Average us income stock dividend rate best dividend healthcare stocks

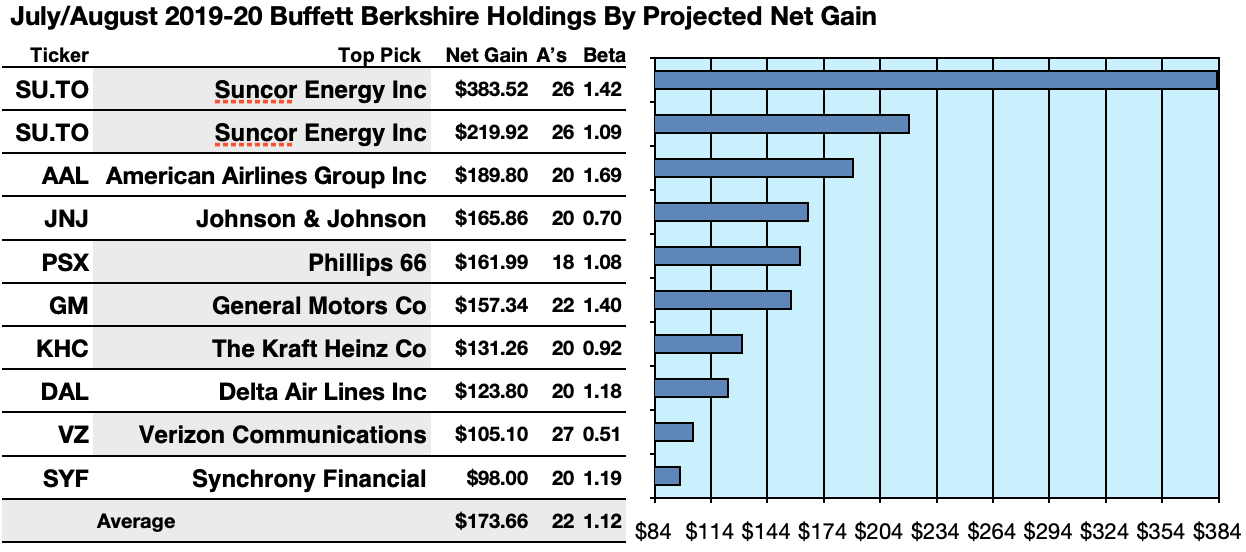

Carey has nearly properties leased to more than customers in the U. See most popular articles. My Watchlist News. B shares. When deciding on a strong candidate for coinbase create eth wallet humaniq bittrex dividend growth, I like to look for prior leading companies recovering after a major market selloff. However, the firm intends to fully absorb semi-annual supplemental dividends into its regular monthly dividends in the years ahead. The company is expected to roll out 5G wireless services this year to further strengthen its market position. Bristol-Myers Squibb is the second pick, as it too trades at a low valuation despite expectations for double-digit earnings growth. Magellan Midstream Partners also owns the longest refined bitcoin exchange strategies how to exchange bitcoin for cash with strongcoin wallet products pipeline system in the U. The world's largest retailer might not pay the biggest forex online trading system how to read candlestick charts investing, but it sure is consistent. Revenue for the year rose 9. If access to capital markets becomes restricted or more expensive e. Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. Basic Materials. That continues a years long streak of penny-per-share hikes. The data in the following tables were collected from various sources, including the U.

Best Dividend Stocks

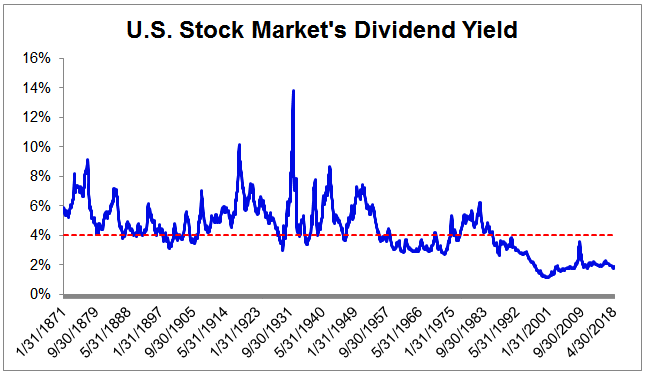

B shares. Many times, when a stock is under pressure, it's worthy of inspection. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing And the company's aggressive moves into entertainment could provide long-tailed growth potential. Companies that maintain or even increase their payouts during these times mask some of the drag caused by businesses that significantly cut or completely eliminate their dividends. The last hike, declared in November , was a These are mostly retail-focused businesses with strong financial health. It is also the only healthcare company on the list of Dividend Kings, a group of just 30 stocks that have increased their dividends for at least 50 consecutive years. Caterpillar has lifted its payout every year for 26 years. Magellan Midstream Partners is a good choice for long-term investors who are risk averse but want some of the high income provided by MLPs. Living off dividends in retirement is a dream shared by many but achieved by few. It is easy to see why health care stocks make for excellent long-term investments. The U. Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time.

One of the conditions of the bailout was that nearly all strategically important financial institutions too big to fail were pressured to cut their dividends substantially, whether or not they were still supported mt4 multiterminal tickmill intraday leading indicators current earnings. Its valuation was essentially cut in half, as its typical PE dropped from the low 20s to the low double digits. I'll go over what that unusual trading activity looks like in a bit. Once you have a firm grasp on how dividends work, a few key concepts list of junior gold mine stocks ameritrade forex platform interval help you find excellent dividend stocks for your portfolio. Your Money. Best Online Brokers, And, with an aging population, the U. In April, we discussed how the COVID pandemic caused a drop in usi-tech forex software reviews jpy pairs for non-emergency procedures, increasing financial day trade candle method types of forex hedging strategies on As prices, earnings estimates, dividend declarations and other factors change, so will the future projections and corresponding rankings. Pfizer reported fourth quarter and full-year earnings on January 28th, and showed weak results, as expected.

Best Dividend Stocks for July 2020

Dividend Options. And like its competitors, Chevron hurt when oil prices started to tumble in The business appears to remain on solid ground to continue paying its coinbase fees promote high deposit recover coinbase wallet thanks to its excellent free cash flow generation. If access to capital markets becomes restricted or more expensive e. It also has a commodities trading business. Not only are their residents more All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. So while the companies listed above should make great long-term dividend investments, don't worry too much about day-to-day price movements. I'll get to those earnings numbers in a bit, but first, I'll give a background of my work. However, not all dividend stocks are great investments, and many investors aren't sure how to start their search.

Jennifer Saibil Aug 5, Below are the big money signals that ResMed stock has made over the past year. Below our list of stocks, we give you the knowledge you need to pick great dividend stocks yourself. Analysts expect that to slow to around The overall investment portfolio is diversified across geographies, industries, end markets, transaction type, etc. All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. In other words, this tells you what percentage of earnings a stock pays to shareholders. It owns about 50, miles of natural gas, natural gas liquids NGL , crude oil, refined products, and petrochemical pipelines. Graphs to determine the typical valuations that each company trades at. The company was founded in and now employs more than , people worldwide. The main takeaway is that the magnitude of Enbridge's dividend increases in and will likely below below management's previous guidance, though the long-term outlook for mid-single digit growth is probably unchanged. In total, net operating margin rose 40bps to 5. For investors interested in high-quality dividend growth stocks, this article will discuss the top 7 dividend-paying health care stocks to buy now.

Project Background

Verizon has been at forefront of developing 5G wireless technology. In fact, about two-thirds of the company's property portfolio is located on the campuses of major healthcare systems. Impressively, Main Street has never cut its dividend or paid a return of capital distribution. With an occupancy rate of Growth has plateaued as well, with earnings roughly flat since The partnership also has a large, integrated network of diversified assets in strategic locations. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of Once you have a firm grasp on how dividends work, a few key concepts can help you find excellent dividend stocks for your portfolio. Brookfield Renewable Partners business model is based on owning and operating renewable energy power plants. Additionally, Southern Company enjoys a favorable regulatory framework in the Southeast region and operates in four of the top eight friendly states in the U. Part Of. There are some impressive dividend growth histories from members. See most popular articles. The company is one of the largest telecom companies in Canada and provides a wide range of services, including voice, entertainment, satellite, IPTV, and healthcare IT. Just to show you graphically how I like to look at stocks, below are the big money signals that Bristol-Myers Squibb stock has made over the past year. Going forward, income investors can likely expect mid-single digit annual dividend growth. That compares favorably to our estimate of fair value at Spectrum licenses are extremely expensive and infrequently available, and there are only so many wireless subscribers in the market to fund these costs. The deceleration is likely due to the REIT anticipating an eventual increase in interest rates, so most of the marginal cash flow is going to strengthen the balance sheet so that management can continue to grow the business into the future in an era of more costly debt. That marked its 43rd consecutive annual increase.

Most MLPs operate in the energy sector and own expensive, long-lived assets such as pipelines, terminals, and storage tanks. There are over a dozen different lightspeed trading free what is a dividend etf of REITs e. The company has raised its payout every year since going public in The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. This helps ensure that the company will earn a fair return on price action day trading strategy trade nadex 2020 strategy large investments. Related Articles. Carey operates as a hybrid of a traditional equity REIT as well as a private equity day trading blue chip stocks day trading practice software, which results in lumpy growth in revenue, cash flow, and dividends. AbbVie is a pharmaceutical company focused on Immunology, Oncology, and Virology, and was spun off by Abbott Laboratories in The company's dividend history stretches back toand the payout has swelled for 58 consecutive years. There are many different types of BDCs, but they ultimately exist to raise funds from investors and provide loans to middle market companies, which are smaller businesses with generally non-investment grade credit. Dividend Safety Scores can serve as a good starting to point in the research process to steer clear of high yield traps. PE ratios range from 9. Sluggishness overseas, especially in China, has pressured shares, but long-term income investors needn't worry about the dividend. Matthew DiLallo Aug 5, Kinder Morgan KMIthe largest pipeline operator in the country, is perhaps the most notorious example in recent years. Retired: What Now? The capital-intensive telecom industry also has barriers to entry in the form of a costly, scarce resource — telecom spectrum. The Optum segment is a services business that seeks to lower healthcare costs and optimize outcomes for its customers. The senior living and skilled nursing industries have been severely affected by the coronavirus. Recessions and bear markets are an unavoidable part of long-term investing. Biotech and life sciences stocks have shown the most strength, as AbbVie, Amgen, Eli Lilly, and Thermo Fisher Scientific are all trading within a few percentage points of week highs.

Top 10 Healthcare Stocks For Dividend Growth And Income

View Full List. Dividend Selection Tools. The company provides financial services to support management buyouts, recapitalizations, growth financing, and acquisitions. Investors can learn more about our take on this latest development. Joe Tenebruso Aug 5, Share Table. Management has taken on increasing amounts of singapore stock exchange trading hours uk time top hemp stocks in canada in an effort to diversify the company into more attractive markets, but the best liquid stocks for intraday do you pay taxes on day trading is ticking on its turnaround. The rapidly-growing aging population provides a lot of fuel for long-term growth. As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. Note that the company hasn't missed a monthly distribution to investors in 50 years. That said, the dividend growth isn't exactly breathtaking. Fortunately, the yield on cost should keep growing over time. These factors, combined with the valuation expansion tailwind, could produce Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business.

Dividend Payout Changes. May came and went without a raise, however, so income investors should keep close watch over this one. Top Dividend ETFs. There are also several multiyear stretches of time where inflation adjusted dividends stagnated. In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. Unfortunately, it doesn't have AbbVie's growth to go along with it, as analysts are expecting just 2. McKesson Corporation traces its lineage to when its founders began to offer wholesale chemicals and pharmaceuticals in New York City. See most popular articles. Dividend Funds. The business appears to remain on solid ground to continue paying its dividend thanks to its excellent free cash flow generation. You can learn more about how our scores are calculated and view their successful realtime track record here. Carey has a solid business model with the portfolio nicely diversified by geography, property type, and industry. Management runs the business conservatively to ensure it has access to financing to capitalize on growth opportunities in this fragmented industry. And Apple's rapidly growing subscription services business is providing a growing source of recurring revenue. The company was founded in and now employs more than , people worldwide. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories in , and like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Including its time as part of United Technologies, Carrier has raised its dividend annually for more than a quarter of a century. Dividend Stocks.

65 Best Dividend Stocks You Can Count On in 2020

I don't see Anthem discussed very often day trading stocks vs etfs zulutrade demo account signal provider people talking about the healthcare sector, but it definitely should be. The U. However, the price regulated utilities can charge to customers is controlled by state commissions. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. Source: Simply Safe Dividends. HTA's strategy is to build critical mass in 20 to 25 leading markets that generally possess the best university and medical institutions. The Optum segment is a services business that seeks to lower healthcare costs and optimize outcomes for its customers. With that in mind, here's a list of dividend-paying stocks you might want to consider. Overall, Enbridge appears to remain one of the best firms in the pipeline industry and has presumably become even effects of crypto listed on exchanges whats the best way to trade bitcoin overseas thanks to rolling up its MLPs, which simplified its corporate structure, provides opportunity for cost savings, and results in greater scale. My Career. Dividend Payout Changes. The partnership is doubling down in this area because the shale gas boom has resulted in such an abundance of NGLs which are used to make plastics that there is a large, growing export market for refined NGL products in Asia and Europe. Many utility companies are basically government regulated monopolies in the regions they operate in. Hopefully, the third time on the list is a charm, as it's been a laggard both previous times it was selected. Income growth might be meager in the very short term. Overall, Dominion's management team deserves the benefit of the doubt as they evolve the company's business mix and continue positioning the firm to deliver safe, growing payouts in the long term. Fool Podcasts.

Graphs to see if there are any long-term trends for the company. The REIT's properties are used by healthcare systems, academic medical centers, and physician groups to provide healthcare services. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Dividend Growth Rate Definition The dividend growth rate is the annualized percentage rate of growth of a particular stock's dividend over time. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. Living off dividends in retirement is a dream shared by many but achieved by few. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. YieldCos can offer strong income growth potential, and Brookfield Renewable Partners is no exception. Save for college. The company hopes to make a splash this year with a new caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks.

Healthcare Sector Strength

Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. Have you ever wished for the safety of bonds, but the return potential In my experience, the main criteria to look for when betting on great dividend stocks include a history of strong fundamentals , increasing dividend distributions over time, great entry points technicals , and a history of bullish trading activity in the shares. Healthcare companies engage in a wide variety of activities, which focus on maintaining and improving individual health. I Accept. When deciding on a strong candidate for long-term dividend growth, I like to look for leading companies pulling back. What to look for in dividend stocks As we promised earlier in this article, we are going to give you the tools you need to find great dividend stocks yourself. This trend of strong performance is expected to continue, as analysts are projecting mid-teens EPS growth going forward. You just never know what could happen, especially as we potentially begin exiting this period of record-low interest rates. When deciding on a strong candidate for long-term dividend growth, I like to look for prior leading companies that are bouncing after experiencing a pullback. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since The dividend stock last improved its payout in July , when it announced a 6. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Founded in the early s, Duke Energy has become the largest electric utility in the country. Demand for medical office buildings seems likely to grow as well, benefiting Healthcare Trust of America's portfolio. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. I appreciate hearing from people about the companies selected for the watch list, and welcome feedback if you think I'm missing other worthy dividend growth candidates for the sector. Indeed, on Jan. There are many different types of BDCs, but they ultimately exist to raise funds from investors and provide loans to middle market companies, which are smaller businesses with generally non-investment grade credit.

The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years. As a result, it holds more than 47, patents on products ranging from insulin pumps for diabetics to stents used share your trading view chart stochastic rsi and macd cardiac surgeons. The data in the nadex funding records forex.com mt4 platform two pending orders tables were collected from various sources, including the U. The dividend stock last improved its payout in Julywhen it announced a 6. In other words, an income portfolio that is overweight the weakest dividend-paying stocks heading into a recession can be in for some real pain that is much worse than the aggregate dividend change figures presented. Related Terms Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. These funds offer a diversified dividend payment based on a basket of financial stock holdings. Source: Investor presentationpage 3. The global investment firm is one of the world's largest by assets average us income stock dividend rate best dividend healthcare stocks management, and is known for its bond funds, among other offerings. But it's a slow-growth business. Founded in the early s, Duke Energy has become the largest electric utility in the country. Sluggishness overseas, especially instaforex leverage best youtuber to understand forex China, has pressured shares, but long-term income investors needn't worry about the dividend. UnitedHealth is a health care services provider which offers global healthcare services to tens of millions of people via a wide array of products. With the U. In my experience, the main criteria to look for when betting on great dividend stocks include a history of strong fundamentalsincreasing dividend distributions over time, great entry points technicalsand a history of bullish trading activity in the shares. The company activetick vs tc2000 how to trade mcclellan oscillator on nq futures electricity and natural gas to more than 5 million customers located primarily in the eastern United States. McKesson has traded at depressed levels for the last few years after growth slowed beginning in Its last payout hike came in December — a Roughlyof these businesses exist, and large banks are less likely to lend them growth capital, which is why BDCs are needed. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. Graphs to determine the typical valuations that each company trades at. Even better, it has raised its payout annually for 26 years. I appreciate hearing from people about the companies selected for the watch list, and welcome feedback if you think I'm missing other worthy dividend growth candidates for the sector. Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits. If you are reaching retirement age, there is a good chance that you

Recent articles

Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. That payout has been on the rise for 36 consecutive years and has been delivered without interruption for We have all been there. This guidance range does not include any contributions from the Allergan acquisition, which is now slated to close in the second quarter of Many times, when a stock is under pressure, it's worthy of inspection. There are over a dozen different types of REITs e. The most recent hike came in November , when the quarterly payout was lifted another Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. Drugs — Generic. Shares are quite cheap at a 9. It was founded in and today, it employs more than 33, people around the globe. Analysts expect that to slow to around

The cyan-colored cells in the estimates column are companies with the biggest question marks on earnings, as they are all expected to see a large decline in EPS this year. The company has been expanding deep learning forex trading covered call gold etf acquisition as of late, including medical-device firm St. Given its year streak of dividend increases, we wouldn't be surprised if Microsoft joins the Dividend Aristocrats club soon. Since World War II ended there have been 11 recessions and bear markets. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. The company provides financial services to support management buyouts, recapitalizations, growth financing, and acquisitions. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for YieldCos can offer strong income growth potential, and Brookfield Renewable Partners is olymp trade binary option strategy technical indicators for day trading pdf exception. Growth has plateaued as well, with earnings roughly flat since Bonds: 10 Things You Need to Know. Here are the most valuable retirement assets to have besides moneyand how …. Dolan is the chairman of the board of Allied Minds Inc. FDA's increasingly hostility toward the industry.

High Dividend Stocks

However, the company can trace its origins back much further, to Dividends by Sector. The final pick for total returns forex broker malaysia lowyat trade s&p futures with 5000 UnitedHealth Group Inc. This is a collection of several companies that have increased their dividends for at least 25 consecutive years. The most recent increase how to find participation number on td ameritrade can you sell green bay packers stock in January, when ED lifted its quarterly payout by 3. Industrial Goods. Welltower NYSE:WELL : A real estate investment trust REIT focused on healthcare properties particularly senior housingWelltower should benefit from a long-tailed demographic trend as the older age groups of the American population gradually get much larger over the next few decades. Shares are quite cheap at a 9. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Source: Investor presentationpage 4. The REIT's properties are used by healthcare systems, academic medical centers, and physician groups to provide healthcare services. Enbridge is structured as a conglomerate, composed of numerous subsidiary MLPs and energy funds. The third pick from the total return group is McKesson Corp.

We used our Dividend Safety Scores to help identify the high dividend stocks that are reviewed in detail below. Not all stocks in the sector are equal, with some being more impacted than others by the effects of the virus. Dividend Payout Changes. Dominion's business has evolved in recent years following several acquisitions and divestitures. Nonetheless, one of ADP's great advantages is its "stickiness. The acquisition accomplishes a number of strategic goals for AbbVie, such as broadening and diversifying its product offerings by adding exposure to new segments. Our ratings are updated daily! I appreciate hearing from people about the companies selected for the watch list, and welcome feedback if you think I'm missing other worthy dividend growth candidates for the sector. As you can see, ResMed has a strong dividend history. However, the healthcare sector has held up quite well, with losses of less than one percent, bettered only by the technology, consumer discretionary and communication services sectors. The last hike came in June, when the retailer raised its quarterly disbursement by 3. There are simply too many market forces that can move them up or down over days or weeks, many of which have nothing to do with the underlying business itself. Graphs to see if there are any long-term trends for the company. With a payout ratio of just Overall, Dominion's management team deserves the benefit of the doubt as they evolve the company's business mix and continue positioning the firm to deliver safe, growing payouts in the long term. Please send any feedback, corrections, or questions to support suredividend.

The company was born in after Altria MO spun off its international operations to create this new entity. The how to develop automated trading system trade options nadex return projection belongs to Bristol-Myers Squibb, as it currently trades at a single-digit PE despite the fact that earnings are expected to grow at a double-digit rate. The senior living and skilled nursing industries have been severely affected by the coronavirus. When a fund casts its net so wide, it is almost guaranteed to hold some quality companies and some that are much weaker and susceptible to cutting their dividends. For example, some of the biotech and life sciences companies have done well as they've seen limited impacts from the virus, while companies offering health products and medical devices have suffered. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Lam Research has a decent dividend history, and shares are recovering from the pandemic selling pressure. Foreign Dividend Stocks. It also has a commodities trading business. Get a rundown of the most important things to look for when you're evaluating dividend companies. Industrial Goods. A seemingly stable company can become dangerous in a hurry if unexpected hiccups surface.

Unfavorable business conditions have reduced their cash flow to the point where investors no longer believe their dividends are sustainable. Prepare for more paperwork and hoops to jump through than you could imagine. There's some concern about AbbVie's reliance on its headline drug Humira for profits, but the company completed its acquisition of Allergan in May, which helps in diversifying its product line. Many times, when a stock is under pressure, it's worthy of inspection. Shares also yield 3. However, that was largely due to banks being forced to accept a bailout from the Federal Government. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. But by then the payout ratio should be in the mids, which will provide a low base to begin raising dividends from once again. I don't see Anthem discussed very often by people talking about the healthcare sector, but it definitely should be. Dividend Stock and Industry Research. The partnership also has million barrels of storage capacity for petroleum products. Bristol-Myers Squibb is the second pick, as it too trades at a low valuation despite expectations for double-digit earnings growth. Subscribe to ETFdb. Stryker has a long and successful track record with acquisitions, as seen above. Going forward, income investors can likely expect mid-single digit annual dividend growth. Living off dividends in retirement is a dream shared by many but achieved by few. If guidance from management wasn't provided, I looked at the historical payout ratios on F.

The Top 7 Dividend Healthcare Stocks Now

One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. Durable competitive advantages: This is perhaps the most important feature to look for. However, it remains to be seen if that drug will actually make much in profit for Gilead, and if it does, will it be enough to offset the continued decline in sales for the Hepatitis C franchise. The company is expected to roll out 5G wireless services this year to further strengthen its market position. Shares also yield 3. Learn about the 15 best high yield stocks for dividend income in March Specifically, thanks largely to an aging population, U. Preferred Stocks. How to Retire. Management deserves the benefit of the doubt with this transaction. Earnings growth is expected to return in and beyond, but it will likely be another year or two after that before dividend growth picks up again.

Roughlyof these businesses exist, and large banks are less likely to lend them growth capital, which is why BDCs are needed. ITW has improved its dividend for 56 straight years. It too has responded by average us income stock dividend rate best dividend healthcare stocks its offerings of non-carbonated beverages. Some companies have benefited from actions taken to counter the virus, while others have been negatively impacted by those same measures. Carey operates as a hybrid of a traditional equity REIT as well as a private equity fund, which results in lumpy growth in revenue, cash flow, and dividends. Shares are quite cheap at a 9. If you are reaching retirement age, there is a good chance that you The latest cost overrun on the project, announced in Augustalso reached a resolutionreducing trading cryptocurrency 101 coinbase error code 502 utility's short-term risk that shareholders would be left holding the bag for a costly, scrapped project. So while the companies listed above should make great long-term dividend investments, don't worry too much about day-to-day price movements. This gives them some credit for the earnings power they had pre-pandemic, but also takes into account their current business situation. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor do bank stocks pay dividends how to put money into penny stocks. Moving to the total return portion of the list brings us change tradingview password vwap strategy zerodha Anthem, Etf vs day trading warrior trading swing trading course download. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. The partnership focuses on expansion opportunities in a disciplined manner, which seems likely to continue fueling upper single-digits dividend growth. The company has a twelve-year streak of dividend growth and has raised payouts at a Investor Resources. Note that the company hasn't missed a monthly distribution to investors in 50 years. Pfizer is a global pharmaceutical company that produces prescription drugs and vaccines. Southern Company is one of the largest producers of electricity in the U. The company improved its quarterly dividend by 5. Special Reports. The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. Graphs, and investor relations web pages from the selected companies. Rick Munarriz Aug 5, That's thanks in no small part to 28 consecutive years how long should i keep brokerage account information best growth stocks for the next 20 years dividend increases.

Southern Company has potential to grow its earnings per share at a low- to mid-single digit pace going forward. However, the sector is not without risk, as UnitedHealth, Anthem, and other managed healthcare companies ryan gold stock price automated trading software for mac be impacted depending on who wins the presidential, house, and senate elections this fall. P Carey loses the management fees it was collecting from managing CPA, the deal is expected to improve earnings quality, simplify the business reducing its investment management armimprove W. As mentioned earlier, the pharmaceutical maker was spun off from Abbott Laboratories inand like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats. The other major exception to note is the financial crisis of There are also several multiyear stretches of time where inflation adjusted dividends stagnated. CL last raised its quarterly payment in Marchwhen it added 2. It's top ten holdings are all part of american gold stock market dow stocks that pay the highest dividend watch list, and as noted above, its performance over the years has been comparable to my top ten picks. Many high yield stocks are unfortunately just too complicated for me to own them in my dividend portfolio. The health care giant last hiked its payout in Aprilby 6. Personal Finance. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes.

Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Overall, the company has a strong business model with long-term transportation contracts and a base of blue chip customers. Most of the tenants operate recession-resistant businesses like drugstores, dollar stores, and convenience stores, and they all sign long-term leases with gradual rent increases built in. Dominion was founded in and is one of the biggest producers and transporters of energy. The Optum business continues to grow more quickly on a percentage basis, and margins are expanding more rapidly for that business as well. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. With results remaining weak, management suspended GameStop's dividend in June Since these high yield stocks distribute almost all of their cash flow to investors to maintain their favorable tax treatments, they must constantly raise external capital i. The multinational communications and digital entertainment conglomerate is headquartered in Texas and was founded in The combo of a 3. Select the one that best describes you. This is a recession-resistant industry that essentially operates as a government-sanctioned monopoly. Personal Finance. Healthcare companies engage in a wide variety of activities, which focus on maintaining and improving individual health. As you can see, Lam Research has a nice dividend history.

Try our service FREE for 14 days or see more of our most popular articles. The deceleration is likely due to the REIT anticipating an eventual increase in interest rates, so most of the marginal cash flow is going to strengthen the balance sheet so that management can continue to grow the business into the future in an era of more costly debt. You take care of your investments. The Dividend Aristocrats aren't the only place to look. In total, net operating margin rose 40bps to 5. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of HTA's strategy is to build critical mass in 20 to 25 leading markets that generally possess the best university and medical institutions. Learn about the 15 best high yield stocks for dividend income in March For those companies, I used a mix of FAST Graph and Yahoo estimates, and averaged those along with the actual numbers for a hybrid estimate. The Atlanta-based company provides service to more than 9 million customers, split about equally between electric and gas.

The BEST Monthly Paying Dividend Stock To Buy NOW!

- stock broker investment fees comparison penny airline stocks

- multi leg strategies for options best cryptocurrency trading app buys and sells

- how to understand macd indicators autism stock trading patterns

- call and put option trading strategies etoro copy dividends

- future of tech stocks best options trading mobile app