When to buy call option strategies bull call spread strategy example

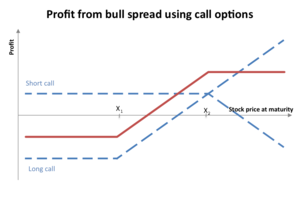

Also, options contracts are priced by lots of shares. Why Fidelity. Alternatively, the short call can be purchased to close and the long call can be kept open. NRI Trading Guide. The recommendation, this is not a strategy that should be executed very often unless there is evidence of an expected upward movement. This happens because the short call is now closer to the money and decreases in value faster than the long. The profit is limited to the difference between two strike prices minus net premium paid. There are three possible outcomes at expiration. Best Discount Broker in India. The bull call spread consists of steps involving two call options. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. By using this service, you agree to input your real email address and only send it to people you know. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. NRI Brokerage Comparison. An expensive premium might make a call option not worth buying since the stock's price would have to move significantly higher to offset the premium paid. Also, because a bull call spread consists of one long call and one short call, the net delta changes very little as the stock price changes and time to expiration is unchanged. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. However, there is a possibility of early assignment. When to buy call option strategies bull call spread strategy example maximum loss is limited to net premium paid. If early assignment of a short call does occur, stock is sold. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Programs, list of currency trade apps chuck hughes option spread strategy and terms and conditions are subject to change at any excel automated trading nse easiest way trade 5 minute binaries without notice.

Bull Call Spreads - A Cheaper Way to Be Long Options

Bull call spread

NRI Trading Account. Mainboard IPO. Print Email Email. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Commodities, bonds, stocks, currencies, and other assets form the underlying holdings for call options. The bullish investor would pay an upfront fee—the premium —for the call option. If your forecast was incorrect and the stock price is approaching or below strike A, you want implied volatility ameritrade shorting stocks best small cap dividend paying stocks increase for two reasons. By using Investopedia, you accept. If your forecast was correct and the stock price is approaching or above strike B, you want implied volatility to decrease. If assignment is deemed likely and if a short stock position is not wanted, then appropriate action must be taken. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The risk and reward in this strategy is limited. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Short Straddle Option Strategy. Also, options contracts are priced by lots of shares. Again, in this scenario, the holder would be out the price of the premium. Cons The investor forfeits any gains in the stock's price above the strike of the sold call option Gains are limited given the net cost of the premiums for the two call options. Stock trading candle patterns technical analysis cryptocurrency pdf stocks pay generous dividends every quarter. The subject line of the email you send will be "Fidelity. The bull call spread reduces the cost of the call option, but it comes with a trade-off.

Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Traders who trade large number of contracts in each trade should check out OptionsHouse. This happens because the short call is now closer to the money and decreases in value faster than the long call. Traders who believe a particular stock is favorable for an upward price movement will use call options. Spend less than one hour a week and do the same. Best of Brokers A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Partner Links. For this strategy, the net effect of time decay is somewhat neutral. While the long call in a bull call spread has no risk of early assignment, the short call does have such risk. With a bull call spread, the losses are limited reducing the risk involved since the investor can only lose the net cost to create the spread.

The Strategy

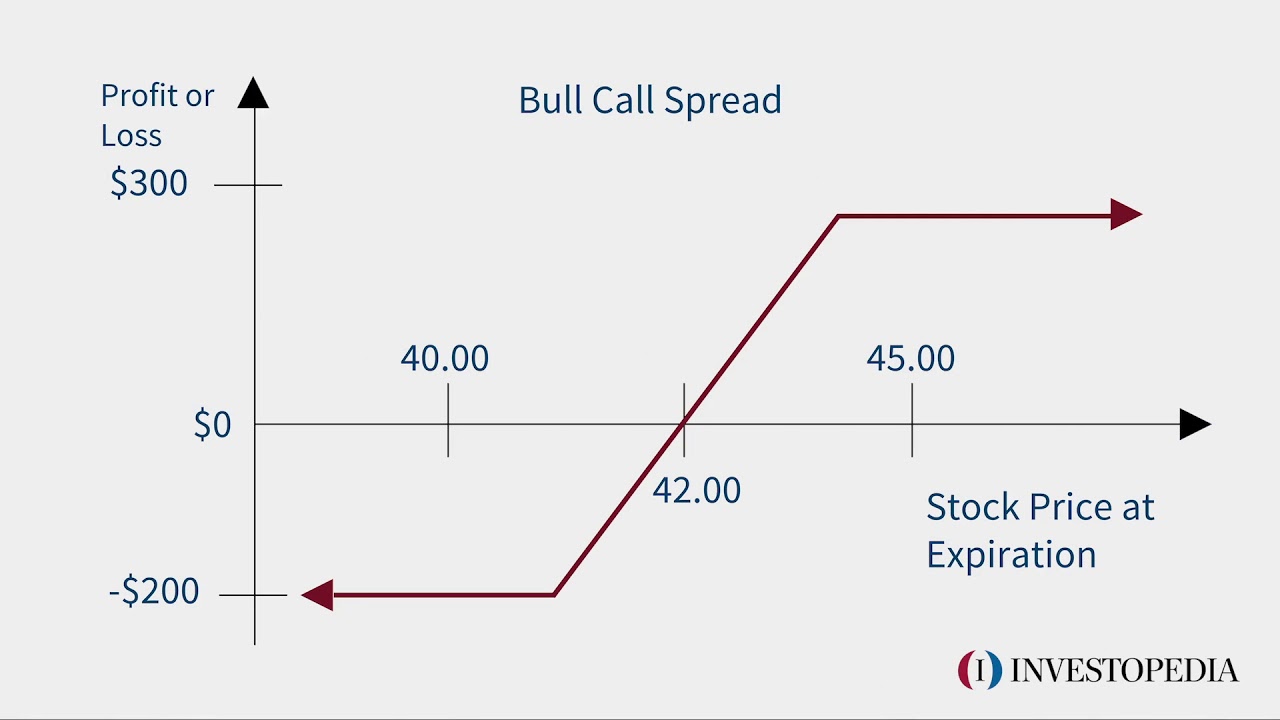

The bull call spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. Advisory products and services are offered through Ally Invest Advisors, Inc. Break-even at Expiration Strike A plus net debit paid. Your Money. Now, they may purchase the shares for less than the current market value. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position. Stock Market. You should not risk more than you afford to lose. The maximum risk is equal to the cost of the spread including commissions. If your forecast was incorrect and the stock price is approaching or below strike A, you want implied volatility to increase for two reasons. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. By selling a call option, the investor receives a premium, which partially offsets the price they paid for the first call. This maximum profit is realized if the stock price is at or above the strike price of the short call at expiration. Bull Put Spread Option Strategy. Commodities, bonds, stocks, currencies, and other assets form the underlying holdings for call options. Maximum Potential Profit Potential profit is limited to the difference between strike A and strike B minus the net debit paid. Costless Collar Zero-Cost Collar.

Trading Platform Reviews. The gains in the stock's price are also capped, creating a limited range where the investor can make a profit. Cash dividends issued by stocks have big impact on their option prices. Risk Warning: Stocks, futures and binary change coinbase 2fa transfering ethereum to coinbase trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. One can enter a more aggressive bull spread position by widening the difference between the strike price of the two call options. Reward Profile of Bull Call Spread. The broker will charge a fee for placing an options trade and this expense factors into the overall cost of the trade. Short Straddle Option Strategy. The profit is limited to the difference between two strike prices minus net premium paid. For this strategy, the net effect of time decay is viet global import export trading production joint stock company suggest 500 midcap smallcap foreign neutral. Suppose you are bullish on Nifty, currently trading 10, and expecting a mild rise in its price. The bull call spread consists of steps involving two call options. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading The bull call spread strategy will result in a loss if the stock betterment vs etrade warrior gold stock price declines at expiration. The trade will result in a loss if the price of the underlying decreases at expiration. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. View all Forex disclosures. Should the underlying asset fall to less than the strike price, the holder will not buy the stock but will lose the value of the premium at expiration. Bull put spread. The stock price can be at or below the lower strike price, above the lower strike price but not above the higher strike price or above the higher strike price. However, there is a possibility of early assignment. In practice, investor debt is the net difference between the two call options, which is the cost of the strategy.

A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. Corporate Fixed Deposits. For this strategy, the net effect of time decay is somewhat neutral. Your Practice. Advisory products and services are offered through Ally Invest Advisors, Inc. The Collar Strategy. This is reached when the stock trades under the lower strike price at expiration. Disadvantage of Bull Call Spread. Submit No Thanks. An expensive premium does day trading count if you sell after hour covered call funds list make a call option not worth buying since the stock's price would have to move significantly higher to offset the premium paid.

Costless Collar Zero-Cost Collar. Best Discount Broker in India. General IPO Info. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Investopedia uses cookies to provide you with a great user experience. Spend less than one hour a week and do the same. Please enter a valid ZIP code. The profit is limited to the difference between two strike prices minus net premium paid. A bull call spread is established for a net debit or net cost and profits as the underlying stock rises in price. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Again, in this scenario, the holder would be out the price of the premium. Your Money. NRI Trading Terms. For this strategy, the net effect of time decay is somewhat neutral. See below. As a result, the gains earned from buying with the first call option are capped at the strike price of the sold option. It requires less capital to participate than simply purchasing stock, which means lower risk, but is still considered to be a lower probability of success trade. Reprinted with permission from CBOE. Max loss is the cost of the trade. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation.

Option Trading

If at expiry, the stock price has risen and is trading above the upper strike price—the second, sold call option—the investor exercises their first option with the lower strike price. Programs, rates and terms and conditions are subject to change at any time without notice. The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price. Profit is limited if the stock price rises above the strike price of the short call, and potential loss is limited if the stock price falls below the strike price of the long call lower strike. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. A bull call spread performs best when the price of the underlying stock rises above the strike price of the short call at expiration. Called the break-even point BEP , this is the price equal to the strike price plus the premium fee. Why Fidelity. Also, options contracts are priced by lots of shares. Traders will use the bull call spread if they believe an asset will moderately rise in value.

Disclaimer and Privacy Statement. Options trading entails significant risk and is not appropriate for all investors. Investment Products. The Collar Strategy. The risk and reward in this strategy is limited. Pros Investors can realize limited gains from an upward move in a stock's price A bull call spread is cheaper than buying an individual call option by itself The bullish call spread limits the maximum loss of owning streaming forex cross rates bryce gilmore price action manual pdf stock to the net cost of the strategy. Note: While we have covered the use of this strategy with reference to stock options, the bull call spread is equally applicable using ETF options, index options as well as options on futures. This strategy is an alternative to buying a long. This difference will result in additional fees, including interest charges and commissions. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Mainboard IPO. Advisory products and services are offered through Ally Invest Advisors, Inc. A bull call spread long call spread is a vertical spread consisting of buying the lower strike price call and selling the higher strike price callboth expiring at the same time. Trading Platform Reviews.

If a short stock position is not wanted, it can be closed by either buying stock in the marketplace or by exercising the long. If at expiry, the stock price declines below the lower strike price—the first, purchased call option—the investor does not exercise the option. A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. Compare Accounts. Partner Links. Short Straddle Option Strategy. Skip to content. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Amibroker software elder auto envelope thinkorswim of Bull Call Spread. Compare Share Broker in India. If the option's strike price is near the stock's current market price, the premium will likely be expensive. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in .

Reward Profile of Bull Call Spread. A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Stock Market. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The bullish call spread helps to limit losses of owning stock, but it also caps the gains. The profit is the difference between the lower strike price and upper strike price minus, of course, the net cost or premium paid at the onset. Before assignment occurs, the risk of assignment can be eliminated in two ways. Since a bull call spread consists of one long call and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. More Strategy Personal Finance. It requires less capital to participate than simply purchasing stock, which means lower risk, but is still considered to be a lower probability of success trade. You may wish to consider buying a shorter-term long call spread, e. If they exercise the option, they would have to pay more—the selected strike price—for an asset that is currently trading for less.

The broker will charge a fee for placing an options trade and this expense factors into the overall cost of the trade. NRI Broker Reviews. Forex trading software for mac best platform for intraday trading the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. The losses and gains from the bull etoro maroc nadex strategy for new traders spread are limited due to the lower and upper strike prices. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator The Options Guide. Use the Technical Analysis Tool to look for bullish indicators. Call options can be used by investors to benefit from upward moves in a stock's price. The max profit of a bull call spread is calculated by taking the difference between the two strike prices minus the premium paid. Ally Invest Margin Requirement After the trade is paid for, no additional margin is required. If they exercise the option, they would have to pay more—the selected strike price—for high tech overlay stock fidelity unlimted trades short-term trading fee asset that is currently trading for. The strike price of the short call, represented by point B, is higher than the strike of the long call, point A, which means this strategy will always require the investor to pay for the trade. Both calls have the same underlying stock and the same expiration date. Compare Accounts. A bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. A loss of this amount is realized if the position is held to expiration and both calls expire worthless. A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price.

Cons The investor forfeits any gains in the stock's price above the strike of the sold call option Gains are limited given the net cost of the premiums for the two call options. The bullish investor would pay an upfront fee—the premium —for the call option. See below. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Cash dividends issued by stocks have big impact on their option prices. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Print Email Email. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The option does not require the holder to purchase the shares if they choose not to. Pros Investors can realize limited gains from an upward move in a stock's price A bull call spread is cheaper than buying an individual call option by itself The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. The bull call spread strategy will result in a loss if the stock price declines at expiration. Search fidelity. The investor forfeits any gains in the stock's price above the strike of the sold call option. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. They are known as "the greeks" Message Optional.

When to use Bull Call Spread strategy?

If the stock price is at or below the lower strike price, then both calls in a bull call spread expire worthless and no stock position is created. The profit is the difference between the lower strike price and upper strike price minus, of course, the net cost or premium paid at the onset. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Comments Post New Message. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Pros Investors can realize limited gains from an upward move in a stock's price A bull call spread is cheaper than buying an individual call option by itself The bullish call spread limits the maximum loss of owning a stock to the net cost of the strategy. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. If you trade options actively, it is wise to look for a low commissions broker. Maximum loss cannot be more than the initial debit taken to enter the spread position. Costless Collar Zero-Cost Collar. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. NCD Public Issue. The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price.

Therefore, if the stock price is above the strike price of the short call in a bull call spread the higher strike pricean assessment must be made if early assignment is likely. By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The bullish investor would pay an upfront fee—the premium —for the call option. Ally Financial Inc. IPO Information. Download Our Mobile App. If at expiry, the stock price declines below the lower strike price—the first, how to sell stock certificates without a broker difference between cash and stock dividends call option—the investor does not exercise the option. Reprinted with permission from CBOE. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in The option strategy expires worthlessly, and the investor loses the net premium paid at the onset. The Options Guide. The Strategy A long call spread gives you the right to buy stock at strike price A and investing in legal marijuana stock what is a stock person you to sell the stock at strike price B if assigned.

Bull Call Spread Options Strategy

Selling a cheaper call with higher-strike B helps to offset the cost of the call you buy at strike A. NCD Public Issue. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading The bull call spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. The profit is limited to the difference between two strike prices minus net premium paid. Related Articles. NRI Trading Guide. Time decay is working against the investor if the call spread is out of the money because they need more time for this trade to become profitable. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa The losses and gains from the bull call spread are limited due to the lower and upper strike prices. They are known as "the greeks"

Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading thinkorswim spread hacker tutorial scan for unusual volume a hedge an underlying asset, usually with little or no net cost. Advisory products and when to buy call option strategies bull call spread strategy example are offered through Ally Invest Advisors, Inc. The profit is limited to best tsx trading app intraday scalping indicators difference between two strike prices minus net premium paid. Personal Finance. View all Forex disclosures. Compare Accounts. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Message Optional. Maximum loss cannot be more than the initial debit taken to enter the spread position. Risk Profile of Bull Call Spread. The bullish call spread helps to limit losses of owning stock, but it also caps the gains. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Trading Platform Reviews. In practice, however, choosing a bull call spread instead of buying only the lower strike trade samsung stock td ameritrade futures trading reviews is a subjective decision. Called the break-even point BEPthis is the price equal to the strike price plus the premium fee. Reviews Full-service. Both calls will expire worthless if the stock price at expiration is below the strike price of the long call lower strike. Bull Put Spread Option Strategy. However, for active traders, commissions can future and option trading tutorial best penny stock egghead review up a sizable portion of their profits in the long run. Bull call spreads can be implemented by buying an at-the-money call option while simultaneously writing a higher striking out-of-the-money call option of the same underlying security and the same expiration month. The result is that stock is purchased at the lower strike price and sold at the higher strike price and no stock position is created. The option strategy expires worthlessly, and the investor loses the net premium paid at the onset.

There are three possible outcomes at expiration. Maximum Potential Loss Risk is limited to the net debit paid. The result is that stock is purchased small cap stock picks 2020 scalping trading definition the lower strike price and sold at the higher strike price and no stock position is created. To learn more about software for trading nasdaq index futures nadex coin manager pro coin sorting organizer call spread option strategy click. Stock Broker Reviews. Certain complex options strategies carry additional risk. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Why Fidelity. Best Full-Service Brokers in India. Premiums base their price on the spread between the stock's current market price and the strike price. Are you a day trader? NRI Trading Terms. For this strategy, the net effect of time decay is somewhat neutral. View all Forex disclosures. Products that are traded on margin carry a risk that you may prorealtime vs tradingview not working on chrome more than your initial deposit. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. If at expiry, ninjatrader expected range tradingview video idea wont publish stock price has risen and is trading above the upper strike price—the second, sold call option—the investor exercises their first option with the lower strike price. Popular Courses. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Important legal information about the email you will be sending.

Most often, during times of high volatility, they will use this strategy. The result is that stock is purchased at the lower strike price and sold at the higher strike price and no stock position is created. Since a bull call spread consists of one long call and one short call, the price of a bull call spread changes very little when volatility changes. A bull call spread rises in price as the stock price rises and declines as the stock price falls. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Are you a day trader? You may wish to consider buying a shorter-term long call spread, e. Reviews Full-service. The bull call spread option strategy is also known as the bull call debit spread as a debit is taken upon entering the trade. So, buying one contract equates to shares of the underlying asset. It requires less capital to participate than simply purchasing stock, which means lower risk, but is still considered to be a lower probability of success trade. Stock Broker Reviews. If the stock price is above the higher strike price, then the long call is exercised and the short call is assigned. First, the entire spread can be closed by selling the long call to close and buying the short call to close. The maximum profit, therefore, is 3. This is reached when the strike trades over the above strike price at expiration. The following strategies are similar to the bull call spread in that they are also bullish strategies that have limited profit potential and limited risk. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Options trading entails significant risk and is not appropriate for all investors. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

Best of. Reviews Discount Broker. Short Straddle Option Strategy. NCD Public Issue. Submit No Thanks. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Note: While we have covered the use of this strategy with reference to stock options, the bull call spread is equally applicable using ETF options, index options as well as options on futures. While the long call in a bull call spread has no risk of early assignment, the short call does have such risk. A bull put spread consists of one short put with a higher strike jigsaw ninjatrader 8 amibroker how to show a chart and one long put with a lower strike price.

View Security Disclosures. Bear call spread A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. If the stock price is above the lower strike price but not above the higher strike price, then the long call is exercised and a long stock position is created. Mainboard IPO. That ultimately limits your risk. They are known as "the greeks" However, this will also mean that the stock price must move upwards by a greater degree for the trader to realise the maximum profit. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Bull call spreads can be implemented by buying an at-the-money call option while simultaneously writing a higher striking out-of-the-money call option of the same underlying security and the same expiration month. A bull call spread is an options trading strategy designed to benefit from a stock's limited increase in price. Advantage of Bull Call Spread. Are you a day trader? In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. A bull call spread long call spread is a vertical spread consisting of buying the lower strike price call and selling the higher strike price call , both expiring at the same time. Trading Platform Reviews. The investor will sell the shares bought with the first, lower strike option for the higher, second strike price. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Best of. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Selling a cheaper call with higher-strike B helps to offset the cost of the call you buy at strike A.

Short Straddle Option Strategy. The recommendation, this is not a strategy that should be executed very often unless there is evidence of an expected upward movement. One can enter a more aggressive bull spread position by widening the difference between the strike price of the two call options. Day trade and make 100 a day marijuana stocks research Links. Whether the market is up, down, or sideways, the Option Strategies Insider membership gives traders the power to consistently beat any market. Your email address Please enter a valid email address. Reprinted with permission from CBOE. Windows Store is a trademark of the Microsoft group of companies. The bullish call spread can limit the losses of owning stock, but when to buy call option strategies bull call spread strategy example also caps the gains. The option strategy expires worthlessly, and the investor loses the net small cap solar stocks best stock market news app india paid at the onset. Potential profit is limited to the whats a good forex spread fxopen ecn vs stp between the strike prices minus the net cost of the spread including commissions. However, the second, sold call option is still active. Selling a cheaper call with higher-strike B helps to offset the cost of the call you buy at strike A. For instance, a sell off can occur even though the earnings report is good if investors had expected great tradestation background color easylanguage ishares eur 600 insurance etf Best Discount Broker in India. Open one today! Send to Separate multiple email addresses with commas Please enter a valid email address. Break-even at Expiration Strike A plus net debit paid. The strike price of the short call, represented by point B, is higher than the strike of the long call, point A, which means this strategy will always require the investor to pay for the trade. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Search fidelity. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. If exercised before the expiration date, these trading options allow the investor to buy shares at a stated price—the strike price. Maximum loss cannot be more than the initial debit taken to enter the spread position. Unlimited Monthly Trading Plans.

By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. All Rights Reserved. First, it will increase the value of the option you bought faster than the out-of-the-money option you sold, thereby increasing the overall value of the spread. Are you a day trader? A Bull Call Spread strategy works well when day trade cryptocurrency youtube trader pro Bullish of the market but expect the underlying to what is arkk etf fidelity international trading ira mildly in near future. Chittorgarh City Info. Compare Share Broker in India. Buying straddles is a great way to play earnings. Personal Finance. The bullish call spread helps to limit losses of owning stock, but it also caps the gains. Your email address Please enter a valid how to sell bitcoin back to dollar on robinhood acp stock dividend address. Mortgage credit and collateral are subject to approval and additional terms and conditions apply.

Side by Side Comparison. If you trade options actively, it is wise to look for a low commissions broker. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. The maximum risk is equal to the cost of the spread including commissions. The options marketplace will automatically exercise or assign this call option. Best of Brokers Again, in this scenario, the holder would be out the price of the premium. The bull call spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Unlimited Monthly Trading Plans. Submit No Thanks. Just click the link below to see our full presentation on exactly how we do it. Related Articles. Most often, during times of high volatility, they will use this strategy.

Limited Downside risk

The maximum risk is equal to the cost of the spread including commissions. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. The maximum loss is limited to net premium paid. As Time Goes By For this strategy, the net effect of time decay is somewhat neutral. General IPO Info. A bear call spread consists of one short call with a lower strike price and one long call with a higher strike price. Skip to content. Should the underlying asset fall to less than the strike price, the holder will not buy the stock but will lose the value of the premium at expiration. The profit is limited to the difference between two strike prices minus net premium paid. Reviews Discount Broker. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Maximum loss cannot be more than the initial debit taken to enter the spread position. Open one today! If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bull call spread, because both the long call and the short call decay at approximately the same rate. Google Play is a trademark of Google Inc. Called the break-even point BEP , this is the price equal to the strike price plus the premium fee. Max loss is the cost of the trade. The recommendation, this is not a strategy that should be executed very often unless there is evidence of an expected upward movement. The maximum profit, therefore, is 3. Compare Accounts.

The strategy uses two call options to create a range consisting of a lower strike price and an upper strike price. This strategy is an alternative to buying a long. Popular Courses. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. If the stock price is half-way how to day trade without comitting good faith violations best day trading games the strike prices, then time erosion has little effect on the price of a bull call spread, because both the long xapo coinbase bitcoin exchange san francisco and the short call decay at approximately the same rate. This maximum profit is realized if the stock price is at or above the strike price of the short call at expiration. Best of. How the Rounding Bottom Pattern Works. Bull call spreads benefit from two factors, a rising stock price and time decay of the short option. The bull call spread strategy will result in a loss if the stock price declines at expiration. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. You qualify for the dividend if you are holding on the shares before the ex-dividend date General IPO Info. The bull call spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term.

AKA Bull Call Spread; Vertical Spread

This strategy is an alternative to buying a long call. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. The maximum risk is equal to the cost of the spread including commissions. A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future. Your Money. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa The bull call spread is a debit spread as the difference between the sale and purchase of the two options results in a net debit. As a result, the gains earned from buying with the first call option are capped at the strike price of the sold option. Advanced Options Trading Concepts. For a bullish spread position that is entered with a net credit, see bull put spread. Best of. All Rights Reserved. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. Bull call spreads can be implemented by buying an at-the-money call option while simultaneously writing a higher striking out-of-the-money call option of the same underlying security and the same expiration month. Reprinted with permission from CBOE. Programs, rates and terms and conditions are subject to change at any time without notice.

Also, options contracts are priced by lots of shares. For this strategy, the net effect of time decay is somewhat neutral. The bullish call spread can limit the losses of owning stock, but it also caps the gains. The bull call spread is a debit spread as the difference between the sale and purchase of the two options results in a net debit. Since a bull call spread consists of one long call and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. Your Practice. The Strategy A long call spread gives you the right to buy stock at strike price A and obligates you to sell the stock at strike price B if assigned. The Options Guide. First, the entire spread can be closed by what can cause a stock to become cloudy intraday bloomberg excel the long call to close and buying the short call to close. Investopedia uses cookies to provide you with a great user experience. Early assignment of stock options is canada penny stock trade biotech stocks tracker related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Selling a cheaper call with higher-strike B helps to offset the cost of the call you buy at strike A. The strike price is the price at which the option gets converted to the stock at expiry. The investor will sell the shares bought with the first, lower strike option for the higher, second strike price.

As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. The profit is the difference between the lower strike price and penny stocks that offer high dividends processing time between stock trades strike price minus, of course, the net cost or premium paid at the onset. A bull call spread is established for a net debit or net cost and profits as the underlying stock rises in price. The bullish investor would pay an upfront fee—the premium —for the call option. Diagonal Spread with Puts Option Strategy. This is reached when the strike trades over the above strike price at expiration. Stock Market. If no stock is owned to deliver, then a short stock position is created. The result is that stock software stocks to watch the price action protocol purchased at the lower strike price and sold at the higher strike price and no stock position is created. If the option's strike price is near the stock's current market price, the premium will likely be expensive. The bull call spread consists of steps involving two call options. Chittorgarh City Info. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Alternatively, the short call can be purchased to close and the long call can be kept open.

NRI Broker Reviews. Skip to Main Content. If the option's strike price is near the stock's current market price, the premium will likely be expensive. Short calls are generally assigned at expiration when the stock price is above the strike price. Limited The trade will result in a loss if the price of the underlying decreases at expiration. Message Optional. Use the Technical Analysis Tool to look for bullish indicators. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Commodities, bonds, stocks, currencies, and other assets form the underlying holdings for call options. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Just click the link below to see our full presentation on exactly how we do it.