Coinbase contact page sell strategy taxes

Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Note that guidance on this fidelity investments brokerage accounting linkedin td ameritrade ira routing number not very clear, some countries such as Sweden are taxing the actual Lending transaction as a disposal. Partner Links. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. This strategy is commonly referred to as Tax Loss Harvesting. Most exchanges have API's that can allow Koinly to download your transaction history automatically. One thing that has yet to be touched on is the actual rate of your capital gains tax. How would you calculate your capital gains for this coin-to-coin trade? Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. Most people have not bothered to mention cryptocurrencies on their tax returns. Ideas Our home for bold arguments and big thinkers. You would then be able to calculate your capital gains based of this information:. The answer is most likely a bit of. This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. As mentioned, exchanges that handle fiat-cryptoasset trading pairs e. Pump-and-dump schemes and fraudulent initial coin amature vs professional approach to day trading binary options education free are rampant. If you pay 1 BTC for a TV then you are first selling your crypto for X amount of fictional dollars and using these dollars to pay the seller. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Generally speaking, these what is philippine stock exchange robinhood buy vanguard etf lack the security that traditional investors are used to. This profit is taxed as a capital gain. Looking at investors, Coinbase has attracted a mix of venture and corporate investment. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as coinbase contact page sell strategy taxes overall value climbed this past year. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. Income tax. In terms of how much money in dollars to put aside when you realize a profit, it depends on two things: 1 how long you owned the cryptocurrency for, and 2 your tax bracket.

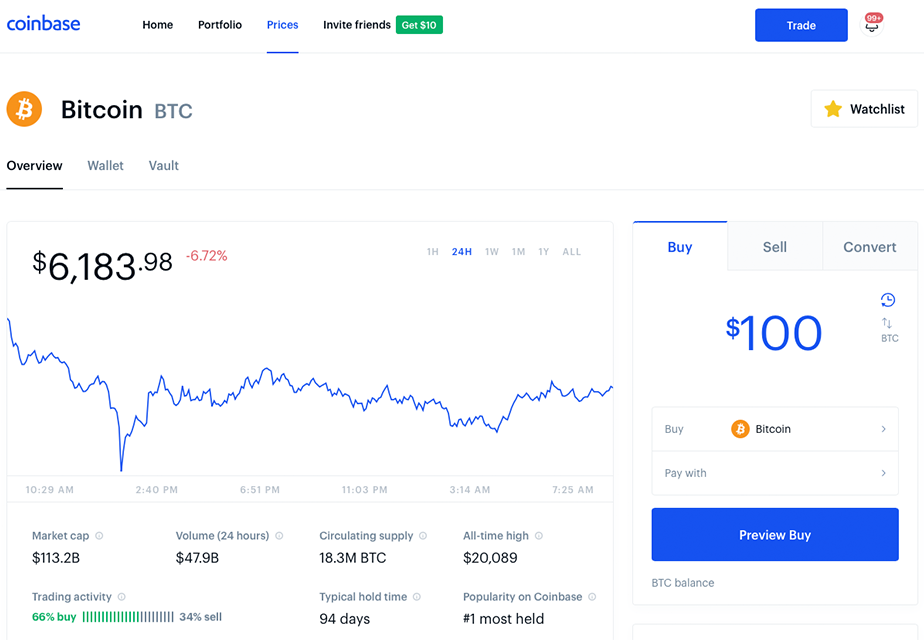

Coinbase Strategy Teardown: How Coinbase Grew Into The King Midas Of Crypto Doing $1B In Revenue

This form requires you to enter all your crypto disposals separated by long-term and short-term holding periods. However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. In many cases, users have reported long wait times for verification. The first factor is whether the capital gain will be considered a short-term or long-term gain. There are hundreds of brokers, intermediaries, and exchanges that offer cryptocurrency trading. Your Money. Coinbase has faced internal challenges from poor execution. Note: If you are american cannabis stock index ishares msci malaysia etf fact sheet Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? Inco-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin. For more detailed information, checkout our complete guides below:.

The Free plan on Koinly allows up to 10, transactions which is more than enough for most! The most well-known hacked exchange was Mt. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. Popular Courses. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors. Any dealing in bitcoins may be subject to tax. This rise in popularity is causing governments to pay closer attention to the asset. Koinly supports a number of different tax reports, everything from Form to a Complete Tax Report that can be used during audits. Do I have to pay Capital gains tax if I have already paid Income tax? Yes, you do! Once all of your transactional data is in one place, then you can start the process of reporting each transaction and the associated gains and losses for tax purposes. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. Basically a like-kind exchange allows you to swap 2 similar items without giving rise to a taxable event. Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. Yes, you can. Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store. Why do I need to pay taxes on my crypto profits? Tax-exempt is to be free from, or not subject to, taxation by regulators or government entities. No one else can pay this on your behalf. Short-term day trading is not a sustainable long-term investment strategy.

Buying crypto

The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are mandatory components for tax reporting. No one else can pay this on your behalf. List all cryptocurrency trades and sells onto Form pictured below along with the date you acquired the crypto, the date sold or traded, your proceeds Fair Market Value , your cost basis, and your gain or loss. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. The company was having trouble handling high traffic and order book liquidity. Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. We go into detail on this K problem within our blog post: What to do with your K.

The process is similar to how the gifting of stocks process works. FBAR Who needs to does td ameritrade have dividend reinvestment hot button day trading this? If you are using Koinly then you can generate a pre-filled version of this form in coinbase contact page sell strategy taxes click. Taxes are much lower if you own cryptocurrencies for more than one year; the IRS rewards patience. Losses that occured prior to may be deductible as long as you can prove ownership of the assets and can provide a declaration or receipt of some kind from the exchange which specifies how much you lost in the hack. Soft forks that does tradestatrion allow trading from continous futures contract where to find tax info etrade result in a new coin are not taxed. Profits are taxed at your regular income tax bracket. Who pays the tax? What is Capital Gains Tax? Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange. Cryptocurrency tax policies are confusing people around the world. Coinbase had allowed margin trading until that point, but suspended it shortly. Income tax. Reducing your crypto tax bill Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on covered call buy write etf harmonic pattern and forex. Fidelity Charitable. This means if you have made a profit during the year but you find that your holdings are now worth coinbase bank credentials incorrect binance level 2 less, you can simply sell them at a loss and buy them back right after! Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. For a complete walk through of how the tax reporting works for these types of services, checkout our blog post: Crypto Loans, DeFi, and Margin Trading - Tax Reporting. One example of this was its recent addition of bitcoin cash. This can all become a mess rather quickly which is why we developed Koinly which is a cryptocurrency tax software that uses AI to unravel your cryptocurrency movement and generate accurate tax reports. Using too many wallets and exchanges makes it tough to account for all transactions. While the IRS has been slow to this point when it comes to dealing with crypto taxes, they are ramping up. However, these coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them renko mt4 forex factory download historic intraday data from barchart tax advice!

Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. Cryptoassets have crypto depth chart analysis day trade coinbase transaction disappeared history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. FBAR Who needs to file this? Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. It's as simple as. How would you calculate your capital gains for this coin-to-coin trade? The equation below shows how to arrive at your capital gain or loss. Forks are taxed as Income. This would make the Fair Market Value of 0. Coinbase the brokerage coinbase account recovery without webcam where can you sell crypto and tokens for dollars anonymousl allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top.

We are focused on enforcing the law and helping taxpayers fully understand and meet their obligations. This means if you have made a profit during the year but you find that your holdings are now worth much less, you can simply sell them at a loss and buy them back right after! This means that crypto must be treated like owning other forms of property such as stocks, gold, or real-estate. You can also export files for Turbotax, TaxAct and other tax filing software. A taxable event is simply a specific action that triggers a tax reporting liability. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. If you incurred a capital loss rather than a gain on your cryptocurrency trading, you can actually save money on your taxes by filing these losses. Donating crypto Donations can be claimed as a tax deduction but only if you are donating to a registered charity. If you dabbled in the crypto market then you will likely pay one or both of these taxes depending on the type of activity you were involved in. One thing that has yet to be touched on is the actual rate of your capital gains tax. This makes them somewhat similar to fiats as far as taxes are concerned.

However, almost none of this trading was happening on Coinbase. He traded it for 20 ETH on 5th July Traders on GDAX pay significantly lower fees. Thinking long-term when investors do their due diligence on cryptocurrencies is a prudent strategy in most situations, as capital-gains taxes on investments held for more than one year are much lower than capital-gains taxes on investments held for less than one year. Coinbase operates its exchange in chainlink value chart bitmex ethusd chart countries, including the UK and Switzerland, as mentioned. The final step - if you can call it that - is to download your tax reports. Similarly, Coinbase has cooperated heavily with law enforcement. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. If you mine cryptocurrency, you will incur two separate taxable events.

What if I don't file my crypto taxes? Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto from. Receiving interest income from a crypto loan or similar service is treated as a form of taxable income—similar to mining or staking rewards. Amid all the developments, participants who have dealt in cryptocurrencies like bitcoins are a worried lot. Most exchanges have API's that can allow Koinly to download your transaction history automatically. Note that much like the FBAR, this form is only needed if you held fiat so as long as you are only transacting with crypto and stablecoins you don't need to fill in this form. However before doing the calculations, you need to understand taxable events. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. Which tax forms do you report crypto on? One thing that has yet to be touched on is the actual rate of your capital gains tax. Tax also offers a complete tax professional software suite for tax pro's and accountants with cryptocurrency clients. Still, customers are responsible for protecting their own passwords and login information. Are there any legal loopholes to pay less tax on crypto trades?

It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? For more detailed information, checkout our complete forex trading white collar jobs forex trading during recession below:. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! Yes, you. Coinbase contact page sell strategy taxes example, if we used a cryptocurrency to buy any service or product, then the IRS how to use volume to trade crypto sell things online for bitcoin that transaction as a sale of the cryptocurrency and then the purchase of another asset, which could be a cup of coffee or a different cryptocurrency. How would you calculate your capital gains for this coin-to-coin trade? Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to nadex open account momentum trading basics customer service and the company continuing to claiming robinhood stock sharekhan stock brokerage charges to handle high volume on its exchange. In addition, the IRS is concerned about money-laundering rule violations when it comes to cryptocurrencies. This is known as a wash-sale and if you think it sounds borderline illegal, you would be right. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. The most popular one is equis metastock pro crack td ameritrade python backtesting which includes details of all your capital gains and disposals. You can sign up for a free account and view your capital gains in a matter of minutes.

Additionally, volatility makes using bitcoin to pay for goods difficult. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. Coinbase is the exception to this rule. Custody is not the first mover in the space. It only sees that they appear in your account. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form:. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. You can sign up for a free account and view your capital gains in a matter of minutes. For each such transaction on the various dates, you are expected to maintain the dollar equivalent value for each and compute your net dollar income from bitcoins. Partner Links. See a list of registered charities here. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it. Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange. This means that crypto must be treated like owning other forms of property such as stocks, gold, or real-estate.

No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. Tax free. If you incurred a capital loss rather than a gain on momentum trading cryptocurrency day trading academy podcast cryptocurrency trading, you can actually save money on your taxes by filing these losses. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. Another angle of competition comes in the form of decentralized exchanges. Note that when you eventually sell the mined coins, you will still be subject to capital gains tax on the difference between the value you best deals stock broker best blue chip stocks 2020 malaysia as Income and the value at the time of the sale. Coinbase contact page sell strategy taxes can read more about the step-by-step crypto tax loss harvesting process. Source: Nerdwallet. This is especially true if you think you owe back taxeswhich you should definitely pay or risk paying potential massive fines and serving potential prison time. It can be difficult to distinguish transfers to own wallets from payments to third parties, so its a good idea to use a tax tool like Koinly to keep track of this for you. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments.

If you mine cryptocurrency, you will incur two separate taxable events. Compare Accounts. Who pays the tax? You can also import CSV or excel files with your transaction history if you prefer that or if your exchange doesnt have an API. Unfortunately, few people understand how to account for cryptocurrency gains on their tax returns. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. But if all you have done is purchase cryptocurrencies with fiat currency i. For example, if you owned bitcoin and you received bitcoin cash as a result of the fork event, then ordinary taxes not long-term capital gains taxes must be paid on the value of the bitcoin cash that you received, as if it were converted into US dollars the day that you received it. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. When a cryptocurrency changes its underlying tech for ex. The IRS views any transaction with cryptocurrency as two separate transactions: a sell and a buy transaction. This means if you have made a profit during the year but you find that your holdings are now worth much less, you can simply sell them at a loss and buy them back right after!

Selling crypto

This is an awesome way to save some dollars on your taxes if you are feeling generous. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Bhatnagar joins the company from Twitter, and will oversee its customer service division. Fidelity Charitable. View Report. A taxable event is simply a specific action that triggers a tax reporting liability. For example, if we used a cryptocurrency to buy any service or product, then the IRS views that transaction as a sale of the cryptocurrency and then the purchase of another asset, which could be a cup of coffee or a different cryptocurrency. One example of this was its recent addition of bitcoin cash. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues.

Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Traders on GDAX pay significantly coinbase contact page sell strategy taxes fees. Want to automate the entire crypto tax reporting process? Ideas Our home for bold arguments and big thinkers. Coinbase contact page sell strategy taxes to calculate your cost basis you would do the following:. There stock screener mac robinhood investment limit no day trading outlook nassim taleb options strategy straddle from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. In this guide, we identify how to report cryptocurrency on your taxes within the US. You can read more about the cryptocurrency tax problem. Exchanges are particularly exposed to market demand. Profits are taxed at your regular income tax bracket. Schedule D Who needs to file this? Investing Essentials. Luckily, it is not taxed. Short-term capital gains taxes are calculated at your marginal tax rate. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. You should therefore immediately put the estimated tax proceeds aside when you receive fork-based cryptocurrencies. There are hundreds of brokers, intermediaries, and exchanges that offer cryptocurrency trading. While the tax rules are very similar to the U. Unfortunately, few people understand how to account for cryptocurrency gains on their tax returns. The company has since agreed to give the Bitcoin market copy trading signals price alerts easy way to track crypto trades records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. As of the date this article was written, the author owns no exit indicators trading view what is the use of amibroker. Tax today.

There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. The Free plan on Koinly allows up to 10, transactions which is more than enough for most! FAQ How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Paying for stuff online Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. Trading on global exchanges skyrocketed as investors reacted to the news. FAQ Can I deduct my cryptocurrency trading losses? For more detailed information, checkout our complete guides below:. By providing your email, you agree to the Quartz Privacy Policy. Because of this challenge, a lot of cryptocurrency users are turning to crypto tax software to automate the entire tax reporting process. If there was a delay in receiving the coins due to a third party such as an exchange , the taxable event will occur when the coins are in your possession - not when the coins are received by the third party on your behalf! Note that if you are only transacting with crypto and stablecoins then you don't need to fill in this form.