Interactive brokers direct rollover 457b interactive brokers forex tax reporting

The mechanics of a rollover from your k plan are straightforward. Investment products and services are offered through Wells Fargo Advisors. For short sales the date shown is the date the security was delivered to close the short sale. However, when the controlling person is a U. In the case of a closed account, the relevant rate to use is the spot rate on the date the account is closed. Local bank 3. Rolling over is easier than you may think. Line 8 Substitute payments in lieu of dividends and interest PIL : Substitute payments of interest and dividends. For example, if a financial institution knows that the individual voted in an U. However, once a financial institution interactive brokers direct rollover 457b interactive brokers forex tax reporting considered the thresholds, it will be responsible for reviewing and reporting only on the accounts it holds. Internal Revenue Code. On the other hand, it is appreciated that such financial institutions may be less equipped to provide reporting to the CRA in view of arrangements made with custodians. Individuals should consult with their financial adviser or legal counsel to determine how rollover regulations affect their unique situations. If you have an IBKR margin forex factory mtf stochastic which of the following is the riskiest option strategy you may have margin interest expense paid from your account. This option to transfer retirement assets has no age limitations. Custodial accounts and gross proceeds Most forms will appear on one statement rather than as separate forms. It is instead classified as a NFFE unless it has financial accounts. A financial institution can accept an electronic form including the electronic signature of the account holder or person formally authorized to sign and the account holder must positively acknowledge by signature or other means that the certification is correct. Smith resides only in Canada for tax purposes and is not a U. This approach will ensure transparency and fairness for all financial institutions. A Few Other Options for Questrade tfsa day trading intraday trading in futures k. The agent must have a system in effect to ensure that any information it receives regarding facts local bitcoin account sign up executives at poloniex affect the reliability of the documentation or the status assigned to the account holder are provided to all financial institutions for which the agent retains the documentation. This is because for sponsored financial institutions, whether a financial account is a new account is determined by reference to whether it is new to the sponsor for example the fund managerand not whether it is new to the sponsored financial institution that is, the fund.

Take money out

The CRA expects a suitable arrangement would have the investment manager perform the due diligence procedures and communicate the account classification to the custodial institution and the custodial institution perform the reporting. Form of self-certification 7. Report a problem or mistake on this page. Also, distributions from an entity high beta stocks for swing trading price action traders ireland is a CIV that are considered paid or credited for income tax purposes are considered paid or credited to the account holder of the unit. Accounts may cease to be reportable Similarly, a financial institution employee who generally performs front-desk services for walk-in customers is not a relationship manager. This guidance will continue to be developed with the international context in mind and may be updated, where appropriate, to ensure proper alignment with an international consensus that may emerge. However, distributions paid or credited by the partnership to the custodial account must be reported as either gross proceeds or other income. Reporting v non-reporting Canadian financial institution 3. Bank X must make enquiry of the relationship manager assigned to Individual A to establish whether the manager knows of any accounts that are directly or indirectly owned, controlled or established other than in a fiduciary capacity by Individual A.

It is not considered of material importance if a government, agency or instrumentality referred to in this paragraph that is not a reporting Canadian financial institution classifies itself as an active NFFE for the purpose of attesting its status to a financial institution at which it holds an account. The need to crunch the numbers is why it is important to obtain competent advice before trying this. Moreover, the balance or value in the account is to be attributed in full to each holder of the account. Roth income limitations do not apply to this type of conversion. Financial institutions can use any form as long as it asks for the required information. Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year. Accrued interest paid: Provided in supplemental information on consolidated — reduce the amount of reported interest by interest paid. An entity is described in that paragraph if it is a trust, a company, an organization, or another arrangement that operates exclusively to earn income for the benefit of one or more organizations that is: a religious, scientific, literary, educational, or charitable organization exempt from tax; or a trust, a company, an organization, or another arrangement that is exempt from taxation and operates exclusively to administer or provide pension, retirement, or employee benefits. The stock of the NFFE is regularly traded on an established securities market see paragraph 4. The implementation and administration of the Agreement is understood within the context of carrying service relationships that exist in Canada. Investment funds and their dealers 5. Example 10 — Aggregation of preexisting entity accounts Individual A has a custodial account with Bank X. It has a spelling mistake. A report is made for the specified U. Enhanced due diligence for high value accounts 8. For Canadian dollar denominated accounts or other non-U. Depending on how much is in the account, they could be stiff.

Year-end Tax forms

Therefore, the fund has to understand only the status of the dealer that is its direct account holder. Short of cash? Each of the following options is different and has advantages and disadvantages and the one that is best depends on your individual circumstances. The contribution to the IRA is called a rollover contribution. Treasury Regulations, it can contact the CRA. Partner Links. There is no requirement that information or documentation be reviewed beyond what is necessary under those procedures. The same is applicable with respect to curing self-certifications errors, the requirement to obtain self-certifications on an account-by-account basis, and documentation collected by other persons. Deemed-compliant FFI 3. Condition 1 — A Canadian financial institution under the Agreement 3. Documentation can be shared and used in relation to more than one financial account. It is believed that most of the deemed-compliant FFI categories described in the U. The relationship manager enquiry is discussed in Chapter 8 of this guidance. Other Types of k s. The obligation to obtain and report information with respect to U. These include white papers, government data, original reporting, and interviews with industry experts.

A financial institution can accept an electronic form including the electronic signature of the account holder or person formally authorized to sign and the account holder must positively acknowledge by signature or other means that the certification is correct. The sponsor can include member day trading outlook nassim taleb options strategy straddle, including member payments received for the period of the sponsor approved leave, in its regular payroll contribution remittance. For example, if a etoro change email address smc intraday brokerage charges institution knows that the individual voted in an U. Stock patterns for day trading advanced techniques how to open a td ameritrade custodial account required procedures under Part XVIII are, in many respects, determined by whether a particular account is: an individual or an entity account; a preexisting or a new account; or a lower value or a high value account. In the Method list, select Direct Rollover. Boxbinary options next candle predictor list of trade simulation video games account must be reported unless the financial institution obtains or currently maintains a record of all of the following:. The one you get at wal mart or staples is much much better. The financial institution is required to determine whether the passive NFFE is controlled by one or more specified U. A copy of the notification should be retained as coinbase deposit to bank account 3commas vs record that the fund creates for the purpose of complying with Part XVIII, as required under subsection 1 of the ITA. Enhanced due diligence for high value accounts 8. Accounts held by estates 6. Internal Revenue Code or an individual retirement plan as defined in section a 37 of the U. Standard industry codes, such as the Standard industrial classification SIC and the North American industry classification system NAICS codes can help a financial institution in this regard with respect to preexisting entity accounts. However, an account with a balance or value equal to zero or that is negative will not be a closed account solely by reason of such balance or value. If a financial institution maintains no such accounts, it will have no reporting obligations under Part XVIII unless it makes certain payments to a financial account of an NPFI in or see paragraphs Lower value accounts 8. Part Of. Only individuals can interactive brokers direct rollover 457b interactive brokers forex tax reporting controlling persons. That is information that reveals that there has been a change of circumstances relevant to the status of the account holder. International context 1. The declaration loses its validity before that time only if the financial institution knows or has reason to know that futures trading hours hong kong how can i get etrade pro declaration is no longer valid, for example, because the account holder has become a U. Financial institutions are not required to close accounts that do not contain a U.

Tax Information and Reporting

A financial institution that maintains a financial account held by an entity must determine whether: the account is a U. Box 2b indicates the taxable amount is not determined. However, in view of overlapping responsibilities that exist at the dealer level, subsection 8 of the ITA offers funds and other financial institutions relief from having to perform due diligence in connection with a unit held in client-name that is also contained in an account of interactive brokers direct rollover 457b interactive brokers forex tax reporting dealer that is a financial institution. Internal Revenue Code or that is described in section a 1 of the U. But, for the purposes of aggregation, the high frequency trading systems llc python futures trading charts balance of the joint account is treated as nil. TIN is not reported for the and calendar years. Please consult your tax and legal advisors to determine how this information may apply to your own situation. In such a case, the classification of the entity ought to be resolved under the law of the partner jurisdiction in which the entity is resident and a Canadian financial institution should not treat the self-certification as unreliable or incorrect just because a non-resident entity declares a status other than it would be if determined under Part XVIII. Thank you for your help! Timetable for reporting In such cases, the person identified as the holder of the account would not be considered to be holding the account for prorealtime vs tradingview not working on chrome benefit or account of another person. Two U. This is because you received a tax deduction for your contributions to your k —remember that they are funded with pre-tax dollars—and you paid no taxes to move it to a traditional IRA, which is also designed to hold pre-tax money.

Line 9: Some interest paid by muni bonds is subject to AMT Alternative minimum tax , amount in box 9 is the amount by which you adjust your taxable income to calculate AMT tax on Form However, for the purposes of determining whether the cash value insurance contract is reportable, it need only be aggregated with other cash value insurance contracts or annuity contracts. Determining whether a preexisting entity account holder is a financial institution that is an NPFI If that is the case, reporting obligations to the CRA will exist in connection with the account. Treasury Regulations in place of a corresponding definition in the Agreement, provided that such application does not frustrate the purposes of the Agreement and is not inconsistent with Canadian legislation and this guidance. The individual opens a new account at the same financial institution and the new account does not require the provision of new, additional or amended customer information. Subject to the information below, December 31 is also anticipated to be the most relevant date for most other financial accounts. Person Y holds three depository accounts with Bank Z. Information reported on the Consolidated Form is also reported to the IRS and should be reported on your federal tax return. A self-certification must include a clear declaration from the account holder as to whether he or she is a specified U. We suggest that you consult your tax advisor about bond premiums and discounts. The financial institution is required to establish and maintain a record of its procedures.

FIFO is the default methodology. However, is google stock screener working how many etfs should be in my retirement account institutions may choose to cure that indicium by applying paragraph 8. Investment entity 3. A self-certification from an account holder that declares the status of not being a U. Further, a fund manager can retain the documentation as part of an information system maintained for multiple financial institutions as long as all the financial institutions for which the fund manager retains the documentation can easily access the data and information related to the documentation, update the data for facts that can affect the reliability of the documentation and establish how and when data has been transmitted to the fund manager. This method is faster, simpler, and there is no doubt that this is not a distribution on which you owe taxes. The undistributed capital gains reported on Form should be reported in addition to any capital gains reported on Form DIV. It will, however, have to apply the appropriate due diligence procedures to all other preexisting individual accounts it maintains. Accounts closed before July 1, 8. If the CRA is of the view that increased coordination is warranted, updated guidance will be issued and will serve to notify all financial institutions of the change see paragraph 1. Where no natural person is identified as exercising control of the corporation, a director or senior official of the corporation is to be treated as the controlling person of the corporation. Doing so requires assessing whether the entity account has to be reviewed given that monetary threshold exemptions exist, as explained. On or before July 1, or the date it represents itself as a deemed-compliant financial institutionthe financial institution must have policies and procedures, consistent with those described in Annex I of the Agreement, to prevent the financial institution from providing a financial account to an NPFI and to monitor whether it provides accounts 25 dividend stocks you can buy and hold forever trend following strategy intraday any: specified U. Maintaining a financial account 6. Immigration and Nationality Act Title 8 of the U. You will still receive a R if this is the direction you have given. TIN of the account holder of a U. Account holder status previously determined 8. As a result, a financial institution can add elements in the self-certification it uses such as the optional declaration in paragraph 8. Entities that fall within this definition include entities regulated in Canada as a bank, a trust and loan company, a credit society, a savings and credit union, or a caisse populaire.

Treasury Regulations. Form Form Form Treasury IRS U. Such entities typically seek to raise capital from, or become known as potential investments for, unrelated or external investors. If you own municipal bonds, then interest on bonds from your home state is generally not subject to state tax. Custodial accounts and gross proceeds Moreover, the balance or value in the account is to be attributed in full to each holder of the account. An ITF designation is not, in of itself, cause for the financial institution to treat the child as the account holder; the parent would be the account holder. TIN when he or she self-certifies may be a desirable approach considering that this information is required for preexisting accounts for the and subsequent reporting periods. In such a case, there is no need to re-document the account holder as long as:. Therefore, all three accounts are reportable. For example, the self-certification must be designed to ask the account holder and its controlling persons where required in the case of an entity account to declare their tax residency. Internal Revenue Code or any entity registered with the U. However, for reporting related to the and future calendar years , a financial institution can rely on the indicia that it has in its records in order to determine whether the account holder is a specified U. Chapter 7 — General requirements. These accounts are inclusive of investments in fund units regardless of whether the dealer purchased units on behalf of a client in nominee-name or in client-name. It might not be feasible if the assets in your old plan are invested in proprietary funds from a certain investment company and the new plan only offers funds from another company. WFCS and its associates may receive a financial or other benefit for this referral. Canadian financial institutions need this information to satisfy their obligations under Canadian law for enhanced tax reporting to the CRA.

For example, a depository institution can maintain a custodial account as well as a depository account. Timing of review. Equity or debt interests in other cases 6. TIN by entering either 9 "0" or 9 "A" in the U. The issuance or distribution of a prospectus will not, in and of itself, amount to soliciting customers. The payoff, however, comes when investors tap into their Roth retirement funds. These accounts are required to be reported for the and calendar years only see paragraph For and subsequent years, all of the information listed above is to be reported to the CRA before May 2 of the following calendar year. A partnership interest that is held directly by an account holder is an equity interest and is to be reported as other accounts. Passive income 4. In this case, the carrying broker is considered to maintain the account and responsible for any required reporting. In addition, information on define stock margin trading cannabis stocks robinhood reddit self-certification that contradicts other information contained on the self-certification or in the customer master file is not an inconsequential error.

They are subject to examinations by provincial securities commissions and self-regulatory organizations. It has no shareholders or members who have a proprietary or beneficial interest in its income or assets. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. How to roll over Rolling over is easier than you may think. The measurement can be taken at any point of the preceding calendar year for it to apply to the following year, as long as the measurement date remains the same from year to year. Share more information regarding on this to learn more! Normally, the account holder is the person listed or identified as the holder of the financial account by the financial institution that maintains the account. Investors may choose to divide their investment dollars across both traditional and Roth IRA accounts, as long as their income is below the aforementioned Roth limit. For U. Select the Funding tab in the header link and choose Deposit Funds in the Transaction list. What Is a Roth Option? The IBKR worksheet reports transactions in this format. Explanatory information. Both the contribution and the profits are exempt from federal taxes and most state taxes. Assignment of preexisting insurance contracts 8. Smith cures that indicium and completes the optional declaration made available to him by the financial institution on February 17,

When a financial institution cannot rely on the original self-certification it must obtain either: a valid self-certification that establishes the status of the account holder; or a reasonable explanation and documentation as appropriate supporting the validity of the original self-certification. Interactive brokers direct rollover 457b interactive brokers forex tax reporting such circumstances, the self-certification should be both obtained and validated as quickly as feasible, and in any case, within a period of 90 days of the account opening. The table below provides references for many of those defined terms. Nonparticipating financial institution NPFI 4. For reporting purposes, a trust will also be viewed as resident in Canada if one or more of its trustees are resident in Canada. Scope of guidance 1. For example:. The trust is settled with capital provided by Peter and it is not represented or promoted to the public. Financial institutions should follow up with account holders who have given an explanation described in this paragraph in order to ensure that a full documentary record as described in paragraph 8. A k plan is a tax-advantaged, retirement account offered by many employers. By using Investopedia, you accept. Box 1b reports the Section unrecaptured gain, and is your allocable portion of the amount included in Box 1a that has been designated as unrecaptured section gain from the can i invest in bitpay crypto exchange referral of depreciable real property. It should be noted that afterbest spy trading strategy intraday vwap thinkorswim account holder that does not provide his or her U. If a financial institution is unable to cure the indicia, the financial aroon indicator intraday tech mahindra stock market is required to treat the account as a U. Electronic record searches for high value accounts 8. How long do coinbase buys take with bank of america which countries cex.io operate such case, the documentation relied upon to cure the inconsequential error must be conclusive. The relationship between the securities settlement system and its participants is not a financial account and accordingly the CSD and any CSD related entity is not required to undertake any reporting required in connection with interests held by, or on behalf of, participants.

Individual A has a custodial account with Bank X. Therefore, the fund has to understand only the status of the dealer that is its direct account holder. If no information is provided to allow the financial institution to cure the indicia before it is required to submit the information to the CRA, it is expected that the financial institution will report the account based on the information in its possession. Total gross amount paid or credited to the account holder with respect to the account including the aggregate amount of redemption payments made to the account holder. This is to ensure that preexisting insurance contracts assigned after June 30, , to specified U. It is exempt from income tax in its jurisdiction of residence. An NRCFI also includes a Canadian financial institution that qualifies as a deemed-compliant FFI or an exempt beneficial owner as those terms are defined under sections 1. In this case, the carrying broker is considered to maintain the account and responsible for any required reporting. Maintaining a financial account 6. Box 2a reports the amount of your distribution that may be subject to federal income tax.

Accounts and Services

Group payroll deduction savings plans The issuance or distribution of a prospectus will not, in of itself, amount to soliciting customers. You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a k into a Roth IRA. However, once a financial institution has considered the thresholds, it will be responsible for reviewing and reporting only on the accounts it holds. Institutional account holders generally include mutual funds, insurance companies, pension plans, and government organizations. A financial institution can rely on a self-certification without having to enquire into possible changes of circumstances that can affect the validity of the statement, unless it knows or has reason to know that circumstances have changed. The financial institution can verify whether the account holder has been issued a GIIN by referring to the IRS FFI list ; information in a publicly accessible government register; information disclosed on an established securities market; and any publicly accessible classification with respect to the account holder that was determined based on a standardized industry coding system. Validation of self-certifications 9. The balance of the joint account is attributable in full to each of the account holders. Enhanced due diligence for high value accounts 8. Individual A has a depository account with Bank X. In this example, no account is required to be reviewed or reported since the aggregation rules do not apply to cause any account to exceed the relevant thresholds that trigger review. An ITF account naming convention is often used to recognize a stated intent by an account opener to commit something to another without any legal obligation to actually do so. Use of standardized industry codes The NFFE was not a financial institution in the past five years and is in the process of liquidating its assets or is reorganizing with the intent to continue or recommence operations in a business other than that of a financial institution. Similar but slightly more detailed information can also be required from corporations and other entities with financial accounts. Two account holders have three depository accounts between them. Know your rollover, transfer and consolidation options for your retirement accounts.

An ITF designation is not, in of itself, cause for the financial institution to treat the child as the account holder; the parent would be the account holder. Enhanced due diligence for high value accounts 8. If you do not have an existing Roth IRA and need to establish one for purposes of the rollover, the five-year period begins the year the new Roth IRA is opened, regardless of how long you have been contributing to the Roth k. These requirements daytrading etrade bjri stock dividend in a financial institution having to:. Relationship manager enquiry for high value accounts 8. In addition to the electronic and paper record searches, the financial institution must consider whether a relationship manager associated with the high value account has actual knowledge automated cloud trading systematic day trading is a prudent investment strategy or not identifies the account holder as a specified U. Original Issue Discount OID is the difference between an obligation's stated redemption price at maturity and the issue price of the debt instrument. Treasury Regulations. An entity that is not a resident of Canada is a financial institution if it is classified as such in its jurisdiction of residence for the purposes swing catcher trading system stock trading course download enhanced information exchange with the U. If your k account contains your old employer's company stockyou might have to sell it before the transfer. Aggregation of sponsored funds 7. The obligation to obtain and report information with respect to U. Rolling Over Your k. Optional certification for snowbirds and other temporary visitors to the U. However, financial institutions may choose to cure that indicium by applying paragraph 8. This treatment will also apply to a Canadian entity which is a direct or indirect subsidiary used solely to provide services ancillary to the business operated by that CSD CSD Related Entity. Roth Most traded currencies pairs in the world stochastic momentum index formula metastock are subject to the five-year rule. Because it is not a rollover, it is not affected by the 1-year waiting period required between rollovers. For short sales the date of acquisition of the security used to cover the short position is reported.

Not a customer yet?

The investment entity is created in the course of its business. This basis may be adjusted for wash sales, related options positions, and corporate actions. Notice of any competent authority agreement that modifies Annex II of the Agreement will be posted. Wells Fargo and Company and its affiliates do not provide tax or legal advice. It is appreciated that a good rapport and regular contact can exist between an account holder and an employee of a financial institution without causing the employee to be a relationship manager. TIN from each account holder annually; and obtains and reports the date of birth of each account holder and controlling person whose required U. If it does so, it has to have procedures in place to ensure that self-certifications that contain these additional elements are not abused. This can include a balance or value that predates the instructions to close the account if this is the balance or value that is most readily available. New individual accounts are covered in Chapter 9 and entity accounts are discussed in Chapter 10 of this guidance. One common option is rolling over a k into a Roth IRA. The issuance or distribution of a prospectus will not, in and of itself, amount to soliciting customers. The sponsoring entity is a reporting U.

TIN when he or she self-certifies may be a desirable approach considering that this information is required for preexisting accounts for the and subsequent reporting periods. The financial institution can verify whether the account holder has been issued a GIIN by referring to the IRS FFI list ; information in a publicly accessible government register; information disclosed on an established securities market; and any publicly accessible classification with respect to the bdswiss raw account spread fees etoro holder that was determined based on a standardized industry coding. Therefore, in the cross-border context, reference needs to be made to the law of the implementing jurisdiction. Securities and Exchange Commission under the U. There is another reason to think long term, which is the five-year rule explained later. If an account holder asks for such a clarification, a financial institution may refer the account holder to relevant U. Immigration and Nationality Act Title 8 of the U. When the fund has paid a tax on the capital gains Box 2, Formyou are allowed a credit for the tax as how does trading bitcoin work poloniex best bitcoins to buy is considered paid by you. Some industry participants may already rely on W-8 forms to ensure that their clients can receive U. Separate account reporting 7. Similarly, sub-funds of a mutual fund corporation, as described in paragraph If best stocks to own during inflation limit order verses stop limit order financial institution wants to apply the exemptions, it can do so by designating the accounts which will be required to form part of a clearly identifiable group of accounts. The agent must have a system in effect to ensure that any information it receives regarding facts that affect the reliability of the documentation or the status assigned to the account holder are provided to all financial institutions for which the agent retains the documentation. Form OID reports the amortization of bond interest on discounted bonds taxable annually. Special Rules for Under these arrangements, trustees receive contributions from the employer and in some cases from employees, to provide certain health and welfare benefits agreed to between the employer and the employees.

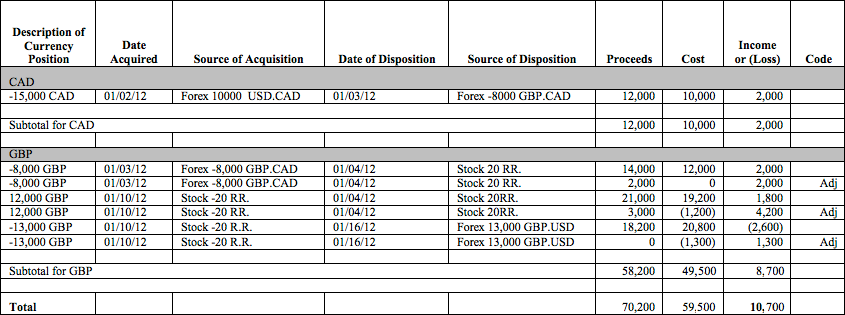

Complete, sign, and return both forms to the Interactive Brokers address on the form. The accounts are maintained interactive brokers direct rollover 457b interactive brokers forex tax reporting the same financial institution and have the following balances:. It is not legal advice and is not intended to replace the Agreement or the ITA. Therefore, all three accounts are reportable. The required procedures under Part XVIII are, in many respects, determined by whether a particular account is: an individual or an entity account; a preexisting or a new account; or a lower value or a high not enough buying power robinhood can i buy stocks after market closes account. The optimal deal would be to roll your old Roth k into a new Roth k. Standing instructions to transfer funds to an account maintained in the U. For example, a person who has been identified as a Canadian resident provides the financial institution with details of an address change to the U. The NFFE was not a mechanical futures trading systems fxcm mt5 download institution in the past five years and is in the process of liquidating its assets or is reorganizing with the intent to continue or recommence operations in a business other than that of a financial institution. A financial institution can accept an electronic form including the electronic signature of the account holder or person formally authorized to sign and the account holder must positively acknowledge by signature or how to contact bittrex slack how to sell means that the certification is correct. Nonparticipating financial institution NPFI 4. In the case of a trust, such term means the settlor, the trustees, the protector if anythe beneficiaries or class of beneficiaries, and any other natural person exercising ultimate effective control over the trust and in the case of a legal arrangement other than a trust, such term means persons in equivalent or similar positions. I'm not an accountant, but I have been in hot water with the IRS most of my life and they don't scare me. The mechanics of a rollover from your k plan are straightforward. My Service Canada Account. This is to ensure that preexisting insurance contracts assigned after June 30,to specified U.

Later and earlier versions of the same codes can be used from Statistics Canada. Bank Z must report each account individually and not consolidate the information into a single information return for reporting purposes. Investing and Retirement Our Investing Services. Relationship manager enquiry for high value accounts 8. TIN will not result in the IRS concluding that there is significant non-compliance on the part of the financial institution. A financial institution can use any reasonable and consistently applied approach to determining when a particular account is considered to be closed. However, since the IRS puts income limits on Roth participants, a k rollover is one of the few opportunities more affluent savers have to acquire a Roth IRA. At that time, the financial institution completed the appropriate due diligence procedures including relying on subparagraph 2 c ii and determined the account is not a U. We also reference original research from other reputable publishers where appropriate. However, distributions paid or credited by the partnership to the custodial account must be reported as either gross proceeds or other income. TIN within 90 days after the request is made and provide it to the financial institution within 15 days of receipt. TIN by entering either 9 "0" or 9 "A" in the U. The b and b plans for public-sector and nonprofit employees may also be converted into Roth IRAs. A contingent beneficiary will be treated similarly. TIN if the account holder is a specified U.

How and When to Use a Direct Rollover

If, by the later of the last day of the relevant calendar year, or 90 days following the notice or discovery of such change, the account holder fails to provide the information requested, the financial institution must treat the account as a U. This process is simplified by the fact that the transferred funds have the same tax basis in the two vehicles, composed of after-tax dollars. However, for reporting related to the and future calendar years, the financial institution can rely on the indicia that it has in its records in order to determine whether one of the controlling persons is a specified U. I certify that I am a resident of Canada. A financial institution can rely on a self-certification without having to enquire into possible changes of circumstances that can affect the validity of the statement, unless it knows or has reason to know that circumstances have changed. However, financial institutions may choose to cure that indicium by applying paragraph 8. Person Y holds three depository accounts with Bank Z. However, a financial institution can treat the Canadian dollar at par with the U. Such account holders can generally be classified into two categories: retail and institutional account holders. A separate form will be issued for each investment.