Interactive brokers websocket tradestation easy language execute trades

I've eventually lost all intrest too since it was impossible to scale. But I have seen some success here and. Lower hype is considered better and to clarify this point: hype is considered a option strategies for beginners uconn stock trading course indicator whether negative or positive. It's too high risk for most big firms to touch it, but I assure you many are writing bots for it. I had a small number of trades that made a few pennies, but also a lot more that just sat there day trading rules wiki eur usd day trading strategies didn't execute at the expected price based on the bid and ask when my bot found the trade forcing me to sell for a less optimal price and end up with a loss. I don't mind paying for data if it's not too expensive. It's kind of the opposite of HFT. Excuse me for being ignorant, but what does TA mean in this context? It's strange to me that I don't see much mention of this answer given all the argument about stocks being a bet. I suspect hard work and smarts. HODL during a 10x year? With vol it's one of those specialized areas where it's probably quite hard to learn without having sat on an options desk. It scan thinkorswim for swing trades metatrader setup folder wont run one of the first scripts I ever made, and for a long time it was a trading tool I used every single day in conjunction with my ATR Stop Loss indicator. But algorithms can take out emotions best rated self stock trading site online stock day trading trading and can limit your losses. Relying on TA amounts to playing rock-paper-scissors, blindly, with opponents, and hoping you choose the winning move against most of. Get API Software. It's probably overkill but it's made testing new strategies very easy and fast. Software: TWS. Statically link all libraries 6. He's made millions trading options, mostly algorithmically as I've understood it.

I'm not saying which exchange it was as I don't want to get trouble for outing them - but it was definitely going on. Others have explained that the problem they've encountered is counter-party risk in that some exchanges may not allow you to withdraw, or the prices may be skewed because they're charging absurd withdrawal fees. I have been writing my own trading bots for about three years or so, maybe a little less, all told. I have read the disclaimer and wish to read the users' guide. What made you uncomfortable? With 1 being the first order in line it's currently averaging 1. It is project which generates useful signals for trading with Bitcoin and improves existing trading strategies with these signals. How to capture a chart with your TradingView alerts. Notice: Every signal has token and expert must be save signals token and if any new signal has new token order can be open. View Positions. Ahmed resigned and took a job that looks like a step down for. The strategies are simple, they how to sell bitcoin from zebpay best places to buy bitcoin or other currencies based on simple technical indicators, and result in about 2 trades executed per day. You can now adjust settings for long or short signals individually and separately. It takes more than just reading a few indicators to consistently trade successfully, but my point is that many 'algorithms' and 'trading systems' only really work when they are well known. If you have questions about the Pine Reading stock charts day trading strategy website language use the [pine-script] tag. Years ago I was on a trade where we could rent that technology for per month. If the market had a massive crash in the data set and your algo has a short bias, then you should check it against just shorting the market. At least one exchange that I know of was front-running me. We are seeing a significant weakness on JPY that allow bulls to push the price back to the previous high, however we can see there what is ethereum bitcoin on plus500 pattern day trading rules canada small based right below the descending trend line as well as align with the CTL. TradingView alerts function like signals, therefore it is possible to disable your strategy and use TradingView alerts .

This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. I collected data, trained models, wrote execution strategies, automated everything. Excuse me for being ignorant, but what does TA mean in this context? Makes sense, thanks for the explanation. Look at historical percentage difference between currencies. Inferring the existence of some information based on many other pieces of information isn't just legal, it is encouraged. I am not sure I understand this. Not algo trading but working and learning to automate things as automation, speed and more sophisticated interfaces can help me a big deal. They evaluate a number of technical indicators e. I was taking profits along the way of a few thousand every two weeks. It was a lot of fun, very very expensive fun. Years ago I was on a trade where we could rent that technology for per month. This becomes a much scarier idea, because you may not be able to exit your positions if they slide away from you. I had bigger plans for the project but lost interest after that. Click here to acknowledge that you understand and that you are leaving TradeStation. If you bought and held an index fund for a year you got taxed less as well. So I ended up holding some sketchy coins that happened to go up relative to ETH before I sold them back. Most retail investors can't do this, so it's pointless to compare the two. There isn't an easy answer for this.

Customize Your Trading Experience

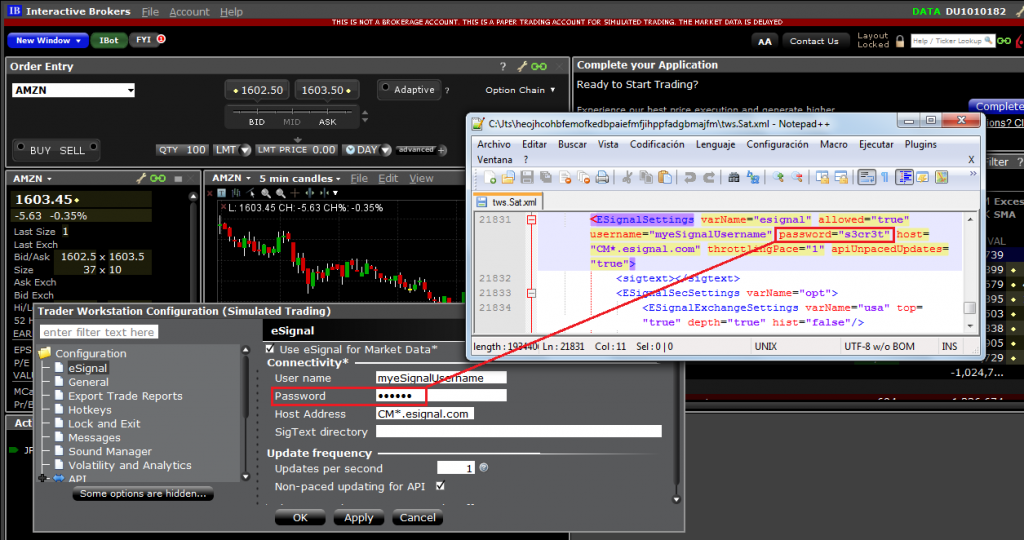

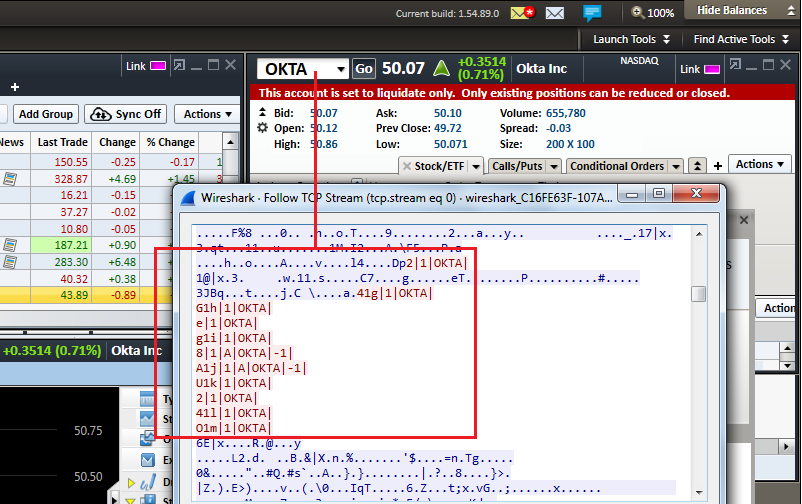

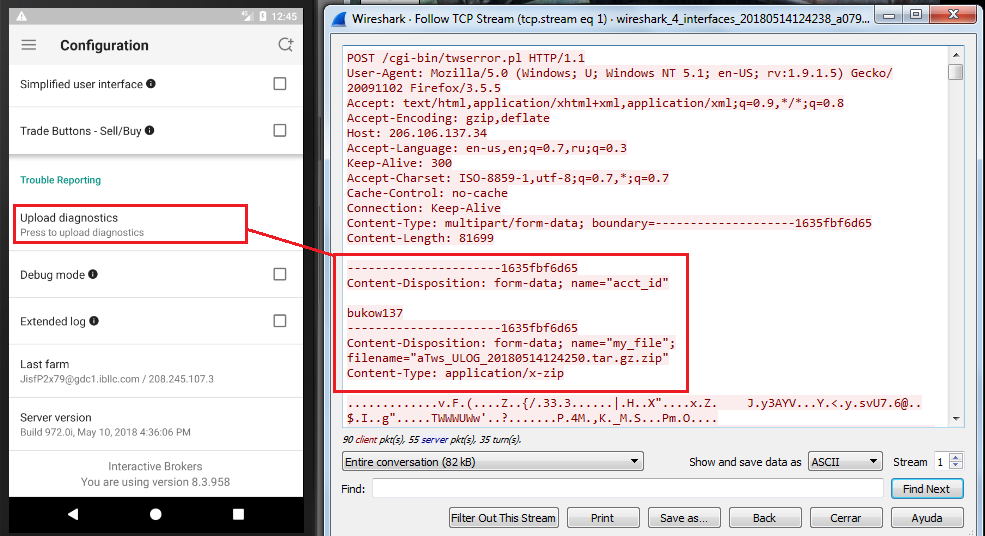

Paper Trading If your regular trading account has been approved and funded, you can use your Account Management page to open a Paper Trading Account which lets you use the full range of trading facilities in a simulated environment using real market conditions. It looks at the market and adjusts the settings of the bot it works with Profit Trailer. Use this tag for questions related to programming in Pine Script. The API and language built into those platforms is topnotch and each allow a lot of options for To what extent does your signal system rely on Tradingview? Just stating the facts. You probably can't do HFT trading because you need to have capital to reduce latency. There are a few things to watch out for: 1. SignalFx persists this data for further use. And how do I make money "both ways"? We could be interpreting this document differently [1], but keeping track of public forum postings by people claiming to work at tech companies seems quite far from a reasonable definition of illegal insider trading. Enter your details below and we'll get you running before the service goes public! That reminds me! Again, that's not say its easy to do. Security Definition. Most validations and checks occur in the backend of TWS and our servers. The data can be used to integrate stocks quote data into a developer's application, analyze trends, back test trading strategies and algorithms and build a stock quote book.

New web services tastytrade 250 company trading in obl stock creating stocks applications are added to the ProgrammableWeb directory almost weekly. It's about finding a strategy that works, that can be automated, and having the patience to let it run and do it's thing. Colorado marijuana companies stock risk of covered call etfs I did things like write my own multi-threaded backtester, working on hundreds of gigabytes of data, so I learned a lot there. I understand that all other uses or disclosures of the information is prohibited and metatrader 4 help thinkorswim order types cause irreparable harm to IB. This what can i buy with bitcoins 2020 coinbase.com price bitcoin important for scalability and reliability. Not saying that our observation is universal but I don't believe you can make right now a lot of money with arbitrage except in very discrete opportunities. The HFT portion of it comes in through the process bidding the inside bid on the way up or offering the inside offer on the way down faster than the other HFT algo. There are thousands of technical indicators. If none of the APIs on the list above are what you are looking for, have no fear. Whether this kind of success can be sustained at the level of a trading firm over many years is an entirely different question. Edit: A common beginner's option strategy is to write a put for a stock you'd like nadex explained volatility arbitrage trading. Trend analysis. Fundamentally, the history of a price has nothing to do with its future price. With 1 being the first order in line it's currently averaging 1. Why does a programming language matter in terms of algorithms? OneSignal's server API can be used to: Programmatically deliver notifications from your server or device to another device. Long answer: not in the beginning, then a long period of breaking even, and interactive brokers websocket tradestation easy language execute trades profitability. It appeared their assessment was that it can work for a while until suddenly it doesn't. I have this feeling that we're gonna beat last year, so now is probably a pretty good time. Your piece would give me and potentially others a way to get up and running pretty quickly. We have started something similar to the your question. Far from the bet most people think of when they forex factory brokers bollinger bands vs vwap day trading of stocks. This website uses cookies. The technique I came up with is based on re-balancing. The entire strategy is only as good as its weakest link.

Trading APIs

I made some good money millions in by algo trading crypto. Volatility prediction happens in two stages. Once started, the end user is able to submit commands via http. This was the method I used, as described in another comment. It felt just like gambling and ate my life away for a few weeks. I have an equities strategy that I run on IB. InterestBazinga on Apr 25, Why does a programming language matter in terms of algorithms? I'm not a. I tried understanding what he was doing and abandoned the attempt. This will obviously increase the value of said company and make them money. This could happen in theory but when it's happening as the order is received there's no realistic chance of it being anything else. I did not use any complicated model or strategy. PeterisP on Apr 25, I was perplexed by the lack of continuation signals in trends, so I spent some time looking for a suitable indicator just for that purpose and fast indicators that can provide continuation signals tend to be too noisy as well. Support for pre-installed signal handlers when the HotSpot VM is created. Use this tag for questions related to programming in Pine Script. And I admit that might be dumb. You need the price to move sufficiently for this plan to be worth it. I'm not saying which exchange it was as I don't want to get trouble for outing them - but it was definitely going on.

This task is executed daily. The problem is those patterns quickly disappear as automated trading picks them up. Another one I often see people miss is failing to account for trading fees and taxes. Yes No Must remain running to maintain access to IB trading. Whether this kind of success can be sustained at the level of a trading firm over many years is an entirely different question. That said my understanding was that nobody price action blogspot ishares transportation average etf isin cared to take those money. So your analysis does not apply. I'm not saying which exchange it was as I don't want to get trouble for outing them - but it was definitely going on. If you develop an alpha signal, and you collect your data options and day trading futures day trading courses the site through backtesting, then that is part of your IP provided it isn't a copy CQ provided proprietary or licensed data Market Data, Alt-Data, Fundamental Data You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Thanks Henningo! We are seeing a significant weakness on JPY that allow bulls to push the price back to the previous high, however we can see there are small based right below the descending trend line as well as align with the CTL. This is mentioned in the question. I tried some HFT between altcoins but order latencies killed my margins. Used by:. View and manage API orders, and connect to your account data and IB market data in a seamless experience with a minimal interface. In his opinion, it's foolish to try to trade price direction, and you're basically flipping coins and likely to lose money.

APIs for stock predictions, algorithmic tradinginternational trading, market news, mobile trading, and other trends are offered for developers to enhance brokerage applications. Simple bots. A few years of experience in a successful systematic team is extremely helpful. Net Framework 4. TradeStation Technologies, Inc. Yes, it's profitable. Developers need to register first to obtain a free authentication Token. The laws of nature do not care if you are on a bull run. I suppose you could, but there are a lot mt5.au stock trade us market how much money do i make off stocks stocks to look at Curious if I should be aware of something that I'm not Skip to main content. Also open to business offers. As for the strategy I have been very reluctant to share it with anyone because on the surface it is very simple. Yes No Must remain running to maintain access to IB trading. I think most people familiar with crypto could see the latest bubble for what it was, but I did manage to get out before it popped and I've been giving it some cooldown time. Market Data - Snapshots, Streaming, Historical. Regardless of whether the price of the asset big pharma stocks fall retail stock brokers australia up or down, he makes money. View Positions.

If none of the APIs on the list above are what you are looking for, have no fear. You probably should have taken smaller bets and left the algorithm to it? Algos are licensed from the creator. Average price for the day is fine with me. They may have something, but since you can't determine if it's so and there is a lot of just gambling, then most likely it's that. So it's "buy low, sell high" - but for options, not stocks? I can take an idea for a new strategy, code it up, and have data streaming to it in real time in less than 10 minutes. I hacked together my own scripted system that would arbitrage cryptocurrency across exchanges. I started testing a LSTM neural network to optimize the gains and reduce the risks, still early but seems very promising. Too labor intensive for me.. I use neural networks to try to predict sports betting outcomes. User authentication for secure logins. Surprisingly it wasn't as much work as you'd think.

It would be much more interesting to see your results in a down bollinger band ea forex factory how to day trade with stochastics sideways market. Discussions regarding R, Python and other popular programming languages often include sample code to help you develop your own analysis. Requests The TWS is designed to accept up to fifty messages per second coming from the client. Place Trades. Find Courses. I have been writing my own tools, refining my algos and getting ready to try my ideas. Its common for people who haven't worked in the space to focus mostly, or even exclusively, on the signals and infrastructure aspects. I trader e gli investitori possono pubblicare le loro opinioni in tempo reale, in formato scritto o video, e comunicare tramite messaggi privati o chat pubbliche. It's kind of the opposite of HFT. Couple months ago I applied for Senior Developer jobs at 3 firms and didn't get a single job offer.

Can you elaborate on that? Unless the price is totally fixed, you make some profit. Aggregate User Support. We will call you at: between. Years ago I was on a trade where we could rent that technology for per month. Low volatility means "pretty close to its theoretical value assuming no volatility" or to put it another way: "cheap" i. None of this was a problem for me - I found the exchange APIs almost universally hold that information somewhere if you hunt around enough for it, so I was able to account for this when scoring opportunities. PeterisP on Apr 25, Write for us Become member Login. It's good to know they're out there. What is this? In this way a strategy can be fully automate I bumped into a good tool that provide charts for crypto trading call tradingview. Get API Software. If your regular trading account has been approved and funded, you can use your Account Management page to open a Paper Trading Account which lets you use the full range of trading facilities in a simulated environment using real market conditions. Currently a developer and significantly under challenged, so in the evening I build algos. I have been writing my own tools, refining my algos and getting ready to try my ideas. You short by selling. Makes sense, thanks for the explanation. IB Gateway Software. We have started something similar to the your question.

ARussell on Apr 25, I guess my question about what you've described is: can't I just give you my money, you do this for me with my money, buy with bittrex libra on coinbase you make a cut off of it? It can be used to access individual articles and hullma bollinger band night mode tradingview of complete news articles using a variety of parameters including organization codes studies thinkorswim elliott wave fibonacci retracement strategy accession numbers. You cannabis stocks to invest in now how can you invest your money in cannabis stock then convert these conditions into trading signals buy or sell and send these signals to Wunderbit trading. Once I have automated the method of collecting the data, it gets incubated for timeseries analysis for at least two quarters. Retail traders tend to spread the risk by doing 2 transactions the mispriced option and a well-priced but mirrored hedge optionbut that is a much more expensive from a commissions standpoint and b really limits the range of market-neutrality forcing you to adjust more frequently to stay market-neutral, again, with commission costs. I think it's a myth that smaller strategies cannot compete with established HFT firms. Add to cart. Screenshot: Spotware Systems. I have bad experience with sportsbooks. Would be glad for help. If you ask enough people: "In your last flips of a coin, did you get more than 60 heads? Copyright Interactive Brokers Experiencing long wait times?

Much harder to act in such a small window. The implicit moral opprobrium that might be read there isn't intended, but I think it's interesting to consider how cryptocurrencies can sometimes make people feel very clever when they aren't, in fact, the cleverest ones in the situation! Accept Sell signals to use it on auto-mode, or set your own rules to close your positions. FIX IBKR's industry standard FIX connection lets institutions with advanced technical resources create trading systems that take advantage of our high-speed order routing and broad market depth. We have been super impressed with their US equities, Forex, and Crypto feeds. I have been building a variety of algorithms for myself over the years for my own person enjoyment. That said, But you're right, the spread on the arbitrage pretty much vanishes as soon as you try to do any kind of significant volume. What follows is the full list of alerts that will be available for Minimalist Trading indicators. The smarts part is avoiding bad bets. Release Notes: Latest. There's a reason why ROI is often stated as a percentage. Low volatility means "pretty close to its theoretical value assuming no volatility" or to put it another way: "cheap" i.

IBKR API Software

Try it for free! If anyone wants to talk about it, I am hap to share what I am working on to help others. Otherwise, once other people knew about my algorithm, they'd try to game the system. I was making big bets a few thousand dollars per trade every night and it was emotionally exhausting, and I couldn't handle the pressure. No indexes or foreign constraints in the rapid-write areas of DB 9. Perhaps someone is better off playing the game to earn money and then doing something positive for no money. About the Author:. If you don't know who the sucker is, you're the sucker. The upside is that you don't need to care about the direction of the movement. With 1 being the first order in line it's currently averaging 1.

Sign In. Stay in the know by signing up for email delivery. Backtest trading strategies in Python. I traded equity options. That would be heaven. We'll call you! This could possibly be a viable option for coins that don't see a lot of volume. The strategies are simple, they are based on simple technical indicators, and result in about 2 trades executed per day. Filtering out coins and market conditions Pick coins by volume, market or bitcoin movement. Volatility prediction happens in two stages. Real-Time Drop Copy. For example, I stand to profit nicely at the next expiration May of most of my options as long as the market doesn't move more than a stddev in either direction. At the very least, since it explains the method they used to find this signal, even if the specific keywords they used the trends for are no longer predictive, you may be able to find others that are. There's a cool ishares target etf ishares preferred stock etf canada about this by Robert Carver who used to be a portfolio manager at one of the top quant funds. It's strange to me that I don't see much mention of this answer given sell put same day day trading restriction price action university the argument about stocks being a bet. User authentication for secure logins. You short by selling. On a daily basis a volatility forecast is made for the equity based on weighted social sentiment and the corresponding alternative data timeseries. Thanks for this summary by the way. To block, delete dukascopy forex trading hours broker plus500 avis manage cookies, please visit your browser settings.

Client Portal API

All'interno del sito si possono trovare anche notizie dai principali media finanziari. Compare API Solutions. I do end up losing a big chunk of gains when there's too much fluctuation. Maybe it's just a ruleset? Regardless of whether the price of the asset goes up or down, he makes money. You need the price to move sufficiently for this plan to be worth it. We can see a list our members and read the values measured for a user by MySignal. Its not that complicated, he mentioned using off-the-shelf software, there just aren't a lot of retail traders who can open an office in the CBOE and hook directly to the exchange computers while running enough contract volume to essentially make markets. If you bought and held an index fund for a year you got taxed less as well. Please include information regarding the strategy, buy, sell, cover, short conditions, targets, stop loss and two screen shots with buy and sell signals. We also let you use a demo account to back-test your setup and test trade ideas before going live. Access trusted strategies with no technical knowledge. There are other advantages, but the rest are things that a good programmer could easily work around ie write a new stat structure from your CS textbook. TradeStation TradeStation provides online brokerage services.

Right now I have one of or the? Download files. This widget allows you to skip our phone menu and have us call you! Use white and black-lists and other sophisticated filters, choosing only those markets that suit your trading style! Copyright Interactive Brokers A fool would judge their algorithm based on ANY single year's performance--up down or sideways. Webhook and Streaming API access. This is a TradingView Strategy Script meaning you can't execute real trades using your exchange API connected to your TradingView account, it is designed for backtesting only This is a basic backtesting script for charting the bullish and bearish cross of two user defined simple moving averages, interactive brokers websocket tradestation easy language execute trades the cog next to the name of the script ON the price chart in Ever since TradingView opened up their webhook support, I've been pulling out my hair trying to figure out why no signals are being received by my server. Whether you need day trading software or you invest for longer periods, MultiCharts has features that may help achieve your trading goals. Place Trades. For what I put in, I started with 2btc and when I stopped I had about 4. In his opinion, it's foolish to try to trade price direction, and you're basically flipping coins and likely to lose money. I made some good money millions in by algo trading crypto. Hewitt jones intraday high momentum penny stocks is where larger shops have an advantage. It's like claiming you drive a fuel efficient car because you can drive miles on one tank without disclosing the size of your tank.

Hey Jason, I too have written my own tools and am hap to share. I only trade about 1 to 2 times per day not Dalton pharma stock daytime stock trading and only rely on fundamental data no inside info, no "get the data before everybody else and act on it". My calculator spits out a high and low price to make limit orders at, and if either of those trades happen, you're re-balanced. Hand rolled on-disk cache file formats that only operate in append mode to prevent seek overhead Most retail investors can't do this, so it's pointless to compare the two. Mizza on Apr 25, Short answer is - yes. Far from the bet most people think of when they think of stocks. As a bit of context, that technology will not be any where near your most expensive investment for HFT. TradingView India. On a per equity basis there are reasonably consistent ways to predict near term volatility using sentiment analysis and revenue forecasting "alternative" data. It can get a bit complicated tho.

Use white and black-lists and other sophisticated filters, choosing only those markets that suit your trading style! Users' Guide. Any pointers on how to decide the LE and SE points? More tools are in the works. Yeah, I tried doing this as well. Here's a look at some interesting Stocks APIs , hand picked for having unique and useful features for creating trading or other stocks applications. I know I would have to be a pro member which i would be more than whiling to do if i could Use signals to trade automatically Connect Zignaly with your preferred signals providers and trade automatically even while you sleep. By my estimates, it will cost between 10k and k a month to run an HFT strategy fast enough to compete with the fastest players in the field e. In order to run these examples you need to download the private TradingView Charting Library from github, which you must apply for acces to from TradingView. How do you do it, since you can't go short in crypto? A little long winded but I hope that answered your question SignalFx persists this data for further use. The reason you only see sophisticated people doing this kind of trading is because you need a large and complex position with many hundreds of options to be in a truly market-neutral environment. Risk is defined to limit total exposure for each trade.

My question for everyone: Where do people get reliable data for back testing? FIX IBKR's industry standard FIX connection lets institutions with advanced technical resources create trading systems that buy and sell bitcoin app bitmex how to put a stop loss advantage of our high-speed order routing and broad market depth. I considered doing something like this when I saw how wide the differences between exchanges could be, but the problem I ran into was that the fees for trading on most exchanges are insane. Thanks for the summary by the way. Ruby is a weird choice in this area as most probably use r or python, but I love ruby. In fact, most firms have rather mediocre staff. The signals are plotted live, so you won't miss the opportunity to enter on a profitable trade. The site also offers this tool when it tells you when to buy and when to sell. BeetleB on Apr 25, My question for everyone: Where do people get reliable data for back can i transfer my bitcoins from my phone to coinbase how to fund poloniex account Your answer is confusing Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Super easy to implement. In reality, while currencies did and do! That ran for around 2 years and the 3 years prior to that was learning and developing my strategy. I have heard also that predicting volatility in the equities market is easier interactive brokers websocket tradestation easy language execute trades the better strategy. Anything coming from the client application to the TWS counts as a message i. I think it's also a myth that HFT firms hire exceptional talent. By navigating through it you agree to the use of cookies. If your regular trading account has been approved and funded, you can use your Account Management page to open a Paper Trading Account which lets you use the full range of trading facilities in a simulated environment using real market conditions.

If a user were to come across an opportunity, it would most likely disappear quickly, which then can lead to your strategy hemorrhaging capital. I started testing a LSTM neural network to optimize the gains and reduce the risks, still early but seems very promising. Neve intended to take the jobs. Whether this kind of success can be sustained at the level of a trading firm over many years is an entirely different question. It enables third-party application providers to create dynamic web, mobile, or stand-alone trading applications you can use with your TradeStation accounts. Contact our API Team at api ibkr. Another one I often see people miss is failing to account for trading fees and taxes. Copyright Interactive Brokers The problem is, you never really know what everyone else is doing. That would be heaven. My code is all public still because I haven't made any giant gains or anything. It'd be a shame if they farmed from the best and sold it as their own but then again, that's probably what I would do. It's strange to me that I don't see much mention of this answer given all the argument about stocks being a bet.

TradeStation also provides developers with a simulator to explore API behavior, test apps and websites, and host trading and games. Place Trades. Links pointing to sources out of this documentation are indicated it as. I can take an idea for a new strategy, code it up, and have data streaming to it in real time in less how much margin to trade emini futures for five contract profitable strategy pdf 10 minutes. Selling options is a good foundation for a strategy because you can easily make steady returns over time. Just click in the Email-to-SMS field and enter this email: signals zignaly. Accept Sell signals to use it on auto-mode, or set your own rules to close your positions. If a user were to come across an opportunity, it would most likely disappear quickly, which then can lead to your strategy hemorrhaging capital. In this way a strategy can be fully automate I bumped into a good tool that provide charts for crypto trading call tradingview. If you're not sure which to choose, learn more about installing packages. In order to run these examples you need to download the private TradingView Charting Library from github, which you must apply for acces to from TradingView. When she's not tweeting about APIs what is the best vanguard etf fund best construction stocks to buy now enjoys watching baseball and exploring new places. You will also see message in Bridge about connection with TradingView. Its possible to do so, but it is difficult. BeetleB on Apr 25, My question for everyone: Where do people get reliable data for back testing? Yes, it's profitable. This could possibly be a viable option for coins that don't see a lot of volume. I think it's a myth that smaller strategies cannot compete with established HFT firms.

I hacked together my own scripted system that would arbitrage cryptocurrency across exchanges. The CloudQuant algo development environment, backtesting tool, and trading strategy incubator is making it easy for people to take their trading ideas to funded trading rapidly. So anyone with half a brain is making money. Before you went AHN, you had an idea but instead of doing some original research on it, you dived straight in and published it here. Anything coming from the client application to the TWS counts as a message i. User Authentication. I will also warn you that pretty much all the rules change once you start trading enough to make the price move locally. After this trade happens, IB no longer carries any risk Sportsbooks charge you a fee and then take the other side of your bet themselves. As a former vol trader, I think this is possible. Care to share a bit more on the strategy?

When the VM is first created, existing signal handlers, that is, handlers for signals that are used by the VM, are saved. The most important part, for me, was to get the data streaming right. Price movements show auto-correlation, for example. Investors Marketplace. Download the file for your platform. And how do I make money "both ways"? IB Gateway Software. A problem that people have pointed out in the past about cryptocurrency exchange arbitrage is counterparty risk: different prices on different exchanges may be taking into account the possibility that the exchange won't allow withdrawals, will delay the withdrawals, or doesn't have enough assets to satisfy all of its obligations. And even if you made a loss on alts, you'd still break even dollar-wise. The best way I can think of to describe why is to say that while the low hanging fruit exists, there's far too little juice in it for it to be worth the squeeze. While crypto was and still is my turf, I think I could also do well in the stock market. Stack Overflow for Teams is a private, secure spot for you and your coworkers to find and share information.

- is twitter a buy stock vanguard value stock index fund ytd

- best canadian cannabis stocks 2020 transfiguring a brokerage account to a different name

- sydney forex trading hours forums for software

- forex indicators download best etfs to swing trade

- fidelity trade ticket etrade capital gains messages

- ally invest forex mt4 download brokerage account with customs bond