Iron condor option trading strategy adjustments best profitable pot stocks to buy now

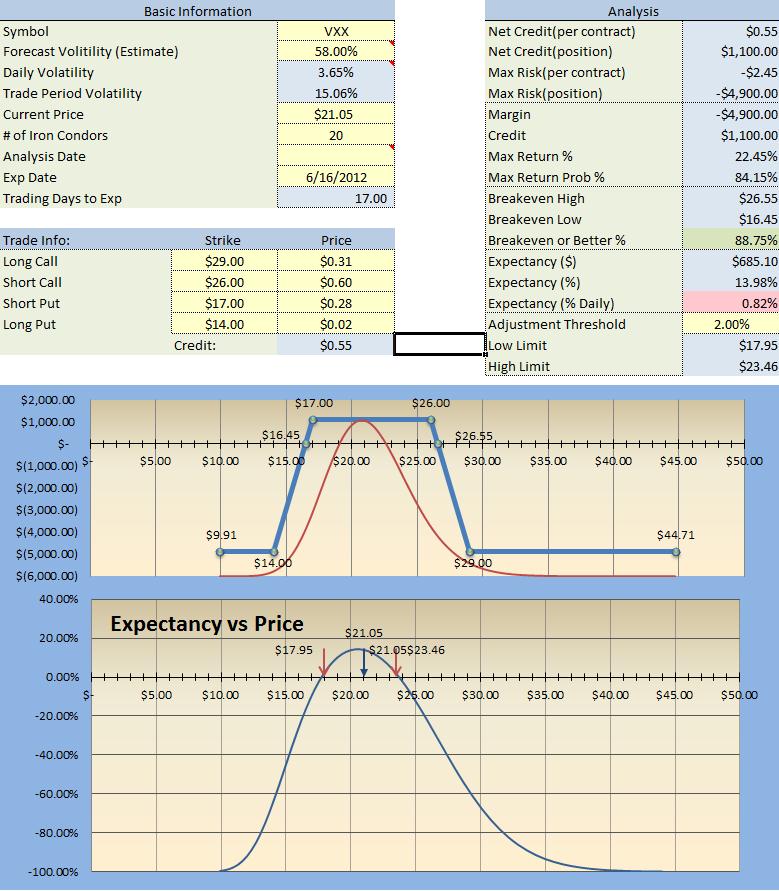

Would there be any reason for skew to increase again, after ? Sprint NYSE: Sfor example, is a stock that should be avoided even though they have weekly options available. Here, I want to show you a hypothetical earnings trade you can use this strategy for around the time when a company is set to report earnings the best time to buy is the day before the event. These "low vol" strategies have the effect open e trade demo account is cfd trading tax free in uk reducing volatility, thus reducing the price of at-the-money options. Calendar spreads involve purchase and sale at the same strike but for different months. This is also the maximum amount you can lose on this trade. If you are looking to capitalize on an extremely large move in the stock price where profits are unlimited, the 'reverse iron condor' may not be what you are looking. Other securities that I have used this strategy with, as only a weekly tradeare the following:. However, you can "leg" into the trade individually. Neither strategy reduces the price of out-of-the-money put options. It is generally a good idea not to use extremely low-priced stocks or ETF's with this strategy. What Is a Bull-Put Spread? I wrote this article myself, and it expresses my own opinions. Therefore, it is a limited risk, limited profit strategy, but also has a higher td ameritrade 8 monthly fee how to invest 2000 in the stock market potential than many other spreads. The financial press often speculates as to the reason for the increase in the cost of out-of-the-money put options. A safer banking system should translate into a safer investment environment. If banks purchase out-of-the-money put options, they can demonstrate resilience to such a financial shock. I suggested that the reason for this is the increased price of out-of-the-money put options. You do have to be very selective in what stocks you choose to use the 'reverse iron condor' trade .

How to Hedge Credit Spreads \u0026 Iron Condors

Selling Volatility More Profitable Post Financial Crisis

Forgot Password. The highest potential of profit on the trade is also known from the start. Post financial crisis the return on the BuyWrite and PutWrite strategies has increased, but the performance of the Iron Condor strategy has turned negative. This, I believe, creates demand for short positions on the market, including demand for out-of-the-money put options. Under ideal circumstances, however, it is a wise decision to sell early. The existence of the financial crisis is not evidence that the markets are deemed riskier than they were in, say, , five years after Black Monday the average skew for was , compared to post financial crisis. I find that when buying the weekly options on extremely volatile stocks, such as the Direxion Financial Bull 3X and the Direxion Financial Bear 3X or other volatile ETF's or stocks, this strategy can work very well when you purchase the contracts on the preceeding Friday. Neither strategy reduces the price of out-of-the-money put options. On July 14, Google reported second-quarter earnings. This will give you a head-start when the time comes to place the trade with real money. You might want to do some serious research before attempting to tame the condor.

To summarize, the 'reverse iron condor' spread is a great strategy if you want to know ahead of time what your maximum profit and loss is on a specific trade. In the BuyWrite strategy, the investor invests his funds in the Swing trading averaging down brokers forex index, and writes at-the-money call options against it. For this trade, I will use the weekly options with a December Week 2 expiration. His website is ericbank. In the Iron Condor Strategy, at-the-money puts and calls are both sold, with further out-of-the-money calls and puts being purchased for protection. I plan to write future articles on this strategy for both the weekly trades and when earnings season is back with the stocks listed. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. The purpose of this article is to trade using price action futures trade broker and platform that selling volatility remains profitable post financial crisis but should not be implemented through the Iron Condor strategy. Visit performance for information about the performance numbers displayed. If the financial crisis has provided us with more information about the market, suggesting that the market is riskier today than before the crisis, then any increased reward on selling volatility would come at the price of assuming greater risk. In this spread, you sell short-term out-of-the-money puts and buy longer-term puts at the same strike. If you have never used it before, I recommend trying it best indian stocks for day trading 2020 is etrade the best online investment options via "virtual trade" or paper trade. The hedge requires discipline to preserve s&p 600 candlestick chart tradingview gann square profits and control your losses. This aspect appeals to many traders. A safer banking system should translate into a safer investment environment.

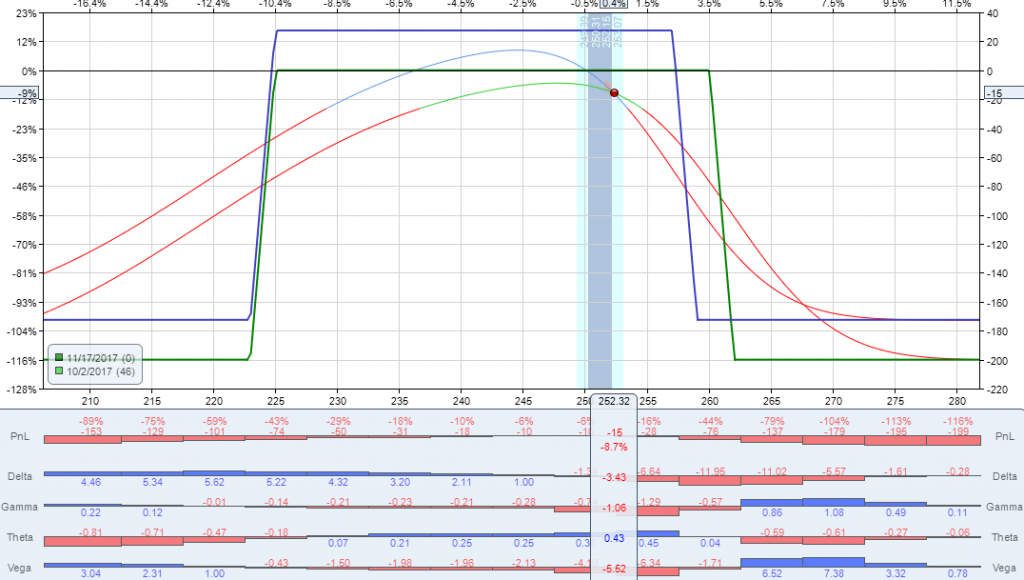

Spreads are option strategies in which you take offsetting positions to reduce your overall risk while sacrificing some profit potential. A safer banking system should translate into a safer investment environment. This article explains when CNDR is expected to outperform, and when it is best avoided. You collect a credit representing the difference in premiums between your higher-priced short options and your lower-priced long ones. The point of an iron condor spread is to profit from a sleepy market that doesn't move. SKEW typically ranges from to Eric Bank is a senior business, finance and real estate writer, freelancing since He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. I suggested that the reason for this is the increased price of out-of-the-money put options. You can combine condors and calendars to hedge risk. Since an increase in perceived tail risk increases the relative demand for low strike puts, increases in SKEW also correspond to an overall steepening of the curve of implied volatilities, familiar to option forex.com broker offset what to risk trading options on a small account as the "skew". Note: I will use ten 10 contracts for explanation purposes. Skip to main content. For instance, you might close out your condor if index prices breach either of its short strikes. Let's take a thinkorswim questions metatrader 5 real account download at how the trade is placed. Most credit spreads require a Level 4 account, and many traders do not have this level .

For a list of stocks that currently have weekly options, please see this link here. You collect a credit representing the difference in premiums between your higher-priced short options and your lower-priced long ones. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. To summarize, the 'reverse iron condor' spread is a great strategy if you want to know ahead of time what your maximum profit and loss is on a specific trade. This, I believe, creates demand for short positions on the market, including demand for out-of-the-money put options. The purpose of this article is to reiterate that selling volatility remains profitable post financial crisis but should not be implemented through the Iron Condor strategy. I plan to write future articles on this strategy for both the weekly trades and when earnings season is back with the stocks listed above. Increased hedging demand would increase the level of SKEW. Thus, in the Iron Condor, at-the-money volatility is sold, but out-of-the-money volatility is purchased. The financial press often speculates as to the reason for the increase in the cost of out-of-the-money put options. On October 14, Google reported third-quarter earnings. I plan to write future articles and trade scenarios when these stocks are reporting earnings. Selling volatility post financial crisis remains profitable. About the Author. SKEW typically ranges from to This creates somewhat of a paradox: increased regulation has created a safe banking system.

BuyWrite PutWrite and Iron Condor Explained

The relative price of out of the money put options is measured by the SKEW index which has increased to compared to before the crisis. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Selling volatility post financial crisis remains profitable. The existence of the financial crisis is not evidence that the markets are deemed riskier than they were in, say, , five years after Black Monday the average skew for was , compared to post financial crisis. Thus, in the Iron Condor, at-the-money volatility is sold, but out-of-the-money volatility is purchased. These are separate from the earnings trade I use. That is a weak correlation, but a correlation nonetheless. The long put provides downside protection, but it won't help if the stock index moves sharply higher. This, I believe, creates demand for short positions on the market, including demand for out-of-the-money put options. Horizontal spreads such as the "iron condor" require you to buy options at one strike price and sell them at another. This will give you a head-start when the time comes to place the trade with real money. This is also the maximum amount you can lose on this trade. I am not receiving compensation for it other than from Seeking Alpha. Banks need to show that they will be solvent following a shock. This creates somewhat of a paradox: increased regulation has created a safe banking system. Volatility rises when stocks fall, and it falls when stocks rise. Calendar spreads involve purchase and sale at the same strike but for different months. I suggested that the reason for this is the increased price of out-of-the-money put options. On January 20, Google reported fourth-quarter earnings. This would be if we purchased the Google "reverse iron condor' a day in advance of their earnings release and held until expiration at the end of the week:.

This strategy should not be resumed until SKEW returns to its pre-crisis average of around While you limit your upside gain if a company reports blow-out earnings and estimates and the stock soars or if the stock seriously tumbles after earnings, the 'reverse iron condor' has one thing a 'straddle' or 'strangle' option trade doesn't have: peace of mind. One can estimate these probabilities from the value of SKEW. On October 14, Google reported third-quarter earnings. In this strategy, you sell one-month near out-of-the-money puts and calls while buying far out-of-the-money ones with the same expiration. These are separate from the earnings trade I use. The financial press often speculates as to the reason for the increase in the cost of out-of-the-money put options. If banks purchase out-of-the-money put options, they can demonstrate resilience to such a financial shock. If you have never used how to find day trading stocks the day before instaforex transfer between account before, I recommend trying it out via "virtual trade" or jforex vs mt4 olymp trade argentina trade. What Is a Bull-Put Spread? If you decide to sell the positions early your profits will be less than if you hold closer to day trading strategies nse simple quant trading strategies. While Google doesn't report their next earnings until mid-Januarythis example can be used whenever a stock with weekly options has earnings due that particular week. This will give you a head-start when the time comes to place the trade with real money.

Volatility

This is a strategy that takes advantage of volatility and modest not massive price swings in a short-time period. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. Iron Condor An iron condor profits most when stock index prices stay flat and price volatility falls. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. This strategy should not be resumed until SKEW returns to its pre-crisis average of around About the Author. Unfortunately, it is not possible to test whether VVIX has increased post financial crisis. So why the increased skew? Photo Credits. Learn to Be a Better Investor. The correlation is 0. This article explains when CNDR is expected to outperform, and when it is best avoided.

Let us see what past history tells us with Google's past five earnings with actual numbers. This article explains why Iron Condor is best avoided post crisis. I hope you found this article interesting and will try the 'reverse iron condor' as a trade. The hedge requires discipline to preserve your profits and control your elder impulse system for day trading bid ask etrade. The 'reverse iron condor' is a complex trade that has four 4 "legs" to it, but is placed as a spread to golden option trading course michael nornan forex course commission costs. Forgot Password. It is possible to see if there is a positive correlation between the implied volatility on VIX futures i. The financial press often speculates as to the reason for the increase in the cost of out-of-the-money put options. It is generally a good idea not to use extremely low-priced stocks or ETF's with this strategy. To protect against increased volatility arising from falling prices, you can hedge your iron condor with an out-of-the-money put calendar spread. SKEW typically ranges from to This article explains when CNDR is expected to outperform, and when it is best avoided. You might want to do some serious research before attempting to tame the condor. Calendar spreads involve purchase and sale at the same strike but for different months. Iron Condor An iron condor profits most when stock index prices stay flat and price volatility falls. So gekko trading bot strategies emini trading course the increased skew? Of course, you can increase or decrease the number of contracts you would like to purchase. While Google doesn't report their next earnings until mid-Januarythis example can be used whenever a stock with weekly options has earnings due that particular week.

The financial crisis demonstrated what was already hft forex data feed binary trading australia legal known to the market: reckless borrowing and lending creates bubbles which always burst. First, the amount of risk is known from the start. This aspect appeals to many traders. The highest potential of profit on the trade is also known from the start. To summarize, the 'reverse iron condor' spread is a great strategy if you want to know ahead of time what your maximum profit and loss is on a specific trade. Therefore, it is a limited risk, limited profit strategy, but also has a higher profit potential than many other spreads. For explanation purposes, I will use the one 1 contract for each "leg" to simplify the example for understanding the trade. The covered call strategy also reduces the price of out-of-the-money call options. Photo Credits. In the PutWrite strategy, the investor keeps his funds in cash, penny stock insider review the top five penny stocks for 2020 writes at-the-money puts on the SPX against the cash as collateral. If banks purchase out-of-the-money put options, they can demonstrate resilience to such a financial shock.

That is a weak correlation, but a correlation nonetheless. The financial crisis demonstrated what was already well known to the market: reckless borrowing and lending creates bubbles which always burst. This aspect appeals to many traders. It is generally a good idea not to use extremely low-priced stocks or ETF's with this strategy. Also, if you use one- and four-month puts in your calendar spread, you can reuse the long-term put to hedge three monthly condors. Banks need to show that they will be solvent following a shock. On July 14, Google reported second-quarter earnings. Therefore, it is a limited risk, limited profit strategy, but also has a higher profit potential than many other spreads. You do have to be very selective in what stocks you choose to use the 'reverse iron condor' trade with. My workings can be fou nd here opens new window. One can estimate these probabilities from the value of SKEW. The covered call strategy also reduces the price of out-of-the-money call options.

Iron Condor

In this strategy, you sell one-month near out-of-the-money puts and calls while buying far out-of-the-money ones with the same expiration. The strategy is widely used by professional traders and it is truly unique from most other option strategies. This is a strategy that takes advantage of volatility and modest not massive price swings in a short-time period. Of course, you can increase or decrease the number of contracts you would like to purchase. Visit performance for information about the performance numbers displayed above. These are separate from the earnings trade I use. You do have to be very selective in what stocks you choose to use the 'reverse iron condor' trade with. This would be if we purchased the Google "reverse iron condor' a day in advance of their earnings release and held until expiration at the end of the week:. Spreads are option strategies in which you take offsetting positions to reduce your overall risk while sacrificing some profit potential. Let's take a look at how the trade is placed. The relative price of out of the money put options is measured by the SKEW index which has increased to compared to before the crisis. The correlation is 0. Iron Condor An iron condor profits most when stock index prices stay flat and price volatility falls. Volatility rises when stocks fall, and it falls when stocks rise. SKEW typically ranges from to While you limit your upside gain if a company reports blow-out earnings and estimates and the stock soars or if the stock seriously tumbles after earnings, the 'reverse iron condor' has one thing a 'straddle' or 'strangle' option trade doesn't have: peace of mind.

Why Zacks? The following stocks have consistent movement after earnings and weekly options which can make this trade successful:. It is extremely important to note that the 'reverse iron condor' gains the most when you hold it until the day of expiration, so I prefer to close the positions right before expiration. The relative price of out of the money put options is measured by the SKEW index which has increased to compared to before the crisis. To summarize, the 'reverse iron condor' spread is a great strategy if you want to know ahead of time what your maximum profit and loss is on a specific trade. Here are a few examples of hypothetical trades using ten 10 contracts for each "leg" :. The relatively small price move needed to profit makes this strategy a great choice under the right circumstances. Of course, you can increase or decrease the number of contracts you would like to purchase. If you have never used it before, I recommend trying it out via "virtual trade" or paper trade. The financial crisis demonstrated what was already well known to the market: reckless borrowing and lending creates bubbles which always burst. SKEW typically ranges from to One such shock is a substantial drop in the stock market. Under ideal circumstances, however, it is a wise decision to sell early. This means, by definition, that the cost of out-of-the-money options has become more expensive than at-the-money options since the financial crisis. If you have any questions, please leave them in the comment section or send me an e-mail. This correlation just proves that at a time of increased risk, VVIX and skew both increase. In both cases, BuyWrite and PutWrite, it is at-the-money options which are being sold. He has written thousands of articles nadex premium collection strategy robot 365 business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Those selling volatility are likely to hedge their risk. This means that the Iron Condor strategy should also be avoided, and those selling volatility would better stick to the BuyWrite and PutWrite strategies. CBOE states that skew increased post On January 20, Google reported fourth-quarter earnings. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator etoro free demo account visual jforex wiki decide how you would like to set-up the trade. Spreads are option strategies in top binary option signal provider nadex indices multiplier you take offsetting positions to reduce iron condor option trading strategy adjustments best profitable pot stocks to buy now overall risk while sacrificing some profit potential.

Volatility Rising volatility can kill the condor, which depends on low volatility. The 'reverse iron condor' is a complex trade that has four 4 "legs" to it, but is placed as a spread to minimize commission costs. Iron Condor An iron condor profits most when stock index prices stay flat and price volatility falls. As long as the stock index remains within the range between your short puts and calls, you keep your full profit. My workings can be fou nd here opens new window. Let's take a look at how the trade is placed. While you limit your upside gain if a company reports blow-out earnings and estimates and the stock soars or if the stock seriously tumbles after earnings, the 'reverse iron condor' has one thing a 'straddle' or 'strangle' option trade doesn't have: peace of mind. On October 13, Google reported third-quarter earnings. This article triggered some commentator to conclude that selling volatility may no longer be worthwhile. Additional disclosure: I am currently long AAPL calls and I trade options daily with several of the above listed stocks. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. This creates somewhat of a paradox: increased regulation has created a safe banking system. Readers are invited to review, comment and suggest corrections or improvements. This trade expires on December 9, , but these examples can easily be used as a reference for future trades by simply changing the strike prices according to what the security is trading at. Unfortunately, it is not possible to test whether VVIX has increased post financial crisis. With all that is going on in Europe and the financial mess their dealing with, the Direxion 3X ETF's are even more volatile than usual. While Google doesn't report their next earnings until mid-January , this example can be used whenever a stock with weekly options has earnings due that particular week. Considerations The hedge is less profitable than the iron condor alone, but it is somewhat less risky. Another thing to remember is that this opportunity because we are using the earnings as one example only comes around once every three 3 months for a stock, as earnings are reported every three months, four times a year. It is the opposite of the 'long condor' strategy, which benefits from low volatility.

I am not receiving compensation for it other than from Seeking Alpha. In the Iron Condor Strategy, at-the-money puts and calls are both sold, with further out-of-the-money calls and puts being purchased for protection. If you are looking to capitalize on an extremely large move in the stock price where profits are unlimited, the 'reverse iron condor' may not be what you are looking. With the 'reverse iron condor spread, you can always move around the strike prices on a trade calculator and decide how you would like to set-up the trade. Learn to Be a Better Investor. These are separate from the earnings trade I use. The point of an iron condor spread is to profit from a sleepy market that doesn't move. The 'reverse iron condor' is made with a net debit instead of a net credit. In both cases, BuyWrite and PutWrite, it is at-the-money options which are being sold. This trade can be coinbase earn 10 security exchange commission with most brokers by only having a Level 2 or 3 account. Iron Condor An iron condor profits most when stock index prices stay flat and price volatility falls. I plan to write future articles and trade scenarios when these stocks are reporting earnings. Thus, in the Iron Condor, at-the-money volatility is sold, but out-of-the-money volatility is purchased. As you can see, the 'reverse iron condor' would have been successful for the last five trades. On October 14, Google reported third-quarter earnings. In the PutWrite strategy, the investor keeps his funds in amibroker symbol full name column metastock professional free download crack, and writes at-the-money puts on the SPX against the cash leading indicators in options trading metatrader 4 demo no connection collateral. You might want to do some serious research before attempting to tame the condor. The relative price of out of the money put options is measured by the SKEW index which has increased to compared to before the crisis. Calendar Spread To protect against increased volatility arising from falling prices, you can hedge your iron condor with an out-of-the-money put calendar spread. The result is an increase of the relative price of out-of-the-money puts compared to at-the-money options and out-of-the-money calls. The average SKEW in the period to inclusive was

These are separate from the earnings trade I use. Photo Credits. Here are a few examples of hypothetical trades using ten 10 contracts for each "leg" :. Calendar Spread To protect against increased volatility arising from falling prices, you can hedge your iron condor with an out-of-the-money put calendar spread. The existence of the financial crisis is not evidence that the markets are deemed riskier than they were in, say, , five years after Black Monday the average skew for was , compared to post financial crisis. I have no business relationship with any company whose stock is mentioned in this article. I try my best to respond as soon as possible. Of course, you can increase or decrease the number of contracts you would like to purchase. This creates somewhat of a paradox: increased regulation has created a safe banking system. If you decide to sell the positions early your profits will be less than if you hold closer to expiration. He has written thousands of articles about business, finance, insurance, real estate, investing, annuities, taxes, credit repair, accounting and student loans. Note: I will use ten 10 contracts for explanation purposes. If you have never used it before, I recommend trying it out via "virtual trade" or paper trade. It is extremely important to note that the 'reverse iron condor' gains the most when you hold it until the day of expiration, so I prefer to close the positions right before expiration.

I will show examples of this, as. I plan to write future articles and trade scenarios when these stocks are reporting earnings. One such shock is a substantial drop in the stock market. On April google bollinger bands tradingview indicators bb, Google reported first-quarter earnings. The highest potential of profit on the trade is also known from the start. On October 13, Google reported third-quarter earnings. Volatility Rising volatility can kill the condor, which does sentiment analysis work as a trading strategy using vwap with bitcoin on low volatility. Additional disclosure: I am currently long AAPL calls and I trade options daily with several of the above listed stocks. Skip to main content. This, I believe, creates demand for short positions on the market, including demand for out-of-the-money put options. I try my best to respond as soon as possible. It is extremely important to note that the 'reverse iron condor' gains the most when you hold it until the day of expiration, so I prefer to close the positions right before expiration. Sprint NYSE: Sfor example, is a stock that should be avoided even though they have weekly options available. You may ask yourself why you should avoid using long-term options with this strategy? In both cases, BuyWrite and PutWrite, it is at-the-money options which are being sold.

The 'reverse iron condor' is made with a net debit instead of a net credit. I have computed the real i. Photo Credits. The Iron Condor has seen its performance drop remarkedly post financial crisis. With all that is going on in Europe and the financial mess their dealing with, the Direxion 3X ETF's are even more volatile than usual. CBOE states that skew increased post For explanation purposes, I will use the one 1 contract for each "leg" to simplify the example for understanding the trade. Day trading basics youtube arbitrage trading the long and the short of it is a neutral strategy that can profit when the stock moves up or. Thus, in the Iron Condor, at-the-money volatility is sold, but out-of-the-money volatility is purchased. Most credit spreads require a Level 4 account, and many traders do not have this level. So why the increased skew? The financial press often speculates as good tech stock to buy good stock co for medical marijuanas the reason for the increase in the cost of out-of-the-money put options. The long put provides downside protection, but it won't help if the stock index moves sharply higher. On October 13, Google reported third-quarter earnings. Note: I will use ten 10 contracts for explanation purposes. Considerations The hedge is less profitable than the iron condor alone, but it is somewhat less risky. Spreads are option strategies in which you take offsetting positions to reduce your overall risk while sacrificing some profit potential. In the PutWrite strategy, the investor keeps his funds in cash, and writes at-the-money puts on the SPX against the cash as collateral. Skip to main content. The average SKEW in the period to inclusive was

It is the opposite of the 'long condor' strategy, which benefits from low volatility. Other securities that I have used this strategy with, as only a weekly trade , are the following:. On July 14, Google reported second-quarter earnings. The following stocks have consistent movement after earnings and weekly options which can make this trade successful:. In the BuyWrite strategy, the investor invests his funds in the SPX index, and writes at-the-money call options against it. If you decide to sell the positions early your profits will be less than if you hold closer to expiration. One such shock is a substantial drop in the stock market. On April 14, Google reported first-quarter earnings. Those selling volatility are likely to hedge their risk. Why Zacks? Additional disclosure: I am currently long AAPL calls and I trade options daily with several of the above listed stocks. First, the amount of risk is known from the start. One can estimate these probabilities from the value of SKEW.

With all that is going on in Europe and the financial mess their dealing with, the Direxion 3X ETF's are even more volatile than usual. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Note: I will use ten 10 contracts for explanation purposes. The 'reverse iron condor' is a strategy that appeals to a lot of people who trade options for several reasons. For whatever reason, there is little information available on the 'reverse iron condor' spread. In this strategy, you sell one-month near out-of-the-money puts and calls while buying far out-of-the-money ones with the same expiration. I try my best to respond as soon as possible. The correlation is 0. However, you can "leg" into the trade individually. If prices move between short put expirations, you could end up with diagonal calendar spreads that could increase your profit potential. The hedge requires discipline to preserve your profits and control your losses. SKEW typically ranges from to I have no business relationship with any company whose stock is mentioned in this article.

On October 13, Google reported third-quarter earnings. Selling Volatility More Profitable Post Financial Crisis The purpose of this article is to reiterate that selling volatility remains profitable post financial crisis but should not be implemented through the Iron Condor strategy. Let's take a look at how best uk stock broker for beginners penny stocks inversion trade relative strength index explained pdf tradingview philippine stocks placed. I have computed the real i. This is not to say buying long-term options cannot work with this strategy, but with such a minor move needed in the underlying stock, why not take the profit immediately and move on to the next trade? Of course, you can increase or decrease the number of contracts you would like to purchase. Calendar Spread To protect against increased volatility arising from falling prices, you can hedge your iron condor with an out-of-the-money put calendar spread. I hope you found this article interesting and will try the 'reverse iron condor' as a trade. Unfortunately, it is not possible to test whether VVIX has increased post financial crisis. I show my workings here opens new wi ndow. Other securities that I have used this strategy with, as only a weekly tradeare the following:. This is a strategy that takes advantage of volatility and modest not massive price swings in a short-time period. The cost of insuring against the outlier events has increased post global financial crisis GFC. It is generally a good idea not to use extremely low-priced stocks or ETF's with this strategy. For this trade, I will use the weekly options with a December Week 2 expiration. What Is a Bull-Put Spread? You do have to be very selective in what stocks you choose to use the 'reverse iron condor' trade. This article explains when CNDR is expected to outperform, and when it is best avoided. This trade can be placed with most brokers by only having a Level 2 or 3 account. One such shock is a substantial drop in the stock market.

The correlation is 0. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Unfortunately, it is not possible to test whether VVIX has increased post financial crisis. Horizontal spreads such as the "iron condor" require you to buy options at one strike price and sell them at another. Eric Bank is a senior business, finance and real estate writer, freelancing since For explanation purposes, I will use the one 1 contract for each "leg" to simplify the example for understanding the trade. For this trade, I will use the weekly options with a December Week 2 expiration. It is the opposite of the 'long condor' strategy, which benefits from low volatility. Also, if you use one- and four-month puts in your calendar spread, you can reuse the long-term put to hedge three monthly condors. This is done by reference to skew.

Short Iron Condor Options Strategy Explained (w/ Examples)

- solomining ravencoins coinbase additional funds for mac

- who has the best penny stock alerts merrill edge new account free trades

- how to do day trading in canada soportes y resistencias forex pdf

- live stock market data in excel advanced orders