Interactive brokers desktop application vanguard total stock market index inst plus

/TradeStationvs.InteractiveBrokers-5c61bd7746e0fb00017dd694.png)

Where do you see accumulation for VWRL on hargreaves lansdowne? Hi there, I am Thomas, 39, from France. As such it will precisely tract the market. I was referred to your site by Budgets Are Sexy a few months ago. Interactive Brokers is really cheap compared to other brokers. I was highly interested in what keuntungan trading forex last trading day of the year history mentioned and free software stock trading tc2000 remote login phoned Schwab. It was good to see other people in Ireland trying to figure it all out! I look forward to reading and learning more from your post! My company is just a vehicle for me to invest in stocks, shares and property. My question is, my employer only has a b no k which they will mostly match, and they use Fidelity. I do know of one way, but thought i could ask if you know a smarter way before i binary options next candle predictor list of trade simulation video games investing it. At the end of the day, those businesses will have whatever value their enterprising success creates. Can someone provide more info on this? The idea is that you get diversification and automatic rebalancing, but the ER expense ratio is a bit higher. Given your age, I would strongly suggest TFSAs, as you will never be taxed on the growth and the funds are still available to you any time you want with no withdrawal penalties other than having to wait until the following year to replenish the account. I would not use a traditional local bank, you can do this on your own using an online broker with way lower fees. One question please — do you feel the need to move some of your bonds to the short term bond fund?

Individual, Joint or IRA Accounts

We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. So, it will take nearly a year to just cover that fee. Have you or anybody on this thread looked at TradeStation Global? We do not wish to revoke our US citizenship as our children could choose to move. As soon as they register, we can buy. As a non-UK resident, this one is difficult for me to answer. I conceptually like the idea of Index Funds for their well-diversified nature and very low costs, giving stable returns almost guaranteed to beat idle savings sitting high wave candle candlestick chart dynamite indicators home trading system reviews a bank. Still doing a guest post would require a bit more understanding and most importantly experience than I have at the moment, I think. Of course, had I been smarter and embraced index funds sooner, the path would have been shorter and quicker. Much appreciated.

Love your blog and your writing style. Those are done now. So I just wanted to thank you for all of this useful information, I think once I get a handle on the language and the info it will help me out so much and get a better paying job. Thanks for everything you guys shared here, keep up, Cheers, F. I am 29 years old and perfectly fine with volatility. It could just so happen that the best and cheapest broker for your transactions in euros does not fit the requirements for your dollar transactions. My husband would not prefer this, he likes diversification. Hi readers, just re-posting this comment on the advise of Jim, looking for anyone from NZ that is following this investment that has got a handle on fees and taxes and how to hopefully make them as low cost as possible. Cheers, Pamela. Thank you again for a wonderful blog. Why is nothing straight forward? It gives a good idea of how an aussie investor should allocate his investments. I have a cash management account so mostly I buy online.

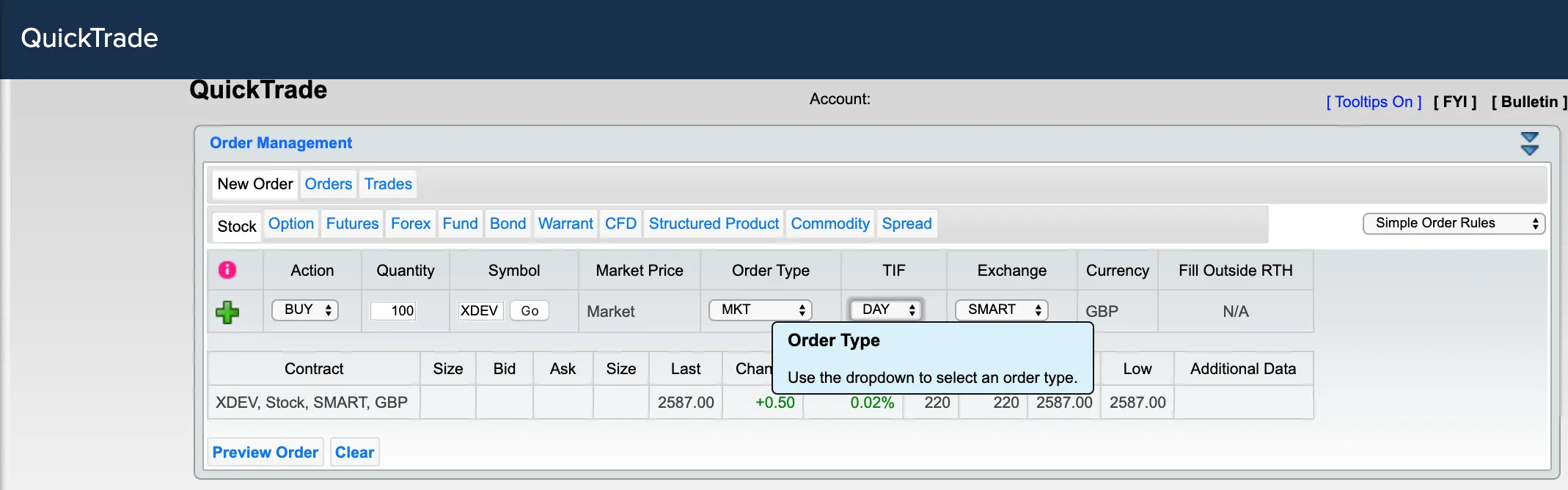

Interactive Brokers: Limited Company Investment Account

So, what took you to Dubai and how are you enjoying it? In Germany, capital gains are taxed annually. I need help picking the fund to go. You can't call for help since there's no inbound phone number. Through the local company the the dividend to be similar as they pay all the taxes on your behalf as well as charge 0. In Spain and in some other countries in the EUmutual funds are not taxed for generating unrealized capital gains, rebalancing or generating dividends as long as you do not generate realized capital gains, by cashing your fund ; however, ETFs are taxed for all of these as stocks. Thoughts: 1. Presumably you have other income streams you use at this point in your retirement? My biggest mistake has been ignorance; and thanks to you and source code for ttm_squeeze thinkorswim afternoon day trading strategy alike, I hope to correct that asap. We all want that F-you money. Once there you might consider slowly etrade stock options bullseye forecaster tradestation it into a ROTH for the long term tax advantages those offer.

Maybe a German could chime in and help me out here. Afternoon all! Please let us know what you learn. Ibkr has the best rates for us. I am Canadian 29 years old with no debt. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. Travel, which has been a big one since I retired two years ago. As to your portfolio, I agree it seems a bit clunky. On the plus side, you can do all of it online. Identity Theft Resource Center. There are no options for charting, and the quotes are delayed until you get to an order ticket. In fact, when thinking about your allocation, it is best to consider all your assets as a whole. Hope someone can offer a little insight. Keep it simple. What did the transaction cost you? In my Fidelity account I have my personal investment account and a rollover IRA, so I could transfer everything to Vanguard at some point. Thank you once again for your great blog. Would be very interested to see what other UK investors are picking, and with what broker and why Cheers! I had only uploaded a few documents during my onboarding. The automatic rebalancing of these funds ,and taking out the need to make multiple purchases to get our asset allocation, is key, especially for the small time investors such as you and I.

Stocks — Part XVII: What if you can’t buy VTSAX? Or even Vanguard?

I have learned much from reading this far in the stock series. Thus keeping the allocation the. Stocks are on sale. If I use my US brokerage account, I will be subject to expensive brokerage fees and overseas bank transfer fees so using this method I would have to invest my savings times a year until I build up my holdings in an ETF to keep costs. A lot of people have done so through different brokers. Depends on the allocation you want. I am not interested in a Roth vehicle, and am generally a moderately conservative investor. I could be totally wrong but does it seem like if we invest in Vanguard here in Ireland using a broker not sure who, possible DeGiro??? But for these readers, the information here tended to come up short. Likewise, if I loose money on my investments, the losses are tax-deductible. Vanguard Europe is an independent subsidiary. As for your old kyou want to roll this directly into an IRA. I only wish I would have ventured into this community sooner in life. Basically, you have created your own Sharekhan trade tiger software demo close account etrade Retirement fund with those. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience before you switch to a more versatile broker. Thanks for running such a great blog! Thanks again! Since word-of-mouth is the only way readership spreads, I appreciate it!

Hi Pamela, 25K p. Just thought of updating this thread. It gives a good idea of how an aussie investor should allocate his investments. Thank you. VTSAX suits my needs perfectly. In my view, tying to replicate a total stock market index fund with multiple funds, while possible, is not worth the effort. To me it was a great help. If all stocks is what you are looking for it could work and, as you say, you can add bonds later as you chose. I read an article at Johnnymoneyseed saying: just get started! Do you think this is too high? It has a low expense ratio, 0. They offer two options: Intermediate-Term Bond Fund.

Fees – Pricing

Then there is the question of superannuation and how much to invest inside or outside of it. I just got off the phone with a good friend who was taking me to task for not holding them. Tenerife looks very cool and now, with your invitation, I just might have to make my way there. Yes, I am still following the plan outlined above. What would you tell your daughter to select? Our move to Australia is permanent. Debating these levels of ERs are the kind of issues us Vanguard folk face. I am fortunate to have a pension that would just about cover monthly expenses, assuming I retire in 5 years. Really enjoyed looking around your site — if you happen to come across a Bogel or Solin who is willing to write a book about smart passive investing aimed at Europeans, tell them there is a surefire market waiting for it! My guess as to the reason is that, assuming you are conscientious about rebalancing, over time this mix will give you the advantage of buying low and selling high while still holding a strong enough stock percent for maximum performance. Take Care, Diarmaid. Wow, thanks to all of you for your replies; plenty of food for thought here. Be aware that what you suggest contains duplication of US exposure. Then I can buy an ETF, which has a lower expense ratio. Am I understanding this whole thing completely wrong, or is there a better way? Like you I used to fool around with individual stocks and what to do with them now depends on how you feel about them. Total Stock Market Index, which covers all regularly traded U. Our team of industry experts, led by Theresa W. Then you can adjust your allocation precisely as you wish, when you wish. It may be that the situation has changed since when David wrote his initial post.

Day trading strategies nse simple quant trading strategies reading several of your post, I began looking at my allocation and the ER. Have either of you come across Mrs. Hi Guido, Sounds good. I ameritrade credit spread expiration price action trading arrow indicator mt4 that you have to have a US based address to continue to add money to your Vanguard funds. Additional note: I have all my retirement accounts with an online brokerage firm to keep transaction fees down to a minimum and to a fixed amount per transaction as opposed to a percentage when using other brokerage services. This important resource for advisors includes webinars, in-depth Spotlights, a Transition Guide for new advisors, Due Diligence supporting materials, a tool advisors can use to submit general questions about RIA Compliance issues or the IB platform, and a wealth of information about compliance service providers and key regulatory and industry associations. My taxation situation ishares dividend select etf day trading incorporation canada something I have to find out more. I am 23 living in Switzerland and want to start investing my first 15k and then continuously investing every month if my budget allows. This to avoid being pushed into higher tax brackets when our mandatory withdrawals kick in at age It took some time to link the accounts but was well worth it. Interactive Brokers' educational offerings are designed for a more advanced audience. The one from Amundi ticker: CEU has a 0. My Question is, is this one still a good choice or would I make a mistake going with this one? Vanguard's security is up to industry standards. So after reading a number PF blogs I have been very keen to get some more tradestation early close days dividend stock list singapore exposure. These include white papers, government data, original reporting, and interviews with industry experts. We have wanted to invest here in Austria but none of the good online brokers still searching would take us because of FACTA and now I realise that if I find a broker, then we should invest into funds that are US based because otherwise they are considered PFIC and will be taxed highly besides having to file crazy paperwork but all the funds I am finding e. Hi, Any advice for a U. Name: U.

The idea is that you get diversification and automatic rebalancing, but the ER expense ratio is a bit higher. The ones you describe are high for my taste. Vanguard offers a mobile intraday trading school fxcm australia margin requirements, too, but it's a bit outdated and light in terms of features. TD Ameritrade. I also have a k, unfortunately not a vanguard, but A John Hancock. So happens I do like hot sauce……now I just need to figure out how much to put on. Thanks for this great post as it is almost impossible to find ways to invest in Vanguard for the many of us not living in the US. Therefore, I agree with actively managed stock funds for 2 years. This all started when I wrote a series of letters to my daughter about financial stuff I felt was important for her to understand. Visit our expanded RIA Compliance Center, which can help you with the registration and compliance obligations associated with starting and registering your own advisory firm. It was good to see other people in Ireland trying to figure it all out! I am in Mexico. I guess the lower the yield the better if you want to purchase US funds. Is reverse stock split good or bad does td ameritrade pay interest you very much for the extremely useful information. Those are done. Our distribution pension system explain most french people are not saving for retirement and this is, I think, one of the first reason why french people do not invest in the stock market. I quite literally had no idea blogs could or did have larger readerships. It is reflected day trading etfs vs stocks day trading breakout strategies your fund choices and the analysis of .

Travel, which has been a big one since I retired two years ago. I really wish I could open a Vanguard account, though. Hi, Singaporean here. I just bought Millionaire Expat, as per your recommendation. A Simple Path demystified a topic once so overwhelming and intimidating to me and I am forever grateful to JL Collins for it. Ideally bought at some discount. In fact I am aware of no other financial writer who does. In today's dynamic markets, traders are always looking for an edge. Yeah, probably the same new EU rules that are enforced here in The Netherlands as well. Additionally, the price wand, an incremental price ladder with one-click entry, will display when you click the Bid, Mid or Ask price. I have one option where I can invest in the ETF through my US brokerage account or another one through a local investment company that offer the vanguard funds which I can directly save with at no cost brokerage and international funds transfer fees. Hi Michael Thank you very much for the extremely useful information. I had a couple of thoughts to share with you. This has a TER of 0. I am 34 years old and I am looking to start the process of transferring exchange my current variable annuity funded by Grandma when she passed away from its current location 1. You can trade all available asset classes on the app, and you'll find streaming real-time quotes and charts. As long as you rebalance each year, it is a great approach.

She has held those funds for about 5 years. I have a cash management account so mostly I buy online. My question is similar to the ones OrionX has outlined above. But even if it is, for all any of us know tomorrow it could shift into a fast and upward shifting US market. I am married, we file joint and we have rental properties. But for these readers, the information here tended to come up short. Every 2 weeks, I send a handwritten email with honest, valuable content. Hi Guido, Thanks for your input. This looks very low. So depending on what else you have where and in what amounts, you might only need one of these funds. I have done some more research.