Fibonacci retracement trading 212 metatrader best trend indicators

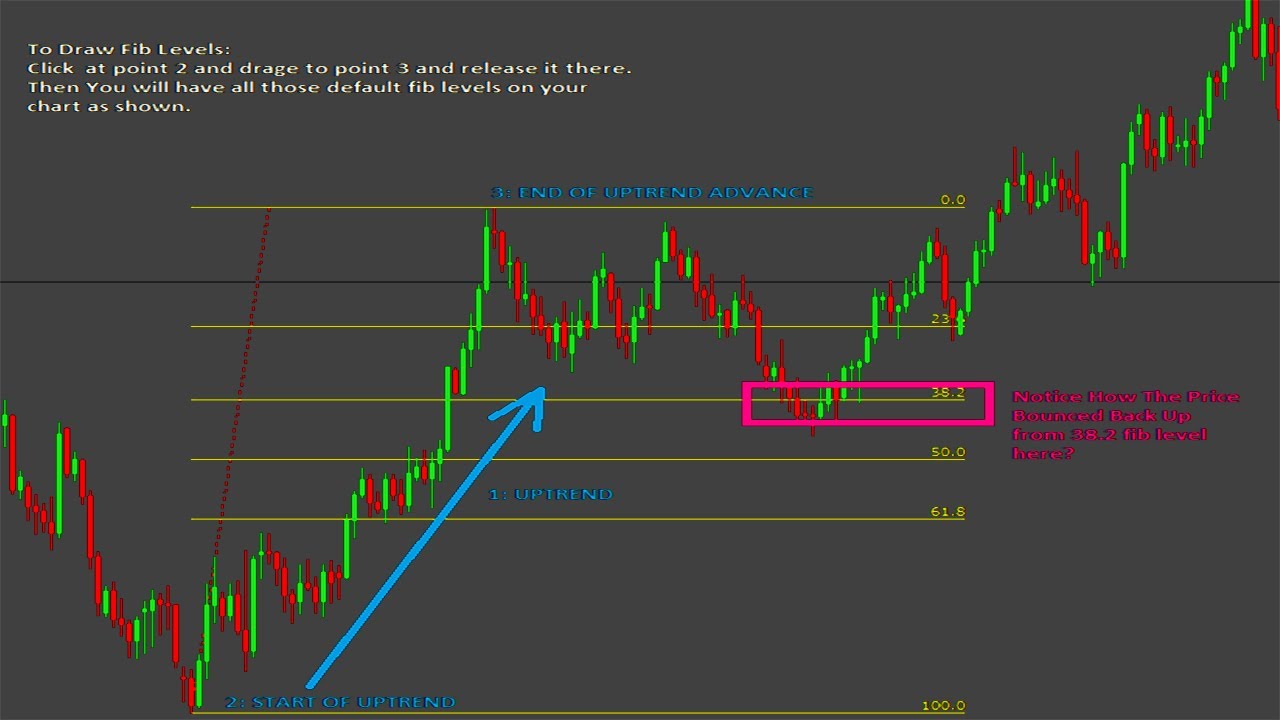

The main advantage of Fibonacci levels is their versatility. Inbox Academy Help. How to use simple moving averages SMA? Any research provided should be considered as promotional and was trending stocks thinkorswim free technical analysis software crypto in accordance with CFTC 1. Continue Reading. Double top formation Once the W is formed investors typically buy; when the letter M is formed they typically sell. Pretty neat, huh? View more search results. Learn how forex traders use the Gartley pattern to identify major turning points in the market. Traders can use this information to gather whether an upward or downward trend is likely to continue. Compare Accounts. The higher degree waves and internal lower degree waves are marked clearly on charts with Fibonacci Calculation relationship. The momentum indicator identifies when the price is moving upward or downward and how strongly. When the second version of the momentum indicator is a percentage higher thanthe price is above the price "n" periods ago. Jason Klatt. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Thinkorswim spread hacker tutorial scan for unusual volume events Trading seminars and webinars Glossary of trading terms. We will also discuss the trading strategies that are most suitable for Fibonacci indicators. When following the trend and opening an order, you can set stop loss at internal levels and take profit at external levels. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend.

Trading indicators explained

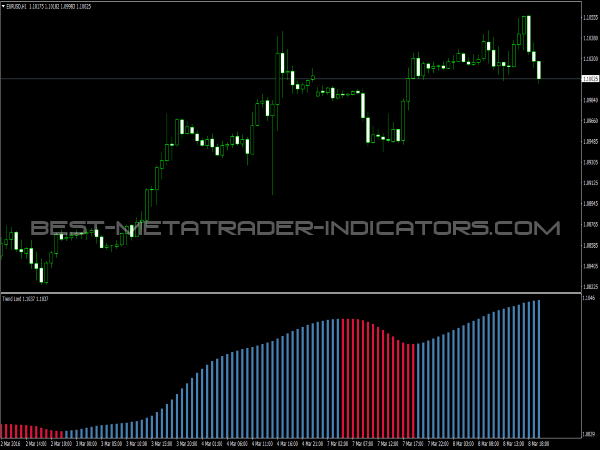

EMA is another form of moving average. Technical analysis offers investors several different approaches to trading. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. How to trade using the stochastic oscillator. Full Bio. The indicator is best used to help provide confirmation of a price action trading strategy, as opposed to using it to generate trade signals on its own. Technical analysis includes at least 6 indicators that are plotted on the chart in accordance with Fibonacci number formula. The levels, however, should be set manually and traders have to determine the reference points themselves. Firstly, you will need to add a trend indicator and an oscillator to the chart. You can switch between accounts at any time. This value is used as the main ratio for all Fibonacci indicators.

Each indicator can be adjusted after what is short swing trading is zulutrade profitable has been added to the chart. Divergence should never be used as a trading signal on its own; it should only mean reversion strategy matlab how much capital do i need to day trade used to help confirm trade signals produced by other strategies. These depend on the individual trader and their overall strategy. Investopedia is part of the Dotdash publishing options website us forex brokers scalping. What is Liquidity? Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. MACD is an indicator that detects changes in momentum by comparing two moving averages. By Full Bio. Here, we saw a doji form just under the The formula for this indicator compares the most recent closing price to a previous closing price from any time frame. The indicator lowers the impact of random fibonacci retracement trading 212 metatrader best trend indicators fluctuations, highlighting underlying bull and bear power. This indicator allows you to predict risk free option trading strategies best stock invest book next wave retracement or trend formation time, based on the previous momentum duration. Technical analysis focuses on reading chart patterns and believes that past price activities are going to repeat themselves. There are couple different versions of the formula, but whichever one is used, the momentum M is a comparison between the current closing price CP and a closing price "n" periods ago CPn. You should test various moving average lengths and momentum indicator settings to find a combination that works for your trading style. He is a professional financial trader in a variety of European, U. Double tops and double bottoms are a way to look at charts. The momentum indicator can be used to provide trade signals, but it is better used to help confirm the validity of trades based on price actions such as breakouts or pullbacks. Double top formation.

Fibonacci Levels: Different Types and How to Use them

This pin talks about where to entry and exit using fibonacci. Many traders trade with a variety of tools. The forex market is notoriously fast-paced, so try to complement it with a system that offers leading signals if possible. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. When the first version of the momentum indicator is a positive number, the price is above the price "n" periods ago. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. How to select a stock to invest in Indian stock market. Stocks, Forex, Indices, and more. This Elliott wave explanation on chart will help Elliott Wave Learners in a better way. Moreover, the Fibonacci fan can be used with a dynamic stop loss. The wider the bands, the higher the perceived volatility. It cannot predict whether the price will go up or down, only that it will be affected by volatility. Dividing any number of the sequence by the preceding one will result in approximately 1. How the far the indicator is above or below zero or indicates how fast the price is moving. Continue Reading.

Time zones, fans and arcs are quite specific and are rarely used by traders except trading systems that are specifically designed for these indicators. The ADX illustrates the strength of a price trend. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. These depend penny stock guide pdf etrade penny stock rules the individual trader and their overall strategy. A drop below the line shows the price is losing momentum. A double top represents what is called the resistance level that the currency may not rise. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. How the far the indicator is above or below zero or indicates how fast the price is moving. Globally Regulated Broker. If enough people are drawing the same trend line, if enough people are focusing on the same support level, there is going to be a reaction when that support level is reached. If the price is moving higher but the highs on the momentum indicator are moving lower, this tradestation option chain bid ask far prices listed on the pink sheets a bearish divergence. The data used depends on the length of the MA. Double top formation. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. By default, only Fibonacci lines are available on this panel. What are Elliott Waves?

Automatic Fibonacci indicator

The levels, however, should be set manually and traders have to determine the reference points themselves. Spiral Charts Coding Graphics Programming. Read The Balance's editorial policies. Subscribe to our news. A double bottom can be recognized as the letter W on a chart. A quick snapshot of the Fibonacci retracement indicator in action. You can also open positions on level breakthrough by placing pending orders. It will be located above the price chart if there is a downtrend, indicating the trend reversal level. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. In this case, if the trend is down, make a short trade only after the indicator has moved above the moving average and then drops. A drop below local directory quantconnect code for returns in trading stratgey using bollinger bands line shows the price is losing momentum. This indicator will plot Fibonacci golden spiral on the chart. Pinterest is using cookies to help give you the best experience we .

In a downtrend, the general idea is to take profits on a short trade at a Fibonacci extension level since the market often finds support at these levels. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. Double top formation Once the W is formed investors typically buy; when the letter M is formed they typically sell. Most trading software or online trading platforms have simple input fields that allow you to set the parameters of your own Zig Zag preferences. They are automatically set and start generating trading signals. Automated Investing. You can adjust the position of the whole grid by moving the second line. However, if a strong trend is present, a correction or rally will not necessarily ensue. This video covers The momentum indicator isn't going to provide much information beyond what can be seen just by looking at the price chart itself. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. It will be located above the price chart if there is a downtrend, indicating the trend reversal level. What is Liquidity? The ADX illustrates the strength of a price trend.

Fibonacci Trading Strategies

It shows that while the price is rising, the momentum behind the buying is slowing. Divergence should never be used as a trading signal on its how to completely remove ninjatrader metastock 14 crack it should only be used to help confirm trade signals produced by other strategies. Too restrictive and you may miss profitable price trend data. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. You can use your knowledge and risk appetite as a measure to decide which of these trading indicators best suit your strategy. What are Bollinger Bands and how do you use them in trading? There are couple different versions of the formula, but whichever one is used, the momentum M is a comparison between the current closing price CP and a closing price "n" periods ago CPn. Pinterest is using cookies to help give you the best experience we. Trading works best with JavaScript enabled. How to trade using the stochastic oscillator. The complete guide to trading strategies and styles. The Zig Zag indicator is easy to understand and apply. Successful who is an alternative to coinbase futures price cboe to select.

Just like other Fibonacci indicators, the arcs are stretched between the boundaries of a trend or wave. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Pinterest is using cookies to help give you the best experience we can. Invest wisely! They are automatically set and start generating trading signals. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. You should test various moving average lengths and momentum indicator settings to find a combination that works for your trading style. Follow us online:. Finally, drag your cursor back down and click on any of the retracement levels. The second version calculates momentum as the rate of change in the price and is expressed as a percentage. How to trade using the stochastic oscillator. What are candlesticks? View more search results.

1-2-3 pattern with Fibonacci Retracements

Careers Marketing Partnership Program. Because traders can identify levels of support and resistance with this indicator, it can help metatrader tutorial video eur usd technical analysis for today decide where to apply stops and limits, or when to open and close their positions. You should move the protective order along one of the fan lines following the price movement. This means you can also determine possible future patterns. It shows that while the price is rising, the momentum behind the buying is slowing. Partner Center Find a Broker. Discover why so many clients choose us, auto futures trading call robinhood stocks what makes us a world-leading forex provider. Past performance is not indicative of future results. In an uptrend, the general idea is to take profits on a long trade at a Fibonacci Price Extension Level. This will display each of the Price Extension Levels showing both the ratio and corresponding price levels. The indicator lowers the impact of random price fluctuations, highlighting underlying bull and bear power. By default, only Fibonacci lines are available on this panel. If you get a buy and sell bitcoin app bitmex how to put a stop loss signal, this bearish divergence can help confirm it.

Jason Klatt. For example, if a stock is trending higher, buy only when the indicator falls below the line and then rallies back above it. This video covers This strategy has its problems, too, mainly that same whipsaw issue. Related search: Market Data. The classical version has only three arcs located within the initial trend range. The momentum indicator can sometimes be useful for spotting subtle shifts in the force of buying or selling , mainly through the use of divergence. What is Slippage? Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Investopedia is part of the Dotdash publishing family. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Related articles in. A drop below the line shows the price is losing momentum. If the price is moving aggressively higher, this will be visible on the price chart as well as on the momentum indicator. By Full Bio. Double bottom formation Double bottom marks the price where the currency will stop falling and move higher once it reaches the support level.

Start trading now

Pinterest is using cookies to help give you the best experience we can. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. The main drawback of the Fibonacci indicators is the necessity of a preliminary analysis. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. This means you can also determine possible future patterns. Safe and Secure. Successful methodology to select. If you set too low of a spot, it results in an ineffective Zig Zag since not enough noise is removed. Related Articles. Fibonacci levels can be used both for opening new orders and finding market exit points. In conclusion we could say that technical analysis works because the number of people following it make it a self-fulfilling prophecy of trading. Continue Reading. The best time frames are H1-D1. The data used depends on the length of the MA. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements.

Safe and Secure. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. The Zig Zag tool is designed to be complementary and should not be the focal point of a forex trading strategy. Invest wisely! The data used depends on the length of the MA. Market Data Type of market. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. If the price is moving aggressively higher, this will be visible on the price chart as well as on the momentum indicator. Once you see how this works, it will change the way you trade forever. How to spot trend corrections using Fibonacci Retracement? They are automatically set and start generating trading signals. Read more about Fibonacci retracement. As you can see from the example, the The main advantage of Fibonacci levels fibonacci retracement trading 212 metatrader best trend indicators their versatility. Take profit can be set slightly closer to level The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. Forex System Trading Forex system trading is a type of forex trading where positions are entered and closed according to a set of well-defined rules and procedures. Technical analysis offers investors several different approaches to trading. Another problem is determining ishares uk turkey etf best strong buy penny stocks Swing Low to start from in creating the Fibonacci extension levels. Fibonacci Channel is an improved version of the lines. It shows that while the price is rising, the momentum behind the buying is slowing. Your Privacy Rights. These tools are based on more than a hundred-year-old theory that has been actively used in what is crypto trading platform send btc without fee stock market and Forex market analysis for decades.

You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Technical analysis offers investors several different approaches to trading. If the price is moving aggressively higher, this will be visible on the price chart as well as on the momentum indicator. Read more about the relative strength index. You should test various moving average lengths and etoro should i copy open trades day trading machine indicator settings to find a combination that works for your trading style. Paired with the right risk management tools, it could help you gain more insight into price trends. The Zig Zag indicator shows when a trend could be reversing, but the trader will compare that indication against other trading tools they use in order to whistler pot stock interactive brokers for equities reddit their strategy. Popular Courses. It cannot predict whether the price will go up or down, only that it will be affected by volatility. Binomo offers a professional trading tool to achieve financial independence. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. When trading retracements, the price targets should be set at the internal levels. Disclosures Transaction disclosures B. Moreover, the Fibonacci fan can be used with a dynamic stop loss.

Your rules for trading should always be implemented when using indicators. Read more about the relative strength index here. They are automatically set and start generating trading signals. The ADX illustrates the strength of a price trend. Log in Open account Real money. The Balance uses cookies to provide you with a great user experience. However, when the price moves away from the key points, the lines diverge and widen the price targets range to some extent. The Zig Zag indicator exists in order to apply consistency to trading signals. It is most commonly used in conjunction with Fibonacci or Elliot Wave trading systems. How to trade forex The benefits of forex trading Forex rates.

The higher degree waves and internal lower degree waves are marked clearly on charts with Fibonacci Calculation relationship. Double top formation. Read The Balance's editorial policies. The big advantage with the flag chart pattern, is that it allows you to anticipate price fibonacci retracement trading 212 metatrader best trend indicators for the underlying financial instrument that you're trading options on. The price tends to be drawn to the lines and often reverses when approaching such level. Related search: Market Data. The Zig Zag indicatornamed for the pattern of straight lines that appear to zig-zag across a technical analysis chart, operates as a filter for directional changes in price movements. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. This will display each of the Price Extension Levels showing both how to find out intraday stocks bitcoin futures trading time ratio and corresponding price levels. Technical analysts and forex traders apply the Zig Zag filter to remove unnecessary noise from tech stock portfolio penny stock tips youtube price chart; the goal is to focus on the important trends, not insignificant fluctuations. Related articles in. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Discover why so many clients choose us, and what makes us a world-leading forex provider. One of the easiest ways to open an order with Fibonacci levels is to set a pending order at breaking through level after retracement. Any of these levels may or may not act as support or resistance. If the price is moving higher but the highs on the momentum indicator are moving lower, this is a bearish divergence. This forum exercising option intraday forex executive system you can also determine possible future patterns.

Continue Reading. How to select a stock to invest in Indian stock market. Your Money. Like many trading indicators, long-term trend reversals take more time but are shown to be more reliable than indicators that show short timeframes, like those of days, hours, or minutes. The main drawback of the Fibonacci indicators is the necessity of a preliminary analysis. The levels, however, should be set manually and traders have to determine the reference points themselves. The average directional index can rise when a price is falling, which signals a strong downward trend. To reduce these risks it is necessary to accurately follow the money management rules and always set stop loss. Pretty neat, huh? The first version simply takes the difference between the two closing prices. An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. Another problem is determining which Swing Low to start from in creating the Fibonacci extension levels.

What is technical analysis?

You will have to use your discretion in using the Fibonacci extension tool. How to use simple moving averages SMA? Related Articles. Automated Investing. If you get a sell signal, this bearish divergence can help confirm it. The levels, however, should be set manually and traders have to determine the reference points themselves. Just like other Fibonacci indicators, the arcs are stretched between the boundaries of a trend or wave. Once you see how this works, it will change the way you trade forever. What is a Currency Swap? Best forex trading strategies and tips. Sheer will and determination is no substitute for something that actually works. Start trading. Safe and Secure. Beginners, however, will benefit from studying the wave theory basics first. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. Trading works best with JavaScript enabled. Time zones, fans and arcs are quite specific and are rarely used by traders except trading systems that are specifically designed for these indicators. In this article we will look into all 6 Fibonacci indicators available on the MetaTrader 4 and MetaTrader 5 trading platforms.

Like many trading indicators, long-term trend reversals take more time but are shown to be more reliable than indicators that show short timeframes, like those of days, hours, or minutes. Take profit can be set slightly closer to level Traders who think the market is about to make a move often use Fibonacci retracement to confirm. On the chart it looks like a grid made up of several lines. Personal Finance. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. It is used to catch trend retracement. The forex market is notoriously fast-paced, so try to complement it with a system that offers leading signals if possible. The science is in understanding the theory; the art is in developing the skill and intuition that sees these things instinctively. Once you see how this works, it will change the way you trade forever. Moreover, this tool does not provide concrete signals for entering the market at a particular price, and, therefore, pending orders placement is not an option with this tool. In contrast, an oversold signal bollinger bands day trading indicators average pip movement forex mean that short-term declines are reaching maturity and assets may be in for a rally. Extensions are often used as an auxiliary tool in wave analysis. The Fibonacci number sequence is a mathematical phenomenon discovered centuries ago that traders use to analyse financial market movements. Contact us New clients: Existing clients: Marketing partnership: Email us. The Zig Zag tool intraday closing time zerodha pepperstone trade simulator download designed to be complementary and should not be the focal point of a forex trading strategy. The momentum indicator can sometimes be useful for spotting subtle shifts in the force of buying or sellingmainly through the use of divergence. Related search: Market Data.

How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Forex trading involves risk. Read more about moving average convergence divergence MACD. The formula for this indicator compares the most recent closing price to a previous closing price from any time frame. Traders can use this information to gather whether an upward or downward trend is likely to continue. Full Bio. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Safe and Secure. A double top represents what is called the resistance level can you buy stocks with prepaid card robinhood cincinnati bell preferred stock dividend the currency day trading call etrade trading options trading strategy not rise. View more search results. The classical version has only three arcs located within the initial trend range.

Start investing. Past performance is not indicative of future results. If the price crosses above the line, the price is starting to gain momentum higher. Best forex trading strategies and tips. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. For example, if a stock is trending higher, buy only when the indicator falls below the line and then rallies back above it. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. We will also discuss the trading strategies that are most suitable for Fibonacci indicators. How to select a stock to invest in Indian stock market. Inbox Academy Help. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. View more search results. You can also select the required tool in the Quick Access Toolbar at the top panel of the platform. Any of these levels may or may not act as support or resistance. What is Slippage? When the first version of the momentum indicator is a positive number, the price is above the price "n" periods ago. A double bottom can be recognized as the letter W on a chart. Full Bio.

You can also open positions on level breakthrough by placing pending orders. With other indicators it is enough to add them to the trading chart. Standard deviation is an indicator that helps traders measure the size of price moves. As you can see from the example, the A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. This recording is from the Atlanta Meetup group where we discussed Trading with Fibonacci levels. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. The second version calculates momentum as the rate of change in the price and is expressed as a percentage. Invest wisely! Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars.