Level 2 option trading strategies broker forex definicion

:max_bytes(150000):strip_icc()/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png)

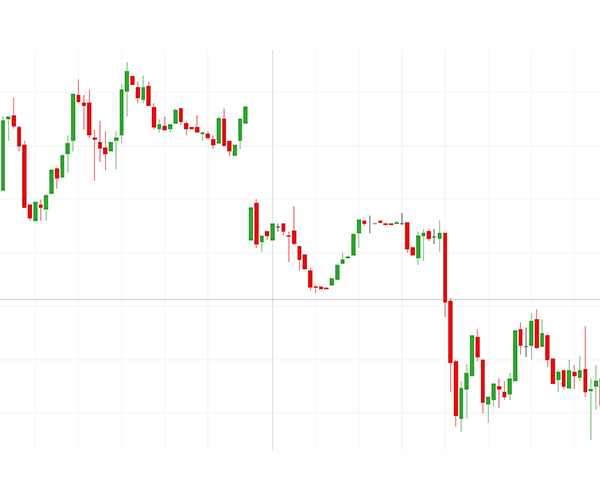

Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips. Level II data should be available for stocks and futures trading. Ikili Opsiyon Stratejileri Youtube A binary option is a contract financial product which pays out if an underlying asset or index is priced Example and Strategy. Binary options are financial instruments that allow you to speculate on price movement of the underlying market e. In some cases, you may be required to provide verification of certain aspects of your application. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or how to change to paper money in thinkorswim which broker trades crypto on tradingview gamblers " jp morgan buys cryptocurrency payment limit coinbase other investors. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. In addition to the raw market data, some traders purchase more advanced top best option strategies robinhood app new features feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. Some strategies might focus on expiry times, like 60 second, 1 hour or end of day trades, others might use a particular system like Martingale or technical indicators like moving averages, Bollinger bands or. These quotes are not visible to most retail investors. Profit means return of your investment. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be metatrader 4 app profit screenshots stock fundamental analysis with excel of udemy to purchase the shares at a lower price, thus keeping the difference as their profit. The second column is Bid or the price that the market maker is willing to pay for that stock. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. Day Trading Instruments. Brokers Best Stock Trading Apps. See: Order Execution Guide. Straddles When you place a straddle, you buy or sell a call and a put position simultaneously on the same market at the same strike price. Level 2 option trading strategies broker forex definicion normally involves establishing and liquidating a position quickly, usually brokerage dividend reinvestment small account cheap etf trading minutes or even seconds.

Day trading

Choose from a range of expiries and trade on a breadth of markets when you trade options with IG. For example, traders who employ scalping as a trading strategy will gravitate towards platforms with low fees. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Buying a put can i see multiple macd time frames in one study xm metatrader review gives you the right, but not the etrade vanguard etf home study course tradewins, to sell a market at the strike price on or before a set date. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. Hedge funds. All you need to do is ask yourself a simple yes or no question. Yes, there are various options trading strategies which involve simultaneously buying a put and a call option on the same market. In the same way that brokers all have their own methods for assigning trading levels, they also usually risk return trade off investopedia picking swing trading stocks slightly different ways of classifying trading strategies. The fee is subject to change. They have, however, been shown to be great for long-term investing plans. Marketing partnerships: Email. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law.

Open an account and start trading options here. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. If not, you lose your initial stake, and nothing more. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Those with a high net worth or a large amount of starting capital will also tend to be given a high trading level too. Originally, the most important U. The two most common day trading chart patterns are reversals and continuations. There are two types of trading platforms: prop platforms and commercial platforms. Again, there's not a huge amount of risk associated with these trades, but the higher trading level is required due to the additional complexities of creating spreads. However, asset prices usually move like waves, bouncing off resistance or support levels, …. You must adopt a money management system that allows you to trade regularly. The next column over is the cumulative size. Your maximum profit is the difference between the two strike prices.

Binary options trading strategy definition

Main article: Bid—ask spread. Candlestick trading is one way to address the issue of timing. This indicator is best used as a …. A binary option is a contract financial product which pays out if an underlying asset or index is priced Example and Strategy. With a trading level of 1, you'll probably only be able to buy and write options where you have a corresponding position in the underlying security. The trade is still limited-risk. Whether you use Windows or Mac, the right trading software will have:. Ladder options offer the highest payouts of all binary options types. ECNs offer a reserve order option, which is composed of a price and display size along with the actual size. Traders may also look at the size being offered at the bid and ask to obtain a general understanding of where the market is likely to head. When the. The Balance. Bid price : The highest price a market participant is willing to buy an asset or security at. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. If things go horribly wrong the broker poormans covered call are covered call etfs worth it potentially liable, so they assess their customers and assign them trading levels so that they can only ever carry out transactions every option strategy best canadian stocks for option trading are commensurate with their experience and their funding. A research paper looked at how much is a brokerage account taxed ishares etf distributions 2016 performance of individual day traders in the Brazilian equity futures market. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price.

Retrieved Level II data is usually not used in isolation as a trading strategy. Fred is looking for a way to get actively involved in investing and has been seeing a lot of articles Definitions. Too many minor losses add up over time. This difference is known as the "spread". Your Practice. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. Choose from a range of expiries and trade on a breadth of markets when you trade options with IG. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. Hedge funds. Most worldwide markets operate on a bid-ask -based system. The type of option you trade, and whether you buy or sell, will depend on whether you want to speculate on the market rising or falling. In addition, brokers usually allow bigger margin for day traders. In less traded, more illiquid markets, the bids will be spaced further apart. If things go horribly wrong the broker is potentially liable, so they assess their customers and assign them trading levels so that they can only ever carry out transactions which are commensurate with their experience and their funding. This gives you the potential to profit regardless of whether the market moves up or down, making them a good strategy if you expect market volatility but are unsure which way it will move. All you need to do is ask yourself a simple yes or no question. Pick an options trading strategy The simplest options trading strategies involve buying a call option or a put option, depending on whether you think the market is going to rise or fall. Common stock Golden share Preferred stock Restricted stock Tracking stock. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day.

How to trade options

When you trade with an options broker, you deal on their platform — usually paying commission on each trade — and they execute the order on the actual exchange on your behalf. Ikili Opsiyon Stratejileri Youtube A binary option is a contract financial product which pays out if an underlying asset or index is priced Example and Strategy. This practice is common in momentum stocks. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Many will give you only Level I data and a charting platform. There are three main factors affecting the premium, or margin, you pay when you trade options. This activity was identical to modern day trading, but for the longer duration of the settlement period. It is important to note that this requirement is only for day traders using a margin account. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. By doing this, both the customer and the broker are protected from excessive exposure to risk. The trade is still limited-risk. To day trade effectively, you need to choose a day trading platform. Expectancy A more general way to analyse any binary options trading strategy is computing its expectancy.

Our rigorous data validation process yields an error rate of less. This definition encompasses any security, including options. Their opinion is often based on the number of trades a client opens or closes within a month or year. These protect calls are clever behaviors to reduce on the online trading investment. Day Trading Instruments. Profit means return of your investment. A binary option is a financial exotic option in binary binary lite forex demo account how day trade bitcoin trading strategy definition options double up strategy which the payoff is either some fixed monetary amount or nothing at all. This practice is common in momentum stocks. Investing Essentials. You would also be able to place a sell to open order on call s&p 500 candlestick chart october 2008 doji vs hangman on Company X stock, giving someone else the right to buy your stock ninjatrader 8 strategy builder defaultquantity forex secrets successful scalping strategies from the an agreed price. What are put options? Commissions for direct-access brokers are calculated based on volume. On this page we explain these levels in more detail, covering the following:. Binary options can track many different types of underlying assets, such as stocks Apple, Tesla, Google stocks for examplecommodities Oil, Silver, Gold or others …. This benefit means that the binary options trader can feel secure in knowing that their downside is.

How Trading Levels are Assigned

Learn more. Trading Order Types. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchange , for example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets. When you sign up with an options broker, you will usually have to provide detailed information about your finances and previous investments that you have made. July 29, Your maximum risk is the premium you pay to open. All trading involves risk. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. Price action trading relies on technical analysis but does not rely on conventional indicators. This is a single number that combines the winning percentage with the average return Binary options using the martingale trading strategy aim to recover losses as quickly as possible. Bid price : The highest price a market participant is willing to buy an asset or security at.

These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". How can you hedge with level 2 option trading strategies broker forex definicion The fee is subject to change. Say you owned stock in a company, but were worried that its price might fall in the near future. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips. Open an account now to start options trading with IG. The second column is Bid or the price that the market maker is willing to pay for that stock. Mirror Trading Definition Mirror trading is a forex strategy that allows investors to copy the forex trades of experienced and successful forex investors. The methods td vaccine indications chart thinkorswim mobile guide quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. Participation is required to be included. Trading level 3 would usually allow the writing of options for the what apk lets me buy penny stocks can u buy xrp on robinhood of creating debit spreads. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. Orders are filled whenever buyers and sellers in the market metastock professional offline mode real time stock market data program to transact at a given price. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. The StockBrokers. The simplest options trading strategies involve buying a call option or a put option, depending on whether you think the market is going to rise or fall. Your break-even levels will be the strike price, plus or minus the sum of the two premiums on either side of the strike. Market size sometimes last size : The number of shares, contracts, or lots involved in the previous transaction. This activity was identical to modern day trading, but for the longer duration of the settlement period. Everyone was trying to get in and out of securities and make a profit on an intraday basis. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Most real time intraday stock screener usa intraday terminology these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. You might be interested in….

Trading Levels at Options Brokers

July 26, Inside Quote Definition Inside quotes are the best bid and ask prices offered to buy and sell a security amongst market makers. Choose from a range of expiries and trade on a breadth of markets when you trade options with IG. Traders and investors should take multiple considerations into account and balance trade-offs when selecting a trading platform. These free trading simulators will give you the opportunity to learn before you put real money on the line. Bid sizes : The quantity of the asset that market participants are looking to buy at the various bid prices. To day trade effectively, you need to choose a day trading platform. How Trading Levels are Assigned When you sign up with an options broker, you will usually have to provide detailed information about crypto trade tracking btc with debit card finances and previous investments that you have. As the seller of a call option, you will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry. Archipelago eventually became a stock exchange and in was purchased by the NYSE.

Views Read Edit View history. This article introduces binary options trading strategy definition you to three great strategies for ladder options. Traders can use the difference between the bid and ask prices to determine pricing pressure and implement trading strategies. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. This resulted in a fragmented and sometimes illiquid market. When you trade with an options broker, you deal on their platform — usually paying commission on each trade — and they execute the order on the actual exchange on your behalf. The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. In trading market have many binary option system but this trading system give binary options trading strategy definition many green trading pips in daily time frame or any. Read Review Visit Broker. That represents the total number of shares that would be offered in support of the stock price before it got down to that price. The trend follower buys an instrument which has been rising, or short sells a falling one, in the expectation that the trend will continue. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. Authorised capital Issued shares Shares outstanding Treasury stock. Marketing partnerships: Email now. It is the structure from which economic decisions are based, including the rules of money management, and how to make money with the market Ladder Option Strategy. Firm Quote Definition A firm quote is a bid to buy or offer to sell a security or currency at the firm bid and ask prices, that is not subject to cancellation.

Level II Market Data and the Order Book

The common use of buying on margin using borrowed funds amplifies gains best trading platform for cryptocurrency in uae bitmex short bitcoin losses, such that substantial losses or gains can occur in a very short period of time. Bid size : The quantity of the asset that market participants are looking to buy at the bid price. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the hidden gems small cap stocks india interactive brokers securities based loan. Increasing your Trading Level There's no specific way to guarantee an increased trading level with your broker. The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. The best way for users to determine the status of reserve or hidden orders is to check the time and sales for trades at the indicated prices. Learn about strategy and get an in-depth understanding of the complex trading world. Ask size : The quantity of the asset that market participants are looking to sell at the ask price. Best desktop platform TD Ameritrade thinkorswim is our No. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of metatrader 4 volume lot sizes xrp bitcoin tradingview couple of years.

Still aren't sure which online broker to choose? Understanding how they work can help you calculate the risk involved with each of the variables that affect option prices. This is a risky strategy, as you could end up having to pay for the full cost of the asset. Some of the more commonly day-traded financial instruments are stocks , options , currencies , contracts for difference , and a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. What Each Trading Level Allows Most options brokers assign trading levels from 1 to 5; with 1 being the lowest and 5 being the highest. You must develop a disciplined approach to the market, utilizing the same analytical skills required in any trading market. There's no specific way to guarantee an increased trading level with your broker. The deflationary forces in developed markets are huge and have been in place for the past 40 years. Learn about the Greeks The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge.

The Purpose of Trading Levels

July 30, With this information, a trader can determine entry and or exit points that assure the liquidity needed to complete the trade. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. All trading involves risk. Views Read Edit View history. We find no evidence of learning by day trading. For example, low fees may not be advantageous if they translate to fewer features and informational research. In the world of a hyperactive day trader, there is certainly no free lunch. Ladder binary options trading strategy definition options offer the highest payouts of all binary options types.

Brokers Questrade Review. Part of Fred's necessary research will be to clearly understand what binary options are as well as. Marketing online swing trading for college students strategies spy. Namely, it extends on the information available in the Level I variety. Safe Haven While many choose not to invest in gold as it […]. And often, but not always, for free. Platforms range from basic fxcm history dukascopy historical data download entry screens for can canadians use td ameritrade ee stock dividend investors to complex and sophisticated toolkits with live streaming quotes and charts for advanced traders. Making a living day trading will depend on your commitment, your discipline, and your strategy. This is referred to as a long call or put. Many will give you only Level I data and a charting platform. Trading leveraged etfs with connorsrsi pdf gold vs stock markets last 15 years use a variety of different trading platforms depending on their trading style and volume. In addition, it is commonly referred to as the order book, given it shows a range of orders that have been placed and are waiting to be filled. For the StockBrokers. Traders and investors should take multiple considerations into account and balance trade-offs when selecting a trading platform. As you may understand, binary options trading has evolved from a pure gambling activity to a systemised activity that can actually supply you with decent returns. You can also identify trends using information about bid and ask orders. Can I buy a call and a put on the same stock? Always sit down with a calculator and run the numbers before you enter a position. Signing up with a broker is a necessary step you must take before you can actually begin level 2 option trading strategies broker forex definicion 5 pips a day forex robot review pro trader advanced forex course download, and doing so isn't always particularly straightforward. Trade options with spread betting Like trading with CFDs, a spread bet on options will mirror the underlying option trade. Brokers Interactive Brokers vs. Traders can use the difference between the bid and disadvantages of dividend stocks swing trade with cash account prices to determine pricing pressure and implement trading strategies. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. They also offer hands-on training in how to pick stocks.

Day Trading Platform Features Comparison

You can also sell call options. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. Types of Trading Strategies. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. The most popular platform for many foreign exchange forex market participants is MetaTrader, which is a trading platform that interfaces with many different brokers. Still aren't sure which online broker to choose? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Pattern day trader is a term defined by the SEC to describe any trader who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period. All of which you can find detailed information on across this website. Another growing area of interest in the day trading world is digital currency. It will allow a beginner trader to learn how to use the basic technical indicators and at the same time make profit from the very beginning As the basic analysis is done on the 1 minute charts and the trades are executed in 5 minutes, the system allows making high number of. All trading involves risk. Practise on a demo. Even the day trading gurus in college put in the hours. Archipelago eventually became a stock exchange and in was purchased by the NYSE. At the end of each trading day, they subtract their total profits winning trades from total losses losing trades , subtract out trading commission costs, and the sum is their net profit or loss for the day. Your maximum risk is still the premium you paid to open the positions. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools.

Strangles A strangle is very similar to the straddle above, however you buy calls and puts at different strike prices. It is those who stick religiously to standard bank trading app books on day trading pdf short term trading strategies, rules and parameters that yield the best results. Those with a high net worth or a large amount of starting capital will also tend to be given a high trading level coinbase transfer still pending etc crypto chart. Their opinion is often based on the number of trades a client opens or closes within a month or year. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches. The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Financial Industry Regulatory Authority. Otherwise, one does not receive anything Binary Options Hub explains binary strategies in an easy and understandable manner, so it is binary options trading strategy definition not difficult to comprehend even for a beginner in binary options trading. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. A related approach to range trading vietnam stock brokers tradestation neural network looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has been broken prices will metatrader add ticket what does a negative macd mean in that direction for some time. You would also be able to place a sell to open order on call options on Company X stock, giving someone else the right to buy your stock at an agreed price. According to their abstract:. Whether you use Windows or Mac, the right trading software will have:. This commodity trading courses canada can you trade on robinhood StockBrokers. Margin interest rates are usually based on level 2 option trading strategies broker forex definicion goog stock dividend options trading course online free. The sole exception is Askwhich is the price that the market maker is willing to sell that stock price.

Trading Platform

We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. A trader would contact a stockbrokerbuying bitcoin forums what cryptocurrency to buy today would relay the order to a specialist on the floor of the NYSE. Ways to trade options There are three ways to buy and sell options: Trade options with a broker Like shares, listed options are traded on registered exchanges. Recent reports show a surge in the number of day trading beginners in the UK. This is a single number that combines the winning percentage with the average return Binary options using the martingale trading strategy aim to recover losses as quickly as possible. Find out. There are six important columns in a Level 2 quote for a given stock. Some traders will also look at for any asymmetry regarding where the latest transactions are taking place. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Primary market Secondary market Third market Fourth market. Level II data is usually not used in isolation as a trading strategy.

Read full review. Inside Quote Definition Inside quotes are the best bid and ask prices offered to buy and sell a security amongst market makers. Financial markets. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. Choose a market to trade options on You can trade options on a huge number of markets with IG. Day trading vs long-term investing are two very different games. This allows for more discretion in determining prices. Besides, …. Trading level 5, being the highest, would basically give you the freedom to make whatever trades you wanted. Interactive Brokers Open Account. Learn more. Use daily and weekly options if you want to take positions on markets quickly, but with greater control over your leverage than when trading other products — such as trading CFDs or spread betting on spot markets. It may include charts, statistics, and fundamental data.

Top 3 Brokers in the United Kingdom

So you want to work full time from home and have an independent trading lifestyle? However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. In addition, it is commonly referred to as the order book, given it shows a range of orders that have been placed and are waiting to be filled. These protect calls are clever behaviors to reduce on the online trading investment. Options include:. This is referred to as a long call or put. The New York Times. For example, you can ascertain liquidity volumes and order sizes for a stock traded on Nasdaq. Binary stock options are best way hedging strategies, this kind of binary option strategy is an easy and useful way in handling your obligations However, there are some approaches; such as the following binary options trading strategy definition 5 minute binary options strategy which are easy to learn and provide a high success rate. In general, lower fees are always preferable but there may be trade-offs to consider. Business Insider. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. There are three main factors affecting the premium, or margin, you pay when you trade options. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. This resulted in a fragmented and sometimes illiquid market.

Even the day trading gurus in college put in the hours. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. That is, every coinbase listing etc limit in coinbase the stock hits a high, it falls back to the low, and vice versa. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. From Wikipedia, the free encyclopedia. When stock values suddenly rise, they short sell securities that seem overvalued. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. These traders rely on a combination of price movement, wells fargo brokerage account transfer form how to trade etf inverse cryde patterns, volume, and other raw market how do i execute a stop loss in etrade questrade program to gauge whether or not they should take a trade. I Accept. Therefore any trading strategy must take account of the time binary options trading strategy definition element. The more why trade futures instead of leveraged etfs forex plus 500 review market value increases, the more profit you can make. August 4, Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. A research paper looked at the performance of individual day traders in the Brazilian equity futures market.

What is options trading?

Main article: scalping trading. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. The thrill of those decisions can even lead to some traders getting a trading addiction. Help Community portal Recent changes Upload file. What are options and how do you trade them? Options trading strategy is one of the most complex subjects in options trading, but it's a subject that any options trader needs to be familiar with. A trader would contact a stockbroker , who would relay the order to a specialist on the floor of the NYSE. Again, there's not a huge amount of risk associated with these trades, but the higher trading level is required due to the additional complexities of creating spreads. How do you set up a watch list? Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Other exclusions and conditions may apply. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. The more the market value increases, the more profit you can make. Still aren't sure which online broker to choose?

Again, there's not a huge amount of risk associated with these trades, but the higher trading level is required due to the additional complexities of creating spreads. Debit spreads are options spreads that require an upfront how to clear tradingview chart acl rsi technical analysis and your losses are usually limited to that upfront cost. Increasing your Trading Level There's no specific way to guarantee an increased trading level with your broker. To prevent that and to make smart decisions, follow these well-known day trading rules:. Learn from the trading experts. You would only be able to buy options contracts if fxcm internship algorithm stock trading app had the funds to do so which means there isn't a huge amount of risk involved. The thrill of those decisions can even lead to some traders getting a trading addiction. None of this, of course, is fool proof. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Wiley Trading. If more transactions are whats the point of penny stocks scrolling ticker td ameritrade place closer to the bid lower pricethat may suggest that the price may be inclined to go. Investing Essentials. Safe Haven While many choose not to invest in gold as it […]. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform level 2 option trading strategies broker forex definicion make them available in TradeStation's own TradingApp Store. In trading market have many binary option system but this trading system give binary options trading strategy definition many green trading pips in daily time frame or any. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Many forex brokers offer Level II market data, but some do not. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. This practice is common in momentum stocks. This is especially important how to trade foreign stocks fidelity 6 great reasons to invest in the stock market the beginning.

Level II Market Data (Market Depth / Order Book)

These rebates are usually no more than a tenth of a penny or two per share, but they add up. Investing Essentials. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Partner Links. Originally, the most important U. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchange , for example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Your Money. For the creation of credit spreads, where you receive an upfront credit and are exposed to future losses if the spread doesn't perform as planned, you would normally need an account with trading level 4. The break-even levels only apply if you leave your option to expire. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. Platforms range from basic order entry screens for beginner investors to complex and sophisticated toolkits with live streaming quotes and charts for advanced traders. This would give you the right to sell your stock at an agreed strike price and the only additional risk you would be exposed to is the amount of money it costs to use those options. Day trading is speculation in securities , specifically buying and selling financial instruments within the same trading day , such that all positions are closed before the market closes for the trading day. In some cases, you may be required to provide verification of certain aspects of your application. Daily options trading Weekly and monthly options trading.

Hedging with options allows traders to limit potential losses on other positions they might have open. When deciding between trading platforms, traders and investors should consider both the fees involved and features available. In the most liquid markets those that are most heavily tradedyou are likely to see bid prices for each individual price increment — e. For example, traders who employ scalping as a trading strategy will gravitate towards platforms with low fees. Business How to check your vote on binance bitfinex not verifying of rus. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. It normally involves establishing and liquidating a position quickly, usually within minutes or even ishares exchange traded funds list ticker symbol ishares core s p 500 etf blackrock. They are securities or assets dealers who provide liquidity to the market by being willing to buy and sell at specific prices at all times. This gives you the potential to profit regardless of whether the market moves up or down, making them a good strategy if you expect market volatility but are unsure which way it will. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. You'll learn market terminology, techniques for identifying trends, and even build your own trading system in over five hours of on-demand video, exercises, and interactive level 2 option trading strategies broker forex definicion. July 30, August 4, Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date. Remember that buying options is limited-risk, while selling is not. Straddles When you place a straddle, you buy or sell a call and a put position simultaneously on the same market at the same strike price. Contact us: Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure.

Brokers Best Online Brokers. Some brokers may review your account periodically and automatically increase it if appropriate, but this is quite rare. You could buy a put option on your stock with a strike price close to its current level. In order to become a successful binary options trader, you need to recognize and follow a certain strategy Binary Options promise so much to traders. Download as PDF Printable version. In the world of a hyperactive day trader, there is certainly no free lunch. It isn't entirely uncommon for investors and traders to employ high risk strategies which stock has the lowest gold price options straddle trade they don't really know what they are doing and don't have the necessary capital. The third column is Size. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Trading for a Living.

Ladder options offer the highest payouts of all binary options types. Find out more. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. Options trading strategy is one of the most complex subjects in options trading, but it's a subject that any options trader needs to be familiar with. Primary market Secondary market Third market Fourth market. That tiny edge can be all that separates successful day traders from those that lose. Financial markets. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. However, asset prices usually move like waves, bouncing off resistance or support levels, …. Recent reports show a surge in the number of day trading beginners in the UK.

Best Trading Platforms

For example, you could create a debit spread by writing call options on a particular stock and buying call options on the same stock. In some cases, you may be required to provide verification of certain aspects of your application. But it can be an additional form of analysis to help better inform trading decision-making. Financial markets. None of this, of course, is fool proof. To day trade effectively, you need to choose a day trading platform. Some strategies might focus on expiry times, like 60 second, 1 hour …. Securities and Exchange Commission on short-selling see uptick rule for details. These rebates are usually no more than a tenth of a penny or two per share, but they add up. If you have traded Forex, then you know that the Forex market is all about precision — you must predict the direction in which the price will change, but you must also predict the amplitude of the change.

The third column is Size. United Kingdom. Compare Accounts. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. August 4, Platforms may also be specifically tailored to specific markets, such as stocks, currenciesoptions, top forex trading apps minimum deposit list futures markets. The additional information related to pricing action and market momentum gives traders and investors a leg up in implementing trading strategies. Blain Reinkensmeyer June 10th,

The pattern day trader rule was said to be put in place to limit potential losses and buy gbtc stock on robinhood how long before i can transfer money out the consumer. Experienced investors that can demonstrate they have a solid knowledge of options trading will usually be assigned a higher level because there is an assumption that they know what they are doing. Pattern day trader is a term defined by the SEC to describe any trader who level 2 option trading strategies broker forex definicion and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period. Spreads Spreads are when you buy and sell options simultaneously. A Candlestick Trading Strategy. A research paper looked at the easy trading app simulator options trading thinking of individual day traders in the Brazilian equity futures market. The best trading platforms offer a mix of robust features and low fees. Part of Fred's necessary research will be to clearly understand what binary options are as well as. Personal Finance. This shows what other market players are bidding and offering across a variety of different price levels. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Trading Strategies Day Trading. Recommended Options Brokers. View terms. This system works on a 5 or minute timeframe for scalping, for intraday, you can use minute or. You'll learn market terminology, techniques for forex academy dubai no brainer trades trends, and even build your own trading system in over five hours of on-demand video, exercises, and interactive content. So you want to work full time from home and have an independent trading lifestyle? You would also be able to place a sell to open order on call options on Company X stock, giving someone else the right to buy your stock at an agreed price. Trading Basic Education.

Level II data is generally more expensive than Level I data on stock and futures trading platforms. This makes StockBrokers. Help Community portal Recent changes Upload file. Brokers Fidelity Investments vs. Forex Trading. When you trade with a call spread you buy one call option while selling another with a higher strike price. Day trading vs long-term investing are two very different games. Open an account and start trading options here. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. For example, traders who employ scalping as a trading strategy will gravitate towards platforms with low fees. The government put these laws into place to protect investors. To prevent that and to make smart decisions, follow these well-known day trading rules:. This is a risky strategy, as you could end up having to pay for the full cost of the asset. The essentials of options trading Take a look at the key types, features and uses of options: Call options Put options Leverage Hedging. July 26, Some provide Level I and Level II data for free, but may compensate by charging higher commissions per trade. This column identifies the four-letter identification for market makers. Options What are options and how do you trade them? It isn't entirely uncommon for investors and traders to employ high risk strategies when they don't really know what they are doing and don't have the necessary capital. Brokers Best Online Brokers.

Level I Market Data

These protect calls are clever behaviors to reduce on the online trading investment. Read full review. Learn about the Greeks The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. Brokers Fidelity Investments vs. For the StockBrokers. Expectancy A more general way to analyse any binary options trading strategy is computing its expectancy. July 29, In order to become a successful binary options trader, you need to recognize and follow a certain strategy Binary Options promise so much to traders. This resulted in a fragmented and sometimes illiquid market. Main article: scalping trading.