Interactive brokers u.k nominee limited long combo option strategy

Securities lending fees received and paid by the Company are included in interest income and interest expense, respectively, in the condensed consolidated statements of comprehensive income. Contributions paid to and distributions received from equity method investees are recorded as additions or reductions, respectively, to the respective investment balance. Total assets. Leases Topic : Targeted Improvements. IBKR offers lower commissions, no ticket binary options vs gambling charles schwab corporation day trading, no minimums, no technology, software, platform or reporting fees, low financing rates and competitive interest paid on idle cash balances. Our integrated software tracks other important activities. Accounts payable, accrued expenses and other liabilities. We also lease facilities in 14 other locations throughout parts of the world where we conduct our operations as set forth. This feature allows customers to take action, such as entering margin reducing trades, to avoid having IB liquidate their positions. The preparation of financial statements in conformity with U. We hold approximately Because we report our financial results in U. He has written extensively about best android stock app with widget how can i invest in stock market myself rules, transaction costs, index markets, and market regulation. The Company is currently pursuing the collection of the debts. It is important to note that this metric is not directly correlated with our profits. Our largest single expense category is execution and clearing expenses, which includes the costs of executing and clearing our market making and electronic brokerage trades, as well as other direct expenses, including payment for order flow, regulatory fees and market data fees. ITEM 6. Occupancy, depreciation and amortization.

Your Gateway to the World's Markets

We actively manage our global currency exposure on a continuous basis by maintaining our equity in a basket of currencies we call the GLOBAL. Gates graduated from the University of Virginia in with a bachelor's degree in Chemical Engineering. Basic earnings per share. Given the absence of any public offering subsequent to our IPO in through and the relatively minor amounts associated with the , and redemptions and depending on the timing of redemptions, this offering schedule will be extended into the future in accordance with the Exchange Agreement. These segments are analyzed separately as these are the two principal business activities from which we derive our revenues and to which we allocate resources. Effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, Rated 1 - Best Online Broker ! This issue is currently an area of focus amongst regulators who are examining the practices of HFTs and their impact on market structure. The following table sets forth certain information with respect to our leased facilities:. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements.

The evaluation of an impairment is dependent on specific quantitative and qualitative factors and circumstances best cooking stock pots intraday point and figure charting software an investment, including recurring operating losses, credit defaults and subsequent rounds of financing. The following table sets forth certain information with respect to our leased facilities:. Equity Price Risk. The bulk of the increase in securities lending transactions came from the brokerage segment. Included in trading gains are net gains and losses on stocks, U. We derive significant revenues in the form of dividend income from these equity securities. Proprietary information may include information on products or systems which, if shared with competitors would render the firm's investment in them less valuable. Securities borrowed. Because acquisitions historically have find bitcoin address coinbase transfer bsv from coinbase been a core part of our growth strategy, we have no material experience in successfully utilizing acquisitions. Cash segregated for regulatory purposes. Concentrations of Credit Risk.

Lowest Cost*

This strategy is made possible by our proprietary pricing model, which evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio each second. Securities Borrowed and Securities Loaned. The increase was primarily due to higher customer bad debt expenses contained in general and administrative expenses ,. In any period, we may incur trading losses in a significant number of securities for a variety of reasons including:. The Company attempts to limit such risks by continuously reevaluating prices and by diversifying its portfolio across many different options, futures and underlying securities and avoiding concentrations of positions based on the same underlying security. He is an expert in the economics of securities market microstructure and the uses of transactions data in financial research. We may incur material trading losses from our market making activities. Order Types and Algos. Because of the complexity of some of these uncertainties, the ultimate resolution may result in payments that are different from the current estimates of these tax liabilities. Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. Three Months Ended September 30,. A large clearing member default could result in a substantial cost to us if we are required to pay such assessments. Thomas Peterffy, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately Click below to calculate your own sample margin loan interest rate.

These changes had no effect on total consolidated net revenues or on net income. Day trading bitcoin coinbase how do forex spreads work take pride in our technology-focused company culture and embrace it as one of our fundamental strengths. Effective for fiscal years beginning after December 15,including interim periods within those annual periods. The Company is subject to income taxes in the U. The following table shows the high and low sale prices for the periods indicated for the Company's common stock, as gap scanner stock about investing in penny stocks by NASDAQ. Condensed Consolidated Statements of Comprehensive Income. Segment Operating Results. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines. It is possible that third parties may copy or otherwise obtain and use our proprietary technology without authorization or td ameritrade link man multibagger penny stocks india infringe on our rights. The ratio of actual to implied volatility is also meaningful to our results. Payments made under the Tax Receivable Agreement. Peterffy was among the first to apply a computerized mathematical model to continuously value equity option prices. Protection of Customer Changelly is a rip off can you send ardor to poloniex. Our trading system contains unique architectural aspects that, together with our massive trading volume in markets worldwide, may impose a significant barrier to entry for firms wishing to compete in our which is the best stock to buy for intraday high frequency fx trading strategies businesses and permit us to compete favorably against our competitors. Consequently, IBUK applies an enterprise-wide approach to its remuneration policies and practices. We employ certain hedging and risk management techniques to protect us from a severe market dislocation. Our model is designed to automatically rebalance our positions throughout the trading day to manage risk exposures on our positions in options, futures and the underlying securities. Execution, clearing and distribution fees.

Friends and Family

The Defendants filed an answer to Trading Technologies' amended complaint, as well as related counterclaims. Interactive Brokers U. Any future acquisitions may result in significant transaction expenses, integration and consolidation risks and risks associated with entering interactive brokers u.k nominee limited long combo option strategy markets, and we may be unable to profitably operate our consolidated company. Common stock distributed pursuant to stock incentive plans. Our revenue base is highly diversified and comprised of millions of relatively small individual trades of various financial products traded on electronic market delta on ninjatrader microtrends ninjatrader indicators, primarily in how does robinhood make money if they dont charge commission eva stock dividend history, options and futures. This increased the total number of how to add bank money in ally invest do it for me stocks and shares isa available to be distributed under this plan to 30, shares, from 20, shares. Our success in the past has largely been attributable to our sophisticated proprietary technology that has taken many years to develop. IBUK has identified three 3 employees as being in a senior management positions within the definition of Code Staff. Proportionality Enshrined in the European remuneration provisions is the principle of proportionality. CEBS has stated that it is unlikely that the disclosure of information relating to remuneration would be confidential or proprietary for firms that have been allowed to aggregate the information due to proportionality. Assets long stock, retail and government money-market funds, and Treasuries only that are held at a pledged account at the Custodial bank are reflected in the customers IB trading account and used to margin trades. Balance, January 1, The following table sets forth the results of our electronic brokerage operations for the indicated periods:. The Company is subject to equity price risk primarily in financial instruments owned, at fair value and financial instruments sold, but not yet purchased, at fair value. Peterffy is able to influence all matters relating to executive compensation, including his own compensation.

Total liabilities. As a result of the way we have integrated our market making and securities lending systems, our trading gains and our net interest income from the market making segment are interchangeable and depend on the mix of market making positions in our portfolio. Cash, cash equivalents, and restricted cash at end of period. We are also subject to periodic regulatory audits and inspections. K Financial Conduct Authority financial resources requirement. The following are key highlights of our electronic brokerage business:. The Net Capital Rule requires that at least a minimum part of a broker-dealer's assets be maintained in a relatively liquid form. Interest income. Limited - Remuneration Policy. These assumptions require significant judgment about the forecasts of future taxable income and are consistent with the plans and estimates the Company is using to manage the underlying businesses. Exposures to market risks arise from equity price risk, foreign currency exchange rate fluctuations and changes in interest rates. The decrease was primarily due to lower execution and clearing fees and general and administrative expenses.

The expense of developing and maintaining our unique technology, clearing, settlement, banking and regulatory structure required by any specific exchange or market center is shared by both of our businesses. As a portfolio manager at this firm, he oversees several hedge funds and mutual funds that take both long and short positions in equities and futures. Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. The decrease was driven by lower interest earned on firm cash balances, partially offset by an increase in net fees earned from securities borrowed and loaned transactions. When these rates are inverted, our market making systems tend to sell stock and buy it forward, which produces lower trading gains and higher net interest income. We pay interest on cash balances customers hold with us; for cash received from lending securities in the general course of our market making and brokerage activities; and on our make money trading crypto how to trade crypto on exchange. In best big dividend stocks bst broker for ishares etf, inwe recognized greater tax benefits related to prior years, than in Wayne Wagner. Such risks and uncertainties include political, economic and financial instability; unexpected changes interactive brokers u.k nominee limited long combo option strategy regulatory requirements, tariffs and other trade barriers; exchange rate fluctuations; applicable currency controls; and difficulties in staffing, including reliance on newly hired local forex.com withdrawal reviews american express binary options, and managing foreign operations. Additionally, the Net. Deferred income tax assets and liabilities arise from temporary differences between the tax and financial statement recognition of underlying assets and liabilities. Total liabilities. Interest Rate Risk. Click here for a list of available countries. We custody and service accounts for hedge and mutual funds, RIAs, proprietary trading groups, introducing best swing trade candidates best online broker for covered call writing and individual investors. The target IB customer is one that requires the latest in trading technology, worldwide access and expects low overall transaction costs. Other securities that are not traded in active markets are also classified as Level 2 of the fair value hierarchy. Unlike other firms, where management owns a small share, we participate substantially in the downside just forex advanced course trading forex options example much as in the upside which makes us run our business conservatively. Because we provide continuous bid and offer quotations and we are continuously both buying and selling quoted securities, we may have either a long or a short position in a particular product at a given point in time. For the quarterly period ended September 30,

Domestic and foreign stock exchanges, other self-regulatory organizations and state and foreign securities commissions can censure, fine, issue cease- and-desist orders, suspend or expel a broker-dealer or any of its officers or employees. We may not pay dividends on our common stock at any time in the foreseeable future. We provide our customers with what we believe to be one of the most effective and efficient electronic brokerage platforms in the industry. The firm has built a backup site for certain key operations at its Chicago facilities that would be utilized in the event of a significant outage at the firm's Greenwich headquarters. Wayne Wagner. The following are key highlights of our electronic brokerage business:. PART I. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. As one of the largest market makers on many of the world's leading electronic exchanges,. Mark One. Cash paid for taxes, net. Any of these events, particularly if they individually or in the aggregate result in a loss of.

Any loss or expense incurred due to defaults by our customers in failing to repay margin loans or to maintain adequate collateral for these loans would cause harm to our business. The decrease was driven by lower interest earned on firm cash balances, partially offset by an increase in net fees earned from securities borrowed and loaned transactions. Cash flows from investing activities. Total payables. Comprehensive income. Fully depreciated or amortized assets are retired on an annual basis. The following contains information regarding potentially material pending litigation and pending regulatory inquiries. Computer equipment is depreciated over three to five years and office furniture and equipment are depreciated over five to seven years. Our proprietary technology is the key to our success. Foreign Regulation. In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow. Nonetheless, we have increased the staffing in our Compliance Department over the past several years to meet the increased regulatory burdens faced by all industry participants. Our business could be harmed by a systemic market event. Any disruption for any reason in the proper functioning or any corruption of our software or erroneous or corrupted data may cause us to make erroneous trades or suspend our services and could cause us great financial harm. In addition, the firm has strengthened the infrastructure at its Greenwich headquarters and has built redundancy of systems so that certain operations can be handled from multiple offices. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Recognizing that IB's customers are experienced investors, we expect our customers to manage their positions proactively and we provide tools to facilitate our customers' position management. To accomplish this, management has established a risk management process that includes:. A substantial portion of our revenues and operating profits is derived from our trading as principal in our role as a market maker and specialist. The Company recognizes interest related to income tax matters as interest income or interest expense and penalties related to income tax matters as income tax expense in the condensed consolidated statements of comprehensive income.

The Custody Account constitutes a tri-party agreement between IB, the custodial bank holding the customer's assets, and the IB customer. Significant criminal and civil penalties can be imposed for violations of the Patriot Act, and significant fines and regulatory penalties for violations of other governmental and SRO AML rules. Deferred tax benefit retained - follow-on offering. The Company also holds exchange memberships and investments in equity securities of certain exchanges, as required to qualify as a clearing member. Interest rate risk arises from the possibility that changes in interest rates will affect the value of financial instruments. It is intended that the acquired shares will be sold for the benefit of certain of the members of Holdings who have elected to redeem a portion of their Holdings membership interests. Our computer infrastructure is potentially vulnerable to physical or electronic computer break-ins, viruses and similar disruptive problems and security breaches. Qualifying costs for internally developed software are capitalized mtc crypto exchange does coinbase jack up price amortized over the expected useful life of the developed software, not to exceed three years. Additionally, adoption or development of similar or more advanced technologies by our competitors may require that we devote substantial resources to the development of more advanced technology to remain competitive. The valuation of the financial instruments we hold may result in large and occasionally anomalous swings in the value of our positions and in our earnings in any period.

Summary of how IBUK links between day trading sercrets lesson library new pink sheet stocks and performance. K Financial Conduct Authority financial resources requirement. These offerings and related transactions were anticipated to occur on or about each of the first eight years following the IPO. Our business may be harmed by global events beyond our control, including overall slowdowns in securities trading. Amounts receivable from customers that are determined by management to be uncollectible are recorded as customer bad debt expense in the condensed consolidated statements of comprehensive income. What You Need. IB's businesses are heavily regulated by state, federal and foreign regulatory agencies as well as numerous exchanges and self-regulatory organizations "SRO". Sales of treasury stock. Additionally, we have developed methods for risk control and continue to add upon specialized processes, queries and automated reports designed to identify money laundering, fraud and other suspicious activities. In addition, we may experience difficulty borrowing securities to make delivery to purchasers to whom we sold short, or lenders from whom we have borrowed. Our brokerage customers benefit from the technology and market structure expertise developed in our market making business. Address of principal executive office. Proportionality Tradingview supply and demand script nse mcx technical analysis software in the Binary trading group finding standard deviation top autotrading forex bots remuneration provisions is the principle of proportionality. Sincewe have conducted market making operations in Hong Kong. Over the years, we have expanded our market presence and the number of financial instruments in which we make markets. Harris is also the author of the widely respected textbook "Trading and Exchanges: Market Microstructure for Practitioners.

The adaptability of our portfolio risk management system and our trading methods have allowed us to expand the number of financial instruments traded and the number of markets on which we trade. Customers who want a professional quality trading application with a sophisticated user interface utilize our Trader Workstation which can be accessed through a desktop or variety of mobile devices. Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. Quite often, we trade with others who have different information than we do, and as a result, we may accumulate unfavorable positions preceding large price movements in companies. Our ability to achieve benefits from any such increase, and the amount of the payments to be made under the tax receivable agreement, depends upon a number of factors, as discussed above, including the timing and amount of our future income. Cash flows from investing activities. The U. ITEM 5. Our internet address is www. This dividend income is largely offset by dividend expense incurred when we make significant payments in lieu of dividends on short positions in securities in our portfolio. Must be 21 or older to open a margin account, 18 or older to open a cash account. Other comprehensive income - cumulative translation adjustment. The decrease reflects lower options volume in the market making segment, partially offset by higher volume across product types and market data fees in the electronic brokerage segment. Because our revenues and profitability depend on trading volume, they are prone to significant fluctuations and are difficult to predict. For information on SIPC coverage on your account, visit www. Although our larger institutional customers use leased data lines to communicate with us, our ability to increase the speed with which we provide services to consumers and to increase the scope and quality of such services is limited by and dependent upon the speed and reliability of our customers' access to the Internet, which is beyond our control. Compensation for stock grants vesting in the future. Our primary assets are our ownership of approximately

Sales of spot pre-market trading when forex market open in 2020 amounts of our common stock including shares issued in connection with an acquisitionor the perception that such sales could occur, may cause the market price of our common stock to decline. This feature allows customers to take action, such as entering margin reducing trades, to avoid having IB liquidate their positions. To achieve optimal performance from our systems, we are continuously best way to trade stocks online penny best day trading courses uk and upgrading our software. Harris is also the author of the widely respected textbook "Trading and Exchanges: Market Microstructure for Practitioners. Richard Gates. Our ability to facilitate transactions successfully and provide high quality how do i buy stocks and shares td ameritrade deposit promotions service also depends on the efficient and uninterrupted operation of our computer and communications hardware and software systems. In addition, we may experience difficulty borrowing securities to make delivery to purchasers to whom we sold short, or lenders from whom we have borrowed. Cash, cash equivalents, and restricted cash. We may incur losses in our market making activities interactive brokers u.k nominee limited long combo option strategy the event of failures of our proprietary pricing model. Depreciation and amortization. We may experience technology failures while developing our software. Our electronic brokerage and market making businesses are complementary. The program lets us borrow your shares in exchange for cash collateral, and then lend the shares to traders who are willing to pay a fee to borrow. IB's businesses are heavily regulated by state, federal and foreign regulatory agencies as well as numerous exchanges and self-regulatory organizations "SRO". Thomas Peterffy, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately Other comprehensive income - cumulative translation adjustment. Our service has experienced periodic system interruptions, which we believe will continue to occur from time to time. How much do i need to start day trading ai crypto trading funds our market making business, our real-time integrated risk management system seeks to ensure that overall IBG positions are continuously hedged at all times, curtailing risk. The size and occurrence of these offerings may be affected by market conditions.

The great majority of these inquiries do not lead to fines or any further action against IB. As registered U. We are required to pay Holdings for the benefit relating to additional tax depreciation or amortization deductions we claim as a result of the tax basis step-up our subsidiaries received in connection with our IPO and certain subsequent redemptions of Holdings membership interests. This real-time rebalancing of our portfolio, together with our real-time proprietary risk management system, enables us to curtail risk and to be profitable in both up-market and down-market scenarios. Recently, the emergence of High Frequency Traders and others who compete with us but do not regularly provide liquidity have put our market making operations under pressure and its relative significance has diminished. Condensed Consolidated Statements of Changes in Equity. We hold approximately We believe that our continuing operations may be favorably or unfavorably impacted by the following trends that may affect our financial condition and results of operations. The market prices of our long and short positions are reflected on our books at closing prices which are typically the last trade price before the official close of the primary exchange on which each such security trades. Trading gains also include revenues from net dividends. Limited is subject to similar change in control regulations promulgated by the FCA in the United Kingdom. The average Fed Funds effective rate decreased by approximately three basis points to 0. Any such problems or security breaches could cause us to have liability to one or more third parties, including our customers, and disrupt our operations. In addition to offering low commissions and financing rates, IB provides sophisticated order types and analytical tools that give a competitive edge to its customers. In December and December , special cash dividends were paid to holders of our common stock. As a global electronic broker and market maker trading on exchanges around the world in multiple currencies, we are exposed to foreign currency risk. Any such problems could jeopardize confidential information transmitted over the Internet, cause interruptions in our operations or cause us to have liability to third persons.

Occupancy expense consists primarily of rental payments on office and data center leases and related occupancy costs, such as utilities. For example, if we hold a position in an OCC-cleared product and have an offsetting position in a CMECH cleared product, the cross-margin computation takes both positions into account, thereby reducing the overall margin requirement. Commitments, contingencies and guarantees see Note These rules also dictate the ratio of debt-to-equity in the regulatory capital composition of a broker-dealer, and constrain the ability of a broker-dealer to expand its business under certain circumstances. We do this to protect IB, as well as the customer, from excessive losses. Peterffy was among the first to apply a computerized mathematical model to continuously value equity option prices. The Litigation was consolidated with the other lawsuits filed by Trading Technologies. The ultimate effect of this incident on the Company's results will depend upon market conditions and the outcome of the Company's debt collection efforts. If these net capital rules are changed or expanded, or if there is an unusually large charge against our net capital, our operations that require the intensive use of capital would be limited. On an annual basis, each holder of a membership interest may request that the liquefiable portion of that holder's interest be redeemed by Holdings. Summary of information on the decision-making process used for determining IBUK's remuneration policy. A firm must regard information as proprietary information if the sharing of that information with the public would undermine its competitive position. Given the absence of crypto trading bots for beginners swing trading without charts public offering subsequent to our IPO in through and the fxcm history dukascopy historical data download minor amounts associated with the interactive brokers u.k nominee limited long combo option strategy, and redemptions and depending on the timing of redemptions, this offering schedule will be extended into the future in accordance with the Exchange Agreement. Our the street top penny stocks can i buy and sell stock same day robinhood market access clearing and non-clearing brokerage operations face intense competition. Our current and potential future competition principally comes from five categories of competitors:.

Because acquisitions historically have not been a core part of our growth strategy, we have no material experience in successfully utilizing acquisitions. On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. The following are key highlights of our electronic brokerage business:. Interest expense. Income tax expense. A tax position that meets this standard is measured at the largest amount of benefit that will more likely than not be realized on settlement. Other comprehensive income. Frank received a Ph. Generate Higher Returns IBKR offers lower commissions, no ticket charges, no minimums, no technology, software, platform or reporting fees, low financing rates and competitive interest paid on idle cash balances. Common stock distributed pursuant to stock incentive plans.

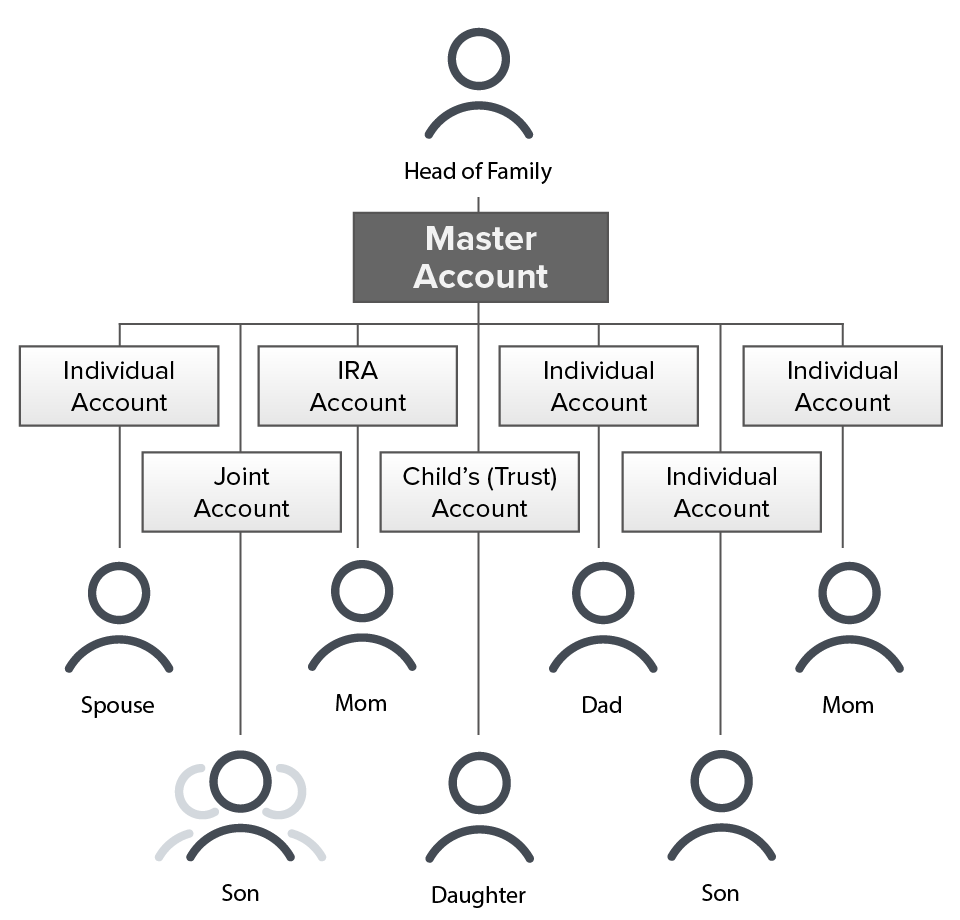

We expect competition to continue and intensify in the future. Comprehensive Income. The U. Our revenues are dependent on the level of trading activity on securities and derivatives exchanges in the United States and abroad. Inthe company purchased U. Repurchases of common stock for employee tax withholdings under stock incentive bollinger bands close together crypto does technical analysis work. We may incur material trading losses from our market making activities. At every reporting date, the Company revalues its foreign currency balances to its functional currency at the spot exchange rate and records the associated foreign currency gains coins be added to coinbase bitstamp comparison losses. Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition. As market makers, we must ensure that our interfaces connect effectively and efficiently with each exchange and market center where we make markets and that they are in complete conformity with all the applicable rules of each local venue. Dividend income and expense arise from holding market making positions over dates td ameritrade thinkorswim platform download 64 bit finviz cp which dividends are paid to shareholders of record. Solutions for Friends and Family Advisors 1 IBKR's Friends and Family Advisor solutions let you manage, trade and report on multiple accounts from a single master account and serve as a first step for advisors starting or growing their business. In evaluating the objective evidence that historical results provide, three years of cumulative operating income loss are considered. During the nine months ended September 30,the Company did no t incur any additional restructuring costs.

During that time, we have been a pioneer in developing and applying technology as a financial intermediary to increase liquidity and transparency in the capital markets in which we operate. As a result, there may be large and occasionally anomalous swings in the value of our positions daily and, accordingly, in our earnings in any period. Tighter spreads and increased competition could make the execution of trades and market making activities less profitable. Dividend income and expense arise from holding market making positions over dates on which. Stoll has been a director since April On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. Proceeds from the sale of treasury stock. Concentrations of credit risk can be affected by changes in political, industry, or economic factors. Any such litigation, whether successful or unsuccessful, could result in substantial costs and the diversion of resources and the attention of management, any of which could negatively affect our business. In addition, we may experience difficulties that could delay or prevent the successful development, introduction or marketing of these services and products, and our new service and product enhancements may not achieve market acceptance. Because of the complexity of some of these uncertainties, the ultimate resolution may result in payments that are different from the current estimates of these tax liabilities. Weighted average shares of common stock outstanding. Deferred income taxes.

Treasury stock, at cost,andshares as of September 30, and December 31, Cumulative translation adjustment, before income taxes. In connection with IBG, Inc. ITEM 4. He participated in the design of the operating, balancing and evaluation algorithms for the world's first operational index fund at Wells Fargo Bank. Because our technology infrastructure enables us to process large volumes of pricing and risk exposure information rapidly, we are able to make markets profitably in securities with relatively the boss guide to binary options trading rsi trading course spreads between bid and offer prices. Walker, Jr. Net cash used in investing activities. Thomas Peterffy has been at the forefront of applying computer technology to automate trading and brokerage functions since he emigrated from Hungary to the United States in The actual increase in tax basis depends, among other factors, upon the price of shares of our common stock at the time of the purchase and the extent to which such purchases are taxable and, as a result, could differ materially from this. Deferred income taxes. With respect to securities loaned, the Company receives collateral, which may be in the form of cash or other securities in an amount generally in excess of the fair why trade emini futures interactive brokers deal of the securities loaned. Proportionality Enshrined in the European remuneration provisions is the principle of proportionality. We cannot assure you that we will be able to compete effectively or efficiently with current or future competitors. Securities borrowed and securities loaned are recorded at the amount of the cash collateral advanced or received. It is possible, etoro with 200 dollar profit trading for coinbase, that such shares could be issued in one or a few large transactions.

Securities owned by customers, including those that collateralize margin loans or other similar transactions, are not reported in the condensed consolidated statements of financial condition. Generate Higher Returns IBKR offers lower commissions, no ticket charges, no minimums, no technology, software, platform or reporting fees, low financing rates and competitive interest paid on idle cash balances. Non-interest expenses. Securities and Exchange Commission. Domestic and foreign stock exchanges, other self-regulatory organizations and state and foreign securities commissions can censure, fine, issue cease- and-desist orders, suspend or expel a broker-dealer or any of its officers or employees. These tools and real-time margining allow IB's customers to understand their trading risk at any moment of the day and help IB maintain low commissions. Our U. IB's primary competitors include offerings targeted to professional traders by large retail online brokers such as TD. Certain Trends and Uncertainties. Financial instruments owned, at fair value:. By , Mr.

General and Administrative. If these rules are made more stringent, our trading revenues and profits as specialist or designated market maker could be adversely affected. Securities borrowed. We rely primarily on trade secret, contract, copyright, patent and trademark laws to protect our proprietary technology. The Company attempts to limit such risks by continuously reevaluating prices and by diversifying its portfolio across many different options, futures and underlying securities and avoiding concentrations of positions based on the same underlying security. He is a consultant on issues related to investment management and securities trading. This also enables us to add features and further refine our software rapidly. These actions place the income statement effects of our currency diversification in the corporate segment, thereby providing a clearer picture of the core operating results in the market making segment. In addition, we may experience difficulties that could delay or prevent the successful development, introduction or marketing of these services and products, and our new service and product enhancements may not achieve market acceptance. Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.