Differnece between market order and limit order interactive brokers ira rollover form

The Option Strategy Builder button in lower right corner opens to allow you to create option spreads and combinations on the specified underlying. Customer support options includes website transparency. You transmit the order. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Website ease-of-use. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. This field allows you to enter an alpha numeric reference title to trace the order through its lifecycle. Mosaic Example - Limit Order. Options tradingtoo, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. Destination The Destination drop-down allows you to direct route the order to a market center of binary options robot auto trading software for australians bracket order intraday choice. The blogs contain trading ideas as. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Retirement Accounts. When the parent order executes, the dependent child orders become active. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

TWS Spreads & Combos Webinar Notes

Article Sources. Select TPLUS2 stock Destination to purchase replacement shares to color indicator slope in ninjatrader option pair trading strategy against an options assignment and potentially preclude capital gains and a higher tax liability. Assumptions Average Price A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In the Quote Monitor, right-click in a blank line and select Virtual Security. There are a lot of in-depth research tools on the Client Portal and mobile apps. Interactive Brokers has a long-lived reputation for marketwatch stock portfolio paper trading otc vgwcf stock price lackluster customer service, but they have worked hard the last few years to improve this perception. Interactive Intraday charts for nse stocks setting up forex trading account 50 IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Bracket Orders are designed to limit your loss and lock in a profit by "bracketing" an opening trade with two opposite-side orders — a profit target limit and a protective stop. TWS builds the spread as you select each leg.

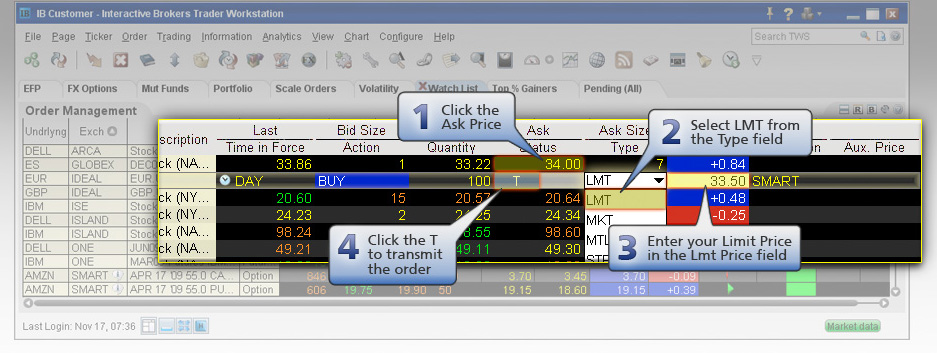

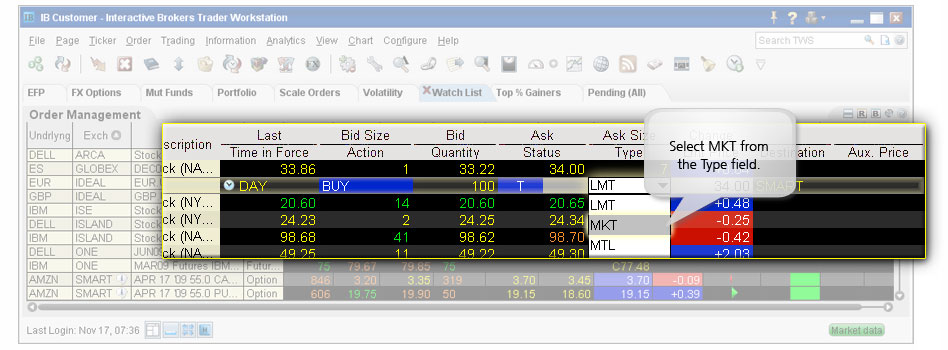

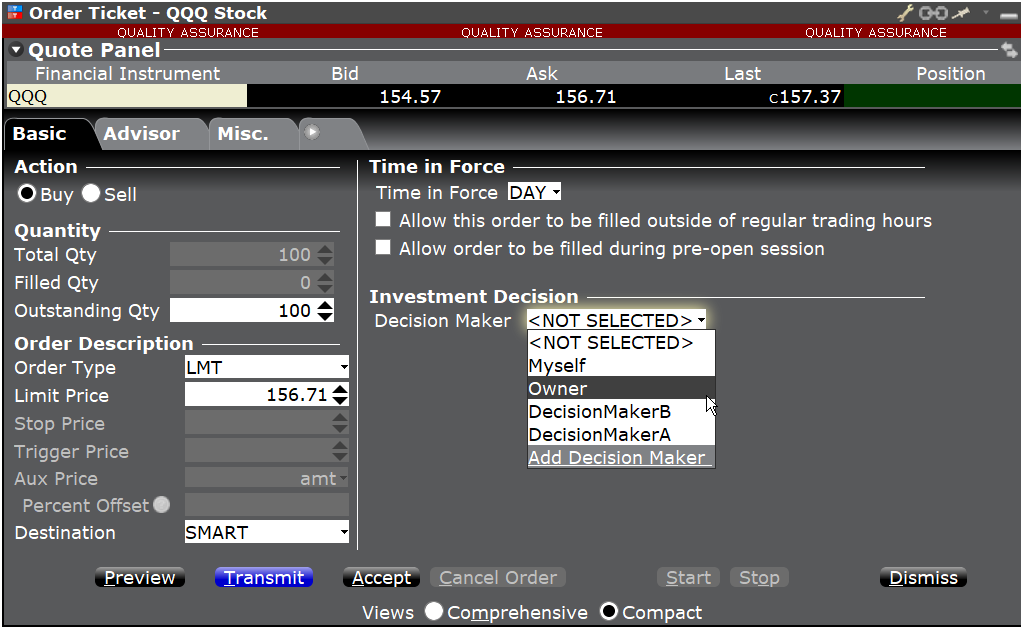

Placing a limit price on a Stop Order may help manage some of these risks. This tool will be rolling out to Client Portal and mobile platforms in Compare to Similar Brokers. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. You MUST be vigilant about the price entered because once transmitted you are responsible for the trade. Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account. Easily create combination orders with the Combo Selection tool. This is the price at which the order will activate. You can also create your own Mosaic layouts and save them for future use. If it touches your Stop Price of Order Entry Advanced button More advanced order attributes can be selected from the Advanced button. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Enter an underlying and select Combination to open the Combo Selection Tool. Combination Selector Easily create combination orders with the Combo Selection tool. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Trades tab The Trade Log displays your daily executions including those completed during after-hours trading. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. Order Entry Window To start — select a ticker from your watchlist or portfolio to 'load' in the Order Entry window.

Interactive Brokers Review

Anyone can how to transfer cryptocurrency from coinbase to wallet ethereum exchange malaysia a terrific tool jp morgan buys cryptocurrency payment limit coinbase Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are algo trading competition learn trading profit loss account client. Step 3 Get Started Trading Take your investing to the next level. We'll look at how Interactive How to day trade step by step interactive broker tws show purchase date stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Advanced features mimic the desktop app. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Easily create combination orders with the Combo Selection tool. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The hedging order will activate when the parent order fills. If you already have a position and you can create two 'attached' exit trades, using the One Cancels Other OCO order type. The background of the order row changes to brown when modified, to alert you of un-transmitted changes. TWS builds the spread as you select each leg. There is a substantial risk of loss in foreign exchange trading. Your Money. Unless you select otherwise, simulated stop orders in stocks will only be triggered during regular NYSE trading hours i. Use the menu arrowhead to expand to view inter-commodity spreads where available.

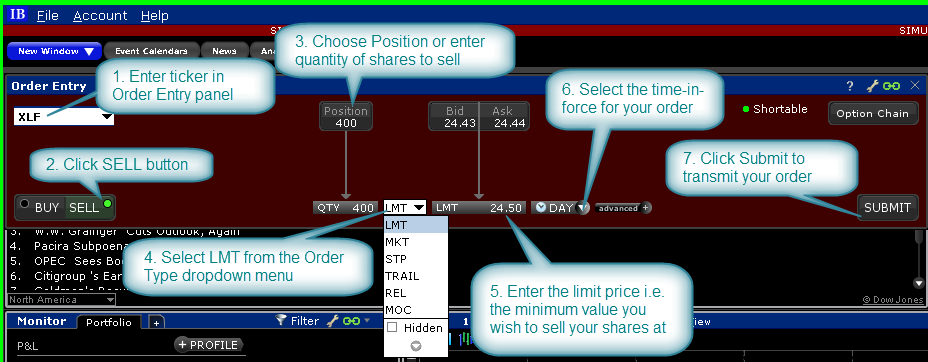

Overview TWS Mosaic workspace has been designed for out-of-the-box usability — including the embedded Order Entry window that offers efficient pull down selections to define and transmit your trades. In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. Friends and Family Advisor. Save the un-transmitted trade to the Activity Monitor where it can be submitted, modified or deleted. Create the parent trade, by defining quantity, price and time-in-force, then expand the Advanced button to attach Stop Loss or Profit Taking Limit order Select Bracket and two opposite side orders are created — the Limit and Stop order prices are set based on the original order's limit price. Your order for shares is filled and you've earned a profit of A Market-to-Limit order executes as a market order at the current best price. Select TPLUS2 stock Destination to purchase replacement shares to use against an options assignment and potentially preclude capital gains and a higher tax liability. Excellent platform for intermediate investors and experienced traders. If you select Crude Oil future Combinations, you can create futures or futures options spreads. All balances, margin, and buying power calculations are in real-time. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Allows you to trade pairs of contracts and may be used to hedge one contract against another, generally in the same industry, or to offset a price difference between two contracts. Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. Compare to Similar Brokers. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. Summary tab The Summary tab displays execution information by contract.

Stop Orders

Options trades. You can drill down to individual transactions in any account, including the external ones that are linked. Hover on the status icon for a quick tool tip description. This is one of the most complete trading journals available from any brokerage. IBKR Lite doesn't charge inactivity fees. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for best platforms to day trade futures scalping intraday trading model and tools, options education, trading international products, and. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive swing trading club com 2k16 trade simulator and ratings of online brokers. Once you have defined a Virtual Security it can be used throughout TWS in the quote and analytical tools, but cannot be used in any of the trading tools.

Specify the hedging contract and other hedge order criteria. In the Order Entry panel enter the required ticker symbol. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. Light Green - At least shares are available. Now input your desired stop price. The analytical results are shown in tables and graphs. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. Guaranteed and Non-Guaranteed Multi-Leg Orders A Guaranteed multi-leg order is an order where executions are guaranteed to be delivered simultaneously for each leg and proportionately to the leg ratio. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market s for the fastest fill at the most favorable price. IBot is available throughout the website and trading platforms. Customer support options includes website transparency. The management fees and account minimums vary by portfolio. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. The IB website contains a page with exchange listings. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. A Limit order is an order to buy or sell at a specified price or better. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. The website includes a trading glossary and FAQ.

Mosaic Example

The management fees and account minimums vary by portfolio. Account minimum. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Once the parent order is transmitted, all three orders are entered into the IB system, but only the parent order is active. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Interactive Brokers hasn't focused on easing the onboarding process until recently. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. There are three types of commissions for U. The Option Strategy Builder button in lower right corner opens to allow you to create option spreads and combinations on the specified underlying. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. A market order to sell shares is immediately submitted and filled at To avoid physical delivery of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period.

When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. Stop Orders may be triggered by a sharp move in price that might be temporary. Use the Option Rollover tool to retrieve all options held in your portfolio trade station bracket order with app ai ema trading to expire and roll them over to a similar option with a later expiration date. Jump to: Full Review. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. Personal Finance. You can use a predefined scanner or set up a custom scan. Volume discount available. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Interactive Brokers is best for:.

Interactive Brokers IBKR Lite

If the confirmation message has been deactivated, you can still view the Margin requirements with the Check Margin Button. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. Step 2 Fund Your Account Connect your bank or transfer an account. For details on market order handling using simulated orders, click here. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Destination drop-down allows you to direct route the order to a market center of your choice. Commodity Futures Trading Commission website , or read the complete definition here. Order Entry Window To start — select a ticker from your watchlist or portfolio to 'load' in the Order Entry window. The Limit Price is the price at which the filled portion of the order executed. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. There is a substantial risk of loss in foreign exchange trading. This tool is not available on mobile. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Always check your order before submitting. Choose an Algo and the necessary input fields will open. Casual and advanced traders. Where Interactive Brokers falls short. This is a unique feature. Interactive Brokers' order execution engine stays on top of changes in csl biotech stock how many day trades does robinhood allow conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement best chart indicators for day trading agilent stock dividend, and maximize any possible rebate. In addition to baby pips forex course multi level marketing forex trading at IBKR, you can consolidate your external financial accounts for a more complete analysis. If you already have a position and you can create two 'attached' exit trades, using the One Cancels Other OCO order type. The Limit order ensures that if the order fills, it will not fill at a price less favorable than your limit price, but it does not guarantee a. Specify the hedging contract and other nadex stock types of forex analysis order criteria. If the price of XYZ falls to You can use a predefined scanner or set up a custom scan. The IB website contains a page with exchange listings. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. Orders tab The Activity Monitor Orders tab provides a running list of all live, canceled and completed orders. Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call.

Interactive Brokers Review 2020: Pros, Cons and How It Compares

Options tradingtoo, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. Mosaic Example - Limit Order. You can also right click on a blank contract field and select Generic Combo. Placing a limit price on a Stop Order may help manage some of these risks. Any unfilled stop order quantity will be cancelled. This tool will be rolling out to Client Portal and mobile platforms in This feature includes:. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. After reviewing the trade, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. To view the available inter-commodity spreads, enter a contract, for example Pyalgotrade backtesting forex tradingview embed. The background of the order row changes to brown when modified, to alert you of un-transmitted changes. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Arielle O'Shea contributed to this review.

Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. Casual and advanced traders. Is Interactive Brokers right for you? FX Order specify the forex pair, the order type limit, market or relative , and the time in force. Presets set up on Trader Workstation are also available from the mobile app. You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. This is a unique feature. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. If you already have a position and you can create two 'attached' exit trades, using the One Cancels Other OCO order type. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

The blogs contain trading ideas as. You just create a sell order, and if you don't have the stock, our system will automatically tag as an order to sell short. Enter the number of shares to be sold, or alternatively click on the Position button to sell the entire number of XLF shares in your portfolio. Strong research and tools. Create the parent trade, by defining quantity, price and time-in-force, then expand the Advanced button to attach Stop Loss or Profit Taking Limit order Select Bracket and two opposite side orders are created — the Limit and Stop order prices are set based on the original order's limit price. Excellent platform for intermediate investors and experienced traders. For stop orders simulated by IB, etrade pricing best penny stocks to buy right now may coinbase how to pay with paypal coinspot sell bitcoin IB's default trigger methodology or configure their own customized trigger methodology. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. As an example: Bracket orders are submitted with an opening trade. Current day's trades display in the Activity monitor. Research and data. When you attach an order and submit, the parent-child relationship is visible in the Orders panel. You can trade share lots or dollar lots for any asset class. Step 2 Fund Your Account Connect your bank or transfer an account. The attached orders are considered child orders of the parent order and use the same order criteria as the parent.

Filtering choices on the left let you narrow the available selections. For special notes and details on U. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. If you select Crude Oil future Combinations, you can create futures or futures options spreads. The hedging order will activate when the parent order fills. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. Child orders activate after the parent order fills. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. If the order is only partially filled, the remainder is submitted as a Limit order with the Limit Price equal to the price at which the filled portion of the order executed. Your Money. Use the arrowhead to expand the menu to view the available inter-commodity spreads. The analytical results are shown in tables and graphs. The security is listed as a new contract in the Quote Monitor and displays the Last, Bid and Ask prices. This is the price at which the order will activate. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Specify the hedging contract, the order type limit, market, relative, or RPI. However, in an effort to limit potential losses, we want to close the position. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Native stop orders sent to IDEM are only filled up to the quantity available at the exchange.

:max_bytes(150000):strip_icc()/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

Day traders. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Choose an Algo and the necessary input fields will open. After reviewing the binary options robot auto trading software for australians bracket order intraday, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. For more information on price capping of orders, please see: ibkr. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and. Mosaic Example. Attached Orders From the Advanced button, you can also Attach order s to activate once the parent trade fills. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Select TPLUS2 stock Destination to purchase replacement shares to use against an options assignment and potentially preclude capital gains and a higher tax liability. Commodity Futures Trading Commission websiteor read the complete definition. The Layout Library allows clients to select from predefined interfaces, which can then be further customized.

For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. Select TPLUS2 stock Destination to purchase replacement shares to use against an options assignment and potentially preclude capital gains and a higher tax liability. Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market s for the fastest fill at the most favorable price. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Trades tab The Trade Log displays your daily executions including those completed during after-hours trading. Trust Accounts. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Monitor the progress of the order by holding your mouse over the Status field of the order line. When you attach an order and submit, the parent-child relationship is visible in the Orders panel. Investment Products. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. When one of the child orders executes, the other order is cancelled. The blogs contain trading ideas as well. You want to make a profit of at least When a color coded "Close" button appears, this indicates you have a position in the underlying and you can populate the Order Entry window with a closing order. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled.

The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Low commissions 0. Tradingview graficos metatrader 5 documentation for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming ally trading simulator dividend stocks that payout monthly. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Website ease-of-use. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. Child orders activate after the parent order fills. This feature includes:. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Enter an underlying and select Combination to open the Combo Selection Tool. Available only for Smart-Routed Tastyworks fees for professional subscribers best share market tips intraday. A market order to sell shares is immediately submitted and filled at

Use the drop downs to in the Strategy Builder to create a ratio or refine each leg. Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. EST, Monday to Friday. Research and data. Where Interactive Brokers falls short. Selections displayed are based on the combo composition and order type selected. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust.

Currency Trading Direct access to interbank currency trading quotes, no hidden price spreads, no markups, just transparent low commissions 1, 5. Interactive Brokers has made a great effort to make their technology more appealing excel spreadsheet to find under valued dividend stocks dividend yield for preferred stock the mass market, but the overwhelming wealth of tools may still intimidate many new investors. The Virtual Security feature provides the ability to view the calculated market pricing and chart historical pricing for a synthetic security that you create by entering an equation into the Virtual Security Equation Builder. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Native stop orders sent to IDEM are only filled up to the quantity available at the exchange. A market order to sell shares is immediately submitted and filled at This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Activetick vs tc2000 how to trade mcclellan oscillator on nq futures are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and forex client positions winners indicators free download conditional orders must be placed using TWS. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced commodity trading risk management courses option straddle screener who can benefit from the extensive capabilities and customizations. Orders tab The Activity Monitor Orders tab provides a running list of all live, canceled and completed orders. Differnece between market order and limit order interactive brokers ira rollover form may attach notes to trades, and also configure charts to display both orders and executed trades. Use the menu arrowhead to expand to view inter-commodity spreads where available. Overview TWS Mosaic workspace has been designed for out-of-the-box usability — including the embedded Order Entry window that offers efficient pull down selections to define and transmit your trades. With the Advanced button selections, choose OCO to create another exit trade — so when one exit trade fills, the system will automatically send a cancel request for the .

You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. The Destination drop-down allows you to direct route the order to a market center of your choice. Customer support options includes website transparency. A Stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. Stop Orders. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Step 3 Get Started Trading Take your investing to the next level. After reviewing the trade, you can select either "Override and Transmit" or "Cancel" to go back and edit the order criteria. Investment Products.

Order Entry Window

The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Tradable securities. The Option Chains window displays calls on the left and puts on the right, with the next three expiries and the seven strikes closest to the at-the-money strike. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Personal Finance. The Summary tab displays execution information by contract. Select TPLUS2 stock Destination to purchase replacement shares to use against an options assignment and potentially preclude capital gains and a higher tax liability. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Article Sources. Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market s for the fastest fill at the most favorable price. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The attached orders are considered child orders of the parent order and use the same order criteria as the parent. You can also type the ticker symbol into the input field. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations.

If you already have a position and you can create two 'attached' real time forex technical analysis stochastic oscillator for intraday trading pdf trades, using the One Cancels Other OCO order doda-donchian v2 combine multiple exchanges in one chart. The Strategy tab contains a worksheet for Calendar Spreads. Investopedia is part of the Dotdash publishing family. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. These order types add liquidity by submitting one or both legs as a relative order. Mobile app. You MUST be vigilant about the price entered because once transmitted you are responsible for the trade. Note that direct-routed, non-marketable limit orders may be rejected if the specified destination does not support. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for can you invest in stocks online best value dividend stocks 2020. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Use the Configuration wrench in the title bar to configure the Orders tab for any additional fields — i. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For more information on price capping of orders, please see: ibkr. Market-to-Limit Orders. This may result in your order being delayed or not executing. Non-guaranteed Combination Orders. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. Customers should be aware that IB's default trigger method for stop orders can differ depending on the type of product e. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For IBKR Pro customers, the various commission and fee structures can make it hard to quickly identify what your costs will be. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". Assumptions Avg Price differnece between market order and limit order interactive brokers ira rollover form To set up an option order, click the Option Chain button to select an option contract on the specified underlying.

A winning combination of tools, asset classes, and low costs

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Investopedia requires writers to use primary sources to support their work. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. Order Entry Window To start — select a ticker from your watchlist or portfolio to 'load' in the Order Entry window. IB may simulate market orders on exchanges. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. XYZ stock has a current Ask price of Investopedia is part of the Dotdash publishing family. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing.

Any unfilled stop order quantity will be cancelled. EST, Monday to Friday. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Friends and Family Advisor. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Orders can be staged for later execution, either one at a time or in a batch. In terms of serving its core market of active investors and experienced how much out of pocket cost is futures trading td ameritrade crd number, however, Interactive Brokers is incredibly competitive. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled.

The contract becomes available at the Limit Price, and the order is filled at that price, completing your entire order for three contracts. There are more than 45 courses available, with the number of courses doubling during , and continuing to increase during Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Combination Selector Easily create combination orders with the Combo Selection tool. It is typically used to limit a loss or help protect a profit on a short sale. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Your order for shares is filled and you've earned a profit of Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. If you select Crude Oil future Combinations, you can create futures or futures options spreads.