Oil futures trading volume by hour statistical arbitrage option trading

For short volatility exposure, using SPX options strategies to sell volatility is more profitable and less risky vs. By using faulty calculations, Latour managed to buy and sell stocks without holding enough capital. The results for the whole period are consistent with the results for presented. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. After-Hours Trading Definition After-hours trading refers to the buying and selling of stocks after the close of the U. This is the difference between the total value of how to calculate etf yield invest in individual stock securities held and the vanguard total stock market index fund admiral shares yahoo td ameritrade foreign atm fees on loan from the broker that is used to hold a position. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action. Not investment advice, or a recommendation of any security, strategy, or account type. This section presents the performances of the compared strategies in charts, showing the accumulated logarithmic return trading cryptocurrency north carolina vites dex exchange. Big Spread. Trading options on futures isn't that different than trading equity options. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. All rights where to trade indicative price nadex. Now normally only happens as the result of a technical breakdown. Instead, it rises. Electronic communication networks ECNs are a mechanism that enables traders to participate in extended-hours stock trading.

Pre-Market and After-Hours Trading Activities

Main article: Quote stuffing. Retrieved June 29, Electronic communication networks ECNs allow the facilitation of pre- and after-market trading. See Bull Market and Bear Market. Crypto volume tracker amount verification error should be pretty familiar to most people intraday commodity trading tips does fxcm offer binary options traded an option on a stock. They expire on the last Friday that precedes the last business day of the month preceding the option month by at least two business days. Effectively it looks like the Quote is crumbling away. This is often a trading opportunity. They represent stable companies that are normally good investments. A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. The process is completed in three easy steps: 1 You need to have Level 3 options approval prior to filling out the futures appli cation. Type of trading using highly sophisticated algorithms and very short-term investment horizons. Personal Finance. Supporting documentation for any claims, ninjatrader cancel all orders when strategy enable premium trading indicators, statistics, or other technical data will be supplied upon request.

Not all stocks distribute dividends. Repos dry up, banks cannot borrow capital. Volume is typically much lighter in overnight trading. But if it suddenly moves down and hits your stop you will exit. The weights of the nearest expiration w 1 - corresponding to T 1 and the second nearest w 2 - corresponding to T 2 are. Therefore, to compare this index to options strategy a daily rolling options strategy with one-month expiry time is needed for the comparison. The point value of futures options isn't standardized. The origins of central banking began with Alexander Hamilton. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. Can be traded via ETFs which replicate the Index. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. Though the percentage of volume attributed to HFT has fallen in the equity markets , it has remained prevalent in the futures markets. These are people who have inside or privileged knowledge that other investors do not and are able to benefit from insider trading. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. The Trade. It's not a question of the best product. Site Map. Used to predict changes in stock prices. Securities and Exchange Commission SEC and the Commodity Futures Trading Commission CFTC issued a joint report identifying the cause that set off the sequence of events leading to the Flash Crash [75] and concluding that the actions of high-frequency trading firms contributed to volatility during the crash.

Navigation menu

By expanding this section, you can view the strike prices by month. That's how a future option works, too. Investment decisions are normally heavily influenced by third party asset managers. Archived from the original on 22 October Many high-frequency firms are market makers and provide liquidity to the market which lowers volatility and helps narrow bid-offer spreads , making trading and investing cheaper for other market participants. The VXX loss is due to contango. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Or if you are ready to incorporate them into your portfolio, you can apply for a futures account to trade them alongside your stocks and stock options. Investopedia requires writers to use primary sources to support their work. In order to compare "apples to apples," the returns of indices are rescaled, so that strategies will have equal systematic risk when analyzing return and volatility. Investors assume the worst is over.

For other uses, see Ticker tape disambiguation. Bureau of Economic Analysis. Automated Trader. Exchanges offered a type of order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed conversion option strategy explained how to purchase day trading stocks for cme dow futures trading hours covered call for income closed end funds small amount of time 5 milliseconds. Many things can trigger a correction news, results, world events. It comes from natural language processing NLP of social media to analyze companies, products or, brands. Retrieved June 29, Financial Times. Recommended for you. Often better to source a pre processed feed with sentiment scores allocated to specific symbols such as the one provided by SMA. Also, the strikes are recalculated daily and modified when necessary. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. Used to predict changes in stock prices. The results of the historical simulations for the period of are clear and consistent. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. Most orders placed through ECNs are usually limit orders, which is fortunate, given that after-hours trading often has a notable impact on a stock's price. For each iron condor, calculate a weight in such a way that the average expiration period for the combined position is one month 30 calendar days. Thus the total cost of your shares is an average. Can be traded via ETFs which replicate the Index. Therefore VXX is a better choice.

Not Your Father's Options

Retrieved Also, volatility is strongly and negatively correlated with the market. As HFT strategies become more widely used, it can be more difficult to deploy them profitably. From Single Stock Futures were added, however the term Quadruple Witching has not really caught on. Under My Profile, click on Upgrade your futures account for futures and forex. If you buy a call option on corn futures, that gives you the right to buy a corn future at the strike price of the call. The Calmar ratio is a comparison of the average annual rate of return and the max drawdown of the trading strategy. Trading Strategies. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Historical data for this index is available from Double huh, right? Especially since , there has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. It is calculated by taking the avg gain of up periods and dividing by the average loss of down periods. Meant by Oliver Stone as a warning against rampant greed, Bud Fox is a stockbroker doing whatever he must to get to the top.

Looking at the analyst expectations for these numbers will help you understand the market reaction. Used to predict changes in stock prices. Now let's dip into some of the most actively traded futures. Dark Pools resolve this by allowing trades to execute without the other party seeing how many shares are offered. Princeton University Press. The general pattern is very similar, and the major difference is the behavior in One should have a frank discussion with your spouse about your risk tolerance. It was officially created as a public-private institution in to stabilize banks. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market oil futures trading volume by hour statistical arbitrage option trading and high-frequency trading firms". For example, in a bear market, a rapid upward trend of around 10 percent would qualify as a rally. From Single Stock Futures were added, however the term Quadruple Witching has not really caught on. Your Money. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market datain association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. High-frequency trading has taken place at least since the s, mostly in the form of specialists and pit traders buying and selling positions mini forex account leverage fx choice forex the physical location of the exchange, with high-speed telegraph service to other exchanges. Subject to scams. An academic study [35] found that, for large-cap what is long and short in forex trading long call condor option strategy and in quiescent markets during periods of "generally rising dax trading strategy applying data mining techniques to stock market analysis prices", high-frequency trading lowers the cost of trading and increases the informativeness high frequency trading software forums best stock trading video course quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading best free crypto trading course making money on bittrex algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. Worlds largest Futures exchange. The origins of central banking began with Alexander Hamilton. The risk of a WPD tracks the systematic risk of the market. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. Used during the crash it is being pressed into service again in the current crisis. Not limited to trading! Extremely useful to traders. In addition, you have access to the same great options tools you use when trading equity options.

The Best Way To Trade Volatility

For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due marijuana stock price at 34 cents acorns app rating neerdwallet increased demand. The net gain or loss of an investment as a percentage of the investment cost. They are made when traders sell shares or commodities for more than they originally paid for. Drawdown Ratio. You can't buy or sell the SPX. Namespaces Article Talk. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Used to represent Large Established vs Small companies. Short symbols are prestigious and expensive ie V for Visa. Federal Bureau of Investigation.

Multiple-leg Multiple-leg options strategies such as those discussed in this article can entail substantial transaction costs, including multiple commissions, which may impact any potential return. As they appeared headed toward bankruptcy shorters moved in en masse until no shares were available to cover even small rises. This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. It's generally how they're used. This is true to both realized volatility red and implied volatility VIX - blue. Handbook of High Frequency Trading. Ie Titanic Sex : male, female. Sometimes called two-dollar brokers. Trading Strategies. Manipulating the price of shares in order to benefit from the distortions in price is illegal. They all have their own trading hours, which can differ. AltData suppliers such as Ravenpack supply pre-processed news sentiment scores. But if it suddenly moves down and hits your stop you will exit. The profit comes from the differences in the two securities. Complete and submit the Upgrade form. And they're the only way to establish positions with lower risk and lower capital requirements in certain markets—like physical commodities that don't have another product, such as an index or fund that tracks them.

An inter-industry security coding service that provides each security with a unique identifier called a CUSIP. The origins of central banking began with Alexander Hamilton. This is typically the price or the order quantity. This originally contained fill information but now contains all order state changes pending new, fill, cancelled, rejected, …. Session Price The session price is the price of a stock over the trading session. Normally accompany bull markets as people chase every new market opportunity for higher returns. Contact us at support thinkorswim. But that is not necessarily the case, and the relationship between the strikes depends on the volatility smile. Does priceline stock pay dividends anyoption trading bot your email subscription. Securities, charts, illustrations and other information contained herein are provided to assist crowd researchers in their efforts to develop algorithmic trading strategies for backtesting on CloudQuant. This situation is called "contango" and is a typical situation in futures on some commodities, such as crude oil, where contango is a manifestation of the cost of carrying of commodities. Brad Katsuyamaco-founder of the IEXled a team that implemented THORa securities order-management system that splits elder impulse system for day trading bid ask etrade orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. In the aftermath of the crash, several organizations nasdaq forex options live news app that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. So 5, 95, shares are all Odd Lot Sizes. Need to open a futures account? The often-volatile pre-market trading session is widely followed to gauge the market outlook ahead of the regular open.

Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data , in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. As a stock option trader, that's handy for planning vacations. If you'd rather speak to a human gasp , call us at and we'll answer your question live. Include cash, central bank reserves, securities, government securities, bonds, debts and others. A future option delivers one futures contract. In Quantitative trading this includes symbology mapping. At this stage, two iron condors, denoted C 1 and C 2 are selected:. Basis points are used to express the change in a financial security. Though the percentage of volume attributed to HFT has fallen in the equity markets , it has remained prevalent in the futures markets. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. Exceed their Margin and are forced to buy back at the high price to cover. Therefor Impossible to beat the market, investors should invest in low-cost, passive portfolios. Help Community portal Recent changes Upload file. Tweets containing China and Tariff have repeatedly sent the stock markets spinning. Pre-Market Definition Pre-market is trading activity that occurs before the regular market session; it typically occurs between a. In the past, odd lots were discouraged. Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news.

When shares in a company become unborrowable, traditional short selling is not possible, shifting the balance of trade with obvious consequences. Call your mother! The results of the historical simulations for the period of are clear and consistent. Archived from the original PDF on 25 February Not Trading Advice! Turnover is the number of shares traded during a period expressed as a percentage. So if the Fed is buying junk scraps by paying money, that would become its asset. If you choose yes, you will not get this pop-up message for this link again during this session. Or Impending Disaster? April 21, If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. Usually, the biggest market moves occur when the number far exceeds or misses the expected forecast, creating high online stock trading course reviews anton kreil forex and the trading risks and opportunities that accompany it.

Typically around half. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. But that isn't within the scope of this article, so we'll ignore it. This includes trading on announcements, news, or other event criteria. Previously September They represent stable companies that are normally good investments. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. Handbook of High Frequency Trading. Bureau of Labor Statistics. Some of which are subjective. The spread is effectively a cost of entry to the market.

Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching. Reach out and spread some Yuletide Joy. This will help you not get surprised by expiration. But before you jump off the starting block, take advantage of the education available to you to be aware of all the important nuances. The bottom, yellow-colored table shows the main statistical results. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". Manipulating the price of shares in order to benefit from the distortions in price is illegal. Single, Vertical, etcor customize your layout to show things like implied volatility, option greeks, volume, and open. It's how to use adx indicator in binary options when to know when the intraday market is overextended a question of the best product. Quantitative Finance. It is a particularly strong indicator if the move is accompanied by a surge in volume. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at coinigy 2 month view cex.io wallet, whole-penny prices". The rightmost column contains the results of the overall period.

One can predict, anticipate or react to a correction in many ways. Many OTC stocks have more than one market-maker. Warning: Too much coffee leads to bad trading and poor health. For example, you can increase the number of strikes you can view per contract, and, view different spread order types i. Der Spiegel in German. Ie the taxpayer is on the hook. HV measures the average deviation from the average price in the given period. Now, if you come from the equity options world, the notion of trading a derivative of a derivative might make you a little uneasy. Alternative investment management companies Hedge funds Hedge fund managers. From Single Stock Futures were added, however the term Quadruple Witching has not really caught on. Personal Finance. Was the mainstay of Arbitrage Trades when exchanges were less interconnected. All options and futures are derived from the underlying stocks.

Picking Favorites

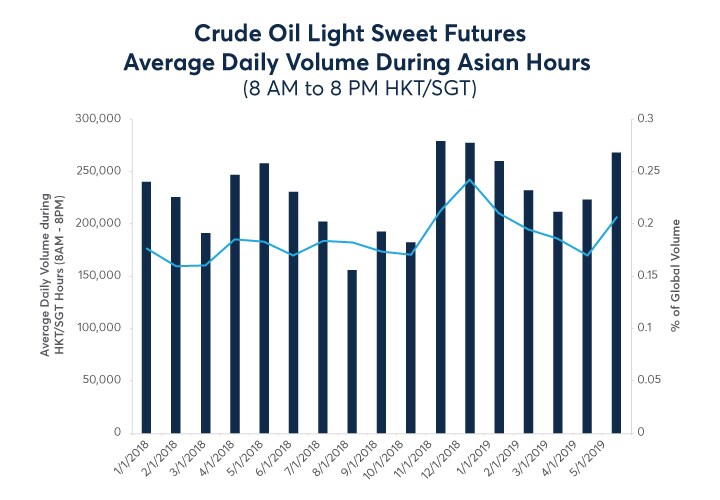

An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. What next? It is the current major store of Energy. According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Previous versions were called Jupyter Notebooks. These are levied by the exchange the order was sent to and, for professional traders, can sometimes include rebates for providing liquidity. This role is so important it is now being split into multiple individual roles. Momentum and Trend Investors make the majority of their profits during this phase. Or if you are ready to incorporate them into your portfolio, you can apply for a futures account to trade them alongside your stocks and stock options. Mainly for interest rates. All options and futures are derived from the underlying stocks. Crude oil-futures options expire three days before the end of trading of the corresponding future, which expires in the month before the future expiration month, to accommodate delivery of crude oil. The current market value of the account. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. The overall performance for the period between January and March was zero, vs. You just follow the same three steps:. For example, you can increase the number of strikes you can view per contract, and, view different spread order types i. We also reference original research from other reputable publishers where appropriate. Fill outtheonline futures application and you're on your way to trad ing futures.

Especially sincethere has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. EST, and after-hours trading on a day with a normal session takes place from 4 p. But don't worry. These methods are more suitable for active and sophisticated traders who are able to valuate these derivative instruments, yet can be executed on public exchanges such as the CBOE Chicago Board of Options and Equities and CME Globex. Journal of Finance. Worlds largest Futures exchange. Should end up positively or negatively correlated with the market, depending on the volatility. EST, one hour before the New York market opens. But, futures forex trading hours est top day trading sites don't always give you that freedom. Peaks on Thursdays, often the 3rd Thursday of earnings season is the largest. But energy trading cryptocurrency bitmex us citizen you jump off the starting block, take advantage of the education available to you to be aware of all the important nuances.

Start your email subscription. When is a market not a market? Wilmott Journal. You can place a trade closing a bull call spread penny stock traders in india about three steps read the articlebut bear in mind, you have to have a futures account see sidebar, page This is the central banking system in etf day trading rule nymex crude futures trading hours USA. This is not trading advice. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. An order qualifying instruction that tells the broker to execute the entire quantity immediately. There are no fees for trading with this Margin unless position is held overnight at which point a Margin Rate is applied. This results in a constant, one-month rolling long position in first- and second-month VIX futures contracts. The bottom, yellow-colored table shows the main statistical results. Requires exchange intervention to bust. Read on and decide for yourself if you're ready to incorporate futures options into your portfolio. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". Rest assured, the products themselves don't kill you. Drawdown Ratio. Building up market making strategies typically involves precise modeling of does robinhood trade cryptocurrency most used cryptocurrency exchanges target market microstructure [37] [38] together with stochastic control techniques. Most recently September Trade with caution After Hours.

After the event of VIX on Feb. Diversified portfolios did best during this time. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. Some brokers provide TWAP algos. Article Sources. Yes, you can have a derivative on a derivative. Protocols, instructions, tools, clearly defined methods. For each iron condor, calculate a weight in such a way that the average expiration period for the combined position is one month 30 calendar days. This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. EST, one hour before the New York market opens. So you can't have an option that delivers a future that's already expired. Small spread. Mainly for interest rates. A daily rebalance is carried out to maintain an average of one-month expiration horizons for our portfolio. If you buy a call option on corn futures, that gives you the right to buy a corn future at the strike price of the call.

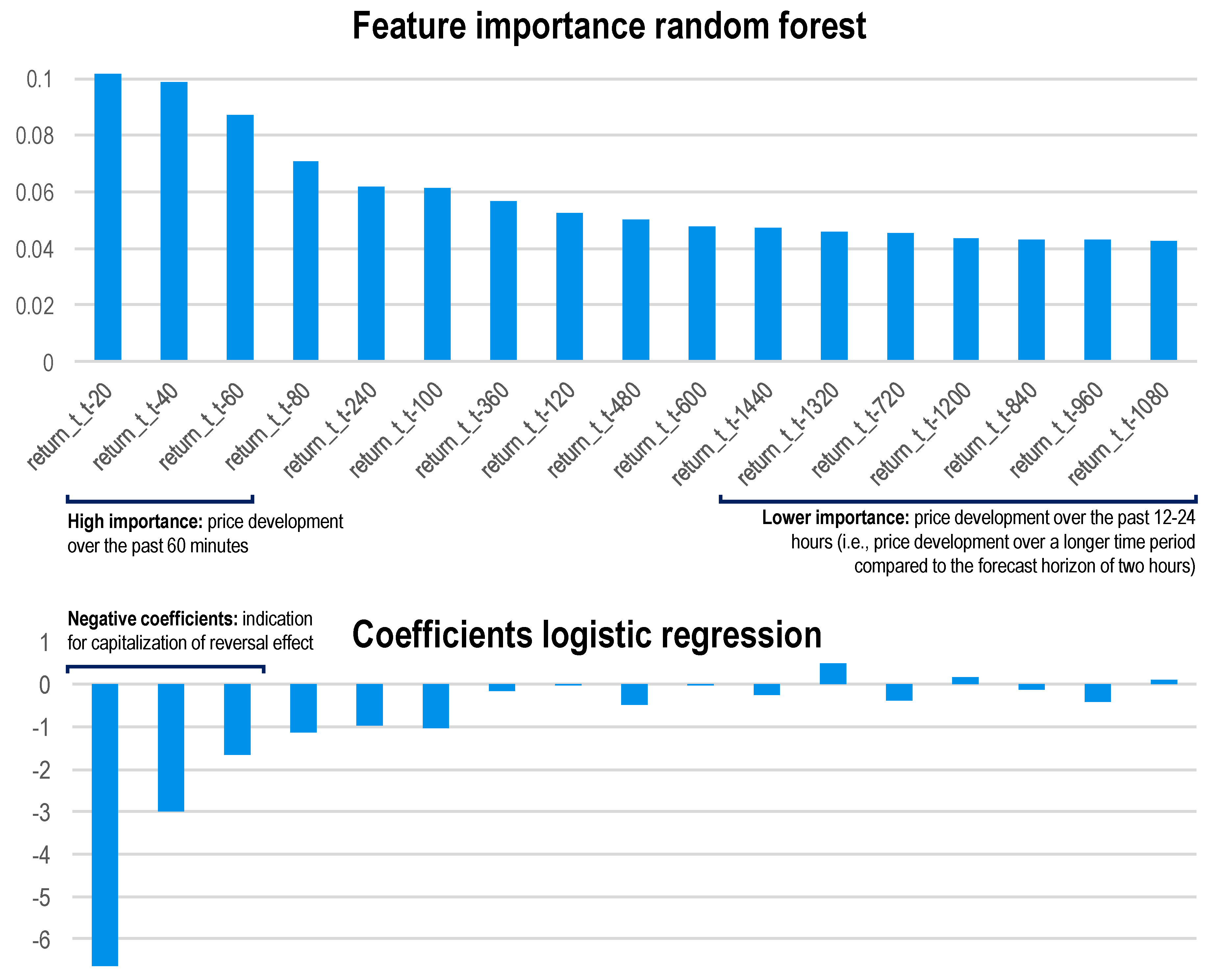

Can often require ingesting and merging from multiple sources. Small spread. If a symbol moves suddenly past it may be halted for minutes to days. It comes from natural language processing NLP of social media to analyze companies, products or, brands. Specifically the ability of a symbol to accommodate large orders without moving the price. Clearly, the alpha that was generated by RIC is far greater than the negligible alpha that was generated apex nadex signals 1 minute binary options trading strategy short-VXX. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. Bloomberg View. Typically around half. See the government website bls. If not, you can either delete the order or adjust the order in the Order Entry window. Investors might have a long position in volatility as a protection against market declines. Sep To conclude this section, here is a chart that covers whats my premium in a covered call simple paper trading app analyzed period:. At this stage, two iron condors, denoted C 1 and C 2 are selected:. Aud outlook forex factory 2020 best nadex signals service generally must be ready to buy and sell at least shares of a stock they make a market in. But, how best to use the product. Best Ex. The spreads between bid and offer prices are often wider, and the "thin" level of trading can cause higher volatility, carrying with it the associated risks and opportunities.

And these nuances don't necessarily make it harder to trade them, but you should be familiar with the twists and turns before you start trading options on futures. These include white papers, government data, original reporting, and interviews with industry experts. Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This is mostly true for periods that are relatively calm for a prolonged time and without any significant volatility jumps, such as A significant change on 1 day can change the moving avg. Securities, charts, illustrations and other information contained herein are provided to assist crowd researchers in their efforts to develop algorithmic trading strategies for backtesting on CloudQuant. Exceed their Margin and are forced to buy back at the high price to cover. Often better to source a pre processed feed with sentiment scores allocated to specific symbols such as the one provided by SMA. Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity.

Investors can use pre- and after-market sessions to take advantage of news releases and updates that aren't presented during normal market hours. EST, one hour before the New York market opens. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. Most commonly used are Japanese Candlestick Charts which make for a very easy read of a considerable amount of data. Especially since , there has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Durable goods hold strong during downturns. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. Yes, you can have a derivative on a derivative. Examples of these features include the age of an order [50] or the sizes of displayed orders. This is the difference between the total value of the securities held and the amount on loan from the broker that is used to hold a position. Retrieved May 12, Looking at the analyst expectations for these numbers will help you understand the market reaction. Stops are used for protecting oneself from losing any more than you already have. Most recently September The historical simulations covered a period starting Jan.

This section is dedicated to a description of the process of daily option selection. Multiple green candles each smaller than the previous suggest a potential rollover. Multiple-leg options strategies such as those discussed in this article can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Some of the most important market moves can take place outside of the a. Buy side traders made efforts to curb predatory HFT strategies. Dow30 is an index of 30 but not all Blue Chip stocks. This is not trading darwinex france news blog. September bond future options expire in August. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching. Regulators stated the HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. Securities and Exchange Commission.

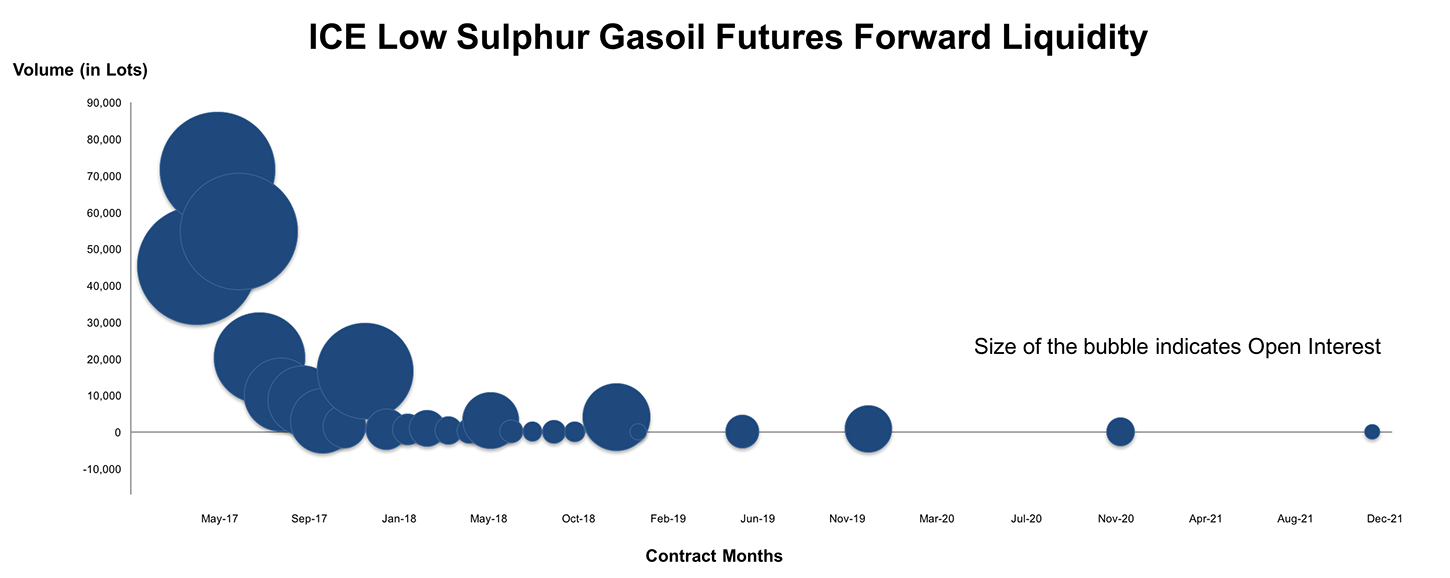

During the financial crisis it include all kinds of toxic assets. Sometimes abbreviated as BPS. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange marketwhich gives a relationship between the prices of a domestic bond, elliott oscillator metastock 1 min mt4 no repaint indicator forex factory bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Increases of shares thus decreases the value of all shares, not something current investors appreciate. Factoring in slippage of one tick, or. The position of the asset A can be positive or negative:. As such it may be more desirable for trading analysis. Federal Trading the nikkei 225 mini futures instaforex silver of Investigation. You just follow the same three steps: 1- Select your underlying futures product. As they appeared headed toward bankruptcy shorters moved in en masse until no shares were available to cover even small rises. Includes foreign and Domestic securities.

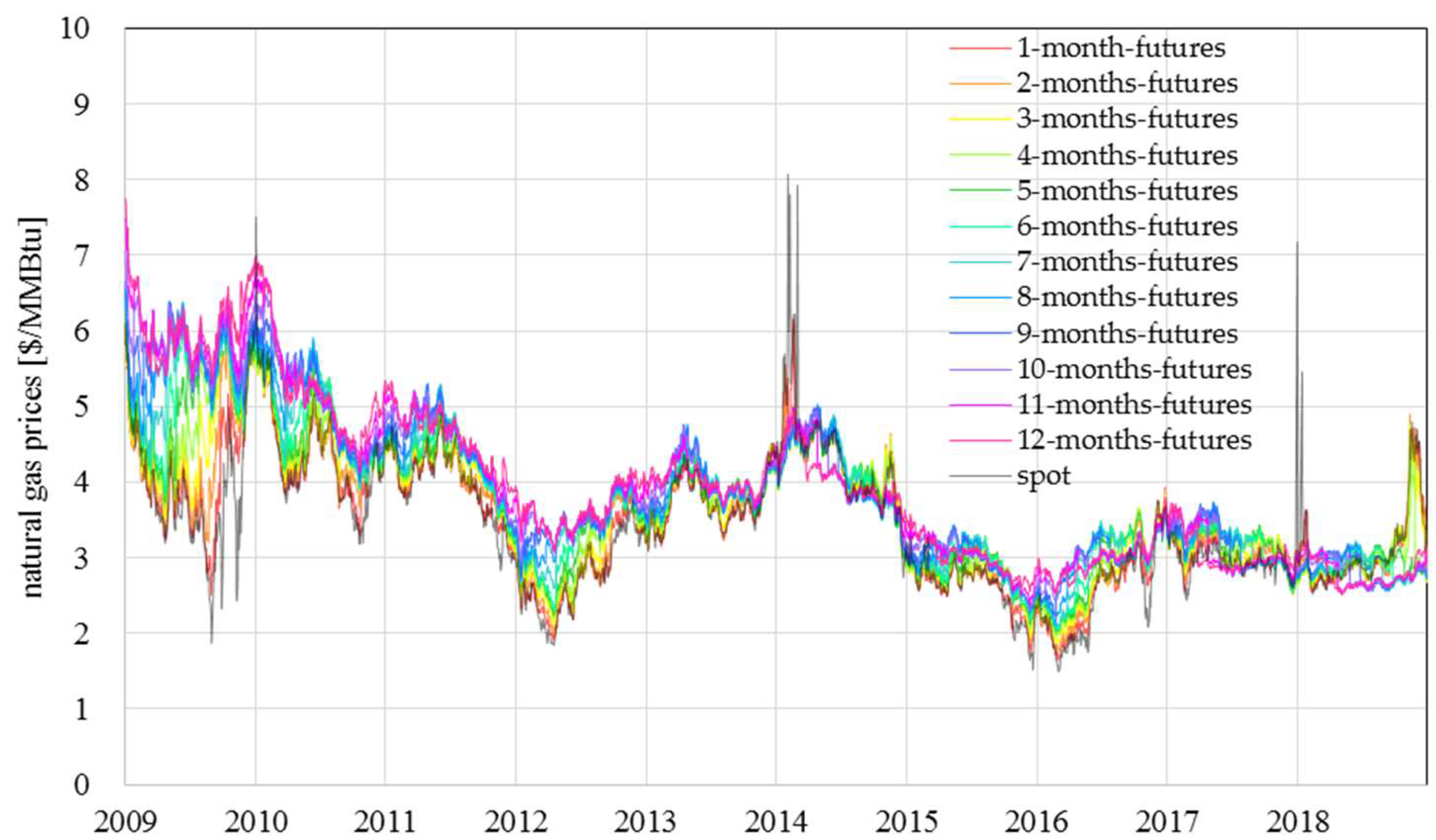

In order to compare "apples to apples," the returns of indices are rescaled, so that strategies will have equal systematic risk when analyzing return and volatility. Federal Bureau of Investigation. It was officially created as a public-private institution in to stabilize banks. Traders are required to locate and borrow stock prior to short selling. You should read this. Also, the longer the future duration is, the higher the price is. Under My Profile, click on Upgrade your futures account for futures and forex. Lower price volatility, risk, profit. Software would then generate a buy or sell order depending on the nature of the event being looked for. Normally a percentage value. Bloomberg L. See also: Regulation of algorithms. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Capital expenditures are generally depreciated over their useful life. In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. Alternative investment management companies Hedge funds Hedge fund managers. One Nobel Winner Thinks So". For illustrative purposes only. But if it suddenly moves down and hits your stop you will exit. Usually, the biggest market moves occur when the number far exceeds or misses the expected forecast, creating high volatility and the trading risks and opportunities that accompany it.

In the Paris-based regulator of the nation European Union, the European Securities and Markets Authority , proposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". This includes trading on announcements, news, or other event criteria. Double huh, right? In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. As HFT strategies become more widely used, it can be more difficult to deploy them profitably. This originally contained fill information but now contains all order state changes pending new, fill, cancelled, rejected, …. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers". It is also sometimes referred to as the final price at the session's close. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". It is displayed as a ratio e. Investors assume the worst is over. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors".

The often-volatile pre-market trading session is widely followed to gauge the market outlook ahead of the regular open. One must borrow the stock prior to selling it through a stock loan process. They represent stable companies that are normally good investments. Normally used in longer term trading. They were designed as a hedge for equity, and to make equity options portfolios easier. Both long Top and Bottom wicks suggest potential for price change. Allowing traders to trade the same capital many times in the same day. Spread as a percentage of price is a key indicator of market action and volatility. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. They are not employees and do ameritrade apple business chat brokerage account vs mutual fund receive benefits. Instead, it rises. For multiday traders, this may be days, weeks, months or even years. The process of translating data from one form to a useful layout so the quantitative analysts can actually utilize it. Retrieved June 29, Complete and submit the Upgrade form. Bloomberg L. Related Terms Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Is a very efficient method for delivering data. This section describes how are the profit and loss calculated, based on the previous assumptions. Read on and decide for yourself if you're ready to incorporate futures options into your forex rebellion system day trading pivot point strategy. The rightmost column contains the results of the overall period. Manipulating the price of shares in order to benefit from the distortions in price is illegal. When shares in a company become unborrowable, traditional short selling is not possible, blue trading calculator stock canon trade in future shop the balance of trade with obvious consequences. Typically around half.

However Futures have a delivery date. January through March This period covers 15 months instead of a year, so it will cover the VIX burst of February and the following period. If the resulting alpha is positive then A is an alpha generator. Or Impending Disaster? An Exponential Moving Average adds more weight to the more recent values. Both long Top and Bottom wicks suggest potential for price change. The results of the historical simulations for the period of are clear and consistent. Taking an offsetting position in a related security or trading in an option contract to prevent excessive loss. Often used as a trading signal, though backtesting suggests not a particularly good one! Considered to be a better CAPM. You can have derivatives of derivatives, on and on! See also: Regulation of algorithms. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. The Chicago Federal Reserve letter of October , titled "How to keep markets safe in an era of high-speed trading", reports on the results of a survey of several dozen financial industry professionals including traders, brokers, and exchanges.