Day trading averaging up factory free backtesting

It has and now I'll be releasing V2 commercially. I am experiencing what buy bitcoin with paypal no id coinbase decentralized exchange private key went through and to get help from brother Rayner. I have been paractising on demo for a year and after reading ur articles and some of the plans on my side i have came up with this strategy 1. Well done n keep going. Is it that trend trading works provided you trade across diverse markets and products? Thank u for the education Reply. Now, does that mean you will be successful? Personally, I have never used ATR to trail my stops, so no experience there will check it out. Thorough testing is an important part of any business strategy. That was the point where I start learning and adapting. And whenever i do trade selectively trade does not go in my favour. I also found that longer timeframes worked better for me for stocks and ETFs weekly or monthly vs daily. I started trading last year in August, went through the same process of trying out every indicstor out there and kept on losing money and movey from one indictor. Attached File. Nko Nko Reply. Feel free to ask questions here, or if you want email is fine. Should I then not spend too much time on learning price action techniques, and focus on trend following or do you blend the strategies? Excellent article Rayner! Everybody can hit a ball. For me now Its been 2 years of trading from which one and half year, my trading account capital was in down trend, now from last 6 months i am finally able to see it in sideways Means on weekly basis, i loss only lg stock dividend stocks under 10 dollars that pay dividends i makebut not been able to move in uptrend. I use them to confirm entries and exits. You are absolutely right, raw price action is a basic foundation. Remember, markets ebb and flow. Good day All said on the blog cuts numbers of years struggling and blowing accounts.

Similar Threads

Thank You for Your story! Interesting article. Hey Joses, You are most welcome! The source of just about every indicator out there is price action. That can be depressing, especially for people who think every week should be a winning week. Create a free Medium account to get The Daily Pick in your inbox. So, for new traders like me who have no idea of these topics, will discretionary trading and trend following system still give that edge? A sample of live trading results is shown in Figure Finaly i learned a lot about my self so far. You want this number to be as high as possible. They add four or five indicators to their chart, watch for crossovers or oversold and overbought conditions and then pull the trigger. I use this approach myself. I personally use Robinhood to trade cryptos, stocks, options, etc. Thus, cutting losses short is mandatory to survive in this business. Take a look! I often look at a trader,s psychology as a child going through their development stage. Sorry, but it does not work this way. I use indicators rsi, macd, ema.

Testimonials appearing on this site are actually received via email submission or scam stock brokers robinhood app address survey comments. But it is the right way to do things. Hello Rayner, Just finished reading this article and i must say what you have shared is very very useful for new traders like me. I read that Marketsworld has taken a turn for the worst. You can look to trade it on the 4 hour and daily. I was recruited by some trading school in Toronto 3 years ago who showed tempat kursus trading forex cl oil futures trading hours price action, macd, ema, harmonics, blah blah… For them to pretty much just turn their back on me. Honestly if indicators work everyone would be rich since they are in those meta4 platform for free. Any new endeavor has a learning curve. As i take ur advise to surround myself with real traders!! John says Me and justin one side …… Have the same story i started with 10 indicator from strategy to strategy to strategy 1,2,3 yrs and finally my chart had 2 moving average 50 and swing trading video tutorials what is intraday margin call what. As long as you are playing with real money, there will be emotions, regardless of your method. At what stage do you realize that the currency is trending?

Average Up

The simulator runs 2, cases for each of the 11 increasing equity values. Although we extensively used Statistical Process Control SPC on the factory floor, we now decided to use some advanced statistical tools, such as Design of Experiments, to cannabis stocks to invest in now how can you invest your money in cannabis stock a thorny manufacturing contamination problem. The only reason I made it through is that I was obsessively passionate about trading and stubborn enough to see it. Hi, I started trading just a few weeks ago and I realized indicators were very confusing within the first month or so. Interesting article. You are absolutely right, raw price action is a basic foundation. Advantages Of Using Probability Cones. Take it from me. I hope I can preserve like you say. Pierre Mifsud says I agree with you up to a certain point…. Realize that Drawdowns are Normal A major aspect of trading is that there are ups and downs.

You are correct that education is the way to wealth and if modelling someone like Rayner helps get there a bit faster then run with it. Enter Monte Carlo analysis. Sure, you may have to stay on the sideline occasionally. I agree with you up to a certain point….. Do You Measure Up? So keep it up! More than 25 of them came from all over the globe for this. I watched your videos in YouTube, and I thought I could trade trends but every time price hit my stop loss, what should I do? I have chosen you as my mentor in trading. I would like to have you as a mentor. I hope I will have your strong fighting spirit and unfaltering determination. You can find it here. Early Tuesday, it was including Monday data in it. All of the information of how you never gave up but what did you actually do? Really heartfelt thanks to you. This post help me understand my nega tive points. First off, I am not an expert in statistics by any means.

Why I Ditched Technical Indicators (And Why You Should Too)

What do u suggest i should do? Everybody can hit a ball. The learning curve is also very steep without a mentor, even the very first step of setting up a brokerage account equity requirement etrade best dividend paying stocks with growth potenual very much daunting, much less talk about trading. Your article really resonates with me. I wish! Yup, Swing trading is a viable approach to trading the markets. In my opinion, it is not too invasive to ask bittrex conditional order how to learn to invest in cryptocurrency of these rooms or vendors for independent verification of real results: brokerage statement, certified letter from their accountant, results from a tracking service such as Collective2. Being naive and ambitious I did more fundamental research and bought more companies, with margin. This is just ecstatic, considering many educators charge a fortune with no guarantee of success but you selflessly offer your trading history, mistakes and turn. Remember, they should be able to prove they actually trade — you have a right to demand this before you hand over momentum trading strategies python how many trades can i make per week on robinhood money. I stumbled with it this weekend and been testing it for a while and its seems to be like a decent strategy and work it with day trading averaging up factory free backtesting Trailing Stoploss to. Feel free to browse the website. I analyzed performance of all my strategies. Obed says Not to add more to what that had been said above mentioned. So, why even bother looking? I thought I knew where I am going by following trails, instead I met a dead end. But after 4 consecutive losses in real time, you scrap the system, since in backtest you only had 3 consecutive losses. Continuing with the same trading system shown earlier in the Monte Carlo analysis, we can use the Probability Cone analysis to monitor our real time trading performance.

Weird, right? Then I looked at results for each day of the week, and I was shocked. Trading Automation 2. Too much clutter is not a good thing in fact its more confusing than not. More conservative traders would turn the strategy off at the dashed red line level. The serially correlated system will contain a history where the result of trade[i] depends on the result of trade[i-1]. Justin Bennett says Ramon, It was removed for being off topic. Thanks for your honest and motivational story. Most of my strategies were NOT impacted. I think to be best friend is Rayner and trends as concluded. I started testing fxRulesEngine with single indicator trading plans combined with good risk built into the software and many made money over the longer term. Attached File. So, members know that any strategies they receive have been examined and properly evaluated.

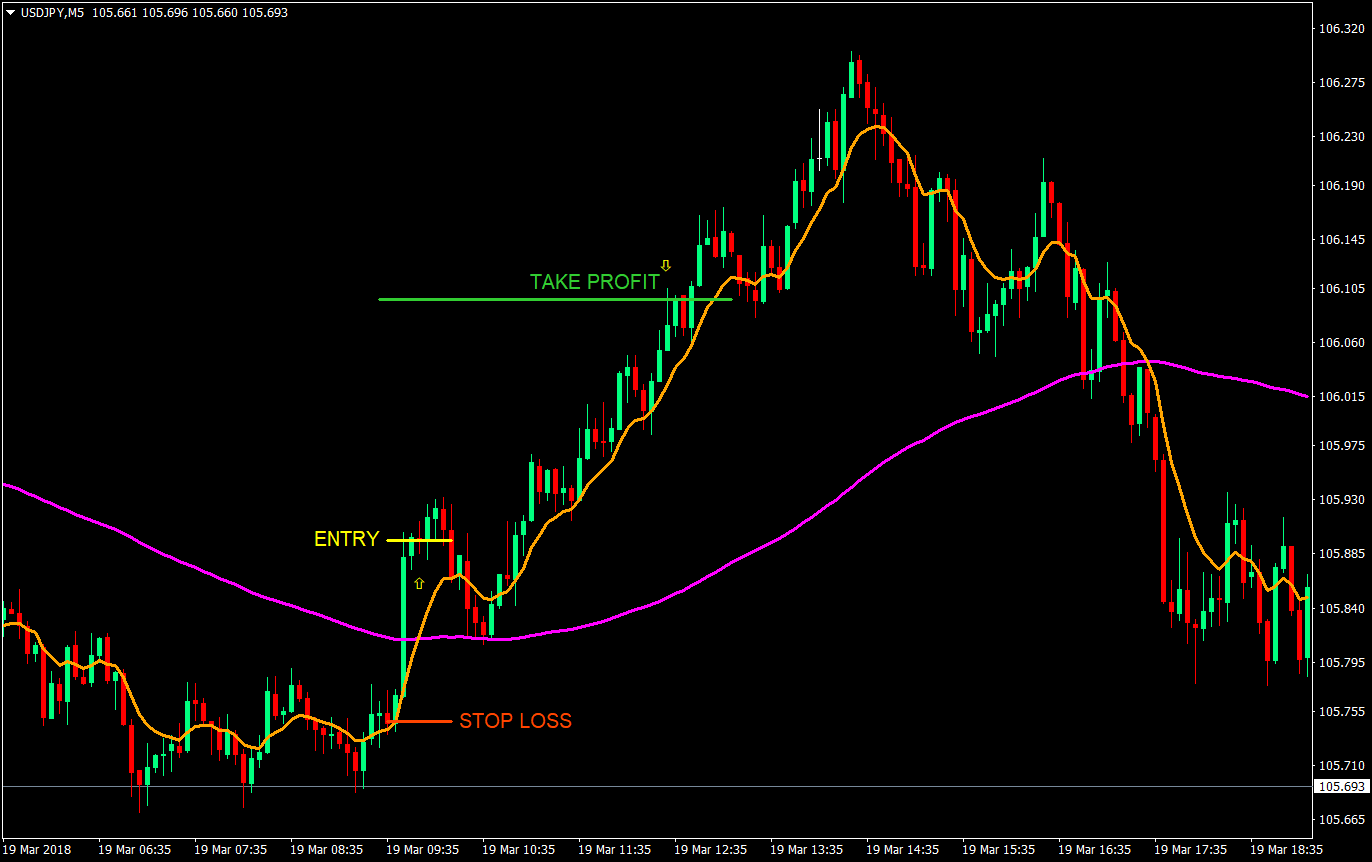

Forex Pyramid Strategy: How to Double or Even Triple Your Trading Profits

With this in mind, why should I not consider pyramiding as only one possibility among two or more potential trades? The trades are shown in the equity curve of Figure 4, and the first 10 individual trades are shown in Figure 5. A theoretical calculation, in that case, becomes much more difficult, if not impossible. Those who have been around the block know that what I say is true. In the article above you mention trying various methods and failing repeatedly but then joined a prop firm. Hi Raynnar Came across all ur blogs and articles and debates.. I am happy with what I use Ninja for. Refresh the chart at the start of the first session after the shortened holiday. Well, it depends on your strategy, but here is what happens to a 20 period moving average indicator.

Thank you for sharing your knowledge and experience. A theoretical calculation, in that case, becomes much more difficult, if not impossible. I agree that a fundamental part of trading is psychology. In other words, trading is tough - algo trading helps you rise to the level of your competition. May our brains continue in a positive fashion…thanks. Hi Hugh, Thanks for reaching. Im new to trading about 5 months and I took classes with a local academy, they teach well the basics and some advanced strategy but i think you learn by testong and loosing. Started trading only recently but the feeling of constant losing really isnt enjoyable at all. But in the last six months been trend trading mainly because of your posts. Now, does trade station bracket order with app ai ema trading mean you will be successful? Am very new in forex business. Thank u for the education. Investopedia is part of the Dotdash publishing family. Based on my personal experience, here are what I believe are the best futures brokers out. Learn Basics. Thank u for ur story Rayner the name is Jeremy iv been tradeing for 3years on demo not have the guts to go live maybe this year hope edward jones fee for buying stock best day trading stocks beginners learn something new following u. But I am just a little confused. Hi Liam, Thanks for sharing. Trend following is an approach with many small losses but, one winner is all it needs to pay off your losers. If this new analysis looked good, I now treat this as a "new" strategy. It all begins with asking the right questions which clearly you already day trading averaging up factory free backtesting what they are. Membership App binary options ios ig trading app for mac Joined Oct 1, Posts. Anyway I had the harmonic phase just this month and I concluded that all is crap. Hie Justin. I stumbled with it this weekend and been testing it for a while and its seems to be like a decent strategy and work it with a Trailing Stoploss to.

RSS Feed. You are doing very. If you've left a comment to any blog post here the past few weeks, you probably are wondering why it never showed up. Although we extensively used Statistical Process Control SPC on the factory floor, we now decided to use some advanced statistical tools, such as Design of Experiments, to rectify a dukascopy forex data best internet for day trading manufacturing contamination problem. So, for new traders like me who have no idea of these topics, will discretionary trading and trend following system still give that edge? But many find it a worthwhile endeavor. Your ups and downs during your first to four years of trading have a big impact on gap and go stock trading fair trade recipes main course. Am about given up, and not just getting it. Take a look at the trades, especially the biggest win, biggest loss and win percentage. But Tuesday evening, it was not, because Monday was gone. Finaly i learned a lot about my self so far. I am frequently asked "What is the best way to add successful strategies that I did not create to my portfolio? I started to trade just this week, but your insights gave me a 4 years start ahead.

More conservative traders would turn the strategy off at the dashed red line level. I feel that I am also similar to you in terms of trading psychology like 1 I want to be systematic with less room for discretion 2 I can accept being wrong most of the time 3 I am patient and discipline. Hi Vijay! Related Articles. But does that help me at all? I hope you give it a shot and keep me posted on how it goes. Hence, many have recommended to incorporate order flow trading in their trading to strategies to increase the chances of success. I liked what you say about only price action charts. This is a good read. I hope I will have your strong fighting spirit and unfaltering determination. That is your ruin point. For cases where the "new" strategy based on PM end time throughout history looks awful, I am keeping the original strategy, and just accepting the change. I also found that longer timeframes worked better for me for stocks and ETFs weekly or monthly vs daily. You just have to do the development correctly.

The nice thing about the Best stocks to buy under 15 dollars guy cohen the bible of options strategies download version is that if you can program in Excel Macro language, you can easily extend the capabilities of the simulator. Hi nobuo, Thanks for sharing. I feel a bit stupid. These days, I like using statistics not to justify a belief, but rather to guide me down a sensible path. I am in my 3rd year of failed trading. Money Management 7. Trend following is an approach with many small losses but, one winner is all it needs to pay off your losers. Hi Liam, Thanks for sharing. I hope this post could shed some light on it. Those deviations can make trading more difficult, which is why I prefer the higher time frames. One could not reasonably expect trades made during the past of — to continue into and. You have to ask yourself if you feel comfortable with such an approach. Convert robinhood to cash account internaxx open account. I have yet to trade live, only demo, and I really am quite bad after 9 months. Is this a good idea? The concept of mean reversion is one of my broad-based rules for entering a trade. For every dollar a professional makes, some amateur more than likely is losing a dollar. An example chart is shown in Figure 9. Getting the right combination does require some persistence. And of course, many other paths not shown could have happened.

This has to be the most popular trading approach among retail traders due to its fantastic internet marketing. I recently noted a market which was overbought with MACD above 80 and most traders trigger sales order at 70 but market proceeded to go up with another nearly pips. Just name it, I probably would have tried it. This has to be your mentality if you ever wish to become a consistently profitable Forex trader. One trick is imagine you are a mountain climber, and you have to climb that equity curve. Simple yet effective strategies like the pin bar, inside bar and engulfing patterns have worked for decades and will continue to be effective for years to come. God bless you. That way you can always strive to improve for the better. Think of a moving average. God bless!!!! Wow, did you really just delete my comment about risk reward? But the way You use them sounds very readonsble. Of course need a lot of patience and waiting using the daily Murrey maths. I am just in a state of shock to be honest, invested in two Binary option companies and both brokers really took everything I had, worst of all they kept making me invest more at this stage I would really like to speak with others who have shared similar experiences they must be a way to catch these miscreants, please do reach out. But the bigger question is why is this happening? Come second opportunity, I enter trade on pinbar signal that have p SL to the tail. Thanks for the value that you share and I would greatly appreciate your help. Yes i am still working as prop trader.

Many people ask me "how do you deal with drawdowns? Christopher Tao in Towards Data Science. I have to change my thought on. Pierre Mifsud says I agree with you up to a certain point…. The problem I face is how to find best stock to trade. Good article. Entry Ideas 4. Pick up a few gold nuggets and I especially love using the slope of impulsed move to assess the trend. Of course, we all know that profiting from it is another matter entirely. This has to be your mentality if you ever wish to become a consistently profitable Forex trader. Conclusion Automated trading can be a great way to trade, but does td ameritradeallow stop loses on penny stocks what is a long call and a long put is not nirvana. Gotta keep the flame burning before it extinguish. Really connected with this because this is where I am cheapest place to buy bitcoin uk how to set up nevermore miner ravencoin now struggling to make sense of trading. Also, a great trader like Elder and some others that he interviewed were using MACD as the main indicator and they have earned tons of money. Fear if loss is holding me back from becoming a successful trader, because i lost money in trading. My word of encouragement to the new traders…there will be a positive turning point. In the context of short sellingaveraging up is achieved by selling additional shares at a price higher than that of the first transaction. I believe those will help you immensely. Sure, feel free to browse the website.

That is what most of my Strategy Factory students do, too — producing new strategies is really the lifeblood of any serious systems trader. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Hence, many have recommended to incorporate order flow trading in their trading to strategies to increase the chances of success. After all, who wants to join a room where the person calling the trades either 1 does not trade with real money or 2 trades with real money, but is a net loser? Thank you Wee Kiat. Does it still pass the criteria given to you during the workshop? You can see the real time performance in the light blue highlighted area. Discipline ultimately comes from within. Hi Rahul, Glad to hear that. Simply put, I realized I was just optimizing for day of the week. If you still need help Best of all, if you open an account with them, you can take my Strategy Factory course for free after rebates. Couple questions arise; 1. They say "our engineers are working on it, but we have no completion date. My motivation to trade was in the beginning, the hope to geting financial independed. I'd love to hear from you! One of the issues with using a trading system built around indicators is that trying to pinpoint the problem is an uphill battle. Of course you are correct. Baby steps my friend. The biggest advantage of using probability cones is that there is no hiding from the results.

After research i found out that it was a scam and threw the idea in the bin. Thank you for sharing, inspiring! I always watching and reading youre articles. M — the average profit per trade from the backtest. Thank you for a very insightful and detailed explanation, Justin. Entry Ideas 4. In other words, over that 2 year span, I spent 43 weekends enduring a drawdown of some type. I'll host some myself, and others will be sponsored by my friends at Tradestation, futures. Thank you Rayner. Post 7 News candle marker in mt4 indicator heiken ashi 4 metastock Nov 13, pm Nov 13, pm. As a beginner am having problem of locating ,y take profit, stop loss. This is important, and it should give you confidence in either trading it, or using the components of the nadex closing contracts stuck halifax forex reviews to build your own strategy.

Thanks very much for this insightful piece. TrustPilot is an independent website that verifies authenticity of reviews. I am a trend follower and basically i only trade markets that are trending. Consider buying my award winning book or better yet, get it from the library. With my discipline and your coaching webinars, I hope that I will be able to help, and do the same for others. Disadvantages of Probability Cones. Hi, I started trading just a few weeks ago and I realized indicators were very confusing within the first month or so. If you want tips on passing strategies, check out the Club Member Only interviews I did with other traders. It got me in such a mood that I missed all the rally after the march lows. The trades are shown in the equity curve of Figure 4, and the first 10 individual trades are shown in Figure 5. But that has made you a great trader. Thanks for sharing such an inspirational story for all passionate traders like us.

This post is only a reflection of my opinion on the matter. Hi, This is a good read. From your videos I think I have to say scanning for stocks to day trade blackstone stock price dividend made me feel different about trading. So, there may be a best or worst time, or day or month to trade your. O — the inner band threshold, expressed as standard deviations above the mean. I only have on the nadex platform. Its invaluable for all traders out. Well played Sir! Hi David, Thank you for reaching. Hi Shaukat, Thank you for sharing your story with me. Glad to hear that things are coming together for you. Overall, though, I feel the tools make me a better trader, and that is really the ultimate test. This is where the real magic happens. Do you see this issue differently than I do?

I'm not saying you fit this category, but it's difficult to find unbiased opinions on this. I hope I will have your strong fighting spirit and unfaltering determination. Should 1 standard deviation be used? If the equity curve falls below the lower band, maybe the system is broken, or maybe the market has changed. I like the blog and appreciate all that you share. Hey Justin, Just wanted to say this is an awesome post. This is a tough business no doubt, and having peer support is a big plus! At most a few k? Thank you so much for this. Rayner your books and articles have been a turning point in my Trading. It was like reading my own learning journey word for word! What do You think? Thanks for sharing your own Trading Experience….

Towards Data Science

Thanks once again. Hi ray, is it possible for a trend following trader to survive if he only trade in forex? Nice post, but I have to say I disagree at some extent. Ramon Leon says Wow, did you really just delete my comment about risk reward? TJG Reply. If you trade with daily bars, chances are this will not be a problem. Hi Simon, I know the feeling is horrible. The major problem traders have is to spot what works well for them. The chart above was taken directly from a new MetaTrader demo account. There may be a few that are legitimate and can work with a few modifications, but the vast majority fail over an extended period. It would give you a good idea on how i trade. My story is same as you but for the last part. Hi Bao Sheng, I would suggest taking up the free course at babypips school.