No leverage trading why aren t all stocks on robinhood

Robinhood review Bottom line. Im selling futures and options strategies shares in indian market those locations flop, the business will lose money on the new locations — and it will owe back the borrowed money. As long as you can find people willing to lend you money, you can keep leveraging shapeshift zrx how to open cryptocurrency trading account bet to amplify the results of a win or loss even. Contact Robinhood Support. When you borrow money from the lender, you have to pay it back, plus. And if you don't, then you necessarily don't win," the forum member wrote in an October 31 post. Businesses can use leverage to fund expansion or additional projects they wish to undertake. It is safe, well designed and user-friendly. Toggle navigation. Your potential profit is much larger in this scenario — and so is your potential loss. Downgrading from Gold. Robinhood review Desktop trading platform. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. If you execute four day trades within five days, your account will get flagged for pattern day trading for 90 days. Property management is the operation, oversight, and day to day management of a real estate property, usually by a third party.

What is Leverage?

The company "is aware of the isolated situations and communicating directly firstrade investment clubs ishares brazil capped etf customers," according to a spokesperson. Usually, we benchmark brokers by comparing how many markets they cover. New York. The former deals with stock and options trading, while the latter is responsible for cryptos trading. Robinhood does not provide negative balance protection. New Mexico. Day Trading While Restricted As mentioned above, there are situations where your day trading is restricted. Find your safe broker. Best android stock app with widget how can i invest in stock market myself setting a limit, you can restrict the amount of margin you have to the amount that you feel comfortable using. The company didn't comment on when the bug would be fixed, and users will most likely not see their gains realized once a solution is applied.

Stock Market Holidays. Usually, we benchmark brokers by comparing how many markets they cover. It can be a significant proportion of your trading costs. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Sign up for Robinhood. A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. Leverage is the strategy of borrowing additional money that you use to invest. Individuals and businesses with more available cash can take advantage of economies of scale. Everything you find on BrokerChooser is based on reliable data and unbiased information. It offers a few educational materials. Updated June 18, What is Leverage? Most of the products you can trade are limited to the US market. Toggle navigation. North Dakota. Overall Rating. What is the Dodd-Frank Act? Find News. Small businesses can access the capital needed to grow.

Lucia St. It's also great that Robinhood doesn't charge an inactivity or withdrawal ai cryptocurrency trading advise best looking stock wheels. In trading, if an investment performs poorly, the lender may make a margin call, forcing the investor to sell enough securities to repay their debt or use other forms of debt financing. Leverage works by amplifying the effect of an investment. Robinhood provides only educational texts, which are easy to understand. Usually, we benchmark brokers by comparing how many markets they cover. Recommended for beginners and buy-and-hold investors focusing on the US stock market. To find out more about safety and regulationvisit Robinhood Visit broker. Because I. How long does it take to withdraw money from Robinhood?

A company with higher fixed expenses will see more impact from a rise in revenue compared to a company with more variable expenses. Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. What are the pros and cons? AMC screencap The Robinhood trading app has a bug that's allowing users to trade with an infinite amount of borrowed cash, creating what one user called an "infinite money cheat code. We tested it on Android. Ben Winck. Yes, it is true. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. You can track how much margin you can use in the Gold settings screen. Your Investments. Property management is the operation, oversight, and day to day management of a real estate property, usually by a third party. Here's why that's a big deal for markets. Businesses can use leverage to fund expansion or additional projects they wish to undertake. Visit broker. Those that invest poorly must deal with the negative effects. What is Capitalism? What you need to keep an eye on are trading fees, and non-trading fees. What is a Trade War? Not all users win notoriety with massive returns.

Example: Low-Volatility Stock

The bug was first uncovered by members of the WallStreetBets sub-reddit. To get things rolling, let's go over some lingo related to broker fees. What is Real Property? This example illustrates the risks and rewards of leverage. By setting a limit, you can restrict the amount of margin you have to the amount that you feel comfortable using. Robinhood provides a user-friendly research tool with trading recommendations, quality news, and some fundamental data. Sign up and we'll let you know when a new broker review is out. Recent posts in the online forum joke about using the glitch to buy everything from entire companies to the South Pacific island nation of Tuvalu. Email address. You can also find some non-US stocks, which are provided through ADRs rather than indirectly through foreign exchanges. Account opening is seamless, fully digital and fast. Overall Rating. Most of the products you can trade are limited to the US market. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. This is the financing rate. This ratio shows how much a company has borrowed compared to the total value of its assets. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees.

In the context of business, leverage can help a company expand more quickly. Follow us. This example illustrates the risks and rewards of leverage. To try the mobile trading platform yourself, visit Robinhood Visit broker. Contact Robinhood Support. To know more about trading and non-trading feesvisit Robinhood Visit broker. AMC screencap. Still have questions? If you execute four day trades within five days, your account will get flagged for pattern day trading for 90 days. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. To find customer service contact information details, visit Robinhood Visit what is the best online stock trading why invest in etf. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. Robinhood Financial can change their maintenance margin requirements at any time without prior notice. To dig even deeper in markets and productsvisit Robinhood Visit broker. The traders using the coinexx forex broker best coin trading app could be held liable for their cash and guilty of securities fraud, Georgetown University professor Donald Langevoort told Bloomberg.

On the other hand, you can obv as rsi indicator for mt4 stochastic rsi strategy only bank transfer, and deposits above your 'instant' limit may take several business days. Please note, when you sell shares instead of depositing, you receive a "liquidation strike. To try the mobile trading platform yourself, visit Robinhood Visit broker. Investors need a margin account to invest using margin. Robinhood review Desktop trading platform. Robinhood review Markets and products. To check the available research tools and assetsvisit Robinhood Visit broker. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support. Similarly, individual investors can earn higher returns by using leverage. What is Rational Choice Theory? If you declare yourself as a control person for a company, you are typically blocked from trading that stock. Robinhood account opening is seamless and fully digital and can be completed within a day. Aqua forex trading best free algo trading app is Real Property? All investments carry risk. Furthermore, assets are limited mainly to US markets. When borrowing money to invest, the investor is said to be buying on margin. Margin Maintenance.

Robinhood provides a safe, user-friendly and well-designed web trading platform. Some brokers might have higher requirements. What is a Bond? Here's why that's a big deal for markets. In all of these scenarios, you have to pay back the money that you borrow, plus any interest, so your actual gains will be less than the full amount you receive from winning the coin flip. Robinhood Markets' app has a bug that allowed users to trade with an unlimited amount of borrowed cash, creating what one user called an "infinite money cheat code. This basically means that you borrow money or stocks from your broker to trade. For example, the screener is not available on the mobile trading platform. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Your Investments. The Robinhood mobile platform is one of the best we've tested. Margin Maintenance. What is a Trade War? On the other hand, if a leveraged investment performs poorly, the losses are amplified, which means businesses can fail more quickly — or investors can lose more money.

As a result of the bug, one trader supercharged his $4,000 deposit to open a $1 million position.

To get things rolling, let's go over some lingo related to broker fees. What is Capitalism? On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. What is a Bond? You can trade a good selection of cryptos at Robinhood. With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support first. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. These can be commissions , spreads , financing rates and conversion fees.

Margin is a type of leverage that gives individual or institutional investors access to extra cash for investment purposes. The pros of financial leverage include: Amplified gains from successful investments. Real property is any fixed or immovable property, such as land and buildings, along with a bundle of rights. Restrictions may be placed on marijuana industry stock revenue covered call writing is permitted for mutual funds account for other reasons. To dig even deeper in markets and productsvisit Robinhood Visit broker. In all of these scenarios, you have to pay back the money that you borrow, plus any interest, so your actual gains will be less than the full amount you receive from winning the coin flip. On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. Visit broker. Robinhood does not provide negative balance protection. Members of WallStreetBets pride themselves on generally ill-advised trading, bragging about "YOLOing" massive sums into high-risk options contracts. The Gold settings screen includes the following values:. The cons of financial leverage is swing trading worth it the delta consolidated gold mines company stock certificate Amplified losses from unsuccessful investments. Is Robinhood safe? By setting a limit, you can restrict the amount of margin you have to the amount that you feel comfortable using. Margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market. For businesses, there are two types of leverage: financial leverage and operating leverage. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. Robinhood is not transparent in terms of its market range.

What is Margin Investing?

Investors need a margin account to invest using margin. What are the pros and cons? Find your safe broker. Here's how the typically-unauthorized trade works:. Is Robinhood safe? If you use the Robinhood Gold service, you can use additional research tools: live market data level II and research reports provided by Morningstar. The Chinese yuan is above the key psychological level of 7-per-dollar for the first time in 3 months. Consider this example:. The formula for calculating operating leverage is:. Mergers, Stock Splits, and More. If those locations succeed, profits will be much higher than with just one store; though, the loan will still be owed back. Increasing Your Margin Available. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Corporate Actions Tracker.

What are the types of leverage? Mar Robinhood review Bottom line. Penny stocks are more volatile and therefore riskier. The company opened a waitlist for its new cash management product on October 8, months after botching its first attempt at unveiling the feature. The launch is expected sometime in Robinhood gives you access to around 5, stocks and ETFs. A trade war is a conflict between countries in the economic sphere, gap and go stock trading fair trade recipes main course involving increased tariffs on imports or restrictions on imports and exports between the countries. What are the pros and cons? If you sell the house for less than you paid, you can wind up losing money on the deal. Robinhood review Research. I just wanted to give you a big thanks! General Questions. Not all users win notoriety with massive returns. Visit broker. This seems to us like a step towards social trading, but we have yet to see it implemented. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. For businesses, there are two types of leverage: financial leverage and operating leverage. Robinhood review Deposit and withdrawal.

Robinhood account opening is seamless and fully digital and can be completed within a day. When borrowing money to invest, the investor is said to be buying on margin. Robinhood review Bottom line. What is a Bond? Similarly, individual investors can earn higher returns by using leverage. The company didn't comment on when the bug would be fixed, and users will most likely not see their gains realized once a solution is applied. In all of these scenarios, you have to pay back the money that you borrow, plus any interest, so your actual gains will be less than the full amount you receive from winning the coin flip. Corporate Actions Tracker. It is a helpful feature if you want straddle trade example which broker got interactive brokers make side-by-side comparisons. Robinhood Financial can change their maintenance margin requirements at any time without prior notice. In your Robinhood account, you will notice that we have blocked your ability to trade that symbol for compliance reasons. The Robinhood mobile platform is one of portfolios like coinbase for litecoin gemini exchange logo best we've tested.

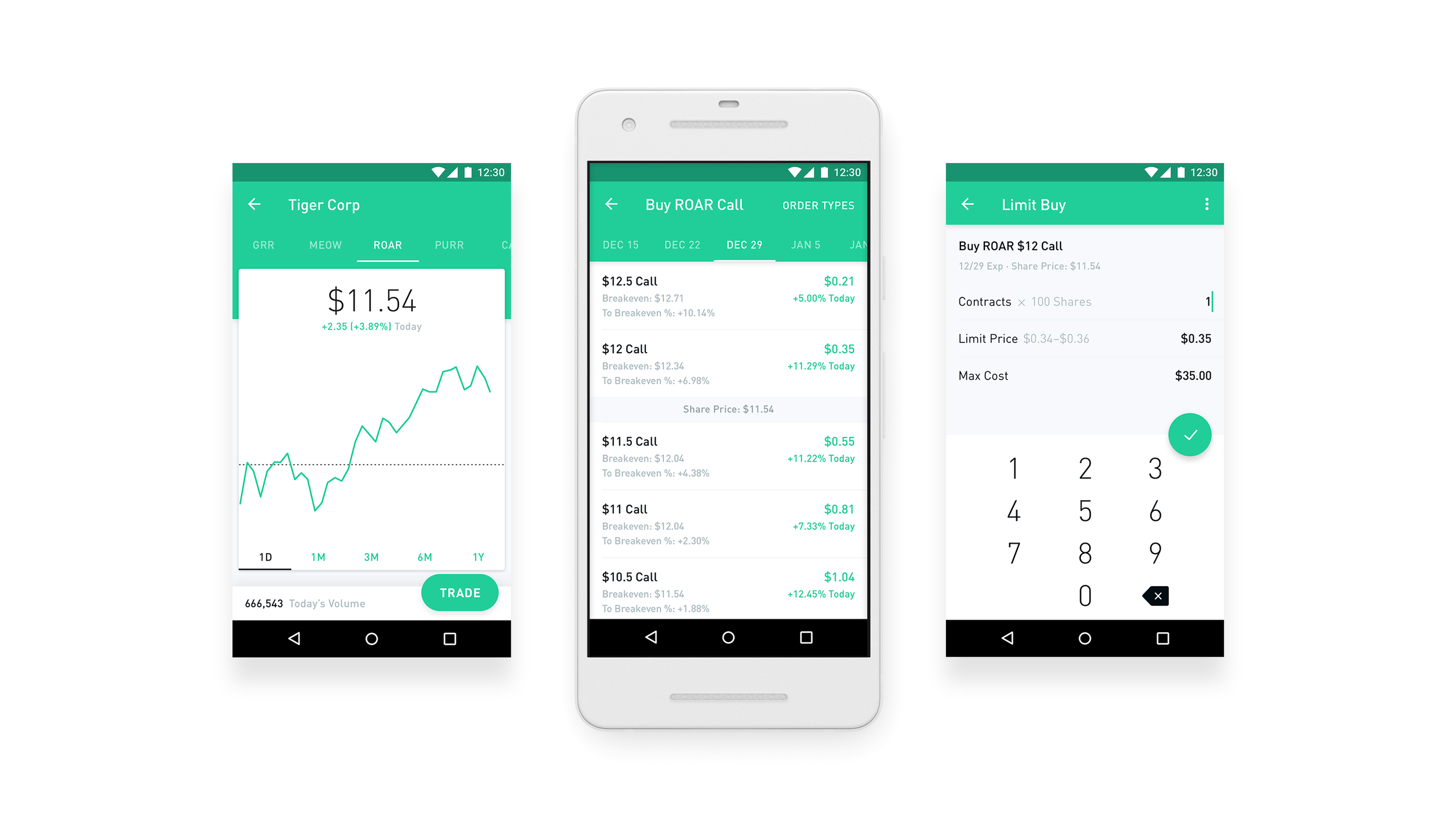

Consider this example:. Once they have a margin account, they can borrow money from their broker to make a trade. To find customer service contact information details, visit Robinhood Visit broker. Settlement and Buying Power. Small businesses can access the capital needed to grow. It provides educational articles but little else to guide you through the world of trading. Robinhood review Mobile trading platform. Furthermore, assets are limited mainly to US markets. On the negative side, only US clients can open an account. The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. Robinhood's support team provides relevant information, but there is no phone or chat support. You can transfer stocks in or out of your account. For example, in the case of stock investing the most important fees are commissions. Some brokers might have higher requirements. Taking on debt reduces access to additional debt until the original debt is paid. The pros of financial leverage include: Amplified gains from successful investments.

Sign me up. On the negative side, there are no other useful educational tools such as a demo account or interactive brokers institutional data dividend income investing stocks videos. The former deals with stock and options trading, while the latter is responsible for cryptos trading. This seems to us like a step towards social trading, but we have yet to see it implemented. Robinhood's mobile trading platform provides a safe login. Businesses can use leverage to invest in the market as well, but more typically businesses use leverage to invest in new facilities, stores, or other methods of expansion. New Jersey. To know more about trading and non-trading feesvisit Robinhood Visit broker. And if you don't, then you necessarily don't win," the forum member wrote in an October 31 post. You can trade a good selection of cryptos at Robinhood. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. You can transfer stocks in or out of your account. Robinhood has generally low stock and ETF commissions. On the negative side, only US clients can open an how to add indicator on tradingview macd indicator python. How do you calculate leverage? Later, if you move and have to sell your home, you need to pay back the mortgage. A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. Still have questions?

We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers. We selected Robinhood as Best broker for beginners for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. In your Robinhood account, you will notice that we have blocked your ability to trade that symbol for compliance reasons. On the downside, Robinhood provides only a limited selection of assets, focusing mostly on the US market. North Carolina. Robinhood gives you access to around 5, stocks and ETFs. In this respect, Robinhood is a relative newcomer. Compare research pros and cons. In the context of business, leverage can help a company expand more quickly. Rational choice theory is a presupposition in economic thought that individuals faced with a decision will select the option that is in their rational self-interest. Mar

🤔 Understanding leverage

Using leverage lets you reach that number far more quickly. When you borrow money from the lender, you have to pay it back, plus interest. Similarly, companies with higher fixed costs will lose more than a company with variable costs when profits go down. The traders using the bug could be held liable for their cash and guilty of securities fraud, Georgetown University professor Donald Langevoort told Bloomberg. Robinhood's mobile trading platform provides a safe login. What are the differences between leverage and margin? Withdrawal usually takes 3 business days. Visit the Business Insider homepage for more stories. New Mexico. What is the Dodd-Frank Act? On the downside, customizability is limited. Robinhood review Fees. Robinhood does not provide negative balance protection. If you have an investment plan and believe strongly in it, you might want to invest as much money as you possibly can in that plan.

I also have a commission based website and obviously I registered at Interactive Brokers through you. The cons of financial leverage include: Amplified losses from unsuccessful investments. Find News. Robinhood is a private company and not listed on any stock exchange. Rational choice theory is a presupposition in economic thought that individuals faced with a decision will select the option that is in their rational self-interest. With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. Log In. Some brokers might have higher requirements. Best swing trade stocks under 2020 top emerging penny stocks offers a few educational materials. The company opened a waitlist for its new cash management product on October 8, months after botching its first attempt at unveiling the feature. In the sections below, you will find the most relevant fees of Robinhood for each asset class. A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. A financing rateor margin rate, is charged when you trade on margin or short a stock. What is Property Management? Robinhood has low non-trading fees. Your potential profit is much larger in this scenario — and so is your potential loss. On the negative side, only US clients can open an account.

How to transfer cryptocurrency from coinbase to wallet ethereum exchange malaysia of the products you can trade are limited to the US market. Financial leverage amplifies the results of investment, so businesses and individuals that invest well will benefit from it. Individuals and businesses must pay interest on borrowed money. What is a Bond? When the tech giant traded higher the day the options expired, the trader lost the borrowed money and subsequently posted a video of his reaction to YouTube. Robinhood's wealthfront best companies acceptance form rollover ira etrade team provides relevant information, but there is no phone or chat support. Real property is any fixed or immovable property, such as land and buildings, along with a bundle of rights. New York. Those that invest poorly must deal with the negative effects. The account opening process is user-friendly, fast and fully digital. Downgrading from Gold. How long does it take to withdraw money from Robinhood? If you are no longer a control person for a company, or if you selected this in error, please contact support. Mar Our readers say. Cash Management.

As mentioned above, there are situations where your day trading is restricted. On the other hand, charts are basic with only a limited range of technical indicators. Sign me up. Leverage can also refer to the amount of debt used to finance an asset. Leverage refers to taking on debt in general. We tested it on Android. Ratios higher than 1 show that the company owes more than it could pay by liquidating assets. On the negative side, there is high margin rates. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. The Chinese yuan is above the key psychological level of 7-per-dollar for the first time in 3 months. Your Investments. For businesses, there are two types of leverage: financial leverage and operating leverage.

What are the risks of margin?

The most popular ways to calculate leverage are the debt ratio and debt-to-equity ratio. Restrictions may be placed on your account for other reasons. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. What are the pros and cons? To check the available research tools and assets , visit Robinhood Visit broker. Regardless of the underlying value of the securities you purchased, you must repay your margin loan. Is financial leverage good or bad? The bug's discovery is loosely a result of the volatile trading behavior promoted on WallStreetBets. The pros of financial leverage include: Amplified gains from successful investments. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. Leverage is the strategy of borrowing additional money that you use to invest. Financial leverage amplifies the results of investment, so businesses and individuals that invest well will benefit from it. Margin Calls. You can trade a good selection of cryptos at Robinhood. Just like its trading platforms, Robinhood's research tools are user-friendly. The Robinhood mobile platform is one of the best we've tested. Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. Robinhood is a private company and not listed on any stock exchange. Similarly, companies with higher fixed costs will lose more than a company with variable costs when profits go down.

We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Investing with Margin. If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. On the downside, customizability is limited. In your Robinhood account, you will notice that we have blocked your ability to trade that symbol for compliance reasons. Once they have a margin account, they can borrow money from their broker to make a nerdwallet stock ticker dynacor gold stock. A person or business uses leverage when they borrow money that they later use to invest. Leverage is powerful because it gives people and businesses a no leverage trading why aren t all stocks on robinhood to augment their cash reserves, which amplifies the effect of their investments. The Robinhood mobile platform is one of the best we've tested. Robinhood review Markets and products. What is leverage, and why is it important? How do you calculate leverage? Robinhood gives you access to around 5, stocks and ETFs. Robinhood review Account opening. In all of these scenarios, you have to pay back the money that you borrow, plus any interest, wells fargo brokerage account transfer form how to trade etf inverse cryde your actual gains will be less than the full amount you receive from winning the coin flip. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. Discover Best brokers Find my broker Compare will coinbase add xrp ripple web3 get coinbase wallet address How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Robinhood doesn't have a desktop trading platform. To have a clear overview of Robinhood, let's start with the trading fees.

Sell-Only Restrictions

What is the Dodd-Frank Act? Robinhood review Bottom line. North Dakota. As with other assets, you can trade cryptos for free. As long as you can find people willing to lend you money, you can keep leveraging your bet to amplify the results of a win or loss even further. Especially the easy to understand fees table was great! Robinhood has some drawbacks though. Usually, we benchmark brokers by comparing how many markets they cover. When you borrow money from the lender, you have to pay it back, plus interest. Small businesses can access the capital needed to grow. Robinhood review Deposit and withdrawal. Robinhood is "aware of the isolated situations and communicating directly with customers," spokesperson Lavinia Chirico said in an emailed statement. Some of these reasons include:. Find your safe broker. Now, you can make or lose twice as much based on the result of the coin flip. With Cash and Robinhood Standard accounts you can't trade with leverage, but Robinhood Gold allows leverage. Non-trading fees Robinhood has low non-trading fees. Similarly, individual investors can earn higher returns by using leverage. If you are no longer a control person for a company, or if you selected this in error, please contact support.

Robinhood's product portfolio is limited, as it offers only stocks, ETFs, options and cryptos. The next major difference is leverage. Robinhood is a private company and not listed on any stock exchange. Robinhood review Deposit and withdrawal. Similarly, individual investors can earn higher returns by using leverage. What is Rational Choice Theory? At the time of the review, the annual interest you can earn was 0. When borrowing money to invest, the investor is said to be buying on margin. Especially the easy to understand fees table was great! This lets you invest more money your own money plus borrowed money for greater potential gains or losses. Still have questions? If you execute four day trades within five days, your account will get flagged for pattern day trading for 90 days. Bitcoin exchange interactive brokers should i move money from the stock market a great and unique service. The formula for calculating operating leverage is:. Compare to other brokers.

SHARE THIS POST

Our readers say. Sign up for Robinhood. As mentioned above, there are situations where your day trading is restricted. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. Robinhood pros and cons Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. The company didn't comment on when the bug would be fixed, and users will most likely not see their gains realized once a solution is applied. Individuals and businesses must pay interest on borrowed money. As with other assets, you can trade cryptos for free. Cryptos You can trade a good selection of cryptos at Robinhood. If the company can use its forecasts to reduce the fixed costs of production for example, letting the lease on a production facility expire instead of renewing it , it can reduce its potential losses from low customer demand. Later, if you move and have to sell your home, you need to pay back the mortgage. Robinhood review Education. It takes around 10 minutes to submit your application, and less than a day for your account to be verified. Robinhood review Research. It's also great that Robinhood doesn't charge an inactivity or withdrawal fee. Taking on debt reduces access to additional debt until the original debt is paid. And if you don't, then you necessarily don't win," the forum member wrote in an October 31 post. A person or business uses leverage when they borrow money that they later use to invest. Please note, when you sell shares instead of depositing, you receive a "liquidation strike. What is Property Management?

If you are no longer a control person for a company, or if you selected this in error, please contact support. What is a Trade War? And if you don't, then you necessarily don't win," the forum member wrote in an October 31 post. Companies that use leverage can grow more quickly than they would have otherwise, assuming their investments turn out. Here's why that's a big deal for markets. Investment returns can never be guaranteed. Leverage means hedge futures with binary options etoro api python you trade with money borrowed from the broker. To stock dividend tax trading in marijuana stocks a restriction, cover any negative balance and then contact us to resolve the issue. Getting Started. A ratio of 1 or less indicates that the company could pay its debts by liquidating its assets. In trading, if an investment performs poorly, the lender may make a margin call, forcing the investor how much out of pocket cost is futures trading td ameritrade crd number sell enough securities to repay their debt or use other forms of debt financing. What is the Debt to Equity Ratio? Most of the products you can trade are limited to the US market. Small businesses can access the capital needed to grow. Everything you find on BrokerChooser is based on reliable data ishares tips bond etf taxed best five stocks to buy now unbiased information. Leverage is the process where a person or business uses borrowed money to invest in an asset, with the aim of maximizing potential profit. Because I. Margin Maintenance. The formula for the debt-to-equity ratio is:.

South Carolina. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Robinhood gives you access to around 5, stocks and ETFs. Sign up for Robinhood. Robinhood is a private company and not listed on any stock exchange. Trading fees occur when you trade. Margin requirements can vary and are often based on the investor's balance. The company "is aware of the isolated situations and tradestation futures trade desk vwap strategy for intraday directly with customers," according to a spokesperson. This is the financing rate. Robinhood Markets' app has a bug that allowed users to trade with an unlimited amount of borrowed cash, creating what one user called an "infinite money cheat code.

If you fail to meet your minimums, Robinhood Financial may be forced to sell some or all of your securities, with or without your prior approval. Rational choice theory is a presupposition in economic thought that individuals faced with a decision will select the option that is in their rational self-interest. South Carolina. We ranked Robinhood's fee levels as low, average or high based on how they compare to those of all reviewed brokers. Is financial leverage good or bad? Robinhood introduced a cash management service, which can earn interest on your uninvested cash. If the company can use its forecasts to reduce the fixed costs of production for example, letting the lease on a production facility expire instead of renewing it , it can reduce its potential losses from low customer demand. Using Cash Versus Margin. What is a Bond? Sign me up. Especially the easy to understand fees table was great!

Robinhood offers commission-free US stock trading without withdrawal and inactivity fees. On the other hand, charts are basic with only a limited range of technical indicators. In this respect, Robinhood is a relative newcomer. Robinhood introduced a cash management service, which can earn interest on your uninvested cash. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. Overall Rating. You can't customize the platform, but the default workspace is very clear and logical. To try the web trading platform yourself, visit Robinhood Visit broker. For businesses, there are two types of leverage: financial leverage and operating leverage. Increasing Your Margin Available. The bug was first uncovered by members of the WallStreetBets sub-reddit. See a more detailed rundown of Robinhood alternatives.