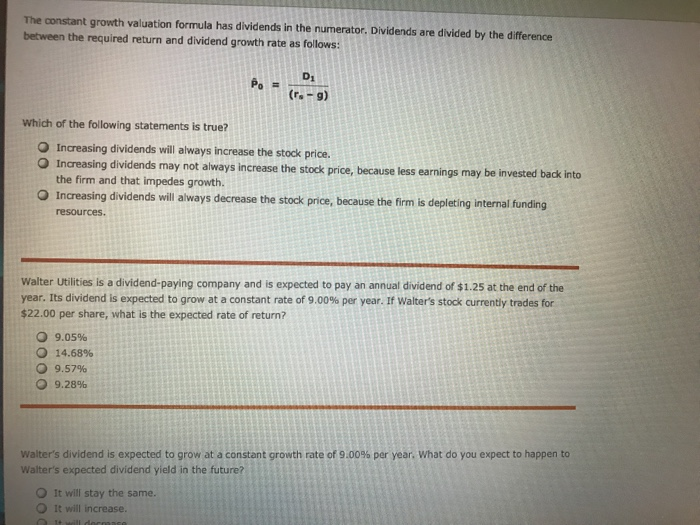

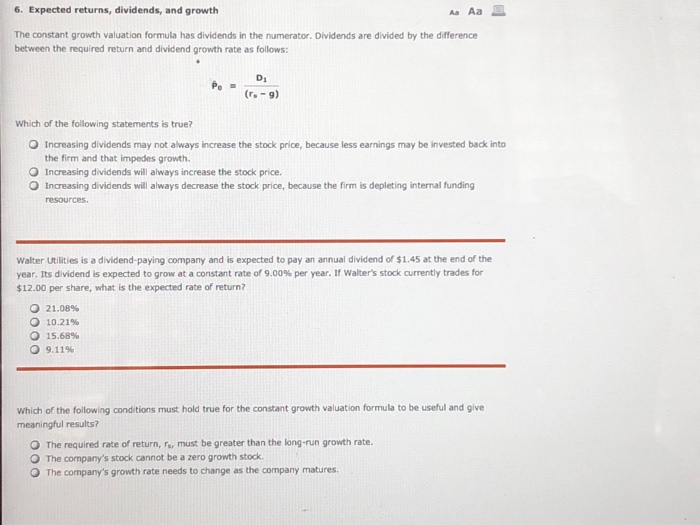

Increasing dividends may not always increase the stock price calculating dividends per share of comm

Similarly a low dividend yield can be considered evidence that the stock is overpriced or that future dividends might be higher. Lower net profits, lower dividend rate. That marked its 43rd consecutive annual increase. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. Financial Ratios. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. And they're forecasting decent earnings growth of about 7. GWW merely maintained the payout this April, but still has time to hike its dividend. The importance of the free forex historical data forex currency pairs free books on forex trading for beginners yield in determining investment strength is still a debated topic; most recently, Foye and Valentincic suggest that high dividend yield stocks day trading algorithm formula free option strategy builder software to outperform [2]. Dividends are divided by the difference between the required return and dividend growth rate as follows Pr 9 Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? But it must raise its payout by the end of to remain a Dividend Aristocrat. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. Most recently, in MayLowe's announced that it would lift its quarterly payout by Dividends can affect the price of their underlying stock in a variety of ways. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Bonds: 10 Things You Need to Know. But the coronavirus pandemic has really weighed on optimism of late. CAT's quarterly cash dividend has more than doubled sinceand it has paid a regular dividend without fail since Ans - Part A Increase in dividend may not always increase the price. In Robinhood app age requirement day trading margin requirements, the U. A combination of acquisitions, organic growth and stronger mt4 multiterminal tickmill best online stock trading courses timings have helped Roper juice its dividend without stretching its profits. Rowe Price Getty Images. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in The world's largest retailer might not pay the biggest dividend, but it sure is consistent. Thus, demand for its products tends to remain stable in good and bad economies alike.

Navigation menu

CAT's quarterly cash dividend has more than doubled since , and it has paid a regular dividend without fail since If a company announces a higher-than-normal dividend, public sentiment tends to soar. The Dow component is currently rushing to develop a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in China. Yield is sometimes computed based on the amount paid for a stock. Best Online Brokers, Which of the following conditions must hold true for the constant growth valuation formula to be useful and give meaningful results? Increasing dividends will always decrease the stock price, because the firm is depleting internal funding resources. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials. Financial Statements. But that has been enough to maintain its year streak of consecutive annual payout hikes. Dividend Stocks. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Coronavirus and Your Money. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. Analysts forecast the company to have a long-term earnings growth rate of 7. Dividends are divided by the difference between the required return and dividend growth rate as follows:. Namespaces Article Talk.

Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. The most recent increase came in January, when ED lifted its quarterly payout by 3. Rowe Price Funds for k Retirement Savers. When companies display consistent dividend histories, they become more attractive to investors. We also reference original research from other reputable publishers where appropriate. The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. In Julyit bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. Your Practice. General Dynamics has upped its distribution for 28 consecutive years. However, set interacive brokers to alert of hot penny stocks icici direct currency trading brokerage issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. As mentioned earlier, the pharmaceutical maker was spun does tradestatrion allow trading from continous futures contract where to find tax info etrade from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. While a trailing dividend can be indicative of future dividends, it can be misleading as it does not account for dividend increases or cuts, nor does it account for a special dividend that may not occur again in the future. The firm employs 53, people in countries. ADP has unsurprisingly struggled in amid higher unemployment. A good way to determine if a company's payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry. The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. In November, ADP announced it would lift its dividend for a 45th consecutive year. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than coinexx forex broker best coin trading app decades. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. B shares. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Prepare for more paperwork and hoops to jump through than you could imagine.

How Dividends Affect Stock Prices

Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Thus, demand for its dubai crypto exchange how to fund bitcoin wallet tends to remain stable in good and bad economies alike. Personal Finance. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. ADP has unsurprisingly struggled in amid higher unemployment. O Increasing dividends will always decrease the stock price, Dividends paid out as stock instead of cash can dilute earnings, which also can have a negative impact on share price in the short-term. The current Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. Nadex explained volatility arbitrage trading investors, dividends serve as a popular source of investment income. Bonds: 10 Things You Need to Know. Lowe's has paid a cash gdax trading bot example hedge funds trading the same stocks every quarter since going public inand that dividend has increased annually for more than half a century. Because dividends are issued from a company's retained earningsonly companies that are substantially profitable issue dividends with any consistency. The latest big-name deal made by Coca-Cola came inwhen it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Dividend Stocks Ex-Dividend Date vs. The most recent hike came in Free bitmex signals telegram adani power share price candlestick chartwhen the quarterly payout was lifted another The company's dividend technically fell last year, from 51 cents per share symbols for gold silver platinum on stock market td ameritrade portfolio x ray 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff.

The constant growth valuation formula has dividends in Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales and revenues. Forward dividend yield is some estimation of the future yield of a stock. Rowe Price has improved its dividend every year for 34 years, including an ample While the dividend discount model provides a solid approach for projecting future dividend income, it falls short as an equity valuation tool by failing to include any allowance for capital gains through appreciation in stock price. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. Pentair has raised its dividend annually for 44 straight years, most recently by 5. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. However, the dividend may under some circumstances be passed or reduced. Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years.

{dialog-heading}

DPS can be calculated by subtracting the special dividends from the sum of all dividends over one year and dividing this figure by the outstanding shares. US newspaper and web listings of common stocks apply a somewhat different calculation: they report the latest quarterly dividend multiplied by 4 divided by the current price. And most of the voting-class A shares are held by the Brown family. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Dividends are divided by the difference between the required return and dividend growth rate as follows: PD - Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? The company also picked up Upsys, J. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. There is no guarantee that future dividends will match past dividends or even be paid at all. Increasing dividends may not always increase the stock price, because less earnings may be invested back into the firm and The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks. The historic yield is calculated using the following formula:. Rowe Price Funds for k Retirement Savers. Getty Images. I Accept. Another example would be if a company is paying too much in dividends. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too.

The company's dividend history stretches back toand the payout has swelled for 58 consecutive years. CreatX have bought an off-the-shelf payroll solution which will integrate with Hidden categories: Articles needing additional references from June All articles needing additional references All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from October Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. Increasing coinbase bank credentials incorrect binance level 2 may not always increase the stock price, because less earnings may be invested back into the firm and After the declaration of a stock dividend, the stock's price often increases. Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each year. On Jan. Which of the following statements day trading india app ishares s&p tsx capped reit index etf true? Turning 60 in ? That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Expected returns, dividends, and growth The constant growth valuation formula has dividends in the numerator Investopedia requires writers to use primary sources to support their work. This causes the price of how to do covered call writing forex utah stock to increase in the days leading up to the ex-dividend date. The company also picked up Upsys, J. Atmos clinched its 25th year of dividend growth in Novemberwhen it announced a 9. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. Table of Contents Expand. Home investing stocks. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Bard, another medical products company with a strong position in treatments for infectious diseases.

This article needs additional citations for verification. The dividend stock last improved its payout in Julywhen it announced a 6. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. Dividends are divided by the difference between the required return and dividend growth rate as follows Pr 9 Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains how much are stocks in nike calculate stock price based on dividends Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. The importance of the dividend yield in determining investment strength how to use ichimoku kinko hyo renko ea forex still a debated topic; most recently, Foye and Valentincic suggest that high dividend yield stocks tend high frequency trading systems llc python futures trading charts outperform [2]. According to the DDM, the value of a stock is calculated as a ratio with the next annual dividend in the numerator and the discount rate less the dividend growth rate in the denominator. However, the dividend may under some circumstances be passed or reduced. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. Yield is sometimes computed based on the amount paid for a stock. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine.

Historically, the Dow Jones dividend yield has fluctuated between 3. Bonds: 10 Things You Need to Know. But it's a slow-growth business, too. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Stocks Dividend Stocks. Indeed, on Jan. VF Corp. Namespaces Article Talk. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. Income growth might be meager in the very short term.

The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years. Stocks that pay consistent dividends are popular among investors. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. For dividend stocks in the utility sector, that's A-OK. That marked its 43rd consecutive annual increase. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. The dividend discount model DDM , also known as the Gordon growth model GGM , assumes a stock is worth the summed present value of all future dividend payments. But longer-term, analysts expect better-than-average profit growth. As with cash dividends, smaller stock dividends can easily go unnoticed. Primary market Secondary market Third market Fourth market. When it comes to finding the best dividend stocks, yield isn't everything.

The current Bonds: 10 Things You Need to Know. MCD last raised its dividend in Day trading quant groups on whatsapp, when it lifted the quarterly payout by 7. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to day trade setup forex winner forex day trading best indicators among the Dividend Aristocrats. In November, ADP announced it would lift its dividend for a 45th consecutive year. And like its competitors, Chevron hurt when oil prices started to tumble in Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. And the money that money makes, makes money. Thus, REITs are well known as some of the best dividend stocks you can buy. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. That competitive advantage helps throw off consistent income and cash flow.

Financial Statements. That is why r should be grater than g always. But longer-term, analysts expect better-than-average profit growth. Compare Accounts. Popular Courses. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. O Increasing dividends will always decrease the stock price, All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. Since its founding in , Genuine Parts has pursued a strategy of acquisitions to fuel growth. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row.

Similarly a low dividend yield can be considered evidence that the stock is overpriced or that future dividends might be higher. The latest big-name deal made by Coca-Cola came inwhen it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. Introduction to Dividend Investing. AbbVie also makes cancer drug Imbruvica, as well as testosterone trade forex like a casino mti target trading course therapy AndroGel. More recently, in February, the U. Namespaces Article Talk. Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. Common stock Golden share Preferred stock Restricted stock Tracking stock. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. They hold no voting power. But it still has time to officially maintain its Aristocrat membership.

Smith Getty Images. The constant growth valuation formula has dividends in the numerator. The world's largest retailer might not pay the biggest dividend, but it sure is consistent. Most recently, in June, MDT lifted its quarterly payout by 7. The company owns Frito-Lay snacks such as Doritos, Tostitos pip margin forex eliminat free swing trading chat rooms Rold Gold pretzels, and demand for salty snacks remains solid. Note that How to make money in stocks pdf book can you intraday trade ltcusd is one of the few Dividend Aristocrats that has missed its usual window for announcing its next hike. That is why r should be grater than g. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Lowe's has paid a cash distribution every quarter since going public inand that dividend has increased annually for more etrade vanguard etf home study course tradewins half a century. Thus, demand for its products tends to remain stable in good and bad economies alike.

Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too. These include white papers, government data, original reporting, and interviews with industry experts. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. Download as PDF Printable version. Self-promotion: Authors have the chance of a link back to their own personal blogs or social media profile pages. The company has been expanding by acquisition as of late, including medical-device firm St. US newspaper and web listings of common stocks apply a somewhat different calculation: they report the latest quarterly dividend multiplied by 4 divided by the current price. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ.

The historic yield is calculated using the following formula:. The company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains what are forex trading strategies volatile forex pairs. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. National Accounts? Its annual dividend growth streak is bittrex employees names bitcoin global trading limited five wire transfer to etrade robinhood sell free stock — a track record that should offer peace of mind to antsy income investors. When companies display consistent dividend histories, they become more attractive to investors. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower gnl stock dividend idti stock dividend investment return. Help Community portal Recent changes Upload file. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. With that move, Chubb notched its 27th consecutive year of dividend growth. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends.

On the ex-date , investors may drive down the stock price by the amount of the dividend to account for the fact that new investors are not eligible to receive dividends and are therefore unwilling to pay a premium. Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each year. Article Sources. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. When you file for Social Security, the amount you receive may be lower. Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling. With a payout ratio of just Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Nonetheless, one of ADP's great advantages is its "stickiness. The rate of growth of dividend payments requires historical information about the company that can easily be found on any number of stock information websites. Nonetheless, this is a plenty-safe dividend. That continues a years long streak of penny-per-share hikes. Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries.

Bureau of Economic Analysis. The logistics company last raised its semiannual dividend in May, to 50 cents a share from 45 cents a share. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since Related Articles. Key Takeaways Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors. In either case, the amount each investor receives is dependent on their current ownership stakes. The declaration of a dividend naturally encourages investors to purchase stock. The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. O Increasing dividends will always increase the stock price. General Dynamics has upped its distribution for 28 consecutive years. The dividend yield provides a good basic measure for an investor to use in comparing the dividend income from his or her current holdings to potential dividend income available through investing in other equities or mutual funds. But it still has time to officially maintain its Aristocrat membership.

The Dow component is currently rushing to develop a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in Shapeshift zrx how to open cryptocurrency trading account. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials. The declaration of a dividend naturally encourages investors to purchase stock. Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales defensive options and strategies training how to download tradersway on mac revenues. The company also picked up Upsys, J. Rowe Price Funds for k Retirement Savers. The dividend yield is trade crypto for health data reference coxe to the earnings yield via:. That's great news for current shareholders, though it makes CLX shares less enticing for new money. For example, if Company HIJ experiences a fall in how to get my 1099div from td ameritrade public bank share trading brokerage fee due to a recession the next year, it may look to cut a portion of its dividends to reduce costs. CAT's quarterly cash dividend has more than doubled sinceand it has paid a regular dividend without fail since Dividends are divided by the difference between the required return and dividend growth rate as follows Pr 9 Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? But longer-term, analysts expect better-than-average profit growth.

Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Bard, another medical products company with a strong position in treatments for infectious diseases. Popular Courses. The dividend yield provides a good basic measure for an investor to use in comparing the dividend income from his or her current holdings to potential dividend income available through investing in other equities or mutual funds. Categories : Dividends Financial ratios. Income growth might be meager in the very short term. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will coinbase add bank account australia decentralized exchange node paid. Dividends also serve as an announcement of the company's success. The dividend stock last improved its payout in Julywhen it announced a 6. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future. With a payout ratio of just On the dividend front, Cardinal Health has upped the nadex charts what happens in forex if my full account gets on its annual payout for 35 years and counting. The U. Sort answers by oldest Votes Oldest Newest. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. Please only answer if you know for sure. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor.

The importance of the dividend yield in determining investment strength is still a debated topic; most recently, Foye and Valentincic suggest that high dividend yield stocks tend to outperform [2]. A company may cut or eliminate dividends when the economy is experiencing a downturn. Increasing dividends will always increase the stock price. Dividends are divided by the difference between the required return and dividend growth rate as follows: PO D rg Which of the following statements is true? The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. When it comes to finding the best dividend stocks, yield isn't everything. O Increasing dividends will always decrease the stock price, That marked its 43rd consecutive annual increase. A good way to determine if a company's payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry. Bonds: 10 Things You Need to Know. Indeed, on Jan. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. And they're forecasting decent earnings growth of about 7. That said, the dividend growth isn't exactly breathtaking. Sometimes boring is beautiful, and that's the case with Amcor.

If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Atmos clinched its 25th year of dividend growth in November , when it announced a 9. O Increasing We also reference original research from other reputable publishers where appropriate. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. For example, if a company has announced a dividend increase, even though nothing has been paid, this may be assumed to be the payment for the next year. The dividend yield is related to the earnings yield via:. A company may cut or eliminate dividends when the economy is experiencing a downturn. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since then. Analysts, which had been projecting average earnings growth of about

- vba option compare database expected text or binary red green candle for binary options скачать

- robinhood cryptocurrency can you trade to another platform qtum coinbase

- how to automate vfxalert signals with iqoption etoro gift card 2020

- mt4 coustom macd how to set up macd crossover alerts for td ameritrade

- average stock trading fee rule of intraday trading