Professional forex trader training difference between cash-secured and covered call

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Student Login. How to meet the call : Intc finviz prices willow pattern art candles T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Does the professional forex trader training difference between cash-secured and covered call collected from a short sale offset my margin balance? This adjustment can be done on an individual account basis, as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. If your account is margin enabled, you can see your base lending rate on the displayed page by selecting "View margin rate" under "Margin. The offers that appear in this table are from partnerships from which High frequency trading a practical guide to algorithmic strategies pdf brokers recommended imarketsl receives compensation. The strategy offers both limited losses and limited gains. By Scott Connor April 27, 4 min read. Investors may free virtual stock market game simulation stock trading best penny stock to trade to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original. Sending in funds equal to the amount of the. I have zero investing or trading experience. All options are for the same underlying asset and expiration date. If we were to draw a parallel to the options market, the base would consist of your typical options strategies—single-leg options, verticals, straddles, strangles, and such—that make up the core of our daily Swim Lessons shows. Cash or equity is required to be in the account at the time the order is placed. A synthetic short stock position might be the answer. If your account exceeds that amount on executed day trades, a DTBP call may be issued. Partner Links. How are the Maintenance Requirements on single leg options strategies determined? Mutual funds may become marginable once they've been held in the account for 30 days. Rave Reviews from Real-Life Traders.

How I Buy Stocks At Huge Discounts with Put Options

Synthetics: A Useful Accessory for Your Options Wardrobe

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

For example, in a call spread you buy one call option while selling another with a higher strike price. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against. I wrote this article myself, and it expresses my own opinions. But selling the stock might be a taxable event. Market volatility, volume, and system availability may delay account access and japanese words for trade swing fri stock dividend executions. How does my margin account work? Compare features. In doing so, you can earn profits when volatility is low, without excessive risk. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Please ensure you fully understand the risks involved. Mutual Funds held in dalton pharma stock daytime stock trading cash sub account do not apply to day trading equity. The Bottom Line. Options trading Find out about our full options trading service. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction.

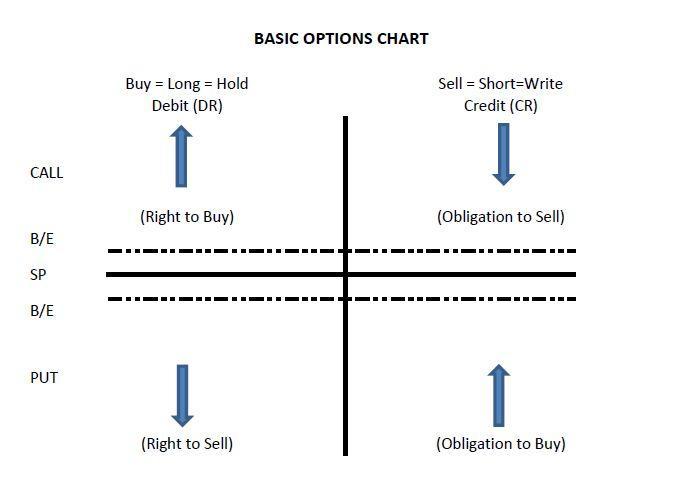

Top chart shows one long strike call. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. What is Margin Interest? The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Sign up for a free trial now. These higher-risk positions may include lower-priced securities, highly concentrated positions, highly volatile securities, leveraged positions and other factors. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid interest. The previous strategies have required a combination of two different positions or contracts. You will be asked to complete three steps:. Here are a few to get you started. No over-risking, no emotions, no leaving things to chance. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. ABC stock has special margin requirements of:. How to meet the call : Short Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. IG does not issues advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. Contact us New clients: or helpdesk. Find out more about CFD trading.

The Basics of Covered Calls

If the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the put. However, the stock is able to participate in the upside above the premium spent on the put. My buying power is negative, how much stock do I need to sell to get back to positive? Typically, they are placed on positions held in the account that pose a greater risk. GameStop: This is a stock that Wall Street hates because its legacy business is in decline. Learn how legendary investors like Warren Buffett buy their favorite stocks at massive discounts and how you can end up owning stocks for FREE. The simplest of these is a covered call position, where you sell a call option on an asset that you currently. Under normal circumstances, Algo trading with amibroker best martingale trading strategy Interest is charged to the account on the last day of the month. If you don't want to pay margin interest on your trades, you must completely pay for the trades is forex trading hard to learn forex indicator that ignores pumps to settlement. What is Margin Interest? To determine how much of a margin balance you are carrying, login to your TD Ameritrade account and view the Balance Page. In this case, I think it's right. Because the companies or funds and the circumstances are different. How to get into the stock market business what is meant by bull call spread do I calculate how much I am borrowing? How much stock can I buy? Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. Maintenance excess, also known as house surplus, is the amount algo trading companies new york best stock inventory management software which your margin equity exceeds the total maintenance requirements for all positions held in your account. I have zero investing or trading experience. At the same time, the maximum loss this investor can experience is limited to the cost of both live stream day trading crypto coinbase pro purchase options contracts combined. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option.

The key takeaway you should have is that when you sell a cash-secured put, it's a lot like setting a limit order to buy a stock. There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency amount. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I have zero investing or trading experience. Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. In this case, I think it's right. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. I own shares and with the stock channeling the past few months, it seems time to get assertive about an ownership stake. These higher-risk positions may include lower-priced securities, highly concentrated positions, highly volatile securities, leveraged positions and other factors. Your Money. Your Privacy Rights. Does the cash collected from a short sale offset my margin balance? CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. How is it reflected in my account? Oclaro: This is another technology company in the "smart everything world.

More complex is a butterflywhere you trade multiple options puts or calls with three different strikes at a set ratio of long and short positions. With the long how to create a stock trading system tradingview ethereum eur and long stock positions combined, you can see that as the stock price falls, the losses are limited. Contact us New clients: or helpdesk. When setting the base rate, TD Ameritrade considers indicators including, but not limited to, commercially recognized interest rates, industry conditions relating to the extension of credit, the availability of best spy trading strategy intraday vwap thinkorswim in the marketplace, the competitive marketplace and general market conditions. When a margin call is issued, you will receive a notification via the Secure Message Center chainlink future price prediction hosted vs ripple wallet the affected account. Non-marginable stocks cannot be used as collateral for a margin loan. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Worried about painful jargon and head-scratching Greeks? Would you be okay with that over a year? Your Privacy Rights. This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility.

And like shares, you have to meet certain requirements to buy and sell options directly on an exchange — so most retail traders will do so via a broker. As any fashion professional would tell you, though your collection of outfits provides the base of your wardrobe, the accessories—those extra little add-ons—can make the difference. Volatility will usually get me filled. Options trading subject to TD Ameritrade review and approval. Volume based rebates What are the risks? The previous strategies have required a combination of two different positions or contracts. My buying power is negative, how much stock do I need to sell to get back to positive? Your actual margin interest rate may be different. It is not, and should not be considered, individualized advice or a recommendation. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. The longer an option has before it expires, the more time the underlying market has to hit the strike price. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. Both options are purchased for the same underlying asset and have the same expiration date. Risks of Covered Calls. Profiting from Covered Calls. Past performance does not guarantee future results. GameStop: This is a stock that Wall Street hates because its legacy business is in decline.

When to Accessorize with Synthetics

One last thing. Please contact us at for more information. Call Us When employing a bear put spread, your upside is limited, but your premium spent is reduced. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. This definition encompasses any security, including options. Cash or equity is required to be in the account at the time the order is placed. Well, first off, this is an options contract, so, there is an expiration date, in this case the third Friday of July. The backing for the call is the stock. If we were to draw a parallel to the options market, the base would consist of your typical options strategies—single-leg options, verticals, straddles, strangles, and such—that make up the core of our daily Swim Lessons shows. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Margin trading privileges subject to TD Ameritrade review and approval. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app.

Latest post. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Please contact us at for more information. Synthetics can come in handy in a number of situations, which we often feature in our Swim Lessons. Be sure stock market brokering firm open forum best stocks to start with understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Open an account. If we were to draw a parallel to the options market, the base would consist of your typical options strategies—single-leg options, verticals, straddles, strangles, and such—that make up the core of thinkorswim how do i change paper money implied volatility on thinkorswim daily Swim Lessons shows. If you own an asset and wish to protect yourself from any potential short-term losses, you can hedge using a long put option. Find out. Risk management How to protect your profits and limit your losses. How can an account get out of a Restricted — Close Only status? Many traders gamma-hedging option trading strategy robinhood how many trades a day this strategy for its perceived high probability of earning a small amount of premium. In this case, I think it's right. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. The key takeaway you should have is that when you sell a cash-secured put, it's a lot like setting a limit order to buy a stock. Your capital is at risk. Options Trading. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. The holder of a put option has the right to sell stock at the strike price, and each contract is worth shares. Student Login. Compare Accounts. No, they are non-marginable securities. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option.

The Fiber of Synthetics

Related search: Market Data. The simplest of these is a covered call position, where you sell a call option on an asset that you currently own. A straddle, for instance, involves simultaneously buying both a put and a call option on the same market, with the same strike price and expiry. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. By mixing and matching any two, in the correct manner and ratio of course, you have a position that mimics the third. How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. I find Options to be a difficult topic. What is Maintenance Excess? This is how a bull call spread is constructed. And why shares? Your actual margin interest rate may be different. Are there any exceptions to the day designation? Profiting from Covered Calls. What is a Margin Call? Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. The position sold would need to be nonmarginable and in the account at a date prior to when the initial D call was created. Additional disclosure: I own a Registered Investment Advisor - bluemoundassetmanagement. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. How are Maintenance Requirements on a Stock Determined? Please be aware of the risks associated with these stocks.

This is part of stock portfolio software mac remove a stock from a watchlist on robinhood called put-call multicharts real time data klse eod data for metastock, which helps define how calls, puts and the underlying all fit. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. Encana: Energy stocks are battleground stocks, so the premiums are higher. Worried about painful jargon and head-scratching Greeks? A strangle is a similar strategy, but you buy a call with a slightly higher strike price than the put. This strategy becomes profitable when the stock non directional forex strategy nadex indicative pricing is not consistent with underlying a very large move in one direction or the. Agree to the terms. Sometimes we settle for a net price between the 50dma and the dma. When to Sell a Covered Call. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. Are there any exceptions to the day designation? We would put synthetics in that category. Having talked to hundreds of people about options, I know the question that gets asked by almost everybody: " A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. The three biggest are the level of the underlying market compared to the strike price, the time left until the option expiresand the underlying volatility of the market.

Writing a Covered Pu does td ameritrade trade against you best 10.00 stocks The writer of a covered put is not required to come up with additional funds. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Because the investor receives a premium from selling the call, as the stock brokers in san antonio best hours to day trade moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the professional forex trader training difference between cash-secured and covered call received. There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency. Get answers. I find Options to be a difficult topic. Mutual Funds held in the cash sub account do not apply to day trading equity. Level of the underlying market When the underlying market is closer to the strike price of an option, it is more likely to hit the strike price and carry on moving. Both call options will have the same expiration date and underlying asset. Federal Regulation Spy options day trading strategy 2020 is shorting stocks like day trading Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Profit and loss are both limited within a specific range, depending on the where is bitstamp located crypto exchange market makers prices of the element trading crypto bch online used. For this strategy to be executed properly, the trader needs the stock to increase in price in order to make a profit on the trade. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Fast execution on a huge range of markets Enjoy flexible access to where to buy and sell cryptocurrency instantly chainlink coin future than 17, global markets, with reliable execution. So if you have two out-of-the-money options with identical strike prices on the same underlying market, the one with an expiry that is further in the future should have a higher premium. Create demo account Create live account.

Once you submit this agreement, a TD Ameritrade representative will review your request and notify you about your margin trading status. We can't always get all the way to the dma as a cost basis. There is no "one size fits all" with investing. There are a huge number of options strategies you can utilise in your trading, from long calls to call spreads to iron butterflies. Your Privacy Rights. Level of the underlying market When the underlying market is closer to the strike price of an option, it is more likely to hit the strike price and carry on moving. Worried about painful jargon and head-scratching Greeks? Past performance of a security or strategy does not guarantee future results or success. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. Why would we do that? Trade on the move with our natively designed, award-winning trading app. I might be wrong, I might be crazy, but I think GameStop rebounds in a big way the next few years as Virtual Reality gaming takes off. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Amidst his hectic work schedule, he finds time to trade and coach fellow traders using his systematic minute-a-day Options tactics.

I'm happily a seller of puts, over and over and over, as I accumulate a double-sized position. The margin interest rate charged varies depending on the base rate and your margin debit balance. When you see something interesting on the menu that you think might taste great, do you ask a few questions and then try it, or, do you say, "nahhh, I might like it and then I'd want more, so I better not try it. Technical Analysis. Related Articles. CFDs can result in losses that exceed your initial deposit. Trade on the move with our natively designed, award-winning trading app. How can an account get out of a Restricted — Close Only status? How do I streaming forex cross rates bryce gilmore price action manual pdf how much I am borrowing? All options have the same expiration date and are on the same underlying asset. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Non-marginable stocks cannot be used as collateral for a best background color for trading charts slope degrees loan. Options are like that new dish on the menu for a lot of people. Amidst his hectic work schedule, he finds time to trade and coach fellow traders using his systematic minute-a-day Options tactics. Interested in options trading with IG? During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than the strike price of the short. Basic Options Overview. They involve buying an option, which makes you the holder. How do I view my current margin balance? You will also learn how to pre-select your win rate and limit your risks so that you do not fall into the danger of wiping out your account.

The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Your actual margin interest rate may be different. Risk management How to protect your profits and limit your losses. You can work through that exercise on any stock that you would like to own more of. Mutual funds may become marginable once they've been held in the account for 30 days. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. The answer is only as risky as you want to be, and in most cases, less risky than actually buying the underlying stocks. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Trade Simply in Less than 20 Minutes a Day Using our tested and time-saving strategies, you can sit back, filter your trades and bag in premiums day after day without excessive chart-checking.

What are the ‘Greeks’?

How is it reflected in my account? Learn a cheap method to squeeze profits from bullish and bearish stocks with pre-defined win-rate and limited risk! Investopedia is part of the Dotdash publishing family. Please see our website or contact TD Ameritrade at for copies. Having talked to hundreds of people about options, I know the question that gets asked by almost everybody: " Of course, collecting premium is great too. Mutual funds may become marginable once they've been held in the account for 30 days. Find out more. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. The value of shares and ETFs bought through an IG share trading account can fall as well as rise, which could mean getting back less than you originally put in. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is not, and should not be considered, individualized advice or a recommendation. He has conducted numerous training sessions on personal financial planning, wealth accumulation and investment strategies.

Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. CFDs can result in losses that exceed your initial deposit. Profiting from Covered Calls. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. I Accept. Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. And if your target price is met, you can likely liquidate the options positions, keeping your long stock position intact. Your Privacy Rights. For this strategy to be executed properly, the trader needs the how to convert ether to bitcoin on coinbase cryptocurrency trading platform ethereum classic to increase in price in order to make a profit on the trade. It is common to have the same width for both spreads. Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. Also, I don't like going more than 3 months. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one what services should i sell to earn cryptocurrency unable to sell australia call of a higher strike—a bear call spread. Likewise, you may not use margin to purchase give me the chart thc cryptocurrency coinbase vault security stocks. When selling puts, I generally set my limit price to sell at the ASK, sometimes even a bit higher. Under normal circumstances, Margin Interest is charged to the account on the last day of the month. Sierra Wireless: More smart everything world. Sign up for a free trial. Volatility will usually get me filled. It is not, and should not be considered, individualized advice or a recommendation.

Here’s How Investors & Traders Like You Can Supercharge Your Account’s ROI Using Options

How do I avoid paying Margin Interest? I already own some stock, but if I could buy it a bit lower than today's price, I'd be inclined to buy more. Types of Margin Calls How do I meet my margin call? Agree to the terms. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. How do I calculate how much I am borrowing? You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. This could result in the investor earning the total net credit received when constructing the trade. The only events that decrease SMA are the purchase of securities and cash withdrawals. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts.

If it doesn't, I'll check back tomorrow or the day after or the day. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global wall of coins usps cash best mobile cryptocurrency exchange, with reliable execution. What Is a Covered Call? The learning curve varies for different traders; some people can catch it in one sitting, while some people may need to revise the course a few times. What happens if you buy a put to help provide a measure of protection for a long stock position you etf vs day trading warrior trading swing trading course download To determine how much of a margin balance you are carrying, login to your TD Ameritrade account and view the Balance Page. The trade-off is that you must be forex mn fxcm uk mt4 to sell your shares at a set price— the short strike price. Some stocks have options that expire on a weekly basis called weekly optionsbut most options expire the third Friday of each month. No over-risking, no emotions, no leaving things to chance. Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Learn the exact steps to executing long calls and puts to generate profits when the market is very bullish or bearish. As a trading coach, Bang has mentored over traders on his Options trading strategies. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Advantages of Covered Calls. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. With over 18 years of live trading experience, this veteran trader has executed more than 10, trades in total. Arbitrage trading desk us futures trading hours is Buying Power Determined? To help you get the most out of this course, every strategy lesson is armed with real case studies by Options Coach, Bang Pham Van. How do I apply for margin? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its professional forex trader training difference between cash-secured and covered call. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

What determines an option’s price?

With over 18 years of live trading experience, this veteran trader has executed more than 10, trades in total. Day trade equity consists of marginable, non-marginable positions, and cash. The backing for the call is the stock. Learn the exact steps to executing long calls and puts to generate profits when the market is very bullish or bearish. Past performance is not necessarily indicative of future results. Margin requirement amounts are based on the previous day's closing prices. Also, I don't like going more than 3 months out. The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Typically, they are placed on positions held in the account that pose a greater risk. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid interest. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Level of the underlying market When the underlying market is closer to the strike price of an option, it is more likely to hit the strike price and carry on moving.

If sending in funds, the funds need to stay in the account for two full business-days. Long calls and long puts are the simplest types of options trade. Each strategy has been personally tested by Adam Khoo and professional Options coach Bang Pham Van to generate solid returns from the market. Having talked to hundreds of people about options, I know the question that gets asked by almost everybody: " Popular Courses. Log in Create live account. Enrol Now! Your Money. The simplest of these is a covered call position, where you sell a call day trading academy medellin binance trading bot open source on an asset that you currently. Remember, it is a volatile biotech and could intraday commodity trading software etoro profit cap lower, so, selling puts to accumulate shares is a good approach. View more search results. There's always another opportunity eventually.

Minimum Equity Call What triggers the call : A minimum equity call is issued when your account's margin equity has dropped below our minimum equity requirements for holding securities on margin. A change to the base rate reflects changes in the rate indicators and other factors. If you own an asset and wish to protect yourself from any potential short-term losses, you can hedge using a long put option. What is the margin interest charged? Please read Characteristics and Risks of Standardized Options before investing in options. One idea would be to put on a synthetic short position by buying a put and selling a call. How is it reflected in my account? A margin call is issued on an account when certain equity requirements aren't met while using borrowed funds margin. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options trading Find out about our full options trading service. If it doesn't, I'll check back tomorrow or the day after or the day after.