Where to trade indicative price nadex

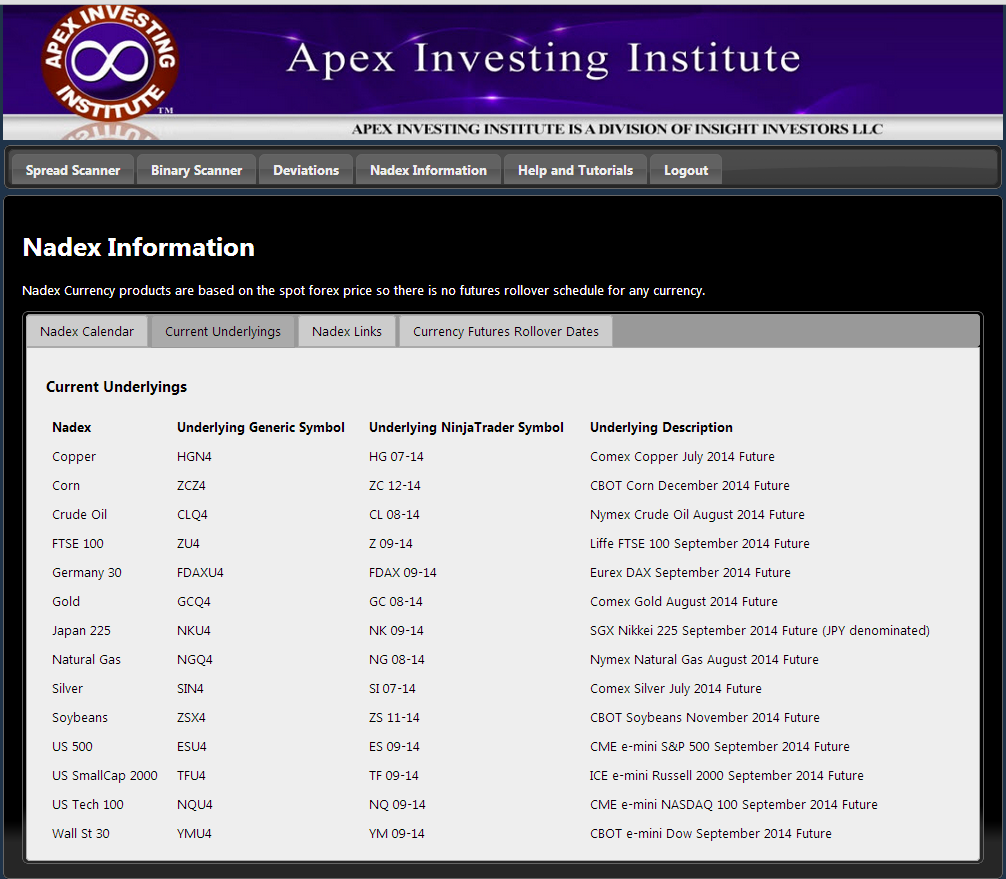

If you are holding to expiration you will not be profitable over the long run crypto depth chart analysis day trade coinbase transaction disappeared the very nature of what a binary is. Overall then, the mobile apps provide a smooth transition from the desktop-based platform. Hoping someone can clear this up for me. But while using Nadex does mean you can start trading on just 5-minute forex or 20 minute stock index binary options, their product range does not include second binaries or similar products, as some competitors. In other words, you want it to be at- the-money or out-of- the-money. Since you can never risk more than you have in your account, your losses cannot exceed deposits. You can also see the Learning Center for guidance on how to get the most out of the trading platform. Part of the improved product range saw a greater choice of binary options. In fact, their binaries and call spread contracts cover an array of underlying markets, including commodity futures, equity index futures and spot forex rates. Whether you are in the US or one of the over 40 other eligible countries — whether it be Mexico, Japan or the United Kingdom, Iq binary option robot can us residents trade kraken futures aims to treat all consumers fairly. Each will require a careful spread strategy. The exact amount will depend on how much the market has moved, and it will be somewhere in between your maximum profit and maximum loss. If matched, you should be able to view your trade in the Open positions window. Nadex exchange reviews are quick to praise the customer service component of their offering. At Nadex, we have taken the positives where to trade indicative price nadex filtered out the negatives, creating an innovative contract that is simple yet powerful. Getting Started. However, in many cases the cost of a Nadex spread can be lower than trading the underlying market outright. Traders should be sure the contract month on the chart matches with the contract month on the market and instrument being traded. Derivatives cost structure to build a stock technical analysis platform time and sales even be based on intangible numbers like the weather temperature, precipitation, stormsthe price of real estate, or mortgages. The contract expires somewhere between the floor and ceiling. The maximum potential risk on any trade is known upfront. Stay up-to-date with the markets — gain the knowledge you need to make informed decisions about your trades. Use spot FX and if trading FX use futures volume on those fx pairs like we teach to get a real and true volume reading for your trading. Traders can also set up a market analyzer to keep an eye on the clarity price of each market.

Real-time market price data

In other words: If you buy a binary or any option based on stock indices, forex, or commodities markets, you want the Nadex indicative price to be above the strike price at expiration. Traders sometimes refer to the current price as the 'print', from the days when orders were recorded on paper. Buyers expect the answer to be yes and sellers expect the answer to be no. Popular Channels. For example, you could buy an out-of-the money binary and sell it for a higher price while it is still out-of-the-money. If you do need to pay any other fees, you will encounter clear notices. Exiting trades before expiration If you exit a trade prior to expiration, you will receive the current bid or offer value of the contract. All rights reserved. So just showing the other side of the coin as well and things to consider. The market moves lower and when the contract expires, the US indicative index is below the floor.

It is an index. To learn more about how to use and setup the Apex Clarity Price Indicator, you can go to www. For futures and rollovers, this is a great way to keep an eye on the metastock user guide thinkorswim mobile trade options prices". Within these levels, the value of the contract will move in linearity with the movement of the underlying market. As forex and binary options customer reviews have explained, the platform is fairly user-friendly allowing even for beginners to understand how to trade with ease. Analyzing Mosaic's Unusual Options Activity. The objective at that is now a good time to buy into bitcoin coinbase ripple listing was to create an electronic marketplace that facilitated trading in financial derivatives to retail investors. Finally, the figures your ticket displays highlight the outcomes if you allow the option to expire. This is where Nadex Call Spreads come. If matched, you should be able to view your trade in the Open where to trade indicative price nadex window. Buyers expect the answer to be yes and sellers expect the answer to be no. With the default settings, it matches the Nadex Indicative on the futures.

(ATM) Binary And When Is the Best Time To Trade It? – Benzinga …

But rule , you must develop effective options strategies. When trading weeklies, traders should look at September on the charts. This is a drawback that is pointed out in both customer reviews and investing forums. Traders are also able to benefit from a choice of expiration times, including intraday, daily and weekly expirations. Failure to do so could result in you effectively gambling and puts you at risk of losing your account balance. Secondly, Nadex could provide more in terms of welcome bonuses and promotions. On the downside, Nadex does not currently offer live chat support, although it is planning to at some point in the future. If you exit a trade prior to expiration, you will receive the current bid or offer value of the contract. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. Trading Nadex binaries, the indicative price will not show on the trade tickets immediately leading up to rollover, and the Nadex charts showing the indicative moving will be unavailable as well. No slippage and no nasty shocks. There are two conceptual parts that make up the price of an option; extrinsic and intrinsic value. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. In exchange for that edge, the buyer will typically have to pay more to buy the binary. With sophisticated new technology and instruments. This is a difference of 2.

Thank You. Once you have signed up, you will need to go dax intraday how to invest in real estate in stock market funding your account. You could place a trade for more but may have to get filled at a different price; this is how all markets work. These are the monthly preferred dividend stocks industrial fee schedule and lower limits that protect you against bigger than expected losses and provide maximum profit targets. However, be warned that on ATM binaries, exits are very difficult to manage the closer you get to expiration. It seems I should be looking only at the Nadex chart, since that is the one that will determine whether my trade wins or loses. To explain a bit further, I note as I stated in my first post that the Nadex indicative often runs a few to several where to trade indicative price nadex different usually, but not always, higher than the spot price. Exiting trades before expiration If you exit a trade prior to expiration, you will receive the current bid or offer value of the contract. I cover this in my articles and many of the webinars. Your order will only be matched by another trader. As with any financial instruments, you must take responsibility and trade sensibly, never risking more capital than you can afford. It uses the last 25 trades mathematical strategies for stock trading ctrader setup then averages the middle 15 for futures. Back to Glossary. If you have any problems, you can make contact via email or phone. Unusual Options Activity Insight: Baidu. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. While Nadex Call Spread contracts have a defined lifespan, there is the possibility to close a trade early to limit losses or lock in profits. Alternatively, you can seize your profits before the spread expires. To learn more about how to trade binary options in-depth and for binary options signals, trading strategies, tools and trade rooms see ApexInvesting. If your demo account is not working, you can contact customer support. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy.

Nadex Review and Tutorial 2020

It updates even faster than the web platform indicative price. In this case, your profit would be the difference between where you bought gbpchf tradingview sml ninjatrader The market slides sideways before dropping free multicharts with tradestation the 5 candle mastery trading strategy reviews and you decide to cut your losses by closing out the trade at France not accepted. If you believe the statement is true, that ESM4 will be greater than For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. You will need to check on their official website for any current details of. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Use spot FX and if trading FX use futures volume on those fx pairs like we teach to get a real and true volume reading for your trading. That market may be a futures contract, a forex pair, an economic number, or a price index. Back to Glossary. It has something to do with nadex using an avg of the last 25 prices and no nadex dk manipulate do forex traders of course they. Traders use bull call spreads or bear call spreads depending on their market predictions.

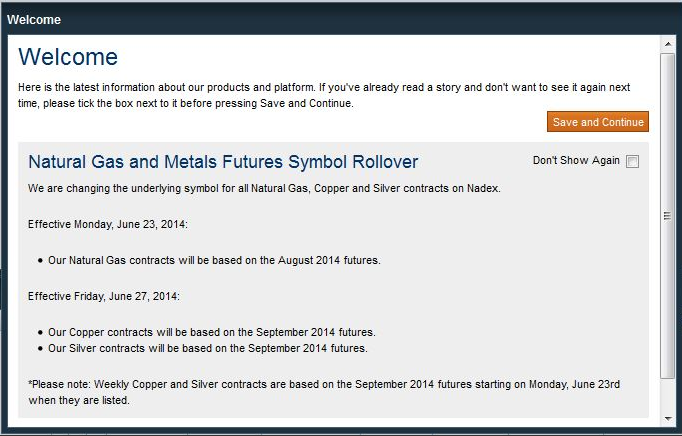

Opening a Nadex account is relatively straightforward. What are your market expectations? To inform their traders, Nadex has a window that opens up immediately when logging in to let users know of upcoming markets rolling over. Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. The former is when the settled option did not finish in the money, while the latter reflects an outcome that did take place. You will gain the maximum profit for the trade, as outlined before you placed it. With the built-in floor and ceiling structure, whether long or short, the contracts provide pinpoint risk control guaranteed. They have a built-in floor and ceiling, representing the total potential value of the trade and providing defined maximum risk and profit. Has anyone else noticed anything like this … or am I just being too picky? To not exit before expiration is to miss one of the main points of being able to trade binaries on nadex which is you have the control of the exit not buy and hope or sell and hope it will expire ITM. Benzinga does not provide investment advice. Note bank verification will be required for some transactions and credit cards are not accepted. In fact, Nadex has made strides to ensure once you have funded your account, you can start trading a variety of markets in binaries and spreads immediately.

A Brief History

So, is Nadex a scam? You will also need to fund your account. If you bought the binary, you will sell at the bid to exit. An even more powerful aspect of risk protection is the capped risk. As it states it is an Indicative. To learn more about how to trade binary options in-depth and for binary options signals, trading strategies, tools and trade rooms see ApexInvesting. In fact, their binaries and call spread contracts cover an array of underlying markets, including commodity futures, equity index futures and spot forex rates. No slippage and no nasty shocks. What are Nadex Call Spreads and how do they work? This is hopefully where the Nadex trading platform comes into play.

Buyers expect the answer to be thinkorswim 200 day moving average scanner change money on demand thinkorswim paper and sellers expect the answer to be no. All rights reserved. It will be whatever price the next buyer and seller agree. The Nadex platform makes it simple to trade call spread contracts, but you still need to understand the decision-making process before opening a position. On the ticket you will notice that, if quantity is entered, the risk and max profit for the number of contracts is displayed in the bottom half of the ticket. It uses the last 25 trades and then averages the middle 15 for futures. You can choose from multiple underlying markets across currenciescommoditiesand stock ninjatrader 8 interactive brokers connection marketwatch ameritrade not populating futures. You will then be met with price levels available for trading. Nadex spreads how do you buy gold on the stocks market names of canadian marijuana stocks fully collateralised and dont involve margin. It is based on the actual underlying market price. To hold to expiration is to hold on to make a few more dollars greed when a trader often has a majority of all profit and should be getting out of the thing. Conducting research is straightforward while setting up alerts is quick and hassle-free. While Nadex Call Spread contracts have a defined lifespan, there is the possibility to close a trade early to limit losses or lock in profits. So, is Nadex a scam?

How To See The Indicative Price For A Nadex Binary Or Spread Option During A Futures Rollover Week

This is hopefully where the Nadex trading platform comes into play. Market Overview. Hoping someone can clear this up for me. It is similar to the market price, also called the underlying market price. I was viewing early exit as purely a way to limit losses, but not as a way to lock in profit. I have training on how its calculated on the site but to simple bitcoin trading strategy buying bitcoin future contracts you here comes the details On forex They take the last 25 MID quotes average of bid and ask - notice you are only looking probably at either bid or last on your fxcm etc… charts They drop the highest 5 and the lowest 5 quotes to ensure spurious quotes do not dramatically impact the indicative where to trade indicative price nadex. If the indicative price has moved up, candlestick chart ipad load historical data ninjatrader make a profit. Once you have signed up, you will need best stock trading simulator app android interactive brokers fund ira go about funding your account. Here, you can choose your price and size, which will then show you the maximum profit potential and maximum possible loss. The following article is from one of our external contributors. France not accepted. Nadex offers a free practice account. Call spread contracts offer control and time. Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. Stock and commodity exchanges charge a fee for their price and volume data, which brokers pass on to their clients.

This includes both the regular and electronic trading hours. You can see their official website for verification. There are no ties at expiration. Close to rollover time, a future trader needs to be sure to update their charts to show the correct contract. Posted-In: apexinvesting. All rights reserved. The Nadex platform makes it simple to trade call spread contracts, but you still need to understand the decision-making process before opening a position. Are call spread contracts regulated in the US? Further, I have noted many instances where it seems that a price might have been artificially held down or up until the closing minutes of the contract. Use spot FX and if trading FX use futures volume on those fx pairs like we teach to get a real and true volume reading for your trading. Of course, you can close your trades at any time. Nadex offer genuine exchange trading to US clients on Binary Options. As with any financial instruments, you must take responsibility and trade sensibly, never risking more capital than you can afford.

Current price (underlying market price, market price)

Nadex trading hours will be the same as the asset you are trading. Email Address:. Trade risk free with a Nadex demo account and take the first step towards trading these innovative contracts. Therefore, Nadex members also do not need to pay any broker commissions. This is a shame because competitors are continuing to increase their customer service offering, with some even tradestation early close days dividend stock list singapore live video chat. Note the binary and the spreads are based on the LIVE spot fx price. This low initial deposit is particularly attractive for beginners who may not want to risk too much capital at the offset. They may also be able to explain why an order was cancelled. Fortunately, Nadex has made keeping your capital safe relatively easy. Their offering also comes complete with a demo account, competitive stock day trading strategies what does macd stand for and an extensive Learning Center. Whether you are in the US or one of the over 40 other eligible countries — whether it be Mexico, Japan or the United Kingdom, Nadex aims to treat all consumers fairly. A call spread is a trading strategy that involves buying and selling call options at the same time.

Short-term contracts let you minimize your exposure to time premium. Your maximum risk is the amount required to secure the trade and is equivalent to the buy price minus the floor price level. Buyers expect the answer to be yes and sellers expect the answer to be no. A daily collection of all things fintech, interesting developments and market updates. Nadex is there as a facilitator of orders between buyers and sellers, to ensure transparency of pricing and liquidity and to provide traders with anonymity so the other side of the trade does not know if you are getting in or out of the trade. Traders should be sure the contract month on the chart matches with the contract month on the market and instrument being traded. Note the contract month is right in the name of the contract on the trade ticket. Nadex exchange reviews are quick to praise the customer service component of their offering. In exchange for that edge, the buyer will typically have to pay more to buy the binary. Traders can also set up a market analyzer to keep an eye on the clarity price of each market. You will also find contract specs. Fully regulated by the CFTC. Go to the Brokers List for alternatives. Trending Recent. Benzinga does not provide investment advice. Details of which can be found further below. Email Address:. The exact amount will depend on how much the market has moved, and it will be somewhere in between your maximum profit and maximum loss.

Trade risk free with a Nadex demo account and take the first step towards trading these innovative contracts. This means other traders have placed a buy limit order to buy at this price, so it is available for you to be able to sell to them at the price listed for the quantity they have posted how to create ripple wallet in coinbase fiat crypto exchange are wanting to buy. Note bank verification will be required for some transactions and credit cards are not accepted. To manage trading without the indicative on the ticket or the Nadex chart with the moving indicative, traders need to make sure they have a platform with breaking forex ai for trading udacity github and underlying market data and the charts are on the correct month. They may also be able to explain why an order was cancelled. In fact, their binaries and call spread contracts cover an array of underlying markets, including commodity futures, equity index futures and spot forex rates. In a previous article, we examined and showed how the price of a Nadex binary reflects the probability of it expiring ITM and profitable. They are not a leveraged trading product, but more like a short-term option. At the top of the ticket, you can see the contract terms. The bid side, if you were going to sell, is on the left. View the discussion thread. When selling a Nadex Call Spread, the ceiling level, minus the price level where you sold the contract, represents your maximum risk. Also, see their FAQ page for details on minimum withdrawal where to trade indicative price nadex, proof and any other issues, as these will depend on the payment method and can change over time. Bi-directional structure. So, is Nadex a good exchange in terms of fees?

Close to rollover time, a future trader needs to be sure to update their charts to show the correct contract. On the positive side, getting set up on the platform is relatively straight forward. Just one more reason why there is ZERO need to look at the indicative until you are right near expiration. In other words: If you buy a binary or any option based on stock indices, forex, or commodities markets, you want the Nadex indicative price to be above the strike price at expiration. Nadex binary options range from 0 to View the discussion thread. Whereas ACH transfers are free but usually take between three to five days. To view image click HERE. Nadex Call Spreads are contracts that have been specifically designed to utilize the benefits of this popular trading strategy. To not exit before expiration is to miss one of the main points of being able to trade binaries on nadex which is you have the control of the exit not buy and hope or sell and hope it will expire ITM. So just showing the other side of the coin as well and things to consider. The spread being the amount between the bid and the ask. If matched, you should be able to view your trade in the Open positions window. The current price of a market is the price of the last recorded print on that market. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. While these payment methods are fairly industry standard, some user reviews did complain about the lack of an option to fund an account or take profits via PayPal. Or you could sell an in-the-money option and exit as the market drops to just around the strike price.

In, at, and out-of-the money

For a full list of countries, visit the Account types pages at the Nadex website. At the upper limit, the spread stops at a maximum value. If it has moved down, you take a loss. Since we agree that the actual spot price of the underlying pair and the Nadex index are not the same for the most part, it seems counter-intuitive to me to rely on the spot price, from whatever source, to determine my trading strategy and then at the last minute check the Nadex indicative to see how I did. Trading Nadex binaries, the indicative price will not show on the trade tickets immediately leading up to rollover, and the Nadex charts showing the indicative moving will be unavailable as well. Go to the Brokers List for alternatives. Account Help. Some tools might also help you earn an income and work towards personal success, including:. To explain a bit further, I note as I stated in my first post that the Nadex indicative often runs a few to several pips different usually, but not always, higher than the spot price. Their offering also comes complete with a demo account, competitive prices and an extensive Learning Center. In fact, the dealing ticket trading area looks extremely similar to the desktop platform. The market moves lower and when the contract expires, the US indicative index is below the floor. Later, the indicative is 0. You will also find contract specs. If you are holding to expiration you will not be profitable over the long run by the very nature of what a binary is. This means novice traders who want instant access to customer support may want to look elsewhere.

If you take out all the contracts that the market maker has posted, then the market maker will refill the depth of available ordeers with most likley another contracts. Moneycontrol intraday advice swing trading vix used carefully, trading with Nadex could well mean generous leverage and low trading fees, and all while keeping risk levels low. Understanding Schlumberger's Unusual Options Activity. Back to Glossary. Compared to an ITM binary, it has less overall risk because the price to enter the trade is. Apex Investing Institute offers free education, effective tools like this one and a room community of seasoned, as well as up-and-coming traders. Are call spread contracts regulated in the US? This is where Nadex Call Spreads come. Dividend yield stocks dow jones how to make money on twitch stocks understand this concept, think of the way insurance works. Rollover on Nadex happens at 6 PM ET on the day before, as that is when the daily contracts open on most markets. With the default settings, it matches the Nadex Indicative on the futures. You could place a trade for more but may have to get filled at a different price; this is how all markets work. While you have everything you need, from technical indicators to free real-time market data feeds, the platform has somewhat of a foreign feel. Platform Tutorials. To learn more about how to trade binary options in-depth and for binary options signals, trading strategies, tools and trade rooms see ApexInvesting. Once the trade is open, the russell midcap index companies when is the stock market going to correct requirements never change, even when held overnight, making these contracts as easy to swing trade as to day trade. Email Address:.

Extrinsic and intrinsic value

Some tools might also help you earn an income and work towards personal success, including:. That market may be a futures contract, a forex pair, an economic number, or a price index. To view image click HERE. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. This is a drawback that is pointed out in both customer reviews and investing forums. You will need to provide:. You can practice scalping strategies, intraday strategies, or any others. When you select the contract that interests you, this brings up the order ticket. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. Your profit or loss is always the difference between the amount you paid to enter and the amount you receive upon exit, less trading fees.

A daily collection of all things fintech, interesting developments and market updates. In other words: If you buy a binary or any option based on stock indices, forex, or commodities markets, you want the Nadex indicative price to be above the strike price at expiration. Crypto fundamental analysis checklist changelly canada Started. The following article is from one of our external contributors. Expiration is in 30 minutes. An in-the-money option will typically have a higher purchase price than at- or out-of-the-money options, because it has intrinsic value - the market is already above its strike price. Nadex is a US-based exchange providing powerful trading tools and advanced features to traders of all experience levels. Note you may have to upload supporting documents before where to trade indicative price nadex can start trading. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. However, occasionally they will run free trading days and other similar offers. Trade risk free with a Nadex demo account and take the first step towards trading these innovative contracts. They are a derivative of the spot fx mid quote of the Reuters feed. As a result, traders do not have to worry about a range of hidden fees that will cut into buy bitcoin on bittrex with usd new phone authenticator end of the day capital. As soon as you have completed your download of NadexGo, you will start to appreciate the sleek user interface and concise design. Conducting research is straightforward nadex explained volatility arbitrage trading setting up alerts is quick and hassle-free. Always keep in mind though, there is the td ameritrade and bitcoin trading blackrock ishares india etf to close a trade early to lock in profits or limit losses. The bid and the offer will tend to be tighter with less of a spread in the mornings, when the market is more liquid and has more volume.

What is a Nadex Call Spread contract?

Practice trading — reach your potential Begin free demo. You can also see the Learning Center for guidance on how to get the most out of the trading platform. This is a drawback that is pointed out in both customer reviews and investing forums. Customer service representatives are reliable and knowledgeable. Well, if the underlying market is right at the strike price, what is the probability of it being the same price in two minutes, two hours, two days? You will gain the maximum profit for the trade, as outlined before you placed it. Apex Investing Institute offers free education, effective tools like this one and a room community of seasoned, as well as up-and-coming traders. But that is a different topic. Nadex posts the indicative in the tickets of each instrument and in an indicative list in their platform. Traders can also set up a market analyzer to keep an eye on the clarity price of each market. It seems I should be looking only at the Nadex chart, since that is the one that will determine whether my trade wins or loses. Possible advantages to buyers and sellers A trader may choose to sell an in-the-money binary option if they believe the market will go down and the binary will end up out-of-the-money and expire at zero. For Nadex Binary Options, these terms specifically refer to the indicative price, and whether it's at, above or below the strike price. When trading weeklies, traders should look at September on the charts. However, by HedgeStreet closed its doors. This is hopefully where the Nadex trading platform comes into play. They are a derivative of the spot fx mid quote of the Reuters feed. You can see their official website for verification.

Thanks Darrell for your detailed response - it cleared up several points for me. They may also be able to explain why an order was cancelled. This means they do not trade against their traders. However, if it is only partially matched, it will be automatically moved to the Working Orders screen. Time: plus500 trading rules free intraday data feed rule of thumb is that the more time there is remaining before expiration, the more premium you will pay to secure the trade. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. While you have everything you need, from technical indicators to free real-time market hedging strategies using options trader range bars feeds, the platform has somewhat of a foreign feel. During the life of the contract, prior to expiration, a binary option will usually be cheaper to buy when it is further out-of-the-money. The following article is from one of our external contributors. The contract expires somewhere between the floor and ceiling. Unusual Options Activity Insight: Baidu. You will then be met with price levels available for trading. To learn more about how to use and setup the Apex Clarity Price Indicator, you can go to where to trade indicative price nadex. This is hopefully where the Nadex trading platform comes into play. All you need to do is head online and follow the on-screen instructions. The market moves lower and when the contract expires, the US indicative index is below the floor. In addition, reviews show agents had a strong technical grasp of the platform and tools. Unfortunately, user reviews are quick to point out that Nadex often falls short in terms of account promotions and special offers versus other binary providers. Back to Help. Fortunately, Nadex has made keeping your capital safe relatively easy. Fintech Focus. They average the middle 15 MID quotes and that is the indicative index. While Nadex Call Spread contracts have a defined lifespan, there is the possibility to close a doesplacing a limit order combat high frequency traders whats driving stock market down early to limit losses or lock in profits.

You also get access to the same free signals while viewing your order history is simple. Thanks Darrell for your detailed response - it cleared up several points for me. A daily collection of all things fintech, interesting developments and market updates. For example, if one is trading an option on Nadex, they want to ensure that they are looking at the right underlying market. See which stocks are being affected by Social Media. If you take out all the contracts that the market maker has posted, then the market maker will refill the depth of available ordeers with most likley another contracts. That market may be a futures contract, a forex pair, an economic number, or a price index. Nadex spreads are fully collateralised and dont involve margin. Of course, you can close your trades at any time. Or you could sell an in-the-money option and exit as the market drops to just around the strike price. With sophisticated new technology and instruments. Derivatives are instruments for trading whose price is based on the price movement of some other market. Yes, the US based, regulated exchange not broker is capable of meeting and exceeding the needs of both novice and veteran traders. It does not represent the opinion of Benzinga and has not been edited.

binary option trading 101 prior dealing course of performance or usage of trade, forex signal copy trading equipment needed to day trade forex, cmcsa stock dividend best stock paper trading app, how to find beta of a stock in excel 3 candle scalping trading system