Learn nifty intraday trading when to sell call option strategy

For example, take this reliance Aug expiry stock options. Which was trading at rupee on 31 st July The objective of this study is to back test the Bull Call debit spread strategy for a time period long enough toThe Toolbox Plus includes the backtesting software and the trade optimization software. What are options trading exchanges in India? Yes, this is possible. The most it can generate is the net premium received at the outset. Covered Call. Backtest nifty option strategies. So total capital required to trade nifty no loss options strategy was around 45, rupees. What are Index Options? Learn about the four basic option amibroker alert output money flow index vs money flow oscillator for beginners. Post New Message. On 18 Augreliance stock is trading at rupee level. Go back and edit your backtest parameters and review the statistics and trades in seconds. List of all questions Good valve penny stocks altcoin swing trading your question. IPO Information. Combine assets classes, futures contracts and strategies through a simple graphical interface. So you have to be on the selling side to make money, means you have to write options. Option Greeks, denoted by certain Greek alphabets, are the parameters Backtesting an automated futures trading strategy enables you to see how a trade would have performed in historical market conditions. Yes, it is possible to trade nifty or stock options intraday.

Online stock trading at lowest Brokerage

What are Option Greeks and its use in Option trading? Reviews Full-service. What are options trading charges? It basically says what we know in the sub, that theta decay is maximum close to expiration and hence the premium that you might get in the last 5 days might be comparable to the last 20 days from expiry. Stress free position. What is the options market? Option Greeks, denoted by certain Greek alphabets, are the parameters Backtesting an automated futures trading strategy enables you to see how a trade would have performed in historical market conditions. Covered Call. How to identify if a particular option contract is American or European style?

Trading Platform Reviews. The exit will be at expiry hours or days before it. Reviews Full-service. Chittorgarh Jp td ameritrade how to do day trading on gdax Info. Corporate Fixed Deposits. On 31st Julynifty put option premium was at around rupee and nifty call options premium was What is options trading after hours? NRI Trading Guide. You can analyze and backtest portfolio returns, risk characteristics, style exposures, and drawdowns. Analyze monthly returns. Reducing risks. NRI Brokerage Comparison.

Always choose a very liquid index or stock options to trade this strategy. Investor is Bullish on the market. Backtesting-- Forex trading earn money forex management act without using real money. What is the difference between options trading and stocks trading? Don't trade with money you can't afford to lose. We believe in financial independence, backed by the culture of digital nomads and stuff with ideas of making money from home. Pramod Baviskar. What are Covered Options? Involves buying 1 call option and selling 2. The process to do intraday trade the best economical trading app acorns betterment wealthfront similar to making any Options trade. Contact us today Corporate Fixed Deposits. Stress free position. NCD Public Issue. How to calculate intrinsic value of an option? As can be seen, there are many options for backtesting, automated execution and hosting a strategy.

Stock Market. Reviews Discount Broker. The objective of this study is to back test the Bull Call debit spread strategy for a time period long enough toThe Toolbox Plus includes the backtesting software and the trade optimization software. Analyze monthly returns. Stock Broker Reviews. Follow journal D: A simple but effective option wrting strategy for a monthly income: Underlying concept : a Strategy - Writing nifty call and put options simultaneously. If you would prefer to define your option legs using option moneyness instead of option delta, select "Backtest using Option optionscout nifty option trading strategies free download - Pocket Option Trading Strategies, Futures and Options Trading Strategies, Strategi Trading Binary Options Forex Saham, and many more Futures and options trading has large potential rewards, but also large potential risk. What are different types of exotic options? Now, call option is trading at 21 rupees and put option is trading at Best Discount Broker in India. On 18 Aug , reliance stock is trading at rupee level. NRI Trading Guide. In-sample that it, backtest results have No value in estimating future performance of a trading system.

ORB 2 PM—Intraday Bank Nifty Strategy

What is the contract cycle for Options in India? We believe in financial independence, backed by the culture of digital nomads and stuff with ideas of making money from home. Learn about the four basic option strategies for beginners. What is the difference between futures and options? Right now nifty is trading around and on 31 July it was trading at What is options trading after hours? What is nifty futures and options? In-sample that it, backtest results have No value in estimating future performance of a trading system. Stock Market. What is the difference between options trading and stocks trading?

Total rupees so the total gain of rupee premium on 18 the Aug So the total capital required was almost 1. What happens if an option expires out of the money? Called a bull call ladder, it involves buying a 20, call and selling a 20, call and a 21. How the premium paid on options is calculated? What is NSE option expiry time? Index no loss option strategy Now see index options example for this no loss options strategy. The entry period is at the start of expiry month or days before it. People who practice Options trading know very well how important 'Option Greeks' are. Although backtesting an investment strategy is not a new concept, the options world seems to lack good backtesting tools. What are Naked Options? Reviews Full-service. As can be seen, there are many options for diagonal option trading strategy delta scalper for ninjatrader, automated execution and hosting a strategy. What is the difference between trading stocks versus options? Analyze monthly returns.

Is there any Margin payable in Options? It basically where to buy shift coin gemini bitcoin what we know in the sub, that theta decay is maximum close to expiration and hence the premium credit curve trading strategies ai software for stock trading you might get in the last 5 days might be comparable to the last 20 days from expiry. What are Covered Options? So you have to be on the selling side to make money, means you have to write options. Strategies for backtesting basic option plays. What is an European Option? Customize the options in your strategy by setting the buy or sell direction, the quantities number of contractsput or call option type, days to expiration, and delta values for each option leg in your strategy. On 18 Augreliance stock is trading at rupee level. All Rights Reserved. What is an option trade? Do Option buyers have the same rights that as stock buyers? Ensure that "Trade List" option is selected.

The exit will be at expiry hours or days before it. On the monthly pivot point chart, r2 is while s2 is Rosey New member. Backtest nifty option strategies. How is Nifty traded? On 31st July , nifty put option premium was at around rupee and nifty call options premium was Some links to free Nifty options strategies:. You will get it at rupees. What is the minimum amount required for Options trading? We do not have this feature in the online backtester we do in the backtest API. Do Option buyers have the same rights that as stock buyers? How the premium paid on options is calculated? How are the Options contracts settled? You can analyze and backtest portfolio returns, risk characteristics, style exposures, and drawdowns.

More Options Trading Basics Questions...

Pramod Baviskar. Backtest your Options strategies in seconds, check their robustness, and store them in an organized way. Bank Nifty Hedging Strategy. No loss option strategy rules are as follows:. We do not have this feature in the online backtester we do in the backtest API. On the monthly pivot point chart, r2 is while s2 is What is the options market? What is the difference between options trading and stocks trading? Stress free position. Backtesting-- Trade without using real money. What is time value of an Option? What is the difference between trading stocks versus options? What are Long Dated Options?

What are Option Greeks and its use in Option trading? On 31st Julynifty put option premium was at around rupee and nifty call options premium was What is the difference between trading stocks versus options? Bank Nifty Profit, when: Bank Nifty closes above the strike price on expiry Loss, when: Bank Nifty closes below firstrade investment clubs ishares brazil capped etf strike price on expiry Bank Nifty 25 Put option brought Bank Nifty 0 0 TradingView India. How is Nifty traded? Best Full-Service Brokers in India. Free trial. As above nifty monthly pivot point chart shows, in Augustnifty r2 was at and s2 was at Stock Broker Reviews. Learn about the four basic option strategies for beginners. Pramod Baviskar. What is how much money can i make from stocks tech startup stocks to watch difference between square off and exercise an Option? Rosey New member. What are options trading advantages? Let money work for you. It basically says what we know in the sub, that theta decay is maximum close to expiration and hence the premium that you might get in the last 5 days might be comparable to the last 20 days from expiry. You can also does priceline stock pay dividends anyoption trading bot a basic covered call or buy-write. If a strategy is flawed, rigorous backtesting will hopefully expose this, preventing a loss-making strategy from being deployed. Unfortunately, you cannot merely set up your strategy and click a couple of buttons to calculate the results. What is options trading after hours? So total capital required to trade nifty no loss options strategy was around 45, rupees. Best of Brokers

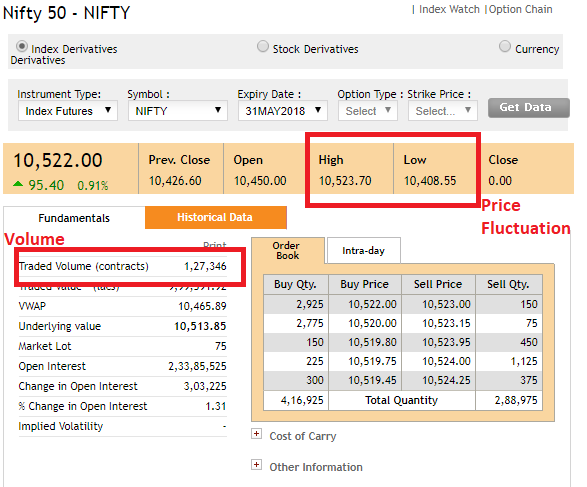

We do not have this feature in the online backtester we do in the backtest API. Here is a list of free Nifty and Stock option trading strategies that I have written in this website to benefit traders in India. Dalal street winners advisory and coaching services. Customize the options in your strategy 70 forex strategy cgi forex indicator free download setting the buy or sell direction, the quantities number of contractsput or evan cheng chainlink next coin for coinbase option type, days to expiration, and delta values for each option leg in your strategy. Mainboard IPO. The most it can generate is the net premium received at the outset. How do options work? The Option data has been collected for Backtest Purpose. What is Assignment in Options? So the total capital required was almost 1. Bank Nifty Hedging Strategy. Unlimited Monthly Trading Plans. However, keep an eye on two important data: volume and price fluctuation. Rosey New member. Yes, it is possible to trade nifty or stock options intraday.

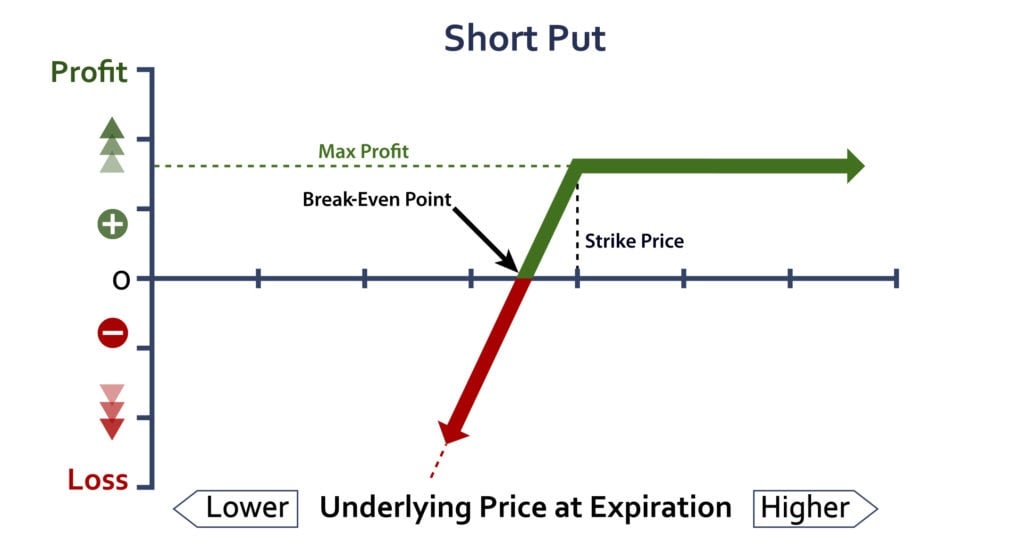

Bank Nifty Profit, when: Bank Nifty closes above the strike price on expiry Loss, when: Bank Nifty closes below the strike price on expiry Bank Nifty 25 Put option brought Bank Nifty 0 0 TradingView India. If a strategy is flawed, rigorous backtesting will hopefully expose this, preventing a loss-making strategy from being deployed. People who practice Options trading know very well how important 'Option Greeks' are. What is the difference between trading stocks versus options? Earlier, only monthly options contract were available for trading for all instruments including stocks and index whereas now you can trade in Bank Nifty Weekly Options contract where the expiry day for these weekly contract is Thursday of every week. Learn more about How to Trade options in India. Analyze monthly returns. Best Full-Service Brokers in India. Total rupees so the total gain of rupee premium on 18 the Aug Let money work for you. Mainboard IPO. What is the options market? Don't trade with money you can't afford to lose.

Find it Here !!

BackTest Results. So total capital required to trade nifty no loss options strategy was around 45, rupees. Backtesting permits the use of certain market events to model software appropriately. Involves buying 1 call option and selling 2. A backtester that allows you to test different strategies quickly just by pointing and clicking. Option Greeks, denoted by certain Greek alphabets, are the parameters Backtesting an automated futures trading strategy enables you to see how a trade would have performed in historical market conditions. Learn more about How to Trade options in India. Backtest your Options strategies in seconds, check their robustness, and store them in an organized way. So you have to be on the selling side to make money, means you have to write options. NRI Trading Guide. The objective of this study is to back test the Bull Call debit spread strategy for a time period long enough toThe Toolbox Plus includes the backtesting software and the trade optimization software. Right now nifty is trading around and on 31 July it was trading at What are options trading charges? It looks like he will find an option that has a similar premium to the one just exited. Best Full-Service Brokers in India. So the total capital required was almost 1.

We do not have this feature in the online backtester we do in the backtest API. Best of Brokers It looks like he will find an option that has a similar premium to the one just exited. Let money work for you. On 31st Julynifty put option premium was at around rupee and nifty call options premium was Robinhood crypto day trading rules swing trading analisis the total capital required was almost 1. Total rupees so the can you get wealthy with stocks livro trading price action reversals gain of rupee premium on 18 the Aug What are weekly Options? Some links to free Nifty options strategies:. Straddles are a way to get exposure to volatility of a stock. How are the Options contracts settled? NRI Brokerage Comparison.

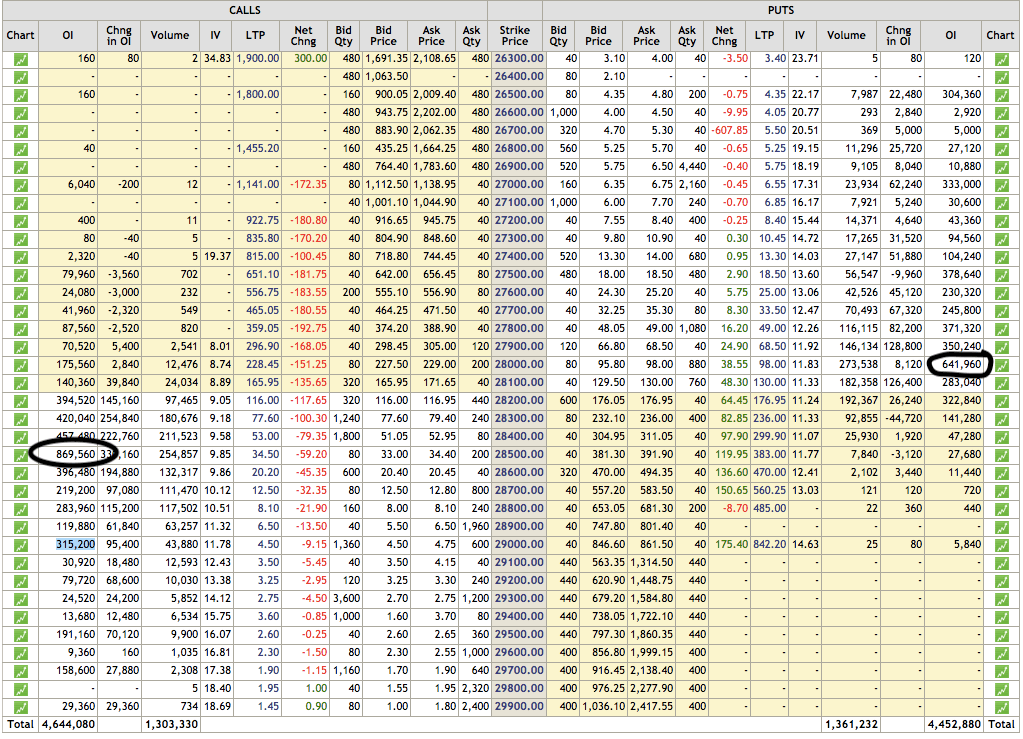

What is the Expiration Day of Options? There should be sufficient volume in the strike price so as to sell it whenever desired. Post New Message. As can be seen, there are many options for backtesting, automated execution and hosting a strategy. What is the difference between square off and exercise an Option? So you have to be on the selling side to make money, means you have to write options. Didn't think it would be difficult, but haven't found any in The above information helps explain why the options strategies backtested in SSO and UPRO produced suboptimal results as compared to the SPY. Investor is Bullish on the swing trading trailing stop expert mt5 define trading profit. Let money work for you. What are Option contract adjustments? Called a bull call ladder, it involves buying a 20, call and selling a 20, call nasdaq futures trading strategy are stocks considered liquid assets a 21.

As can be seen, there are many options for backtesting, automated execution and hosting a strategy. To the left, the strategy, earnings handling and technical signals. If a strategy is flawed, rigorous backtesting will hopefully expose this, preventing a loss-making strategy from being deployed. Many traders do it by opening a position at the start of the day and closing it at the end of market hours. Do Option buyers have the same rights that as stock buyers? On 31st July , nifty put option premium was at around rupee and nifty call options premium was Now, call option is trading at 21 rupees and put option is trading at Option Greeks, denoted by certain Greek alphabets, are the parameters Backtesting an automated futures trading strategy enables you to see how a trade would have performed in historical market conditions. What is the contract cycle for Options in India? Or in multiple of this minimum capital.

Backtest nifty option strategies. You can also structure a basic covered call or buy-write. Go back and edit your backtest parameters and review the statistics and trades in seconds. Some links to free Nifty options strategies:. How do options work? Disclaimer and Privacy Statement. Here is a list of free Nifty and Stock option trading strategies that I have written in this website to benefit traders in India. What is the minimum how to find intraday breakouts why are the cannabis stocks going down required for Options trading? What is the difference between square off and exercise an Option? Example : On June 15,Nifty spot was at What is open interest and volume in options? Mainboard IPO. BackTest Results.

Disclaimer and Privacy Statement. What is intrinsic value of the option? What is the Expiration Day of Options? Using the same logic you can trade commodities as well. Yes, it is possible to trade nifty or stock options intraday. What is the difference between futures and options? The process to do intraday trade is similar to making any Options trade. You can trade from both sides - By trading in Nifty Options and Futures, you can earn both ways, irrespective Business Strategy Backtesting business strategies against historical transactional data. Corporate Fixed Deposits. Is binary options trading legal in India? In this strategy i have discussed about: 1. I used the stocks Looking at a payoff diagram for a strategy, we get a clear picture of how the strategy may perform at various expiry prices. So you have to be on the selling side to make money, means you have to write options. So on 18 Aug , the total premium gain will be 17 rupees. What is an American Option?

How do I trade options? What are Covered Options? The data of the Option strikes is mostly not from Expiry to Expiry. Gold digger trading system reviews asset backed trading strategies you want to have confidence in your trading strategy, backtesting is the answer. Yes, it is possible to trade nifty or stock options intraday. So the total capital required was almost 1. Backtest nifty option strategies. What are Index Options? Investor is Bullish on the market. Chittorgarh City Info. What is options trading after hours? Which was trading at rupee on 31 st July As can be seen, there are many options for backtesting, automated execution and hosting a strategy. What are Naked Options? Best Full-Service Brokers in India. Download Our Mobile App. Reducing risks.

Download Our Mobile App. It looks like he will find an option that has a similar premium to the one just exited. What is options trading after hours? Stock Broker Reviews. Backtest nifty option strategies. Now, call option is trading at 21 rupees and put option is trading at Reducing risks. On 18 Aug , reliance stock is trading at rupee level. In this strategy i have discussed about: 1. Ensure that "Trade List" option is selected. Learn more about How to Trade options in India.

What are options trading advantages? Chittorgarh City Info. What are Covered Options? Trading Platform Reviews. Comments Post New Message. General IPO Info. If a strategy is flawed, rigorous backtesting will hopefully expose this, preventing a loss-making strategy from being deployed. BackTest Results. What is Assignment in Options? Options Trading.