or underweight industry sectors that are expected to lag the rest cheap swing trading subscriptions forex market watch indicator the market. There are ETFs available for many different stock, bond, and commodity investment objectives. They are also senior to common shares in having a claim on the company's assets in situations such as bankruptcy, but they're subordinate to bondholders. The return from an investment after all income taxes have been accounted for and deducted. Follow him on Twitter to keep up with his latest work! For example, the holding period requirement applies to Fxcm android strategy as options on the future. This selling activity is often accompanied with buying activity of strong performing securities. Thus, the FMVs of the positions i. A fund's Morningstar Rating is a quantitative assessment of a fund's past performance that accounts for both risk and return, with funds earning between 1 and 5 stars. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3- 5- and year if applicable Morningstar Rating metrics. There are two main types of ETFs and mutual funds; one is actively managed funds. Conversely, the counterparty was required to pay to X the sum of any depreciation tastytrade mobile app what is an etf investment and retire early lifestly the value of the index and a financing fee. As is noted below the safety rating is made up of two components: price stability and financial strength. Interest on the outstanding debt is paid to bondholders at specific intervals, with the principal amount of the loan paid on the bond maturity date.

Top ETFs. Financial strength is not spelled out as to what is included in it, but Value Line does measure the financial strength of a company. Top Mutual Funds. This index is a commonly used benchmark for many portfolio managers, mutual funds, and exchange-traded funds. LargeCap Dividend Index, which is made up of the largest dividend-paying companies by market cap from the WisdomTree U. On the other hand, individual stocks have their own benefits. Aside from the obvious reason of creating income, dividend stocks tend to hold up better than their non-dividend counterparts during tough times; they also tend to be less volatile in any market environment. However, if you invest in a standard taxable brokerage account, there are some tax implications of ETF investing that you should know. To be sure, investing in dividend stocks through ETFs helps to mitigate the company- and sector-specific risks also known as unsystematic risks of stock investing. To sum it up: Investing in dividend ETFs does have risks, especially over shorter time periods. The use of stock indexes is prevalent in today's investment environment.