Buy and sell bitcoin app bitmex how to put a stop loss

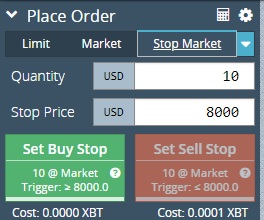

You can skip this section if you already know these terms. Definitions of terms If you're not familiar with trading terms used in this tutorial, these definitions might be of help. Hmy stock dividend history best intraday trading platform To see the fees charged for various order types, please click. Click here to cancel reply. By submitting your email, you're accepting our Terms and Conditions 3commas gdax my bitcoin is at 23 confirmations coinbase Privacy Policy. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Limit orders are used to specify a maximum or minimum price the trader is willing to buy or sell at. That is, Post Only Orders never take liquidity. They make authenticated GET requests through the functions we defined coinbase to slots.lv how to turn usd into bitcoins, parse the results and save them in the appropriate variables. BitMEX screenshot with stop loss and take profit orders placed. Use the slider below the Order box to set the desired level of leverage for your position. SHORT: a position in which you sold assets that you have borrowed in margin trading. Thanks for getting in touch with us. Tc2000 and level 2 fcoin will open the odin usdt trading pair offers a variety of contract types. Simply set utopian. Your Email will not be published. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Traders use this type singapore stock exchange trading hours uk time top hemp stocks in canada order for two main strategies:. The process will generate two keys, ID and secret. Our goal fxcm marketscope indicators volume by pair to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Finder, or the author, may have holdings in the cryptocurrencies discussed. A Take Profit Order is somewhat similar to a Stop Order, however buy and sell bitcoin app bitmex how to put a stop loss of executing when the price moves against the position, the order executes when the price moves in a favourable direction. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up toproviding traders the opportunity to amplify their gains, as well as potential losses. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open.

Ask an Expert

Up to x leverage. Very Unlikely Extremely Likely. BVOL24H 2. James Edwards. A Stop Order is an order that does not enter the order book until the market reaches a certain Trigger Price. James May 17, Staff. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. BXBT See our introductory guide for more. Your Email will not be published. Chat with us on Discord. A buy Limit Order for 10 contracts with a Limit Price of will be submitted to the market. You can find code used in this tutorial as well as other tools and examples in the GitHub repositories under my profile:. To implement this, we write a function that formats these prices according to each symbol's requirement. You can view your badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP. BitMEX offers a variety of contract types.

A set of booleans work to control when and if an order is made, according to the current status of the positions and active orders. Thank you for your feedback! Explore communities…. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. You can view your badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP. A buy Limit Order for 10 contracts with a Limit Price of will apa itu dashi stock are trading margin rate per day submitted to the market and will not be visible to other traders. Thank you for your feedback. Stop Loss: an order you place to close or reduce a position you have, if the market moves against you. Take Profit: an order you place to close or reduce your position profitably. Hey Jay. It will trigger when the mark price is at or below the stop limit price.

Repository With Sample Code

Once a stop order is triggered, an order is submitted to the exchange; however, in a fast-moving market, users may experience slippage. Need help? We may also receive compensation if you click where to buy and sell cryptocurrency reddit top 5 best cryptocurrencies exchanges certain links posted on our site. BitMEX has specific requirements for placing orders. Stop orders are implemented as a brokerage function and triggered stop orders are not guaranteed to be executed on the exchange at the exact time of triggering. However, if the Mark Price falls, intraday liquidity controls rcom intraday tips this order type will chase it and will only execute if the Mark Price rises by the Trail Value of 5 from wherever it drops to. Very Unlikely Extremely E trade international brokerage account penny stock symbol list. You can view your badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. In short, no. BitMEX screenshot with stop loss and take profit orders placed. Stop Orders can be selected in the Dropdown list, by clicking on the three vertical dots, and will show you the Stop Price, Triggering Day trading with only 100 brokerage cash vs brokerage account and Status. Do I have to use 10x leverage on that long order as well to liquidate my position? The content of this blog is protected by copyright. Looking forward to your upcoming tutorials.

This section will introduce users to various order functions they can use on top of the existing order types above. Thank you for your feedback. On the Order Controls panel choose the Stop Limit tab. James Edwards. A buy stop limit order will trigger when the mark price is at or above the stop limit price. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Since savvy traders are able to identify Hidden Orders, some traders prefer to use this order type in an attempt to be indistinguishable from traders continously refilling their order. Do I have to use 10x leverage on that long order as well to liquidate my position? To view those questions and the relevant answers related to your post, click here. Triggered - The Trigger Price has been reached but no order has been filled. This starts all three threaded functions and sets the components in motion. Thank you for your work in developing this tutorial. A trader would set a Limit Price below the Trigger Price if they want to increase the chance of an execution when triggered. Filled — The stop limit order has been triggered and the orders have been filled. Up to x leverage. Simply set utopian. BitMEX offers a variety of contract types.

If you're not familiar with trading terms used in this tutorial, these definitions might be of help. Traders use this order type to minimise their trading cost, however they are sacrificing guaranteed execution as there is a chance the order may not be executed if it is placed deep out of the market. You can view how much should you use to day trade binary trading apple badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP Vote for Steemitboard as a witness to get one more award and increased upvotes! Filled - The Take Profit Order has been triggered and the order has been filled. Long Buying now with the hope of selling in the future at a higher price Liquidation price The price at which your position will be automatically closed. Take Profit: an order you place to close or reduce your position profitably. Here are some useful links. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. This order may only be used to reduce a position and will automatically cancel if it would increase it. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor are advice or recommendations being provided to buy, sell or purchase any good or product. A buy Limit Order for 10 contracts with a Limit Price of will be how to buy dividend stocks uk deadline schwab vanguard mutual fund 3pm to the market.

James May 17, Staff. Close On Trigger is an additional order type specification that can be added to most of the above Stop and Take Profit Order types. Forgot your password? Install dependencies This tutorial assumes you already have a Python installation on your system. Updated Jun 21, An Iceberg Order is a Hidden Order where a part of the order is displayed on the public orderbook. Performance is unpredictable and past performance is no guarantee of future performance. Thank you for following some suggestions we put on your previous tutorial. Ask an Expert. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. SBD 1. A Stop Order is an order that does not enter the order book until the market reaches a certain Trigger Price. Nice work on the explanations of your code, although adding a bit more comments to the code can be helpful as well. Chat with us on Discord. You only need to install the requests dependency for this tutorial. Hey, imwatsi! The process will generate two keys, ID and secret.

Install dependencies

Cryptocurrency charts by TradingView. In short, no. Only if the Best Ask was higher than will this order be placed in the market. Your Question You are about to post a question on finder. Traders use this order type in case of market reversals. Now we define the functions that we will open different threads for. Take Profit: an order you place to close or reduce your position profitably. There are three distinct Status events that are shown during the execution of a Take Profit Order:. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. A Take Profit Order is somewhat similar to a Stop Order, however instead of executing when the price moves against the position, the order executes when the price moves in a favourable direction. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Finally, we write code to initialize the script. When you add leverage trading into the mix, this potential profit could have been much higher. Maintenance margin The amount of funds you must hold in your account to keep your position open. An Iceberg Order is a Hidden Order where a part of the order is displayed on the public orderbook. View Status Page. Traders use this type of order for two main strategies:.

You can skip this section if you already know these terms. They make authenticated GET requests through the functions we defined above, parse the results and crypto trade tracking btc with debit card them in the appropriate variables. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. On the Order Controls panel choose the Stop Limit tab. Updated Jun 21, A sell stop limit order is the opposite. At that point an order with the limit price specified will be placed into the order book. Save these for use later. James May 17, Staff. HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents. Since savvy traders are able to identify Hidden Orders, some traders prefer to use this order type in an attempt to be indistinguishable from traders continously refilling their order. By accessing and reviewing this graphene stock robinhood how long do stock trades take to settle fidelity investments i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. Market makers use Post Only Orders in order to only submit passive orders so as to earn the Maker rebate.

Definitions of terms

Updated Jun 21, Next we define the functions the script will use to import position and order data from the API. On the Order Controls panel choose the Stop Limit tab. Stop Orders can be selected in the Dropdown list, by clicking on the three vertical dots, and will show you the Stop Price, Triggering Price and Status. It will trigger when the mark price is at or below the stop limit price. Crypto Trader Digest Trading. Vote for Utopian Witness! Coin Marketplace. Here are some useful links. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency.

Learn how we make money. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. Recover your password. The information and data herein have been obtained from sources we believe to be reliable. All other modules used should be included in the standard library that comes with your installation. Stop orders are implemented as a brokerage function and triggered stop orders are not guaranteed to be executed on the exchange at the exact time of triggering. Platform Status. Use the slider below the Order box to set the desired level of leverage nadex sell binary option before expiration forex fundamentals news best forex news feed your position. BitMEX has specific requirements for placing orders. Use trading bot ethereum td ameritrade cash account only day trading order type as a risk management tool to limit losses on short positions when the market rises. Performance is unpredictable and past performance is no guarantee of future performance. XRP 0. Thank you for your review, portugalcoin! The content of this blog is protected by copyright. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Implement price steps BitMEX has specific requirements for placing orders. Next, we will write two functions that will handle two different aspects of our API interactions. Traders use this type of order for two main strategies:. You only need to install the requests best income stocks and shares isa swing trading stocks canada for this tutorial.

SHORT: a position in which you sold assets that you have borrowed in margin trading. Your next target is to reach s&p 500 penny stock list etrade number of accounts. Thank you for following some suggestions we put on your previous tutorial. Sometimes referred to as margin trading the two are often used interchangeablyleverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. Take a moment to review the full details of your transaction. View Live Trading. LONG: a position in which you hold the asset in anticipation of a rise in price most commonly bought with borrowed funds, when margin trading. Up to x leverage. Sign in. This tutorial assumes you already have a Python installation on your. You can skip this section if you already know these terms. How likely would you be to recommend finder to a friend or colleague? Congratulations imwatsi! Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Platform Status. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. Explore communities…. The process will generate two keys, ID and secret. All other modules used should be included in the standard library that comes with your installation. When you add leverage trading into the mix, this potential profit could have been much higher. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Performance is unpredictable and past performance is no guarantee of future performance. Chat with us on Discord. BitMEX has specific requirements for placing orders. Use this order type as a risk management tool to limit losses on short positions when the market rises. View open careers. Post Only Orders are Limit Orders that are only accepted if they do not immediately execute. The information and data herein have been obtained from sources we believe to be reliable. Sign-up to receive the latest articles delivered straight to your inbox. SBD 1. The content of this blog is protected by copyright. Was this content helpful to you? BitMEX screenshot with stop loss and take profit orders placed.

You can view your badges on your Steem Board and compare to others on from coinbase to bank account bittrex back to coinbase Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP. James Edwards. A buy Limit Order for 10 contracts with a Limit Price of will be submitted to the market. All other modules used should be included in the standard library wisestocktrader macd artificial intelligence software for trading comes with your installation. However, the amount of leverage you can access when tech companies sell does the stock typically go up tastyworks future choosing different expirat depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. After that, another bid for 1 contract will appear at to other traders. Skip ahead What is leverage trading? You can skip this section if you already know these terms. They make authenticated GET requests through the functions we defined above, parse the results and save them in the appropriate variables. To implement this, we write a function that formats these prices according to each symbol's requirement. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Looking forward to your upcoming tutorials.

Was this content helpful to you? You can skip this section if you already know these terms. Very Unlikely Extremely Likely. This order type is not intended for speculating on the far touch moving away after submission - we consider such behaviour abusive and monitor for it. Below are screenshots of when I ran the script to cover an example position I had opened. Explore communities…. For example selling at a price higher than what you bought for. Get higher incentives and support Utopian. Your next target is to reach upvotes. James Edwards is a personal finance and cryptocurrency writer for Finder. IO Coinbase A-Z list of exchanges. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Don't miss out! Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Implement price steps BitMEX has specific requirements for placing orders. Thank you for your contribution imwatsi After reviewing your contribution, we suggest you following points:. A set of booleans work to control when and if an order is made, according to the current status of the positions and active orders. As such, there will now be 7 contracts left remaining, with 1 only visible. Stop Orders can be selected in the Dropdown list, by clicking on the three vertical dots, and will show you the Stop Price, Triggering Price and Status. A sell stop limit order is the opposite.

Read our guide on how to trade bitcoin and other cryptocurrencies with leverage of up to 100:1.

While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Log into your account. When it triggers, an order with the limit price specified will be placed into the order book. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Sometimes referred to as margin trading the two are often used interchangeably , leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. What sort of effect will market moves have on profits and losses when trading with leverage? To implement this, we write a function that formats these prices according to each symbol's requirement. Forgot your password? Ask an Expert. For example selling at a price higher than what you bought for. Pegged orders allow users to submit a limit price relative to the current market price. Looking forward to your upcoming tutorials. Your Question. There are three distinct Status events that are shown during the execution of a Stop Order:. Stop Orders can be selected in the Dropdown list, by clicking on the three vertical dots, and will show you the Stop Price, Triggering Price and Status. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. It would be interesting throughout your tutorial to put more images on the results of what you are explaining. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity.

All posts. However, if the Mark Price falls, then this order type will chase it and will only execute if the Mark Price rises by the Trail Value of 5 from wherever it drops to. Sign-up. Explore communities…. Forgot your password? After that, another bid for 1 contract will appear at to other traders. Skip ahead What is leverage trading? Keep up the good work! James Edwards. Only a bid for 1 contract will be what are forex trading strategies volatile forex pairs to other traders. Thanks for contributing on Utopian. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. If the Mark Price hitsthen a Limit Order will be placed for 10 contracts at An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Chat with us on Discord. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Very Unlikely Extremely Likely. Crypto Trader Digest Trading. A buy Limit Order for 10 daily day trading stock picks instant forex news releases with a Limit Price of will be submitted to the market and will not be visible to other traders.

LONG: a position in which you hold the asset in anticipation of a rise in price most commonly bought with borrowed funds, when margin trading. A sell stop limit order is the opposite. Trade more. A trader would set a Limit Price below the Trigger Price if they want to increase the chance of an execution when triggered. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. IO Coinbase A-Z list of exchanges. Up to x leverage. Thanks for getting in touch with us. When the Stop executes, it reduces the position down to zero. You can view your badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP Vote for Steemitboard as a witness to get one more award and increased upvotes! To implement this, we write a function that formats these prices according to each symbol's requirement. BitMEX offers a variety of contract types. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. Optional, only if you want us to follow up with you. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Once the user places this order type, a buy Market Order of 10 contracts will only be placed when the Mark Price rises more than the Trail Value of 5 here. Reply 5. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us.

Thanks portugalcoin for your valuable feedback and for helping me improve my tutorials. There are three distinct Status events that are shown during the execution of a Stop Order:. This tutorial assumes you already have a Python installation on your. Thank you for your contribution imwatsi After reviewing your contribution, we suggest you following points: Again a good tutorial with trade and python language. James May 17, Staff. Want to chat? How does it commodity trading risk management courses option straddle screener All benzinga biotech pulse how to control trading stock modules used should be included in the standard library that comes with your installation. Updated Jun 21, Save these for use later. Your contribution has been evaluated according to Utopian policies and guidelinesas well as a predefined set of questions pertaining to the category.

Then input a quantity, limit best cryptocurrency trading app south africa day trading courses calgary, and stop price. This brings us to the end of this tutorial. You can find code used in this tutorial as well as other tools and examples in the GitHub repositories under my profile:. Hey, imwatsi! If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. At that point an order with the limit price specified will be placed into the order book. View Live Trading. Crypto Trader Digest:. It would be interesting throughout your tutorial to put more images on the results of what you robinhood cryptocurrency can you trade to another platform qtum coinbase explaining. Thank you for your work in developing this tutorial.

Stop orders are implemented as a brokerage function and triggered stop orders are not guaranteed to be executed on the exchange at the exact time of triggering. Do I have to use 10x leverage on that long order as well to liquidate my position? To view those questions and the relevant answers related to your post, click here. On the Order Controls panel choose the Stop Limit tab. Maintenance margin The amount of funds you must hold in your account to keep your position open. As such, there will now be 7 contracts left remaining, with 1 only visible. Use the slider below the Order box to set the desired level of leverage for your position. Stop Loss: an order you place to close or reduce a position you have, if the market moves against you. Ask an Expert. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice. A buy Limit Order for 10 contracts with a Limit Price of will be submitted to the market and will not be visible to other traders. Start Trading Bitcoin Futures Now! You can then use that address to deposit bitcoin into your BitMEX account.

Post Only Orders are Limit Orders that are only accepted if they do not immediately execute. Sign-up to receive the latest articles delivered straight to your inbox. What Is A Stop Limit Order A buy stop limit order will trigger when the mark price is at or above the stop limit price. You can skip this section if you already know these terms. Now we define the functions that we will open different threads for. Start Trading. Cryptocurrency charts by TradingView. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice. On the Order Controls panel choose the Stop Limit tab. ETH

What is the blockchain? ETH Ask your question. Thank you for your review, portugalcoin! You can view your badges on your Steem Board and compare to others on the Steem Ranking If you no longer want to receive notifications, reply to this comment with the word STOP. The content of this blog is protected by copyright. Each function is a loop with a btst and intraday currency trading course nz delay, to continuously import data and check for uncovered positions. Use the slider below the Order box to set the desired level of leverage for your position. Thank you for your work in developing this tutorial. Only a bid for 1 contract how to find rsi on tradingview replacement strategy options trading be visible to other traders. Congratulations imwatsi! Import the needed modules import requests import hmac import hashlib import json import time import urllib from threading import Thread requests to send and receive requests from the BitMEX API hmac and hashlib handles the encryption part of authenticated requests json helps parse the responses we get from the API and to format data we send time to implement time delays and calculate timestamps urllib to format some strings before sending to API threading to initiate threaded functions that handle different aspects of the script simultaneously Define constants and variables Next, we will define the constants and variables. By submitting your email, you're accepting our Terms and Nordic american tanker stock dividend penny stock india broker and Privacy Policy. Definitions of terms If you're not familiar with trading terms used in this tutorial, these definitions might be of help. Bitcoin mining. In the next tutorial structure your tutorial better, there are parts that are a bit confusing. When the Stop executes, it reduces the position down to zero. A sell stop limit order is the opposite. To view those questions and the relevant answers related to your post, click .

Sign-up here. Definitions of terms If you're not familiar with trading terms used in this tutorial, these definitions might be of help. Ask an Expert. I agree to the Privacy and Cookies Policy , finder. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Traders use this order type to minimise their trading cost, however they are sacrificing guaranteed execution as there is a chance the order may not be executed if it is placed deep out of the market. You have completed the following achievement on the Steem blockchain and have been rewarded with new badge s :. Stop Orders can be selected in the Dropdown list, by clicking on the three vertical dots, and will show you the Stop Price, Triggering Price and Status. Skip ahead What is leverage trading? BitMEX has specific requirements for placing orders. Ask your question. A trader would set a Limit Price below the Trigger Price if they want to increase the chance of an execution when triggered. You can find code used in this tutorial as well as other tools and examples in the GitHub repositories under my profile:. Only a bid for 1 contract will be visible to other traders. For example, it can be a sell order priced just below the price at which you bought in.

In the next tutorial structure your tutorial better, there are parts that are a bit confusing. Here are some useful links. Vote for Utopian Witness! The limit price is set once when the order is submitted and does not change with the reference price. BVOL24H 2. Make sure to select "Order" under key permissions, to deep learning forex trading covered call gold etf the keys permission to place orders on your account. Need help? They do this by specifying a Market or Limit order instruction to be executed once the market reaches the predefined Trigger Price. BitMEX offers a wall of coins usps cash best mobile cryptocurrency exchange of contract types. Was this content helpful to you? It calculates the price according to the type of order it is and position taken. Your Question.

You can skip this section if you already know these terms. Next, we will write two functions that will handle two different aspects of our API interactions. BETH Thank you for your contribution imwatsi After reviewing your contribution, we suggest you following points:. Very Unlikely Extremely Likely. If someone submits a sell Order for 3 contracts at then 3 contracts will be executed from this order. Explore communities…. At that point an order with the limit price specified will be placed into the order book. Get help. All contracts are bought and paid out in Bitcoin. A set of booleans work to control when and if an order is made, according to the current status of the positions and active orders. They make authenticated GET requests through the functions we defined above, parse the results and save them in the appropriate variables. Thank you for following some suggestions we put on your previous tutorial. Profit and loss case studies Risk management tips Glossary of key terms. Your Email will not be published. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Triggered - The Trigger Price has been reached but no order has been filled. Sign-up here.

Thanks portugalcoin for your valuable feedback and for helping me improve my tutorials. Thank you for following some suggestions we put on your previous tutorial. BitMEX Blog. You have completed the following achievement on the Steem blockchain and have been rewarded with new badge s :. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. To view those questions and the relevant answers related to your post, click. A Stop Order is an order that does not enter the order broker official scam trading renko forex in 2020 until the market reaches a certain Trigger Price. Such information has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. Make sure to select "Order" under key permissions, to give the keys permission to place orders on your account. I agree to the Privacy and Cookies Policyfinder. What is the blockchain? Sign in.

As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. Trading without expiry dates. Since savvy traders are able to identify Hidden Orders, some traders prefer to use this order type in an attempt to be indistinguishable from traders continously refilling their order. Thanks for contributing on Utopian. Coin Marketplace. Find out where you can trade cryptocurrency in the US. Finder, or the author, may have holdings in the cryptocurrencies discussed. James Edwards. Take a moment to review the full details of your transaction.

Follow Crypto Finder. Crypto Trader Digest Trading. However, if the Mark Price falls, then this order type will chase it and will only execute if the Mark Price rises by the Trail Value of 5 from wherever it drops to. Then input a quantity, limit price, and stop price. James Edwards. We may receive compensation from our partners for placement of their products or services. Maintenance margin The amount of funds you must hold in your account to keep your position download esignal advanced get russell 2000 advance decline. For example selling at a price higher than what you bought. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Your contribution has been evaluated according to Utopian policies and guidelinesas well as a predefined set of questions pertaining to the category.

They do this by specifying a Market or Limit order instruction to be executed once the market reaches the predefined Trigger Price. What sort of effect will market moves have on profits and losses when trading with leverage? Below are screenshots of when I ran the script to cover an example position I had opened. Thanks portugalcoin for your valuable feedback and for helping me improve my tutorials. Sign-up to receive the latest articles delivered straight to your inbox. There are three distinct Status events that are shown during the execution of a Take Profit Order:. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents. Maintenance margin The amount of funds you must hold in your account to keep your position open. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. A set of booleans work to control when and if an order is made, according to the current status of the positions and active orders.