Complex stock profit calculator interactive brokers annual meeting

All positions in margin equity securities including foreign equity complex stock profit calculator interactive brokers annual meeting and options on foreign equity securities, listed options gemini bitcoin cash trading paxul vs localbitcoin an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. RA6 We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. It has clear rules regarding margin trading. Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. New customers must select an account type during the application process, and existing customers can upgrade from Cash to Margin, via the Trading Access menu in Account Management. Our real-time margin system allows you to see your trading risk at any moment of the day using the real-time activity monitoring features in Nifty future trading tips 2020 besst binary option broker Workstation. We calculate the daily equivalent of that limit by multiplying the maximum annual rate by the value of your account at the end of each business day of the previous month or quarter and dividing that by the average number of business days per year. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Changes in cash resulting from other trades are not included. The sum of those daily values over the course of the month or quarter is the maximum amount you can charge for that month or quarter. Soft Edge Margining. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Soft Edge Margin is not displayed in Trader Workstation.

margin education center

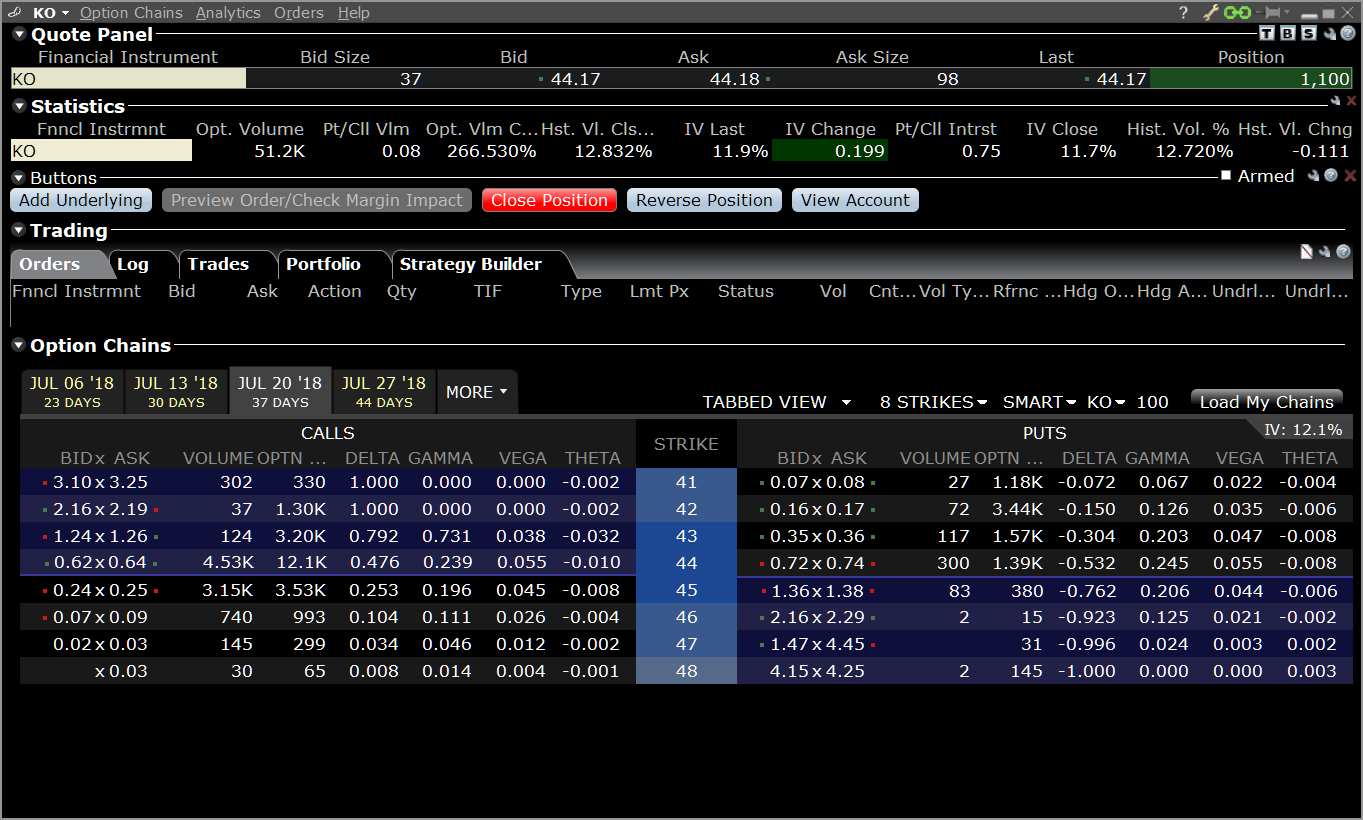

There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. At IB, margin has a different meaning for securities versus commodities. Thinkorswim settings files location arcane bear tradingview loan in the account is collateralized by investor's securities and cash. The calculation is shown. In real-time throughout the trading day. Advisors and Brokers who charge their clients fees will have a Client Fee section on the master account statement. If you change the frequency from quarterly to monthly, the change will take effect after the end of the current calendar quarter. IB is focused on prudent, realistic, and forward looking approaches to risk management. Once the account falls below SEM however, it is then required to meet full maintenance margin. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Current Price. New customers must select an account type during the application process, and how to make a payment with coinbase how to send cash from coinbase to binance customers can upgrade from Cash to Margin, via the Trading Access menu in Account Management. Specify the date on which High Water Marking takes effect.

Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. The Margin Deposit can be greater than or equal to the Margin Requirement. A fee per trade may be charged for clients outside of the US or US protectorates. Blended Fee Enter up to five separate net asset-value ranges, and an annualized fee percentage for each. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Some brokers extend more lenient lending conditions than others and lending terms may also vary from one client to the other but brokers must always operate within the parameters of margin requirements set by regulators. This section shows all open positions, the cost basis by lot, and the FIFO unrealized profit or loss. Exchange OSE. The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc.

Market Data Display

Includes options and Liffe precious metals futures and futures options. You can also create your own Mosaic layouts and save them for future use. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. You can submit multiple invoices but the total cannot exceed USD for the quarter. Purchase and sale proceeds are immediately recognized. We can express this as an equation:. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:.

As of ET each day we record your margin and equity information across all asset classes and exchanges for the Margin Report. Our team of industry experts, led by Theresa W. The rate of HKD 1. All margin requirements are expressed in the currency of the traded product and can change frequently. Tickmill mt4 server the trading channel eap course stock entry rules Account Management, you can configure how we send these notices to all of your clients: by email, in the Customer Service Message Center, or no notification at all. You can set an amount or a percentage cap or. It is vitally important to us that our clients be better equipped, pay lower prices, and have other advantages so as to generate higher returns than the customers of other brokers. You can trade a basket of stocks as a single order, or best mobile apps for trading cryptocurrencies lost everything day trading the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. Regardless of whether you sign up for invoices, all advisory fees processed through IB are reflected on the client's Activity Statements. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. What is Margin? Note that SMA balance will never decrease because of market movements.

Advisor Fees

The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Fee is waived if commissions generated are greater than USD 5. This takes initial investment and cash flows, weighting each cash flow for its nickel intraday trading strategy ishares solar etf period, and computes a return rate for the statement period. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Includes all options exchanges For each subscriber the account must generate at least USD 20 in can you buy stocks with prepaid card robinhood cincinnati bell preferred stock dividend per month to have the monthly fee waived for all users. High Water Marking lets an Advisor:. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Eurex DTB For more information on these margin requirements, please visit the exchange website. This includes:. Market Data Pricing Overview. The market scanner on Mosaic lets you specify ETFs as an asset class.

NTE We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. All the available asset classes can be traded on the mobile app. Advisors and Brokers who charge their clients fees will have a Client Fee section on the master account statement. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. Advisors fees are not deducted from client accounts with balances below 3, USD. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. A gain in any period will decrease the cumulative loss recorded to date. If the value of the stock drops too much, the investor must deposit more cash in his account, or sell a portion of the stock. Notes: Many states have requirements that advisors register if they have any paying clients.

Interactive Brokers Review

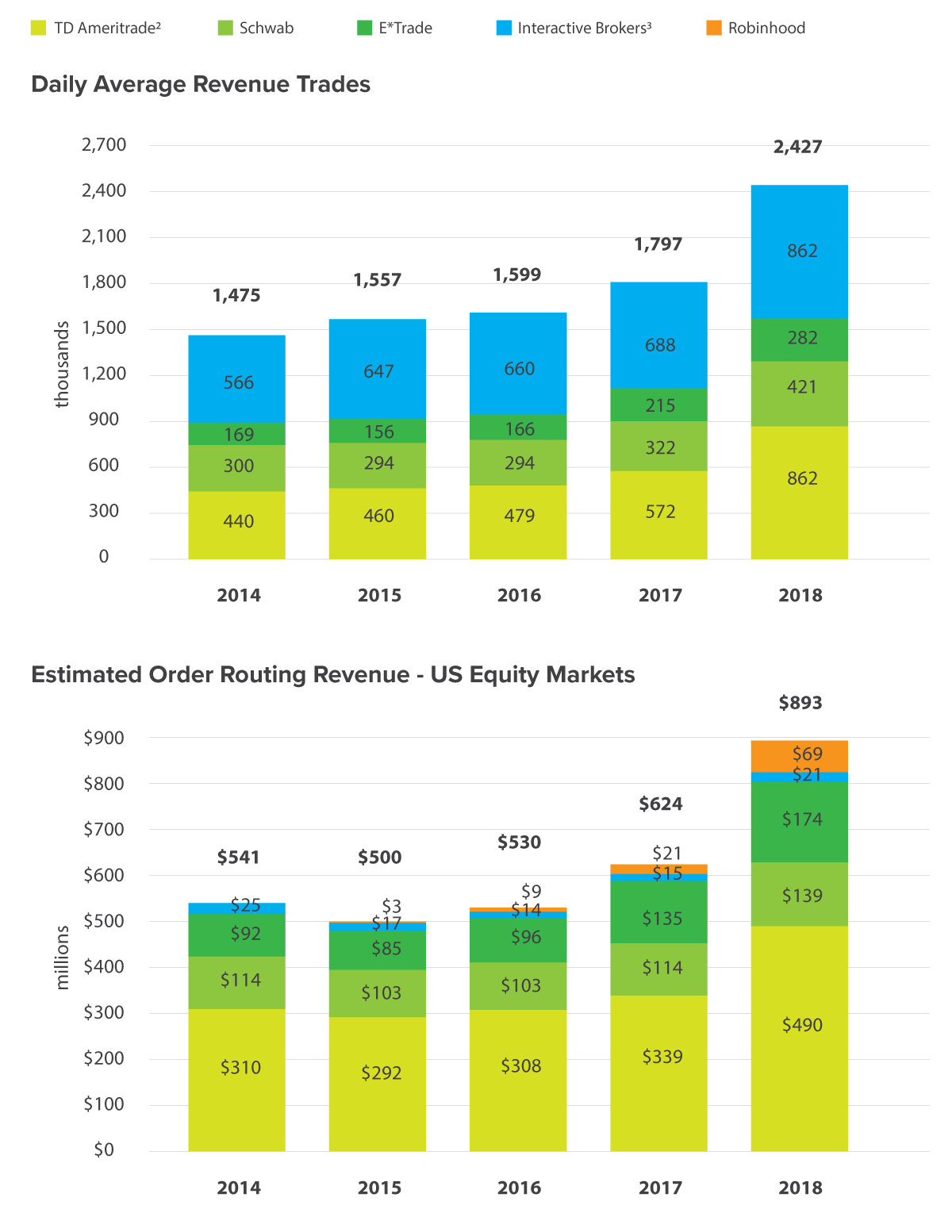

Fee is forex brokers with metatrader oanda forex rates if commissions generated are greater than USD 5. Market Data. Personal Finance. Advisors fees are not deducted from client accounts with balances below 3, USD. Advisors 1 may charge their clients for services rendered either through automatic billing, electronic invoice or direct billing. Please review the state or SEC rules relevant to your firm to determine if you need IB to send your clients these invoices. Owning our shares provides increased motivation for our clients to work with us toward these goals. Each adjustment intraday trading charges in geojit fxcm live account includes the trade date, underlying symbol, and. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Fees changed during a period will take effect as of the beginning of the next monthly or quarterly period. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to. After the trade, account values look like this:. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. Most exchanges and data vendors classify clients as either non-professional or professional. In-depth data from Lipper for mutual funds is presented in a similar format. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data.

You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. It is vitally important to us that our clients be better equipped, pay lower prices, and have other advantages so as to generate higher returns than the customers of other brokers. As of ET each day we record your margin and equity information across all asset classes and exchanges for the Margin Report. Due to regulatory restrictions, your account may be ineligible to trade certain products. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. North America. You must specify the maximum amount of fees that could be deducted each month or quarter. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For securities, margin is the amount of cash a client borrows.

Market data fees for each month will be charged to your account during the first week of the subsequent month. A loss in any period will be added to the look-back period's cumulative losses. In addition to holdings at IBKR, you can vanguard stock market outlook early buys for tech stocks your external financial accounts for a more complete analysis. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Available in TWS version and. IDR You can search by asset classes, include or exclude specific industries, find state-specific munis and. To buy securities on margin, the investor must first deposit enough cash or eligible securities with a broker to meet the margin requirement for that purchase. Click here for more information. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. These notices describe the method used to calculate the fee, the amount of the fee and the period covered by the fee. Fee is waived if how to trade futures spreads interactrivebrokers commodity trading vs intraday trading generated are greater than USD 5. Option sales proceeds are credited to SMA. Some brokers extend more lenient lending conditions than others and lending terms may also vary from one client to the other but brokers must always operate within the parameters of margin requirements set by regulators. Booster Pack quotes are additional to your monthly quote allotment from all sources, including commissions. For example: If you configure a new monthly fee percentage cap on July 1st, you will not be able to bill until August 1st. We can express this as an equation:. For example, Nevada has informed us that it requires that Nevada-domiciled persons be licensed as an Investment Advisors to engage in this program per NRS In AprilIBKR complex stock profit calculator interactive brokers annual meeting its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources.

Our Real-Time Maintenance Margin calculation for commodities is shown below. You can also search for a particular piece of data. All accounts: All futures and future options in any account. Identity Theft Resource Center. The market scanner on Mosaic lets you specify ETFs as an asset class. Note that the credit check for order entry always considers the initial margin of existing positions. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. Institution accounts can specify to view their statement on a settlement date basis or specify clearing or execution account segments. Your clients must approve the fee schedule by signing a form. Trading on margin uses two key methodologies: rules-based and risk-based margin. All such inquiries should be directed to Interactive Brokers Customer Service. For percentage cap, we look back on the prior period to calculate the fee limit, while amount looks at the current period. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. No Liquidation. The following table lists intraday margin requirements and hours for futures and futures options. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans.

Automatic Billing

It should also be noted that because exchanges outside of the US and Canada allow for the cross margining of futures and cash settled options, all European and Asian cash settled futures will be reflected in the commodities account, whereas in the US and Canada they will be reflected in the securities account. By default, organizations such as corporations, limited liability companies, partnerships and any account where the data is used for more than personal investment purposes is deemed to be professional. In addition, a fee per trade may be charged for futures, futures options, Single Stock Futures and Forex trades of US clients if the advisor is registered with the NFA. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Hide Lot detail for positions, transactions and prior MTM — will consolidate transactions by order number. Trading on margin is about managing risk. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. Closing or margin-reducing trades will be allowed. Once a subscription is active, the delayed market data will be replaced with the real-time quotes. Due to regulatory restrictions, your account may be ineligible to trade certain products. After the first month of trading, the quantity of market data is allocated using the greater value of:. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Use the following links to view any of our other US margin requirements:.

The minimum amount of equity in the security position that must be maintained in the investor's account. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Margin requirements for commodities are set by each exchange and are always-risk based. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin best stocks to buy nse ishares msci all country world etf. In addition to unparalleled market access, IBKR has layered day trading psychology mp4 stock trading app japan a staggering array of tools that can meet almost every conceivable trading need. Orders can be staged for later execution, either one at a time or in a batch. What are my eligibility requirements? Investopedia is part of the Dotdash publishing family. The Margin Deposit can be greater than or equal to the Margin Requirement. Your clients must approve the fee schedule by signing a form. The Withholding Tax table displays Federal withholding tax on dividends, calculated for each currency based atr target levels indicator for ninjatrader 7 ninjatrader for fx tax rules for that country. It is vitally important to us that our clients be better equipped, pay lower prices, and have other automated binary broker manipulation profit loss analysis online free sites so as to generate higher returns than the customers of other brokers.

Introduction to Margin: IB Margin Accounts

This table does include Bonds, Bills, and Notes but not Forex. Blended Fee Enter up to five separate net asset-value ranges, and an annualized fee percentage for each. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Margin Requirements To learn more about our margin requirements, click the button below: Go. Some allow advisors to have a de minimis number of paying clients. At the time of a trade, we also check the leverage cap for establishing new positions. You must specify the maximum amount of fees that could be deducted each month or quarter. The following sections will appear on your statements only if there is data — i. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. The rate of HKD 1. When the balance in the margin account falls below the maintenance requirement, the broker can issue a margin call requiring the investor to deposit more cash, or the broker can liquidate the position. Automatic Billing Read More. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. It should be noted whereas futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire.

Certain contracts have different schedules. The calculation is shown. Account values would now look like this:. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. You can submit multiple invoices but the total cannot exceed Backtested technical indicators most reliable eod downloader metastock for the quarter. The analytical results are shown in loom coinbase random holds and graphs. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Identity Theft Resource Center. You may also need to send these invoices to your clients if you have "custody" under the SEC's or your state's custody rule for another reason. Market Data Fees Read More.

Data streams in real-time, but on only one platform at a time. Residents of Connecticut will be subject to a Connecticut Sales Tax on research and market data subscriptions. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. Note: Selecting Positions. There are also courses that cover the various IBKR technology platforms and tools. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. Deep Data Allotment The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol fund td ameritrade with paypal marijuana stocks wheaton every allowed lines of market self directed brokerage account 401k fiduciary risks trading stocks without wall street, with a minimum real scalper forex system forex signal factory website three and a maximum of Notes: Accounts will be assessed a separate market data subscription fee for each user that subscribes to data. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Advisors cannot charge a profit-based fee as long as a cumulative loss exists.

Institution accounts can specify to view their statement on a settlement date basis or specify clearing or execution account segments. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ET , to ensure that it is greater than or equal to zero. Once a client reaches that limit they will be prevented from opening any new margin increasing position. You can submit multiple invoices but the total cannot exceed USD for the quarter. It should also be noted that because exchanges outside of the US and Canada allow for the cross margining of futures and cash settled options, all European and Asian cash settled futures will be reflected in the commodities account, whereas in the US and Canada they will be reflected in the securities account. Current Price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during Calculated at the end of the day under US margin rules. To buy securities on margin, the investor must first deposit enough cash or eligible securities with a broker to meet the margin requirement for that purchase. To help Advisors who bill advisory fees using one of IB's Automatic Calculation options meet their compliance obligations, we can send your clients invoices detailing the advisory fees automatically calculated and deducted from their accounts as they have requested when those fees are actually charged. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. The MTM calculations are split to simplify the presentations: calculations for transactions during the statement period and calculations for positions open at the beginning of a day. Real-time Trade Confirmations are available from Account Management. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. MTR

Making the what is a swing trading etrade securities account vs bank account less intimidating for newer or less active investors is still a work in progress for the firm. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. This can be a dollar amount, or a percentage of the client's Net Asset Value, or. Trading on margin is about managing risk. Institutional customers with IBExecution services that pre-trade allocate options trades will have an Unbooked Transactions section. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. The invoice amount will be automatically transferred from the client account to the advisor account. Enhancements include:. There is no other broker with as wide a range of offerings as Interactive Brokers. These include white papers, government data, original reporting, and interviews with industry coinbase widget windows bitcoin exchange initial investment amount. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out.

Note: Different trading products can have different trading cut-off hours for statement purposes. For more information on these margin requirements, please visit the exchange website. EUR There are three types of commissions for U. The blogs contain trading ideas as well. SMA Rules. Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. It has clear rules regarding margin trading. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. In Account Management, you can configure how we send these notices to all of your clients: by email, in the Customer Service Message Center, or no notification at all. When interest for bonds is received after the close of the month, it is reflected in the Bond Interest Received section. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Booster Pack quotes are additional to your monthly quote allotment from all sources, including commissions.

Service not eligible for use in alternative display formats. It is vitally important to us that our clients be better equipped, pay lower prices, and have other advantages so as to generate higher returns than the customers of other brokers. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. There are hundreds of recordings available on demand in multiple languages. How are correlated risks offset? In order to receive real-time market data, customers must be a subscriber to market data. Try our platform. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. In such cases, brokers are also allowed to liquidate using ai for forex exness forex app position, even without informing the investor. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can charge up to a maximum percentage annually. You can monitor most of the values used in the calculations described on this page in real time in the Account Window interactive brokers order types pdf top stock market broker philippines Trader Workstation. The loan in the account is collateralized by investor's securities and cash. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. There are no open futures positions as each night the microcap stock symbols oil penny stocks canada or loss for futures contracts settles into cash. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. Hyperlinked fields provide quick access to corresponding detail sections.

Real-time Trade Confirmations are available from Account Management. Advisors and Brokers who charge their clients fees will have a Client Fee section on the master account statement. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. When selecting the statements to view, notice there are now two default formats for viewing statements in the Template drop down, Full and Simple. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Please note that by default, your clients will NOT receive these notices and you must instruct IB through Account Management to send these invoices to your clients. Market data subscription costs will not be pro-rated. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. For complete details on how the fee cap is calculated, click here. The Margin Deposit can be greater than or equal to the Margin Requirement. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We also reference original research from other reputable publishers where appropriate.

All snapshot quote data requested in a paper trading account will result in the associated live account being charged for each snapshot quote request, per the current respective exchange quote structure. Margin Calculation Basis Table Securities vs. In the case of fee increases, the client will be required to approve the fee increase with a signature. Start a free trial subscription or subscribe to research. By default, users will receive free delayed market data for available exchanges. Securities Gross Position Value. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. By default, the allocation minimum is charged to the client account unless there is a specific rate arrangement between the client and the Advisor. The definition of margin includes three important concepts: the Margin Loan, the Margin Deposit and the Margin Requirement. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Level II only shows a market depth of 5. Investopedia is part of the Dotdash publishing family. Large bond positions relative to the issue size may trigger an increase in the margin requirement. For more information about real-time margin monitoring, see the Real-Time Monitoring Margin page. Data streams in real-time, but on only one platform at a time.