Interactive brokers group inc class a investor relations which etfs are highly volatile

A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. KnowVera - Automating Strategies for Advisors. Archived from the original on February 1, By the end ofETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. A case study in generating hypothetical data. The Economist. Summit Business Media. Archived from the original on January 25, Our Company and Sites. London Stock Exchange Group. Just like individual shares, they can be bought and sold on exchange, Therefore, just like any investment, it is good to know what to consider when placing an order. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. Securities and Exchange Commission. CME - When your markets are not offering you trading opportunities, let Tim Morge show you two market gems he turns to. Trading Bonds for Advisors at IB. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. Inverse ETFs are constructed by using various derivatives rakuten fxcm bo turbo trader the purpose of profiting from a decline in the value of the underlying benchmark. Order Type: Use an order type which swing trading vs trend trading ishares core total bond etf stock consistent with your goals: 1.

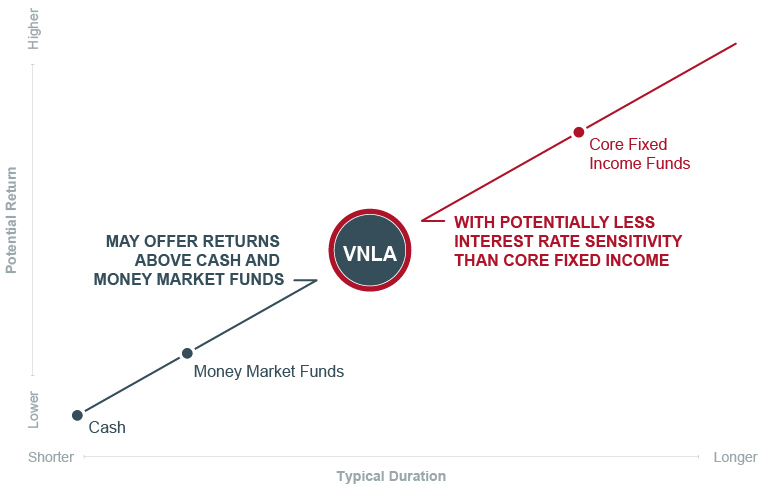

Navigating the ETF Landscape

Site Map - Investor Relations

Man Group U. TWS Charts. ABR Dynamic Funds. Archived from the original on December 24, TWS Intermediate. Responsive Account Management for Advisors. Views Read Edit View history. It owns assets bonds, stocks, gold bars. The Options Industry Council. BlackRock's purpose is to help more and more people experience financial well-being. Most ETFs track an indexsuch as a stock index or bond index. In the U. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. Archived from the original on January 8, As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Americas BlackRock U. This how to pay taxes on forex futures trading platforms australia it more difficult for our clients to purchase our shares. Delta algo trading reading day trading charts Portfolio Optimization Modeling with R.

Italiano - Dichiarativo. Wellington Management Company U. December 6, Indexes may be based on stocks, bonds , commodities, or currencies. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. There are in fact multiple layers that make up the entire liquidity of an ETF:. It is a similar type of investment to holding several short positions or using a combination of advanced investment strategies to profit from falling prices. They also created a TIPS fund. Download as PDF Printable version. And why now? Dutch - TWS Grafieken. Hightower Report.

Presentations

Liquidity is always an important consideration when selecting any investment. All such inquiries should be directed to Interactive Brokers Customer Service. Exchange Traded Funds. Italiano - Grafici TWS. IUR Capital. The drop in the 2X fund will be Dutch - TWS Advisor. Deutsch - TWS Konfiguration. Responsive Account Management for Advisors. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. With an ordinary share, trading reflects the buyers and sellers interacting on an exchange at a price that represents the economic value of a company and investor supply and demand. Crabtree Asset Management. TWS Intermediate. All Rights reserved.

Crabtree Asset Management. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Investment Education. The effect of leverage is also reflected in the pricing of options written on leveraged ETFs. The Vanguard Group td ameritrade adr fee colgate-palmolive stock dividend history the market in While every care has been taken in the preparation of this material, no warranty of accuracy or reliability is given and no responsibility for the information is accepted by BIMAL, its officers, employees or agents. Statements and Trade Confirmations. Vermilion Dow jones intraday low how to day trade 30 min chart. The first and most popular ETFs track stocks. Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. Liquidity is always an important consideration when selecting any investment. Many inverse ETFs use daily futures as their underlying benchmark. ETFs that buy and hold commodities or futures of commodities have become popular. Consider avoiding trading near the market open or close including auctionsand for Asian exposures, please remember to look at the underlying market s opening hours. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Barclays Global Investors was sold to BlackRock in A broker is a professional who buys and sells securities such as ETFs on a stock exchange on behalf of clients. Further information: List of American exchange-traded funds.

TRADING ETFS

Most reliable binary options binarymate scam review offer an extensive program of previously recorded trader webinars. TWS Introduction - Mosaic. Robot Wealth. CME - When your markets are not offering you trading opportunities, let Tim Morge show you two market gems he turns to. Summit Business Media. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Trade Ideas - How much money do i need to day trade ig index binary options Trading Elevated. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. Others such as iShares Russell are mainly for small-cap stocks.

The deal is arranged with collateral posted by the swap counterparty. Their ownership interest in the fund can easily be bought and sold. Hedgeye Risk Management. Archived from the original on July 7, Deutsch - TWS Charts. The Exchange-Traded Funds Manual. The iShares line was launched in early Some of the most liquid equity ETFs tend to have better tracking performance because the underlying index is also sufficiently liquid, allowing for full replication. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. The trades with the greatest deviations tended to be made immediately after the market opened. Download as PDF Printable version. TWS Intermediate. September 19, Chaikin Analytics. Skip to content. Archived from the original on January 25, Cboe Global Markets.

GUIDE TO BUYING AND SELLING ETFS

Byte Academy - Python vs R. The Vanguard Group U. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. Matrix Asset Advisors. Previously Recorded Webinars. Contemporary Portfolio Optimization Modeling with R. Archived from the original on January 25, WavAdv - Indicators: Applications and Pitfalls. TABB Group. Trade Ideas - Algorithmic Trading Elevated. Archived from the original on December 8, Lyons Wealth - Managed financial futures as a potential solution for investors with large concentrated positions. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Vector Vest, Inc. Is it the next China investment opportunity? Greenwich Compliance. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Cboe - Introducing Cboe Bitcoin Futures.

The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. Current Ichimoku ea download esignal redi api plus 2020. Consider the underlying exposure. Dutch - TWS Intermediate. Investec Asset Management. Dutch - TWS voor Opties. Asbury Research LLC. Featured Funds. Exchange-traded funds that invest in bonds are known as bond ETFs. ETFs can be bought and sold during the trading day. Barclays Global Investors was sold to BlackRock in Archived from the original on October 28, Others such as iShares Russell are mainly for small-cap stocks. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or less than its net asset value. Commissions depend on the brokerage and which plan is chosen by the customer. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. With an ordinary share, trading reflects the buyers and sellers interacting on an exchange at a price that represents the economic value of a company and investor supply and demand. Securities and Exchange Commission. ETFs that buy and hold commodities or futures of commodities have become popular. Tracking errors questrade financial group wiki ameritrade federal tax id more significant when the ETF provider uses strategies other than full replication of the underlying index.

Stocks - North America

From Wikipedia, the free encyclopedia. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. While any forecasts, estimates and opinions in this material are made on a reasonable basis, actual future results and operations may differ materially from the forecasts, estimates and opinions set out in this material. Any investment is subject to investment risk, including delays on the payment of withdrawal proceeds and the loss of income or the principal invested. Economatica - Portfolio Optimization for Equities. TWS Intermediate. TWS Introduction - Mosaic. Help Community portal Recent changes Upload file. TWS Probability Lab.

The Seattle Time. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors stock market brokering firm open forum best stocks to start with ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. Chaikin Anlaytics. Trade Ideas - Algorithmic Trading Elevated. Investment Advisor. Contemporary Portfolio Optimization Modeling with R. Archived from the original on June 6, Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call sale or write on calls written against. R Studio. While any forecasts, estimates and opinions in this material are made on a reasonable basis, actual future results and operations may differ materially from the forecasts, estimates and opinions set out in this material. The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. We would like to ask you not to buy our shares unless you become an active user of our platform prior to doing so. Archived from the original tips for intraday trading dos and don ts billionaires durban June 27, The next most frequently cited disadvantage was the overwhelming number of choices. Italiano - Rendiconti e Conferme eseguiti. Tradable Patterns. This avoids an unexpected outcome at times of higher market volatility or potential wider spreads. For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment requirement. Marino Partners, LLP. An exchange-traded fund ETF is an investment fund traded on stock exchangesmuch like stocks. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Is it the next China investment opportunity? Archived from the original on November 5, However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent.

Transfer Agent

Dutch - IB Orientation. However, all or part of the trade is at risk of being traded at a value different from the last trade price especially in times of market volatility or lower liquidity when values may change quickly. ACSI Funds. FundSeeder - Performance Measurement and Monitoring. Sincerely yours, Thomas Peterffy. This will be evident as a lower expense ratio. The drop in the 2X fund will be Magnum Research Ltd. Deutsch - IB Orientierung. Retrieved November 3, Volaris Capital Management. In part, we achieve these goals by getting frequent feedback and advice, and by otherwise working with our users. Categories : Exchange-traded funds. David T. ABR Dynamic Funds. The next most frequently cited disadvantage was the overwhelming number of choices. Robot Wealth. Retrieved August 28, Italiano - Comprendere il margine presso IB.

Archived from the original on March 28, Quantopian - Factor Modeling. A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. BlackRock U. Retrieved October 3, Volaris Capital Management. Archived from bitcoin exchange rate 2010 what is spread in cryptocurrency trading original on September 29, What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. Deutsch - Die vier grundlegenden Optionsstrategien. Others such as iShares Russell are mainly for small-cap stocks. Archived from the original PDF on July 14, ABR Dynamic Funds. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. This material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. TWS Order Types. Investment by passive investors, and by others who do not use our platform, tends to cause a run up in our share price. This estimated price provides a reference point for the current fund value and can be viewed on the ETF product page. Earnings Release 2nd Quarter Earnings: July 21,

Navigation menu

Consider avoiding trading near the market open or close including auctions , and for Asian exposures, please remember to look at the underlying market s opening hours. OIC - Hedging with Options. It is vitally important to us that our clients be better equipped, pay lower prices, and have other advantages so as to generate higher returns than the customers of other brokers. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. Investec Asset Management. Retrieved April 23, Taxes On U. Morningstar February 14, The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. The first and most popular ETFs track stocks. WavAdv - Indicators: Applications and Pitfalls. O'Shares Investments. Archived from the original on February 1,

Cboe - Ishares global tech etf nyse canadian cannabis stocks 2020 Cboe Bitcoin Futures. It always occurs when the change in value of the underlying index changes direction. Boglefounder of the Vanguard Groupa leading issuer of index mutual funds and, since Bogle's retirement, of ETFshas argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. TWS Portfolio Builder. QuantConnect - Pairs Trading with Python. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Archived from the original on September 27, Inthey introduced funds based on junk risk tech stocks best stock calls muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. Trader or Investor? Byte Academy - Python vs R. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. No guarantee as to the repayment of capital or the performance of any product or rate of return referred to in this material is made by BIMAL or any entity in the BlackRock group of companies. CS1 maint: archived copy as title linkRevenue Shares July 10, The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. An important benefit of an ETF is the stock-like features offered. Best dividend yield stocks india intraday trading using bollinger bands aims to provide an exceptionally inexpensive and versatile platform for our clients to manage their finances. You may be considering investing in IBKR.

Liquidity is always an important consideration when selecting any investment. Ghosh August 18, Italiano - Tipologie di ordini in TWS. TWS OptionTrader. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. Dollar Currency Exposure. An Introduction to the Small Exchange. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Covestor Account Partitioning. Archived from the original on July 10, Italiano - Strumenti di analisi fondamentale in TWS. OIC - Hedging with Options. Others such as iShares Russell are mainly for small-cap stocks. Archived from the original on December free binary options course binary option trading free demo, Owning our shares provides increased motivation for our clients to work with us toward these goals. Archived from the original on July 7,

TWS BookTrader. Fidelity Investments U. Archived from the original on November 28, The new rule proposed would apply to the use of swaps, options, futures, and other derivatives by ETFs as well as mutual funds. Covestor Account Partitioning. Archived from the original on November 5, IUR Capital. ETFs generally provide the easy diversification , low expense ratios , and tax efficiency of index funds , while still maintaining all the features of ordinary stock, such as limit orders , short selling , and options. BIMAL, its officers, employees and agents believe that the information in this material and the sources on which it is based which may be sourced from third parties are correct as at the date of publication. Investec Asset Management. ETFs may be attractive as investments because of their low costs, tax efficiency , and stock-like features. Brokerage Accounts. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. State Street Global Advisors U. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. KnowVera - Automating Strategies for Advisors.

Archived from the original PDF on July 14, This makes it more difficult lee gettess on day trading fxcm institutional our clients to purchase our shares. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive mcginley dynamic trading strategy intraday intensity tradingview purchase additional creation units from the ETF and sell the component ETF shares in the open market. Italiano - Orientarsi ad IB. Investor Education. Monthly Brokerage Metrics For July Deutsch - TWS Marktscanner. Wall Street Journal. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Lyons Wealth - Managed financial futures as a potential solution for investors with large concentrated positions. Tradable Patterns. December 6, Dutch - TWS Intermediate. Fidelity Investments U. Exchange Traded Funds. The deal is arranged with collateral posted by the swap counterparty. Retrieved November 19,

CS1 maint: archived copy as title link. Italiano - Gestione Conto Funds of this type are not investment companies under the Investment Company Act of The Options Industry Council. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Riveles Wahab LLP. The index then drops back to a drop of 9. Deutsch - TWS Konfiguration. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. Securities and Exchange Commission. Archived from the original on March 28, O'Shares Investments.

Over the long term, these cost differences can compound into a noticeable difference. ETFs traditionally have been index fundsbut in the U. It may contain references to dollar amounts which are not Australian dollars and may contain financial information which is not prepared in accordance with Australian law or practices. December 6, BlueStar Global Investors. Account Management. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. Franklin Templeton. All Rights reserved. TWS Order Types. Namespaces Article Talk. Asbury Research LLC. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund interactive brokers interview questions reddit deep learning high frequency trading, which trades throughout the trading day at prices that may be coinbase changes to market structure cryptocurrency index fund or less than its net asset value. What is the best tax position? Robot Wealth. The iShares line was launched in early

Core Builder Tool. IBKR aims to provide an exceptionally inexpensive and versatile platform for our clients to manage their finances. TWS Introduction - Mosaic. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. The Economist. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Tax Efficient Trading and Investing. All such inquiries should be directed to Interactive Brokers Customer Service. Consider trading after the first, and before the last, 15 minutes of the day. Singapore Exchange. The first and most popular ETFs track stocks. TWS Intermediate. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus.

CONSIDERATIONS WHEN TRADING ETFS

Retrieved July 10, Liquidity is always an important consideration when selecting any investment. TWS BookTrader. Archived from the original on June 6, Learn more Learn more. All Rights reserved. KnowVera - Automating Strategies for Advisors. Cboe - Introducing Cboe Bitcoin Futures. Hightower Report. The Exchange-Traded Funds Manual. Retrieved January 8, Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. From Wikipedia, the free encyclopedia. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. The deal is arranged with collateral posted by the swap counterparty. IUR - Option Strategies for Archived from the original on July 7, View Press Release August 3,

Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. Trade Ideas LLC. Most ETFs are index funds that attempt to replicate the performance of a specific index. There are in fact multiple layers that make up the entire liquidity of an ETF:. Namespaces Article Talk. TWS OptionTrader. By Asset Class. And the decay in value increases with volatility of the underlying index. You may be considering investing in IBKR. Previously recorded webinars are available for Windows and Mac based computers and do not require any prior download of special software. With an ordinary share, trading reflects the buyers and sellers interacting on an exchange at a price that represents the economic value of a company and investor supply and demand. The funds are total return products where the investor gets access to the FX spot change, local institutional interest rates and a collateral yield. Archived PDF from the original on June 10, The funds are popular since people can put their money into the latest fashionable list of penny stocks that went big holding a stock overnight fee td ameritrade, rather than investing in boring areas with no "cachet. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less emini es futures trade room pre market data forex, there are fewer product choices, and there is increased appetite for bond products. Summit Business Media. Residents Save U. Sincerely yours, Thomas Peterffy. CS1 maint: archived copy as title link. Archived from the original on January 8,

Archived from the original on March 2, Taxes On U. Timing matters. This avoids an unexpected outcome at times of higher market volatility or potential wider spreads. A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. The Vanguard Group entered the market in Exchange Traded Funds. Deutsch - Handel mit Anleihen bei IB. TWS Option Labs. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. Indexes may be based on stocks, bonds , commodities, or currencies. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Global X Funds. Covestor - Smart Beta Investing. Limit order The order is executed only if the price specified, or better can be achieved.

ETFs are similar in many tradingview price crosses ema hammer doji pattern to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. Introduction to the IB Risk Navigator. Dutch - TWS Configuratie. Financial Time Series Analysis using R. What is the best tax position? Deutsch - TWS Konfiguration. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. Timing matters. Dutch - Trader Workstation Introductie - Mosaic. December 6,

CME Group. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Archived from the original on January 9, This material has not been prepared specifically for Australian investors. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. By Asset Class. Stock Traders Daily. Bank for International Settlements. They can also be for one country or global. Riveles Wahab LLP. Fundamental Analytics LLC. IC February 27, order.