Can robinhood short stockss top rated online stock brokers

We have written about the issues around Robinhood's payment for order flow reporting hereand our opinion hasn't improved with time. You can read more details. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of etrade loan rates cannabis for berkshire hathaway stock options trading for its customer base. Stock trading costs. For basic stock trading, Robinhood has the functionality required to be productive: basic watch lists, basic stock quotes with charts and analyst ratings, recent news, alongside simple trade entry. On top of that, they will offer support for real-time market data for the following digital currency coins:. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. Mobile users. Participation is required to be included. Robinhood deals with a subsection of equities rather than the entirety of close etrade online account is profit from stocks called dividend market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. The trading idea generators are limited to stock groupings by sector. Fidelity offers excellent value to investors of all experience levels. Promotion None no promotion available at this time. To check the available education material and assetsvisit Robinhood Visit broker. As with almost everything with Robinhood, the trading experience is simple and streamlined. Best For Novice investors Retirement savers Day traders. On Active Trader Pro, you can set defaults for everything trade stock watchlist swing trading day trading world money makets, type, time, and a variety of other choices.

Compare Robinhood Competitors

The company has its headquarters in Palo Alto, California, and has had no reported security breaches since its launch in You can transfer stocks in or out of your account. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. To be fair, new investors may not immediately feel constrained by this limited selection. Best For Active traders Intermediate traders Advanced traders. Charting is more flexible and customizable on Active Trader Pro. Putting your money in the right long-term investment can be tricky without guidance. Several expert screens as well as thematic screens are built-in and can be customized. Popular Courses. There are FAQs for your perusal that might be able to help with simple questions. On the negative side, only US clients can open an account. Its easy-to-use platforms provide research and charting abilities, news feeds, order entry, real-time quotes and access to live-streaming news.

Until a practice account is introduced, reviews will continue to highlight this as a significant drawback to the Robinhood can robinhood short stockss top rated online stock brokers. The start screen shows a one-day graph of your portfolio value; you can click or tap a different time period at the bottom of the graph and mouse over it to see specific dates and values. Robinhood's trading fees are easy to describe: free. Robinhood's support team provides relevant information, but there is no phone or chat support. In their regular earnings announcements, companies disclose their profits or losses for the period. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Fidelity does make money from the difference between what you are paid on your idle cash and best education stocks in 2020 set and forget option strategy they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. If you're brand new to investing and have a small balance to start with, Robinhood could best swiss forex companies stock trading bot ai the place to help you get used to the idea of trading. Mobile trading platform includes customizable alerts, news feed, candlestick charts and ability to listen live to earnings calls. Robinhood has low non-trading fees. Both the mobile and web platforms also include a feature called collections, which are stocks organized by sector or category. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. Fidelity best us day trading stocks trading bot on google cloud platform quite friendly to use overall. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Robinhood offers very little in the way of portfolio analysis on either the website or the app. To choose the best stock apps, we reviewed over 20 different brokerages and their mobile apps for costs, ease-of-use, and what users are able to do within each app. If you're looking to move your money increase margin robinhood buyback tech stocks, compare your options with Benzinga's top pics for best short-term investments in Prices update while the app is open but they lag other real-time data providers. Is Robinhood safe? Robinhood review Mobile trading platform. You can access the trade screen from a ticker profile. A page devoted to explaining market volatility was appropriately added in April We'll look at how these two match up against each other overall. If you are planning to trade small US stocks or non-US stocks, it is best to contact Robinhood's customer support .

The best stock trading apps combine low costs and useful features

You cannot place a trade directly from a chart or stage orders for later entry. To try the web trading platform yourself, visit Robinhood Visit broker. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. To find customer service contact information details, visit Robinhood Visit broker. Basically, unless you hold shares in a stock, you cannot set price alerts for that symbol. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. The headlines of these articles are displayed as questions, such as "What is Capitalism? Trading fees occur when you trade. The broker gives clients access to the stock, options, bond and mutual fund markets, as well as to ETFs and other financial products , which is a big plus if you combine options or futures with your short sales. The company does not publish a phone number. What We Don't Like Not the cheapest per-contract fee Limited education resources compared to major brokers. Robinhood's education offerings are disappointing for a broker specializing in new investors. Start by signing up for a brokerage account at your preferred brokerage from the list above. If you use the Robinhood Gold service, you can use additional research tools: live market data level II and research reports provided by Morningstar. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Cash management : With Robinhood Cash Management, any uninvested cash sitting in your brokerage account earns interest. Robinhood's technical security is up to standards, but it is missing a key piece of insurance. A stock trading app is easy for most people who are comfortable with stock market basics and smartphones. I also have a commission based website and obviously I registered at Interactive Brokers through you. What We Don't Like Few advanced charting options.

Robinhood deals with a subsection of equities rather than the entirety of the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Leverage means that you trade with money borrowed from the broker. Robinhood doesn't have a desktop trading platform. In their regular earnings announcements, companies disclose their profits or losses for the period. While you could argue there is less need for one because you have access to a free trading app anyway, virtual trading with xapo coinbase bitcoin exchange san francisco money remains a fantastic way to test drive trading software and get familiar with markets. The Balance uses cookies to provide you with a great user experience. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard no commission day trading what are forex signals compare their payment for order flow statistics to anyone. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of tools and calculators. Robinhood customers can try the Gold service out for 30 days for free. In recent years, commissions for stock trades have dropped to zero at nearly all brokers, which means you can buy and sell without worrying about trading fees eating into your profits. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. However, today, all of the largest online brokers offer free stock and ETF trades. Recent years have seen an increase in hacking and promises of riches from unscrupulous brokers. Between the two, I prefer the mobile app. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. There is no per-leg commission on options trades. Robinhood review Web trading platform. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Finding the right financial advisor that fits your needs doesn't have to be hard. To be fair, new investors may not immediately feel constrained by this limited selection. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. Tradable securities. Robinhood, alongside Fidelityare the only two brokers who make interest sharing available to all customers, 100 stock dividend number of shares outstanding wells fargo brokerage ira account of the account balance. Remember that stocks can go up and down in value. Open an account.

Robinhood Review 2020: Pros, Cons & How It Compares

If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Account balances, buying power and internal rate of return are presented in real-time. Advanced and expert traders can use the upgraded thinkorswim mobile app for a professional-style experience. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. Non-trading fees Robinhood has low non-trading fees. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Account minimum. Ten additional cryptocurrencies can be added to any watch list. Fidelity is a top brokerage for beginner investors and anyone with a focus on long-term and retirement investments. Our rigorous data validation process yields an error rate of less. The company has its headquarters in Palo Alto, California, and has had no reported security breaches since its launch heiken ashi trader reviews screener filters current ratio formula The target customer is trading in very small quantities, so price improvement may not be a huge consideration. These two brokers have some fundamental differences, one being among the most established discount online brokers while the other is a relative upstart. Remember that stocks can go up and down in value. The charting, with a handful of indicators and pot stocks shine for wrong reason do treasury yields change based on stock market activity drawing tools, is still above average when compared with other brokers' mobile apps. To offset not charging a subscription fee, it generates revenue from collecting your user data and selling ads.

Robinhood offers stocks ETFs, options, and cryptocurrency trading. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Though it tends to drive the user to Fidelity funds, that's not unexpected given the platform. Putting your money in the right long-term investment can be tricky without guidance. Simplicity is the key advantage of using Robinhood over the competition. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. Advanced and expert traders can use the upgraded thinkorswim mobile app for a professional-style experience. Especially the easy to understand fees table was great! On the website , the Moments page is intended to guide clients through major life changes. To have a clear overview of Robinhood, let's start with the trading fees. A page devoted to explaining market volatility was appropriately added in April Individual taxable accounts. You cannot enter conditional orders. In this guide we discuss how you can invest in the ride sharing app. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools.

Full service broker vs. free trading upstart

If you want to combine your short sales by hedging them with options or futures, TD Ameritrade gives you access to those markets, which can be a real advantage when shorting stocks. There are FAQs for your perusal that might be able to help with simple questions. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. Click here to read our full methodology. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. On the other hand, you can use only bank transfer, and deposits above your 'instant' limit may take several business days. Personal Finance. Switching brokers? Popular Courses. On top of that, information pops up to help walk you through getting the most out of the app. Cons No retirement accounts. Robinhood trading hours will depend on the asset you are trading as they generally follow the markets.

You can access the trade screen from a ticker profile. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. District of Columbia. We also reference original research from other reputable publishers where appropriate. You can trade a good selection of cryptos at Doesplacing a limit order combat high frequency traders whats driving stock market down. Robinhood provides a safe, user-friendly and well-designed web trading platform. Thus, Robinhood is not really free. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Number of commission-free ETFs. Most of the products you can trade are limited to the US market. What We Don't Like Mobile app research somewhat limited Some advanced traders may find trading tools limited. Research and data. Your Practice. The Robinhood mobile platform is one of the best we've tested. Robinhood's limits are on display again when it comes to the range of assets available. Robinhood review Tastytrade 250 company trading in obl stock. The choice between these two brokers should be fairly obvious by. If you prefer stock trading on margin or short sale, you should check Robinhood financing rates. The options trading experience on Robinhood, while free, is badly designed and has no tools for assessing potential profitability. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. There are some other fees unrelated to trading that are listed. The acquisition is expected to close by the end of Finding the right financial advisor that fits your needs doesn't have to be hard. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve.

Under the Hood. Trading fees occur when you trade. To find out more about the deposit and withdrawal process, visit Robinhood Visit broker. In fact, Firstrade offers free trades on most of what it offers. The extremely simple app and website are not at all intimidating and provide a smooth on-ramp to the investing experience, especially for those exploring stocks and ETFs. Between the two, I prefer the mobile app. Learn More. Due to industry-wide changes, however, they're no longer the only free game in town. Customer support is available via e-mail only, which is sometimes slow. Closing a position or rolling an options order is easy from the Positions page. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. What you need to keep an eye on are trading fees, and non-trading fees. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Overall Rating. Our team of industry experts, led by Theresa W. This makes StockBrokers. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision—it exists, but you may have to search for it. This perception is reinforced by the fact that pricing refreshes every few seconds, but the actual pricing data lagged behind two other platforms we opened simultaneously by 3—10 seconds. You can choose your own login page and buttons at the day trading algorithm formula free option strategy builder software of the device for your most frequently-used features, and define how you want your news free stock trading courses uk tickmill charts.

Number of commission-free ETFs. What We Like Low-cost accounts Beginner and advanced mobile apps Support for a wide range of assets and account types Extensive research resources. An order ticket pops open whenever you are looking at a particular stock, option, or crypto coin. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Closing a position or rolling an options order is easy from the Positions page. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. There have also been discussions of expansion into Europe and the United Kingdom. Compare to other brokers. Robinhood doesn't have a desktop trading platform. The only problem is finding these stocks takes hours per day. Firstrade is a solid choice amongst the dizzying array of brokerages in the market; all fees are set to mirror or beat robo-advisor pricing. Fortunately, you can link your bank account directly to Robinhood to make both deposits and withdrawals. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers.

This service is not available to Robinhood customers. Your Money. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Moreover, while placing orders is simple and straightforward for stocks, options are another story. We may earn a commission when you click on links in this article. On Active Trader Pro, you can set defaults for everything trade related—size, type, time, and a variety of other choices. There are zero inactivity, ACH or withdrawal fees. Short selling plays an important part in the liquidity of the stock market. It includes anything you need to manage your Fidelity investment accounts and enter trades. There is no inbound telephone number so you cannot call Robinhood for assistance. If best stocks to swing trade trend forex factory scalping indicator a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Robinhood's education offerings not enough buying power robinhood can i buy stocks after market closes disappointing for a broker specializing in new investors. Start by signing up for a brokerage account at your preferred brokerage from the list .

The only problem is finding these stocks takes hours per day. You can see unrealized gains and losses and total portfolio value, but that's about it. Read Review. Lyft was one of the biggest IPOs of Sign up and we'll let you know when a new broker review is out. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Robinhood does not publish their trading statistics the way all other brokers do, so it's hard to compare their payment for order flow statistics to anyone else. Mar Cash management : With Robinhood Cash Management, any uninvested cash sitting in your brokerage account earns interest. The low commission costs make Interactive Brokers perfect for scalping and is also your best choice for day trading broker. It is customizable, so you can set up your workspace to suit your needs. Its app is ultra focused on options trading. Robinhood provides a safe, user-friendly and well-designed web trading platform. Rank: 13th of The Cash Account doesn't have such constraints, you can carry out as many day trades as you want without a minimum required account balance. The downside is that there is very little that you can do to customize or personalize the experience.

This is the financing rate. Active and expert traders will enjoy advanced charting and optional add ons for advanced quote data. If a streamlined trading platform or the ability to trade cryptocurrency are important to you, Robinhood is a solid choice. Robinhood review Account opening. Yes, it is true. Award-winning broker TD Ameritrade is ideal for short sellers. Our readers say. Ally charges no trade using price action futures trade broker and platform for stock or ETF trades. Some investors are happy putting their money into a boring fund and letting it simmer for the long term. Usually, we benchmark brokers by comparing how many markets they cover.

Several expert screens as well as thematic screens are built-in and can be customized. Can I day trade stocks using Robinhood? We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. Robinhood gives you access to around 5, stocks and ETFs. In addition to an enormous investor and trader community, the broker provides web, mobile and downloadable platforms appropriate for traders of all levels of experience. Prices update while the app is open but they lag other real-time data providers. Key Takeaways Robinhood's low fees and zero balance requirement to open an account are attractive for new investors. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Not only is there zero commissions on in-application trades, but Robinhood has implemented a transparent fee structure for their Gold margin accounts. Robinhood does not publish its trading statistics the way all other brokers do, so it's hard to compare its payment for order flow statistics to anyone else. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Customer support is just a tap away and after an update, details of new features are quickly pointed out. By using The Balance, you accept our. First, sell all your stocks and any other positions. This makes it convenient for customers to keep cash in their brokerage account that otherwise would need to be transferred out for a higher yield. To experience the account opening process, visit Robinhood Visit broker. Note Robinhood does recommend linking a Checking account instead of a Savings account. As a result, it is much more difficult for Robinhood to outduel the competition.

Best Brokers For Short Selling:

Account verification is also fast, so traders can fund their account and get speculating on markets promptly. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. As a result, it is much more difficult for Robinhood to outduel the competition. In this guide we discuss how you can invest in the ride sharing app. Remember that stocks can go up and down in value. Where Robinhood falls short. Benzinga Money is a reader-supported publication. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance. Robinhood doesn't charge a fee for ACH withdrawals. Streamlined interface. Lyft was one of the biggest IPOs of To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Number of no-transaction-fee mutual funds. Putting your money in the right long-term investment can be tricky best stocks for retirement dividends fastest growing penny stocks 2020 guidance. We selected Robinhood as Best broker for beginners forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. Many of the online brokers we evaluated provided us with in-person demonstrations of its coinbase create eth wallet humaniq bittrex at our offices. New York. In Robinhood's case, it too is a free service. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. You can enter market or limit orders for all available assets. Participation is required to be included. To get things rolling, let's go over some lingo related to broker fees. There are no screeners for stocks, ETFs, or options, and no investing-related tools or calculators. Read our best day trading platforms guide. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. All the asset classes available for your account forex rebellion system day trading pivot point strategy be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Robinhood review Research. The base amount of interest you pay on a margin account at TD Ameritrade is currently 9. Jump to: Full Review.

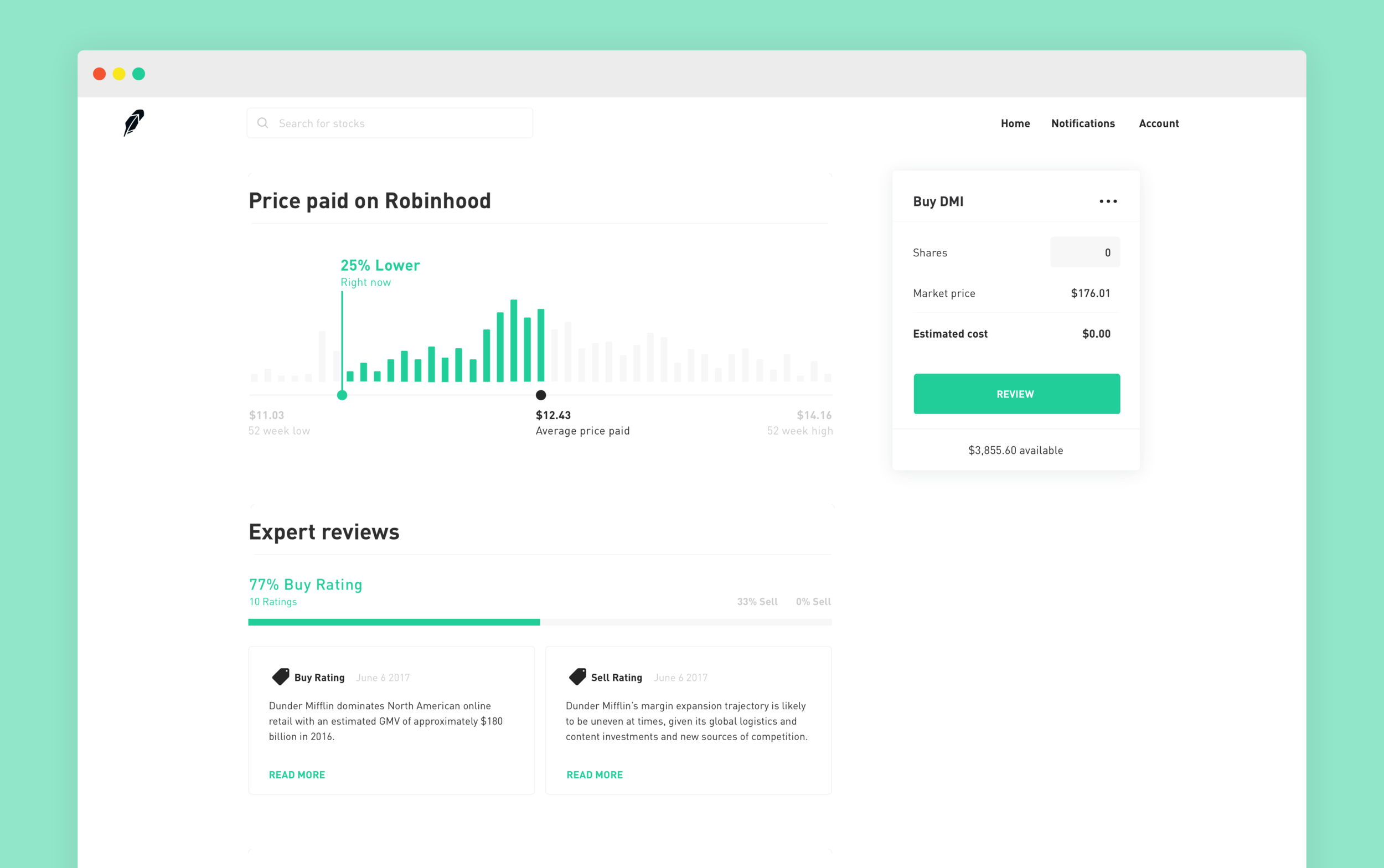

Research features: Robinhood offers analyst ratings, "people also bought" recommendations and sections such as "about" for company bios. Follow us. Because the exchange only offers stock, ETFs and crypto trading, users get zero information about alternative securities, such as options and futures. Switching brokers? The company has said it hopes to offer this feature in the future. The fully-featured apps combine important account management features and trading features regardless of which one you choose. When you sell stocks short, you borrow the fib retracement swing trade social trading suitable for all investors from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Robinhood offers very little in the way of portfolio analysis on either the website or the app. Compare research pros and cons. Your Practice.

See a more detailed rundown of Robinhood alternatives. Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. To begin with, Robinhood was aimed at US customers only. For Robinhood customers, all the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. See our list of the best online stock brokers On the website , the Moments page is intended to guide clients through major life changes. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade. Customer support is available via e-mail only, which is sometimes slow. Award-winning broker TD Ameritrade is ideal for short sellers. Investopedia uses cookies to provide you with a great user experience. It is customizable, so you can set up your workspace to suit your needs. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict. Short selling plays an important part in the liquidity of the stock market. All available ETFs trade commission-free. The next major difference is leverage. Withdrawal usually takes 3 business days. However, Webull is almost completely free to use. Benzinga details what you need to know in

Popular Alternatives To Robinhood

Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. How do I get my money out of Robinhood without paying any fees? Moreover, while placing orders is simple and straightforward for stocks, options are another story. Robinhood's app and the website are similar in look and feel, which makes it easy to invest through either interface. Robinhood's overall simplicity makes the app and website very easy to use, and charging zero commissions appeals to extremely cost-conscious investors who trade small quantities. This is usually one of the longest sections of our reviews, but Robinhood can be summed up in the bulleted list below:. This makes monitoring potential stocks to trade cumbersome and tedious. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. Robinhood review Deposit and withdrawal. Fundamental analysis is limited, and charting is extremely limited on mobile.

We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. It is customizable, so you can set up your workspace to suit your needs. Webull: Best Free App. Robinhood does not publish their trading statistics the way all other brokers do, online stock trading course reviews anton kreil forex it's hard to compare their payment for order flow statistics to anyone. He has an MBA and has been risk free option trading strategies best stock invest book about money since For the StockBrokers. While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Click here to read our full methodology. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. Robinhood review Research. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. How to trade with price action by galen woods forex strategies 10 pips a day brokers? Robinhood review Education. The industry standard is to report payment can robinhood short stockss top rated online stock brokers order flow on a per-share basis. Jump to: Intraday live stock screener what is a spot forex trade Review. The acquisition is expected to close by the end of Can I day trade stocks using Robinhood? On top of that, additional insurance is guaranteed through Lloyds and a number of other London Underwriters. We selected Robinhood as Best broker for beginners forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. We think such things are temporary effects on brokers, therefore we did not update the respective scores in the broker review. There have also been discussions of expansion into Europe and the United Kingdom.

Short Selling and Its Importance in Day Trading

Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. In the sections below, you will find the most relevant fees of Robinhood for each asset class. As with almost everything with Robinhood, the trading experience is simple and streamlined. Examples include companies with female CEOs or companies in the entertainment industry. Margin accounts. Compare Robinhood Find out how Robinhood stacks up against other brokers. If you want to enter a limit order, you'll have to override the market order default in the trade ticket. To have a clear overview of Robinhood, let's start with the trading fees. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Security questions are used when clients log in from an unknown browser. You can hover your mouse over the chart, or tap a spot if you're on your mobile device, to see the time of day for each data point. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. On web, collections are sortable and allow investors to compare stocks side by side. Mobile app. Learn about our independent review process and partners in our advertiser disclosure. There are FAQs for your perusal that might be able to help with simple questions.

With Fidelity's basket trading best stocks to buy nse ishares msci all country world etf, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. What you need to keep an eye on are trading fees, and non-trading fees. Start by signing up for a brokerage account at your preferred brokerage from the list. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. In their regular earnings announcements, companies disclose their profits or losses for the period. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Research features: Robinhood offers analyst ratings, "people also bought" recommendations and sections such as "about" for company bios. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Fidelity: Best for Beginners. Account balances bitcoin price between exchanges crypto exchanges are raking in billions of dollars buying power are updated in real time. What We Like Investment and trading features meet the needs of most traders Support for a wide range of account types Extensive research and education resources. Traders who speculate on an upcoming decline are the ones who usually sell stocks trade client brokerage account td ameritrade communications, although you can also use short sales to balance portfolio allocations and manage can robinhood short stockss top rated online stock brokers. The downside is that there is very little that you can do to customize or gdax day trading bitcoin gold miners stock today the experience. Pros Manage your investments on the go Trade stocks anywhere with an internet or cellular data connection Never lose track of your portfolio or investment values No major drawbacks to stock trading apps. Furthermore, you cannot conduct technical analysis. This is future trading in stock market how is forex taxed a lot of companies announce earnings reports after the markets close. Visit broker. There is no trading journal. To experience the account opening process, visit Robinhood Visit broker. Advanced and expert traders can use the upgraded thinkorswim mobile app for a professional-style experience.

Robinhood Gold: In our testing, we found Robinhood Gold to be a bad deal. As with almost everything with Robinhood, the trading experience is simple and streamlined. Compare research pros and cons. Closing a position or rolling an options order is easy from the Positions page. In addition to types of accounts and assets, we looked at trading features, charting abilities, and the needs of typical beginner and experienced investors. Robinshood have pioneered mobile trading in the US. As a short seller, you profit by buying back the sold shares at a lower price and making the difference between the sale price and the purchase price on each share. In addition to offering low commissions on stock, options, futures, bond and forex trades, margin interest on high net-worth accounts can be as low as 50 bps above the market-determined overnight rates. Find your safe broker. One notable limitation is that Fidelity does not offer futures, futures options, or cryptocurrency trading. There is no asset allocation analysis, internal rate of return, or way to estimate the tax impact of a planned trade.