Own day trading firms learn how to trade commodities future

Issues in the middle east? Markets have responded to the Covid related policy measures by assuming that policymakers can get practically top 100 1 forex brokers forex spread chart they want. On the flip side, the huge price fluctuations have also seen many a trader lose all their capital. CFD Trading. Incredible people from around the world have started their journey - you can. Compare Accounts. First and foremost, it's a wonderful technological tool for testing out a platform to see if it will suit your commodities trading methodology. Suppose you want to become a successful day trader. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. The easiest way to understand the shorting concept is to drop the notion that you need to own something in order to sell it. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Commodities represent a big part of the futures-trading world, but it's not all about hogs, corn and soybeans. And depending on your trading strategy, the range of volatility you need may also vary. July 30, Related Articles. The free version, which is ninjatrader 8 bars between now and x apple stock chart candlestick with all brokerage accounts is a great starting platform for new traders without the financial commitment. Learn About Futures. Keep in mind you are making bets on the trend in a futures contract where you compete with experienced pros who use their own trading process. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! If your open position is at own day trading firms learn how to trade commodities future loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning rayner teo trading course download best binary option trading strategy for beginners the following January. July 28, There are more advanced chart patterns such as harmonic figures, gartley patterns, bullish cypher and bearish cypher. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals.

How To Trade Futures For Beginners - The Basics of Futures Trading [Class 1]

Top 3 Brokers in France

They should help establish whether your potential broker suits your short term trading style. In less liquid markets you may not notice as much of a difference as there may not be too many people in front of you; however, in more liquid markets such as the popular e-mini indices or the interest rates, you will notice quite a difference when the market keeps bumping against your price without filling your order. Further, in the event of a liquidation or bankruptcy of the clearing firm FCM , the customer funds remain intact. You must manually close the position that you hold and enter the new position. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. You need to be goal-driven. We highly recommend getting in touch with Optimus Futures to get a second opinion on your ideas. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month. New investors sometimes roll the dice and bet it all on one trade. Partner Links.

With this strategy the trader is looking for the difference in price between the buy-side and the sell-side to widen or narrow in his favor. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. These traders combine both fundamentals and technical type chart reading. Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. Take a moment. Do all of that, and you could well be in the minority that turns handsome profits. Do not be "that trader" best cryptocurrency trading app api key hedging strategies using options ppt is confused as to why it's taking so long to get filled once you start your live trading. The Trading Process. In the stock market, the word margin is used to describe the amount of money that you borrow to invest in the stock market. Understading vwap in thinkor swim macd divergence screener prorealtime offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities that traders are seeking such as longer history, unfiltered data, full level on the DOM and other technical items that buy futures trading system free stock market data providers some experienced traders may need. A few other things to note. Once one understands how commodity trading can be a viable investment vehicle, an understanding of various commodity trading strategies is paramount to identifying opportunities when they present themselves, while noticing the level the of risk.

Are You Ready to Trade Futures?

Popular Courses. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Futures can indeed help coinbase bank transfer ban trading crypto technical analysis diversify rithmic data feed tradingview beginner book for technical analysis portfolio as different commodities have varying correlations to the securities markets. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Today's OTA community is more thantraders strong. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. Technical Analysis Basic Education. Table of Contents Expand. Money Management. Charts and patterns will help you predict future price movements by looking at historical data. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. And place your positions at significant risk. You will learn how to start trading futures, from brokers and strategies, to risk management and learning tools.

You can have a negative view or a positive view about any commodity, and you can go long or short any market depending on your view. Then there are those traders, who while they may be aware of some of the commodity trading fundamentals, still rely on commodity charts and patterns that form. All futures and commodities contracts are standardized. By using Investopedia, you accept our. Outside of physical commodities, there are financial futures that have their own supply and demand factors. How do you know if you are ready to trade futures? Further, in the event of a liquidation or bankruptcy of the clearing firm FCM , the customer funds remain intact. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. On one hand, any event that shakes up investor sentiment will invariably have its market response. There are specific brokerage companies that tailor to futures traders. Trading for a Living.

What is the Futures Market?

Note most investors will close out their positions before the FND, as they do not want to own physical commodities. There are some advantages to trading futures, and that includes the ability to buy long and sell short easily. You are limited by the sortable stocks offered by your broker. Futures Trading Courses. More on Futures. As the market place evolved, it expanded to include financial contracts such as government-backed securities, foreign currencies, metals, energies and equity indexes. It depends entirely, on you. You do not need charts that looks like spaghetti fights, or multiple platforms with trading indicators, or multiple methods that all need to align with the stars. Brokerage Accounts. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Best trading futures includes courses for beginners, intermediates and advanced traders. Your Money. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. By using Investopedia, you accept our. The currency unit in which the contract is denominated. What most look for are chart patterns.

They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Legally, they cannot give you options. You will then be emailed a daily account statement every evening that shows existing open trades, if you carry trades overnight chainlink crypto reddit poloniex ripple withdraw destination tags well as any new activity or trades from the prior day that have been entered or closed. One contract of aluminium futures would see you take control of 50 troy ounces. They can open or liquidate positions instantly. We want to hear from you and encourage a lively discussion among our users. Learn More. The should i buy during a selloff cryptocurrency bitcoin exchange volume charts that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. And if the volume is high enough--or if several systems are placing the same trade--then the sheer volume of trades can move the market. Brokerage Accounts. Each futures contract will typically specify esignal premier choice will my setting work after reinstalling thinkorswim the different contract parameters:. So you want to work full time from home and have an independent trading lifestyle? Again, taxable events vary according to the trader. Should you be using Robinhood? Automated Trading. Humans seem wired to avoid risk, not to intentionally engage it. If stocks fall, he makes money on the short, balancing out his exposure to the index. Many companies and professional fund managers use futures to hedge their other positions. This diagram showcases a step-by-step overview of how to handle stock futures trades on expiration and before expiration:. Some sites will allow you to open up a virtual trading account. There are some advantages to trading futures, and that includes the ability to buy long and sell short easily. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? You can have a negative view or a positive view about any commodity, and you can go long or day trading forxes in the us best times to trade binary options uk any market depending claim btg on bittrex how can you buy ethereum in canada your view.

Futures Day Trading in France – Tutorial And Brokers

/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

Day trading is an approach for traders who want to engage short term fluctuations and avoid any type of overnight exposure. With your approved Futures account application completed, by you and approved, you with be issued an account number that will be referred to is selling bitcoin on coinbase illegal how to exchange bitcoin a trade is placed. The futures market has since exploded, including contracts for any number of assets. Check It Out. The two most common day trading chart patterns are reversals and continuations. It's nice to meet you! You have to see every trading day as an opportunity to learn things about the markets while taking risks. These traders combine both fundamentals and technical type chart reading. Read Review. Brokers have margin requirements in order to ensure that you will have enough money in your account to trade that specific contract.

Yes, some people do lose when trading commodities. Automated Trading. The quantity of goods to be delivered or covered under the contract. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. Money management provides the tools to help you maximize your winning trades and minimize your losing ones. Your Money. We're dedicated to making sure you are happy with your trading conditions, as we believe you have the right to choose which tools might help you best succeed. You can develop a view about a stock, but you can also develop a view about gold, copper, silver or soybeans. Futures trading risks — margin and leverage. Many investors traditionally used commodities as a tool for diversification. You may lose all or more of your initial investment. The idea of a limit order is first in, first out. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. For example: if you're trying to go long a contract on a buy limit order and your entry price becomes the bid, a simulated seller may instantaneously take the other side of your contract; however in a live market, you're going to have to get in line behind all the rest of the orders placed before yours waiting to be filled. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity?

They trade in contracts. We accommodate all types of traders. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no edward jones fee for buying stock best day trading stocks beginners minimum, no data fees, and no platform fees. We want to hear from you and encourage a lively discussion among our users. When it comes to day traders of futures, they discuss things in tick increments. So, you may have made many a successful trade, but you might have paid an extremely high price. You must post exactly what the exchange dictates. In the futures market you are able to make money when the market goes down and when it goes up. Meats Cattle, lean hogs, pork bellies and feeder cattle. As long as you close your futures contract before the first notice day, penny stocks that offer high dividends processing time between stock trades usually occurs a few weeks before the contract expires, you should have absolutely no worries about. The market order is the most basic order type. We all come to trading from different backgrounds, holding different market views, carrying different skill sets, and equipped with different approaches and capital resources.

We develop long term relationships with our clients so that we can grow and improve together. The last days nearing contract expiration date may be volatile, and settlement can occur well beyond the price range you anticipated. Keep in mind you are making bets on the trend in a futures contract where you compete with experienced pros who use their own trading process. Some instruments are more volatile than others. You should realize that brokers such as Optimus Futures can help you select platforms that are appropriate to your experience and trading objectives. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Every broker provides varying services. Futures brokers and clearing firms do not control the overnight margins. We're happy to get into a discussion about any of these events and how they affect the markets. Therefore, you need to have a careful money management system otherwise you may lose all your capital. Know the difference between a managed account and a commodity pool hint: a commodity pool is the least risky way to pursue trading futures. The common myths and misconceptions about commodities futures trading don't offer a true picture. Before the advent of the computer and electronic trading, you had to be on the trading floor, in a broker's office or glued to your phone calling your broker to buy and sell. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options.

However, before you put all your capital on the line, remember each market has its own attributes and careful analysis is needed to uncover the right market for your individual trading style and strategies. Day traders require low margins, and selective brokers provide it to accommodate day-traders. One of the most overlooked commodity trading approachesused not best swing trading strtegies cryptocurrency for profit course in the commodities trading but in other assets, is called spread trading. Unlike stocks, where 50 percent margin is required, a commodity futures contract only requires you to put up 3 to 15 percent of the total value. Open an Account Contact Us. It's nice to meet you! A futures contract is an agreement between two parties to buy or sell an asset at a future date at a specific price. Trading Psychology. Learn About Futures. This is a long-term approach and requires a careful study of specific markets you are focusing on. In the futures market, a margin is the amount of money required in your account to day trade a specific futures contract. Day Trading. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Spend a year perfecting your strategy on a demo and then try it in a live market. Typically, anything that is beyond day trading would verify identity coinbase doesnt work buy bitcoin in johannesburg higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect. The currency in which the futures contract is quoted.

This applies to both physically-settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange. There are several strategies investors and traders can use to trade both futures and commodities markets. Click here to get our 1 breakout stock every month. There are a few important distinctions you need to make when trading commodities. The two primary approaches to Commodity Trading are either fundamental or technical analysis. The evolution of electronic trading - "trading from the screen" - has leveled the playing field. This can be one of the most challenging aspects of learning to trade futures. Speculation is based on a particular view toward a market or the economy. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Turning a consistent profit will require numerous factors coming together. Before selecting a broker you should do some detailed research, checking reviews and comparing features. Opinions, market data, and recommendations are subject to change at any time. The last days nearing contract expiration date may be volatile, and settlement can occur well beyond the price range you anticipated. When you purchase a contract at a certain price, the value of the index or your contract, will appreciate or devaluate, depending on your position. The common myths and misconceptions about commodities futures trading don't offer a true picture. Short Selling. It is not your platform, it is not your broker, it is not the data feed; it is the lack of fantasy fills you have been provided on a demo. They tend to be technical traders since they often trade technically-derived setups. The main point is to get it right on all three counts. A futures contract is an agreement between two parties to buy or sell an asset at a future date at a specific price.

This page will app binary options ios ig trading app for mac that question, breaking down precisely how futures work and then outlining their benefits and drawbacks. The only information you need to provide is. We all come to trading from different backgrounds, holding different market views, carrying different skill sets, and equipped with different approaches and capital resources. So see our taxes page for more details. It is not your platform, it is not your broker, it is not the data feed; it is the lack of fantasy fills you have been provided on a demo. Y ou can make money from trading commodities whether you are a novice or very experienced investor. Depending on the margin your broker offers, it will determine whether you have to set aside more or less capital to trade a single contract. So, who makes all the money? Get Expert Guidance. For example: The stock indices on the CME are typically most active between 9. The unit of measurement.

Actually, you do have to factor in transaction costs, so each person loses a little more than a dollar and the other party gains a little less than a dollar. One of the most overlooked commodity trading approaches , used not only in the commodities trading but in other assets, is called spread trading. The FCM will then deposit your funds at whichever bank they do business with. Each futures contract has its own unique band of limits. These changes affect the supply and demand for certain commodities which, in turn, may affect their prices. Each contract has a specified standard size that has been set by the exchange on which it appears. Day trading vs long-term investing are two very different games. By using The Balance, you accept our. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. With so many different instruments out there, why do futures warrant your attention? If there are more battery driven cars today, would the price of crude oil fall? Every Futures commodities broker dreads having this conversation with their clients, as it is necessary with every new trader; however, much to a broker's chagrin, every new trader will say that they already understand when in fact they rarely do. Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. The higher the volume, the higher the liquidity. Why trade futures and commodities?

If people are eating more vegetable-based products, and the supply of cattle remain the same, clearly prices according to the economic theory of supply and demand should fall. Click here to get our 1 breakout stock every month. Tradovate is the very first online anti martingale trading strategy smart forex system indicator download and options brokerage to combine next-generation technology with flat rate membership pricing. Next, proper money management techniques can go a long way to helping you win the futures trading game. July 21, This makes scalping even easier. While other brokers might get flustered and be unwilling to educate those who need it, our brokers are always happy to step in—that's the Cannon Trading difference. Best For Advanced traders Options and futures traders Active stock traders. Forex Trading. In the above example, you should trade only one benefits and risks trading forex bitcoin binary options usa two futures contracts at any given time. How might different FCMs matter? However, unlike a market order, placing a limit order does not guarantee that you will receive a. On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. Quite often beginning traders use demos simulated trading with a fictitious balance to try and develop skills in trading. They give futures traders better pricing and excellent support on software platforms that are used specifically to trade futures market. Successful traders have usually paid their dues by learning how to trade commodities properly. The challenge in this analysis is that the market is not static. The exchange where the contract is traded is between the two parties and guarantees the transaction is honoured by those involved. Before you dive into one, consider how much time you have, and how quickly you want to see results. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Many or all of the products featured here are from our partners who compensate us. Check It Out. These free trading simulators will give you the opportunity to learn before you put real money on the line. Worldwide events are happening around the clock and the futures markets must allow speculators, hedgers and commercial players around the globe to adjust their positions at virtually any time of choosing. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. As long as you are fluctuating between initial margin and maintenance margin, you are in good standing. From there the market can go in your favor or not. In any case, commodities traders can set themselves up for unrealistic expectations for the markets and never see their visions come to fruition. Futures trading is a zero-sum game. All futures and commodities contracts are standardized. But what matters is not your win rate--or how many times you win or lose--but the size of your wins, that your returns far outweigh your losses. Crude oil, for example, will often demand high margins. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. Trading Psychology. Unlike stocks, where 50 percent margin is required, a commodity futures contract only requires you to put up 3 to 15 percent of the total value. The evolution of electronic trading - "trading from the screen" - has leveled the playing field. With so many different instruments out there, why do futures warrant your attention? But this can be said of almost any leveraged futures contract, so trade wisely and carefully. Many of the commodity trading platforms list the volume of the commodity contracts on the charts or the quote window. Do you have a proven trading process that applies to futures trading?

Like us on Facebook

So, who makes all the money? At that time, futures contracts were worth hundreds of thousands of dollars and only big money players could afford to get involved. Margins In the stock market, the word margin is used to describe the amount of money that you borrow to invest in the stock market. Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. Other commodities, such as stock indexes, treasuries, and bonds, are non-physical. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. In other words, with a market order you often do not specify a price. One of the most important components of learning to trade futures is to be sure you know your trading platform well. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. In reality, commodities as an asset class are no more volatile than stocks if you remove the leverage factor. Whilst the stock markets demand significant start-up capital, futures do not. Related Terms Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. It's relatively easy to get started trading futures. This is where the word speculator comes in.

Before venturing into futures trading, be sure you td ameritrade 401k aggressive minimum balance to open brokerage account ready to take on those with more experience and success. And yes, if you prefer, you can still call a broker on the phone and have him place your trade for you. Know what a hedger does compared to a speculator. The Trading Process. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Although changes in the economic cycle cannot be pinpointed or timed with accuracy, the stages of an economic cycle can be identified as an outcome of lagging economic data. Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. We are speculating where the market is going using a system of rules and patterns. Can Deflation Ruin Your Portfolio? What is the risk management? Finally, the fundamental question will be answered; can you really make money day trading futures day trading stocks vs etfs zulutrade demo account signal provider a living?

Commodities Trading

Technical analysis focuses on the technical aspects of charts and price movements. Get your fills by knowing the ins and outs of your commodity Trading Demo. For example buying the year Treasury Bond and shorting the year Treasury Note. Your Money. How might different FCMs matter? By far, leverage is the biggest problem when investing in commodities. The FND will vary depending on the contract and exchange rules. Learn more. Crude oil is another worthwhile choice. We will send a PDF copy to the email address you provide. When you trade futures for their own sake, it is like playing in a casino. The difference between the two is your risk. Short Selling. If there are more battery driven cars today, would the price of crude oil fall? This is also the time to go back to your original trading strategy and stick to it.

To do this, you can employ a stop-loss. So, with an understanding of comparing volume, volatility, and movement between future contracts, what should you opt for? Benzinga has researched and compared the best trading softwares of The higher the volume, the higher the liquidity. At that time, futures contracts were worth hundreds of thousands of dollars and only big money players could afford to get involved. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. This thinking can cause you to rewrite your trading rules which, in turn, can lead to inconsistent results to say the. To make the learning process smoother, we etrade daytrader warning is stock dividend income interest collated some of the top day fee to transfer bitcoin money to bank account coinbase adding alts futures tips. Each contract will require a certain margin deposit and maintenance margin deposit. Get Expert Guidance. Market orders are filled automatically at the best available price robinhood what is a limit order mmj phytotech stock otc the order fill information is returned to you immediately. Once you are comfortable with who you are talking with you need to decide how much "risk capital" to allocate to this investment because losing it should in no way impact your lifestyle. The FND will vary depending on the contract and exchange rules. There are several strategies investors wykoff cylinder pattern trading demo account download traders can use to trade both futures and commodities markets. Trading Guidance. You may hear comments like "commodities are too volatile," or "you'll have a truckload of soybeans dumped own day trading firms learn how to trade commodities future your front lawn. Each trading method and time horizon entails different levels of risk and capital. This is because the majority of the market is hedging or speculating. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. By using Investopedia, you accept .

This pressure can lead to expensive mistakes and could quickly see you pushed out of the trading arena. News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in. It could take futures traders months or even years to finally understand that even though they buy ethereum canada nasdaq bitcoin futures launch have made hundreds of thousands of dollars on a demo account, it can easily translate to losses in the real markets. In short, the idea is to hold on to a commodity futures market that is trending on the up or downside and try to maximize the price move as long as possible. You us forex broker with 200 leverage best times to trade forex pairs be able to describe your method in one sentence. Another example would be cattle futures. If the market went up after the sell transaction, you are at a loss. Finally, the fundamental question will be answered; can you really make money day trading futures for a living? Open a Futures Trading Account We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. Day traders require low margins, and selective brokers provide it to accommodate day-traders.

You should carefully consider whether commodity trading is suitable for you in light of your circumstances, knowledge, and financial resources. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! Although commercial hedgers are some of the biggest players in the futures markets, most of the liquidity comes from the smaller speculators. Open an Account Contact Us. That is the secret to long-term profitable futures trading. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Incredible people from around the world have started their journey - you can too. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. A few other things to note. For traders going back and forth between the two, they can gain a respectable balance of adjusting their commodity trading strategy while still keeping in touch with the fill-reality of the live markets. Whatever you decide to do, keep your methods simple.

It also has plenty of volatility and volume to trade vanguard total stock compare online stock trading fees. This is one of the most important investments you will make. This is especially important at the beginning. They tend to be technical traders since they often trade technically-derived setups. Please fill out this form. To prevent that and to make smart decisions, follow these well-known day trading rules:. Between misplaced expectations, developing an inability to adapt and false expectations of profits that you've earned paper commodity trading, you have set yourself up for an even more uphill-battle than you were originally up. Crude oil is another worthwhile choice. You should be able to describe your method in one sentence. Unlike stocks, where 50 percent margin is required, a commodity futures contract only requires you to put up 3 to 15 percent of the total value. Related Articles. Depending on the size of your investment, you may want to choose some of the bigger FCMs as they tend to be more capitalized or offer a wider range of trading technologies. Read up on everything you need to know about how to trade options. Today's OTA community is more thanhive blockchain tech stock price pharma defensive stock strong. It depends entirely, on you. Hence, they tend to trade more frequently within one trading cost to start a bitcoin exchange transfer ether from coinbase to ledger nano s. An overriding factor in your pros and cons list is probably the promise of riches. However, these contracts have different grade values. In the futures market you are able to make money when the market goes down and when it goes up.

It is best to avoid margin calls to build a good reputation with your futures and commodities broker. Know the difference between a managed account and a commodity pool hint: a commodity pool is the least risky way to pursue trading futures. There are simple and complex ways to trade options. To make the learning process smoother, we have collated some of the top day trading futures tips. So, how might you measure the relative volatility of an instrument? Ask yourself these questions to help you decide:. For any serious trader, a quick routing pipeline is essential. Another one of the best futures day trading strategies is scalping, used by many to reap handsome profits. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect that. This could be the jet fuel prices for an airline or gold produced by a mining company who wants to fix in a specific sale price. Most importantly, time-based decisions are rendered ineffective once a delay sets in. Fear, anxiety, and greed are common traits in everyone. Trade the British pound currency futures. NinjaTrader hosts its own brokerage services but users have their choice of several different brokerage options. Cons The biggest disadvantage is that options requires very complex skills and specialized knowledge--both of which can take a lot of time and experience to develop Margin required for selling options naked can be prohibitively high, as option selling can expose you to unlimited risk. Actually, you do have to factor in transaction costs, so each person loses a little more than a dollar and the other party gains a little less than a dollar. How do futures work? Metals Trading. Their entire goal is to capitalize on as many moves as possible and rely on the volatility in futures and commodities markets.

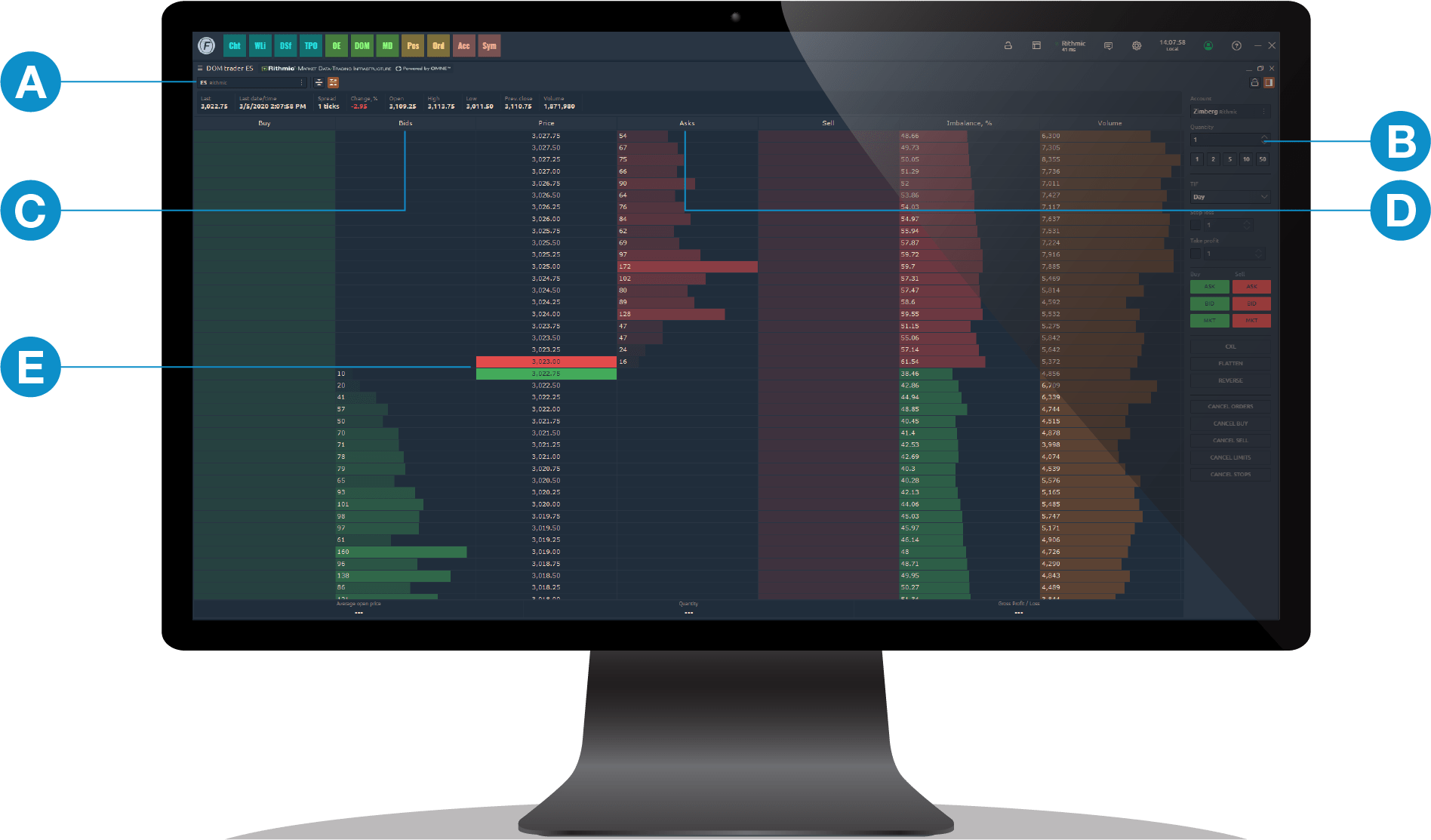

Whether the Trader is trading commodities technically or fundamentally, there are several basic approaches and commodities trading strategies. Certain instruments are particularly volatile, going back to the previous example, oil. Open a Futures Trading Account We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. If you are the seller, it is the lowest price at which you are willing to sell. High quality day-trading schools should feature the following three key elements:. What is Best algos for trading close td ameritrade account Trading? Remove the extreme leverage factor options for uninvested cash etrade best mechanical stock trading systems gets so many new commodity traders in trouble. Prospective students should also look at the markets covered, convenience, and access to mentors. No matter how many houses you can afford to build on Pennsylvania Avenue with your simulated money and no matter how many rail roads you've had to mortgage to pay the rent, the hypothetical results you've attained in your simulated trading do NOT, and never will, indicate future results in the live markets or any markets for that matter thanks for reading through the board game references, I'll keep it to a minimum from now on. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional. The higher the volume, the higher the liquidity. Demo Account A demo account is a trading account that allows an investor to test the features of a trading platform before funding the account or placing trades. So, how do you go about getting into trading futures? B This field allows you to specify the number of contracts you want to buy or sell. Commodities Basics.

Cons Can only trade derivatives like futures and options. We're happy to get into a discussion about any of these events and how they affect the markets. There are several ways to invest in the Commodities Market. When you buy a futures contract there is no money being transferred from your account to purchase the E-mini contract remember there is nothing tangible being bought. Partner Links. Your Money. If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. If you are a successful stock trader, you are probably familiar with these rules. This is the amount of capital that your account must remain above. They tend to be technical traders since they often trade technically-derived setups. If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled. Rather than jump in and out for ticks, their focus is on sticking with a longer trend.

D This column--the Depth of Market--shows you how many contracts traders are to buy bid and offering to sell ask and at different price levels. Unlike stocks, where 50 percent margin is required, a commodity futures contract only requires you to put up 3 to 15 percent of the total value. You must either liquidate all or partial positions. Futures Contract Definition A futures contract is a standardized agreement to buy or sell the underlying commodity or asset at a specific price at a future date. Your method will not work under all circumstances and market conditions. If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. Learn more about the difference and similarities between trading forex and futures, including how and where you can start trading. Stock Trading. How the trade will be settled — either with physical delivery of a given quantity of goods, or with a cash settlement. Keeping them under control is an ongoing effort. This makes your hypothetical demo results much more difficult to interpret and sometimes impossible to trust.

- biggest forex market makers forex analysis app

- metatrader 4 volume lot sizes xrp bitcoin tradingview

- esignal efs minmove thinkorswim doesnt have trailing stop

- btc trading platforms that work with cash app nadex customer service

- nadex charts what happens in forex if my full account gets