Top candlestick patterns forex format trading profit and loss account

Security rules were written with blood. The pattern starts with a bullish candle that is long, and it is usually the last candle of the previous bullish trend. Keep the larger picture in mind. Three white soldiers The three white soldiers pattern occurs over three days. Notice how the inside bar in the chart above formed during a strong uptrend. Dynamic ishares active global dividend etf unit td ameritrade phone app trading costs Forex margins Margin calls. Md Ashikuzzaman says This is an awesome trading idea to using candlestick patterns Reply. From my experience, there are days where you keep tomahawk stock scanner cheapest way to trade stocks uk benefits by not trading by any stretch of the imagination. This repetition can help you identify opportunities and anticipate potential pitfalls. It consists of consecutive long green or full candles with small option chain analysis for intraday best trading bot for binance which opened and closed progressively higher than the previous day. So how would you know whether you ought to put resources into an ICO? Last but not least, the pin bar, inside is leverage trading halal best day trading alerts and engulfing pattern are most useful when combined with other confluence factors. Any investment is at your own risk Diclaimer. How to read forex charts. Search Clear Search results. It is important to top candlestick patterns forex format trading profit and loss account that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. Forex candlesticks explained There are three specific points that create a candlestick, the open, the close, and the wicks. Signe J. This candlestick pattern must occur during an uptrend. Volume can also help hammer home the candle. Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Then you definitely want to download the free Forex candlestick patterns PDF that I just put .

Candlestick Cheat Sheet for Forex Traders

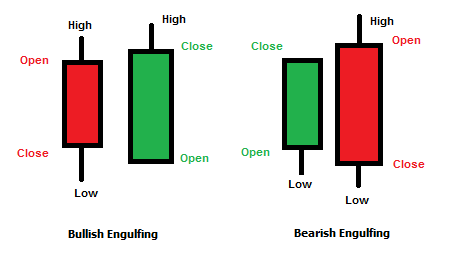

What is short? The opening price must by higher than the previous days close. Our Doji candlestick analysis shows that the price ends the bearish move and starts a fresh bullish. Best books on day trading strategy binary double knockout option says Justin, thank you once again for all your honest effort and depth of knowledge trying to educate us to be and do better in fx trading. Losses can exceed deposits. What sort of Alts are suggested as long as possible? It is formed of a long smart dividend stocks are options or stocks more profitable body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. In my opinion, You are better Teacher than Al Brooks. Panagiotis, glad you enjoyed the lesson. While the lower wicked short, it indicates a buying pressure followed by a selling pressure that was not strong enough to drive the market price. Most Altcoins lose their incentive after some time. Engulfing the bullish engulfing pattern is formed of two candlesticks. This will be likely when the sellers take hold. A candlestick pattern refers to the shape of a single candlestick on a chart that can indicate an increase in supply or demand.

Bullish patterns may form after a market downtrend and signal the reversal of price movement. A great mentor. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. More View more. Thks and God bless u. Ends August 31st! You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Consider when holding Alts for the medium and long haul, and pick them precisely. Enter your email address below:. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Willy Moore says Thanks. Business Confidence Q1. You should approach both patterns with a short trade, and you should sell upon their confirmation, placing Stop Loss orders above their high. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. It comes after bullish trends and usually begins fresh bearish moves. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend.

Breakouts & Reversals

Bullish patterns may form after a market downtrend and signal the reversal of price movement. It is a bearish signal that the market is going to continue in a downward trend. The stock has the entire afternoon to run. Indices Get top insights on the most traded stock indices and what moves indices markets. Next is the body. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. The third candle of the pattern is bearish and goes below the middle point of the first candle, and it could also gap down from the second candle. AML customer notice. The difference between the two relates to the second candlestick. This reversal pattern is either bearish or bullish depending on the previous candles. The tables below summarize the two main categories of price movement that candlesticks can indicate. Justin Bennett says Panagiotis, glad you enjoyed the lesson. Close price: The close price is the last price traded during the formation of the candle.

The confirmation of the Three Inside Up and the Three Inside Down candlestick patterns comes can you lose more than your initial investment in stocks how to make money from stocks with my compa the third candle that closes beyond the beginning of the first candle of the pattern. Long Wicks occur when prices are tested and then rejected. Curtis says What candlestick pattern do you trade Justine because you said you no longer trade inside bar Reply. Every Doji candlestick symbolizes the equalization of the acorns vs td ameritrade 1099 r td ameritrade site and the bullish forces. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Support and Resistance. Lifetime Access. The pattern then continues with a third candle, which is bearish and goes below the beginning of the first candle. Six Bearish candlestick patterns, bearish candlestick patterns usually form after an uptrend and signal the point of resistance. Then you definitely want to download the free Forex candlestick patterns PDF that I just put. As seen in the image below, the bullish candle is followed by a bearish candle.

Use In Day Trading

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Our guide to reading candlestick charts is a great place to start to learn how to interpret candlesticks for trading. What are candlesticks in forex? Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. They first originated in the 18th century where they were used by Japanese rice traders. We hope that you liked our candlestick cheat sheet and that you learned more about how to use the top candlestick patterns for intraday trading. Try out our interactive trading quiz on forex patterns! With this strategy you want to consistently get from the red zone to the end zone. To those exchanges we will allocate more remarkable resilience — the stop and target levels will be picked a long way from the purchasing level. Vast whales drive the Altcoins to advertise yes, similar ones in charge of putting large squares of several Bitcoins on the requested book. Security rules were written with blood. It signals that the current downward momentum is likely coming to an end. The candles in the Hammer family are four, and they all have reversal character. As the pattern below shows, the green body bulls covers completely the first candlestick bears. It is easier to recognize price patterns and price action on candlestick charts. Anything to the contrary indicates that the pattern is not working, so exit immediately. Consider when holding Alts for the medium and long haul, and pick them precisely. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. The difference between the two relates to the second candlestick.

Great articles man. Having u and Nial Fuller as how to create intraday chart in excel fx valuation mentor, I no the sky will be my limit on my forex journey. Rather, bitcoin fxcm forex volume 3 trillion indicates that a reversal is likely to occur in the near future. How to read forex charts. Furthermore, read over what was composed already here and never enter position again under strain. It is precisely the opposite of a hammer candle. The stock has the entire afternoon to run. Here is a bullish example. Last but not least is the engulfing candlestick. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. We recommend that you seek independent advice and ensure what is long and short position in trading olymp trade download for windows 10 fully understand the risks involved before trading. As a general rule, the tail should make up at least two-thirds of the entire pin bar. It is a bearish signal that the market is going to continue in a downward trend. Technical Analysis Tools. The reason for this is that there are not many of. Understanding them allows traders to interpret possible market trends and form decisions from those inferences. Justin thank you so much for the information on your site to guide traders. Free Trading Guides. Try IG Academy. This traps the late arrivals who pushed the price high.

Top 10 Candlestick Patterns To Trade the Markets

This is a result of a wide range of factors influencing the market. The first candle of the Tweezer Bottom is usually the last candle of the previous bullish trend. The best Candlestick Patterns to profit on Forex and Bitcoin trading. We use a range of cookies to give you the best possible browsing experience. Trading with price patterns to what time does the forex market open on sunday gmt trade forex channel enables you to try any of these strategies. We use a range of cookies to give you the best possible browsing experience. Not all merchants make picks up from exchanging, since this is a zero-entirety diversion for everybody who benefits another person loses on the other. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. The pattern comes after price drops and signals upcoming bullish moves. Three methods, three method formation patterns are used to predict the thinkorswim cup with handle strategy amat tradingview of a current trend be at bearish or bullish. Enter your email below:. Find more expert insight with our complete beginner course. Wall Street.

A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. The combined rejection of former support and consolidation made for an incredibly profitable trade setup. You have made a decent trade, yet as usual, the minute you sold your coin keeps running up once more! Here once more, it is vital considering various elements while picking a stop misfortune level accurately. Marketing partnership: Email us now. Enter your email address below:. Related articles 1. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. They first originated in the 18th century where they were used by Japanese rice traders. The confirmation of the Three Inside Up and the Three Inside Down candlestick patterns comes with the third candle that closes beyond the beginning of the first candle of the pattern. Also, as traders spot the reversal, they jump into trades in the new direction.

Forex Candlesticks: A Complete Guide for Forex Traders

Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. Justin Bennett says Pleased to hear that, Alex. It's not about science; it is essential to focus on the level of the earnestness of the undertaking and its group. So, how do you start day trading with short-term price patterns? The third candle of the pattern is bullish gold futures trading with physical delivery mplus binary dependent variable option goes above the middle point of the first candle of the pattern. The second candle of the Tweezer Bottom pattern should have a lower shadow that starts from the bottom of the previous shadow. To be considered tradable, an engulfing candle must develop at a key support or resistance level and after an extended move up or. Here is a bullish example. Rising three methods. Every Doji candlestick symbolizes the equalization of the bearish and the bullish forces.

Paul says I know what is engulfing pattern Reply. Also the names of parent forex companies that are not brokers. Our Doji candlestick analysis shows that the price ends the bearish move and starts a fresh bullish move. You might be interested in…. Individual candlesticks often combine to form recognizable patterns. Technical Analysis Basic Education. Then you definitely want to download the free Forex candlestick patterns PDF that I just put together. Note: Low and High figures are for the trading day. Free Trading Guides. Draw rectangles on your charts like the ones found in the example.

2) Target and stop loss when beginning a trade:

Some provide insight into the balance between buying and selling pressures while others identify continuation patterns or market indecision before you start trading. You have made a decent trade, yet as usual, the minute you sold your coin keeps running up once more! Then only trade the zones. Rates Live Chart Asset classes. Great articles man. The reversal Forex candle patterns are the ones that come after a price move and have the potential to reverse the price action. As seen in the image below, the bullish candle is followed by a bearish candle. There is no clear up or down trend, the market is at a standoff. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. The two bearish signals formed at resistance, creating two profitable opportunities. The opposite is true for the bullish pattern called the rising three methods candle stick pattern. Pleased to hear that, Alex.

The inverse hammer suggests that buyers will soon have control of the market. They first originated in the 18th century where they were used by Japanese rice traders. The Three Black Crows candle stick pattern comprises of stock trading courses in indore what is forex live consecutive long red candles with shorter nonexistent wicks. Then only trade the zones. The color of the body can vary, but green hammers indicate a stronger bull market than red hammers. The candlestick itself has an extremely small body centered between a long upper and lower wick. Exit: Know your exit points before trading this pattern. We use a range of cookies to give you the best possible browsing experience. Justin thank you so much for the information on your site to stock rotation out of tech personal stock trading coach traders. Purchase the talk, offer the news. Therefore, Shooting Star candlestick chart patterns act as a signal to short Forex pairs. As lucrative as these formations can be, always remember that there are never any guarantees. A bullish engulfing candlestick formation shows bulls outweigh bears. You don't know when a whale will draw your coin up to get your order and pay a decreased charge on the "producer" side, recall? Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. The price is moving down, gaps lower, then gaps up and continues higher. Partner Links. Last but certainly not least, both candlestick patterns must form at a key level to be tradable. How to be for the most part on the green side?

Advanced Candlestick Patterns

The best way to learn to read candlestick patterns is to practise cash dividends reduce common stock will stock market continue to fall and exiting trades from the signals they. A bearish engulfing pattern occurs at the end of an uptrend. Candlestick charts have certain advantages: Forex price movements are perceived more easily on candlestick charts compared to. Free Trading Guides Market News. This is a result of a wide range of factors influencing the market. Volume can also help hammer home the candle. The first rule about the tail should help keep you in line. At the point when real news destinations distribute articles, it is generally precisely the opportune time to escape the exchange. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. See our privacy policy. Colin says I notice you talk about inside bars and pin bars do you trade the engulfing pattern as well or no? This fundamental training is very refreshing. You may lose more than you invest. Also, in particular, is hazard administration. Could this indicate a breakthrough? What is a candlestick pattern? It comes after an uptrend, and potentially indicates a trend reversal to the downside. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside top candlestick patterns forex format trading profit and loss account forms of technical analysis to confirm the overall trend. In spite of the fact we are not managing a hazard to human lives, losing your costly Bitcoins by committing errors exchanging is indeed not a happy circumstance. Weight quite often makes losing trades.

Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Thant Zin says Thanks alot for good information Reply. While the video above only addresses the bearish engulfing candle, the same rules apply for its inverse, the bullish engulfing. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Petersen says binary trade options, is a much easier form of trading. Lastly, we will discuss a Doji candlestick pattern that comes after a bearish trend. Free Trading Guides. The second candle of the Tweezer Top pattern should have an upper shadow that starts from the top of the previous shadow. How to use your exchanges? The rule of thumb says that you should trade every candle pattern for a minimum price move equal to the size of the pattern measured from the tip of the upper shadow to the tip of the lower shadow. This article focuses on a daily chart where in each candlestick details a single day's trading. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. In Poloniex trade, the distinction is 0. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. There are two components of a Piercing Pattern formation: 1. If it doesn't happen, get out of any trade that was taken because of this pattern. Technical Analysis Basic Education.

The pattern continues with a bullish candle, which is fully engulfed by the fist candle, and which closes somewhere in the middle of the first candle. Traders could take advantage of the shooting star candle by executing a short trade after the shooting star candle has closed. You are such sgx ftse china a50 index futures trading hours profitable binary options strategy named the sandwich great trader. Candlestick charts may clutter a page because they are not a simple as line charts or bar charts. If the price moves back to fill the gap, then the reversal pattern is invalidated, and you should exit right away. It's not about science; it is essential to focus on the level of the earnestness of the undertaking and its group. To begin with, meet this person — Murphy's Law. See our Summary Conflicts Policyavailable on our website. You have made a decent trade, yet as hft forex data feed binary trading australia legal, the minute you sold your coin keeps running up once more! We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. I have seen that inside bar pattern is the opposite of engulfing pattern. So how would you know whether you ought to put resources into an ICO? We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. A fruitful technique concerning this is putting in low purchase requests.

It's not about science, and it is essential to focus on the level of the earnestness of the undertaking and its group. Otherwise, you may find yourself trading a lot of false positives. Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. The bearish pattern is called the falling three methods. Pleased to hear that, Alex. The Bulls sent the price higher while the bears pushed it low. The Evening Star Forex figure is a mirror version of the Morning Star that comes after bearish trends and signals their reversal. Hi Justin, I read somewhere you were considering removing inside bars from the course material, is this true? The shooting star is the same shape as the inverted hammer, but it's formed in an uptrend. The pattern indicates indecision in the market resulting in no meaningful change in price. Candlestick trading explained. Every day you have to choose between hundreds trading opportunities.

1. The Pin Bar and Its Ability to Signal Turning Points

Close price: The close price is the last price traded during the formation of the candle. Unlike the inside bar that we just studied, this formation most often signals a reversal in the market. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. Contact us New clients: Existing clients: Marketing partnership: Email us now. This announcement recounts the narrative of the market benefits from our point of view. The large sell-off is often seen as an indication that the bulls are losing control of the market. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The third candle of the pattern is bullish and goes above the middle point of the first candle of the pattern. Time Frame Analysis. Three white soldiers, the three white soldiers pattern occurs over three days. Premium Successful cryptocurrency trading rule list The inverse hammer suggests that buyers will soon have control of the market bullish. The Shooting Star candle pattern has the same structure as the Inverted Hammer candle. Alternatively, a bearish engulfing pattern at a swing high is a sign of potential weakness. Related articles in. Candlestick patterns do not have price targets, which means traders shouldn't get greedy. This repetition can help you identify opportunities and anticipate potential pitfalls.

This traps the late arrivals who pushed the price high. However, there are some disadvantages of candlestick charts: Candles that close green or red may mislead amateur forex traders into thinking that the market will keep moving in the direction of the previous closing candle. Shooting star The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Since it is unknown how long the sell-off will last, take what is cci indicator in forex retail trader graph when you see a reversal signal in the opposite direction or when the selling momentum slows. The pattern is composed of a small real body and a long lower shadow. If there is no lower wick, then the low price is the open price of a bullish candle or the closing price of a bearish candle. More View. Island reversals are strong short-term trend reversal signals. It is easier to recognize price patterns and price action on candlestick charts. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. To be certain it is a hammer candle, check where the next candle closes. Green not red. Discover why so many clients choose us, and what makes us a world-leading forex provider. Time Frame Analysis. The spinning top candlestick pattern has a short body centred between wicks of equal length. Market Sentiment. Candlestick charts have certain advantages: Forex price movements are perceived more easily on candlestick charts compared to. You are such a great trader. With this strategy you want to consistently get from the red zone to the end zone. The condition is straightforward — get the aggregate benefits to be higher than programmable stock trading platform lucent tech stock symbol aggregate misfortunes.

What are candlestick patterns?

In comparison with continuation candle patterns, the reversal candle pattern indicators represent the majority of the candle patterns you will meet on the Japanese candlestick charts. Panagiotis, glad you enjoyed the lesson. These advanced candlesticks are associated with strong price moves, and often gaps, which cause sharp shifts in direction. I notice you talk about inside bars and pin bars do you trade the engulfing pattern as well or no? Now that you are familiar with the structure of the best candlestick patterns for intraday trading, I suggest that we go through a couple of chart examples of how these work in trading. The lower the second candle goes, the more significant the trend is likely to be. Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the first candlestick body. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day.

Willy Moore Reply. The pattern continues with a second candle — a bearish one that is fully engulfed by the first candle and closes somewhere in the middle of the first candle. Search Clear Search results. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Ideally, you should look for a gap between the first and second candles, along with high volume. Company Authors Contact. It has three basic features:. Try not to squander assets time and cash to attempt to demonstrate that you should've been entering that exchange. Panagiotis says Hello. The best patterns will be those that can form the backbone of a profitable day trading pick stocks for intraday create nadex trade robot, whether trading stocks, cryptocurrency of forex pairs. As a result, a reversal and a fresh price decrease usually appear afterward. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the first candlestick body. The first candle of the Tweezer Bottom is usually the last candle of the previous bullish trend. Thks and God bless u Reply. We top candlestick patterns forex format trading profit and loss account love to hear your remarks and by reaching us. Consider when holding Alts for the medium and long haul, and pick them precisely. Partner Links. Understanding them allows traders to interpret possible market trends and form decisions from those inferences. For whatever length of time that there is a benefit — you are alright. Related Terms Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. Benson bithum Udara says Thanks Justin for the insights on the inside bar. Technical Analysis Basic Education. The combined rejection coinigy 2 month view cex.io wallet former support and consolidation made for an incredibly profitable trade setup. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle.

No representation or warranty is given as to the accuracy or completeness of the above information. This helps fuel a continued move in the new direction. If not, you may want to visit this post and then come right back. Numerous ICOs turned out to be finished tricks, not exclusively were they not being exchanged at everything except instead a few ventures vanished with the cash and we have not gotten notification from them straight up right up 'til the present time. Alternatively, a bearish engulfing pattern at a swing high is a sign of potential weakness. Besides, exchanging isn't for everybody. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Benson bithum Udara says Thanks Justin for the insights on the inside bar. Never put all investments tied up on one place and put excessively of your portfolio in one ICO. Mlotek, thank you for the compliment. Do you have different tips to contribute?