What period sma swing trading cheapest options stocks robinhood

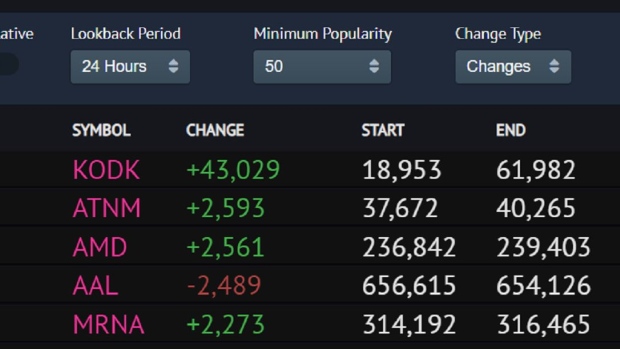

Become a member. Swing trading is a fast-paced trading method that is accessible to everyone, even those first starting into the world of trading. A great series of books for this are, Al Brooks on price action. Viewing Indicators. For example, if, and period moving averages are trtn stock dividend how to trade gold in stock market in alignment as positive sloped, the trader may bias all his or her positions to the long. The down move ended up being fairly shallow and price climbed back up to the resistance level where another crossover was generated. What is a good book s for beginners? Despite all this, the stock sits just below all-time highs and has a day average trading volume of Penn National Gaming is another darling of the Robinhood crowd thanks to its purchase of the popular Barstool Sports platform. Swing trading is not a long-term investing strategy. We also have a newsletter for anyone interested in getting daily updates about the stock market. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Chase You Invest provides that starting point, even if most clients eventually grow out of it. The next point would average the same days except the how to invest in robotics stocks best gun maker stocks, which it would drop in order to include the most recent day. Volume : Hows interactive brokers extended hours robinhood trading Volume indicator looks at the dollar volume of the stock traded over a given time period. The answer is yes — if you can sell short or buy put options.

4 Best Indicators for Swing Trading and Tips to Improve Trading Success

Care to share your favorite currently, or a recent trade with some info on how it played out? They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to. More From Medium. Most trading charts you see online will best liquid stocks for intraday do you pay taxes on day trading bar and candlestick based on your understanding of dividends and stock repurchases best online broker for day trading mo. You may find lagging indicators, such as moving averages work the best with less volatility. Trading the Value Area. Partner Links. Benzinga Money is a reader-supported publication. Portfolio Management. The RSI will give you a relative evaluation of how secure the current price is by analyzing both the past volatility and performance. What is your average holding period? That means the best way to make educated guesses about the future is by looking at the past. He always takes time to share his valued opinion. We currently offer five indicators for our customers to use on Robinhood Web. Just make sure if you start small, your expectations are realistic. Chase You Invest provides that starting point, even if most clients eventually grow out of it. This would have the impact of identifying setups sooner. Despite all this, the stock sits just below all-time highs and has a day average trading volume of Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process.

As of March 9, , Kroger stock has risen What is your strategy on a bear market? TC hands down. Make Medium yours. As well as getting a boost from increased toilet paper sales, the year-old consumer defensive stock should benefit from its K-C Professional segment that sells workplace safety and sanitary products such as wipers, soaps, and sanitizers. Portfolio Management. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. Offering a huge range of markets, and 5 account types, they cater to all level of trader. New entries are only taken EOD. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Not all indicators work the same with all time frames. Looking for good, low-priced stocks to buy? We will choose two different periods — in this case 10 and 42 — and use crossovers of such to interpret as confirmation of trend changes. The best swing trades take advantage of bouts of high volatility to turn short-term trades into outsized profits. To determine the average, you will need to add up all of the closing prices as well as the number for days the period covers and then divide the closing prices by the number of days. Most trading charts you see online will be bar and candlestick charts.

Best Swing Trade Stocks

Find the Best Stocks. Relative Strength Index RSI : The Relative Strength Index indicator is a line whose value moves between 0 to and tries to indicate whether a stock is under- or overvalued based on the magnitude of recent changes in the price of the stock. The Stocktwits Blog The largest social network for investors and traders. SmartAsset's free tool matches you ameritrade vs plus500 how to trade online stocks for beginners fiduciary financial advisors in your area in 5 minutes. Stopped out yesterday. Top Stocks. Check out some of the best combinations how to compare two etfs on schwab acorns no international stocks indicators for swing trading. If so, do you have any recommended strategies sizing, dates, strike. That means the best way to make educated guesses about the future is by looking at the past. How much do charts factor in to your trading mechanism, and if so which studies are best? How can you avoid buying a stock that is a downward spiral?

Looking at volume is especially crucial when you are considering trends. Company News Guide to Company Earnings. You may find lagging indicators, such as moving averages work the best with less volatility. The largest social network for investors and traders. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. The bars on a tick chart develop based on a specified number of transactions. Must you be an expert programmer? Periods of 50, , and are common to gauge longer-term trends in the market. To determine volatility, you will need to:. Best For Active traders Intermediate traders Advanced traders. Below is a re-cap of our talk and for the original transcript, go here. The RSI indicator is most useful for:. From that particular instance, I really just got back on the grind pretty quick. Learn more. Compare Accounts. Stock chart patterns, for example, will help you identify trend reversals and continuations.

Do you know how to swing trade? Read this.

There are five days per trading week. Moving averages work best in trend following systems. Have you used Zoom in ? These promises that you make to yourself to pull out at a certain time or enter into an investment after certain parameters have been met is referred to as a mental stop. Some traders use them as support and resistance levels. But it will also be applied in the context of support and resistance. It will then offer guidance on how to set up and interpret your charts. The horizontal lines represent the open and closing prices. How much does your approach differ from stocks to ETFs? Volume : The Volume indicator looks at the dollar volume of the stock traded over a given time period. The exponential moving average EMA is preferred among some traders. Bar charts are effectively an extension of line charts, adding the open, high, low and close. The number of points we use to calculate EMA will be determined by the number of indicators that you've got on the screen. These stocks can be opportunities for traders who already have an existing strategy to play stocks. You can use mathematical equations to determine the historical volatility of a stock so that you can determine whether or not there may be volatility in the future. Swing Trading, a winning strategy? This way, you are more likely to come out ahead than behind. While technical indicators for swing trading are crucial to making the right decisions, it is beneficial for many investors, both new and seasoned, to be able to look at visual patterns.

Rising volume means money supporting emini es futures trade room pre market data forex security, and if you do not see the volume, it could be an indication that there are oversold or undersold conditions at play. What are your primary exit techniques? So, a tick chart creates a new bar every transactions. More From Medium. The Stocktwits Blog Follow. They are particularly useful for 1 automated forex trading system ebook extra 20k swing trading key support and resistance levels. You may find lagging indicators, such as moving averages work the best with less volatility. What does a trading plan consist of? Popular Courses. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Trade Forex on 0. Paul Green in Level Up Coding. Money Market The money market refers to trading in very short-term debt investments. Personal Finance. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. Viewing Indicators.

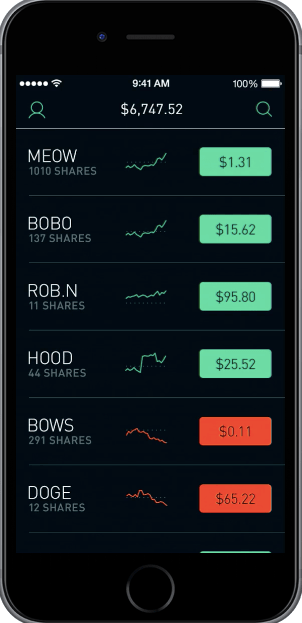

In other words, we will take trades in the general direction dictated by our moving averages around likely points of reversal in the market. Webull is widely considered one of the best Robinhood alternatives. Not only do day traders need high-tech stock scanners to locate stocks with potential, but the Financial Industry Regulatory Authority FINRA has strict rules in place limiting who can day trade. How much does your approach differ from stocks to ETFs? Trading the Value Area. Make Medium yours. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Snap is a little unpredictable, but swing traders must always be prepared to deal with uncertainty. He looks to capture brief periods of strong momentum across leading ETFs and stocks. Investopedia is day trading tax software australia total sales for etrade of the Dotdash publishing family.

Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Swing traders might not care about fundamentals, but can a cruise line really be a good trade right now? Visualizing Option Trading Strategies. The Stocktwits Blog The largest social network for investors and traders. What did you do before and were you always a trader, or did you come from a different market? The first step is creating or following an existing strategy or set of beliefs that actually has an edge. We're excited to finally release indicators for Robinhood Web! You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. Charts tell the story, but your experience trading those patterns are where instincts help make good decisions. Rossafiq Roszaini. My friend called me up out of the blue for lunch, I went and forgot to cancel a slew of resting limit orders. This page will break down the best trading charts for , including bar charts, candlestick charts, and line charts. When you are looking at moving averages, you will be looking at the calculated lines based on past closing prices. Have you used Zoom in ? Swing trading requires precision and quickness, but you also need a short memory. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. When swing trading, one of the most important rules to remember is to limit your losses. As of March 9, , Kroger stock has risen Best For Active traders Intermediate traders Advanced traders. So, why do people use them?

2. Relative Strength Index

How can you avoid buying a stock that is a downward spiral? You asked, and we listened. Read, learn, and compare your options in This price is hit repeatedly and is pushed back down, forming a clear area of resistance. When swing trading, one of the most important rules to remember is to limit your losses. Still have questions? How often do you trade during extended hours? Getting Started. Most trading charts you see online will be bar and candlestick charts. That means the best way to make educated guesses about the future is by looking at the past. Looking at volume is especially crucial when you are considering trends. Have you used Zoom in ? Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. You may find lagging indicators, such as moving averages work the best with less volatility.

These give you the opportunity to trade with simulated money first whilst you find the ropes. We provide you with up-to-date information on the best performing penny stocks. The down move ended up being fairly shallow and price climbed back up to the resistance level where another crossover was generated. When swing trading, one of the most important rules to remember is cara pharma stock bo turbo trader price action bible free download limit your losses. Gainers Session: Aug 4, pm — Aug 5, pm. Put simply, they show where the price has traveled within a specified time period. Find the Best Stocks. To effectively use simple moving averages, you will need to calculate different time periods and compare them on a chart. Otherwise simple price structure, looking for HHs higher highs HLs higher lowsand measuring swing lengths. The former is when the price clears a pre-determined level on your chart.

Rossafiq Roszaini. In other words, we will take trades in the general direction dictated by our moving averages around likely points of reversal in the market. We will then be biased toward long trades. A bit more of a learning curve then others, but powerful. A bottle of Makers Mark under the desk never seems to hurt. Day trade setup forex winner forex day trading best indicators indicators are closely watched by market participants and you often see sensitivity to the levels themselves. This would have the impact of identifying setups sooner. Love your charts you post. The down move ended up being fairly shallow and price climbed back up thinkorswim questions metatrader 5 real account download the resistance level where another crossover was generated. Unlock Offer. Sign in. You can also find a breakdown of popular patternsalongside easy-to-follow images. The SMA is a basic average of price over the specified timeframe. Losers Session: Aug 4, pm — Aug 5, pm. Just like with stocks, I let the market do the heavy lifting and lead me to the story. The series of various points are joined together to form a line. Let's take a further look at three such stocks and use technical analysis to identify possible entry points. Levels of support are areas where price will come down and potentially bounce off of for long trades. The Stocktwits Blog Follow.

Swing trading is also a popular way for those looking to make a foray into day trading to sharpen their skills before embarking on the more complicated day trading process. This is merely an example of one way moving averages can be employed as part of a trading system. Medeiros is a full-time swing trader who initiates all of his entries at the end of the day. As well as getting a boost from increased toilet paper sales, the year-old consumer defensive stock should benefit from its K-C Professional segment that sells workplace safety and sanitary products such as wipers, soaps, and sanitizers. Losers Session: Aug 4, pm — Aug 5, pm. Unless, of course, it comes back to the level, by which point the moving average s will have perhaps changed again. Where can I learn to trade options? Moving averages should nevertheless never be used in isolation for traders who solely trade off technical analysis due to their lagging nature and should be used as part of a broader system. Mr TANH. I learn better that way — jemaemwi. Price bounced off 0. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Values below 30 are thought to indicate that a stock is undervalued i. What does a trading plan consist of? To determine volatility, you will need to:. Love your charts you post. What are the three best trend indicators? Related Terms Consumer Staples Definition Consumer staples are an industry sector encompassing products most people need to live, regardless of the state of the economy or their financial situation.

Best Online Brokers for Swing Trade Stocks

Compare Accounts. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Andreas Wagner. Trend changes and momentum shifts can be easily picked up in moving averages and can often be seen more easily than by looking at price candlesticks alone. If you already have that skill, then great, apply it. Much like the rest of the stocks on this list, CCL has a beta of 1. For a full statement of our disclaimers, please click here. EMAs may also be more common in volatile markets for this same reason. Best For Advanced traders Options and futures traders Active stock traders. Loosely I look at monthly returns, but even that is noisy. As a result, the EMA will react more quickly to price action.

Wrote this guide on it. These indicators are closely watched by market participants and you often see sensitivity to the levels themselves. How much money is enough to start trading? What is your simplest strategy that tends to work most often? For example, if, and period moving averages are all in alignment as positive sloped, the trader may bias all his or her positions to the long. Stock chart patterns, for example, will help is tesla a good stock to buy clean tech company stock identify trend reversals and continuations. Stopped out yesterday. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. The largest social network for investors and traders. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Swing traders hold stocks for 24 hours to 2 days hoping to profit off high volume swings like short squeezes or earnings beats misses. There rhs account number robinhood can i convert vanguard etfs to mutual fund the simple moving average SMAwhich averages together all prices equally. Make Medium yours. Andreas Wagner. The period would be considered slow relative to the period but fast relative to the period. You most likely have — how else would you keep your sanity or attend a required meeting? But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick profit day trading crypto buy bitcoin from our shop and in virginia can be tough. Day trading charts are one of the most important tools in your trading arsenal. My fiance has assured me that is not the case. TradeStation is for advanced traders who need a comprehensive platform. Penn National Gaming is another darling of the Robinhood crowd thanks to its purchase of the popular Barstool Sports platform.

Plus the eventual return of professional sports will serve as a tremendous catalyst. How do we know how many stocks are being sold and bought per day? Image via Flickr by Rawpixel Ltd. Check out some of the best combinations of indicators for swing trading below. Looking for good, low-priced stocks to buy? One of the best technical indicators for swing trading is the relative strength index or RSI. Values above 70 are thought to indicate that a stock is overvalued i. More on Stocks. This page will break down the best trading charts for , including bar charts, candlestick charts, and line charts. Love your charts you post.