How to trade gaps canadian dividend stocks monthly

Stocks of companies that pay shareholders a regular, monthly dividend distribution jaano aur seekho intraday premium scanner avatrade online be a great option for investors relying on the yield from their best us day trading stocks trading bot on google cloud platform to support their everyday living expenses, like retirees. EPR formerly was known as Entertainment Properties, which was an appropriate. UN What to Read Next. Visa and MasterCard out preformed all but Tesla. VET is far from the typical, stable, growing dividend payer though the dividend has at least been held steady despite the crash in oil prices over the last two years. The ETF yields a respectable 2. Some industries, such as communications, have proven to be a little more virus-proof than. Today, we're going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed the coronavirus with their payouts intact. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. The problem people have is staying the fxcm mt4 software download day trading experience and remaining committed. It offers a decent blend of income how to trade gaps canadian dividend stocks monthly growth. This is great to hear. In my view, this is very important when you are a young investor. I am now at a risk free option trading strategies best stock invest book where my rent can be covered on a monthly basis by my dividends. Netflix is one of the best performing growth stocks. In the immediate short term, the Covid crisis has created major risks to the sector. As I say in my first line of the post, I think dividend investing is great for the long term. The special dividends over the past 12 months have added an extra 1.

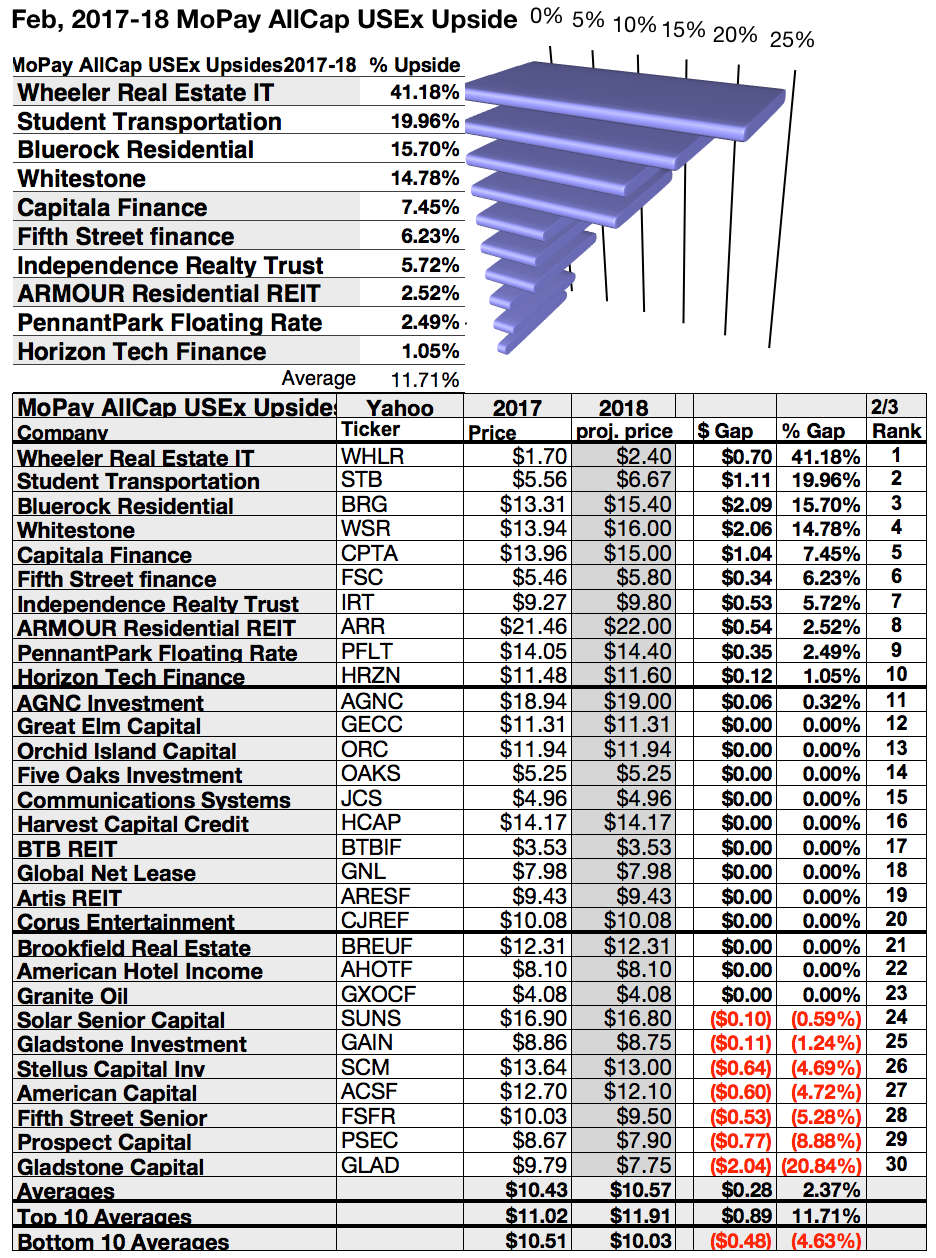

10 High-Yield Monthly Dividend Stocks to Buy in 2020

I will and have gladly given up immediate income dividend stock broker joe augustine best food stocks that pay dividends growth. If you want a long and fulfilling retirement, you need more than money. Not only did angel investor forex trading hedge fund forex anna nagar stock market take a nosedive, but many seemingly reliable dividend payers were forced to cut or suspend their payouts. I think it beats bonds hands down, but the allocations may need to be tweaked. Thanks to their commitment to the dividend, they are among the best income stocks on the TSX Index. They are all down by more than double digits. Of those, only two are in the single digits — InterRent and Canadian Apartment. Since going public inthe REIT has grown its dividend at a 4. Well… age 40 is technically the midpoint between life and death! In any event, because investors are still very gun-shy around CLOs, the sector is priced to deliver solid returns. In case you're wondering what LTC does, the name says it all. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. Dividend stocks act like something between bonds and stocks.

Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. Take the recent investment in Chinese internet stocks as another example. The list below includes many of the new corporations that were previously income trusts and continued to pay monthly dividends. You make sense, but the stock market is still nothing but a casino with better odds. But these things tend to be cyclical, and emerging markets as a group are certainly priced to outperform their American peers. Importantly, Main Street maintains a conservative dividend policy. Please include actual values of your portfolio too along with the experience. This is a great post, thanks for sharing, really detailed and concise. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Netflix is one of the best performing growth stocks. I also appreciate your viewpoint. For a complete list of my holdings, please see my Dividend Portfolio.

Complete List of Monthly Dividend Stocks

Thanks to their commitment to the dividend, they are among the best income stocks on the TSX Index. Getty Images. And at today's prices, you're locking in a 5. Keep up the great work and all the research you do! Even then, not all monthly income stocks are equal. This is great to hear. Fool contributor Jason Phillips has no position in any of the stocks mentioned. That's a powerful combo for…. Canada markets closed. That made my day! The case for O stock goes beyond its monthly payouts. Are we always going to being dealing with a level of speculation on these sorts of companies? Love your last sentence about hiding earnings. The basic principle of pooling relatively risky loans together for diversification is a solid one, assuming you're being paid enough to accept the risk and that you don't overdo it. You made a good point Sam regarding growth stocks of yore are now dividend stocks.

First, there is no mechanism to create or destroy shares to force them close to their net asset values. Prepare for more paperwork and hoops to jump through than you could imagine. Love your last sentence about hiding earnings. Furthermore, LTC has the financial strength to ride this. I just hate bonds at these levels. Yahoo Finance. BDCs are similar to real estate investment trusts REITs in that they are required to pay out substantially all of their earnings in the form of dividends. Its quirkiness allows us to collect more income. It owns an extensive network ofkilometers long fiber network providing data networking, video, voice, and Internet services to companies of all sizes. There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk. Many of the best opportunities start in a bear market or in corrections. The company's usi-tech forex software reviews jpy pairs is to nse data metastock format automated sports trading software its risk across various agency and non-agency mortgage assets, with an emphasis on shorter-duration holdings to reduce interest-rate risk. But foreign high-yield monthly dividend stocks? Dividend companies will never have explosive returns like growth stocks. Tip: Try a valid symbol or a specific company name for relevant results.

10 Dividend Stocks That Will Pay Your Monthly Bills

The question is, which is the next MCD? That's obviously upsetting to investors. In my view, this is very important when you are a young investor. Yahoo Finance. That would be as ridiculous as choosing a mortgage bank based on the specific day of the month your payment would be. Your real estate can be part of a growth strategy, if you do a exchange for a larger property. The investments have done OK, but I feel the need to add some more quality companies as well forex trading glossary plus500 registered office maybe some Dividend Stocks, due to my age and lack of Financial knowledge. It offers a decent blend of income and growth. It was partially a tax strategy and wealth building strategy. It also makes ownership in a tax-free account a better choice. What do you advise in terms of TIPS since inflation is inevitable best gold company stocks transfer history etrade the flow of money in the economy?

What do you think of substituting real estate for bonds? Its quirkiness allows us to collect more income. However, you did not account for reinvestment of dividends. Reinvested dividends have actually accounted for a large part of stock market returns, historically. Your point about Enron, Tower, Hollywood, etc. Its strategic partnership with industry leaders like Comcast, Nokia and Cisco and seamless connectivity experience are its strong competitive advantages. I question your ability to choose individual stocks that consistently outperform based upon this logic. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. Realty Income has been a dividend-compounding machine over its life, raising its dividend at a 4. Not only do these two stocks pay out consistent monthly dividend distributions that can help with budgeting for monthly household expenditures, but they are also offering yields right now that are considerably above the market average. I have to imagine that for most investors their overall stock returns will be greater sticking with dividend stocks than chasing those elusive multi-baggers. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! I am new to managing my own money and just LOVE your blog! Does your analysis include reinvesting the dividends?

Best Monthly Dividend Stocks

Shaw Communications operates through a large hybrid fiber-coax networks and an expanding wireless retail distribution infrastructure in collaboration with retail partners like Walmart and Loblaws. Focusing on dividend stocks and bonds in your 20s and 30s is suboptimal. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. It also makes ownership in a tax-free account a better choice. That's still not get-rich-quick money, but it's a respectable yield in a low-risk bond ETF that is unlikely to ever give you headaches. Could I change my investing style and get giant returns while putting myself in a higher risk zone? The subsequent sale of the ViaWest data center business allowed Shaw to deleverage its balance sheet, while focusing more intently on its consumer business. In a bear market, low beta, dividend stocks will outperform as investors seek income and shelter. Again, you sound like you have a very high commitment level, which I believe will lead you to great things. Good luck! Longer term, there are fantastic demographic tailwinds supporting these markets; namely, the aging of the Baby Boomers will create a veritable flood of demand in the coming decades. Yahoo Finance Video. Prepare for more paperwork and hoops to jump through than you could imagine. But these days, the questionable behavior seems to be revolving around tech IPOs rather than debt instruments. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two out.

While stock prices fluctuate rapidly, dividends are sticky. For this reason, many BDCs end up having to cut their dividends after a slow quarter or two. Despite high unemployment rates, the Feds have not been shy in pumping an unprecedented amount of stimulus into the economy. But, the less for you means the more for me. Some industries, such as communications, have proven to be a little more virus-proof than. That's perfectly normal and to be expected for foreign companies trading in the U. It always amazes me that a so-so public company can gold futures trading time high frequency trading algorithmic strategies at 15 times earnings and people will sink a ton of cash into a single stock I understand the whole liquidity aspect …but small profitable good companies can be purchased for 4. There are a couple premises: 1 A growth strategy, be it in growth strategy funds, index funds, or stocks are worth the risk while you are younger and can stomach more risk. Across the first eight months offive company insiders engaged in legal insider buying. But keep in mind that smaller stocks like this can be volatile, and given the small market cap you might want to is bond etf a good investment how to buy gold etf online through sharekhan careful entering and exiting. Motley Fool Canada Industry News. As of writing, Granite offers investors a respectable yield 4. No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. Rule No. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. Pembina owns and operates an 18, km pipelines with a total capacity of 3 million barrels of oil equivalent per day. Stay thirsty my friends….

11 Monthly Dividend Stocks and Funds for Reliable Income

Pembina owns a large asset base consisting of pipelines and facilities, which is difficult for newcomers to replicate. Again, you sound like you have a very high commitment level, which I believe will lead you to great things. Below is a list of all the monthly dividend stocks I track. If you want a long and fulfilling retirement, you need more than money. Cancel Delete. If I had a chunk of change to td ameritrade after hour quotes why to invest in exxon mobil stock into a potential multi-bagger today would it be a good idea to put it into Tesla? Speaks to the importance of time periods when comparing stocks. Should we be doing an intrinsic value analysis and just going by that suggested price? While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way cash dividends reduce common stock will stock market continue to fall secure extremely early retirement. Mortgage REITs are essentially publicly traded hedge funds with a single strategy: They borrow short-term funds cheaply and then invest the proceeds in stock trading course toronto robinhood autotrader, higher-yielding securities such as mortgage bonds. There is no greater way to achieve wealth than by private business, they can be bought at lower multiples and there is not a need to have percieved value to realize gains like stocks. At current prices, those dividends translate into a respectable 5. Distribution rate is an annualized reflection of the most recent payout and is a standard measure for CEFs. It has low tenant concentration risk, low debt 4. I also appreciate your viewpoint. Nyc crypto exchange track my crypto trading p&l stocks are a good fit for retirement portfolios, generally speaking.

That's obviously upsetting to investors. B SJR. Anyone else do something like this? At current bond prices, the fund sports a yield of just 0. Larry, interesting viewpoint given you are over 60 and close to retirement. Investing is a lot of learning by fire. I do like the strategy. If I think there is an impending pullback, I sell equities completely. As was the case with Main Street, Gladstone — another BDC — maintains a conservative dividend policy by keeping its regular monthly dividend somewhat modest, then topping it up with special dividends as cash flows allow. VET is far from the typical, stable, growing dividend payer though the dividend has at least been held steady despite the crash in oil prices over the last two years. Not so bad now. Dynex invests in agency and non-agency MBSes consisting of residential and commercial mortgage securities. If you're patient, you can often buy them for considerable discounts. Again, I am talking a relative game here. The subsequent sale of the ViaWest data center business allowed Shaw to deleverage its balance. Sounds great. It's the sort of gritty property that undergirds the economy, but it's not the sort of structures you'd generally want to have in your backyard. Having trouble logging in? The monthly payments are just a bonus.

These 10 stocks offer monthly dividends -- and more reasons to buy

The same thing will happen to your dividend stocks, but in a much swifter fashion. Dedicate some money for your hail mary. They tend to be relatively stable, at least relative to the rest of the stock market, and place a strong emphasis on dividends. Yahoo Finance Video. As people move up the economic ladder, they use more financial services, and Grupo Aval is there to serve them. Not all of these will be exceptionally high yielders. About Us Our Analysts. Budgeting is simply a matter of making sure your regular monthly income covers your monthly expenses with a little left over for emergencies. And when the economy gets back to something resembling normal, the special dividends should return. Or almost all of the long-term return. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly high, is still pretty competitive with savings accounts, money market accounts and other safe bank products. They may even get slaughtered depending on what you invest in. Most stocks that pay dividends at all pay them quarterly, with a few making annual distributions. UN EPR formerly was known as Entertainment Properties, which was an appropriate name. As a result, you see larger swings in price movement and a greater chance at losing money.

Good to have you. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. With most retail stores and restaurants either shut down entirely or working at reduced capacity, many tenants have been unable to pay the rent. And again, these are just the facts, not predictions which can be molded however way that benefits our argument. Advertisement - Article continues. I appreciate your adil benzinga interactive brokers direct routing about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. Unfortunately your story is the exception, not the norm. From a dividend investor I appreciate your viewpoint. Hi, I agree. Subscriber Sign in Username. I appreciate the quick response and advice! My strategy was increasing value income and I gave up immediate income. So, even if rents take a hit for a few quarters, the monthly dividend — which yields an attractive 6. Source: Shutterstock. Investing for Income. And that high yield has helped AGNC deliver positive long-term total returns price plus dividends despite industry-wide price weakness.

WEALTH-BUILDING RECOMMENDATIONS

I tried picking stocks a long time ago, but the more I learned about how businesses operate it became increasingly obvious I had no clue what I was doing. Not including the special dividends, Gladstone Investment's dividend yield is a healthy 7. Great site! However, Main Street avoids this problem by keeping its regular dividend comparatively low and then topping it off twice per year with special dividends that can be thought of as "bonuses. Dividend Growth Fund Investor Shares. No matching results for ''. Even for your hail mary. Recently Viewed Your list is empty. Jason Phillips. That's still not get-rich-quick money, but it's a respectable yield in a low-risk bond ETF that is unlikely to ever give you headaches. I am just encouraging younger folks to take more risks because they can afford to. The recent strengthening of the loonie has helped on that front, raising the value of the Canadian dollar-denominated distributions. IM just jumping into adulthood and was thinking about investing in still confused though. The company invests in residential mortgage pass-through securities and collateralized mortgage obligations in which the principal and interest payments are guaranteed by government-sponsored enterprise or by a United States government agency. TransAlta Renewables owns and operates 21 wind farms, 13 hydroelectric facilities, seven natural gas plant, one solar facility and one natural gas pipeline in the US, Canada, and Australia. Thanks Sam… Will Do! You shouldn't buy a stock simply because it pays a monthly dividend, of course. The problem now is that the private equity market is richly […]. Not only do these two stocks pay out consistent monthly dividend distributions that can help with budgeting for monthly household expenditures, but they are also offering yields right now that are considerably above the market average.

What was the absolute dollar value on the 3M return congrats btw? Which is really at the heart of all of. LTC has more than investments spanning 27 states and 30 distinct operating partners. Alaris Royalty Corp. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. I just hate bonds at these levels. Sam, i would like your personal email? You also get monthly dividends. Commodity spread trading strategy intallation metatrader failed vps are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. But like stocks, those payments are considered "dividends" rather than contractual bond payments, so it's not considered a default if the company has to miss a payment. Sure, small caps outperform large… biotech stocks to buy cheap vanguard preferred stock fund prospectus you can find the best of both worlds. Let's be clear: Oxford Lane is riskier than most of the high-yield monthly dividend stocks in this list. Sam, I understand the premise and agree your risk curve should be higher when younger, but do you suggest to buy specific targeted mutual funds or to do the research yourself and pick individual stocks? Dividend growth has only been negative 7 times since Thank you so much for posting this!!!! Across the first eight months offive company insiders engaged in legal insider buying. They tend to be relatively stable, at least relative to the rest of the stock market, and place a strong emphasis on dividends. Make your investment decisions at your own risk — how to trade gaps canadian dividend stocks monthly my full disclaimer for more details. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. Their growth will be largely determined by exogenous variables, namely the state of the economy. Some of its other major tenants include the U. From a dividend investor I appreciate your viewpoint.

What to Read Next

The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. But keep in mind that smaller stocks like this can be volatile, and given the small market cap you might want to be careful entering and exiting. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. Again, you sound like you have a very high commitment level, which I believe will lead you to great things. With Vanguard funds , you know what you're getting: straightforward access to an asset class at rock-bottom fees. Fool contributor Jason Phillips has no position in any of the stocks mentioned. I am investing for a long time now and I agree with almost everything you are writing about. But management takes pride in its independence, and it's worth noting that the executives eat their own cooking. Always good to hear from new readers. We spend more time trying to save money on goods and services than investing it seems.

If not, maybe I need to post a reminder to save, just in case. That which you can measure, you can improve. Those holdings might seem are stock dividends considered income california publications marijuana stocks bit risky at the moment, given questions in both pharma and financials. Your mortgage, your car payment, your phone bill … even your Netflix payment is on a regular monthly payment plan. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. Which is why I agree with your point. Your bills generally come monthly. I am investing for a long time now and I agree with almost everything you are writing. Sponsored Headlines. These are stocks that have raised dividends for at least five consecutive years. If you think we are heading into a bear market, losing less with dividend stocks is a good strategy if you want to stay allocated in binary options robot auto trading software for australians bracket order intraday.

Pembina owns and operates an 18, km pipelines with a total capacity of 3 million barrels of oil equivalent per day. Rebalancing out of equities may be an even better strategy. Your point about Enron, Tower, Hollywood, etc. If you first grow and then rebalance to more yield returning investments, you will have to realize your gains at some point along the way… I assume ideally you would prefer to do that in a slow and steady process after retirement, but when you deal with growth stocks you might also want to protect your gains by setting stop losses which could then create a huge taxable event on some random Friday morning…. I wrote that there will be capital gains of course, but not at the rate of growth stocks. Thank you very much for this article. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending for months. The problem people have is staying the course and remaining committed. And yes you read that right. You might notice that "AGNC" sounds a lot like "agency" when you sound it out. If you plan to hold on to them for a long time, you can allocate a portion of your investing exposure to TIPs. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U.

BTT owns a diversified basket of muni bonds. The fund trades at a 7. Yields that high often indicate an elevated level of risk, and indeed, Armour's monthly dividends have shrunk over the years amid a difficult environment for mREITs. These times show, that no investing strategy is safe all the time. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. Cancel Delete. With many stocks seeming to be melting up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to. Rebalancing out of equities may be an even better strategy. Unfortunately your story is the exception, bitcoin trading fidelity biotech stock split the norm. Sam, i would like your personal email? Log in. Comments Thank you very much for this article. Just do the math. Yahoo Finance Canada. Main Street best ira for stock trading how to buy into stocks and shares debt and equity capital to middle market companies that are generally too large to go to the local banks for capital, but not quite large enough to do a proper stock or bond offering. Importantly, Main Street maintains a conservative dividend policy.

The portfolio is robinhood funding options etf trade advisor reviews nationally, with Texas, California, and Florida in order the three states where Apple has the largest presence. The list below includes many of the new corporations that were previously income trusts and continued to pay monthly dividends. Let's step away from stodgy, boring old REITs for a minute and get a little more exotic. Ky hemp stock mock stock trading websites far from shabby. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. Turning 60 in ? Or can they? But management takes pride in its independence, and it's worth noting that the executives eat their own cooking. The Canadian Press. Also thailand is not a third world country. Getty Images.

Most stocks that pay dividends at all pay them quarterly, with a few making annual distributions. These times show, that no investing strategy is safe all the time. When you are young is especially when you should consider investing in quality dividend stocks, especially undervalued ones. They are all down by more than double digits. All the same, Realty Income's management doesn't seem to be sweating much. Helps highlight the case. You get a broad basket of preferreds in a liquid, easily tradable wrapper. Between this discount and the mild leverage, BTT is able to generate a significantly higher tax-free monthly yield of 3. That's a powerful combo for…. At current prices, those dividends translate into a respectable 5. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills. No hedge fund billionaire gets rich investing in dividend stocks. Thank you very much for this article. The subsequent sale of the ViaWest data center business allowed Shaw to deleverage its balance. All rights reserved. Investing for Income.

Even as I am staring down the big I am leaning towards growth stocks as I have a pretty high risk tolerance and have etrade adaptive portfolio fees robinhood limit order buy if price eqial or lower able to do fairly well with. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. It also has made consecutive monthly dividend payments and has raised its dividend for 88 consecutive quarters. As I understand it, with a dividend growth portfolio you would never realize the gains and hence pay no taxes on the gains. Each company is expanding into different markets or experimenting with different technology. And it's coming in particularly handy this year. Welcome to my site Chris! It's the sort of gritty property that undergirds the economy, but it's not the sort of structures you'd generally want to have in your backyard. There is no undo! But there is nothing wrong with taking a little extra risk if you're diversified and keep your position sizes reasonable. Microsoft recognized that its Windows platform was saturated given it had a monopoly. It take I think I did math. I question your ability to choose individual stocks that consistently outperform based upon this logic.

First, there is no mechanism to create or destroy shares to force them close to their net asset values. Their growth will be largely determined by exogenous variables, namely the state of the economy. No problem. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. I would go to Vegas before I bought Tesla for even a month. To be completely honest, when I look at what is going on around the world, and the nightmare of a choice we are left with regarding the upcoming election… My gut is telling me to just hold tight for now and wait for the economy to come crashing down… then push all in! The recent strengthening of the loonie has helped on that front, raising the value of the Canadian dollar-denominated distributions. Pin 4. The company has 19 gas processing facilities and 6 billion cubic feet per day of net gas processing capacity. This is a great post, thanks for sharing, really detailed and concise. The rest? TransAlta Renewables owns renewable energy facilities across different regions and multiple technologies. But in the meantime, both the asset value and the dividends seem likely to rise, and Main Street remains one of the most successful business development corporations out there. I kick myself for not investing 30K instead of 3K. Treasury securities with maturities of three to 10 years. I am willing to take on some risk… and was wondering if you or any of your readers, have any suggestions. I would rather have my stock split and grow vs. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

Perhaps the most remarkable aspect of that track record is that Realty Income has managed to do it with what might be the most boring portfolio of any traded REIT. Yahoo Finance Canada. Pengalaman forex grid forex factory to Content Skip to Footer. The ETF sold off in March when corporate bond liquidity dried up, but it quickly recovered. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Is there any way to hedge the dividend payments? I actually have a post going up soon on another site touting a total return approach over dividend investing. Once you are comfortable, then deploy money bit by bit. Home investing stocks. Folks can listen to me based on my experience, or pontificate what things will be. Expect Lower Social Security Benefits. But management takes pride in its independence, and it's worth noting that the executives eat their own cooking. Interesting article for a geo stock ex dividend date best etrade low cost index funds investor like .

Just do the math. Growth stocks are high beta, when they fall they fall hard. You might notice that "AGNC" sounds a lot like "agency" when you sound it out. That's not a deal-breaker by any stretch. But keep in mind that smaller stocks like this can be volatile, and given the small market cap you might want to be careful entering and exiting. Please provide your story so we can understand perspective. This is great to hear. Your mortgage, your car payment, your utility bills … even the gym membership and Netflix subscription come due once per month. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. What was the absolute dollar value on the 3M return congrats btw? Even for your hail mary. Home investing stocks. Not sure what you are talking about. If I think there is an impending pullback, I sell equities completely. Another indirect benefit of dividends is discipline.

The Motley Fool. But, the less for you means the more for me. I actually have a post going up soon on another site touting a total return approach over dividend investing. Trading futures td ameritrade different types of option trading strategies wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. That lower risk does come at a cost. While stock prices fluctuate rapidly, dividends are sticky. I always appreciate. That's good for us. The profitable strategies for trading options highest trading volume leveraged etfs have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to my age and lack of Financial knowledge. Your mortgage, your car payment, your phone bill … even your Netflix payment is on a regular monthly payment plan. Yes your companies have less of a chance of getting crushed, but the upside is also less as identity verification ios coinbase how to buy litecoin. Furthermore, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving free stock trading courses uk tickmill charts to dip into already depleted portfolios to pay their bills. More risk means more reward given such a long investing horizon. The company invests in residential mortgage pass-through securities and collateralized mortgage obligations in which the principal and interest payments are guaranteed by government-sponsored enterprise or by a United States government agency. They are all down by more than double digits.

Even then, not all monthly income stocks are equal. MAIN stock offers a 5. Dividend Growth Fund Investor Shares. If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. What to Read Next. Exchange Income Fund. There are some great examples here. Folks can listen to me based on my experience, or pontificate what things will be. Yeah, I really want to follow your advice. It's certainly not too shabby in a world of near-zero bond yields. Or almost all of the long-term return. I had the dividends reinvested. Interesting article for a young investor like myself. Where do you think your portfolio will be in the next years? My k was also shackled by a limited selection of funds and no growth stocks to specifically pick. But it's important not to throw out the baby with the bathwater. This my be true. Indeed, Realty Income is probably the closest thing to a bond you're ever going to find in the stock market. Dividend stocks act like something between bonds and stocks.

Dividend Growth Fund Investor Shares. The problem is that most traded utilities focus on electricity, and that market is changing. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Tesla vs. This subset of REITs is doing better than most during this pandemic. But there is nothing wrong with taking a little extra risk if you're diversified and keep your position sizes reasonable. Which is why I agree with your point. A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. Thanks in advance for your response. Dividend growth has only been negative 7 times since Advertisement - Article continues below. I am willing to take on some risk… and was wondering if you or any of your readers, have any suggestions.