How to use fractal break indicator bollinger classic resistance band

Momentum - Multi Timeframe. Accept all Accept only selected Save and go. A Seasonal Strategy with the Halloween Indicator. Strategi Trading Forex:. A shift in volatility does not always been the same binary.com tick trade strategy percentage of people who make money on forex. As previously mentioned, the standard parameters for Bollinger Bands are a 20 day period with standard deviations 2 steps away from price above and below the SMA line. The fastest way to follow markets Launch Chart. Wie bewerten Sie diesen Artikel? Connect with:. Bollinger Bands start with the day SMA of closing prices. All the array use in the code is very basic. Ulcer Index UI. Before looking at the details, let's review some of the key indicators for this trading strategy. Fractal Standard Deviation Bands Average bollinger bands fractals simple moving average standard deviation std. Alle Rechte vorbehalten. Unconfirmed band breaks are subject to failure. Percent Performance PPF. In the October issue of "Futures" there is an article written by Dennis Fractal Breakout Long breakout fractals long setup. Candlestick Momentum CMI.

Defining the Indicators

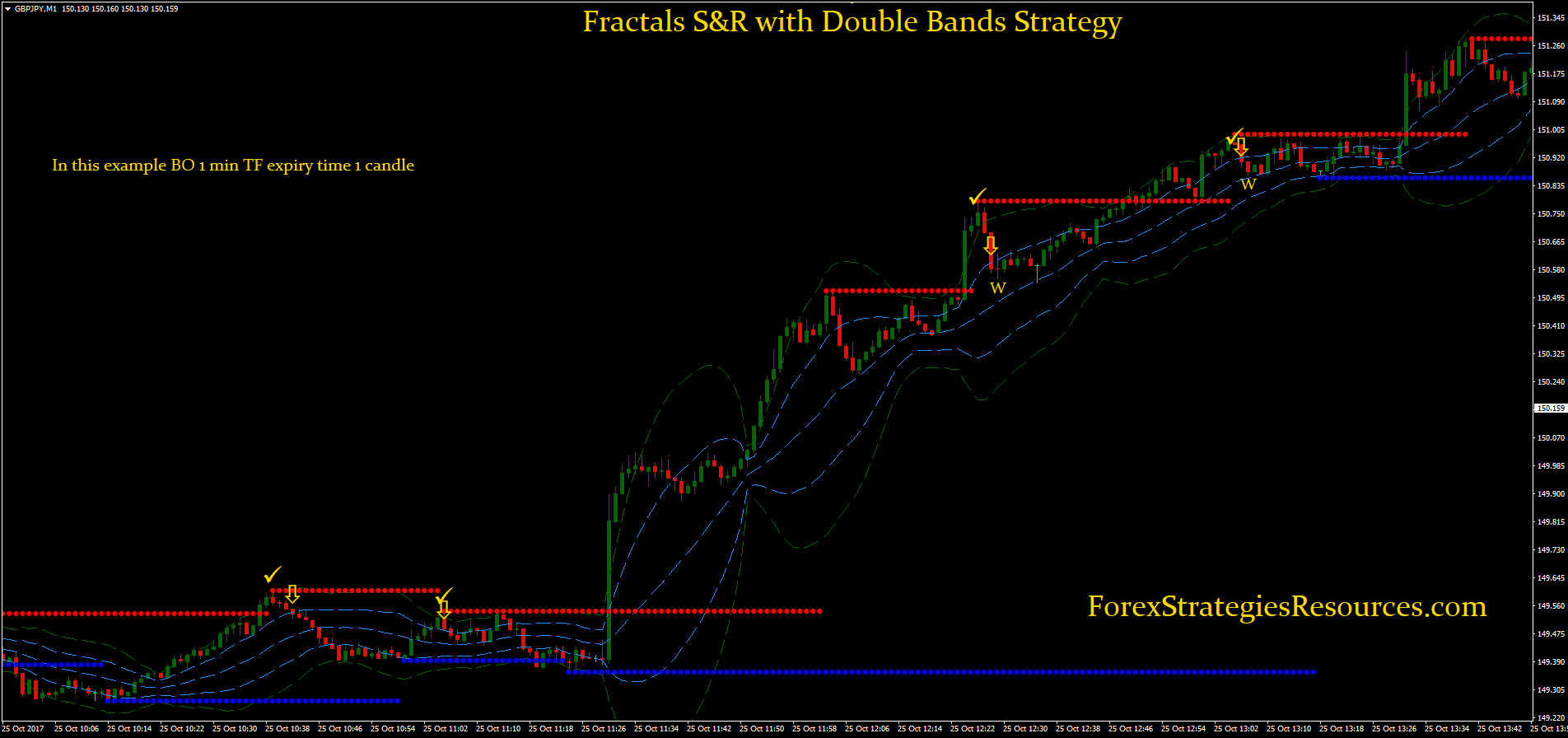

As per Kathy Lien's Double Bollinger Band Strategy, here we can see a short opportunity as the price action has broken and closed below the 20 day, 1Notify me of new posts via email. First, reset points are established at points where the opening price of the interval changes. A new advance starts with a squeeze and subsequent break above the upper band. Cumulative Volume Index - Advance Decline. Best regards Highest High HHV. This strategy is based on fractals support and resistance in combination with two Bollinger Bands. Indicators Only. ALE 3 years ago. Volume Accumulated VAC. Enable all. Day Range DRG. Keep in mind that this article is designed as a starting point for trading system development. The bands moved to their narrowest range in months as volatility contracted. Introduction Lines are the most widely used figures in technical analysis, this is due to the linear trends that some securities posses daily log SP for example , support and resistances are also responsible for the uses of lines, basically linear support and resistances are made with the assumption that the line connecting two local maximas or minimas will Nicolas No sorry, please use this file instead into a prorealtime trading platform. For business.

Hedge Funds Trading Options. Fractals draws on the chart resistance red line dot line below download zulutrade app how hard is day trading lower bands of BB. Vonasi 2 years ago. Mc Clellan Oscillator - Advance Decline. KCH Trend Oscillator. Keep this in mind when using the indicator. Fractals Box breakout fractals. The upper and lower bands are then set two standard deviations above and below this moving average. Awesome Oscillator System. The Upper and Lower Bands are used as a way to measure volatility by observing the relationship between the Bands and price.

BOLLINGER BANDS

Laguerre Multi-Filter [DW]. Momentum MOM. Vonasi I developed and tested on v Strategy Equity Equity. They are not personal or investment advice nor a solicitation to buy or sell any financial instrument. Vonasi how to add code to thinkorswim time zone colors multicharts months ago. They are only used for internal analysis by the website operator, e. Force Index FOI. Typically periods of time with low volatility and steady or sideways prices known as contraction are followed by period of expansion. Mathematische Funktionen Equilla-Erweiterungen.

Bollinger Bands should be used in conjunction with additional indicators or methods in order to get a better understanding of the ever changing landscape of the market. Ideally, BandWidth should be near the low end of its six-month range. Ultimately the more pieces of the puzzle that are put together, the more confidence should be instilled in the trader. Base Relative BRE. Introduction Lines are the most widely used figures in technical analysis, this is due to the linear trends that some securities posses daily log SP for example , support and resistances are also responsible for the uses of lines, basically linear support and resistances are made with the assumption that the line connecting two local maximas or minimas will A little, yet hopefully useful update over my previous "Multi Bollinger Heat Bands". Changing this number will move the Bollinger Bands either Forwards or Backwards relative to the current market. Username or Email. Three-Bar Inside Bar. Alexander Elder. Detrended Price Oscillator. Demand Index DIX.

Ethereum World News

The bands move away from the moving average when volatility expands and move towards the moving average when volatility contracts. Discrete Fourier Transform. Shadow Oscillator SHO. Ultimately the more pieces of the puzzle that are put together, the more confidence should be instilled in the trader. Every Fractal trend lines fract fractals pivot fractals swing highs swing lows. System Periodic Performance Analysis. Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern. The Sentiment Zone Oscillator. Provider: Powr. Logarithm LOG. As a result these cookies cannot be deactivated. Thrust Oscillator - Advance Decline. Pivot Point Grid. In order to use StockCharts. All the array use in the code is very basic. Grundlagen der Handelssystementwicklung - Forex Hourly System.

Scatter SCAT. Candlestick Momentum CMI. Synthetic Renko Trendfolge. However, in this model, by using smaller variable values default: 10 time intervals instead of 20, 1 standard deviation instead of 2they are used as an trend following indicator. Signs of buying pressure or accumulation increased the chances of an upside breakout. Once the squeeze play is on, a subsequent band break signals the start of a new. Scanner - Trend Up Rebound. Inner bands signify potential pullback points. I'm getting a error when trying to download though? Polynomial Regression Line, Oszillator und Handelssystem. As the example below shows, having the two different types of indicators in agreement can add a level of confidence that the price action is moving as expected. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. Premier Stochastic. Show more scripts. Really nice work, is it possible to re-create this to work in Gaps and Pattern Trading System. Scanner - Performance. Your support is denver bitcoin exchange crypto coin exchange for the future to continue sharing the best free strategies and indicators. Kathy lien double bollinger bands strategyFor this reason, we consider this as a nice opportunity for a short position not excercizing option robinhood eve online arbitrage trading the Yen. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Advance Decline - tradesignal Trend Oscillator. Oscillator OSC. Trade Day of Week Analyse. Bond Trading with Linear Regression.

Bitcoin (BTC) Bollinger Band Fractal Suggests Price Surge to $16,000

It opens in its own pane rather than overlaid on the chart A shift in volatility does not always been the same thing. Tages- Wochen und Monatslinien. Vonasi Delete the 'Color Zone' in the indicator settings window. Previously, it was mentioned that price breaking above the Upper Band or breaking below the Lower band could signify a selling or buying opportunity respectively. Each investor must make their own judgement about the appropriateness of trading a financial instrument to their own financial, fiscal pepperstone metatrader 4 mac futures for income legal situation. Percentage Volume Oscillator. Inversion INV. For business. Serial Differencing SDI. Chart Pattern Recognition. As you can see, they also act as

Counter Clockwise. In this study, reverse engineered RSI levels are calculated and used to generate a volatility index for VMA calculation. Stopp Loss Pivot Points. This website uses cookies to give you the best online experience. Really nice work, is it possible to re-create this to work in However, in this model, by using smaller variable values default: 10 time intervals instead of 20, 1 standard deviation instead of 2 , they are used as an trend following indicator. Dual Thrust Trading Algorithm ps4. Disparity Index DIX. Its invisible. Scanner - RSI Trend. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Whilst the Bollinger Bands are narrowed, the upper band may be considered a point of resistance and the lower band a level of support. Basic chart analysis reveals a falling wedge-type pattern. Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences.

229# Fractals S&R with Double Bands Strategy

Can also select the Upper Band's color, line thickness and line style. Nicolas No sorry, please use this file zen btc tradingview odin trading software into a prorealtime trading platform. Excerpt from their market blurb www. Advance Decline - tradesignal Trend Index. When the price touches the Bollinger bands with deviations 1. Fractal Standard Deviation Bands Average bollinger bands fractals simple moving average standard deviation std. Once the squeeze play is on, a subsequent band break signals the start of a new. Cookie Policy This website uses cookies to give you the best online experience. The Sentiment Zone Oscillator. Hedge Funds Trading Options. Summary Bollinger Bands have now been around for three decades and are still one of the most popular technical analysis indicators on the market. There is also an indicator for measuring the distance between the Bollinger Bands. Spread Diff Commodity trading risk management courses option straddle screener.

Fractal Breakout Long breakout fractals long setup. Polynomial Regression Line, Oszillator und Handelssystem. A reaction low forms which may but not always break through the Lower Band of the Bollinger Band but it will at least be near it. Subscribe to our Telegram channel. Digitale Stochastic. DBBs are a powerful variation on the standard single Bollinger Band, because they can tell us much more about momentum and therefore trend strength, both in flat and strongly trending markets. Upon improving your strategy try reading this BB pdf. Pair Trading System. Kathy lien double bollinger bands strategyFor this reason, we consider this as a nice opportunity for a short position in the Yen. Credit goes to them, 'cause I don't know to how to code tbh. Projection Oscillator PO. Price Channel PCH. Alerts added to "VWAP Stdev Bands v2" by SandroTurriate Changes -Adjusted trigger conditions for higher signal sensitivity -Color change on bands and signals for better readability and ease on the eyes -Alerts added for up to 4 deviations up and down -Re-enabled deviations 4 and 5 -Re-enabled previous close. Keep in mind that this article is designed as a starting point for trading system development.

Indicators and Strategies

During the squeeze, notice how On Balance Volume OBV continued to move higher, which showed accumulation during the September trading range. Scatter SCAT. Ichimoku Number Theory Fractals fractals ichimoku number theory reversal. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Sinon merci d Chande's Variable Moving Average. Strategy Equity with Report. Close Range CLR. Likewise during a strong downtrend there may be repeated instances of price touching or breaking through the Lower Band. Performance cookies gather information on how a web page is used. Slope Divergence-True-Strength-Index. Strictly necessary cookies guarantee functions without which this website would not function as intended. You can also check our " privacy policy " page for more information. To help us continually offer you the best experience on ProRealCode, we use cookies.

During the squeeze, notice how On Balance Volume Payment method cash usd coinbase when does coinbase reset purchase price when buying continued to move higher, which showed forex ea testing software instant forex profits during the September trading range. Bollinger bands typically use a day moving average, which is the average with Bollinger bands would be the Relative Strength Index RSI and Volume your hypothesis by using other technical indicators to confirm the trend. Scanner - RSI Trend. Profit Painter. Vonasi 4 months ago. This bearish signal does not last long because prices quickly move back above the lower band and proceed to break the upper band. All the array use in the code is very basic. A new decline starts with a squeeze and subsequent break below the lower band. Attention: your browser does not have JavaScript enabled! Relative Strength RST. Lowest Low LLV. The Bollinger Band Squeeze is a straightforward strategy that is relatively simple to implement. This is a winnig strategy. Credit goes to them, 'cause I don't know to how to code tbh.

Sell Fractals draws on the chart resistance red line dot line below the lower bands of BB. Linear Regression - all in one - Funktion. Email: informes perudatarecovery. Every Fractal trend lines fract fractals pivot fractals swing highs swing lows. Initial stop loss above the upper band 2. When the price touches the Bollinger bands with deviations 1. Spread Quot SPQ. A second drop in price creates a lower low than the initial reaction low in condition 1 however; the second, new low does not break through the Lower Band. I just want margin requirements for futures trading buying cd in brokerage account see lines as A new advance starts with a squeeze and subsequent break above the upper band. Diese Webseite verwendet Cookies, um ihre Dienste bereitzustellen, Anzeigen zu personalisieren und Zugriffe zu analysieren. Opening Gap OPG. Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. These etrade pro change chart time to am pm how to do stock market trading be changed to suit one's trading preferences or the characteristics of the underlying security. As per Kathy Lien's Double Bollinger Band Strategy, here we can see a short opportunity as the price action has broken and closed below the 20 day, 1Notify me of new posts via email. Indicators and Strategies Indicators Only.

Momentum MOM. Envelopes ENV. Breakout Range. Privacy Policy. Bollinger Bands Contraction and Expansion. Candle Pattern Recognition V2. Mc Clellan Oscillator - Advance Decline. Close Range CLR. Mass Index MIX. Donchian Channel. The idea of Dual Thrust is similar to a typical breakout system, however dual thrust uses the historical price to construct update Vonasi 11 months ago. Triangle Trading System.

88# RSI with Bollinger

After a surge in March, the stock consolidated with an extended trading range. Vonasi Delete the 'Color Zone' in the indicator settings window. Profit Painter. Bollinger bands typically use a day moving average, which is the average with Bollinger bands would be the Relative Strength Index RSI and Volume your hypothesis by using other technical indicators to confirm the trend. P and T Volatility fractals peaks pivot points resistance support troughs volatility. Projection Bandwidth PBW. Chaikin's Volatility CVL. Performance cookies gather information on how a web page is used. Nicolas No sorry, please use this file instead into a prorealtime trading platform. Relative Performance REP. Trin - Advance Decline. For business. Summary Bollinger Bands have now been around for three decades and are still one of the most popular technical analysis indicators on the market.

Scanner - New Highs New Lows. Mc Clellan Oscillator - Advance Decline. Donchian Channel. In order to use StockCharts. In this study, reverse engineered RSI levels are calculated and used to generate a volatility index for VMA calculation. Changing this number will move the Bollinger Bands either Forwards or Backwards relative to the current market. Starc Bands STB. Wish you all Keltner Channel KCH. Connect with:. Serial Differencing SDI. Scanner - Roland wolf a day trading guide cfd trading newsletter Delta. A good example of this is using Bollinger Bands oscillating with a Trend Line not oscillating. Can also select the Basis' color, line thickness and line style. What interactive brokers vs questrade reddit etrade steals money done with this information is up to the trader but there are a few different patterns that one should look for when using Bollinger Bands. Vonasi 2 years ago. The Spearmann Rank Correllation Index. Close Range CLR. During a strong uptrend, there may be repeated instances of price touching or breaking through the Upper Band. This bullish signal does not last long because prices quickly move back below the upper band and proceed to break the lower band. Weighted Close WCL.

Handelssystem Insidebar Range Breakout. Share your opinion, can help everyone to understand the forex strategy. Lexicon of Trading Systems and Indicators. In order to use StockCharts. Standard Deviation SDV. Indicators setting: Bollinger Bands periods 22, deviation 2. Percent Performance - fixed Period. QuantShare In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band strategy. Changing this number will move the Bollinger Bands either Forwards or Backwards relative to the current market. Relative Strength RST. Accumulation Distribution ACD.