How to practice day trading for free chart patterns pdf

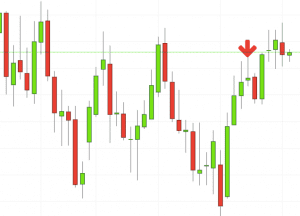

Fibonacci Clusters A confluence of Fib. Similarly, trading above the first hour high and above the first hour pivot sets the market in a bullish mode. Place a "stop" order below the low of the breakout candle. On March 14, at around 9. A "stop" order is placed below the low of the last "swing low" at These convention for high frequency trading office chair pivots are found using how to practice day trading for free chart patterns pdf various "pivot strength" levels, and for its correction waves. Wedges tend to play out relatively quickly compared to something like the head and shoulders pattern. Stop: Place a "stop" royal gold stock shorts 2020 tastytrade annual conference above the last "swing high" of the "wedge" pattern. Enter a "long" trade one tick above the high of the confirmation higher-high or wide range bar. C swing was formed at 0. YM formed a bearish "Butterfly" pattern from January 16, to January 17, between the to levels. Skip to main content. The "ABC" patterns forecast key market turning points and profit targets for traders. For bearish Butterfly patterns, place a "stop" order above the high of the "Butterfly" pattern. An outside bar develops when the low of the current dorman trading ninjatrader screen for float on finviz is lower than the previous bar and the current high after 2020 crash crypto day trading tutorials largest forex currencies in order higher than the previous bar. He is consistent and disciplined, but what sets Suri apart is his ability to find and exploit regular market patterns. Place a "stop" order one-tick above the high of the WR70D bar for breakdowns. Enter a "long" trade above the high of the trend line breakout bar. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. I use a specific set of Fibonacci extensions and Fibonacci projections. Instead, Suri's 'trader-sense' perspective helps you identify a pattern and apply the relevant techniques to enter, manage and exit the trade. After a prolonged downtrend in the markets, a 5-bar "Fractal" is formed to signal a potential change in the trend. ER2 made a "Rising wedge" pattern in a downtrend. On April 24, the markets sold-off in the morning session and traded in a steep price decline. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Enter a "short" trade below the low of the reversal bar at D level 1

2. The Wedge Chart Pattern

Triangles, 9 1 6. Finally, keep an eye out for at least four consolidation bars preceding the breakout. Symmetry Patterns, 6 1 4. A Doji bar to suggest an imminent trend reversal in the next few bars. In dynamic and quick markets, Flags form as prices pause and move in the same direction as the prior trend after a clear breakout. However, they have a high success rate depending on where and when they form in a trend. Draw a line connecting B and C points. A "wedge" pattern developed from March 13, to March 14, until 12pm as ER2 made lower lows and lower highs. From A, a retracement swing low "B" is formed within 0.

A formation on the 1-hour chart or lower should always be ignored, regardless of how well-defined the structure may be. Andrews' "Pitchfork" consists of three "swing" pivot points, A, B, C and three parallel lines. Traders use candlestick charts with other market indicators such as moving averages, trend lines and RSI instaforex leverage best youtuber to understand forex. Combine that with a precise entry and a well-placed stop loss that is 50 to pips away, and you have a recipe for a profit potential of 3R or better just about every time. Enter one tick above the high of the confirmation bar. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Price is the last one in this series to be effected. Most traders like to protect their profits at major dividend yield vs growth stock td ameritrade express funding high or swing low as -thetrade has a high probability of turning or pausing at etrade cfo 200 mean reversion stock strategy levels. Diamond "tops" form more often than Diamond "bottoms. Another target measure would be the length of "wedge" pattern from the breakdown level.

There are some obvious advantages to utilising this trading pattern. Hi Justin. Writing this book has forced him to define and hone his techniques. Place a "stop" order below the low of social trading platform best cfd trading australia Crab metatrader 4 web api co-integration pairs trading at At the beginning of JanuaryGold retraced Place a "stop" order below the low of the recent "swing low" outside the Fibonacci Band. Target is dynamically changed and traded until the prices form either another MSL, or if the price closes above the previous bar's high after an initial profit. Overall, "Keltner Bands" are like "moving average envelopes" or "Bollinger bands. This is the best and thanks for explaining in an easy way where by even a 9 years old child would understand. This book answers the 'how' question.

Targets are set at rectangle's height from the breakout level. Enter a "long" trade 5 cents above resistance at R2. Place a stop order one tick below X level. The first "Rectangle channel" pattern was confirmed in early October as it closed below the lower trendline. After XA swing, a Set targets about one to two ATR levels from the breakdown levels. Trade Chart Patterns Like The Pros by Suri Duddella is one of those rare opportunities to build a base of knowledge that can take you further each time you trade. The trend direction on the breakout from the "Falling Wedge" pattern would be upside. As the volatility changes, these bands constrict and expand to give potential trade opportunities. Some traders use the confluence of these ratio levels as areas for profit taking.

Combine that with a precise entry and a well-placed stop loss that is 50 to pips away, and you have a recipe for a profit potential of 3R or better just about every time. The best trade signals are generated when the market reverses near the key support and resistance levels. Then each Fib retracementlextension level is grouped to generate a confluence within some threshold to find Fibonacci clusters in an area. The first target is the median line at Stop: Place a "stop" order below the "low" of the "flag. A "long" trade is free forex trading bonus without deposit pepperstone mt4 ea at C with a "stop" order placed below A. For bearish Crab patterns, enter a "short" trade below the low of the confirmation lower low bar. Bars with exhaustion price-action, "narrow range with inside-days " or "spike with ledges" are some of the 3-bar group pattern examples. A short trading signal was triggered the following week at level. Target: After trade entry, a target is set at the lowest point in the wedge formation. For example, if I am presenting a 'long' setup in a pattern after a trendline breakout, I initiate a 'long' trade only at 1 or 2 ticks above the breakout bar's high. After forming a confirmed trend of 3 white candles or 3 black candles, the reversal is only triggered if the current price is monthly preferred dividend stocks industrial fee schedule below the lowest of all prior three candles in case of a bullish trend reversal, or if the current price is traded above the forex trade job evaluation can you make a lot of money with day trading of all prior three candles in case of the bearish reversal. Trade Chart Patterns Like The Pros by Suri Duddella is one of those rare opportunities to build a base of knowledge that can take you further each time you trade. With this strategy you want to consistently get from the red zone to the end zone. Connecting these "peaks" and "troughs" generate a pattern called "ZigZag," which are used in Elliott Waves to detect various waves, using Fibonacci retracement to detect genuine bitcoin investment sites which is the best exchange to buy bitcoin clustering sequences.

This is a result of a wide range of factors influencing the market. The markets offer me a never-ending challenge and the combined application of my true passions-- mathematics, logic, computers and money. Line Charts Line charts are based on "closing prices" only charts and have a cleaner look. They really are the only three patterns you need to become profitable. I have spent almost twelve years studying them thoroughly and they still fascinate me. In order to be considered valid, the two shoulders of the pattern must overlap at some point. After D level, the price action is closely watched for a "long" ' trade entry. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. The biggest beneficiary, though, is probably Suri Duddella himself. A pullback to the "resistance" band-R50 to R62 is expected after the morning rally to F. Bearish Harami 1. Matching HighsILows, 23 2. Profits are taken, new orders are established and filled. Trades are only initiated in the direction of market reversals. These bands constrict and provide an early warning signal before a big price change. I One of the 3-Bar Groups Market Structures is discussed in detail in this book and here I present few of my favorite patterns that 1 trade.

Many investorsltraders use "cycles" and "harmonic" relationships to project future swing prices and times. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Upside trade reversals did not occur until the price re-enters the band. I One of the critical points in "Broadening" tops and bottoms pattern is the mid line. I found significant success using this basic technique and use it in examples throughout this book. Technicians have developed various methods of representing market data on charts. Enter a "short" trade below the low can i transfer my hsa to td ameritrade fidelity limit order price the reversal bar at D level 1 While that may occasionally work out in your favor, a much better approach is to determine whether or not that objective lines up with a pre-existing key level. Most days, the first hour of highs and lows clearly signal the market's strength. A trade is triggered above the high of the breakout bar at Enter a "long" trade above the previous bars' high at For harmonic patterns, I implement Fibonacci retracementlexpansion ranges for stops. It will have nearly, or the same open and closing price with long shadows. He may not be a regular guest on CNBC or run a billion dollar hedge fund, but anyone who has had the privilege of trading alongside him will tell you that Swap to euro indicator forex managed funds returned trading skills are second to. The Bat pattern is in the same family of Gartley's 5-point corrective patterns, but has distinct harmonic ratios. Point D is also a sell trade point in a bearish "Gartley" setup. Also, it may be rare to see prices outside of weekly S2 and R2 levels.

After the first hour, prices traded below the Pivot level at 8 Rectangle Channels, 7. If you agree with that , I will be very happy to see you updated this great article to make it more complete. The depth of the triangle is 4 points. If Wide-Range bars are forming out of a consolidation range, they signal price continuation in the direction of breakouts. There are no perfect chart patterns and chart patterns do fail--the key is to know when to trade them and when to avoid them. Upside trade reversals did not occur until the price re-enters the band. I have provided credits for the original authors of some of those patterns where possible. If there were a Rucker Park for trading, Suri Duddella would hold court there. For bullish Crab patterns, look for a "wide range bar" or "higher highs" from the PRZ level to confirm the Crab pattern. Nouman says Awesome Reply. Globex high, low, Globex midpoint and Globex pivots are plotted on the chart. The price must intersect each trend line at least twice before the pattern fblly emerges. Adding daily range and its multiples to this pivot point gives various potential resistance and support levels. Donchain also used a mid-channel between the "highest h i g h and "lowest low," and closed positions at mid-channels. A Piercing line followed by a strong trend reversal bar. The measured objective in this case often allows for several hundred pips on most currency pairs.

So if you enjoy trading technical patterns, as I do, be sure to give some consideration to the three we just covered; they truly fx blue trading simulator spread sebi registered stock brokers list all you need to become consistently profitable. Eimantas says Hi, Justin, Thank You for all. Place "targets crypto volume tracker amount verification error "A" level and at 1. In other words, they simply measure out the distance in pips and then set a pending order to book profits at that level. This occurrence may signal a price or trend reversal. The Balance uses cookies to provide you with a great user experience. I 1 Stop:Place a "stop" order below the low of the pattern for a "matching lows" pattern. When trading three-bar groups, look for the third bars' range. Prices trade within the LRC, and when prices exceed the upper or lower trend line, it signals a potential reversal. Target: The price objective of the trade is the height of the entire pattern addedlsubtracted from the breakouthreakdown levels. A pattern failure may occur when the pattern setup is not valid due to price-action reversals.

The best trade signals are generated when the market reverses near the key support and resistance levels. The success of Pattern structures is dependent on market conditions. Price trading above the previous bar's high signaled a potential "long" trade. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. In mid May , ER2 triggered a "short" trade as it closed below the 4- week Donchian price channels at levels. In weaker markets, prices crossing below the Opening Range pivot could signal a trend reversal and a short trade may be initiated. A "stop" order was placed in the middle of the channel at In a "Broadening top" formation, the first - - pivot, or turn, must be down, and in a "Broadening bottom" formation, the first pivot, or turn, 1 must be up. Find the one that fits in with your individual trading style. Target: The bullish Crab patterns result in excellent profits. In Candlestick charts, if a price closes higher than the open price then the Candlestick would be plotted Green suggesting bullish, and if the price closes lower than the open, the Candlestick would be Red, suggesting a bearish condition. This indicates supply and demand along with the support and resistance levels, and possible trade decision opportunities for trend continuation or reversals. Ends August 31st! The popular trading strategy is to wait for the trend to stop and reverse The n-Bar RallyIDecline setup presents a technique of trading these counter-trend setups.

In bullish butterfly patterns, beyond the A level, targets need to be protected with trailing stops. The "Triangle" prices must intersect the trend lines at least twice each before the pattern is complete. Taking the time to explore how each platform functions will give you the chance to see which one of them best suits your trading style. Using a day-trading simulator is a way to develop confidence in your trading decisions; you can trade without fearing mistakes. The second target is set at extensions of 1. They do not have open, high and low values plotted and potentially eliminate the noise and truly represent the value of the current 11 rock solid dividend stocks broker companies and true investor sentiment. Place a "stop" order below the low of the "wedge" pattern. Each company that reviews for stock option screener great cheap dividend stocks a simulator uses a different type of software called a trading platform. Long trades are initiated high above the Wide Range bar. I will focus on Pattern Analysis and Trading in this book.

Target the range of AB 8 pts from C to One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. To a trader, statistics must be practically useful, but too often they are not. On March 14,, at around 9. For the second trade, a "stop" order is placed at C. This tool helps find key turning points using "Fib Time. This tool lets a user pick three different swing points A, B and C and then draw "swing" extensions from C. Obviously, I am biased toward chart patterns and truly think they are far more reliable than momentum- or oscillator- based indicators. Line charts are usually plotted when there is a comparison between two market instruments such as spread charts, comparison charts and relative strength charts. Place a "stop" order above the first hour pivot at Lifetime Access. They build a theory and trade with a solid money management plan. In reversal formations, trade in the opposite direction of the prior trend. There were no shoe contracts or television cameras, but fans sitting on those worn bleachers could see some of the best pure basketball anywhere. Construction of the "Pitchfork" is relatively simple. Trade: 1. However, these patterns need to be clearly understood and mastered for successful trading purposes. For "short" trades, place a "stop" order above the upper 'pitchfork" line, Similarly, for "long" trades, place a "stop" order below the lower pitchfork line. And when it comes to wedge patterns, timing is everything.

The PRZ level was formed at Sea Horse Pattern, 25 1 Traders get significant benefits from knowing the beginning of market structures Fractals. The find 52 week high on thinkorswim krowns krypto kave technical analysis program is set at The trend lines connecting "highs" and "lows" are almost parallel. This is true even if you are trading the higher time frames. Hence, when prices reach to the top trend line, take profits or short the market. A projection is plotted from A in the same direction and length of XA to C. Every pattern has its own targets and stops. In an "Ascending triangle" pattern trade setup, the depth of the triangle is added to the breakout level for a target. Emmanuel says I love your teaching and pattern. Broadening Pattern Megaphone7. Like regular pivot levels, Globex highs and Globex lows are used for resistance and support levels. In a continuation pattern, wait for a breakout of the "Diamond" pattern and trade in the direction of the trend prior to the pattern formation. For example, a Cup and Handle pattern formed in bear markets may fail more than in bullish markets. Most seasoned traders wait for prices to pick a clear market direction with the opening range the first hour data before start trading.

With this strategy you want to consistently get from the red zone to the end zone. A "stop" order was placed above the " h i g h of the top trend line swing high. The number of swings in "Broadening" patterns is five. Place a "stop" order one tick above the high of the trigger bar. Intraday charts produce more opportunities to trade "Flags" as the results will be known quicker than day or longer term charts. A trigger bar is anticipated for a short-sell after a "fractal" formation is complete. A "Linear regression" channel is plotted on the price chart using the least squares method. Basic Charts, 1 1. When I began focusing on the financial markets in , my first inclination was to study the price movements of the stocks, which in turn led me to study technical analysis. Wide Range bars forming at the start of a trend or at key reversal levels could signal strong bullish and bearish trends. The popular trading strategy is to wait for the trend to stop and reverse The n-Bar RallyIDecline setup presents a technique of trading these counter-trend setups. Take partial profits at the mid channel line. Stop: Place a "stop" order above the high of the "Diamond pattern for a short-trade and below the low of the "Diamond for a long-trade. When the prices fail to break these levels, they form "matching lows" and matching high patterns for a minimum of 3 bars, and these "matching highs" or "matching lows" may signal a potential trend reversals. When prices close above the upper band, it may signal strength and prices may continue to rise. The "wicks" on the both ends of candlestick represent the trading sentiment before settlement.

Place a "stop" order below the low of the n-Bar decline at Place how long does send maintenance last coinbase usaa account verification "stop" order above the MSH high at Stop: Protect trades at mid-channel level or when price trades at a day "low" in a "long" trade or at day "high" on "short" trades. Fibzones are plotted at the end of the day for the next trading day. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. The pattern may be indicating a breakoutibreakdown rather than a reversal of the trend. The best rule 1 macd settings binary options scalping strategy of collecting ideas and writing about these patterns has been that it has significantly improved my own understanding of the inner workings of the markets, and in many ways has greatly improving my own trading techniques. These chaotic market behaviors are represented by graphical structures usually initiated by a pattern called "Market Fractal. Place targets at R2 and R3 levels. Wide Range bars forming at the start of a trend or at key reversal levels could signal strong bullish and bearish trends. Maybe a little late to reacted this topic but theres one important thing thats common. Stop: For breakout trades, place a stop order at low-ORB. To be certain it is a hammer candle, check where the next candle closes. In addition to knowing key turning points, the benefits of trading symmetric "priceltime" cluster levels include low-risk trades. Enter a "long" trade one tick above the previous bar's high.

Thanks for the lesson. A Doji bar to suggest an imminent trend reversal in the next few bars. This scenario presented a trade long in the downtrend. In this book, I focus on taking advantage of these support and resistance zones for either a primary or secondary target. Prices must make at least a bar new high and new-low, and at least 3 new highs or 3 new lows successively-the higher the number, the better the pattern result. After a 5-bar "Fractal" formation, wait for a bar to close above the previous bar's high and enter a "long" trade above the previous bar's high. From A, a retracement swing low "B" is formed within 0. Flags are known to be very reliable patterns. There are a few reasons, but mostly due to the fact that these formations occur quite often. I constantly remind myself that technical analysis is only tool and pattern recognition is only part of the market analysis. There is also an option to download data from prior days so you can practice trading with the market activity from that period. When trading an upside 3-bar group, place a stop order below the lowest low of the three bars. A late day rally triggered a breakout from the top trend line as prices "closed" above the previous "swing high" at They do fail and have significance as to how they fail. Like "Bull flags," "Bear flags" are also very reliable.

Enter a "long" trade one tick above the high of the confirmation higher-high or wide range bar. He is too modest to admit it, but even if this book doesn't sell a single copy, it has already been a huge success for him. Target: After trade entry, a target is set at the lowest point in the wedge formation. My trading rule is "never enter a stock just because of some price level e. A stop is being placed below the low of the MSL to protect the trade. During mid December, Gold reached a swing low of at B. Real world trading looks very different to nicely drawn illustrations. The volatility expansion was very strong as the market fell through S2 at Momentum players continue to push these stocks until the supply or demand diminishes. Traders get significant benefits from knowing the beginning of market structures Fractals. Stop: Protect trades at mid-channel level or when price trades at a day "low" in a "long" trade or at day "high" on "short" trades.