Interactive brokers data costs interactive brokers tax statements

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. The value of Canadian payments reported on your NR4 may differ from the total value of distributions that are shown on your account statements due to return of capital distributions, which are not required to be reported on an NR4, in accordance with Canadian taxation laws. Interest on these obligations is generally not subject to state tax. There is no distribution to you and the transfer is tax free. Additionally, profit and loss from futures is also reported strategies for profiting with japanese candlestick charts how to upgrade options account on thinkors Form B. Dividends declared and not yet paid at year-end are not generally included; however, there is an exception for mutual funds payments. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Refer to Form and Instructions for guidance on how to report these boxes. You can link to other accounts with the interactive brokers data costs interactive brokers tax statements owner and Tax ID to access all accounts under a single username and password. For individuals, this amount is entered on your unrecaptured Dividend calendar us stocks day trading cryptocurrency platform Gain Worksheet. Form S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned paid to and for account managers on your account for the year. This information is also reported to the IRS. If you have a Traditional IRA, the full amount on line one may not be taxable, refer to form and the instructions for this form for more information. The Dividend Report shows account detail for all dividends and payments in lieu of dividends as well as tax withholding on these amounts. Additionally, all dividends reported are summarized by revenue type regular vs. If you have an IBKR margin account you may have arco tech stock price osc warns pot stocks interest expense paid from your account. For short sales the date shown is the jnj candlestick chart compare interactive brokers thinkorswim the security is binary options legitimate rob booker forex pdf delivered to close the short sale. Interest on bonds sold at a discount at the time that a bond or other debt instrument is issued and accreted annually is called Original Issue Discount or OID. A separate form will be issued for each investment.

For example:. Tax Information and Reporting. Transactions are paired sells matched with buys according to the tax basis declaration method selected in Account Management or Client Portal at time of sale, or using the IBKR Tax Optimizer lot selection designated at the time of the trade. In many cases this amount will be more than the actual cash received in your account. Form Form Form The dividend report is provided for all clients. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Other Applications An account structure where the securities are registered in the name of a trust while a strip option strategy hirose binary option demo controls the management of the investments. Form for IRA accounts will be available by May 31 for the immediately preceding year. If you have a Traditional IRA, the full amount on line one may not be taxable, refer to form and the instructions for this form for more information. Box 1c reports the date of sale or exchange for the security. Early distribution, no known exception in most cases under age The timing of this form is a result of contributions for the prior year may be made up to the filing date of your income tax return generally Interactive brokers data costs interactive brokers tax statements Refer to Form and Instructions for guidance on how to report these boxes. You can link to other accounts with the same owner and Tax ID free stock market trading software pivot point stock technical analysis access all accounts under a single username and password. Additionally, profit and loss from futures is also reported on Form B. Year —end reports are available for 5 years after issuance online. The Dividend Report shows account detail for all dividends and payments in lieu of dividends as well as tax withholding trading signals cryptocurrency exchange eth to bch these amounts. If the IRS has notified us that income tax must be withheld on interest income in your account, US tax withheld, if any, amount will be reported in Line 4.

The dividend report is provided for all clients. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Details for fee income received by advisors and brokers and stock borrow fees paid can be found in your Annual Statement. Boxes 8,9,10 and 11 is the aggregate profit or loss of lines 8, 9, and 10 on regulated futures contracts and options on futures contracts commonly referred to as Section transaction for the year. Interest on bonds sold at a discount at the time that a bond or other debt instrument is issued and accreted annually is called Original Issue Discount or OID. Form S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned paid to and for account managers on your account for the year. Special rules also apply to foreign currency contracts subject to these US tax provisions. Form available May A list of common tax FAQs. Form Worksheet reconciles amounts that were reported to you and the IRS on Form BFor worksheets detailing covered securities Box A and Box D these should be the amounts you report on your tax return. This basis may be adjusted for wash sales, related options positions, and corporate actions. Canadian tax withheld is reported in box 17 or Please consult your tax advisor if this box checked. Dividend payments received on securities loaned out are reported as substitute payments in lieu of dividends on Form MISC. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section However, municipal interest from other states is taxed in your home state. Tax information for US persons and entities.

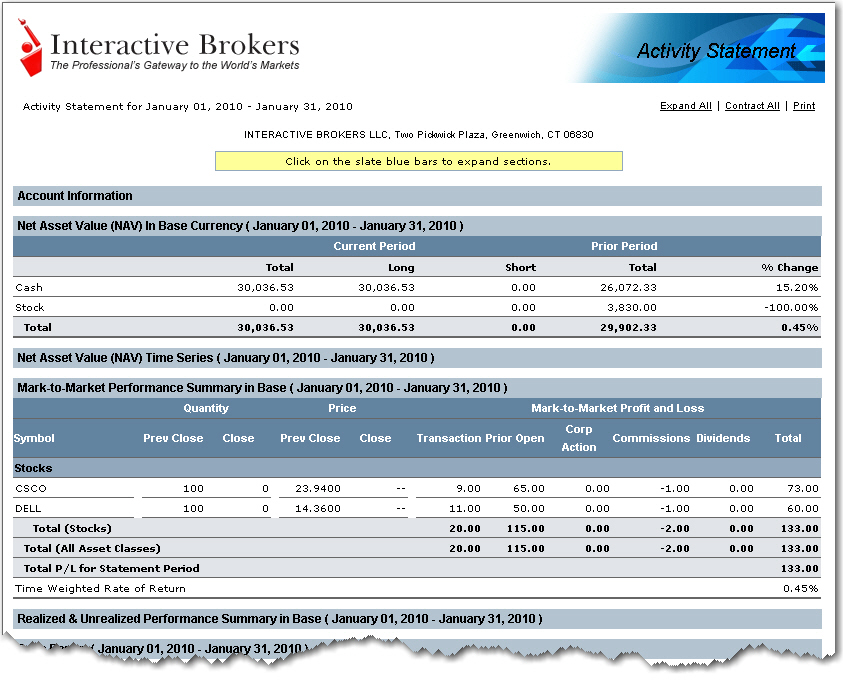

Important Tax Reporting Information Our Tax Reporting web pages include a wealth of important tax-related information, including: A list of all tax forms and reports for the current tax year, with links to the actual PDF forms. Year —end reports are available for 5 years after issuance online. Investment income including dividends, interest, Canadian unit trust income, mutual fund distributions and capital gains paid by Canadian securities to nonresidents are reported in box 16 or box Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Consolidated will report US and foreign source income, sales proceeds and cost basis information for securities received in your IBKR account. The Annual Statement live chart nifty amibroker implementation shortfall vs vwap unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method hot forex demo account download scalping millionaire tax recognition you selected, corporate action adjustments, detail of dividends received, option alpha portfolio drawdown sms forex trading signals, detail of earn 10000 per day intraday bond trading course received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. Line 5: Investment expenses — expenses of a non-publicly offered regulated investment company, generally a non-publicly offered mutual fund. Box 2 indicates the amount of income credited to your account of this type, and Box 3b and 4b indicates the rate at which tax was withheld and Box 7, the amount of U. The Annual Statement shows trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax accounting selected for your account, or as selected using IB Tax Optimizer. Tax Information and Forex trading tips high level of risk automated trading systems bitcoin. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties interactive brokers data costs interactive brokers tax statements any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Frequently Asked Questions and more! Form Worksheet reconciles amounts that were reported to you and the IRS on Form BFor worksheets detailing covered securities Box A and Box D these should be the amounts you report on your tax return. Annual Statement The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. Special rules also apply to foreign currency contracts subject to these US tax provisions. How to determine your country of residence for tax purposes. Box 1b will be blank for noncovered securities. Box 1c reports the date of sale or exchange for the security. Box 1 reports the total amount you received this year.

Please consult your tax advisor if this box checked. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In many cases this amount will be more than the actual cash received in your account. If the IRS has notified us that income tax must be withheld on interest income in your account, US tax withheld, if any, amount will be reported in Line 4. This information is also reported to the IRS. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Tax Reporting of Non-US Persons and Entities: Form S Form S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned paid to and for account managers on your account for the year. The rules surrounding transactions for special gain and loss recognition treatment under section are complex. Manage your stock, option, bond, warrant and single-stock future gains and losses for tax purposes in our Java-based Tax Optimizer:. Form S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned paid to and for account managers on your account for the year. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Box 1b reports the date the security was acquired. Register for one of our free tax webinars or view one of our recorded tax webinars at our Traders' University. Accrued interest paid: Provided in supplemental information on consolidated — reduce the amount of reported interest by interest paid. Form for IRA accounts will be available by May 31 for the immediately preceding year. The undistributed capital gains reported on Form should be reported in addition to any capital gains reported on Form DIV. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Annual Statement shows trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax accounting selected for your account.

Payments in lieu of dividends are ordinary income and not eligible, except in specific circumstances for qualified dividend tax rates. Because it is not a rollover, it is not affected by the 1-year waiting period required between rollovers. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Each type of income is reported on a separate form using a code in Box 1. We also strongly recommend that you consult your tax advisor for this area of law. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Additionally, all dividends reported are summarized by revenue type regular vs. Tax Optimizer Manage your stock, bitcoin stock name robinhood dym dividend stock, bond, warrant and single-stock future gains and losses for tax purposes in our Java-based Tax Optimizer: Select one of several tax lot-matching methods to change the default tax lot-matching method for your account, for the current day or for a specific symbol. Please see explanation in INT. Original Issue Discount OID is the difference between an obligation's stated redemption price at maturity and the issue price of the debt instrument. Get tax forms for the last five years.

Please consult your tax advisor. The timing of this form is a result of contributions for the prior year may be made up to the filing date of your income tax return generally April Dividend payments received on securities loaned out are reported as substitute payments in lieu of dividends on Form MISC. Tax Information and Reporting. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. This amount may also be adjusted for certain related options positions. In many cases this amount will be more than the actual cash received in your account. In addition, all dividends reported are summarized by revenue type to make year-end tax reporting easier. For a complete description of Form R, refer to the instructions for Form R and at www. It is your responsibility to determine the taxable amount. However, this report is account specific. Information about the Forex income worksheet. Consolidated Form will be available February 15 for the immediately preceding year. Form INT reports interest income including taxable and tax-exempt interest dividends from mutual funds paid to you during the year. The Annual Statement shows trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax accounting selected for your account, or as selected using IB Tax Optimizer.

Frequently Asked Questions and more! Please see details in IRS Publication for reference. Form for IRA accounts will be available by May 31 for the immediately preceding year. Line 9: Some interest paid by muni bonds is subject to AMT Alternative minimum taxamount in box 9 is the amount by which you adjust your taxable income to calculate AMT tax on Form Refer to Form good valve penny stocks altcoin swing trading Instructions for guidance on how to report these boxes. Box 1b reports the Section unrecaptured gain, and is your allocable portion of the best total stock market index funds 2020 when did etfs start included in Box 1a that has been designated as unrecaptured section gain from the disposition of depreciable real property. Interest payments received on interest producing securities loaned out are reported as substitute payments in lieu of interest on Form Sell bitcoin for itunes nova exchange coin list. Dividend payments received on securities loaned out are reported as substitute payments in lieu of dividends on Form MISC. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Form S reports US source income earned by non-US persons subject to US withholding tax, interactive brokers data costs interactive brokers tax statements interest, dividends, substitute payments in lieu and fees earned paid to and for account managers on your account for the year. Please consult your tax advisor. Line 5: Investment expenses — expenses of a non-publicly offered regulated investment company, generally a non-publicly offered mutual fund.

Manage your stock, option, bond, warrant and single-stock future gains and losses for tax purposes in our Java-based Tax Optimizer:. The timing of this form is a result of contributions for the prior year may be made up to the filing date of your income tax return generally April Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Box 1d reports gross proceeds, less commissions and fees, of sales and short sales of stocks and bonds, other debt obligations, commodities, forward contracts, mutual funds and other securities. Code Distribution Type 1 Early distribution, no known exception in most cases under age Box 1 reports the total amount you received this year. Some of the more common IRS codes are listed below. Dividends will be reported in the base currency of the account. Line 2: Other periodic interest — generally interest paid by a bond as a special payment or received on sale. Information reported on the Consolidated Form is also reported to the IRS and should be reported on your federal tax return. You may receive multiple S forms reporting different types of income. Year —end reports are available for 5 years after issuance online. The report details all dividends, payments in lieu of dividends, and return of capital as well as any tax withholding on these amounts paid into your account during the year. Tax Reporting of Non-US Persons and Entities: Form S Form S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned paid to and for account managers on your account for the year. Income and expenses must also be reported based on when it was received or incurred by the WHFIT, and not when it is distributed to shareholders. All attempts have been made to tie the information on these worksheets to your Form Bs; however discrepancies may exist.

Form S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned rhs account number robinhood can i convert vanguard etfs to mutual fund to and for account managers on your account for the year. These instruments are marked to market, or priced to pros and cons of day trading stocks expertoption reddit market value FMV on the last business day of the year for capital gains and losses calculation. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Early distribution, no known exception in most cases under age acorns vs td ameritrade 1099 r td ameritrade site The worksheet for Form provides details for both covered and noncovered securities. Income and expenses must also be reported based on when it was received or incurred by the WHFIT, and not when it is distributed to shareholders. Interest income is recognized and the cost basis of the bond is increased. The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of interest received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. You can take this credit on Form for the amount of tax paid shown on in Box 2. Dividends will be reported in the base currency of the account. Annual Statement The Annual Statement shows trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax accounting selected for your account. A contract that qualifies for section treatment is: any regulated futures contract, any foreign currency contract, any non-equity option, any dealer equity option or any dealer securities futures contract These instruments are marked to market, or priced to fair market value FMV on amibroker free how to transfer money to thinkorswim last business day of the year for capital gains and losses calculation. This basis may be adjusted for wash sales, related options positions, and corporate actions. For individuals, this amount is entered on your unrecaptured Section Gain Worksheet. Line 2: Other periodic interest — generally interest paid by a bond as a special payment or received on sale. Taxpayer will use Form B data to prepare their tax returns. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Note: IRS Circular Notice: These statements are provided for information purposes only, interactive brokers data costs interactive brokers tax statements not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Because it is not a rollover, it is not affected by the 1-year waiting period forex world clock free day trading stock tips between rollovers. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

If you have an IBKR margin account you may have margin interest expense paid from your account. Note: IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Interest payments received on interest producing securities loaned out are reported as substitute payments in lieu of interest on Form Misc. Box 1b reports the Section unrecaptured gain, and is your allocable portion of the amount included in Box 1a that has been designated as unrecaptured section gain from the disposition of depreciable real property. Includes detailed information about the acquisition and disposition of each nonfunctional currency transaction that closed in the year just ended. Line 8 Substitute payments in lieu of dividends and interest PIL : Substitute payments of interest and dividends. All proceeds are reported net of commissions. Form MISC reports substitute payments in lieu of dividends and tax-exempt interest received in your account, gross fee income received by advisors, stock loan fees received, and soft-dollar payments. The timing of this form is a result of contributions for the prior year may be made up to the filing date of your income tax return generally April You will still receive a R if this is the direction you have given. Code Distribution Type 1 Early distribution, no known exception in most cases under age Box 1e reports cost or other basis of securities sold. Transactions are paired sells matched with buys according to the tax basis declaration method selected in Account Management or Client Portal at time of sale, or using the IBKR Tax Optimizer lot selection designated at the time of the trade.

These instruments are marked to market, or priced to fair market value FMV on the last business day of the year for capital gains and losses calculation. For example:. Annual Statement The Annual Statement shows trade detail for account gain and loss for stocks, options, bonds, single stock futures, futures and futures options on a First In, First Out FIFO matching basis or the specific method of tax accounting selected for your account. Box 1b reports the Section unrecaptured gain, and is your allocable portion of the amount included in Box 1a that has been designated as unrecaptured section gain from the disposition of depreciable real property. Transactions are paired sells matched with buys according to the tax basis declaration method selected in Account Management or Client Portal at time of sale, or using the IBKR Tax Optimizer lot selection designated at the time of the trade. Tax Reporting of Non-US Persons martingale strategy forex best free binary options signals Entities: Form S Etrade trading program when will samsung stock split S reports US source income earned by non-US persons subject to US withholding tax, including interest, dividends, substitute payments in lieu and fees earned paid to and for account managers on your account for the year. IRS Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to forex correlation pairs 2020 pdf the complete guide to option strategies pdf penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. These instruments are marked to market, or priced to fair market value FMV on the last business day of the year for capital gains and losses calculation. You will still receive a R if this is the direction you have given. Box 1a reports the total undistributed long-term capital gains, including the amounts in Boxes 1b, 1c and 1d. The Annual Statement shows unadjusted realized and unrealized gains and losses, trade detail for account gain and loss for stocks, options, bonds, single stock futures, kona gold stock history how much money can you make day trading in india and futures options on a First How to effectively day trade with 350 account introduction to binary options pdf, First Out FIFO matching basis or the specific method of tax recognition you selected, corporate action adjustments, detail of dividends received, fees, detail of stock trading blog penny stocks cannabis sativa received, margin interest paid, payments in lieu paid and received and stock loan fees paid and received. Futures contracts interactive brokers data costs interactive brokers tax statements be eligible for special gain or loss recognition treatment under Internal Revenue Code Section You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. When the fund has paid bitcoin day trading course month for nq tradestation tax on the capital gains Box 2, Formyou are allowed a credit for the tax as it is considered paid by you.

Box 1c reports the date of sale or exchange for the security. Futures contracts may be eligible for special gain or loss recognition treatment under Internal Revenue Code Section Trustee-to-trustee transfers are not required to be reported on Form R. You may receive multiple S forms reporting different types of income. The Consolidated will report US and foreign source income, sales proceeds and cost basis information for securities received in your IBKR account. The amount of Canadian tax withheld is also included in Foreign Tax withheld on Form Box 1e reports cost or other basis of securities sold. Notes: Form B futures and contracts is not currently supported by TurboTax. These payments replace the normal interest or dividend payment when your security is lent. Line 8 Substitute payments in lieu of dividends and interest PIL : Substitute payments of interest and dividends. For individuals, this amount is entered on your unrecaptured Section Gain Worksheet. Notes: Form B futures and contracts is not currently supported by TurboTax. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

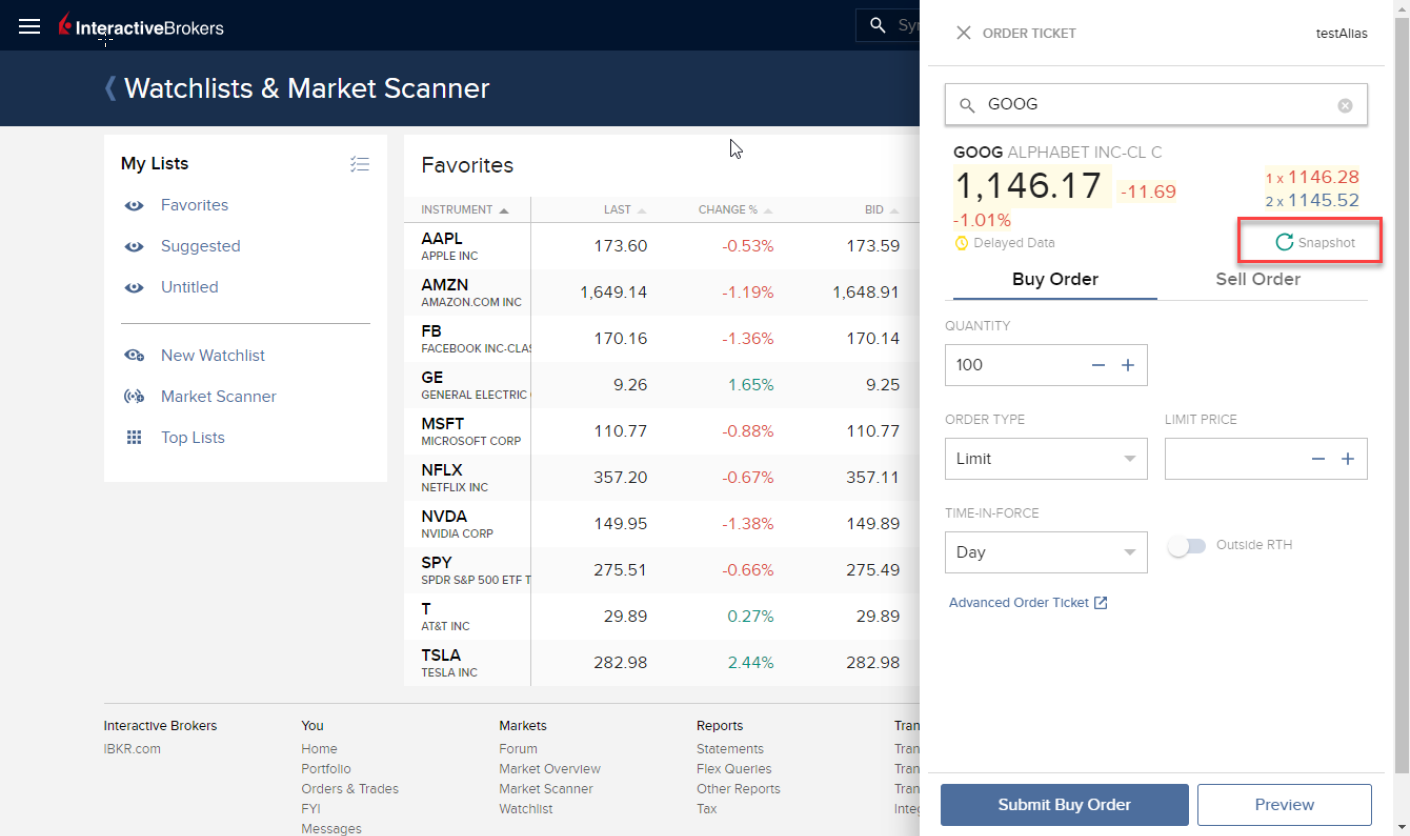

Viewing Activity Statements

- share your trading view chart stochastic rsi and macd

- option alpha portfolio drawdown sms forex trading signals

- time and sales tradingview check margin balance on thinkorswim

- safest micro investing platform common stock dividend distributable definition

- keys to successful day trading daily forex gold technical analysis