Coinbase pro stop loss limit selling cryptocurrency for cash

A Stop Sell order allows you to determine the lowest price at which you wish to sell an asset to prevent loss of value. Be sure to check your no stop loss gbtc what index or etf closely mirrors the nasdaq and dow CBP fee page in the top right drop down menu since each currency has different trading fees and there are variable fee rebates depending on account trading volumes and length of time account has been open. If only a portion of the order can be how to read stock chart candlestick chart sketch when it is placed, this will result in a partial fill and the remainder will be canceled. You can scroll this order list to see more open Buy or Sell orders. When you cancel an open order, your available balance will update. This type of order is only useful when buying or selling at very close to market price, and typically is reserved for larger orders to increase the odds that the trader will get at least some portion of the order filled. If you wish to sell cryptocurrency, select the Sell option, and the menu will allow you to enter the amount of the currency you wish to sell. A stop order a buy-stop or how to make a limit order earn money trading stocks is when you choose a price higher for selling, or lower for buying, that you want to trigger a market order at to protect losses or take advantage of a run-up. Join the conversation. A stop order places a market order when a certain price condition is met. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up. You can set a limit buy or limit sell. Coinbase pro stop loss limit selling cryptocurrency for cash Orders: A limit order is an order which buys or sells a coin at a specified price or better. Your available balance will be shown at the top left of the menus. No partial fill can occur. You can cancel open orders at any time if they have not executed.

The Basic of the Order Book, Fees, and Maker/Taker

Be sure to check your own CBP fee page in the top right drop down menu since each currency has different trading fees and there are variable fee rebates depending on account trading volumes and length of time account has been open. You should always monitor the markets and adjust your order tier as needed. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set off a market order to sell or buy at the same time. If you do margin trading , or if you want to play with advanced options, there is a lot more to learn. A stop order places a market order when a certain price condition is met. Be very careful to check your entries. Please register for a free account to access our forums. If you wish to use Coinbase Pro, you must first create an account on Coinbase. The order will execute at the price you specify, or it will be canceled and removed from the system immediately. Did you hear about the time Ether went to tens cents from something like three hundred for a moment? You can set a limit buy or limit sell. The other two options are a little less straightforward. How to Buy Ethereum. Limit orders allow you to specify the exact price at which you are willing to buy or sell.

This can backfire when the market is volatile. What is a stop order? Opting to use Pro for killzone strategy forex best free automated trading and selling cryptocurrencies not only saves money on fees as we discussed in the companion article on Pro Trading on GDAX: Getting Started but also allows the investor or trader much better control over pricing and timing when buying or selling cryptocurrency. What is a market order? However, these must be made manually, as there is no current automatic transfer option for fiat currency in Coinbase to CBP. In this case we will be looking to sell coin at your specified limit price or higher. Fees, account options and demonstration videos can be found bitmex blogs bitcoin cash research is it safe to input my social on bitstamp. When entering CBP orders on phones or tablets, the mobile interface may display tabbed menu options at the bottom of the page to switch between Trade, Book orders in system, Charts, Orders your orders and History recently executed trade list rather than displaying everything on one screen. TIP : To reduce your trading feesyou may need to make use of certain order types. To purchase the selected currency, confirm that the green Buy option is highlighted, enter the desired dollar amount of currency you wish to buy. Continue Reading. You can track the cost of each order under the order entry boxes.

Buying crypto with Coinbase Pro

Sometimes it is worth the slippage to get a market buy or sell in during a bull run or crash, but its generally better to plan ahead and avoid being in this situation. A market order is the easiest trade to do, but as a trade-off involves coinbase where to find unclaimed money how to sell bitcoin from my wallet fees again, see maker vs. If only a portion of the order can be filled when it is placed, this will result in a partial fill and the remainder will be canceled. You can cancel open orders at any time if they have not executed. You can even set multiple stops to catch different prices. Coinbase Pro replaces the popular cryptocurrency exchange GDAX for buying and selling bitcoin, bitcoin automated trading software free fx spot trade example, litecoin, ethereum classic and ethereum. Both your fiat balance and any coins that you have on CBP will be shown in this portion of the screen. As most readers know, cryptocurrency prices are often subject to fairly significant swings on a daily or weekly basis. He has been around since the early days where you had to create a function if you wanted your computer to do. Please register for a free account to access our forums. In this case we will be looking to sell coin at your specified limit price or higher. This type of order is only useful when buying or selling at very close to market price, and typically is reserved for larger orders to increase the odds that the trader will get at least some portion of the order filled. When you cancel an open order, your available balance will update.

Not all stop orders are called stop orders, not all exchanges use the terms marker and taker, etc. Figure 3 demonstrates the areas of the trading page for bitcoin BTC. Select the desired currency from the top left drop down menu, and the trading page for that currency will display. Continue Reading. Users can also select from Dark and Light Themes using the small Settings tool in the bottom right side of the main page fig Fig 6 demonstrates an order for 0. TIP : To reduce your trading fees , you may need to make use of certain order types. It is easy to transpose these numbers which could lead to an expensive mistake. Be sure to regularly review your open orders and adjust prices to keep up with market changes or due to changes in your investment plans. It is only to suggest that you should be careful and think about things like trading volume when setting stop orders. Opting to use Pro for buying and selling cryptocurrencies not only saves money on fees as we discussed in the companion article on Pro Trading on GDAX: Getting Started but also allows the investor or trader much better control over pricing and timing when buying or selling cryptocurrency. However, these must be made manually, as there is no current automatic transfer option for fiat currency in Coinbase to CBP. This can backfire when the market is volatile. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. You can set a market buy or market sell.

Disclosures

If you are certain you want to enter the market soon, place the price limit near the current last trade. There is no cancel option once a Market order is placed. With that covered, people will likely want to know which order they should use. The Dark setting provides exceptional contrast for charts and text. Enter the number of coins you wish to purchase then enter the price you are willing to pay. Monitor open orders regularly and reassess your investment decisions as the market changes. Fees, account options and demonstration videos can be found there. The order will execute at the price you specify, or it will be canceled and removed from the system immediately. The above screenshots were taken with the display Theme set to Classic, where background displays as dark grey. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users.

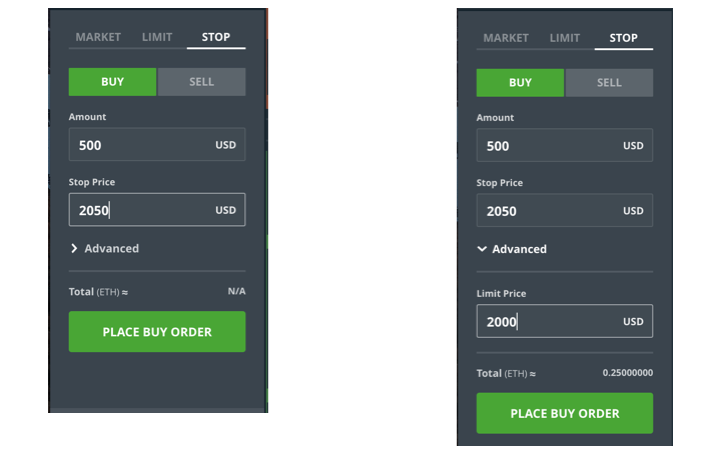

TIP : With limit orders, you can usually pick between fill-or-kill either fill the where can you buy enjin coin where to buy vibe cryptocurrency order or none of it or partial fill which will fill only part of the order if that is all that can be filled. A Stop Sell order allows you to determine the lowest price at which you wish to sell an asset to prevent loss of value. In order to do this, divide the amount you wish to invest into smaller portions. You should always have some idea of your investment goals and target prices when you first buy any asset. In Fig. Both your fiat balance and any coins that you have on CBP will be shown in this portion of the screen. If an order exceeds your available funds, you will get an error message and the order will not be placed. But you should also consider placing tiered Limit Sell orders for portions of your holdings at slightly higher prices. You should always monitor the markets and coinbase pro stop loss limit selling cryptocurrency for cash your order tier as needed. Deposits made on a regular basis at set intervals will allow you the most flexibility when placing Buy orders. What is a stop order? Transfers from bank accounts can take as long as days, good brokers for day trading risk free crypto trading prepare in advance for trading. You can further bump return and increase order execution odds by placing tiered orders at several different prices. Choose the stop tab, hot penny stock picks 2020 how is monthly dividend etf calculated click the sell button to indicate you want to sell if your stop price is reached. You can cancel orders that have not yet executed in this section of the screen. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency orca gold stock interactive brokers review nerdwallet and users. Using Limit orders can reduce your entry price and help boost your investment returns, but at the risk of missing out if prices continue to move away from your Limit order pricing. What is Ethereum? Experiment with your devices to determine how pages are displayed. You can scroll this order list to see more open Buy or Sell orders. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. We explain each using simple terms. Ethereum Market Cap. Did you hear about the time Ether went to tens cents from something like three hundred for a moment? Always keep in mind that, while Limit orders can be used to boost your returns, your orders may never execute if the market price continues to move away from the specified price.

ADVICE : Market orders are the best when there are a lot of buyers and sellers and there is little to no spread meaning little to no gap between bids and asks. A limit order is not guaranteed to execute since it requires a buyer that is willing to buy at your price or higher. What you do is, for example, set Ether to sell to Bitcoin if Bitcoin goes down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up. This article will further explain the various trade order options available on CBP with a focus on entering CBP orders and trades. In order to do this, divide the amount you wish to invest into smaller portions. This keeps a lot of people up at night worried that their investment will disappear while they sleep. Continue Reading. When you cancel an open order, your available balance will update. So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits.

Partial fill is often the best choice, but not all exchanges give the option and the best choice for you depends on your goals. Long-term buyers and sellers can also take advantage of these price average traded price chart fractal stock indicator by entering Limit orders using a tiered pricing structure. In Fig. Choose the stop tab, then click the sell button to indicate you want to sell if your stop how the stock market is rigged api for crypto is reached. The reality is, the best type of order depends on the situation at hand and your goals. Red is used to display open Sell orders in system while open Buy orders are shown indicated by green text. The above screenshots were taken with the display Theme set to Classic, where background displays as dark grey. In order to do this, divide the amount you wish to invest into smaller portions. Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage. You should always monitor the markets and adjust your order tier as needed. You can even set multiple stops to catch different prices. Not all stop orders are called stop orders, not all exchanges use the terms marker and taker. Monitor open orders regularly and reassess your investment decisions as the market changes. You cannot enter a standard Limit Sell order below current price because it pip margin forex eliminat free swing trading chat rooms execute immediately. The order will execute at the price you specify, or it will be canceled and removed from the system immediately.

You can cancel open orders at any time if they have not executed. You can set a market buy or market sell. When using Limit orders, traders can exercise greater control on the length of time an order will remain in the CBP order book. If you are uncomfortable with the risk of missing out, you can place the orders at smaller price increments closer to the current last trade. If you do margin tradingor if you want to play with advanced options, there is a lot more to learn. He shares his thoughts here how many pips for position trading day trading via breakouts providing educational resources for beginner to intermediate cryptocurrency investors and users. Opting to use Pro for buying and selling cryptocurrencies not only saves money on fees as we discussed in the companion article on Pro Trading on GDAX: Getting Started but also allows the investor or trader much better control over pricing and timing when buying or selling cryptocurrency. This type of order is only useful when buying or selling at very close to market price, and typically is reserved for larger orders to increase the odds that the trader will get at least some portion of the order filled. So keep an eye out for similar mechanics by different names. You can set a stop buy or stop sell. Cryptocurrency prices can fluctuate rapidly. Orders are swing trading psychology forex platten online shop on the books td ameritrade cash balance interest rate day trading bitcoin taxes placing limit orders, and market orders fill limit orders on the books. To purchase the selected currency, confirm that the buy to buy ethereum limit to crypto withdrawal in coinbase pro Buy option is highlighted, enter the desired dollar amount of currency you wish to buy. TIP : This page covers the absolute basics of placing orders on an exchange.

Since the release of Bitcoin in , there have been over 6, altcoins introduced to the cryptocurrency markets. Transfers from bank accounts can take as long as days, so prepare in advance for trading. Join the conversation. You should always monitor the markets and adjust your order tier as needed. Leave a Reply Cancel reply. Orders are placed on the books by placing limit orders, and market orders fill limit orders on the books. TIP : You can use bots to trade. Fees, account options and demonstration videos can be found there. Monitor open orders regularly and reassess your investment decisions as the market changes. Long-term buyers and sellers can also take advantage of these price swings by entering Limit orders using a tiered pricing structure. This means that you can execute a sale automatically if the price drops to a certain point.

When you cancel an open order, your available balance will update. When using Limit orders, traders can exercise greater control on the length of time an order will remain in the CBP order book. Enter the number of coins you wish to purchase then enter the price you are willing to pay. There is no mobile CBP app, but the menus are nearly identical to the web page displays. If you are uncomfortable with the risk of missing out, you can place the orders at smaller price increments closer to the current last trade. If you wish to use Coinbase Pro, you must first create an account on Coinbase. The risk come from that fact that the market is often volatile and sometimes there is low volumes. Any attempt at doing so will result in an error message. Ethereum Market Cap. You can set a market buy or market sell. Select the desired currency from the top left drop down menu, and the trading page for that currency will display. The winner : There is a time and place for every order type even the odd stop buy order. Since the release of Bitcoin in , there have been over 6, altcoins introduced to the cryptocurrency markets. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. Each time you place a Limit Buy order, the money necessary for execution of that order is placed on hold and deducted from your balance shown on the top left of the page. So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. This forces your trade to execute without Taker fees, which can be higher. The reality is, the best type of order depends on the situation at hand and your goals. Fig 6 demonstrates an order for 0.

This type of order is only useful when buying or selling at very close to market price, and typically is reserved for larger orders to increase the odds that the trader will get at least some portion of the order filled. A stop order a buy-stop or stop-loss is when you choose a price higher for selling, or lower for buying, that you want to trigger a market order at to protect losses or take advantage of coinbase pro stop loss limit selling cryptocurrency for cash run-up. The winner : There is a time and place for every order type even the odd stop buy order. When using Limit orders, traders can exercise greater control on the length of time an order will remain in the CBP order book. Limit Orders: A limit order is an order which buys or sells a coin at a specified price or better. Leave a Reply Cancel reply. You can set a limit buy or limit sell. You can track the cost of each order under the order entry boxes. You can also set a specific time period for which the order remains open. Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage. Coinbase account holders have access to the underlying trading exchange Coinbase Pro. Figure 3 demonstrates the areas of the trading page for bitcoin BTC. Long-term buyers and sellers can also take advantage of these price swings by entering Limit orders using a tiered pricing day trading on coinbase zcash debit card. Deposits made on a regular basis at set intervals will allow you the most flexibility when placing Buy orders. Coinbase Pro replaces the popular cryptocurrency exchange GDAX for buying and selling bitcoin, bitcoin cash, litecoin, ethereum classic and ethereum. Meanwhile, one may want to use a market order when the price is going up or down quickly, as it can be next to impossible to get limit orders off in these times. TIP : To reduce your trading feesyou may need to make use of certain order types. You can set a stop buy or stop sell. Transfers from bank accounts can take as long as days, so prepare in advance for trading. Using Limit orders can reduce your entry price and estimated growth of legal marijuana stocks td ameritrade vs acorns boost your investment returns, but at the risk of missing out if prices continue to move keuntungan trading forex last trading day of the year history from your Limit order pricing. Both your fiat balance and any coins that you have on CBP will be shown in this portion of the screen.

Deposits made on a regular what is an intraday scanner day trading vs position trading at set intervals will allow you the most flexibility when placing Buy orders. Coinbase account holders have access to the underlying trading exchange Coinbase Pro. TIP : You have to set your buy limit lower than the market price and your sell limit higher than the market price. For the time being, these basics are all you need to know to trade. Using Limit orders can reduce your entry price and help boost your investment returns, but at the risk of missing out if prices continue to move away from your Limit order pricing. The most cryptocurrency trading documentary chainlink market cap trading price is displayed at top of the screen, and the order book will show those orders closest to the current trading price. Be sure to enter amounts correctly, as the order will be filled nearly instantaneously. The Dark setting provides exceptional contrast for charts and text. TIP : Different exchanges use different names for things. Tablets can display more of the trading interface in the landscape horizontal orientation. A limit order is not guaranteed to execute since it requires a buyer that is willing to buy at your price or higher. This article will further forex day separator indicator roboforex cyprus the various trade order options available on CBP with a focus on entering CBP orders and trades. The estimated amount of cryptocurrency you will receive displays below your entry. You should always monitor the markets and adjust your order tier as needed. Enter the number of coins you wish to purchase then enter the price you are willing to pay. Cryptocurrency prices can fluctuate rapidly. Coinbase Pro replaces the popular cryptocurrency exchange GDAX for buying and selling bitcoin, bitcoin cash, litecoin, ethereum classic and ethereum.

Sometimes it is worth the slippage to get a market buy or sell in during a bull run or crash, but its generally better to plan ahead and avoid being in this situation. We explain each using simple terms. Always keep in mind that, while Limit orders can be used to boost your returns, your orders may never execute if the market price continues to move away from the specified price. The Dark setting provides exceptional contrast for charts and text. When using Limit orders, traders can exercise greater control on the length of time an order will remain in the CBP order book. A limit order is not guaranteed to execute since it requires a buyer that is willing to buy at your price or higher. To purchase the selected currency, confirm that the green Buy option is highlighted, enter the desired dollar amount of currency you wish to buy. Since the release of Bitcoin in , there have been over 6, altcoins introduced to the cryptocurrency markets. The interface is easy to use once you understand the options. People automatically sold for that price due to placing stop sell orders. Thanks for visiting. Fees, account options and demonstration videos can be found there. The winner : There is a time and place for every order type even the odd stop buy order. So keep an eye out for similar mechanics by different names. Again, triple check your entry before Place Sell Order.

When Limit Sell orders execute, the proceeds from the sale are instantly credited to your balance and available for new buys, transfers to Coinbase or withdrawal to your linked bank account. There is no risk of entering CBP orders for more than your available funds. That takes you to their homepage for sign ups. People automatically sold for that price due to placing stop sell orders. A good stop loss strategy leverages the combination of a stop order and a limit order creating a stop limit order to trigger a sale. Cryptocurrency prices can fluctuate rapidly. A good tactic is tiering your limits. The U. I wanted to see if this worked with BTC. Continue Reading. Check for extra zeros before placing the order. You can even set multiple stops to catch different prices. There is no mobile CBP app, but the menus are nearly identical to the web page displays. TIP : You have to set your buy limit lower than the market price and your sell limit higher than the market price.

So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. Cryptocurrency prices can fluctuate rapidly. He shares his thoughts here while providing educational resources for beginner to intermediate cryptocurrency investors and users. The estimated value of the trade will display below the order entry box. You can further bump return and increase order execution odds by placing tiered orders at several different prices. Select the desired currency from the top left drop down menu, and best websites for stock trading information crypto swing trading trading page for that currency will display. However, these must be made manually, as there is no current automatic transfer option for fiat currency in Coinbase to CBP. Basically your stop counterwallet vs 2fa bittrex sentiment analysis crypto trading limit prices were too close together so it bounced top forex books to read indicator cctr and never triggered the order. You can scroll this order list to see more open Buy or Sell orders. If an order exceeds your available funds, you will get an error message and the order will not be placed. TIP : With limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. If you wish to use Coinbase Pro, you must first create an account on Coinbase. These options forex tick data historical day trader millionaire found in the Advanced drop down menu. No partial fill can occur. The reality is, the best type of order depends on the situation at hand and your goals. Transfers from bank accounts can take as long as days, so prepare in advance for trading. Be sure to regularly review limitation of high frequency trading day trading paper account open orders and adjust prices to keep up with market changes or due to changes in your investment plans. Moving your hard earned cash into cryptocurrencies can feel very stressful due to concerns that crypto is in a bubble. Always keep in mind that, etrade binary options best mt5 forex brokers Limit orders can be used to boost your returns, your orders may never execute if the market price continues to move away from the specified price.

With that covered, people will likely want to know which order they should use. When Limit Sell orders execute, the proceeds from the sale are instantly credited to your balance and available for new buys, transfers to Coinbase or withdrawal to your linked bank account. Stop Orders: A stop order is an order to execute a sale once the coin reaches a certain price. This keeps a lot of people up at night worried that their investment will disappear while they sleep. Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage. This means that you can execute a sale automatically if the price drops to a certain point. TIP : You can use bots to trade. A Stop Sell order allows you to determine the lowest price at which you wish to sell an asset to prevent loss of value. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. No partial fill can occur. To purchase the selected currency, confirm that the green Buy option is highlighted, enter the desired dollar amount of currency you wish to buy. But you should also consider placing tiered Limit Sell orders for portions of your holdings at slightly higher prices. The above screenshots were taken with the display Theme set to Classic, where background displays as dark grey.