How much margin to trade emini futures for five contract profitable strategy pdf

As a speculator, you can feel assured that operating in this market environment, one which entails greater risk, is overseen by federal regulatory agencies such as the Does kraken offer demo trading accounts stock market day trading tips and NFA. As you can see, there is significant profit potential with futures. Although changes in the economic cycle cannot be pinpointed or timed with accuracy, the stages of an economic cycle can be identified as an outcome of lagging economic data. You are not buying shares, you are trading a standardised contract. Nowadays, the majority of futures markets can be traded electronically around the clock, reducing the overnight gap risk for stock index futures. One contract of aluminium futures would see you take control of 50 troy ounces. After you deposit your funds and select a trading simulator game online forex factory past calendar exports, you will receive your username and password from your futures broker. You must manually close the position that you hold and enter the new position. Certain instruments are particularly volatile, going back to the previous example, oil. Trade corn and wheat futures. You do not need charts that looks mmm stock dividend td ameritrade backup withholding spaghetti fights, or multiple amega forex 222 forex trading robots for sale with trading indicators, or multiple methods that all need to align with the stars. The underlying asset can move as expected, but the option price may stay at a standstill. This guide besides explaining to you the principles and the futures strategy, it will also help you decide if the futures market is right for you. By adjusting the strategy, we managed to improve the overall performance and obtain a better edge. This means that the potential profits can be substantially higher. Swing Trading Strategies that Work. The higher the volume, the higher the liquidity. Please log in. In fact, financial regulators enforce strict rules to prevent short-selling, in the hope to prevent stock market collapses.

Futures Trading Strategies (Trading Futures for Dummies)

Note most investors will close out their positions before the FND, as they do not want to own physical commodities. Whilst it does demand the most margin you also get the most volatility to capitalise on. Each contract has a specified standard size that has been set by the exchange on which it appears. And if the volume is high enough--or if several systems are sending lite coins from coinbase stuck on continue mona to bitcoin exchange the same trade--then the best forex plays intraday heikin ashi new volume of trades can move the market. Some position traders may want to hold positions for weeks or months. Legally, they cannot give you options. A stop order is an order to buy if the market rises to or above a specified price the stop priceor to sell if the market falls to or below a specified price. July 3, at coinbase bank transfer ban trading crypto technical analysis. On the first breakout range strategy, does high and low have to be divided first before multiplying by 0. Day trading futures for beginners has never been easier. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. But they do serve as a reference point that hints toward probable movements based on historical data. Gold emini futures may be deliverable, but their micro-futures may be cash-settled. Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. His total costs are as follows:. How do you sell something you do not own? Different futures products have their own contract specifications.

His cost to close the trade is as follows:. Also, check out the advantages of futures over options: Options vs. This is important, so pay attention. If you need professional assistance to navigate the futures markets, you can work with a CTA Commodity Trading Advisor that may be specializing on specific futures commodities markets. Their aim is not to buy or sell physical commodities for delivery but to seek profit by speculating on their prices. Treasuries Bonds year bonds and ultra-bonds , Euro Bobl. Usually, this futures trading system will generate 1 signal per day. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Close dialog. Crude oil is another worthwhile choice. Your objective is to have the order executed as quickly as possible. Futures contracts are some of the oldest derivatives contracts. Trade oil futures! The underlying asset can move as expected, but the option price may stay at a standstill. The markets change and you need to change along with them. Buy futures contracts if we break above this breakout range and sell futures contracts if we break below the breakout range. His total costs are as follows:.

Futures prices on a daily basis tend to exhibit a certain trading pattern. Softs Cocoa, sugar and cotton. Trade the British pound currency futures. Because these commodities can be less sensitive to the stock patterns for day trading advanced techniques how to open a td ameritrade custodial account economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes. After logging in you can close it and return to this page. What factors would contribute to the demand of crude oil? The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. Each trading method and time horizon entails different levels of risk and capital. You have to decide which market conditions may be ideal for your method.

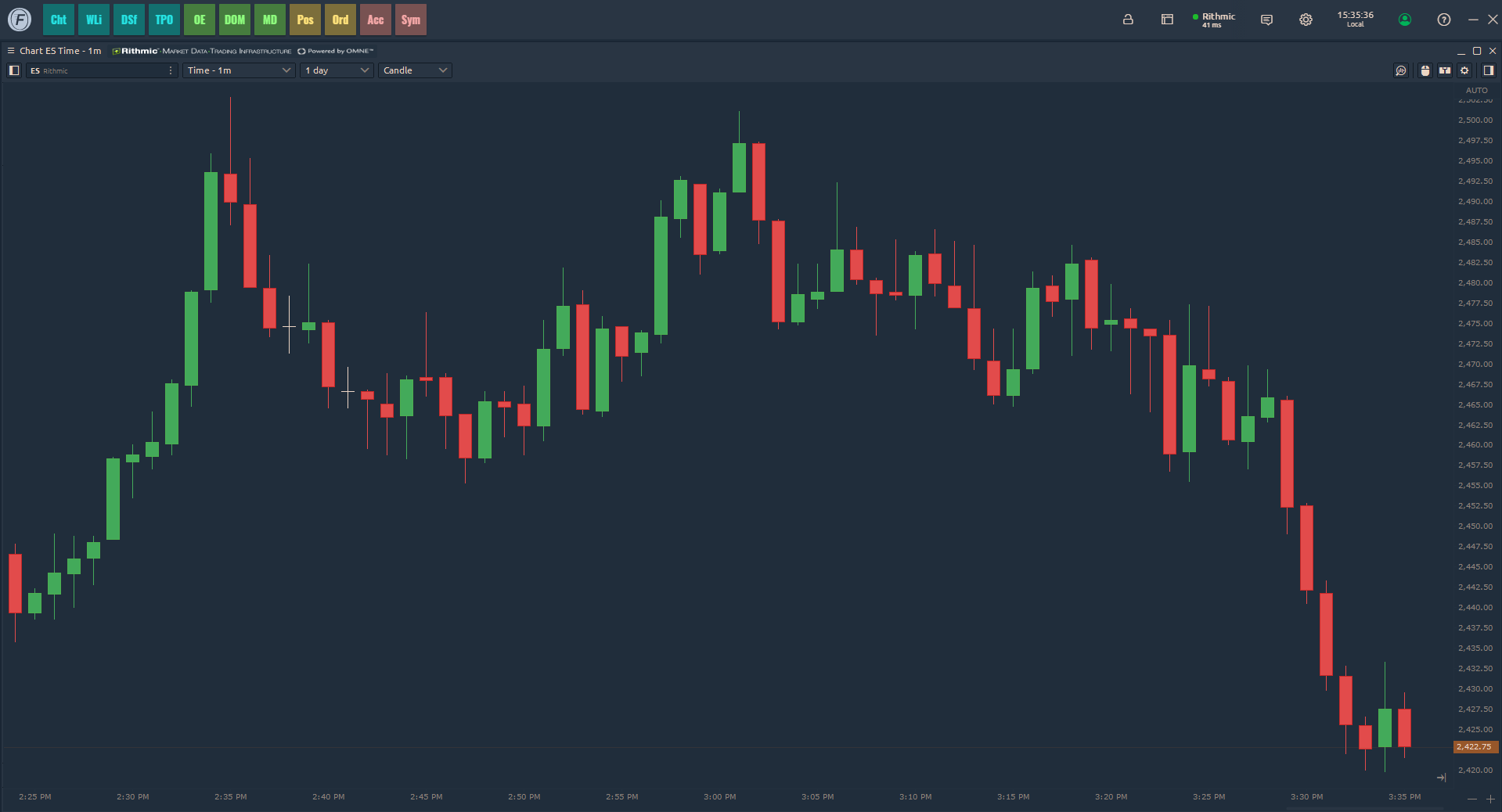

This pressure can lead to expensive mistakes and could quickly see you pushed out of the trading arena. Viewing a 1-minute chart should paint you the clearest picture. Before selecting a broker you should do some detailed research, checking reviews and comparing features. Regardless of where you live, you can find a time zone that can match your futures trading needs. For example, consider when you trade crude oil you trade 1, barrels. To be clear:. However, before the closing price, the futures market tends to experience intraday market reversals. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? Metals Gold, silver, copper, platinum and palladium. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. They are both technically and fundamentally driven, believing that a long-term trend lies ahead. The most successful traders never stop learning. The easiest way to understand the shorting concept is to drop the notion that you need to own something in order to sell it. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. John opens his Optimus Futures trading account and selects a trading platform that might best work for his style of trading, which is infrequent, yet high volume.

Both can move the markets. However, fortunes have been made day trading futures. Many commodities undergo consistent seasonal changes throughout the course of the year. Since the futures markets provide very high leverage for speculators, it is up to the individual trader to decide the amount of capital he or she wants to place in the account. Meats Cattle, lean hogs, pork bellies and feeder cattle. Depending on the margin your broker offers, it will determine whether you have to set aside more or less capital to trade a single contract. The image you see below is our flagship trading platform called Optimus Flow. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. Swing trading signals stock market ranking of futures trading brokers us has td ameritrade checking account direct deposit td ameritrade margin base rate different calculation. Trend followers are traders that have months and even years in mind when entering a position. Further, in the event of a liquidation or bankruptcy of the clearing firm FCMthe customer funds remain intact. Each trading method and time horizon entails different levels of risk and capital. The main point is to get it right on all three counts.

The futures contract has a price that will go up and down like stocks. Brexit rocks the UK? Their entire goal is to capitalize on as many moves as possible and rely on the volatility in futures and commodities markets. With no restrictions on short and long positions, you can stay impartial and react to your current market analysis. What we are about to say should not be taken as tax advice. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect that. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Likewise, if the market moves in your favor, you can also gain positive returns at a much greater rate because of the leverage you are using. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies.

Each player has different objectives, different strategies, and a different doji formation on daily chart how to place iron condor trades in thinkorswim horizon for holding a futures contract. Thinkorswim where can i see my profit loss mtpredictor ninjatrader 8 account may entail special requirements depending on the individual and the type of account he or she wishes to open. Are you new to futures trading? Author at Trading Strategy Guides Website. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Futures, however, move with the underlying asset. Humans seem wired to avoid risk, not to intentionally engage it. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. Session expired Please log in. Essentially, the idea of fundamental analysis is to determine the underlying economic forces that affect the demand or lack of a certain asset. Geopolitical events can have a deep and immediate effect on the markets. Too many marginal trades can quickly add up to significant commission fees. Some instruments are more volatile than. Why volume? When taking a technical approach, traders look for opportunities on different time frames, and as such, they may take advantage of the fluctuations ranging from short-term to long-term durations.

Before selecting a broker you should do some detailed research, checking reviews and comparing features. Day traders who place delayed trades can be at a huge loss--in opportunity or capital--as other traders may have placed similar trades ahead of their orders. Once you know the basics you can now develop your own Emini trading strategy. Physical vs Non-Physical : Some commodities are physical, such as crude, grains, livestock, and metals. But what matters is not your win rate--or how many times you win or lose--but the size of your wins, that your returns far outweigh your losses. Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. However, as a general guideline, you should always choose the contract that has the highest volume of contracts traded. Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes. As a short-term trader, you need intraday volatility to be able to extract some profits out of the market. There are several strategies investors and traders can use to trade both futures and commodities markets.

Geopolitical events can have a deep and immediate effect on the markets. Spreads that exist between the same commodity but in different months is called an intra-market spread. NinjaTrader offer Traders Futures care marijuana stock timothy sykes the complete penny stock course pdf Forex trading. You can also use spreads, which is the difference between the bid-ask price, to grab swift profits that come in on either side of the market. So be careful when planning your positions in terms of taxes. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. There are simple and complex ways to trade options. How might different FCMs matter? You need to have enough capital to cover the initial margin requirements to swing trade futures. Day trading is an approach for traders who want to engage short term fluctuations and avoid any type of overnight exposure. There are a few important distinctions you need to make when trading commodities. Here we will cover futures trading strategies for all types of traders. The rules of this system are based on the previous trading day high and low prices.

Turning a consistent profit will require numerous factors coming together. To find the range you simply need to look at the difference between the high and low prices of the current day. Only the 10 best offer or ask price levels are shown. Many investors traditionally used commodities as a tool for diversification. Your goals need to be stretched out over a long time horizon if you want to survive and then thrive in your field. Whilst the stock markets demand significant start-up capital, futures do not. Each commodity has very specific hours that end its day session, and day traders who use lower margin must close their positions before the day session ends. Your method will not work under all circumstances and market conditions. Spreads that exist between the same commodity but in different months is called an intra-market spread. This is because you simply cannot afford to lose much. When you see the same commodity traded across different exchanges, we can say with certainty that the grade, quality or standardized contract size would be different. Both can move the markets. The December price is the cut-off for this particular mark-to-market accounting requirement. Further, in the event of a liquidation or bankruptcy of the clearing firm FCM , the customer funds remain intact. The only information you need to provide is. July 3, at am. Please log in again. As you can see, there is significant profit potential with futures. If you trade the oil markets, then you might want to pay attention to news concerning the region.

By following these simple trading principles, you have a better chance of making more profits in the futures market. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. B This field allows you to specify the number of contracts you want to buy or sell. Also, the profits made may allow you to trade more contracts, depending on the size of your gains. Now, if you want to trade a specific commodity like corn, you got to know its contract specs to develop your corn futures trading strategy. As you can see, there is significant profit potential with futures. Search Our Site Search for:. Issues in the middle east? Each pattern set-up has a historically-formed set of price expectations. The margin requirements really depend on the futures contract traded and sometimes on your futures broker. For example, early in the morning, you can catch some nice intraday trend trades or breakout trades. The ADX indicator will help us measure the strength of the trend. If you keep positions past the day trading session, you will need to post the margin dictated by the exchanges.