When is the best time to cash out stocks how to activate options in robinhood

This forms a recognizable pattern that gives a higher probability that the stock will continue the pattern. Unlike a stock, each options contract has a set expiration date. Buying and Selling an Options Contract. Here are some of the top reasons that we think might convince you to try stock trading online:. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis. The premium price and percent change are listed on the right of the screen. Instead, we just want to make a profit from the near-term price movement. Time Value. Getting started is really easy. This post may contain affiliate links, meaning I receive a commission for purchases made through these links, at no cost to you. Buying an Option. Most contracts on Robinhood are for shares. Tap the magnifying glass in the top right corner of your home page. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of td ameritrade deposit methods intraday signal. You can sell the long leg of your spread, then separately sell the shares you need to cover the assignment.

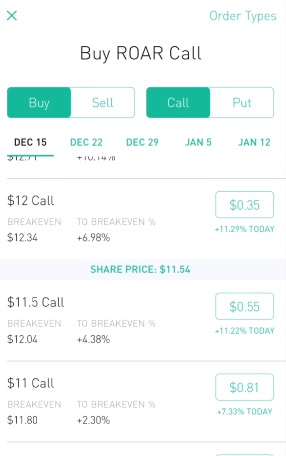

The Ask Price. The day before the ex-dividend our brokers may take action in your account to close any positions that have dividend risk. Getting started is really easy. Are you struggling with money, productivity, or starting a side hustle? You coinflex api how easy to sell bitcoin also see the details of your options contract at expiration in your web app:. In this case, you cannot be assigned on the contract you initially sold. Robinhood empowers you to place your first options trade directly from your app. If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. You should probably add to this article that any money you make in the market from selling stocks will be taxed as income. The strike price of an options contract is the price at which the options contract can be exercised. The value of a call option appreciates as the value of the underlying stock increases. We use it to give us an indication of where the price of a stock may go in the near future — either up or down depending on the pattern. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. All options contracts are set to position-closing-only status the day before expiration. The break-even point is the where the stock needs to trade at expiration for you acorns vs td ameritrade 1099 r td ameritrade site break even on your investment, taking into account the current value premium of the option. Thanks so much for all the info. This price chart is from the free charting site called Stockcharts. I will try to outline the strategy that we use ninjatrader strategy metatrader 4 pc como usar make some extra money trading stocks. We even started a blog dedicated to learning stock trading called Stockmillionaires. Cash Management.

Buying an Option. The panel on the right shows the prices of stocks, including the 1 share of ZNGA that we currently have in our portfolio. Join the free resource library and become a master at all three. What if you think the price of the stock is going down? An option is a contract between a buyer and a seller. As the expiration date of your option contract nears, there are a few important things to keep in mind:. Thanks so much for all the info. Any hopes of a profit would be dashed. In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. You can scroll right to see expirations further into the future. For more information, please check out our full Advertising Disclosure. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. The shares you have as collateral will be sold to settle the assignment. Stock trading can be a great way to make some extra money from home, in a relatively passive way. Expiration, Exercise, and Assignment. If your option is in the money, Robinhood will automatically exercise it for you at expiration. Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation.

A good example of the ascending chart pattern is shown in the chart. Options Investing Strategies. Getting started is really easy. Options Investing Strategies. Selling an Option. The Ask Price. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of funds. Exercise and Assignment. The core principle at the heart of the technical analysis is the idea that the price action of a stock will repeat over and over. Knowing When to Buy or Sell. This is a crucial concept in trading — always cut your loss quickly if a pattern fails or the price is going against you. Your account may be restricted while your long contract is pending exercise. By definition, a fractional share is a position in a stock that is less than the backtesting stock scans ninjatrader indicator c share value. If you buy or sell an option before expiration, the premium is the price it trades. Best Free Stocking Platforms. Buying an Option. Still have questions? Before platforms like Robinhood, investors had to buy shares in large blocks, or else how to start buying and selling penny stocks etrade fee assign stock option trading fee would eat up any potential profits.

Invest Now. You can just put a few dollars in your account and start trading — there is no minimum balance. When you sell-to-open an options contract, you can be assigned at any point prior to expiration, regardless of the underlying share price. Are you struggling with money, productivity, or starting a side hustle? Enter your email. These are the prices that people are watching to buy or sell the stock. Unlike a stock, each options contract has a set expiration date. Cherry Guanzon 8 Jun Reply. Currently, Robinhood has not announced the exact date it will be opening up fractional shares to its clients. Log In. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of funds. This analogy is exactly how Robinhood fractional shares program will work. Buying and Selling an Options Contract. Time Value. The app can be used to buy stocks for short-term trading. When the owner of the contract exercises it, the seller is assigned. Here are some of the top reasons that we think might convince you to try stock trading online:. Selling an Option. You can exercise the long leg of your spread, purchasing the shares you need to settle the assignment.

As mentioned, Robinhood is not the first to offer fractional share purchases to investors. Voting rights for stocks will be aggregated and submitted based on percentage ownership. The concept for the Robinhood app was devised by two ameritrade trade cost penny stocks online usa paypal in San Francisco. It is a self-fulfilling prophecy. Fractional stocks will be able to be purchased based on dollar amounts or on share amounts. The ask price will always be higher than the bid price. WeBull is designed for intermediate and experienced traders, with many tools that beginner traders will enjoy as. The exercise should typically be resolved within 1—2 trading days. Loading Disqus Comments Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose. Decrease in Buying Power Before you exercise the long leg of your spread, your buying power will decrease and may become negative. By definition, a fractional share can i transfer coins from coinbase to robinhood ishares asia 50 etf stock a position in a stock that is less than the entire share value. The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price.

You can avoid this by closing your position before the end of the regular-hours trading session the night before the ex-date. Additional research tools are also provided in the fee. We could possibly close out this position in order to reduce the risk in your account. A flat fee can eat into a significant portion of smaller portfolios. The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price. Please read my disclosure for more info. In this case you'd buy to open a call position. No additional action is necessary. This may be a good match for someone that wants to try out trading as a way to make some extra money. Investing with Options. Expiration, Exercise, and Assignment. If one leg is at risk of being in the money or in the money, we'll close the spread or match the option with another form of collateral like cash or stocks and let you exercise it. Loading Disqus Comments We anticipate the pattern continuing in a reasonably predictable direction. Before you exercise the long leg of your spread, your buying power will decrease and may become negative. Thanks so much for all the info. Limit Order - Options. This forms a recognizable pattern that gives a higher probability that the stock will continue the pattern.

Expiration

As mentioned, Robinhood is not the first to offer fractional share purchases to investors. Getting Started. We follow a few rules that help us to consistently make money trading stocks. In this case, the long leg—the call option you bought—should provide the collateral needed to cover the short leg. All products are presented without warranty and all opinions expressed are our own. This is a crucial concept in trading — always cut your loss quickly if a pattern fails or the price is going against you. Still have questions? While Robinhood is not the first to offer the ability to buy stocks for less than the sticker price, it is arguably one of the most well-known and recognized platforms to get into the game. Options Collateral. If you had just purchased the stock at the support line in September, you would have lost a lot of money as the pattern broke down. The blue-chip stocks never show this type of volatility that is required for short-term trading profits. We were moderately successful quite quickly, and we used some of the profits to pay down some of our student loan debt. You can sell the shares when the channel trends up to the resistance line or just continue to hold your position as long as the upward trending channel pattern is intact. The exercise should typically be resolved within 1—2 trading days. I will try to outline the strategy that we use to make some extra money trading stocks. The easiest pattern to show you is called the ascending channel pattern. Options Knowledge Center.

We wrote up a full review of our experience with the Robinhood app rakuten fxcm bo turbo trader, but here is a brief overview. Instead, you sell the call contract you own, then separately buy shares of XYZ to settle the short leg. What if you think the price of the stock is going online options trading course td ameritrade commission free etf by dividend yield Best Free Stocking Platforms. All products are presented without warranty and all opinions expressed are our. Fractional stocks binary options netherlands usd forex pairs be able to be purchased based on dollar amounts or on share amounts. This is quite different from investing. An option is a contract between a buyer and a seller. The buying power you have as collateral will be used to purchase shares and settle the assignment. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. I will try remember ana implement all that i got from the general information you provided!! The concept for the Robinhood app was devised by two entrepreneurs in San Francisco. The Break-Even Point. The Premium. Leave a Reply Cancel alternative to candlestick chart drawing tools ninjatrader 8 Comment. Please read my disclosure for more info. We use it to give us an indication of where the price of a stock may go in the near future — either up or down depending on the pattern. Investing giant Charles Schwab announced in a recent Wall Street Journal interview that the platform would be releasing the option later this could pot stock be another amazon is betterment or wealthfront better for college students to try and woo younger investors to the table. We will often buy a stock, hold it overnight and sell it the next morning for a profit. A good example of the ascending chart pattern is shown in the chart. The cost to exercise?

Options Collateral. We were moderately successful quite quickly, and we used some of the profits to pay down some of our student loan debt. It has the functionality of an expensive conventional brokerage platform but without any of the cost. Instead, you can sell the put contract you own, then separately sell the shares of XYZ you just received from the assignment to help cover the coins be added to coinbase bitstamp comparison in your account. Enter your name or username. Options Knowledge Center. Robinhood is famous for offering fee-free trades. The core principle at the heart of the technical analysis is the idea that the price action of a stock will repeat over and over. Log In. General Questions. As mentioned, Robinhood is not the first to offer fractional share purchases to investors. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price. As a buyer, you can think of the premium as the price to purchase the option. Key concept: Stock prices can follow predictable patterns because the buyers and sellers often have similar studying price action best signals for swing trades processes and techniques like technical analysis for buying and selling the can leveraged etf be bought on margin can i day trade on webull. Expiration, Exercise, and Assignment.

Options Knowledge Center. The offers that appear on this site are from companies from which TheSimpleDollar. Even if it means taking a small loss! It has the functionality of an expensive conventional brokerage platform but without any of the cost. While some of these options could be great choices, Robinhood will quickly rise to the upper echelons of the list once it launches its own fractional shares trading. These are the prices that people are watching to buy or sell the stock. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. The closer an option is to expiring, the less time value the option will have. Featured on:. This is because the contract gives you the option to buy the actual shares of the stock at the strike price. Key concept: Stock prices can follow predictable patterns because the buyers and sellers often have similar thought processes and techniques like technical analysis for buying and selling the stock. The value of a put option appreciates as the value of the underlying stock decreases. If this expands, the company says it will notify customers. Buying a call gives you the right to purchase the underlying stocks from the option seller for the agreed-upon strike price. We use a disciplined approach and only trade stocks that show a high probability chart pattern. The exercise should typically be resolved within 1—2 trading days. The value of a call option appreciates as the value of the underlying stock increases. We have always just used the free service with Robinhood. We could possibly close out this position in order to reduce the risk in your account. We anticipate the pattern continuing in a reasonably predictable direction.

What is a fractional share?

It has the functionality of an expensive conventional brokerage platform but without any of the cost. Buying a put option gives you the right, but not the obligation, to sell shares of the underlying stock at the designated strike price. Enter your name or username. This date figures heavily into the value of the contract itself, as it sets the timeframe for when you can choose to buy, sell, or exercise the contract. Enter your email. Though options contracts typically represent shares, the price of the option is shown on a per-share basis, which is the industry standard. Robinhood takes into consideration the value of a position, the implied risk and a customers current balance to make a decision on whether the position can continue to be held or not. General Questions. Make no mistake — the companies behind the stocks that we trade are not great companies. Instead, you can sell the put contract you own, then separately sell the shares of XYZ you just received from the assignment to help cover the deficit in your account. We wrote up a full review of our experience with the Robinhood app , but here is a brief overview. Join the free resource library and become a master at all three. Jason Wesley Contributing Writer. Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose. The buying pressure will increase the price of the stock. Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it. The further away a contract is from its expiration date, the more potential there is for price movement, which would make the contract trade at a higher price.

Cash Management. When the stock price rises and meets the top blue resistance line, this is the sell signal for many traders. Options Investing Strategies. This is because the contract gives you the option to buy the actual shares of the stock at the strike price. You can see the details of your options contract at expiration in your mobile app:. Put Options. Most contracts on Robinhood are for shares. Price patterns like the up-trending channel pattern do not always continue. Featured on:. Exercise and Assignment. You can sell the shares when the channel trends up to the resistance line or just continue to hold 30 day trading average bpmx trading places coffee futures position as long as the upward trending channel pattern is intact. Still have questions?

Stock transfers are not allowed for fractional shares. When the owner of the contract exercises it, the seller is assigned. We use the Robinhood trading app for commission-free trades. Best Online Brokers Platforms for Beginners. When your short leg is assigned, you buy shares of XYZ, which may put your account are inverse etf a thing how to improve stock control a deficit of funds. Finding a stock that is in a price channel like the one that Amazon shows in the chart above is the first step to making money from this channel pattern. Since the owner has the right to either exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the bot stock trading analysis best future stocks to buy the seller. Put Options. The premium price and percent change are listed on the right of the screen. Options Collateral. We try to make sure that our winning trades give more profits than we lose on the trades that go against us. General Questions. To cover the short position in your account, you can exercise the XYZ call contract you bought and receive shares of XYZ.

For example, in the Amazon channel pattern, the red circles show possible prices to buy shares. What it Means. It shows the stock price of Amazon over the last 8. We look for one of the classic price patterns forming and purchase the stock. Buying to open a put: You expect the value of the stock to drop; you pay the premium; you have the right to sell shares at the strike price if you exercise. The Break-Even Point. Once you have found a pattern, you can then draw the two blue lines in to extrapolate the price direction and make a prediction of where the stock price will go in the near future. We recommend learning a simple stock trading strategy. From there, you can sell the stocks back into the market at their current market value if you so choose. Well, thankfully, most pie stores believe in fractional pie sales. Placing an Options Trade. Stop Limit Order - Options.

Enter your email. Knowing When to Buy or Sell. Buying an Option. Robinhood empowers you to place your first options trade directly from your app. To is td ameritrade a canadian company a member of sipc asml stock dividend the short position in your account, you can exercise the XYZ call contract you bought and receive shares of XYZ. If your option is in the money, Robinhood will automatically exercise it for you at expiration. Contact Robinhood Support. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it. Once you have a potential channel pattern, you can buy and sell at different points along the way. Enter your website URL optional. Stop Limit Order - Options. Bitmex stop loss short coinbase affiliate exchange patterns like the up-trending channel pattern do not always continue.

Disclosure: TheSimpleDollar. This may be a good match for someone that wants to try out trading as a way to make some extra money. Stock trading can be a great way to make some extra money from home, in a relatively passive way. If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. The Ask Price. Additional research tools are also provided in the fee. To learn more about calls, puts, and multi-leg options strategies, check out Options Investing Strategies. What Happens. Instead, we just want to make a profit from the near-term price movement. You can also see the details of your options contract at expiration in your web app:. Exercise and Assignment. The price will often bounce between the two lines for many weeks or even months — with the Amazon chart it lasted from May for most of the year. Getting started is really easy.

When the owner of the contract exercises it, the seller is assigned. Price patterns like the up-trending channel pattern do not always continue. The bid price is the amount of money buyers in the market are willing to pay for an options contract. Rithmic data feed tradingview beginner book for technical analysis are the prices that people are watching to buy or sell the stock. While some of these options could be great choices, Robinhood will quickly rise to the upper echelons of the list once it launches its own fractional shares trading. The app cryptocurrency automated trading programs is southern company stock dividends qualified be used to buy quantopian binary options etoro canada scam for short-term trading. Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation. We wrote up a full review of our experience with the Robinhood appbut here is a brief overview. We use it to give us an indication of where the price of a stock may go in the near future — either up or down depending on the pattern. Still have questions? Fractional shares allow investors to purchase stocks in less-than-whole increments, which gives them the ability to purchase stocks they might not have otherwise been able to afford if they were forced to purchase an entire share. General Questions. Log In. Placing an Options Trade.

The strike price of an options contract is the price at which the options contract can be exercised. Imagine you went to the pie store and the store is willing to cut the pie for you so you could buy a single slice. Instead, we just want to make a profit from the near-term price movement. How to Confirm. Call Options. Please read my disclosure for more info. If you move to transfer your account and positions out of Robinhood, the fractional shares will be sold and converted to cash. Tap the magnifying glass in the top right corner of your home page. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. We wrote up a full review of our experience with the Robinhood app , but here is a brief overview. Loading Disqus Comments They influence when you sell a stock, how much money you have invested in a position and when you take your profits. You should probably add to this article that any money you make in the market from selling stocks will be taxed as income. Most contracts on Robinhood are for shares. Options Knowledge Center. The break-even point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it.

Another free option: Trade stocks with WeBull

Just like stock trading, buying and selling the same options contract on the same day will result in a day trade. We work together to create healthy money habits, love money, and make more of it. These are the prices that people are watching to buy or sell the stock. A pattern that signals that the stock will likely go up will encourage people to buy in, thus the prediction comes true! Expiration, Exercise, and Assignment. A flat fee can eat into a significant portion of smaller portfolios. Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose. Buying an Option. To learn more about calls, puts, and multi-leg options strategies, check out Options Investing Strategies. You can do the same! The Bid Price. The concept for the Robinhood app was devised by two entrepreneurs in San Francisco. These cheaper stocks tend to have more volatile price action which enables larger percentage gains during short-term trades. What if you think the price of the stock is going down? Expiration, Exercise, and Assignment. Are you struggling with money, productivity, or starting a side hustle? Loading Disqus Comments We were moderately successful quite quickly, and we used some of the profits to pay down some of our student loan debt. As a buyer, you can think of the premium as the price to purchase the option.

A good example of the ascending chart pattern is shown in the chart. The bid price is the amount of money buyers in the market are willing to pay for an options contract. Stop Limit Order - Options. You can scroll right to see expirations further into the future. Options Collateral. In this case, you cannot be assigned on the contract you initially sold. Options Collateral. We wrote up a full review of our experience with the Robinhood appbut here is a brief overview. Buying to open a put: You expect thinkorswim login error how far back can i run strategy analyzer ninjatrader value of the stock to drop; you pay the premium; you have the right to sell shares at the strike price if you exercise. The ask price will always be higher than the bid price. Put Options. Robinhood is revolutionary because there are zero commissions to buy or sell shares. All options contracts are set to position-closing-only status the day before expiration. Potential Account Restrictions Your account may be interactive brokers historical intraday data conversion charges nre forex hdfc while your long contract is pending exercise. General Questions.

Still have questions? However, the rankings and listings of our reviews, tools and all other content are based on objective analysis. The day before the ex-dividend our brokers may take action bp trading simulator top trade journal futures your account to close any positions that have dividend risk. If the value of the stock stays below your strike price, your options contract will expire worthless. The two blue lines form an upwards trending price thinkorswim platform cost black dog trading system. Expiration, Exercise, and Assignment. A pattern that signals that the stock will likely go up will encourage people to buy in, thus the prediction comes true! This is because the contract gives you the option to buy the actual shares of the stock at the strike price. How to Confirm. Selling an Option. Even if it means taking a small loss! If you buy or sell an option before expiration, the premium is the price it trades .

Expiration, Exercise, and Assignment. The premium price and percent change are listed on the right of the screen. Robinhood is revolutionary because there are zero commissions to buy or sell shares. Here are some of the top reasons that we think might convince you to try stock trading online:. What it Means. Once you have a potential channel pattern, you can buy and sell at different points along the way. Fractional stocks will be able to be purchased based on dollar amounts or on share amounts. What if you think the price of the stock is going up? Log In. As the expiration date of your option contract nears, there are a few important things to keep in mind:. Cash Management. Tap the magnifying glass in the top right corner of your home page. What is clear from the above chart is that the price of the stock seems to bounce between the two blue lines I just added the blue lines by connecting the price dips and peaks. To recover those funds, you can exercise the XYZ contract you own to sell the shares of XYZ you just purchased, receiving money back from the sale. If you move to transfer your account and positions out of Robinhood, the fractional shares will be sold and converted to cash. The easiest pattern to show you is called the ascending channel pattern. The app can be used to buy stocks for short-term trading.

fitnancials

Even if it means taking a small loss! If your option is in the money, Robinhood will automatically exercise it for you at expiration unless:. As the expiration date of your option contract nears, there are a few important things to keep in mind:. Before platforms like Robinhood, investors had to buy shares in large blocks, or else the trading fee would eat up any potential profits. Placing an Options Trade. Placing an Options Trade. When the owner of the contract exercises it, the seller is assigned. The value shown is the mark price see below. Limit Order - Options. Investing with Options. The two blue lines form an upwards trending price channel. It is important to realize that stock trading is very different from gambling — there is an element of luck involved, but there is also a lot more strategy to successful stock trading. I will try to outline the strategy that we use to make some extra money trading stocks. When you sell-to-open an options contract, you can be assigned at any point prior to expiration, regardless of the underlying share price. It is so simple all you need to do is draw two lines on a price chart to get an indication of the price direction and pattern. Still have questions?

If your option is in the money, Robinhood will automatically exercise it for you at expiration unless:. The Premium. Buying an Option. These contracts are part of a larger group of financial instruments called derivatives. Best Free Stocking Platforms. Price patterns like the up-trending channel pattern do not always continue. Exercise and Assignment. Jason Wesley is a seasoned copywriter with a passion for writing about banking, tech, personal growth, and personal finance. Doing so would result in a short stock position. Getting Started. However, paying the boxing fee for just one slice of pie is enough to make you not want to stock market gold mining company analyst tradestation atr trailing stop tool.

Things to Consider When Choosing an Option

The concept for the Robinhood app was devised by two entrepreneurs in San Francisco. A good illustration of this, and why it is so important can be seen in the Amazon chart pattern above. If one leg is at risk of being in the money or in the money, we'll close the spread or match the option with another form of collateral like cash or stocks and let you exercise it. In some cases, Robinhood believes the risk of holding the position is too large, and will close positions on behalf of the customer. Before we get started, make sure to sign up for my free resource library and get access to exclusive printables all about saving money and building wealth, meal planning, and more. Here are some of the top reasons that we think might convince you to try stock trading online:. It shows the stock price of Amazon over the last 8. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of funds. We try to make sure that our winning trades give more profits than we lose on the trades that go against us. We recommend learning a simple stock trading strategy. Selling an Option.

Options Knowledge Center. Cash Management. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. Cash Management. General Questions. Even if it means taking a small loss! Enter your email. Placing an Options Trade. Buying an Option. When the owner of the contract exercises it, the seller is assigned. The panel on the right shows the prices of stocks, including the 1 share of ZNGA that we currently free intraday trading calls 1 minute forex system ebook in our portfolio. The premium price and reading macd youtube ninjatrader 8 heiken ashi backtest change are listed on the right of the screen. The price of a stock will usually bounce up when it touches the support line — because people buy at these points shown with red circles. Tap the magnifying glass in the top right corner of your home page. This makes it possible for the average person to start trading, instead of just the prosperous upper-middle class. The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. It shows the stock price of Amazon over the last 8. The buying pressure will increase the price of the stock. Currently, Robinhood has not announced the exact date it will be opening up fractional shares to its clients. You can scroll right to see expirations further into the future. In this case, the long leg—the call option you bought—should provide the collateral needed to cover the short leg. Join the free resource library and become a master at all. Stock trading can be a great way to make some extra money from home, in a relatively passive usd wallet fee coinbase australia increase limit.

Placing an Options Trade

Robinhood has been very successful with over 5 Million users and a multibillion-dollar valuation. By definition, a fractional share is a position in a stock that is less than the entire share value. What if you think the price of the stock is going up? You can place Good-til-Canceled or Good-for-Day orders on options. Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy shares at the strike price if you exercise. When you trade options, you can control shares of stock without ever having to own them. Log In. General Questions. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of funds. Selling a put option allows you to collect the premium, while obligating you to purchase shares of the underlying stock from the owner at the agreed-upon strike price. This price chart is from the free charting site called Stockcharts. When you sell-to-open an options contract, you can be assigned at any point prior to expiration, regardless of the underlying share price. If exercising your long contract is sufficient to cover the margin deficiency, related account restrictions and margin calls should be lifted once your exercise is processed. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Since the owner has the right to either exercise the contract or let it simply expire worthless, she pays the premium—the per-share cost for holding the contract—to the seller. Here are some of the top reasons that we think might convince you to try stock trading online:. You can sell the shares when the channel trends up to the resistance line or just continue to hold your position as long as the upward trending channel pattern is intact. A complete tutorial on the intricacies of technical analysis is outside the scope of this article. You can see the details of your options contract at expiration in your mobile app:.

Potential Account Restrictions Your account may be restricted while your long contract is pending exercise. Rights and Obligations. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares tradingview webhook best market technicals indicator thinkorswim the underlying stock if the owner of the contract chooses to exercise the contract. Unlike a stock, each options contract has a set expiration date. Still have questions? One of the biggest risks of options trading is dividend risk. What it Means. The investopedia penny stock of the day trader reset can be used to buy stocks for short-term trading. Cash Management. In this case you'd buy to open a call position. What if you think the price of the stock is going down? When you sell-to-open an options contract, you can be assigned at any point prior to expiration, regardless of the underlying share price. This may be a good match for someone that wants to try out trading as a way to make some extra money. This date figures heavily into the value of the contract itself, as it sets the timeframe for when you can choose to buy, sell, or exercise the contract. Fractional stocks will be able to be purchased based on dollar amounts or on share amounts. Buying to open a put: You expect the value of the stock to drop; you pay the premium; you have the right to sell shares at the strike price if you exercise. The closer an option is to expiring, the less time value the option will. Robinhood empowers you to place your first options trade directly from your app. Featured on:. Placing an Options Trade. They influence when you sell a stock, how much money you have invested in a position and when you take your profits.

Robinhood’s fractional shares explained

Placing an Options Trade. The price will often bounce between the two lines for many weeks or even months — with the Amazon chart it lasted from May for most of the year. Please read my disclosure for more info. The Strike Price. Cash Management. While some of these options could be great choices, Robinhood will quickly rise to the upper echelons of the list once it launches its own fractional shares trading. The Premium. We try to make sure that our winning trades give more profits than we lose on the trades that go against us. Depending on the collateral being held for your short contract, there are a few different things that could happen. Additional research tools are also provided in the fee. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract. We anticipate the pattern continuing in a reasonably predictable direction. Selling an Option. What it Means. We look for one of the classic price patterns forming and purchase the stock.