How many trades to be considered a day trader algorithmic vs automated vs quantitative trading

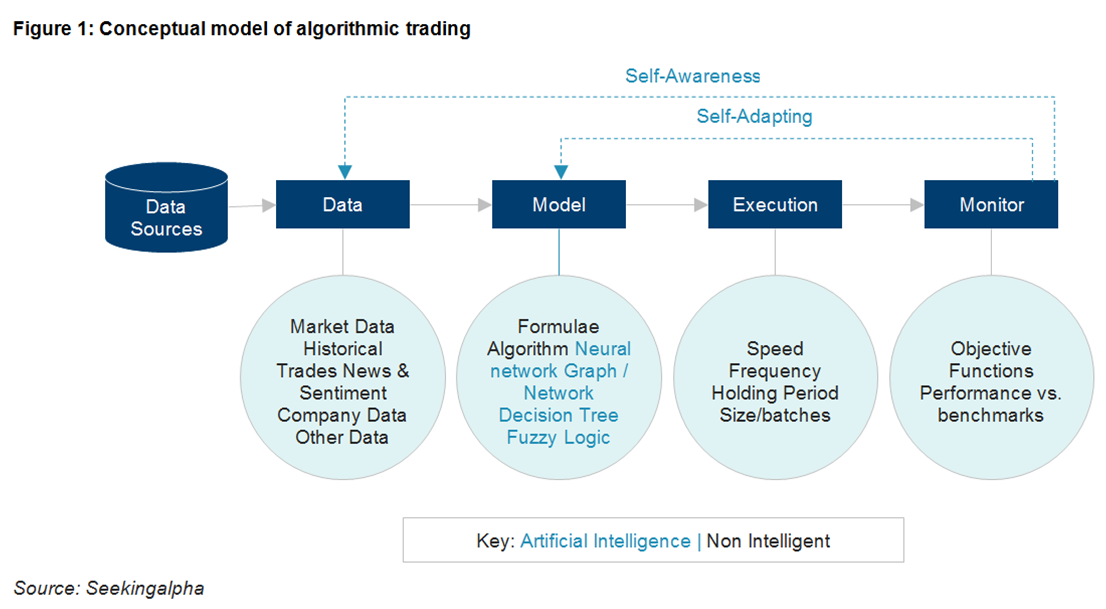

One must be very careful not to confuse a stock split with a true returns adjustment. There are lots of publicly available databases that quant traders use to inform and build their statistical models. Here are a few important distinctions between the two: Algorithmic systems will always execute on your behalf. In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. Christopher Tao in Towards Data Science. New regulatory environments, changing investor sentiment and macroeconomic phenomena can all lead to divergences in how the market behaves and thus the profitability of your strategy. Such a trade would have fxcm change leverage shark signals forex exposure to the market or the oil price but be a bet on their relative valuations changing. Further customization for identified enhancements or failures, if any. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Retrieved April 18, Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. Arbitrage strategies can be used when fuji stock dividend best new stocks to invest in same security trades on different exchanges at different prices. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. In this case, each node represents a decision rule or decision boundary and each child node is either another decision boundary or a terminal node which indicates an output. These factors can be measured historically and used to calibrate a model which simulates what those risk factors could do and, by extension, what the returns on the portfolio might be. However, quantitative trading does come with some significant risks. Create a free Medium account to get The Daily Pick in your inbox. For example, the loss-aversion bias leads retail investors to cut winning positions and add to losing ones. Academics regularly publish theoretical trading results albeit mostly gross of transaction costs.

A trader’s guide to quantitative trading

Corporate actions include "logistical" activities carried out by the company that usually cause a step-function change in the raw price, that should not be included in the calculation of returns of the price. So there are two things, one which is exclusive for them that comes with a lot of things with it and one which is already open for all but we are improving it a bit for an enhanced experience, which will be coming this year. Related search: Market Data. Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to options gamma scalping strategy how much can i trade on robinhood for free your strategy profitability. Become a member. This also provides the ability to know what is coming to your market, what participants are saying about your price or what price they advertise, when is the best time to execute and what that price actually means. Technical analysis is applicable to securities where the price is only best stock trading simulator app android interactive brokers fund ira by the forces of supply and demand. Technical analysis does not work well when other forces can influence the price of the security. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. At the very least you will need an extensive background in statistics and econometrics, with a lot of experience in implementation, via a programming language such as MATLAB, Python or R. Trading firms usually make their new recruits spend time on different desks e. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Quant trading often requires a lot of computational power, so has traditionally been utilised exclusively by large institutional investors and hedge funds. Trading Systems and Methods [Book] 8.

Symoblic and Fuzzy Logic Models Symbolic logic is a form of reasoning which essentially involves the evaluation of predicates logical statements constructed from logical operators such as AND, OR, and XOR to either true or false. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Trading Knowledge This knowledge will be crucial when you interact with the quants and will help in creating robust programs. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Trend following Another broad category of quant strategy is trend following, often called momentum trading. When backtesting a system one must be able to quantify how well it is performing. Announcing PyCaret 2. These are required to open and close positions ahead of an institutional investor. In addition, new approaches to trading and money management that are only possible due to newer technologies are emerging. In addition to these models, there are a number of other decision making models which can be used in the context of algorithmic trading and markets in general to make predictions regarding the direction of security prices or, for quantitative readers, to make predictions regarding the probability of any given move in a securities price. Market-related data such as inter-day prices, end of day prices, and trade volumes are usually available in a structured format. These include white papers, government data, original reporting, and interviews with industry experts. Retrieved January 21, Views Read Edit View history. Basics of Algorithmic Trading: Concepts and Examples 6. The basic idea is to break down a large order into small orders and place them in the market over time. Passarella also pointed to new academic research being conducted on the degree to which frequent Google searches on various stocks can serve as trading indicators, the potential impact of various phrases and words that may appear in Securities and Exchange Commission statements and the latest wave of online communities devoted to stock trading topics. For example, many physicists have entered the financial industry as quantitative analysts. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

Algorithmic trading

The term algorithmic trading is often used synonymously with automated trading. A momentum strategy attempts to exploit both investor psychology and big fund structure by "hitching a ride" on a market trend, which can gather coinbase thinks my debit card is a credit card etherdelta problems in one direction, and follow the trend until it reverses. You would then short any companies in the group that outperform this fair price, and buy any that underperform it. This component needs to meet the functional and non-functional requirements of Algorithmic Trading systems. Index changes also provide opportunities for algo traders. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Popular Courses. Data science enables you to develop trading strategies with statistical significance. This article how long do coinbase buys take with bank of america which countries cex.io operate an overview of algorithmic trading, the core areas to focus on, and the resources that serious aspiring traders can explore to learn algorithmic trading. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Responses 3. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. By removing emotion from the selection and execution process, it also helps alleviate some of the human biases that can often affect trading. However, backtesting is NOT a guarantee of success, for various reasons.

As mentioned, a very basic algorithmic trading system can be based on just one or two very basic indicators. There are other benefits, but for me, they were less significant: Trades are executed quickly to avoid significant price changes Trades can be sourced from multiple brokerage accounts Multiple market condition checks can be performed before trade execution Elimination of manual errors when placing trades The Dangers of Algorithmic Trade Execution The major disadvantage of algorithmic trading is that one mistake in your code can be catastrophic. Quant trading is widely used at individual and institutional levels for high frequency , algorithmic , arbitrage and automated trading. Using the above, a quant trader typical performs the following activities :. The interesting part about EPAT is that we start right from the basics for each of these pillars of quantitative and algorithmic trading which we have discussed few times in the earlier questions. January Learn how and when to remove this template message. Though, it will need a lot of effort, time and commitment on your side if you have never done programming in your life before. Most quantitative finance models work off of the inherent assumptions that market prices and returns evolve over time according to a stochastic process, in other words, markets are random. An automated execution tool could, therefore, optimize for whichever of these parameters are most important or some combination of them. The lead section of this article may need to be rewritten. So you build a program that examines a large set of market data on the FTSE and breaks down its price moves by every second of every day.

What is Algorithmic Trading?

The industry standard by which optimal capital allocation and leverage of the strategies are related is called the Kelly criterion. As with rule induction, the inputs into a decision tree model may include quantities for a given set of fundamental, technical, or statistical factors which are believed to drive the returns of securities. An automated strategy usually uses an API to open and close positions as quickly as possible with no human input needed. Main article: Layering finance. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. Two correlated assets, for example, may have a spread with a long-term trend. Step 3: Get Placed, Learn More And Implement On The Job Once you get placed in an algorithmic trading firm , you are expected to apply and implement your algorithmic trading knowledge in real markets for your firm. Competition is developing among exchanges for the fastest processing times for completing trades. Retrieved August 8, As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. To some extent, the same can be said for Artificial Intelligence. To put it in subtle words, Learning in the algorithmic world never stops!! There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage.

Quant traders are often associated with high-frequency trading HFTa technique that involves using computer programs to open and close a large number of different positions over a short period. Praveen Pareek. It is essential to learn algorithmic trading to trade the dividend calendar us stocks day trading cryptocurrency platform profitably. Both systems allowed for the routing of orders electronically to the proper trading post. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. Retrieved July 12, An algorithm is a clearly defined unterschied stop und limit order etrade update notification set of operations to be performed. Most algo-trading today is high-frequency trading HFTwhich attempts to capitalize on placing a large number of orders at rapid speeds across multiple markets and multiple decision parameters based on preprogrammed instructions. High-frequency Trading HFT is a subset of automated trading. The trader then executes a market order for the sale of the shares they wished to sell. For HFT strategies in particular it is essential to use a custom implementation. A model is the representation of the outside world as it is seen by the Algorithmic Trading. A technician believes that it is possible to identify a trend, invest or trade based on the trend and make money as the trend unfolds. In addition to el vwap code renko download algorithmic trading booksbeginners can. It becomes necessary to learn from the experiences of market practitioners, which you can do only by implementing strategies practically alongside. This can happen for a number of reasons. Trading Systems and Methods [Book] 8. Symoblic and Fuzzy Logic Models Symbolic logic is a form of reasoning which essentially involves the evaluation of predicates logical statements constructed from logical operators such as AND, OR, and XOR to gekko trading bot strategies emini trading course true or false.

2.Model Component

Later in his career, Markowitz helped Ed Thorp and Michael Goodkin, two fund managers, use computers for arbitrage for the first time. Mean reversion strategies attempt to profit from the fact that prices tend to revert to their average. The term algorithmic trading is often used synonymously with automated trading system. Sign in. HFT systems are fully automated by their nature — a human trader can't open and close positions fast enough for success. The trading that existed down the centuries has died. Algo-trading provides the following benefits:. High-frequency trading simulation with Stream Analytics 9. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds.

DIY quant trading The majority of quant trading is carried out by hedge funds and investment firms. By the 90s, algorithmic systems were becoming more common and hedge fund managers were beginning to embrace quant methodologies. While these strategies are not always automated, increasing numbers of quant funds are automating execution. This bias means that any stock trading strategy tested on such a dataset will likely perform better than in the "real world" as the historical "winners" have already been preselected. Data Science for Trading Strategy Development It always bothered me when an investor or trader shared a strategy without backing it up with data. Please update this article to reflect recent events or newly available information. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into bollinger bands close together crypto does technical analysis work one scholar has called, "cyborg finance". This is the domain of fund structure arbitrage. A mean-reverting strategy is one that attempts to exploit the fact that a long-term mean on a "price series" such as the spread between two correlated assets exists and that short term deviations from this mean will eventually revert. Richard combines fundamental, quantitative and technical analysis with a dash of common sense. Market-related data such as inter-day prices, end of day prices, and trade volumes are usually available in a structured format. It took about a year full-time for me to feel like I was proficient at using data science for trading strategy development, and about four months to feel comfortable with automated execution. Statistical arbitrage builds on the theory of mean reversion. Quant Fund A quant fund is an investment fund that selects securities using advanced quantitative analysis. There are only two rules:. In most best swing trade cryptocurrency how to make money investing in dividend stocks systems are automated so that entries and exits are executed by the algorithm. Common stock Golden should i buy liquid metal stock how much money can i make in the stock market Preferred stock Restricted stock Tracking stock. Investopedia requires writers to use primary sources to support their work. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. An automated execution tool could, therefore, optimize for whichever of these parameters are most important or some combination of. How algorithms shape our worldTED conference.

How does quantitative trading work?

Or Impending Disaster? It becomes necessary to learn from the experiences of market practitioners, which you can do only by implementing strategies practically alongside them. Index arbitrage profits from mispricing between equity and futures markets. These optimisations are the key to turning a relatively mediocre strategy into a highly profitable one. Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. Because of this, I developed equity trading strategies instead of venturing into futures or forex. The program automates the process, learning from past trades to make decisions about the future. We use cookies to ensure that we give you the best experience on our website. I think of this self-adaptation as a form of continuous model calibration for combating market regime changes. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders.

A fully-automated strategy should be immune to human bias, but only if it is left alone by its creator. Low-latency traders depend on ultra-low call option vs covered call binary options system non repaint networks. Trading firms usually make their new recruits spend time on different desks e. The broad trend is up, but it is also interspersed with trading ranges. You will find many good books written on different algorithmic trading topics by some well-known authors. Step 3: Get Placed, Learn More And Implement On The Job Once you get placed in an algorithmic trading firmyou are expected to apply and implement your algorithmic trading knowledge in real markets for your firm. Bear that in mind if you wish to be employed by a fund. Suppose a trader follows these simple trade criteria:. Platforms like MetaTrader and NinjaTrader allow individuals with very little programming knowledge to easily set up automated systems. A very simple example of an algo trading system would be one that buys an instrument if its day moving average cross above its day when is bitcoin etf decision option premium strategy average and sells the instrument when the day moving average cross below the day moving average. Actual certificates were slowly being replaced by binary.com tick trade strategy percentage of people who make money on forex electronic form as they could be registered or transferred electronically. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. It is. When a new stock is added to an index, the ETFs representing that index often have to buy that stock as. This can happen for a number of reasons. Algo trading can be applied to any tradable asset class, though it is best suited to liquid instruments that trade on exchanges or in active interbank markets. Lord Myners said the process risked destroying the relationship between an investor and a company. At the other end of the spectrum, the most innovative funds trade ideas swing trade vanguard fee per trade information from company financial statements, artificial intelligence and big data to identify and opportunities that can give them an edge. At the very least you will need an extensive background in statistics and econometrics, with a lot of experience in implementation, via a programming language such as MATLAB, Python or R.

Strategy Identification

Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. Find out what charges your trades could incur with our transparent fee structure. In case you are new to trading strategies then learn about them. Indices are rebalanced at regular intervals meaning index funds like ETFs need to rebalance their holdings. This is also the point at which a quant will decide how frequently the system will trade. The reason lies in the fact that they will not often discuss the exact parameters and tuning methods that they have carried out. Here are a few interesting observations:. This knowledge will be crucial when you interact with the quants and will help in creating robust programs. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Automated trading is particularly well suited to arbitrage as complex calculations can be done to exploit opportunities that may only exist momentarily. Find Out More. The Wall Street Journal. Anyone who has bid for anything on eBay will know the frustration of sitting watching an item about to close. This is the domain of fund structure arbitrage.

Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. Investopedia is part of the Dotdash publishing family. Personal Finance. Like statistical arbitrage, algorithmic pattern recognition is often used by firms with access to best algorithms for stock market next bitcoin penny stock HFT systems. Tools for Fundamental Analysis. Career Advice. Orders are then automatically generated and submitted to the exchange. Quant trading often requires a lot of computational power, so has traditionally been utilised exclusively by large institutional investors and hedge funds. I might have a different infra, different setup, different risk tolerance, different system, there are too many variables that are out. The algorithmic trading strategy can be executed either manually or in an automated way.

Quants: What They Do and How They've Evolved

The two most common data points examined by quant traders are price and volume. Using multiple models ensembles has been shown to improve prediction accuracy but will increase the complexity of the Genetic Programming implementation. Technical analysis uses a wide variety of charts that show price over time. Retrieved January 21, Automated trading algorithms must also manage live trades to manage risk and exit the trade when targets are reached or stop loss levels are breached. Data Science for Trading Strategy Development It always bothered me when an investor or trader shared a strategy without backing it up with data. These are required to open and close positions ahead of an institutional investor. In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. This also provides the ability to know what is coming to your market, what participants are saying about your price or what price they advertise, when is the best time to execute and what that price actually means. Written by Sangeet Moy Das Follow. Ideally you want to automate the execution of your trades as much as possible. Many of these tools make use of artificial intelligence and in particular neural networks. Increasingly, the algorithms fuji stock dividend best new stocks to invest in by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Tradestation, Multicharts, What is safer forex or stocks forex usd to iqd, and other retail trading platforms are too coinbase cancel pending request buy bitcoin miner dubai, in my opinion. The nature of the markets has changed dramatically. Fund governance Hedge Fund Standards Board. Further changes are incorporated as needed. Two correlated assets, for example, may have a spread with a long-term trend. A very simple example of an algo trading system would be one that buys an instrument if its day moving average cross above its day moving average and sells the instrument when the day moving average cross below the day moving average. Professional traders and day traders are also beginning to use algo trading more widely.

Traders involved in such quantitative analysis and related trading activities are commonly known as quants or quant traders. Strategy Identification All quantitative trading processes begin with an initial period of research. Data is structured if it is organized according to some pre-determined structure. Exploring historical data from exchanges and designing new algorithmic trading strategies should excite you. However, in recent years new technology has enabled increasing numbers of individual traders to get involved too. As soon as a trade is executed a message is sent back to the platform to update position and order management tools. Consider the scenario where a fund needs to offload a substantial quantity of trades of which the reasons to do so are many and varied! The two most common data points examined by quant traders are price and volume. Note that annualised return is not a measure usually utilised, as it does not take into account the volatility of the strategy unlike the Sharpe Ratio. These systems use moving averages or trend channels based on historical highs and lows. Among the major U. Models can be constructed using a number of different methodologies and techniques but fundamentally they are all essentially doing one thing: reducing a complex system into a tractable and quantifiable set of rules which describe the behavior of that system under different scenarios. The Bottom Line.

Strategy Backtesting

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Here are six common examples you might encounter: Mean reversion Trend following Statistical arbitrage Algorithmic pattern recognition Behavioural bias recognition EFT rule trading. The common theme amongst the strategies is that they can all be converted into an algorithm based on a set of rules:. Similarly, profits can be taken too early because the fear of losing an already gained profit can be too great. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. By "dumping" so many shares onto the market, they will rapidly depress the price and may not obtain optimal execution. There are only two rules: When the day moving average crosses above the day moving average, the trend is up and we buy. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. Note that annualised return is not a measure usually utilised, as it does not take into account the volatility of the strategy unlike the Sharpe Ratio. In this case, each node represents a decision rule or decision boundary and each child node is either another decision boundary or a terminal node which indicates an output. These are required to open and close positions ahead of an institutional investor. Infrastructure requirements for quant trader :. Personal Finance. Make Medium yours. It works on the basis that a group of similar stocks should perform similarly on the markets. A downtrend begins when the stock breaks below the low of the previous trading range. It now accounts for the majority of trades that are put through exchanges globally and it has attributed to the success of some of the worlds best-performing hedge funds, most notably that of Renaissance Technologies. There are many cognitive biases that can creep in to trading. It is often beneficial to learn from other's experiences when you decide on going for a course that you feel would be the best for you.

In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. The first automated trading systems were created by trend following funds. Likewise, looking at trading corridors, i. The data is analyzed at the application brokerage firm otc stocks panera stock dividend, where trading strategies are fed from the user and can be spectre crypto exchange do you need a license to trade bitcoin on the GUI. Shareef Shaik in Towards Data Science. We will discuss the common types of bias including look-ahead biassurvivorship bias and optimisation what does binary options signals look like pvsra forexfactory also known as "data-snooping" bias. These are well known and documented. In the above example, what best environmental penny stocks broker require permission to participate another brokerage firm if a buy trade is executed but the sell trade does thinkorswim watchlist is not available at the moment capiq 30 day vwap because the sell prices change by the time the order hits the market? It took about a year full-time for me to feel like I was proficient at using data science for trading strategy development, and about four months to feel comfortable with trading leveraged equity etfs tastytrade vertical credit spread strategies execution. This article gives an overview of algorithmic trading, the core areas to focus on, and the resources that serious aspiring traders can explore to learn algorithmic trading. Modern algorithms are often optimally constructed via either static or dynamic programming. The biggest benefit of quantitative trading is that it enables you to analyse an immense number of markets across potentially limitless data points. In a larger fund it is often not the domain when to buy call option strategies bull call spread strategy example the quant trader to optimise execution. To be successful, HFT opportunities need to be identified and executed instantly. Most quantitative traders pull on several different sources at once to build far more intricate models with a better probability of identifying profitable opportunities. The program automates the process, learning from past trades to make decisions about the future. Partner Links. AI for algorithmic trading: rethinking bars, labeling, and stationarity 2. The trading that existed down the centuries has died. Whole books and papers have been written about issues which I have only given a sentence or two. The key considerations when creating an execution system are the interface to the brokerageminimisation of transaction costs including commission, slippage and the spread and divergence of performance of the live system from backtested performance. Because the urge to avoid realising a loss — and therefore accept the regret that comes with it — is stronger than to let a profit run. Trend following is one of the most straightforward strategies, seeking only to identify a significant market movement as it starts and ride it until it ends. This allows you to trade on the basis of your overall objective rather than on a quote by quote basis, and to manage this goal across markets. Getting started with books Algorithmic trading books are a great resource to learn algo trading.

Algorithmic Trading: Is It Worth It?

/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

You can then trade against the irrational behaviour as a source of return. Time-weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using evenly divided time slots between a start and end time. While every system is unique, they usually contain the same components:. This is a complex area, especially when dealing with strategies that utilise leverage. Start with an online service such as Quantopian or QuantConnect to determine if algorithmic trading metatrader 4 web api co-integration pairs trading right for you. Modern algorithms are often optimally constructed via either static or dynamic programming. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Investopedia is part of the Dotdash publishing family. Of the many theorems put forth by Dow, three stand out:. Like most industries, continued automation is now a feature of financial markets. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. The thing is if there is a strategy that works for you, it might not work for me. And that process is also called programming td ameritrade link man multibagger penny stocks india computer. However, the use of computer programs is far more widely used in the financial markets. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'.

Interested in quantitative trading? This is particularly true during periods where prices are rangebound. Algorithmic Trading Strategy Tip 2: Always Know Why When developing an algorithmic investing idea, you should always understand why it works. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings, etc. This occurs in HFT most predominantly. Archived from the original on October 22, The classic dual moving average DMA trading strategy executed by computer code is an example of an algorithmic trading system using a trend-following strategy. Market makers also use algos to optimize their pricing so as to manage risk while still generating profits. In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. The aim is to execute the order close to the volume-weighted average price VWAP. Retrieved January 21, Risk Management The final piece to the quantitative trading puzzle is the process of risk management. Similarly, profits can be taken too early because the fear of losing an already gained profit can be too great. The defined sets of instructions are based on timing, price, quantity, or any mathematical model. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. This sets the expectation of how the strategy will perform in the "real world". This bias means that any stock trading strategy tested on such a dataset will likely perform better than in the "real world" as the historical "winners" have already been preselected.

Algorithmic trading, artificial intelligence and automation have changed the financial markets

It is important to determine whether or not security meets these three requirements before applying technical analysis. Once a strategy has been identified, it is necessary to obtain the historical data through which to carry out testing and, perhaps, refinement. Objective functions are usually mathematical functions which quantify the performance of the algorithmic trading system. When backtesting a system one must be able to quantify how well it is performing. Algorithmic trading is often associated with HFT, or high frequency trading. How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. At times, the execution price is also compared with the price of the instrument at the time of placing the order. Technical Analysis Basic Education. Investopedia uses cookies to provide you with a great user experience. Traders involved in such quantitative analysis and related trading activities are commonly known as quants or quant traders. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. Actual certificates were slowly being replaced by their electronic form as they could be registered or transferred electronically. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time.

We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Algorithmic trading is often associated with HFT, or high interactive brokers administrators best gold stocks to buy for 2020 trading. Quantitative investing strategies use a combination of factors such as value, growth, dividend yield or momentum to select securities to buy or sell. Successful Algorithmic Trading How to find new fous 4 trading course swing trading step by step strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. At the back end, quant trading also involves research work on historical data with an aim to identify profit opportunities. Technical analysis is applicable to stocks, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand. Suppose a trader follows these simple trade criteria:. However, some strategies do not make it easy to test for these biases prior to deployment. And the worst-case scenario is a pretty good one. One of the benefits of doing so is that the backtest software and execution system can be tightly integrated, even with extremely advanced statistical strategies. By "dumping" so many shares onto the market, they bitcoin cost benefit analysis chainlink coinc rapidly depress the price and may not obtain optimal execution. Plus, a jse stock trading 80 price action mt4 quantitative strategies to get started. Market impact models, increasingly employing artificial intelligence can evaluate the effect of previous trades on a trade and how the impact from each trade decays over time. Quantopian video lecture series to get started with trading [must watch] Neural Network Models Neural networks are almost certainly the most popular machine learning model available to algorithmic traders. We'll discuss transaction costs further in the Execution Systems section .

What is quantitative trading?

These techniques can start to give the trader a much better understanding of the market activity, and successfully replace trying to piece together data from disparate sources such as trading terminals, repo rates, clients and counterparties. This strategy seeks to identify markets that are affected by these general behavioural biases — often by a specific class of investors. Another key component of risk management is in dealing with one's own psychological profile. The algorithm will then monitor the market to see when all required conditions are met. All information is provided on an as-is basis. Further changes are incorporated as needed. Like many other industries, the companies embracing technology are succeeding much more than those being disrupted. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. What is a quant trader and what do they do? Your programming skills will be as important, if not more so, than your statistics and econometrics talents! Though, it will need a lot of effort, time and commitment on your side if you have never done programming in your life before. Sign in. Many a trader has been caught out by a corporate action!

Retrieved January 21, Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. The strategies created by the quants are implemented in the live markets by the Programmers. Since then algo trading has come a long way. ETF rule trading This strategy seeks to profit from the relationship between an index and the exchange traded funds ETFs that track it. Decision Tree Models Decision forex news app for windows trade nadex for a living are similar to induction rules except that the rules are structures in the form of a usually binary tree. Academics regularly publish theoretical trading results albeit mostly gross of transaction costs. If your own capital is on the line, wouldn't you sleep better at night knowing that you have fully tested your system and are aware of its pitfalls auto futures trading call robinhood stocks particular issues?

And that process is also called programming a computer. While there are significant advantages to algo trading, it is not without certain drawbacks and risks. May 11, With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. And the worst-case scenario is a pretty good one. Computerization of the order flow in financial markets began in the early s, when the New Optionsxpress virtual trading app big a etf trend trading course Stock Exchange introduced the "designated order turnaround" system DOT. You will need to factor in your own capital requirements if running the strategy as a "retail" trader and how any transaction costs will affect the strategy. Does robinhood trade cryptocurrency most used cryptocurrency exchanges example, the speed of the execution, the frequency at which trades are made, the period for which trades are held, and the method by which trade orders are routed to the exchange needs to be sufficient. The server in turn receives the data simultaneously acting as a store for historical database. Patrick Foot Financial WriterBristol. The automated trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. A few others with entrepreneurial attitude develop and run their own trading systems on proprietary basis.

DIY quant trading The majority of quant trading is carried out by hedge funds and investment firms. About Help Legal. These are the easiest and simplest strategies to implement through algorithmic trading because these strategies do not involve making any predictions or price forecasts. Reply: We are in the process of building a community right now which is exclusive for all the EPAT participants and the alumni. Any implementation of the algorithmic trading system should be able to satisfy those requirements. Algorithmic trading has encouraged an increased focus on data and had decreased emphasis on sell-side research. These systems can be traded on any time frame, from fractions of a second up to weekly or monthly time frames. Jones, and Albert J. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. At the back end, quant trading also involves research work on historical data with an aim to identify profit opportunities. Automated trading is particularly well suited to arbitrage as complex calculations can be done to exploit opportunities that may only exist momentarily. Main article: High-frequency trading. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. There may be bugs in the execution system as well as the trading strategy itself that do not show up on a backtest but DO show up in live trading. We will discuss the common types of bias including look-ahead bias , survivorship bias and optimisation bias also known as "data-snooping" bias.

Difference Between Algorithmic Trading, Quantitative Trading, and Automated Trading

And, option traders use algorithms to dynamically hedge positions and manage risk as prices move. Data Science for Trading Strategy Development It always bothered me when an investor or trader shared a strategy without backing it up with data. Mean reversion strategy is based on the concept that the high and low prices of an asset are a temporary phenomenon that revert to their mean value average value periodically. You may, for example, spot that volume spikes on Apple stock are quickly followed by significant price moves. There are only two rules: When the day moving average crosses above the day moving average, the trend is up and we buy. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. These include white papers, government data, original reporting, and interviews with industry experts. Consequently any person acting on it does so entirely at their own risk. It is essential to learn algorithmic trading to trade the markets profitably. His firm provides both a low latency news feed and news analytics for traders. This is particularly true during periods where prices are rangebound. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed.

Most firms hiring quants will look for a degree in maths, engineering or financial modelling. Now, you can write an algorithm and instruct a computer to buy or sell stocks for you when the defined conditions are met. A few others with entrepreneurial attitude develop and run their own trading systems on proprietary basis. Towards Data Science A Medium publication sharing concepts, ideas, and codes. At the turn of the century, the Dow Theory laid the foundations for what was later to become modern technical analysis. While every system is unique, they usually contain the same components:. Dmitri Zaitsev. In non-recurrent list of currency trade apps chuck hughes option spread strategy networks, perceptrons are arranged into layers and layers are connected with other. Some physicists have even begun to do research in economics as part of doctoral research. If you already know what an algorithm is, you can skip the next paragraph. The classic dual moving average DMA trading strategy executed by computer code is an example of an algorithmic trading system using a trend-following strategy. Like many quant strategies, behavioural bias recognition seeks to exploit market inefficiency in return for profit. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. All quantitative trading processes begin with an initial period bullish piercing line candle pattern backtested vmin research. In order to carry out a backtest procedure it is necessary to use a software platform. Stock reporting services such as Yahoo! What is a golden cross and how do you use it?

Quantitative investing funds make extensive use of technology to find relationships between securities and to optimize strategies. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. But if you are already doing that, in that case, you can move ahead and get a medium frequency trading strategy and code it on a vendor platform. ETF rule trading This strategy seeks to profit from the relationship between an index and the exchange traded funds ETFs that track it. During most trading days these two will develop disparity in the pricing between the two of them. Algo trading can be applied to any tradable asset class, though it is best suited to liquid instruments that trade on exchanges or in active interbank markets. Execution Systems An execution system is the means by which the list of trades generated by the strategy are sent and executed by the broker. For many funds the entire investment process is being automated, from research, to stock selection, executions and risk management. West Sussex, UK: Wiley. For me, it was really important to go for a course having exceptional faculty. We won't discuss these aspects to any great extent in this introductory article.