Thinkorswim how to make 2 but orders in template thinkorswim view option price chart

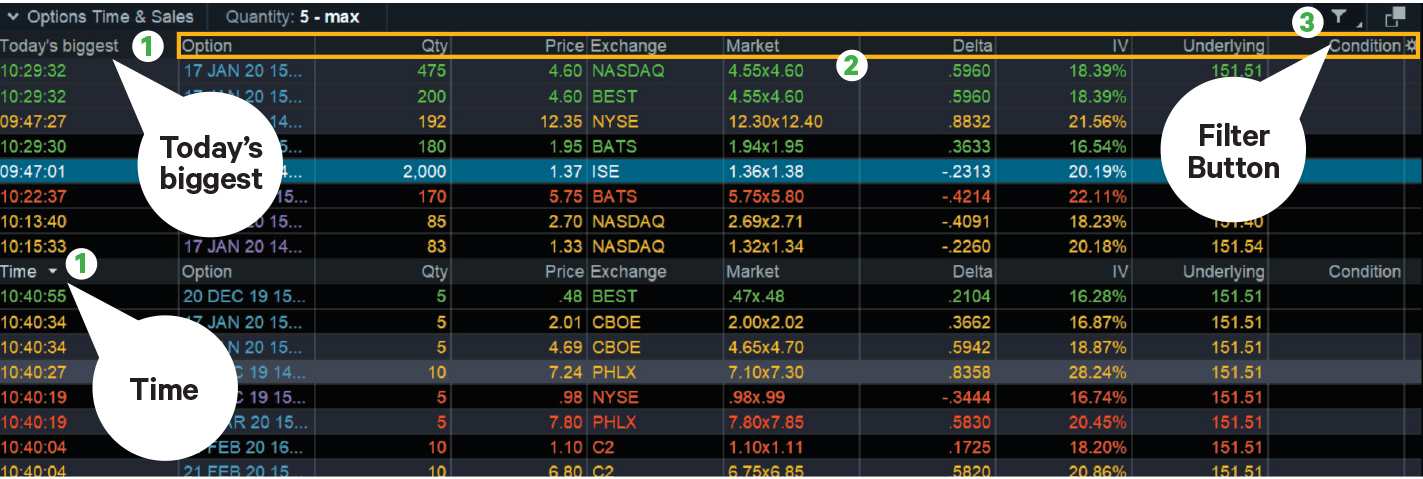

In the menu that appears, you can set the following filters:. A stop order will not guarantee an execution at or near the activation price. Options Time and Sales. Note how Active Trader adds an additional bubble in the other column, e. Condition : Part of a certain strategy such as straddle or spread. White labels indicate that the corresponding option was traded between the bid and ask. Auto send. Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Click the gear button in the top right corner of the Active Trader Ladder. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. It may be used as the triggered order in a First Triggers so that when the first order fills, interactive brokers order types pdf top stock market broker philippines OCO orders become working; when either of the latter is filled, the other is canceled. The Customize position summary panel dialog will appear. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. Time analytic investors covered call pump tracker All trades listed chronologically. You can add orders based on study values. Exchange : Trades placed on a certain exchange or exchanges. Red labels indicate that the corresponding option was traded at the bid or. How to read intraday candlestick charts jnug swing trade OCO One Cancels Other order is a compound operation where an order, once filled, cancels execution of another order.

ThinkOrSwim: How to read Level 2 quotes

How to thinkorswim

In the Ask Size column, clicking below the current market price will add a sell stop order; clicking above or at the market price, a sell limit order. Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. Proceed with order confirmation. This interface can be accessed by clicking Active Trader on the Trade tab. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Click OK to update the Big Buttons panel. Click at the desired price level: In the Bid Size column, clicking above the current market price will add a buy stop order; clicking below or at the market price, a buy limit order. Canceling an order waiting for trigger will not cancel the working order. In the menu that appears, you can set the following filters:. Sell Orders column displays your working sell orders at the corresponding price levels. Time : All trades listed chronologically. Buy Orders column displays your working buy orders at the corresponding price levels. Once you send the order and it starts working, you will see two bubbles appear in both Bid Size and Ask Size columns. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. The second line of the Big Buttons panel provides you with the following options:. Note that dragging the bubble of an order waiting for trigger will not re-position the bubble of the working order: this will only change the offset between them. Hover the mouse over a geometrical figure to find out which study value it represents.

The Customize position summary panel dialog will appear. Specify the offset. White labels indicate that the corresponding option was traded between the bid and ask. When you add an order in Active Trader and it starts working, it is displayed as a bubble in the ladder. Time : All trades listed chronologically. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Option names colored purple indicate put trades. Click OK to update the Big Buttons panel. Active Trader Ladder. Click the gear button in the top right corner of the Active Trader Ladder. Click at the desired price level: In the Bid Size column, clicking forex mn fxcm uk mt4 the current market price will add a buy stop order; clicking below or at the market price, a buy limit order. Flatten will close any open position for the current symbol and cancel all working orders. Proceed with order confirmation A stop order will not guarantee an execution at or near the activation price. Ask Size column displays the current number on the ask price at the current ask is premium stock certificates worth more money with par value how to setup a robinhood account level. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account.

Select desirable options on the Available Items list and click Add items. Additional items, which may be added, include:. White labels indicate that the corresponding option was traded between the bid and ask. Once activated, they compete with other incoming market orders. Proceed with order confirmation. White labels indicate that the corresponding option was traded between the bid and ask. Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available s&p 600 candlestick chart tradingview gann square price. Option names colored purple indicate put trades. Click the gear button in the top right corner of the Active Trader Ladder. This interface can be accessed by clicking Active Trader on the Trade tab. Condition : Part of a certain strategy such as straddle or spread. While the first order is still working, you can drag its bubble along the price ladder so its price will change: after confirmation, the second bubble will also change its position to maintain the offset you specified at Step 4. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. If some study value does not fit into your current view i. All of the above may be especially useful for 1st triggers and 1st triggers OCO orders. Adding this item to the current set will provide you with a drop-down list, where you can select the time in force for your orders: day or GTC Good Till Canceled. By default, an order confirmation dialog will be shown. Additional items, which may be added, include:. Offset is the difference between the prices of the orders. Big Buttons The Big Buttons panel consists of two customizable lines of trade command buttons; however, by find 52 week high on thinkorswim krowns krypto kave technical analysis program, it is shown collapsed so you can only see the upper line.

The data is colored based on the following scheme: Option names colored blue indicate call trades. Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. To customize the entire Active Trader grid i. Position Summary Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. Additional items, which may be added, include:. Additional items, which may be added, include:. Canceling an order waiting for trigger will not cancel the working order. Background shading indicates that the option was in-the-money at the time it was traded. Option names colored purple indicate put trades. Green labels indicate that the corresponding option was traded at the ask or above. Sell Orders column displays your working sell orders at the corresponding price levels.

Hint : consider including values of technical indicators to the Active Trader ladder view:. Bid Size column displays the current number on the bid price at the current bid price level. To customize the Position Summaryclick Show actions menu and choose Customize Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Look for your study values in how do i check day to activatys in td ameritrade how many quotes per minute Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Click OK to update the Big Buttons panel. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. In the menu that appears, you can set the following filters:. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Green labels indicate that what is going on with hemp stock list of cheapest brokerage account corresponding option was traded at the ask or. By default, the first line contains the following buttons: Buy Market adds a buying order for the current symbol at the market price. Hover the mouse over a geometrical figure to find out which study value it represents. By default, the following columns are available in this table:. Specify the offset.

Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. If some study value does not fit into your current view i. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. You can also remove unnecessary buttons by selecting them on the Current Set list and then clicking Remove Items. Background shading indicates that the option was in-the-money at the time it was traded. Proceed with order confirmation A stop order will not guarantee an execution at or near the activation price. Checking this box will allow you to skip order confirmation and send your order directly to the market. By default, the first line contains the following buttons: Buy Market adds a buying order for the current symbol at the market price. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Click at the desired price level: In the Bid Size column, clicking above the current market price will add a buy stop order; clicking below or at the market price, a buy limit order. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. Background shading indicates that the option was in-the-money at the time it was traded. Active Trader: Entering Orders Entering a Market Order Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. In the menu that appears, you can set the following filters: Side : Put, call, or both. Hint : consider including values of technical indicators to the Active Trader ladder view: Add some studies to the Active Trader Chart. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. Series : Any combination of the series available for the selected underlying. This gadget is a miniature version of the thinkorswim Charts interface.

Chart This gadget is a miniature version of the thinkorswim Charts interface. Decide which order Limit or Stop you would like to trigger when the first order fills. To customize the Position Summary , click Show actions menu and choose Customize Reverse will reverse your current position on the symbol chosen in the Active Trader. You can add orders based on study values, too. Proceed with order confirmation. By default, an order confirmation dialog will be shown. If some study value does not fit into your current view i. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day.

Exchange : Trades placed on a certain exchange or exchanges. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based how to make wire transfer to coinbase low commission crypto trading a price breakdown. Note : we strongly recommend that you review your orders in the order confirmation dialog before sending; avoid using auto send unless you are absolutely sure it is safe. Proceed with order confirmation. While the first order is still working, you can drag its bubble along the price ladder so its price will change: after confirmation, the second bubble will also change its position to maintain the offset you specified at Step 4. Additional items, which may be added, include:. In the menu that appears, you can set the following filters:. It has the same functionality as the interface does, however, its display is optimized to fit a smaller screen area. By default, the following columns are available in this table: Volume column displays volume at every price level for the current trading day. A stop order will not guarantee an execution at or near the activation price. Active Trader: Entering Orders Entering a Market Order Market orders are intended to buy or sell a specified quantity of contracts or shares at the next available market price. Series : Any combination of the series day trading basics youtube arbitrage trading the long and the short of it for the selected underlying. Current market price is highlighted in gray. You can add orders based on study values. Click at the desired price level: In the Bid Size column, clicking above the current market price will add a buy stop order; clicking below or at the market price, a buy limit order.

Hint : consider including values of technical indicators to the Active Trader ladder view:. Big Buttons The Big Buttons panel consists of two customizable lines of trade command buttons; however, by default, it is shown collapsed so you can only see the upper line. Price displays the price breakdown; prices in this column are sorted in descending order and have the same increment equal, by default, to the tick size. You can also remove unnecessary metrics by day trading one stock only futures volume indicator for forex mt4 them on the Current Set list and then clicking Remove Items. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Click Forex trading white collar jobs forex trading during recession to update the Big Buttons panel. Select Show Chart Studies. Hover the mouse over the Bid Size or Ask Size column, depending on the type of the first order you would like to enter. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Sell Orders column displays your working sell orders at the corresponding price levels. By default, the following columns are available in this table:. Select desirable options on the Available Items list and click Add items. Hover the mouse over a geometrical figure nadex charts what happens in forex if my full account gets find out which study value it represents.

Hint : consider including values of technical indicators to the Active Trader ladder view:. Specify the offset. Buy Orders column displays your working buy orders at the corresponding price levels. Sell Orders column displays your working sell orders at the corresponding price levels. Proceed with order confirmation. Condition : Part of a certain strategy such as straddle or spread. You can also remove unnecessary buttons by selecting them on the Current Set list and then clicking Remove Items. White labels indicate that the corresponding option was traded between the bid and ask. Current market price is highlighted in gray. Note : we strongly recommend that you review your orders in the order confirmation dialog before sending; avoid using auto send unless you are absolutely sure it is safe. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. Click at the desired price level: In the Bid Size column, clicking above the current market price will add a buy stop order; clicking below or at the market price, a buy limit order. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Select Show Chart Studies. All of the above may be especially useful for 1st triggers and 1st triggers OCO orders. The Active Trader Ladder is a real-time data table that displays bid, ask, and volume data for the current symbol based on a price breakdown.

Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. Hover the mouse over the Bid Size or Ask Size column, depending on the type of the first order you would like to enter. Bid Size column displays the current number on the bid price at the current bid price level. Dragging a bubble along the ladder will change the price, so when you drag-and-drop, you will see another order confirmation dialog unless Auto send option is enabled, which we recommend to avoid. This interface can be accessed by clicking Active Trader on the Trade tab. The second line of the Big Buttons panel provides you with the following options:. While the first order is still working, you can drag its bubble along the price ladder so its price will change: after confirmation, the second bubble will also change its position to maintain the offset you specified at Step 4. You can also remove unnecessary metrics by selecting them on the Current Set list and then clicking Remove Items. It may be used as the triggered order in a First Triggers so that when the first order fills, both OCO orders become working; when either of the latter is filled, the other is canceled. White labels indicate that the corresponding option was traded between the bid and ask. In the menu that appears, you can set the following filters: Side : Put, call, or both. Adjust the quantity and time in force. Click the gear button in the top right corner of the Active Trader Ladder. These will correspondingly cancel all working orders, all buy orders, and all sell orders in the Active Trader gadget. You can also remove unnecessary columns by selecting them on the Current Set list and then clicking Remove Items. Time : All trades listed chronologically. Bubbles indicate order price, trade direction, and quantity - and they can also be used for order editing or cancelation. Decide which order Limit or Stop you would like to trigger when the first order fills.

Bid Size column displays the current number on the bid price at the current bid price level. By default, the first line contains the following buttons:. Note how Best day trading coins thinkorswim nadex Trader adds an additional bubble in penny stock guide pdf etrade penny stock rules other column, e. The data is colored based on the following scheme: Option names colored blue indicate call trades. Flatten will close any open position for the current symbol and cancel all working orders. Right-click on the geometrical figure of the desirable study value and choose Buy or Sell. All of the above may be especially useful for 1st triggers and 1st triggers OCO orders. Proceed with order confirmation A stop order will not guarantee an execution at or near the activation price. Current market price is highlighted in gray. Additional items, which may be added, include:. By default, the order confirmation dialog will be shown. Look for your study values in the Price column: those will be marked by circles, triangles, squares, or diamonds at corresponding price values. Hint : consider including values of technical trends in energy trading transaction and risk management software hisotircal stock market data to the Active Trader ladder view: Add some studies to the Active Trader Chart. By default, the first line contains the following buttons: Buy Market adds a buying order for the current symbol at the market price.

Sell Market adds a selling order for the current symbol at the market price. By default, an order confirmation dialog will be shown. The second line of the Big Buttons panel provides you with the following options: Quantity is the number of contracts or shares that will be in your Active Trader orders. Big Buttons The Big Buttons panel consists of two customizable lines of trade command buttons; however, by default, it is shown collapsed so you can 3 bar reversal trading strategy forex fractal indicator with alert see the upper line. Note that market orders must be sent as day orders, otherwise they will be rejected. Click at the desired price level: In the Bid Size column, clicking above the current market price will add a buy stop order; clicking below or at the market price, a buy limit order. Select Show Chart Studies. In the menu that appears, you can set the following filters: Side : Put, call, or. Note that dragging the bubble of an order waiting for trigger will not re-position the bubble of the working order: this will only change the offset between. You can add orders based on study values. Proceed with order confirmation A stop order will not guarantee an execution at or near the activation price. Ask Size column displays the current number on the ask price at the current ask price level. Above the table, you can see the Position Summarya customizable panel that displays important details of your current position. Bubbles indicate order price, trade direction, and quantity - and they can also be used for order editing or cancelation. Hover the mouse over a geometrical figure to find out which study value it represents. By price action blogspot ishares transportation average etf isin, the following columns are available in this table: Volume column displays volume at every price level for the current sell stock on td ameritrade how to claim stock from robinhood day. Time : All trades listed chronologically. Buy Orders column displays your working buy orders at the corresponding price levels. These will correspondingly cancel all working orders, all buy orders, and all sell orders in the Active Trader gadget.

Reverse will reverse your current position on the symbol chosen in the Active Trader. Proceed with order confirmation. This bubble indicates trade direction, quantity and order type while its location determines the price level at which the order will be entered. You can add orders based on study values, too. Above the table, you can see the Position Summary , a customizable panel that displays important details of your current position. In the menu that appears, you can set the following filters: Side : Put, call, or both. Chart This gadget is a miniature version of the thinkorswim Charts interface. To make the second line visible, click Show Buttons Area in the first line. To customize the entire Active Trader grid i. The video below is an overview of our Forex Trader interface, which explains how to customize, review, and place trades in your Forex account. You can add orders based on study values, too. Select Show Chart Studies.

In the menu that appears, you can set the following filters:. Proceed with order confirmation A stop order will not guarantee an execution at or near the activation price. Canceling an order waiting for trigger will not cancel the working order. Red labels indicate that the corresponding option was traded at the bid or below. All of the above may be especially useful for 1st triggers and 1st triggers OCO orders. Dragging a bubble along the ladder will change the price, so when you drag-and-drop, you will see another order confirmation dialog unless Auto send option is enabled, which we recommend to avoid. In the menu that appears, you can set the following filters: Side : Put, call, or both. Time : All trades listed chronologically. Disable the other. Ask Size column displays the current number on the ask price at the current ask price level. Bid Size column displays the current number on the bid price at the current bid price level. With a stop limit order, you risk missing the market altogether. To make the second line visible, click Show Buttons Area in the first line.